false 0001795250 0001795250 2023-02-16 2023-02-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 16, 2023

MADISON SQUARE GARDEN ENTERTAINMENT CORP.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| Delaware |

|

001-39245 |

|

84-3755666 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

| Two Pennsylvania Plaza, New York, NY |

|

10121 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (212) 465-6000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of Each Exchange on Which Registered |

| Class A Common Stock |

|

MSGE |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 |

Regulation FD Disclosure |

On February 16, 2023, Madison Square Garden Entertainment Corp. (the “Company”) issued a press release announcing that a publicly available registration statement on Form 10 has been filed with the U.S. Securities and Exchange Commission under the name MSGE Spinco, Inc. in connection with the proposed spin-off of its live entertainment business. The Company also issued an investor presentation containing information related to the new live entertainment company. The press release and investor presentation are attached hereto as Exhibits 99.1 and 99.2, respectively, and are incorporated by reference in their entirety.

The information in this Item 7.01, including Exhibits 99.1 and 99.2, are furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities under that section, and shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act of 1933 or the Exchange Act, regardless of any general incorporation language in such filings.

Forward-Looking Statements

This document may contain statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Investors are cautioned that any such forward-looking statements are not guarantees of future performance or results and involve risks and uncertainties, and that actual results, developments or events may differ materially from those in the forward-looking statements as a result of various factors, including financial community perceptions of the Company and its business, operations, financial condition and the industries in which it operates, the impact of the COVID-19 pandemic, the potential spin-off of the live entertainment business and the factors described in the Company’s filings with the Securities and Exchange Commission, including the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained therein. The Company disclaims any obligation to update any forward-looking statements contained herein.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

| MADISON SQUARE GARDEN ENTERTAINMENT CORP. |

| (Registrant) |

|

|

| By: |

|

/s/ David F. Byrnes |

| Name: |

|

David F. Byrnes |

| Title: |

|

Executive Vice President and |

|

|

Chief Financial Officer |

Date: February 16, 2023

Exhibit 99.1

MADISON SQUARE GARDEN ENTERTAINMENT CORP. PROVIDES UPDATE ON

PROPOSED SPIN-OFF TRANSACTION

NEW YORK, NY – February 16, 2023 – Madison Square Garden Entertainment Corp. (NYSE: MSGE) today announced that it is continuing to make

progress on the proposed tax-free spin-off of its traditional live entertainment businesses.

The Company (to be renamed MSG Sphere Corp. following the spin-off) has filed a publicly available Form 10

Registration Statement with the U.S. Securities and Exchange Commission (“SEC”) for the new live entertainment company, which would take on the name Madison Square Garden Entertainment Corp. (“MSG Entertainment”). The Company has

also published an investor presentation, available at investor.msgentertainment.com, highlighting the new live entertainment company’s assets and financial profile.

The proposed spin-off would create two distinct companies for shareholders – MSG Entertainment, a pure-play live

entertainment company with a diverse collection of venues in New York and Chicago, the Company’s entertainment and sports bookings business, as well as the Christmas Spectacular Starring the Radio City Rockettes production; and MSG

Sphere Corp., which would be comprised of the Company’s MSG Sphere, MSG Networks and Tao Group Hospitality businesses.

The Company also announced

that James L. Dolan is expected to serve as Executive Chairman and Chief Executive Officer of MSG Entertainment, and remain the Executive Chairman and Chief Executive Officer of MSG Sphere Corp.

Completion of the transaction remains subject to various conditions, including effectiveness of the Form 10 Registration Statement, certain league and other

approvals, receipt of a tax opinion from counsel and final Board approval. Securities of MSG Entertainment may not be sold, nor may offers to buy be accepted, prior to the time the Form 10 becomes effective. This release shall not constitute an

offer to sell or the solicitation of an offer to buy, nor shall there be any sale of the securities of MSG Entertainment in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification

under the securities laws of any such state or jurisdiction.

The Form 10 Registration Statement is filed under the name MSGE Spinco, Inc. (to be

renamed Madison Square Garden Entertainment Corp. following the spin-off).

About Madison Square Garden

Entertainment Corp.

Madison Square Garden Entertainment Corp. is a leader in live entertainment. Madison Square Garden Entertainment

Corp. presents or hosts a broad array of events in its diverse collection of venues: New York’s Madison Square Garden, The Theater at Madison Square Garden, Radio City Music Hall, and Beacon Theatre; and The Chicago Theatre. Madison Square

Garden Entertainment Corp. is also building a new state-of-the-art venue in Las Vegas, MSG Sphere at The Venetian. In addition,

Madison Square Garden Entertainment Corp. features the original production, the Christmas Spectacular Starring the Radio City Rockettes, and delivers a wide range of live sports content and other programming through two regional sports and

entertainment networks, MSG Network and MSG Sportsnet. Also under the Madison

Square Garden Entertainment Corp. umbrella is Tao Group Hospitality, with entertainment dining and nightlife brands including: Tao, Hakkasan, Omnia, Marquee, Lavo, Beauty & Essex, and

Cathédrale. More information is available at www.msgentertainment.com.

Forward-Looking Statements

This press release may contain statements that constitute forward-looking statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Investors are cautioned that any such forward-looking statements are not guarantees of future performance or results and involve risks and uncertainties, and that actual results, developments or events may differ materially from

those in the forward-looking statements as a result of various factors, including financial community perceptions of the Company and its business, operations, financial condition and the industries in which it operates, the impact of the COVID-19 pandemic, the potential spin-off of the live entertainment business and the factors described in the Company’s filings with the Securities and Exchange

Commission, including the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained therein. The Company disclaims any obligation to update any

forward-looking statements contained herein.

# # #

Contact:

Ari Danes, CFA

Senior Vice President, Investor Relations, Financial Communications & Treasury

Madison Square Garden Entertainment Corp.

(212) 465-6072

Justin Blaber

Vice President, Financial Communications

Madison Square Garden

Entertainment Corp.

(212) 465-6109

Grace Kaminer

Senior Director, Investor Relations &

Treasury

Madison Square Garden Entertainment Corp.

(212) 631-5076

Exhibit 99.2 FEBRUARY 2023

SAFE HARBOUR MSGE Spinco, Inc. (to be renamed Madison Square Garden

Entertainment Corp. in connection with the Distribution as defined in the Form 10) (the Company ) has filed with the Securities and Exchange Commission a registration statement on Form 10. The Form 10 contains extensive disclosure about the Company

and its business, including selected historical and pro forma financial information and risk factors that an investor should consider before deciding whether to invest in securities of the Company. This presentation may contain statements that

constitute forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, certain expectations, goals, projections, and benefits. Words or phrases

“expects,” “anticipates,” “believes,” “estimates,” “may,” “will,” “should,” “could,” “potential,” “continue,”

“intends,” “plans,” and similar words and terms used in the discussion of future operating and future financial performance identify forward looking statements. Investors are cautioned that any such forward looking statements

are not guarantees of future performance or results and are subject to known and unknown risks, uncertainties and other factors. Actual results, developments or events may differ materially from those in the forward looking statements as a result of

v arious factors, including, but not limited to, the performance of the Company and its business and operations, its financial condition, factors affecting the industries in which it operates, the impact of the COVID 19 pandemic and the factors

described in the Form 10, including the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained therein. Forward looking statements speak only

as of the date they are made. The Company disclaims any obligation to update or revise any forward-looking statements contained herein, whether written or oral, that may be made from time to time, whether as a result of new information, future

developments or for any other reason, except to the extent required by law. Investors should not place undue reliance on such forward-looking statements and should not regard the inclusion of such statements as representations by the Company that

its plans and objectives will be achieved or realized. Investors are further advised to consult any further disclosures by the Company in its subsequent filings with the Securities and Exchange Commission. 2

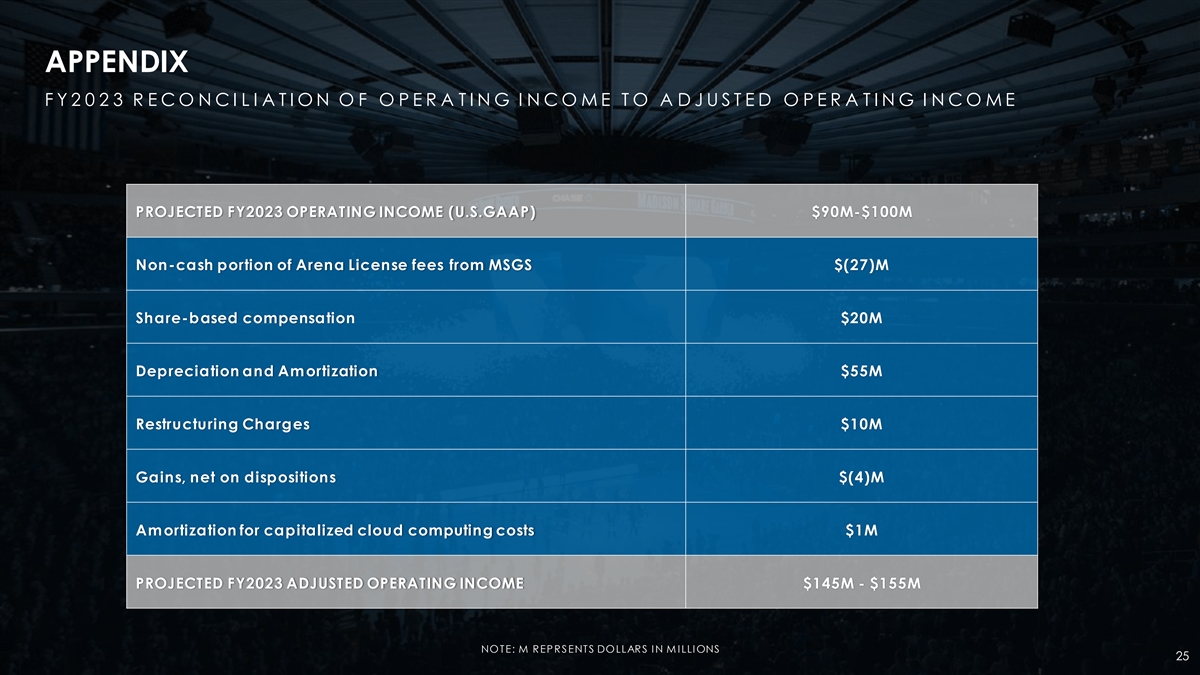

NON-GAAP FINANCIAL MEASURES We define adjusted operating income (loss)

(“AOI”), which is a non-GAAP financial measure, as operating income (loss) excluding (i) the impact of non- cash straight-line leasing revenue associated w ith the Arena License Agreements w ith Madison Square Garden Sports Corp. ( MSG

Sports ), (ii) depreciation, amortization and impairments of property and equipment, goodwill and intangible assets, (iii) amortization for capitalized cloud computing arrangement costs, (iv) share-based compensation expense, (v ) restructuring

charges or credits, (v i) merger and acquisition-related costs, including litigation expenses, (vii) gains or losses on sales or dispositions of businesses and associated settlements, (viii) the impa ct of purchase accounting adjustments related to

business acquisitions, and (ix) gains and losses related to the remeasurement of liabilities under Mad ison Square Garden Entertainment Corp. Executive Deferred Compensation Plan (w hich was established in November 2021). We believe that given the

length of the Arena License Agreements and resulting magnitude of the difference in leasing revenue recognized and cash revenue received, the exc lusion of non-cash leasing revenue provides investors with a clearer picture of the Company's operating

performance. Management believes that th is adjustment is beneficial for other incremental reasons as w ell. This adjustment provides senior management, investors and analysts w ith imp ortant information regarding a long-term related party

agreement with M SG Sports. I n addition, this adjustment is included under the Company's debt covenant compliance calculation and is a component of the performance measures used to evaluate, and compensate senior management of t he Company. We

believe that the exclusion of share-based compensation expense or benefit allows investors to better track the performance of our business without regard to the settlement of an obligation that is not expected to be made in cash. We eliminate merger

and acquisition -related costs, w hen applicable, because the Company does not consider such costs to be indicative of the ongoing operating performance of the Company as they result from an ev ent that is of a non-recurring nature, thereby

enhancing comparability. In addition, management believes that the exclusion of gains and losses related to the remeasurement of liabilities under M SG Entertainment’s Executive Deferred Compensation Plan, w hich were includ ed for the first

time in Fiscal Year 2022, provides investors with a clearer picture of the Company's operating performance given that, in accordance with GAAP, gains and losses related to the remeasurement of liabilities under M SG Entertainment’s Executive

Deferred Compensation Plan are recogni zed in Operating (income) loss whereas gains and losses related to the remeasurement of the assets under M SG Entertainment’s Executive Deferre d Compensation Plan, w hich are equal to and therefore fully

offset the gains and losses related to the remeasurement of liabilities, are recognize d in Other income (expense), net, w hich is not reflected in Operating income (loss). We believe AOI is an appropriate measure for evaluating the operating

performance of the Company on a combined basis. AOI and similar measures w ith similar titles are common performance measures used by inv estors and analysts to analyze our performance. Internally, we use revenues and AOI as the most important

indicators of our business performance, and evaluate management’s effectiveness w ith specific reference to these indicators. AOI should be v iewed as a supplement to and not a substitute for operating income (loss), net income (loss), cash

flows from oper ating activities, and other measures of performance and/or liquidity presented in accordance w ith U .S. generally accepted accounting principles (“GAAP”). Since AOI is not a measure of performance calculated in

accordance with GAAP, this measure may not be comparable to similar measures w ith simila r titles used by other companies. For a reconciliation from Operating I ncome (U .S. GAAP Basis) to AOI please refer to the appendix w ithin this prese

ntation. 3

LEGENDARY ICONIC COMPELLING OPPORTUNITIES BRANDS VENUES 4

TRANSACTION OVERVIEW ◼ 67% spin-off of live entertainment business

to be named Madison Square Garden Entertainment Corp. (NYSE: MSGE) ◼ Current parent company to be renamed MSG Sphere Corp. (NYSE: SPHR) ◼ Separation creates more focused investment profiles as well as enhanced strategic and financial

flexibility for both companies ◼ Spin-off expected to be completed by the end of March 2023 MSG Sphere Corp. 1 33% Retained Stake in the live entertainment company 1 M SG ENTERTAINMENT WILL BE REQU IRED BY APPLICABLE TAX RU LES TO DISPOSE OF

THE RETAINED INTEREST WITHIN A FIXED PERIOD OF TIM E, WHICH MAY 5 OCCU R THROU GH A SERIES OF STEPS INCLUDING SALES, EXCHANGE OFFERS OR PRO RATA DISTRIBU TIONS

KEY INVESTMENT HIGHLIGHTS ENDURING PROFITABLE WORLD-CLASS POPULARITY OF

BUSINESS ENTERTAINMENT POISED FOR CHRISTMAS VENUES SPECTACULAR GROWTH SUBSTANTIAL POTENTIAL FOR PRESENCE IN RETURN OF CAPITAL NEW YORK MARKET OVER TIME 6

OUR PORTFOLIO 7

5 ICONIC VENUES OVER 900 LIVE EVENTS ACROSS NEW YORK AND CHICAGO

PROJECTED IN FISCAL 2023 5+ MILLION GUESTS PROJECTED IN FISCAL 2023 35 YEAR DEALS 89 YEARS TO HOST HOME GAMES FOR OF THE CHRISTMAS SPECTACULAR NEW YORK KNICKS & RANGERS STARRING THE RADIO CITY ROCKETTES 8

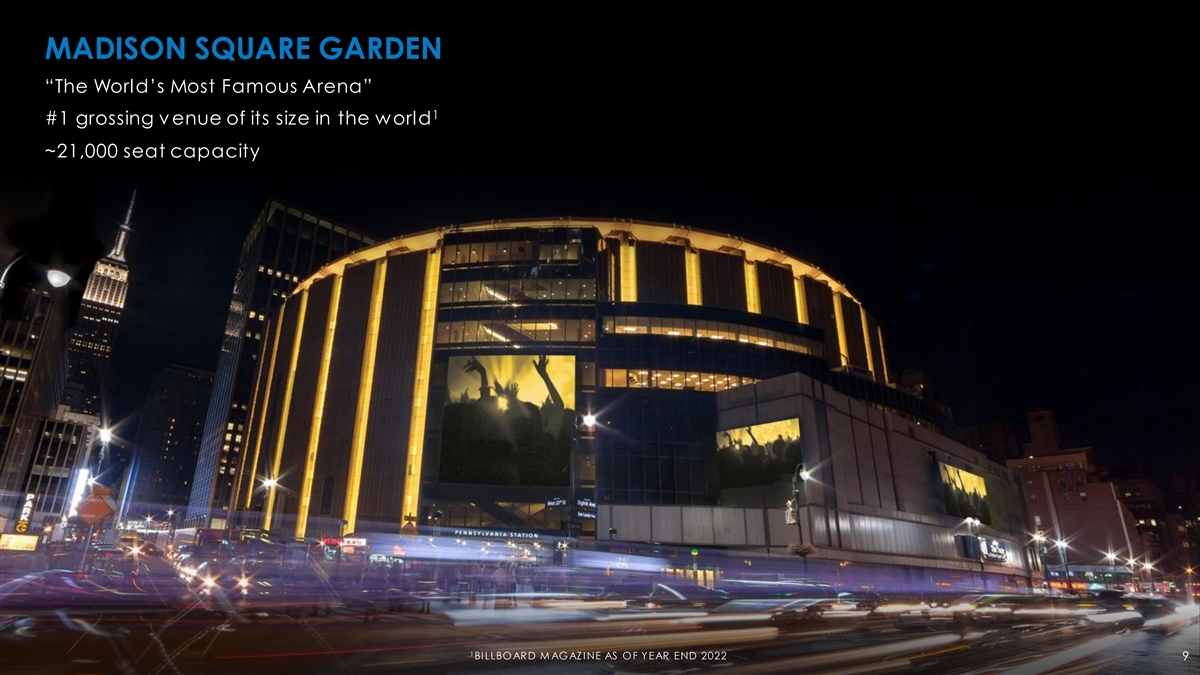

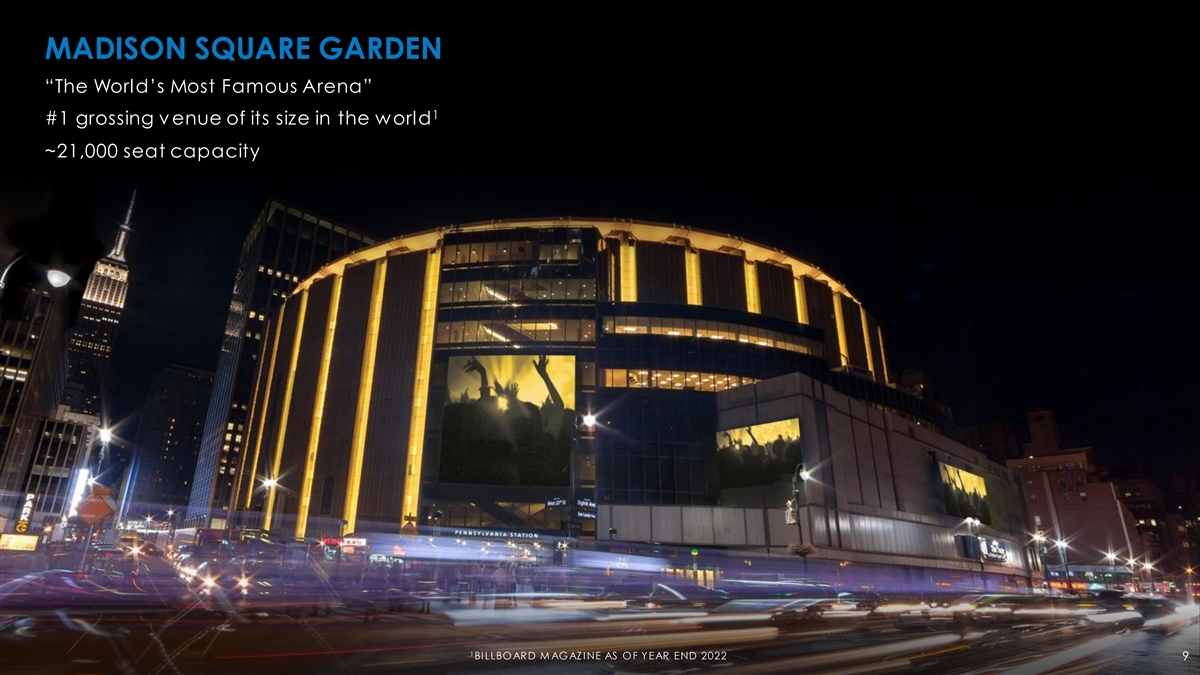

MADISON SQUARE GARDEN “The World’s Most Famous Arena”

1 #1 grossing v enue of its size in the world ~21,000 seat capacity 1 BILLBOARD M AGAZ INE AS OF YEAR END 2022 9

THE THEATER RADIO CITY MUSIC HALL 1 AT MADISON SQUARE GARDEN #3

grossing v enue of its size in the world Intimate env ironment in central New York City location New York City and national landmark ~5,600 seat capacity ~6,000 seat capacity 1 BILLBOARD M AGAZ INE AS OF YEAR END 2022 10

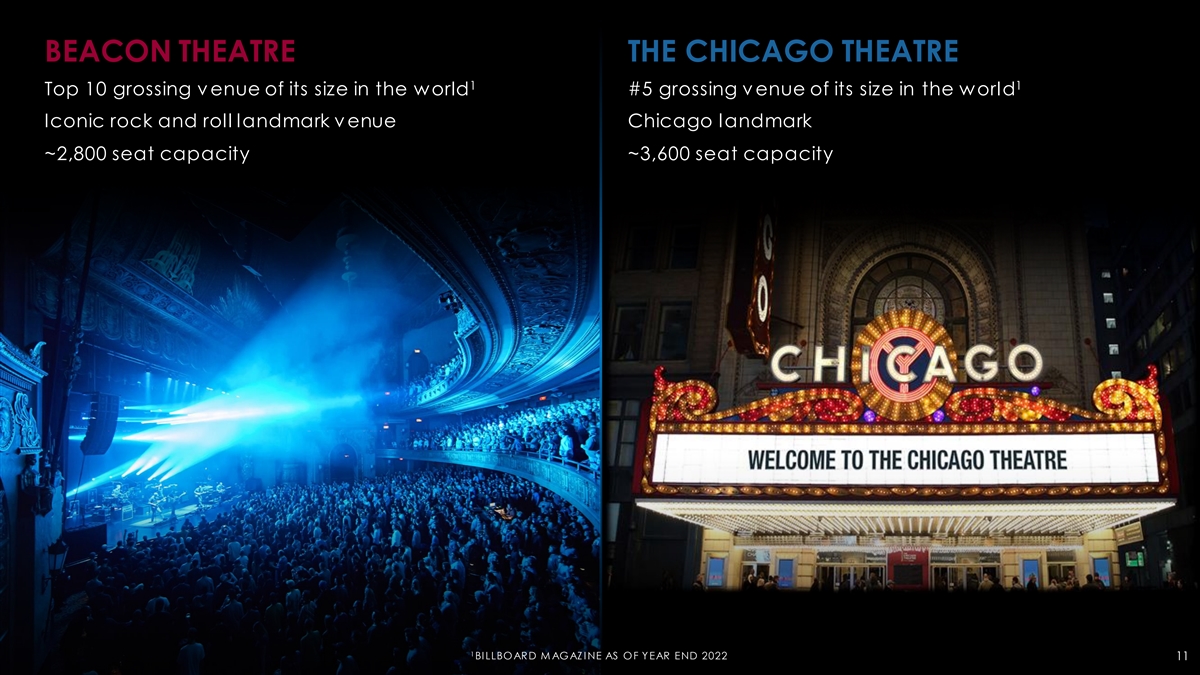

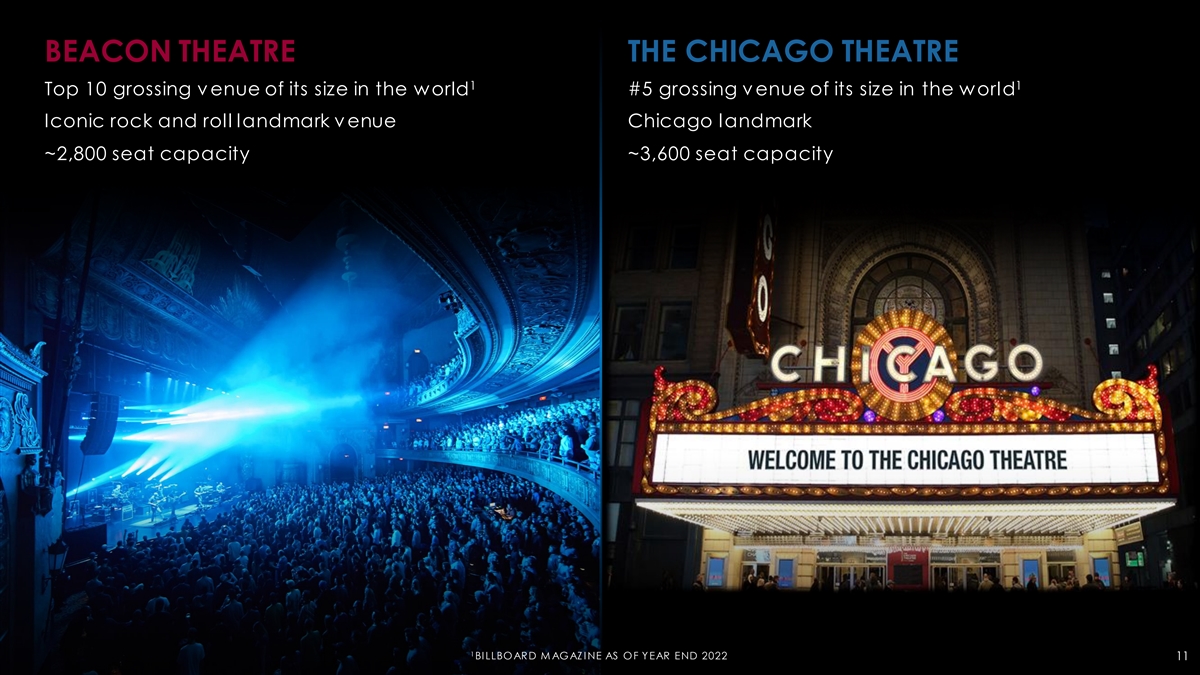

BEACON THEATRE THE CHICAGO THEATRE 1 1 Top 10 grossing v enue of its

size in the world #5 grossing v enue of its size in the world Iconic rock and roll landmark v enue Chicago landmark ~2,800 seat capacity ~3,600 seat capacity 1 BILLBOARD M AGAZ INE AS OF YEAR END 2022 11

CHRISTMAS SPECTACULAR STARRING THE RADIO CITY ROCKETTES Own the Radio

City Rockettes and Christmas Spectacular brands 1 Av eraging 1 million or more people annually 1 AVERAGE ANNU AL VISITATION FROM FISCAL YEAR 2011-2020 AND 2023. FISCAL YEAR 2021 CHRISTMAS SPECTACULAR WAS CANCELLED DU E TO IM PACT OF COVID-19 AND

FISCAL YEAR 2021 PRODU CTION RU N ENDED EARLY DU E TO OM ICRON COVID -19 VARIANT 12

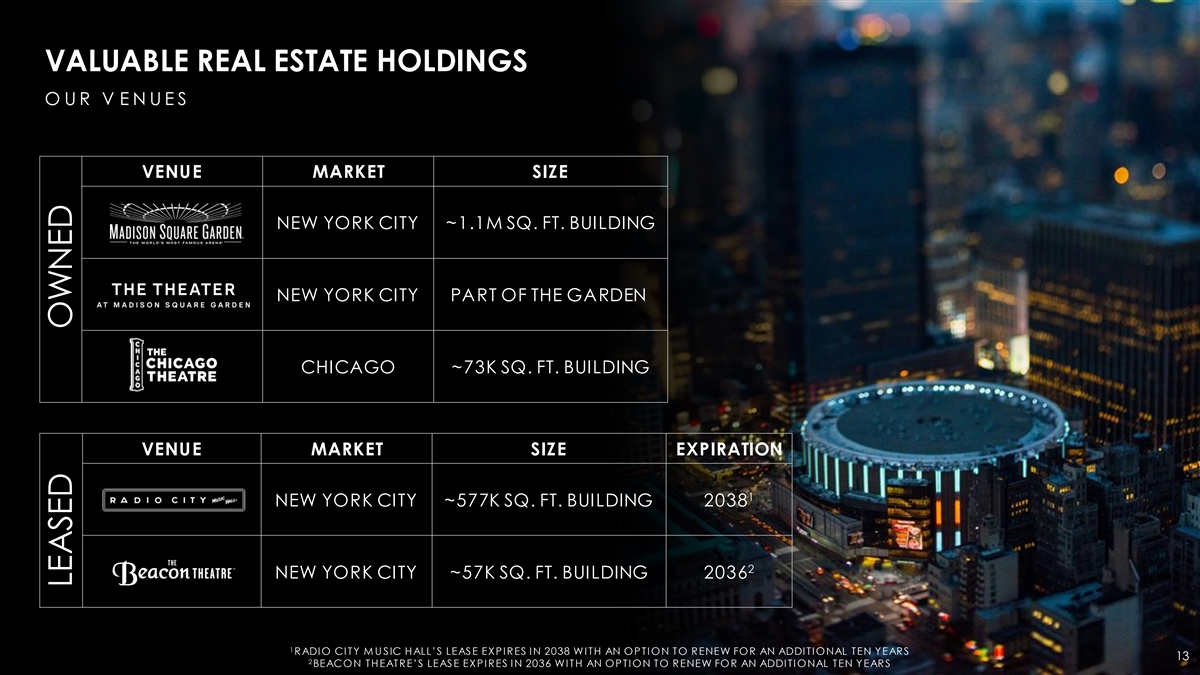

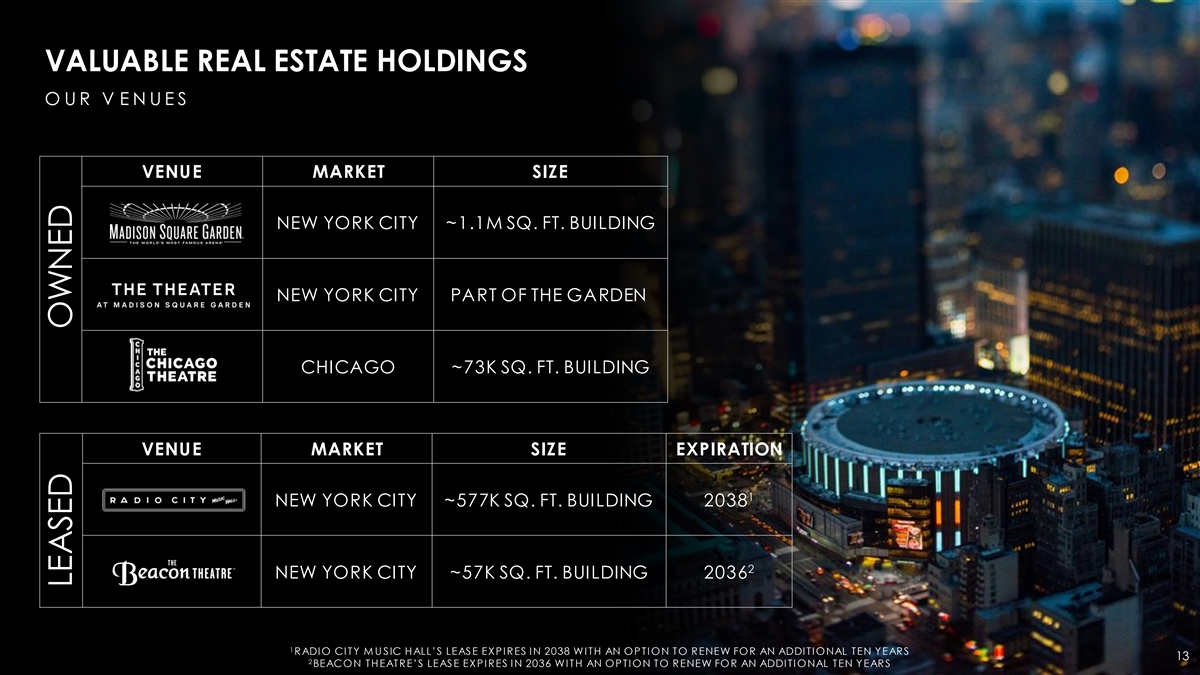

VALUABLE REAL ESTATE HOLDINGS O U R V E N U E S VENUE MARKET SIZE NEW

YORK CITY ~1.1M SQ. FT. BUILDING NEW YORK CITY PART OF THE GARDEN CHICAGO ~73K SQ. FT. BUILDING VENUE MARKET SIZE EXPIRATION 1 NEW YORK CITY ~577K SQ. FT. BUILDING 2038 2 NEW YORK CITY ~57K SQ. FT. BUILDING 2036 1 RADIO CITY M U SIC HALL’S

LEASE EXPIRES IN 2038 WITH AN OPTION TO RENEW FOR AN ADDITIONAL TEN YEARS 13 2 BEACON THEATRE’S LEASE EXPIRES IN 2036 WITH AN OPTION TO RENEW FOR AN ADDITIONAL TEN YEARS LEASED OWNED

OUR BUSINESS 14

SUBSTANTIAL PRESENCE IN NEW YORK CITY METRO AREA T H E E N T E R T A I

N M E N T A N D F I N A N C I A L C A P I T A L O F T H E W O R L D 23 MILLION+ 65 MILLION+ 1 POPULATION ANNUAL TOURISTS 2 PRE-PANDEMIC HOME TO GREATEST # RANKED #1 OF 210 4 3 OF FORTUNE 500 COMPANIES DESIGNATED MARKET AREAS 5 #1 CONCERT AND

ENTERTAINMENT MARKET IN THE WORLD 1 U NITED STATES CENSUS BU REAU 2 2019 NEW YORK CITY TRAVEL & TOU RISM REPORT 3 FORTU NE 500 COM PANIES BY REGION REPORT 2022 4 TRACKED BY NIELSEN RESEARCH 5 15 2023 POLLSTAR CONCERT M ARKET RANKINGS (AS OF

DECEM BER 2022)

ESTABLISHED LEADER IN LIVE U N I Q U E A P P R O A C H D R I V E S B O

O K I N G S U C C E S S OPPORTUNITIES UNMATCHED EXPERIENCES • Grow per-event revenue and • World-class facilities and operations profitability • Lev eraging innov ative technology • Drive repeat visitation ARTIST-FIRST

APPROACH • Talent-friendly v enues and serv ice • Increase venue utilization • Exclusive recurring programming • Exploring new ev ent types ESTABLISHED RELATIONSHIPS • Deep and div erse industry connections •

Improve revenue and engagement across assets • Promoter agnostic • Large and growing proprietary • Enable tailored offerings and cross-promotion customer database 16

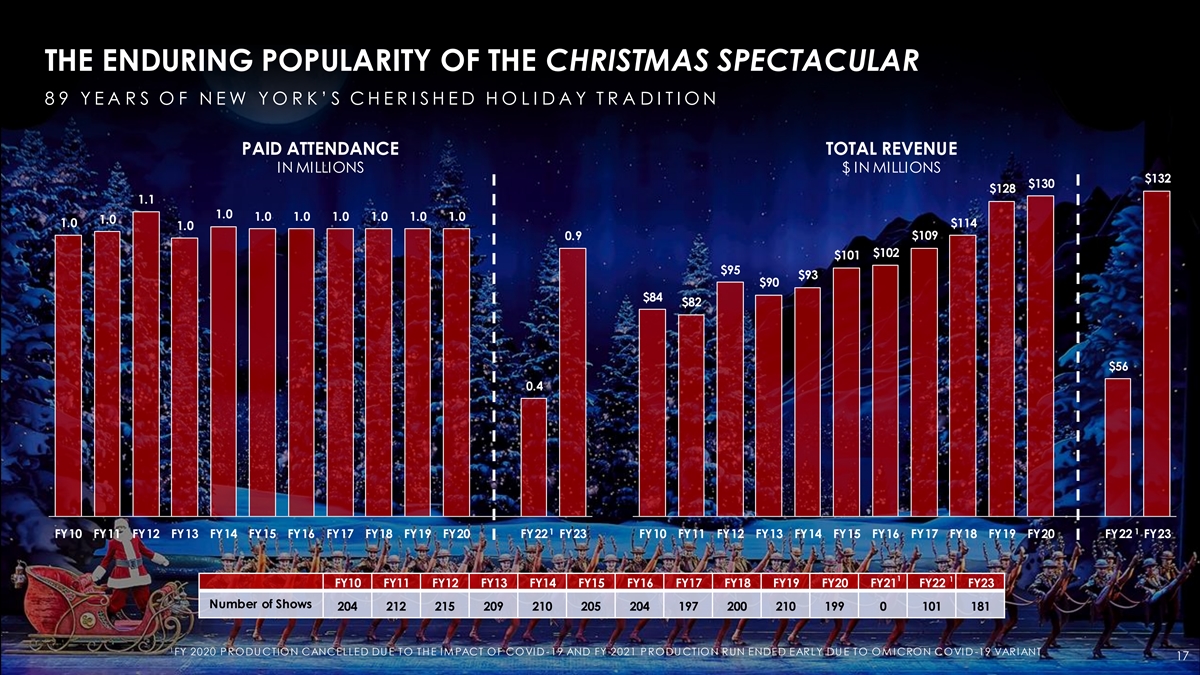

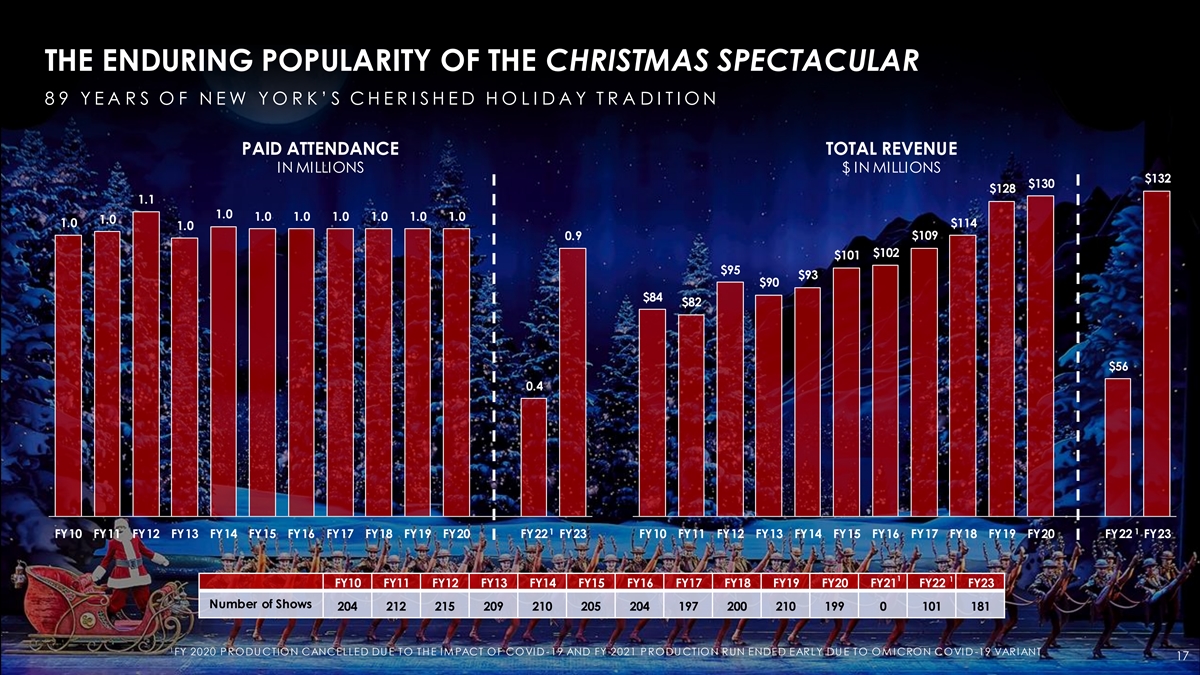

THE ENDURING POPULARITY OF THE CHRISTMAS SPECTACULAR 8 9 Y E A R S O F

N E W Y O R K ’ S C H E R I S H E D H O L I D A Y T R A D I T I O N PAID ATTENDANCE TOTAL REVENUE IN MILLIONS $ IN MILLIONS $132 $130 $128 1.1 1.0 1.0 1.0 1.0 1.0 1.0 1.0 1.0 1.0 $114 1.0 0.9 $109 $102 $101 $95 $93 $90 $84 $82 $56 0.4 1 1 FY10

FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY22 FY23 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY22 FY23 1 1 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23 Number of Shows 204 212 215 209 210 205 204 197

200 210 199 0 101 181 1 FY 2020 PRODU CTION CANCELLED DU E TO THE IM PACT OF COVID -19 AND FY 2021 PRODU CTION RUN ENDED EARLY DU E TO OM ICRON COVID -19 VARIANT 17

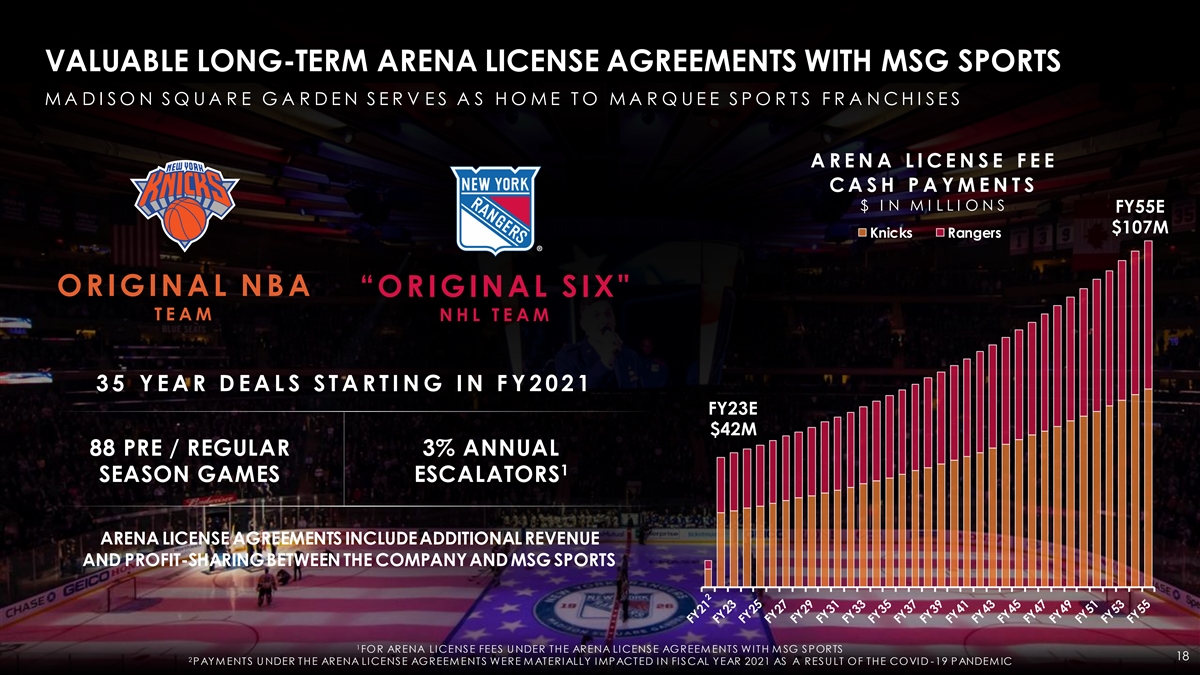

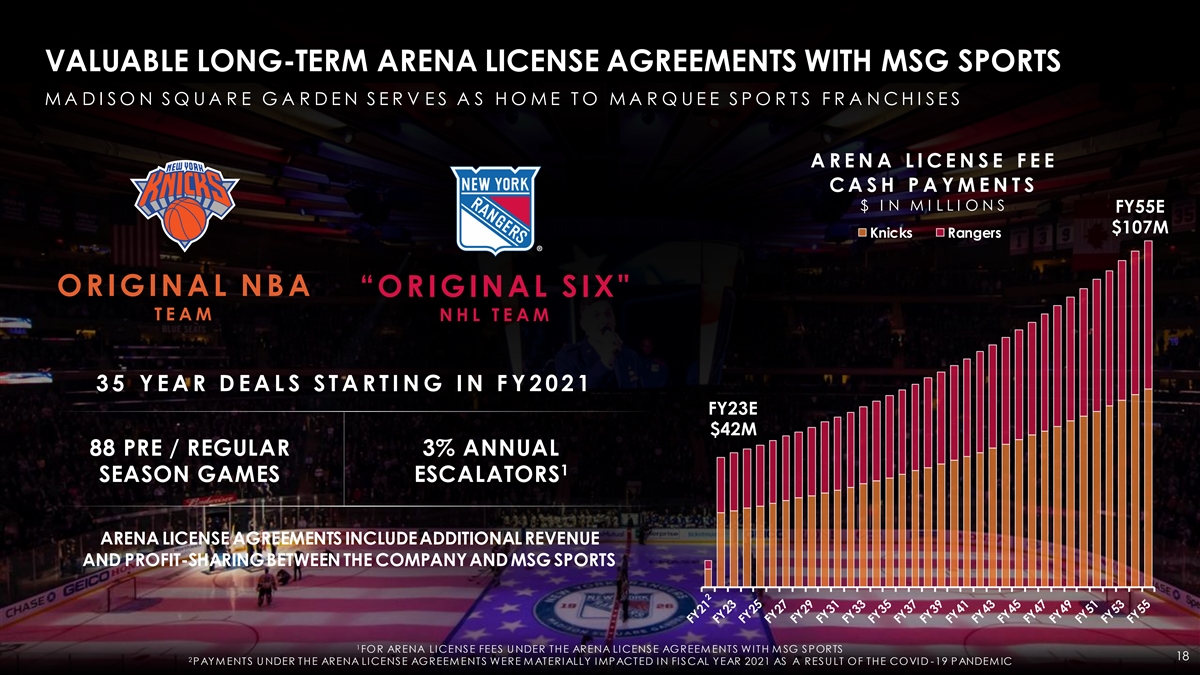

VALUABLE LONG-TERM ARENA LICENSE AGREEMENTS WITH MSG SPORTS M A D I S O

N S Q U A R E G A R D E N S E R V E S A S H O M E T O M A R Q U E E S P O R T S F R A N C H I S E S A R E N A L I C E N S E F E E C A S H P A Y M E N T S $ I N M I L L I O N S FY55E $107M Knicks Rangers ORIGINAL NBA “ORIGINAL SIX T E A M N H L

T E A M 3 5 Y E A R D E A L S S T A R T I N G I N F Y 2 0 2 1 FY23E $42M 88 PRE / REGULAR 3% ANNUAL 1 SEASON GAMES ESCALATORS ARENA LICENSE AGREEMENTS INCLUDE ADDITIONAL REVENUE AND PROFIT-SHARING BETWEEN THE COMPANY AND MSG SPORTS 1 FOR ARENA

LICENSE FEES U NDER THE ARENA LICENSE AGREEM ENTS WITH M SG SPORTS 18 2 PAYM ENTS U NDER THE ARENA LICENSE AGREEM ENTS WERE M ATERIALLY IMPACTED IN FISCAL YEAR 2021 AS A RESU LT OF THE COVID -19 PANDEM IC

STRONG MARKETING PARTNERSHIP TRACK RECORD S P O N S O R S H I P R E L A

T I O N S H I P S D E L I V E R C O M P E L L I N G V A L U E INNOVATIVE MARKETING PARTNERSHIP OFFERINGS • Sought-after entertainment brands • Significant exposure in NYC • Cross-selling opportunities with MSG Sports VALUABLE

MULTI-YEAR PARTNERSHIPS • Signature and Marquee partners represent majority of sponsorship revenue ATTRACTIVE GROWTH OPPORTUNITIES • Utilizing integrated approach to renew existing partners • Targeting emerging and underpenetrated

v erticals • Selectively expanding reach through outdoor signage 19

EXCEPTIONAL HOSPITALITY OFFERINGS D E L I V E R I N G F I R S T - C L A

S S E X P E R I E N C E S 21 58 WIDE ARRAY OF PREMIUM PRODUCTS EVENT LEVEL LEXUS LEVEL SUITES SUITES • Ov er 100 premium hospitality offerings • Range of exclusive private spaces, first-class amenities and premier seating locations PRIME

POSITIONING IN NEW YORK CITY • Primarily licensed to corporate customers 18 CAESARS • Multi-year agreements for v ast majority of suites SPORTSBOOK INFOSYS LEVEL SUITES LOUNGE • Partnership with MSG Sports offers access to premium

liv e sporting ev ents POISED FOR GROWTH • Strength of product and content offerings bolsters ongoing renewal and new sales activity • Plan to explore enhancing and expanding offerings, THE SUITE creating new monetization opportunities

HUB LOFT SIXTEEN 20

FINANCIAL OVERVIEW 21

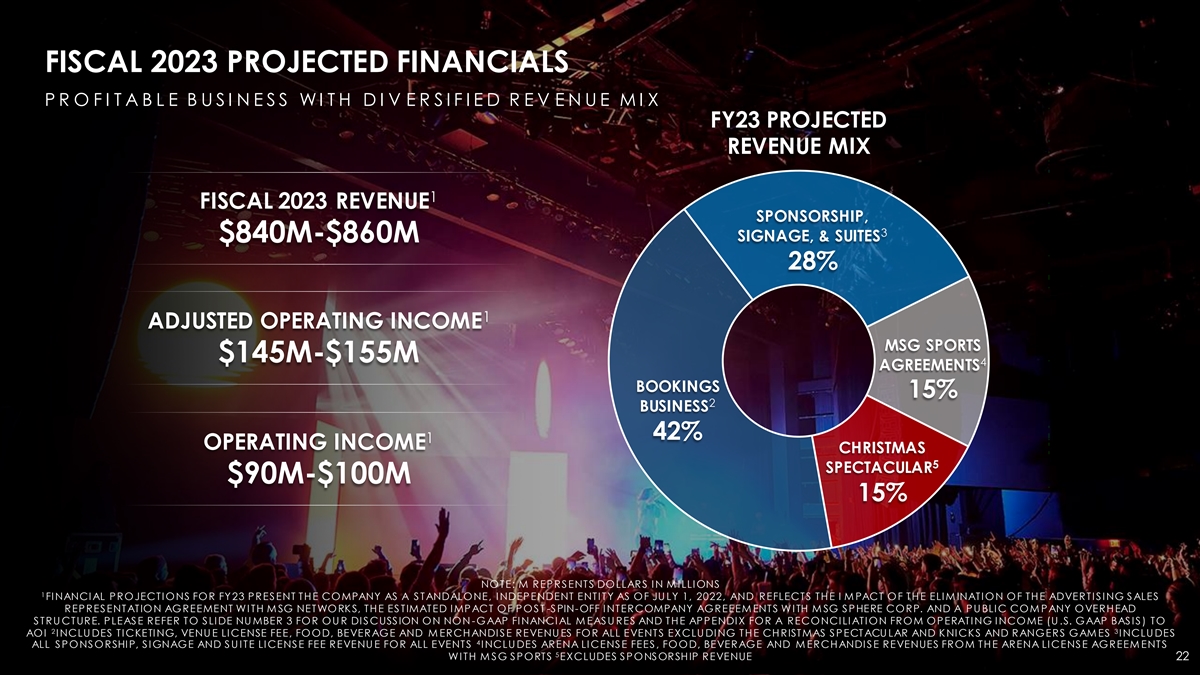

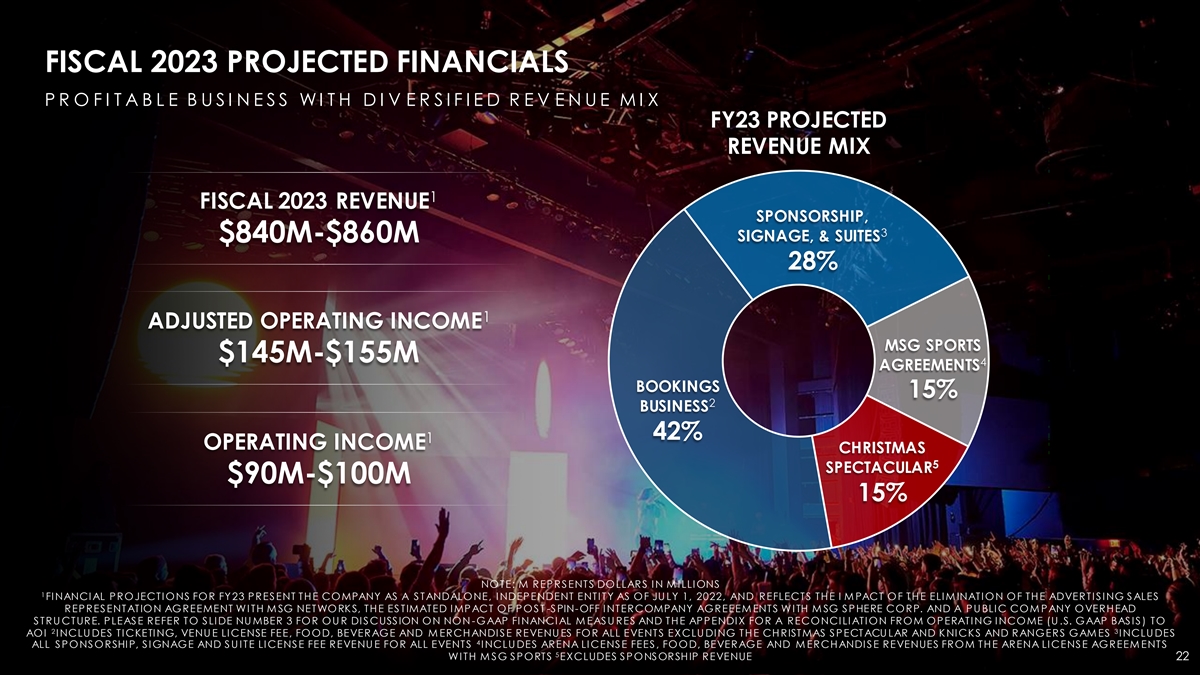

FISCAL 2023 PROJECTED FINANCIALS P R O F I T A B L E B U S I N E S S W

I T H D I V E R S I F I E D R E V E N U E M I X FY23 PROJECTED REVENUE MIX 1 FISCAL 2023 REVENUE SPONSORSHIP, 3 SIGNAGE, & SUITES $840M-$860M 28% 1 ADJUSTED OPERATING INCOME MSG SPORTS $145M-$155M 4 AGREEMENTS BOOKINGS 15% 2 BUSINESS 42% 1

OPERATING INCOME CHRISTMAS 5 SPECTACULAR $90M-$100M 15% NOTE: M REPRSENTS DOLLARS IN M ILLIONS 1 FINANCIAL PROJECTIONS FOR FY23 PRESENT THE COMPANY AS A STANDALONE, INDEPENDENT ENTITY AS OF JU LY 1, 2022, AND REFLECTS THE I M PACT OF THE ELIM

INATION OF THE ADVERTIS ING S ALES REPRESENTATION AGREEMENT WITH M SG NETWORKS, THE ESTIMATED IMPACT OF POST -SPIN-OFF INTERCOMPANY AGREEEM ENTS WITH M SG SPHERE CORP. AND A PU BLIC COM PANY OVERHEAD STRU CTURE. PLEASE REFER TO SLIDE NU MBER 3 FOR

OU R DISCUSSION ON NON -GAAP FINANCIAL M EASU RES AND THE APPENDIX FOR A RECONCILIATION FROM OPERATING INCOME (U .S. GAAP BASIS) TO 2 3 AOI INCLU DES TICKETING, VENU E LICENSE FEE, FOOD, BEVERAGE AND M ERCHANDISE REVENU ES FOR ALL EVENTS EXCLU DING

THE CHRISTMAS SPECTACU LAR AND KNICKS AND RANGERS GAM ES INCLU DES 4 ALL SPONSORSHIP, SIGNAGE AND SU ITE LICENSE FEE REVENU E FOR ALL EVENTS INCLU DES ARENA LICENSE FEES, FOOD, BEVERAGE AND M ERCHANDISE REVENUES FROM THE ARENA LICENSE AGREEM ENTS 5

WITH M SG SPORTS EXCLUDES SPONSORSHIP REVENUE 22

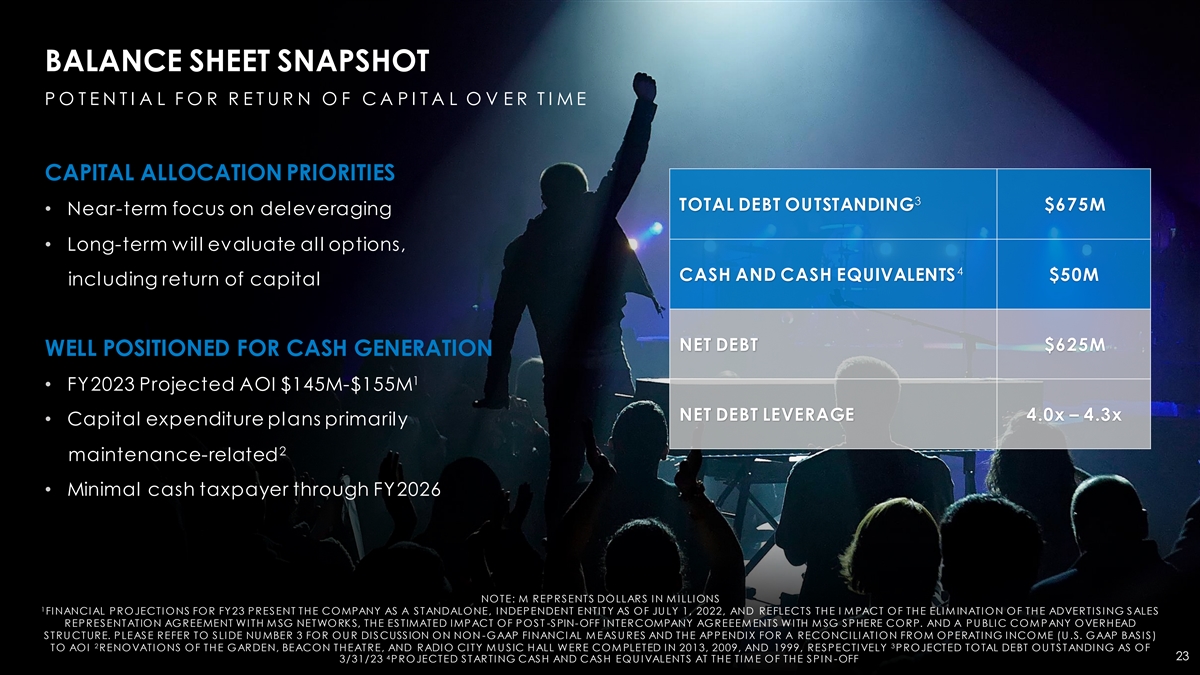

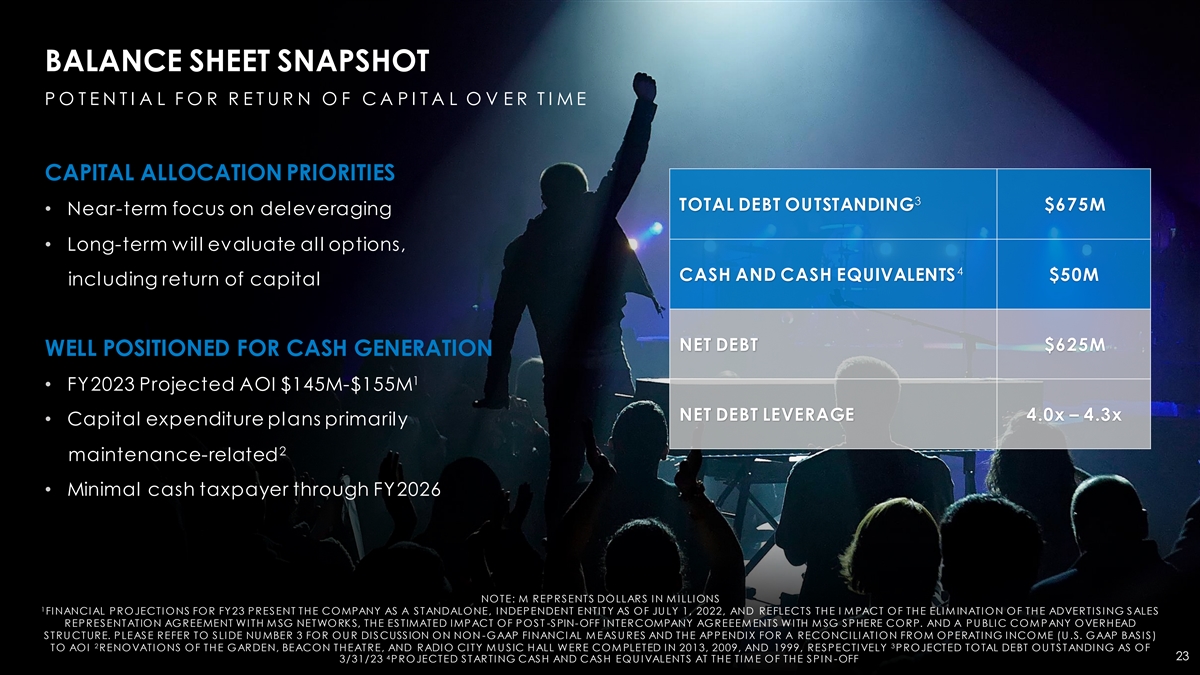

BALANCE SHEET SNAPSHOT P O T E N T I A L F O R R E T U R N O F C A P I

T A L O V E R T I M E CAPITAL ALLOCATION PRIORITIES 3 TOTAL DEBT OUTSTANDING $675M • Near-term focus on deleveraging • Long-term will evaluate all options, 4 CASH AND CASH EQUIVALENTS $50M including return of capital NET DEBT $625M WELL

POSITIONED FOR CASH GENERATION 1 • FY2023 Projected AOI $145M-$155M NET DEBT LEVERAGE 4.0x – 4.3x • Capital expenditure plans primarily 2 maintenance-related • Minimal cash taxpayer through FY2026 NOTE: M REPRSENTS DOLLARS IN

M ILLIONS 1 FINANCIAL PROJECTIONS FOR FY23 PRESENT THE COMPANY AS A STANDALONE, INDEPENDENT ENTITY AS OF JU LY 1, 2022, AND REFLECTS THE I M PACT OF THE ELIM INATION OF THE ADVERTIS ING S ALES REPRESENTATION AGREEMENT WITH M SG NETWORKS, THE

ESTIMATED IMPACT OF POST -SPIN-OFF INTERCOMPANY AGREEEM ENTS WITH M SG SPHERE CORP. AND A PU BLIC COM PANY OVERHEAD STRU CTURE. PLEASE REFER TO SLIDE NU MBER 3 FOR OU R DISCUSSION ON NON -GAAP FINANCIAL M EASU RES AND THE APPENDIX FOR A

RECONCILIATION FROM OPERATING INCOME (U .S. GAAP BASIS) 2 3 TO AOI RENOVATI ONS OF THE GARDEN, BEACON THEATRE, AND RADIO CITY M U SIC HALL WERE COM PLETED IN 2013, 2009, AND 1999, RESPECTIVELY PROJECTED TOTAL DEBT OU TSTANDING AS OF 4 23 3/31/23

PROJECTED STARTING CASH AND CASH EQU IVALENTS AT THE TIM E OF THE SPIN -OFF

APPENDIX 24

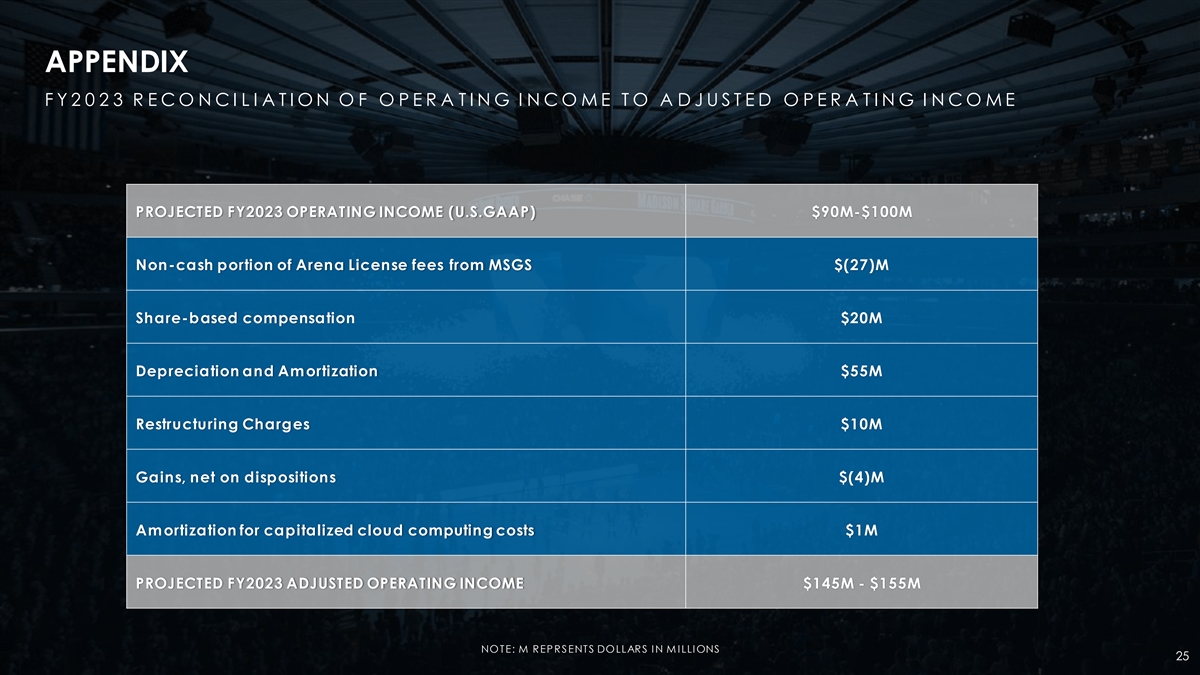

APPENDIX F Y 2 0 2 3 R E C O N C I L I A T I O N O F O P E R A T I N G

I N C O M E T O A D J U S T E D O P E R A T I N G I N C O M E PROJECTED FY2023 OPERATING INCOME (U.S.GAAP) $90M-$100M Non-cash portion of Arena License fees from MSGS $(27)M Share-based compensation $20M Depreciation and Amortization $55M

Restructuring Charges $10M Gains, net on dispositions $(4)M Amortization for capitalized cloud computing costs $1M PROJECTED FY2023 ADJUSTED OPERATING INCOME $145M - $155M NOTE: M REPRSENTS DOLLARS IN M ILLIONS 25

26

v3.22.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

{

"instance": {

"d424259d8k.htm": {

"axisCustom": 0,

"axisStandard": 0,

"baseTaxonomies": {

"http://xbrl.sec.gov/dei/2022": 22

},

"contextCount": 1,

"dts": {

"inline": {

"local": [

"d424259d8k.htm"

]

},

"labelLink": {

"local": [

"msge-20230216_lab.xml"

]

},

"presentationLink": {

"local": [

"msge-20230216_pre.xml"

]

},

"schema": {

"local": [

"msge-20230216.xsd"

],

"remote": [

"http://www.xbrl.org/2003/xbrl-instance-2003-12-31.xsd",

"http://www.xbrl.org/2003/xbrl-linkbase-2003-12-31.xsd",

"http://www.xbrl.org/2003/xl-2003-12-31.xsd",

"http://www.xbrl.org/2003/xlink-2003-12-31.xsd",

"http://www.xbrl.org/2005/xbrldt-2005.xsd",

"http://www.xbrl.org/dtr/type/nonNumeric-2009-12-16.xsd",

"http://www.xbrl.org/dtr/type/numeric-2009-12-16.xsd",

"https://www.xbrl.org/dtr/type/2020-01-21/types.xsd",

"https://xbrl.sec.gov/dei/2022/dei-2022.xsd",

"https://xbrl.sec.gov/naics/2022/naics-2022.xsd"

]

}

},

"elementCount": 23,

"entityCount": 1,

"hidden": {

"http://xbrl.sec.gov/dei/2022": 2,

"total": 2

},

"keyCustom": 0,

"keyStandard": 22,

"memberCustom": 0,

"memberStandard": 0,

"nsprefix": "msge",

"nsuri": "http://www.msgentertainment.com/20230216",

"report": {

"R1": {

"firstAnchor": {

"ancestors": [

"span",

"p",

"div",

"div",

"body",

"html"

],

"baseRef": "d424259d8k.htm",

"contextRef": "duration_2023-02-16_to_2023-02-16",

"decimals": null,

"first": true,

"lang": "en-US",

"name": "dei:DocumentType",

"reportCount": 1,

"unique": true,

"unitRef": null,

"xsiNil": "false"

},

"groupType": "document",

"isDefault": "true",

"longName": "100000 - Document - Document and Entity Information",

"menuCat": "Cover",

"order": "1",

"role": "http://www.msgentertainment.com//20230216/taxonomy/role/DocumentDocumentAndEntityInformation",

"shortName": "Document and Entity Information",

"subGroupType": "",

"uniqueAnchor": {

"ancestors": [

"span",

"p",

"div",

"div",

"body",

"html"

],

"baseRef": "d424259d8k.htm",

"contextRef": "duration_2023-02-16_to_2023-02-16",

"decimals": null,

"first": true,

"lang": "en-US",

"name": "dei:DocumentType",

"reportCount": 1,

"unique": true,

"unitRef": null,

"xsiNil": "false"

}

}

},

"segmentCount": 0,

"tag": {

"dei_AmendmentFlag": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "Boolean flag that is true when the XBRL content amends previously-filed or accepted submission.",

"label": "Amendment Flag",

"terseLabel": "Amendment Flag"

}

}

},

"localname": "AmendmentFlag",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://www.msgentertainment.com//20230216/taxonomy/role/DocumentDocumentAndEntityInformation"

],

"xbrltype": "booleanItemType"

},

"dei_CityAreaCode": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "Area code of city",

"label": "City Area Code",

"terseLabel": "City Area Code"

}

}

},

"localname": "CityAreaCode",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://www.msgentertainment.com//20230216/taxonomy/role/DocumentDocumentAndEntityInformation"

],

"xbrltype": "normalizedStringItemType"

},

"dei_CoverAbstract": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "Cover page.",

"label": "Cover [Abstract]",

"terseLabel": "Cover [Abstract]"

}

}

},

"localname": "CoverAbstract",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"xbrltype": "stringItemType"

},

"dei_DocumentPeriodEndDate": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "For the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.",

"label": "Document Period End Date",

"terseLabel": "Document Period End Date"

}

}

},

"localname": "DocumentPeriodEndDate",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://www.msgentertainment.com//20230216/taxonomy/role/DocumentDocumentAndEntityInformation"

],

"xbrltype": "dateItemType"

},

"dei_DocumentType": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "The type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.",

"label": "Document Type",

"terseLabel": "Document Type"

}

}

},

"localname": "DocumentType",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://www.msgentertainment.com//20230216/taxonomy/role/DocumentDocumentAndEntityInformation"

],

"xbrltype": "submissionTypeItemType"

},

"dei_EntityAddressAddressLine1": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "Address Line 1 such as Attn, Building Name, Street Name",

"label": "Entity Address, Address Line One",

"terseLabel": "Entity Address, Address Line One"

}

}

},

"localname": "EntityAddressAddressLine1",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://www.msgentertainment.com//20230216/taxonomy/role/DocumentDocumentAndEntityInformation"

],

"xbrltype": "normalizedStringItemType"

},

"dei_EntityAddressCityOrTown": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "Name of the City or Town",

"label": "Entity Address, City or Town",

"terseLabel": "Entity Address, City or Town"

}

}

},

"localname": "EntityAddressCityOrTown",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://www.msgentertainment.com//20230216/taxonomy/role/DocumentDocumentAndEntityInformation"

],

"xbrltype": "normalizedStringItemType"

},

"dei_EntityAddressPostalZipCode": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "Code for the postal or zip code",

"label": "Entity Address, Postal Zip Code",

"terseLabel": "Entity Address, Postal Zip Code"

}

}

},

"localname": "EntityAddressPostalZipCode",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://www.msgentertainment.com//20230216/taxonomy/role/DocumentDocumentAndEntityInformation"

],

"xbrltype": "normalizedStringItemType"

},

"dei_EntityAddressStateOrProvince": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "Name of the state or province.",

"label": "Entity Address, State or Province",

"terseLabel": "Entity Address, State or Province"

}

}

},

"localname": "EntityAddressStateOrProvince",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://www.msgentertainment.com//20230216/taxonomy/role/DocumentDocumentAndEntityInformation"

],

"xbrltype": "stateOrProvinceItemType"

},

"dei_EntityCentralIndexKey": {

"auth_ref": [

"r1"

],

"lang": {

"en-us": {

"role": {

"documentation": "A unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK.",

"label": "Entity Central Index Key",

"terseLabel": "Entity Central Index Key"

}

}

},

"localname": "EntityCentralIndexKey",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://www.msgentertainment.com//20230216/taxonomy/role/DocumentDocumentAndEntityInformation"

],

"xbrltype": "centralIndexKeyItemType"

},

"dei_EntityEmergingGrowthCompany": {

"auth_ref": [

"r1"

],

"lang": {

"en-us": {

"role": {

"documentation": "Indicate if registrant meets the emerging growth company criteria.",

"label": "Entity Emerging Growth Company",

"terseLabel": "Entity Emerging Growth Company"

}

}

},

"localname": "EntityEmergingGrowthCompany",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://www.msgentertainment.com//20230216/taxonomy/role/DocumentDocumentAndEntityInformation"

],

"xbrltype": "booleanItemType"

},

"dei_EntityFileNumber": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "Commission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.",

"label": "Entity File Number",

"terseLabel": "Entity File Number"

}

}

},

"localname": "EntityFileNumber",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://www.msgentertainment.com//20230216/taxonomy/role/DocumentDocumentAndEntityInformation"

],

"xbrltype": "fileNumberItemType"

},

"dei_EntityIncorporationStateCountryCode": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "Two-character EDGAR code representing the state or country of incorporation.",

"label": "Entity Incorporation State Country Code",

"terseLabel": "Entity Incorporation State Country Code"

}

}

},

"localname": "EntityIncorporationStateCountryCode",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://www.msgentertainment.com//20230216/taxonomy/role/DocumentDocumentAndEntityInformation"

],

"xbrltype": "edgarStateCountryItemType"

},

"dei_EntityRegistrantName": {

"auth_ref": [

"r1"

],

"lang": {

"en-us": {

"role": {

"documentation": "The exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC.",

"label": "Entity Registrant Name",

"terseLabel": "Entity Registrant Name"

}

}

},

"localname": "EntityRegistrantName",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://www.msgentertainment.com//20230216/taxonomy/role/DocumentDocumentAndEntityInformation"

],

"xbrltype": "normalizedStringItemType"

},

"dei_EntityTaxIdentificationNumber": {

"auth_ref": [

"r1"

],

"lang": {

"en-us": {

"role": {

"documentation": "The Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS.",

"label": "Entity Tax Identification Number",

"terseLabel": "Entity Tax Identification Number"

}

}

},

"localname": "EntityTaxIdentificationNumber",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://www.msgentertainment.com//20230216/taxonomy/role/DocumentDocumentAndEntityInformation"

],

"xbrltype": "employerIdItemType"

},

"dei_LocalPhoneNumber": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "Local phone number for entity.",

"label": "Local Phone Number",

"terseLabel": "Local Phone Number"

}

}

},

"localname": "LocalPhoneNumber",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://www.msgentertainment.com//20230216/taxonomy/role/DocumentDocumentAndEntityInformation"

],

"xbrltype": "normalizedStringItemType"

},

"dei_PreCommencementIssuerTenderOffer": {

"auth_ref": [

"r3"

],

"lang": {

"en-us": {

"role": {

"documentation": "Boolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act.",

"label": "Pre Commencement Issuer Tender Offer",

"terseLabel": "Pre Commencement Issuer Tender Offer"

}

}

},

"localname": "PreCommencementIssuerTenderOffer",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://www.msgentertainment.com//20230216/taxonomy/role/DocumentDocumentAndEntityInformation"

],

"xbrltype": "booleanItemType"

},

"dei_PreCommencementTenderOffer": {

"auth_ref": [

"r4"

],

"lang": {

"en-us": {

"role": {

"documentation": "Boolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act.",

"label": "Pre Commencement Tender Offer",

"terseLabel": "Pre Commencement Tender Offer"

}

}

},

"localname": "PreCommencementTenderOffer",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://www.msgentertainment.com//20230216/taxonomy/role/DocumentDocumentAndEntityInformation"

],

"xbrltype": "booleanItemType"

},

"dei_Security12bTitle": {

"auth_ref": [

"r0"

],

"lang": {

"en-us": {

"role": {

"documentation": "Title of a 12(b) registered security.",

"label": "Security 12b Title",

"terseLabel": "Security 12b Title"

}

}

},

"localname": "Security12bTitle",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://www.msgentertainment.com//20230216/taxonomy/role/DocumentDocumentAndEntityInformation"

],

"xbrltype": "securityTitleItemType"

},

"dei_SecurityExchangeName": {

"auth_ref": [

"r2"

],

"lang": {

"en-us": {

"role": {

"documentation": "Name of the Exchange on which a security is registered.",

"label": "Security Exchange Name",

"terseLabel": "Security Exchange Name"

}

}

},

"localname": "SecurityExchangeName",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://www.msgentertainment.com//20230216/taxonomy/role/DocumentDocumentAndEntityInformation"

],

"xbrltype": "edgarExchangeCodeItemType"

},

"dei_SolicitingMaterial": {

"auth_ref": [

"r5"

],

"lang": {

"en-us": {

"role": {

"documentation": "Boolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act.",

"label": "Soliciting Material",

"terseLabel": "Soliciting Material"

}

}

},

"localname": "SolicitingMaterial",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://www.msgentertainment.com//20230216/taxonomy/role/DocumentDocumentAndEntityInformation"

],

"xbrltype": "booleanItemType"

},

"dei_TradingSymbol": {

"auth_ref": [],

"lang": {

"en-us": {

"role": {

"documentation": "Trading symbol of an instrument as listed on an exchange.",

"label": "Trading Symbol",

"terseLabel": "Trading Symbol"

}

}

},

"localname": "TradingSymbol",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://www.msgentertainment.com//20230216/taxonomy/role/DocumentDocumentAndEntityInformation"

],

"xbrltype": "tradingSymbolItemType"

},

"dei_WrittenCommunications": {

"auth_ref": [

"r6"

],

"lang": {

"en-us": {

"role": {

"documentation": "Boolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act.",

"label": "Written Communications",

"terseLabel": "Written Communications"

}

}

},

"localname": "WrittenCommunications",

"nsuri": "http://xbrl.sec.gov/dei/2022",

"presentation": [

"http://www.msgentertainment.com//20230216/taxonomy/role/DocumentDocumentAndEntityInformation"

],

"xbrltype": "booleanItemType"

}

},

"unitCount": 0

}

},

"std_ref": {

"r0": {

"Name": "Exchange Act",

"Number": "240",

"Publisher": "SEC",

"Section": "12",

"Subsection": "b",

"role": "http://www.xbrl.org/2003/role/presentationRef"

},

"r1": {

"Name": "Exchange Act",

"Number": "240",

"Publisher": "SEC",

"Section": "12",

"Subsection": "b-2",

"role": "http://www.xbrl.org/2003/role/presentationRef"

},

"r2": {

"Name": "Exchange Act",

"Number": "240",

"Publisher": "SEC",

"Section": "12",

"Subsection": "d1-1",

"role": "http://www.xbrl.org/2003/role/presentationRef"

},

"r3": {

"Name": "Exchange Act",

"Number": "240",

"Publisher": "SEC",

"Section": "13e",

"Subsection": "4c",

"role": "http://www.xbrl.org/2003/role/presentationRef"

},

"r4": {

"Name": "Exchange Act",

"Number": "240",

"Publisher": "SEC",

"Section": "14d",

"Subsection": "2b",

"role": "http://www.xbrl.org/2003/role/presentationRef"

},

"r5": {

"Name": "Exchange Act",

"Number": "240",

"Publisher": "SEC",

"Section": "14a",

"Subsection": "12",

"role": "http://www.xbrl.org/2003/role/presentationRef"

},

"r6": {

"Name": "Securities Act",

"Number": "230",

"Publisher": "SEC",

"Section": "425",

"role": "http://www.xbrl.org/2003/role/presentationRef"

}

},

"version": "2.2"

}