SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 20-F

| (Mark One) | |

| Registration statement pursuant to Section 12 (b) or 12(g) of the Securities Exchange Act of 1934 | |

| or | |

| Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |

| For the financial year ended: 31 December 2004 | |

| or | |

| Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |

| For the transition period from: __________ to __________ | |

| Commission file number: 1-10533 | Commission file number: 0-20122 |

| Rio Tinto plc | Rio Tinto Limited |

| ABN 96 004 458 404 | |

| (Exact name of Registrant as specified in its charter) | (Exact name of Registrant as specified in its charter) |

| England and Wales | Victoria, Australia |

| (Jurisdiction of incorporation or organisation) | (Jurisdiction of incorporation or organisation) |

| 6 St James’s Square | Level 33, 55 Collins Street |

| London, SW1Y 4LD, England | Melbourne, Victoria 3001, Australia |

| (Address of principal executive offices) | (Address of principal executive offices) |

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange | Name of each exchange | Title of each class |

| on which registered | on which registered | ||

| American Depositary | New York | None | |

| Shares* | Stock Exchange | ||

| Ordinary Shares of 10p | New York | ||

| each** | Stock Exchange |

| * | Evidenced by American Depository Receipts. Each American Depository Share Represents four Rio Tinto plc Ordinary Shares of 10p each. |

| ** | Not for trading, but only in connection with the listing of American Depositary Shares, pursuant to the requirements of the Securities and Exchange Commission |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

| Title of each class | Title of each class |

| None | American Depositary Shares*** |

| Ordinary Shares |

| *** | Evidenced by American Depository Receipts. Each American Depository Share represents four Rio Tinto Limited Ordinary Shares. |

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

| None | None |

Indicate

the number of outstanding shares of each of the Issuer’s classes of

capital or common stock as of the close of

the period covered by the annual

report:

| Title of each class | Number | Number | Title of each class |

| Ordinary Shares of 10p each | 1,066,674,301 | 499,058,420 | Shares |

| DLC Dividend Share of 10p | 1 | 1 | DLC Dividend Share |

| Special Voting Share of 10p | 1 | 1 | Special Voting Share |

Indicate

by check mark whether the Registrants (1) have filed all reports required

to

be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during

the preceding 12 months (or for such shorter period that the registrants

were required to file such reports), and

(2) have been

subject to such filing requirements for the past 90 days:

Yes ![]() No

No ![]()

Indicate by check mark which financial statement item the Registrants have elected to follow:

Item 17 ![]() Item

18

Item

18 ![]()

EXPLANATORY NOTE

The Rio Tinto Group is a leading international mining group, combining

Rio Tinto plc and Rio Tinto Limited in a dual listed companies (‘DLC’)

merger that has created a single economic enterprise, nevertheless both companies

remain separate legal entities with separate share listings and registrars, and

with separate ADR programmes.

Rio Tinto plc and Rio Tinto Limited prepare annual reports and financial statements for the combined group that are presented to their shareholders as their consolidated accounts in accordance with both United Kingdom and Australian legislation and regulations. The current such document is the 2004 Annual report and financial statements. They also prepare their annual reports on Form 20-F,that are filed with the SEC in accordance with United States legislation and regulations, as a combined document.

Rio Tinto 2004 Form 20-F 2

CONTENTS

Rio Tinto 2004 Form 20-F 3

RIO TINTO

PART I

Item 1. Identity

of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer

Statistics

and Expected Timetable

Not applicable.

Rio Tinto 2004 Form 20-F 4

Item 3. Key Information

SELECTED FINANCIAL DATA FOR THE RIO TINTO GROUP for the period 2000 to 2004

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

Rio Tinto 2004 Form 20-F 5

The following selected consolidated financial data has been derived from the consolidated financial statements of the Rio Tinto Group and of the Rio Tinto plc and Rio Tinto Limited parts of the Group presented elsewhere herein, restated where appropriate to accord with the current accounting policies and presentations. The selected consolidated financial data should be read in conjunction with, and qualified in their entirety by reference to, the consolidated financial statements and notes thereto included elsewhere in this annual report on Form 20-F.

The consolidated financial statements are prepared

in accordance with UK GAAP, which differs in certain respects from US GAAP. Details

of the principal differences between UK GAAP and US GAAP are set out in note

42 on pages A-65 to A-84.

RIO TINTO GROUP

| Income Statement Data | ||||||||||

| For the years ending 31 December | 2000 | 2001 | 2002 | 2003 | 2004 | |||||

| Amounts in accordance with UK GAAP | ||||||||||

| (US$ millions) | ||||||||||

| Consolidated turnover (f) | 8,081 | 8,343 | 8,715 | 9,568 | 11,799 | |||||

| Group operating profit (a) | 2,188 | 1,562 | 831 | 1,496 | 1,722 | |||||

| Net earnings (a) | 1,507 | 1,079 | 651 | 1,508 | 2,813 | |||||

| Group operating profit per share (US cents) | 159.4 | 113.6 | 60.3 | 108.6 | 124.9 | |||||

| Earnings per share (US cents) | 109.8 | 78.5 | 47.3 | 109.5 | 204.0 | |||||

| Diluted earnings per share (US cents) | 109.7 | 78.3 | 47.2 | 109.3 | 203.6 | |||||

| Dividends per share (US cents) (b) | 57.5 | 59.0 | 60.0 | 64.0 | 77.0 | |||||

| Dividends per share (pence) (b) | 38.87 | 41.68 | 37.47 | 37.13 | 41.48 | |||||

| Dividends per share (Australian cents) (b) | 102.44 | 115.27 | 105.93 | 89.70 | 103.82 | |||||

| Weighted average number of shares (millions) (b) | 1,373 | 1,375 | 1,377 | 1,378 | 1,379 | |||||

| Amounts in accordance with US GAAP | ||||||||||

| (US$ millions) | ||||||||||

| Consolidated turnover (c) (f) | 8,065 | 8,348 | 8,719 | 9,545 | 11,814 | |||||

| Group operating profit | 1,948 | 1,821 | 746 | 1,041 | 1,442 | |||||

| Net earnings | 1,174 | 1,038 | 581 | 1,977 | 2,823 | |||||

| Group operating profit per share (US cents) | 141.9 | 132.4 | 54.2 | 75.5 | 104.6 | |||||

| Earnings per share (US cents) | 85.5 | 75.5 | 42.2 | 143.5 | 204.7 | |||||

| Diluted earnings per share (US cents) | 85.4 | 75.4 | 42.1 | 143.3 | 204.4 | |||||

| Balance Sheet Data | ||||||||||

| at 31 December | 2000 | 2001 | 2002 | 2003 | 2004 | |||||

| Amounts in accordance with UK GAAP | ||||||||||

| (US$ millions) | ||||||||||

| Total assets | 19,367 | 19,540 | 20,204 | 24,081 | 25,711 | |||||

| Share capital / premium | 2,535 | 2,486 | 2,580 | 2,869 | 2,938 | |||||

| Shareholders' funds (net assets) | 7,211 | 7,043 | 7,462 | 10,037 | 12,584 | |||||

| Amounts in accordance with US GAAP | ||||||||||

| (US$ millions) | ||||||||||

| Total assets | 21,530 | 22,102 | 22,600 | 26,959 | 28,938 | |||||

| Share capital / premium | 2,535 | 2,486 | 2,580 | 2,869 | 2,938 | |||||

| Shareholders' funds (net assets) | 9,812 | 9,571 | 9,517 | 12,044 | 14,462 |

Rio Tinto 2004 Form 20-F 6

RIO TINTO PLC - PART OF RIO TINTO GROUP

| Income Statement Data | ||||||||||

| for the years ending 31 December | 2000 | 2001 | 2002 | 2003 | 2004 | |||||

| Amounts in accordance with UK GAAP | ||||||||||

| (US$ millions) | ||||||||||

| Consolidated turnover (f) | 4,045 | 3,769 | 3,993 | 4,092 | 5,275 | |||||

| Group operating profit (a) | 915 | 137 | (19 | ) | 368 | 289 | ||||

| Net earnings (a) | 1,064 | 491 | 195 | 956 | 2,073 | |||||

| Group operating profit per share (US cents) | 86.0 | 12.9 | (1.8 | ) | 34.5 | 27.1 | ||||

| Earnings per share (US cents) | 100.1 | 46.1 | 18.3 | 89.7 | 194.2 | |||||

| Diluted earnings per share (US cents) | 100.0 | 46.0 | 18.3 | 89.5 | 193.9 | |||||

| Dividends per share (US cents) (b) | 57.5 | 59.0 | 60.0 | 64.0 | 77.0 | |||||

| Dividends per share (pence) (b) | 38.87 | 41.68 | 37.47 | 37.13 | 41.48 | |||||

| Weighted average number of shares (millions) (b) | 1,063 | 1,064 | 1,065 | 1,066 | 1,067 | |||||

| Amounts in accordance with US GAAP | ||||||||||

| (US$ millions) | ||||||||||

| Consolidated turnover (c) (f) | 4,034 | 3,783 | 3,993 | 4,072 | 5,298 | |||||

| Group operating profit | 747 | 548 | (481 | ) | (7 | ) | 162 | |||

| Net earnings | 820 | 618 | (206 | ) | 949 | 2,010 | ||||

| Group operating profit per share (US cents) | 70.2 | 51.5 | (45.2 | ) | (0.7 | ) | 15.2 | |||

| Earnings per share (US cents) | 77.1 | 58.1 | (19.3 | ) | 89.0 | 188.3 | ||||

| Diluted earnings per share (US cents) | 77.1 | 58.0 | (19.3 | ) | 88.9 | 188.0 | ||||

| BALANCE SHEET DATA | ||||||||||

| AT 31 DECEMBER | 2000 | 2001 | 2002 | 2003 | 2004 | |||||

| Amounts in accordance with UK GAAP | ||||||||||

| (US$ millions) | ||||||||||

| Total assets | 11,948 | 11,921 | 12,606 | 13,708 | 15,516 | |||||

| Share capital / premium | 1,741 | 1,754 | 1,764 | 1,784 | 1,805 | |||||

| Shareholders’ funds (net assets) | 6,325 | 5,902 | 5,899 | 7,343 | 9,139 | |||||

| Amounts in accordance with US GAAP | ||||||||||

| (US$ millions) | ||||||||||

| Total assets | 13,557 | 13,735 | 13,941 | 15,180 | 17,375 | |||||

| Share capital / premium | 1,741 | 1,754 | 1,764 | 1,784 | 1,805 | |||||

| Shareholders’ funds (net assets) | 8,693 | 8,371 | 7,697 | 8,931 | 10,560 |

Rio Tinto 2004 Form 20-F 7

RIO TINTO LIMITED - PART OF RIO TINTO GROUP

| Income Statement Data | ||||||||||

| for the years ending 31 December | 2000 | 2001 | 2002 | 2003 | 2004 | |||||

| Amounts in accordance with UK GAAP | ||||||||||

| (US$ millions) | ||||||||||

| Consolidated turnover (f) | 4,036 | 4,574 | 4,722 | 5,476 | 6,524 | |||||

| Group operating profit (a) | 1,273 | 1,425 | 855 | 1,128 | 1,433 | |||||

| Net earnings (a) | 771 | 942 | 736 | 884 | 1,185 | |||||

| Group operating profit per share (US cents) | 235.7 | 286.1 | 171.3 | 226.1 | 287.2 | |||||

| Earnings per share (US cents) | 142.8 | 189.0 | 147.6 | 177.2 | 237.4 | |||||

| Diluted earnings per share (US cents) | 142.7 | 188.9 | 147.4 | 176.9 | 236.9 | |||||

| Dividends per share (US cents) (b) | 57.5 | 59.0 | 60.0 | 64.0 | 77.0 | |||||

| Dividends per share (Australian cents) (b) | 102.44 | 115.27 | 105.93 | 89.70 | 103.82 | |||||

| Weighted average number of shares (millions) (b) | 540 | 498 | 499 | 499 | 499 | |||||

| Amounts in accordance with US GAAP | ||||||||||

| (US$ millions) | ||||||||||

| Consolidated turnover (c) (f) | 4,027 | 4,575 | 4,726 | 5,473 | 6,516 | |||||

| Group operating profit | 1,201 | 1,273 | 1,231 | 1,048 | 1,280 | |||||

| Net earnings | 614 | 671 | 1,267 | 1,647 | 1,301 | |||||

| Group operating profit per share (US cents) | 222.4 | 255.6 | 246.7 | 210.0 | 256.5 | |||||

| Earnings per share (US cents) | 113.9 | 134.6 | 254.0 | 330.1 | 260.6 | |||||

| Diluted earnings per share (US cents) | 113.9 | 134.5 | 253.7 | 330.0 | 260.1 | |||||

| BALANCE SHEET DATA | ||||||||||

| AT 31 DECEMBER | 2000 | 2001 | 2002 | 2003 | 2004 | |||||

| Amounts in accordance with UK GAAP | ||||||||||

| (US$ millions) | ||||||||||

| Total assets | 9,542 | 9,977 | 10,382 | 13,542 | 15,316 | |||||

| Share capital / premium | 939 | 865 | 964 | 1,280 | 1,336 | |||||

| Shareholders' funds (net assets) | 1,420 | 1,828 | 2,510 | 4,324 | 5,515 | |||||

| Amounts in accordance with US GAAP | ||||||||||

| (US$ millions) | ||||||||||

| Total assets | 10,236 | 10,770 | 11,609 | 15,234 | 16,964 | |||||

| Share capital / premium | 939 | 865 | 964 | 1,280 | 1,336 | |||||

| Shareholders' funds (net assets) | 1,795 | 1,920 | 2,922 | 4,996 | 6,247 |

| (a) | In 2004 Rio Tinto Group operating

profit under UK GAAP is stated after charging US$558 million for certain

asset write downs and provisions for contract obligations which relate

to Rio Tinto plc. In 2004, net earnings for the Rio Tinto Group include

net write downs and provisions for contract obligations of US$321 million

relating to Rio Tinto plc. In addition the Group’s net earnings for

2004 include exceptional gains of US$913 million arising on the sale of

certain operations of which US$827 million relate to Rio Tinto plc and

US$137 million relate to Rio Tinto Limited. In 2003 Rio Tinto Group net earnings under UK GAAP are stated after exceptional gains totalling US$126 million which arose on the sale of certain operations by Rio Tinto Limited. In 2002 Rio Tinto Group operating profit under UK GAAP is stated after charging US$962 million for asset write downs, of which US$529 million relates to Rio Tinto plc and US$433 million relates to Rio Tinto Limited. In addition, group operating profit for 2002 includes US$116 million for environmental remediation charges which all relate to Rio Tinto plc. In 2002 net earnings for the Rio Tinto Group include US$763 million for asset write downs of which US$623 million relates to Rio Tinto plc and US$225 million relates to Rio Tinto Limited. In addition the Group’s net earnings for 2002 include US$116 million for environmental remediation charges which all relate to Rio Tinto plc. In 2001 Rio Tinto Group operating profit under UK GAAP is stated after charging US$715 million for exceptional asset write downs, of which US$644 million relates to Rio Tinto plc and US$71 million relates to Rio Tinto Limited. In 2001 Rio Tinto Group net earnings under UK GAAP are after charges of US$583 million for asset write downs of which US$551 million relates to Rio Tinto plc and US$52 million relates to Rio Tinto Limited. Under UK GAAP asset write downs and the environmental remediation charges are classified as ‘exceptional' but none of these items would be classified as ‘extraordinary’ items under US GAAP. |

| (b) | These figures are the same under both UK and US GAAP. |

| (c) | A cumulative adjustment was made in 2000 to reflect the application of Staff Accounting Bulletin No. 104 (‘SAB104’) Revenue recognition in financial statements. The effect of SAB 104 is described on page A-70. |

| (d) | The results for all years relate wholly to continuing operations. |

| (e) | The decrease in Rio Tinto Limited shareholders’ funds in 2000 reflects the buy back of 91,000,000 shares from Rio Tinto plc in that year. |

| (f) | The historical data for 2000-2003 has been reclassified for the impact of reporting the reimbursement of certain shipping and handling costs incurred by the Group as “turnover” rather than a reduction of “net operating costs”. See note (c) on page A-2.Footnotes. |

Rio Tinto 2004 Form 20-F 8

RISK FACTORS

The

following describes some of the risks that could affect Rio Tinto. There may

be additional risks unknown to Rio Tinto and other risks, currently believed

to be immaterial, could turn out to be material. These risks, whether they

materialise individually or simultaneously, could significantly affect the

Group’s business

and financial results. They should also be considered in connection with any

forward looking statements in this document and the cautionary statement below.

Economic condition

Commodity

prices, and demand for the Group’s products, are influenced strongly by world economic growth, particularly that in the US and Asia. The Group’s normal policy is to sell its products at prevailing market prices. Commodity prices can fluctuate widely and could have a material and adverse impact on the Group’s

asset values, revenues, earnings and cash flows. Further discussion can be

found on page 14, Business environment and markets, and on page 39, commodity

prices.

Exchange rates

The Group’s asset values, earnings and cash flows are influenced by a wide variety of currencies due to the geographic diversity of the Group’s sales and areas of operation. The majority of the Group’s sales are denominated in US dollars. The Australian and US dollars are the most important currencies influencing costs. The relative value of currencies can fluctuate widely and could have a material and adverse impact on the Group’s

asset values, costs, earnings and cash flows. Further discussion can be found

on page 37, exchange rates, reporting currencies and currency exposure.

Acquisitions

The Group has grown

partly through the acquisition of other businesses. Business combinations commonly

entail a number of risks and Rio Tinto cannot be sure that management will be

able effectively to integrate businesses acquired or generate the cost savings

and synergies anticipated. Failure to do so could have a material and adverse

impact on the Group’s costs, earnings and cash flows.

Exploration and new projects

The Group seeks

to identify new mining properties through an active exploration programme. There

is no guarantee, however, that such expenditure will be recouped or that existing

mineral reserves will be replaced. Failure to do so could have a material and

adverse impact on the Group’s financial results and prospects.

The Group develops new mining properties and expands its existing operations as a means of generating shareholder value. Increasing regulatory, environmental and social approvals are, however, required which can result in significant increases in construction costs and/or significant delays in construction. These increases could materially and adversely affect a project’s economics, the Group’s

asset values, costs, earnings and cash flows.

Reserve estimation

There are numerous

uncertainties inherent in estimating ore reserves. Reserves that are valid at

the time of estimation may change significantly when new information becomes

available. Fluctuations in the price of commodities, exchange rates, increased

production costs or reduced recovery rates may render lower grade reserves uneconomic

and may, ultimately, result in a restatement. A significant restatement could

have a material and adverse impact on the Group’s asset values, costs, cash

flows and earnings.

Political and community

The Group has operations in jurisdictions having varying degrees of political instability. Political instability can result in civil unrest, expropriation, nationalisation, renegotiation or nullification of existing agreements, mining leases and permits, changes in laws, taxation policies or currency restrictions. Any of these can have a material adverse effect on the profitability or, in extreme cases, the viability of an operation.

Some of the Group’s current and potential operations are located in or near communities that may now, or in the future, regard such an operation as having a detrimental effect on their economic and social circumstances. Should this occur, it might have a material adverse impact on the profitability or, in extreme cases, the viability of an operation. In addition, such an event may adversely affect the Group’s

ability to enter into new operations in the country.

Technology

The Group has invested

in and implemented information system and operational initiatives. Several technical

aspects of these initiatives are still unproven and the eventual operational

outcome or viability cannot be assessed with certainty. Accordingly, the costs

and benefits from these initiatives and the consequent effects on the Group’s

future earnings and financial results may vary widely from present expectations.

Land and resource tenure

The Group operates

in several countries where title to land and rights in respect of land and resources

(including indigenous title) may be unclear and may lead to disputes over resource

development. Such disputes could disrupt relevant mining projects and/or impede

the Group’s ability to develop new mining properties.

Health,

safety and environment

Rio Tinto operates

in an industry that is subject to numerous health, safety and environmental

laws and regulations as well as community expectations. Evolving regulatory

standards and expectations can result in increased litigation and/or increased

costs all of which can have a material and adverse effect on earnings and

cash flows.

Mining

operations

Mining

operations are vulnerable to a number of circumstances beyond the Group’s control,

including natural disasters, unexpected geological variations and industrial

actions. These can affect costs at particular mines for varying periods.

Mining, smelting and refining processes also rely on key inputs, for example

fuel and electricity. Appropriate insurance can provide protection from some,

but not all, of the costs that may arise from unforeseen events. Disruption

to the supply of key inputs, or changes in their pricing, may have a material

and adverse impact on the Group’s asset values, costs, earnings and

cash flows.

Rio Tinto 2004 Form 20-F 9

Rehabilitation

Costs associated

with rehabilitating land disturbed during the mining process and addressing environmental,

health and community issues are estimated and provided for based on the most

current information available. Estimates may, however, be insufficient and/or

further issues may be identified. Any underestimated or unidentified rehabilitation

costs will reduce earnings and could materially and adversely affect the Group’s

asset values, earnings and cash flows.

Non managed operations

Rio Tinto cannot

guarantee that management of mining and processing assets not subject to its

management control will comply with the Group’s standards and objectives,

nor that effective policies, procedures and controls will be maintained over

those assets.

CAUTIONARY STATEMENT ABOUT FORWARD LOOKING STATEMENTS

This document contains

certain forward looking statements with respect to the financial condition, results

of operations and business of the Rio Tinto Group. The words “intend”, “aim”, “project”, “anticipate”, “estimate”, “plan”, “believes”, “expects”, “may”, “should”, “will”, or similar expressions, commonly identify such forward looking statements. Examples of forward looking statements in this annual report on Form 20-F include those regarding estimated reserves, anticipated production or construction commencement dates, costs, outputs and productive lives of assets or similar factors. Forward looking statements involve known and unknown risks, uncertainties, assumptions and other factors set forth in this document that are beyond the Group’s

control. For example, future reserves will be based in part on market prices

that may vary significantly from current levels. These may materially affect

the timing and feasibility of particular developments. Other factors include

the ability to produce and transport products profitably, the effect of foreign

currency exchange rates on market prices and operating costs, and activities

by governmental authorities, such as changes in taxation or regulation, and political

uncertainty.

In light of these risks, uncertainties and assumptions, actual results could be materially different from any future results expressed or implied by these forward looking statements which speak only as at the date of this report. Except as required by applicable regulations or by law, the Group does not undertake any obligation to publicly update or revise any forward looking statements, whether as a result of new information or future events. The Group cannot guarantee that its forward looking statements will not differ materially from actual results.

Item 4. Information on the Company

INTRODUCTION

Rio Tinto Limited and Rio Tinto plc operate as one business organisation, referred to in this report as Rio Tinto, the Rio Tinto Group or, more simply, the Group. These collective expressions are used for convenience only since both Companies, and the individual companies in which they directly or indirectly own investments, are separate and distinct legal entities.

“Limited”, “plc”, “Pty”, “Inc”, “Limitada”, or “SA” has

generally been omitted from Group company names, except to distinguish between

Rio Tinto plc and Rio Tinto Limited.

Financial

data in United States dollars (US$) is derived from, and should be read in conjunction

with, the Rio Tinto Group’s consolidated financial statements which are in US$. In general, financial data in pounds sterling (£) and Australian dollars (A$) have been translated from the consolidated financial statements at the rates shown on page 112 and have been provided solely for convenience; exceptions arise where data, such as directors’ remuneration,

can be extracted directly from source records.

Rio

Tinto Group turnover, profit before tax and net earnings and operating assets

for 2003 and 2004 attributable to the Group’s products and geographical

areas are shown in Notes 26 and 27 to the consolidated financial statements on

pages A-39 to A-43. In the Operational review, operating assets and turnover

are consistent with the financial information by business unit on pages A-63

and A-64.

The tables on pages 17 to 20 show production for 2002, 2003 and 2004 and include estimates of proven and probable reserves and mineral resources. The weights and measures used are mainly metric units; conversions into other units are shown on page 112. Words and phrases, often technical, have been used which have particular meanings; definitions of these terms are on pages 109 to 111.

AN OVERVIEW

OF RIO TINTO

Rio Tinto is

a leading international mining group, combining Rio Tinto plc and Rio Tinto

Limited in a dual listed companies (DLC) structure as a single economic entity.

Nevertheless, both Companies remain legal entities with separate share listings

and registers. Rio Tinto plc is incorporated in England and Wales and Rio

Tinto Limited is incorporated in Australia.

Rio

Tinto’s international headquarters are in London whilst the Australian

representative office in Melbourne provides support for the operations, undertakes

external and investor relations and fulfils statutory obligations. The registered

office of Rio Tinto plc is at 6 St James’s Square, London, SW1Y 4LD

(telephone: +44 20 7930 2399) and the registered office of Rio Tinto Limited

is at Level 33, 55 Collins Street, Melbourne, Victoria 3000 (telephone: +61

3 9283 3333).

Rio Tinto 2004 Form 20-F 10

For legal purposes, Rio Tinto’s US agent is Shannon Crompton, Secretary of Rio Tinto’s US holding companies, 8309 West 3595 South, Magna, Utah 84044. Investor relations in the US are provided by Makinson Cowell US Limited, One Penn Plaza, 250 W 34th St, Suite 1935, New York, NY 10119.

| Objective, strategy and management structure | |

| Rio Tinto’s fundamental objective is to maximise the overall long term return to its shareholders by operating responsibly and sustainably in areas of proven expertise where the Group has competitive advantage. Its strategy is to maximise the net present value per share by investing in large, long life, cost competitive mines. Investments are driven by the quality of opportunity, not choice of commodity. | |

| Rio Tinto’s mining interests are diverse both in geography and product. The Group consists of wholly and partly owned subsidiaries, joint ventures, associated companies and joint arrangements, the principal ones being listed in Notes 31 to 34 of the consolidated financial statements on pages A-52 to A-53. | |

| Rio Tinto’s management structure is designed to facilitate a clear focus on business performance and the Group’s objective. The management structure, which is reflected in this report, is based on principal product and global support groups: | |

| • | Iron Ore |

| • | Energy |

| • | Industrial Minerals |

| • | Aluminium |

| • | Copper |

| • | Diamonds |

| • | Exploration, and |

| • | Technology |

| The chief executive of each group reports to the chief executive of Rio Tinto. | |

2004 financial summary

On 31 December

2004, Rio Tinto plc had a market capitalisation of £16.4 billion (US$31.6 billion) and Rio Tinto Limited had a market capitalisation of A$19.5 billion (US$15.2 billion). The combined Group’s

market capitalisation in publicly held shares at the end of 2004 was US$41.1

billion.

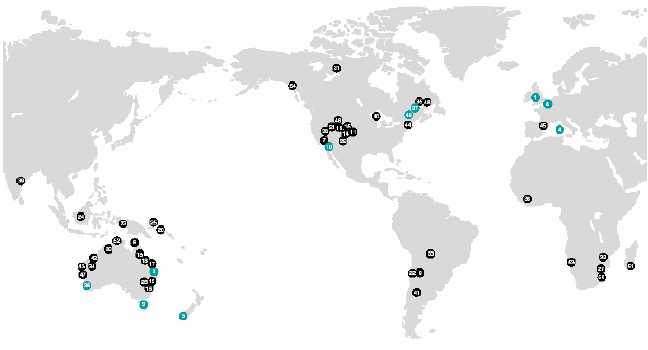

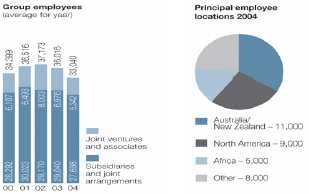

At

31 December 2004, Rio Tinto had consolidated operating assets of US$16.6 billion:

61 per cent were located in Australia and New Zealand and 27 per cent in North

America. Group turnover, or sales revenue, in 2004 was US$14.6 billion (or US$11.8

billion excluding Rio Tinto’s share of joint ventures’ and associates’ turnover).

Net earnings in 2004 were US$2,813 million.

History

The Rio Tinto Company was formed by investors in 1873 to mine ancient copper workings at Rio Tinto in southern Spain. The Consolidated Zinc Corporation was incorporated in 1905, initially to treat zinc bearing mine waste at Broken Hill, New South Wales, Australia.

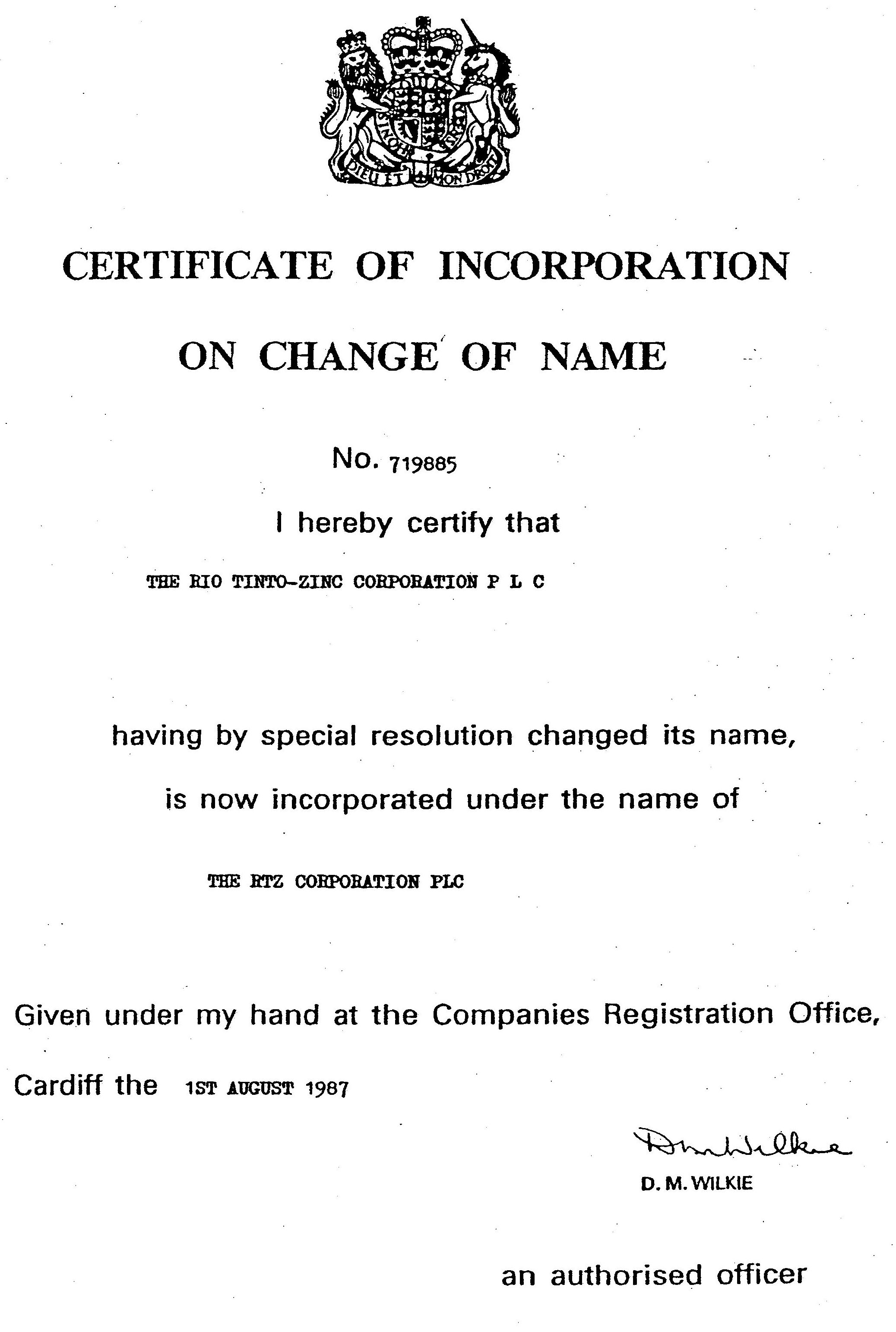

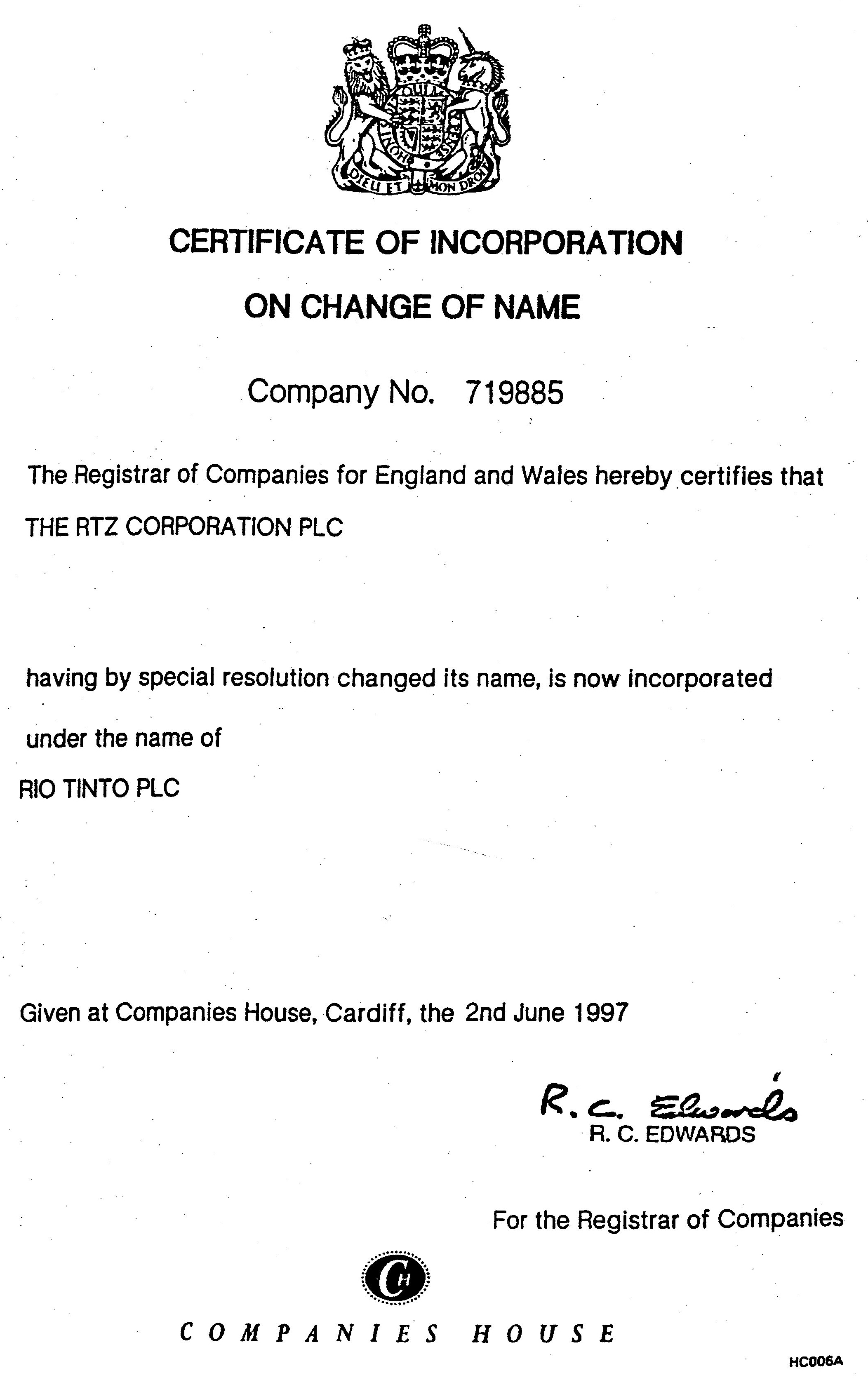

The RTZ Corporation (formerly The Rio Tinto-Zinc Corporation) was formed in 1962 by the merger of The Rio Tinto Company and The Consolidated Zinc Corporation. CRA Limited (formerly Conzinc Riotinto of Australia Limited) was formed at the same time by a merger of the Australian interests of The Consolidated Zinc Corporation and The Rio Tinto Company. Between 1962 and 1995, RTZ and CRA discovered important mineral deposits, developed major mining projects and also grew through acquisition.

RTZ and CRA were unified in December 1995 through a DLC structure. Directed by a common board of directors, this is designed to place the shareholders of both companies in substantially the same position as if they held shares in a single enterprise owning all of the assets of both Companies.

In June 1997, The RTZ Corporation became Rio Tinto plc and CRA Limited became Rio Tinto Limited, together known as the Rio Tinto Group. Since the 1995 merger, the Group has continued to invest in developments and acquisitions in keeping with its strategy.

RECENT

DEVELOPMENTS

Share

buybacks and issues 2004-2005 to date

In April 2004,

Rio Tinto plc shareholders renewed approvals for the buyback of up to ten

per cent of its own shares and Rio Tinto Limited shareholders renewed approvals

to buy back up to 100 per cent of Rio Tinto Limited shares held by Tinto

Holdings Australia Pty Limited (a wholly owned subsidiary of Rio Tinto plc)

plus, on market, up to ten per cent of the publicly held capital in any 12

month period.

The

Group announced on 3 February 2005, its intention to return up to US$1.5

billion of capital to shareholders, therefore, Rio Tinto plc and Rio Tinto

Limited obtained renewal of their existing shareholder approvals at their

respective annual general meetings in 2005. Both Companies also obtained

shareholder approval for Rio Tinto Limited to make off market purchases of

its shares within 12 months of the annual general meeting, within the overall

limit of ten per cent of publicly held capital described above. This was

to be through a tender process at a discount to the market price. The shareholders’ approval

obtained would also allow Rio Tinto Limited to buy back its shares from Tinto

Holdings Australia, after such an off market tender (at the same price),

to maintain the proportional holding of Tinto Holdings Australia following

the off market buyback. The number of shares which may eventually be bought

back under these authorities will be determined by the directors, based on

what they consider to be in the best interests of all shareholders.

Rio Tinto 2004 Form 20-F 11

In the

year to 31 December 2004, neither Rio Tinto plc nor Rio Tinto Limited purchased

any publicly held shares for cancellation in either Company. However, a

further 1,346,874 Rio Tinto plc and 280,332 Rio Tinto Limited shares were

issued in respect of the Companies’ employee share plans. During the year, options for a further 1,541,367 Rio Tinto plc and 1,339,834 Rio Tinto Limited shares were granted under Rio Tinto’s

share plans.

On

9 May 2005 Rio Tinto Limited announced the successful result of its off market

share buy back. A total of approximately 27.3 million shares, representing 8.7

per cent of Rio Tinto Limited’s publicly held issued share capital (2.0

per cent of the Rio Tinto Group), were bought back at A$36.70 per share at a

cost of approximately A$1 billion (US$780 million). The buy back price of A$36.70

per share represented a 14 per cent discount to the relevant volume weighted

average price of Rio Tinto Limited shares sold on the ASX over the five trading

days up to and including the closing date of the buy back. It also represented

a discount of 15.6 per cent to the closing price for Rio Tinto Limited shares

on 6 May 2005, of A$43.50.

Under a separate buy back, Tinto Holdings Australia accepted the same A$36.70 buy back price for a proportion of its 37.5 per cent holding of Rio Tinto Limited shares so that there was no change in the proportional shareholding in Rio Tinto Limited as a result of the buy back. Rio Tinto Limited therefore bought back a further 16.4 million shares at a cost of approximately A$600 million (US$470 million).

Share buybacks and issues 2002-2003

In 2002, 887,000

Rio Tinto plc and 360,000 Rio Tinto Limited shares were issued under the Companies’ employee share plans and options were granted over 2.6 million Rio Tinto plc shares and 2.2 million Rio Tinto Limited shares. In 2003, 1,193,000 Rio Tinto plc and 240,000 Rio Tinto Limited shares were issued in respect of the Companies’ employee share plans. During 2003, options were granted over 2.7 million Rio Tinto plc and 1.6 million Rio Tinto Limited shares in respect of the Companies’ employee

share plans.

In the years 2002 and 2003, neither Rio Tinto plc nor Rio Tinto Limited purchased any publicly held shares for cancellation in either Company.

Operations acquired and divested 2004-2005 to date

In January 2004,

Rio Tinto completed the sale of its 100 per cent interest in the nickel mining

company Mineração Serra da Fortaleza Ltda to Votorantim Metais,

a Brazilian controlled mining company. Including an adjustment for future nickel

prices, the total cash consideration was approximately US$80 million.

A 20 per cent interest in the Sepon project in Laos, comprising a gold operation and the Khanong copper project, was sold to Oxiana Limited for a cash consideration of US$85 million.

In

March, Rio Tinto completed the sale of its shareholding in Freeport-McMoRan Copper & Gold

Inc (FCX). Rio Tinto received net proceeds of US$882 million for its 23,931,100

FCX shares. Rio Tinto retains its 40 per cent joint venture interest in reserves

discovered after 1994 at the Grasberg mine which is managed by FCX. The sale

of FCX shares does not affect the terms of the joint venture nor the management

of the Grasberg mine.

In

June, Rio Tinto completed the sale of its 100 per cent interest in Zinkgruvan

Mining AB to South Atlantic Ventures. Zinkgruvan was acquired in 2000 as part

of North. Rio Tinto received US$101 million in cash plus US$5 million for working

capital, and can earn a further US$5 million over the next two years in price

participation payments based on zinc, lead and silver prices. Also in June, Rio

Tinto’s interest in the Boké bauxite deposit in west Africa was divested

for US$12 million.

Rio

Tinto and Empresa de Desenvolvimento Mineiro completed the sale of their interests

in the Neves Corvo copper mine in Portugal to EuroZinc for a cash consideration

and a participation in the average copper price in excess of certain thresholds.

Rio Tinto’s share of the consideration for its 49 per cent share of the

mine was US$70 million. The remaining price participation rights relating to

copper production from Neves Corvo, which was sold in the first half of the year,

were themselves sold for US$22 million.

The

directors of Rio Tinto Zimbabwe (RioZim) agreed to a restructuring of Rio

Tinto’s 56 per cent shareholding in RioZim. The Murowa diamond project

in Zimbabwe had been a 50:50 joint venture between Rio Tinto and RioZim.

As a result of the restructuring, Rio Tinto owns a direct 78 per cent interest

in Murowa and RioZim became an independent Zimbabwean controlled, listed

company owning the remaining 22 per cent of Murowa. Rio Tinto ceased to be

an ordinary shareholder in RioZim but retains a reduced cash participation

in RioZim’s assets other than the Murowa diamond project for a period

of ten years. The transaction had no material effect on Rio Tinto.

The

sale of the Group’s 51 per cent interest in Rio Paracatu Mineração,

the owner of the Morro do Ouro mine in Brazil, was completed on 31 December

2004 for US$250 million, subject to an adjustment for working capital.

The

sale to Nippon Steel of an eight per cent interest in the Hail Creek Joint

Venture, and the increase in the combined share of the original participants,

Marubeni Coal and Sumisho Coal Development, by two per cent was completed

in the fourth quarter. Rio Tinto will receive about US$150 million for the

sale of these interests in the Hail Creek Joint Venture together with the

sale of a 47 per cent interest in the Beasley River iron ore deposit to its

joint venture partners in Robe River, which includes Nippon Steel.

In

December Kennecott Energy successfully bid for an additional 177 million

tonnes of in-situ coal reserves at West Antelope at a cost of US$146 million.

Rio Tinto 2004 Form 20-F 12

In March 2005 the Group announced the sale of its entire holding in the Labrador Iron Ore Royalty Income Fund (LIORIF) for net cash proceeds of US$130 million. LIORIF has an equity interest of 15.1 per cent in, and receives royalties from, the Iron Ore Company of Canada. This transaction has no effect on Rio Tinto’s 59 per cent direct interest in the Iron Ore Company of Canada.

Operations acquired and divested 2002-2003

In

January 2002, Kennecott Energy (KEC) purchased the North Jacobs Ranch coal reserves

for US$380 million, payable in instalments over a five year period. The reserves

are adjacent to KEC’s existing Jacobs Ranch operation and provide a basis

for low cost expansion in line with market demand.

Following

the purchase of outstanding units in the Western Australian Diamond Trust, Rio

Tinto’s interest in Argyle Diamonds increased from 99.8 per cent to 100

per cent.

In

August 2002, Comalco completed the acquisition of an additional 9.5 per cent

interest in reduction lines 1 and 2 of the Boyne Island Smelter for US$80 million.

This increased Comalco’s share in lines 1 and 2 of the smelter to 59.5 per cent from 50 per cent. Comalco’s

interest in line 3 remains unchanged at 59.25 per cent.

During

the first half of 2002, Coal & Allied Industries completed the sale of its interest in the Moura Joint Venture for US$166 million and in Narama and Ravensworth for US$64 million. These were classified as assets held for resale and consequently their disposal had no effect on net earnings. In September, Rio Tinto acquired for cash in the market a further three per cent in Coal & Allied

to bring its shareholding to 75.7 per cent.

As

a result of a refinancing in December 2002, in which the Labrador Iron Ore Royalty

Income Fund (LIORF) chose not to participate, Rio Tinto’s interest in Iron

Ore Company of Canada increased from 56.1 to 58.7 per cent.

The

sale of Rio Tinto’s 25 per cent interest in Minera Alumbrera Limited in

Argentina, acquired as part of North, together with its wholly owned Peak gold

mine in New South Wales, Australia, was completed in March 2003. The cash consideration

was US$210 million.

Rio

Tinto Zimbabwe sold the Patchway gold mine in 2003. The Framework Agreement signed

with the Government of Indonesia in 2002 for divestment of 51 per cent of Kaltim

Prima Coal (KPC) to Indonesian interests lapsed in 2003 when no assignment of

KPC’s offer was made or accepted within the required timeframe.

On 21 July 2003 Rio Tinto and BP announced that they had agreed to sell their interests in KPC for a cash price of US$500 million, including assumed debt, to PT Bumi Resources, a public company listed on the Jakarta and Surabaya Stock Exchanges. The sale was completed on 10 October and each company received 50 per cent of the net proceeds.

Development projects 2004-2005 to date

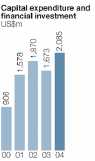

Rio Tinto invested over US$2.2 billion in 2004 on development projects around the world.

In December 2003, Hamersley Iron announced the US$920 million expansion of its port and mine capacity, with further expenditure on the rail network and power infrastructure being evaluated. In April 2005 a further US$290 million was committed to expand the existing iron ore mines. The partners in the Robe River Joint Venture approved US$214 million (Rio Tinto share US$113 million) to dual track a significant part of the Hamersley Iron rail line. Hamersley Iron will spend a further US$46 million to upgrade power infrastructure in the Pilbara. The port and mine expansions are on track for completion by the end of 2005.

In

January 2004, Rio Tinto approved the expansion of QIT-Fer et Titane Inc.’s

upgraded slag (UGS) plant in Quebec, Canada. Total investment will be US$76 million

and capacity will be increased from 250,000 tonnes per year to 325,000 tonnes

per year in 2005.

The owners of the Escondida copper mine in Chile approved expenditure of US$870 million (Rio Tinto share US$270 million) on a sulphide leach project to produce 180,000 tonnes (Rio Tinto share 54,000 tonnes) of copper cathode per annum for more than 25 years starting in the second half of 2006.

Construction of the US$100 million second block cave at the underground Northparkes copper and gold mine in New South Wales, Australia was completed and production commenced in 2004.

Development of the 54 per cent owned Eastern Range iron ore mine in Australia with a capacity of ten million tonnes per year was completed. First shipments started in the first half of 2004.

Expansion

of the Weipa bauxite mine in Queensland, Australia, was completed, resulting

in an increase in production capacity to 16.5 million tonnes per annum. This

supports the requirements of the new Comalco Alumina Refinery. A key component

of the US$150 million expenditure is a 9.5 million tonne beneficiation plant

for ore from the Andoom deposit. In 2005, a new US$42 million power station

will be constructed to service the Weipa mining operations and surrounding

communities.

Construction

of the first stage of Comalco’s new alumina refinery at Gladstone, Queensland

commenced in January 2002 and was completed in late 2004, three months early

and in line with its budget of US$750 million. Initial shipments from the

1.4 million tonnes per year plant started in early 2005. There is potential

for the refinery capacity to increase to over four million tonnes per year

in two additional stages when market conditions allow.

Construction

began in January 2003 on an expanded US$200 million HIsmelt® plant

at Kwinana in Western Australia. Cold commissioning commenced in late 2004

and the first hot metal was produced in the hot commissioning process during

the second quarter of 2005. The full production rate of 800,000 tonnes per

year is expected to be achieved in 2007.

Rio Tinto 2004 Form 20-F 13

Approval

was given in 2004 for expansion of the Hail Creek coal mine in Australia to

eight million tonnes per year at a cost of US$157 million. At the Diavik diamond

mine in Canada construction begins in 2005 of a second dike at a cost of US$190

million to enable mining of a third orebody. Also approved was an optimisation

study costing US$75 million including construction of an exploration decline

to investigate underground mining.

Kennecott

Land’s Project Daybreak in Utah, US, a mixed use land development on a

1,800 hectare site, started in 2003, with the first land sales in 2004 that

are expected to ramp up over a period of five to six years.

Further

detail on these investments and projects is provided in the operational review

on pages 44 to 67.

Development

projects have been funded using internally generated funds and proceeds of

asset disposals.

Development projects 2002-2003

Work

on the Robe River Joint Venture’s US$450 million West Angelas iron ore mine

and port facilities in Western Australia was completed in mid-2002 and the first

shipments were made.

Freeport

Indonesia’s Deep Ore Zone (DOZ) underground block cave project was declared

fully operational from 1 October 2002. This achieved design capacity of 25,000

tonnes of ore per day in 2002, a year earlier than originally projected. In the

first quarter of 2003, Freeport Indonesia completed a further DOZ expansion to

35,000 tonnes per day at a cost of US$34 million.

The Diavik diamond project in the Northwest Territories, Canada was completed in January 2003 three months early and within budget. Initial production commenced from the contact zone above the orebody with the main orebody accessed during the second half of 2003.

Production

ramp up at Palabora’s US$465 million underground copper mine in South Africa

started in 2003 but was constrained by an inability to clear drawpoints blocked

by poorly fragmented, large rocks.

Development

of the Escondida Norte satellite deposit at the 30 per cent owned Escondida copper

mine in Chile was started in June 2003 to provide mill feed to keep Escondida’s

capacity above 1.2 million tonnes of copper per year to the end of 2008. First

production is expected by the end of 2005. Commissioning of the new US$1,045

million, 110,000 tonnes of ore per day Laguna Seca concentrator was completed

in the second quarter of 2003.

In 2003, Rio Tinto Coal Australia completed development of the US$255 million Hail Creek coking coal project in Queensland, Australia with an initial capacity of 5.5 million tonnes annually.

BUSINESS ENVIRONMENT AND MARKETS

Competitive environment

Rio Tinto is a major producer in all the metals and minerals markets in which it operates. It is generally among the top five global producers by volume. It has market shares for different commodities ranging from five per cent to 40 per cent. The competitive arena is spread across the globe, including eastern Europe, Russia and China.

Most

of Rio Tinto’s competitors are private sector companies which are publicly

quoted. Several are, like Rio Tinto, diversified in terms of commodity exposure,

but others are focused on particular commodity segments. Metal and mineral markets

are highly competitive with few barriers to entry. They can be subject to price

declines in real terms reflecting large productivity gains, increasing technical

sophistication, better management, and advances in information technology.

High

quality, long life mineral resources, the basis of good financial returns, are

relatively scarce. Rio Tinto’s ownership of or interest in some of the world’s

largest deposits enables it to contribute to long term market growth. World production

volumes are likely to grow at least in line with global economic activity. The

emergence of China and eventually India as economic forces requiring metals and

minerals for development could mean even higher market growth.

Economic overview

World economic activity in 2004 grew at the fastest rate since the 1970s, rising to over five per cent from three per cent the year before on a purchasing power parity basis. Trade growth accelerated even faster, to more than eight per cent in real terms, nearly double the rate seen in 2003.

The

increase in economic activity was widely based, led by the US and China which

grew by 4.3 per cent and nine per cent respectively. Japan benefited from

strong exports, which stimulated growth of four per cent. Growth elsewhere

in Asia was also stimulated by exports. Latin America grew by five per cent,

driven by the boom in demand for metals, oil and some agricultural products.

European activity lagged, but higher exports enabled growth to rise to over

two per cent.

Inflation

remained low by historical standards in spite of the large rise in prices

of oil and other commodities. This reflected fierce competition in the manufacturing

sector and generally weak labour markets.

The

US benefited from very low real interest rates and a loose fiscal policy

in the run up to the presidential election. The twin deficits of government

finance and trade increased rapidly. The fact that US growth was based on

borrowing was underscored by the decline in the value of the US dollar, which

fell eight per cent in trade weighted terms, following an 11 per cent fall

in 2003. Some currencies are pegged to the US dollar, notably the Chinese

renminbi, and the fall against freely traded currencies such as the euro

and the Australian dollar was considerably greater.

The

other pillar of global growth was China, with GDP rising by nine per cent.

This was driven by investment in fixed assets, which rose by more than 25

per cent for the second successive year, and industrial output, which grew

more than 16 per cent, also for the second year running.

Rio Tinto 2004 Form 20-F 14

Growth was strongest in the first half and then slowed. This was most notable in Europe and Japan as their currencies strengthened against the US dollar. The picture in China was less clear. Growth there seems to have slowed from the earlier breakneck pace as the government signalled before the middle of the year that it wanted to reduce growth in investment in fixed assets and introduced curbs. Trade with China in many commodities eased considerably in the second half, but other factors including port congestion also contributed.

Commodity markets had already started to improve in 2003, but the acceleration in economic activity and trade in 2004 tipped many of them into a zone of extreme tightness. Prices soared, aided by a declining US dollar. Fund activity fluctuated through the year, but provided strong support for prices overall. Demand for many products grew considerably faster than the world economy. Chinese growth continued to be very commodity intensive, and there was some rebuilding of stocks in the supply chain. Global steel production grew nine per cent, the fastest since 1973.

Copper benefited more than most non ferrous metals from the acceleration in growth, as it was already in deficit and refined output was held back by a series of disruptions to mine output and by smelter capacity. Demand grew by seven per cent, the deficit in refined copper rose sharply and exchange stocks fell below the levels seen in the mid 1990s. Fund buying intensified pricing in a very tight physical market. The average cash LME price rose to US$1.30 per pound from 80 US cents per pound the year before, only just short of the highest ever price in nominal terms (not adjusted for inflation). In contrast, the copper concentrates market, which had been tight for several years, was well supplied in the second half.

The

seaborne iron ore trade continued to grow strongly with China’s iron ore

imports nearly 40 per cent above their 2003 level. Price increases of nearly

20 per cent early in the year underlined the tightness of the market. The rapid

growth in demand for iron ore caused a shortage of shipping capacity leading

to the highest freight rates ever recorded.

Prices for seaborne thermal coal rose by over 60 per cent. Even a rise of this magnitude, however, did not dampen the market and spot prices remained above the contract settlement price throughout the year. World seaborne thermal coal trade is estimated to have grown by about six per cent during 2004. Coking coal prices rose by less than those of thermal coal but significant increases in demand in Asia meant that some spot cargos were trading at very high prices.

The North American aluminium market improved significantly in 2004 with demand growth of around ten per cent. Combined with demand in China, the primary aluminium market moved into deficit for the first time since 2000. The annual average price of aluminium increased accordingly to 78 US cents per pound in 2004 from 65 US cents the previous year. However, the rise was not as strong as for copper because stocks were higher. The spot price for alumina remained very high by historical standards throughout 2004 reflecting general market tightness and strong demand from Chinese aluminium smelters.

The economic recovery in developed countries, the US in particular, benefited the demand for industrial minerals such as borates and titanium minerals. Demand growth for these products, however, generally continued to fall short of that achieved by metal markets. This was partly due to a lower exposure to the present stage of Chinese growth.

Gold averaged US$409 per ounce, a 16 year nominal high, almost entirely driven by the falling US dollar. Many less widely traded metals also benefited from much higher prices, notably molybdenum, which averaged US$14 per pound for trader oxide, a 25 year nominal high, and silver, which averaged US$6.70 per ounce, up 40 per cent year on year.

A discussion of the financial results for the three years to 31 December 2004 is given in the Financial review on pages 31 to 44.

Comments

on the financial performance of the individual product groups for the three years

to 31 December 2004 are included in the operational review on pages 44 to 67.

Details of production, reserves and information on Group mines are given on pages

17 to 20, A-85 to A-95 and 22 to 26, respectively. Analyses of Rio Tinto’s

revenues by product group, geographical origin and geographical destination have

been set out in Notes 26 to 27 to the consolidated financial statements on pages

A-39 to A-43.

Marketing

channels

Each business

within each product group is responsible for the marketing and sale of their

respective metal and mineral production. Consequently, Rio Tinto has numerous

marketing channels, which now include electronic marketplaces, with differing

characteristics and pricing mechanisms.

In

general, Rio Tinto’s businesses contract their metal and mineral production

direct to end users under long term supply contracts and at prevailing market

prices. Typically, these contracts specify annual volume commitments and

an agreed mechanism for determining prices, for example, businesses producing

non ferrous metals and minerals reference their sales prices to the London

Metal Exchange (LME) or other metal exchanges such as the Commodity Exchange

Inc (Comex) in New York. Fluctuations in these prices, particularly for aluminium,

copper and gold, inevitably affect the Group’s financial results.

Businesses

producing coal and iron ore would typically reference their sales prices

to annually negotiated industry benchmarks. In markets where international

reference market prices do not exist or are not transparent, businesses negotiate

product prices on an individual customer basis.

Rio

Tinto’s marketing channels include a network of regional sales offices

worldwide. Some products in certain geographical markets are sold via third

party agents or to major trading companies.

Rio Tinto 2004 Form 20-F 15

Governmental

regulations

Rio

Tinto is subject to extensive governmental regulations affecting all aspects

of its operations and consistently seeks to apply best practice in all of its

activities. Due to Rio Tinto’s product and geographical spread, there is

unlikely to be any single governmental regulation that could have a material

effect on the Group’s

business.

Rio

Tinto’s businesses in Australia, New Zealand, Papua New Guinea and Indonesia

are subject to state and federal regulations of general application governing

mining and processing, land tenure and use, environmental requirements, workplace

health and safety, trade and export, corporations, competition, foreign investment

and taxation. Some operations are conducted under specific agreements with the

respective governments and associated acts of parliament. In addition, Rio Tinto’s

uranium operation in the Northern Territory, Australia is subject to specific

regulation in relation to its mining and export of uranium.

US and Canada based operations are subject to local and national regulations governing land use, environmental aspects of operations, product and workplace health and safety and trade and export administration.

The

South African Mineral and Petroleum Resources Development Act 2002, as read with

the Empowerment Charter for the South African Mining Industry, targets the transfer

for fair value of 26 per cent ownership of South African mining assets to historically

disadvantaged South Africans (HDSAs) within ten years. Attached to the Empowerment

Charter is a “scorecard” by which companies will be judged on their

progress towards empowerment and the attainment of the target transfer of 26

per cent ownership. The scorecard also provides that 15 per cent ownership should

vest in HDSAs within five years of 1 May 2004. The Mineral and Petroleum Royalty

Act, proposed for approval in 2005, will govern state royalties and introduce

new royalty payments in respect of mining tenements in South Africa. The royalty

will be calculated on a gross sales value basis in relation to any minerals extracted,

rather than on the basis of profits generated. The South African government has

confirmed that any such royalties would become payable only from 2009.

Rio Tinto 2004 Form 20-F 16

METALS AND MINERALS PRODUCTION

| 2002 | 2003 | 2004 | ||||||||||||

| Production (a) | Production (a) | Production (a) | ||||||||||||

| Rio Tinto | Total | Rio Tinto | Total | Rio Tinto | Total | Rio Tinto | ||||||||

| % share (b) | share | share | share | |||||||||||

| ALUMINA (’000 tonnes) | ||||||||||||||

| Comalco Alumina Refinery (Australia) (c) | 100.0 | – | – | – | – | 175 | 175 | |||||||

| Eurallumina (Italy) | 56.2 | 1,010 | 567 | 1,021 | 573 | 1,064 | 597 | |||||||

| Queensland Alumina (Australia) | 38.6 | 3,574 | 1,380 | 3,731 | 1,440 | 3,778 | 1,459 | |||||||

| Rio Tinto total | 1,947 | 2,014 | 2,231 | |||||||||||

| ALUMINIUM (refined) (’000 tonnes) | ||||||||||||||

| Anglesey (UK) | 51.0 | 136.8 | 69.8 | 141.9 | 72.4 | 144.8 | 73.8 | |||||||

| Bell Bay (Australia) | 100.0 | 163.9 | 163.9 | 166.6 | 166.6 | 162.0 | 162.0 | |||||||

| Boyne Island (Australia) (d) | 59.4 | 520.2 | 294.6 | 520.9 | 311.1 | 540.5 | 321.2 | |||||||

| Tiwai Point (New Zealand) | 79.4 | 333.9 | 265.9 | 334.4 | 266.5 | 350.3 | 279.5 | |||||||

| Rio Tinto total | 794.1 | 816.6 | 836.5 | |||||||||||

| BAUXITE (’000 tonnes) | ||||||||||||||

| Boké (Guinea) (e) | – | 12,041 | 482 | 12,060 | 418 | 5,773 | 179 | |||||||

| Weipa (Australia) | 100.0 | 11,241 | 11,241 | 11,898 | 11,898 | 12,649 | 12,649 | |||||||

| Rio Tinto total | 11,724 | 12,316 | 12,828 | |||||||||||

| BORATES (’000 tonnes) (f) | ||||||||||||||

| Boron mine (US) | 100.0 | 514 | 514 | 541 | 541 | 543 | 543 | |||||||

| Borax Argentina (Argentina) | 100.0 | 15 | 15 | 17 | 17 | 22 | 22 | |||||||

| Rio Tinto total | 528 | 559 | 565 | |||||||||||

| COAL – HARD COKING (’000 tonnes) | ||||||||||||||

| Rio Tinto Coal Australia (g) | ||||||||||||||

| Hail Creek Coal (Australia) (h) | 82.0 | – | – | 883 | 812 | 5,104 | 4,633 | |||||||

| Kestrel Coal (Australia) | 80.0 | 2,406 | 1,925 | 1,873 | 1,499 | 2,659 | 2,127 | |||||||

| Rio Tinto total hard coking coal | 1,925 | 2,311 | 6,760 | |||||||||||

| COAL – OTHER* (’000 tonnes) | ||||||||||||||

| Coal & Allied Industries (i) | ||||||||||||||

| Bengalla (Australia) | 30.3 | 5,385 | 1,587 | 6,203 | 1,879 | 5,312 | 1,609 | |||||||

| Hunter Valley Operations (Australia) | 75.7 | 12,625 | 9,287 | 12,008 | 9,091 | 13,269 | 10,046 | |||||||

| Mount Thorley Operations (Australia) | 60.6 | 4,292 | 2,524 | 3,153 | 1,910 | 3,548 | 2,149 | |||||||

| Moura (Australia) (j) | – | 2,399 | 959 | – | – | – | – | |||||||

| Narama (Australia) (j) | – | 370 | 135 | – | – | – | – | |||||||

| Ravensworth East (Australia) (j) | – | 387 | 281 | – | – | – | – | |||||||

| Warkworth (Australia) | 42.1 | 6,882 | 2,817 | 5,868 | 2,469 | 6,954 | 2,926 | |||||||

| Total Coal & Allied Industries other coal | 17,590 | 15,348 | 16,729 | |||||||||||

| Rio Tinto Coal Australia (g) | ||||||||||||||

| Blair Athol (Australia) | 71.2 | 11,809 | 8,412 | 12,480 | 8,890 | 12,229 | 8,712 | |||||||

| Kestrel Coal (Australia) | 80.0 | 1,685 | 1,348 | 1,449 | 1,159 | 623 | 499 | |||||||

| Tarong Coal (Australia) | 100.0 | 5,685 | 5,685 | 6,538 | 6,538 | 7,004 | 7,004 | |||||||

| Total Rio Tinto Coal Australia other coal | 15,445 | 16,587 | 16,214 | |||||||||||

| Total Australian other coal | 33,035 | 31,935 | 32,943 | |||||||||||

| Kaltim Prima Coal (Indonesia) (k) | – | 17,740 | 8,870 | 12,655 | 6,327 | – | – | |||||||

| Kennecott Energy | ||||||||||||||

| Antelope (US) | 100.0 | 24,319 | 24,319 | 26,806 | 26,806 | 26,928 | 26,928 | |||||||

| Colowyo (US) | (l) | 4,889 | 4,889 | 4,535 | 4,535 | 5,788 | 5,788 | |||||||

| Cordero Rojo (US) | 100.0 | 34,724 | 34,724 | 32,671 | 32,671 | 35,233 | 35,233 | |||||||

| Decker (US) | 50.0 | 9,021 | 4,511 | 7,358 | 3,679 | 7,831 | 3,916 | |||||||

| Jacobs Ranch (US) | 100.0 | 28,784 | 28,784 | 32,418 | 32,418 | 34,979 | 34,979 | |||||||

| Spring Creek (US) | 100.0 | 8,093 | 8,093 | 8,069 | 8,069 | 10,892 | 10,892 | |||||||

| Total US coal | 105,320 | 108,177 | 117,734 | |||||||||||

| Rio Tinto total other coal | 147,225 | 146,439 | 150,677 | |||||||||||

* Coal – other includes thermal coal, semi-soft coking coal

and semi-hard coking coal.

See notes on page 20

Rio Tinto 2004 Form 20-F 17

| 2002 | 2003 | 2004 | |||||||||||

| Production (a) | Production (a) | Production (a) | |||||||||||

| Rio | Total | Rio | Total | Rio | Total | Rio | |||||||

| Tinto | Tinto | Tinto | Tinto | ||||||||||

| % share (b) | share | share | share | ||||||||||

| COPPER (mined) (’000 tonnes) | |||||||||||||

| Alumbrera (Argentina) (m) | – | 203.7 | 50.9 | 34.9 | 8.7 | – | – | ||||||

| Bingham Canyon (US) | 100.0 | 260.2 | 260.2 | 281.8 | 281.8 | 263.7 | 263.7 | ||||||

| Escondida (Chile) | 30.0 | 754.5 | 226.3 | 992.7 | 297.8 | 1,207.1 | 362.1 | ||||||

| Grasberg – FCX (Indonesia) (n) | – | 494.4 | 107.5 | 444.1 | 84.5 | 396.4 | 5.5 | ||||||

| Grasberg – Joint Venture (Indonesia) (n) | 40.0 | 370.0 | 148.0 | 271.7 | 108.7 | 120.0 | 48.0 | ||||||

| Neves Corvo (Portugal) (o) | – | 77.2 | 37.8 | 77.5 | 38.0 | 46.9 | 23.0 | ||||||

| Northparkes (Australia) | 80.0 | 38.4 | 30.7 | 27.1 | 21.7 | 30.0 | 24.0 | ||||||

| Palabora (South Africa) | 49.2 | 52.2 | 25.7 | 52.4 | 25.8 | 54.4 | 26.8 | ||||||

| Rio Tinto total | 887.1 | 867.0 | 753.1 | ||||||||||

| COPPER (refined) (’000 tonnes) | |||||||||||||

| Atlantic Copper (Spain) (n) | – | 250.5 | 41.5 | 247.1 | 38.1 | 58.4 | 7.0 | ||||||

| Escondida (Chile) | 30.0 | 138.7 | 41.6 | 147.6 | 44.3 | 152.1 | 45.6 | ||||||

| Kennecott Utah Copper (US) | – | 293.7 | 293.7 | 230.6 | 230.6 | 246.7 | 246.7 | ||||||

| Palabora (South Africa) | 49.2 | 81.6 | 40.2 | 73.4 | 36.1 | 67.5 | 33.2 | ||||||

| Rio Tinto total | 416.9 | 349.1 | 332.6 | ||||||||||

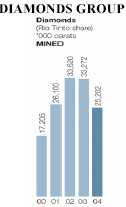

| DIAMONDS (’000 carats) | |||||||||||||

| Argyle (Australia) (p) | 100.0 | 33,519 | 33,503 | 30,910 | 30,910 | 20,620 | 20,620 | ||||||

| Diavik (Canada) | 60.0 | – | – | 3,833 | 2,300 | 7,575 | 4,545 | ||||||

| Merlin (Australia) | – | 117 | 117 | 62 | 62 | – | – | ||||||

| Murowa (Zimbabwe) (q) | 77.8 | – | – | – | – | 47 | 36 | ||||||

| Rio Tinto total | 33,620 | 33,272 | 25,202 | ||||||||||

| GOLD (mined) (’000 ounces) | |||||||||||||

| Alumbrera (Argentina) (m) | – | 754 | 188 | 124 | 31 | – | – | ||||||

| Barneys Canyon (US) | 100.0 | 75 | 75 | 35 | 35 | 22 | 22 | ||||||

| Bingham Canyon (US) | 100.0 | 412 | 412 | 305 | 305 | 308 | 308 | ||||||

| Cortez/Pipeline (US) | 40.0 | 1,082 | 433 | 1,085 | 434 | 1,051 | 421 | ||||||

| Escondida (Chile) | 30.0 | 126 | 38 | 184 | 55 | 217 | 65 | ||||||

| Grasberg – FCX (Indonesia) (n) | – | 1,375 | 355 | 1,456 | 354 | 1,377 | 14 | ||||||

| Grasberg – Joint Venture (Indonesia) (n) | 40.0 | 1,655 | 662 | 1,806 | 722 | 207 | 83 | ||||||

| Greens Creek (US) | 70.3 | 103 | 72 | 99 | 70 | 86 | 61 | ||||||

| Kelian (Indonesia) | 90.0 | 539 | 485 | 469 | 422 | 328 | 295 | ||||||

| Lihir (Papua New Guinea) (r) | 14.5 | 607 | 99 | 551 | 88 | 599 | 87 | ||||||

| Morro do Ouro (Brazil) (s) | – | 225 | 115 | 201 | 103 | 188 | 96 | ||||||

| Northparkes (Australia) | 80.0 | 41 | 33 | 49 | 39 | 79 | 63 | ||||||

| Peak (Australia) (m) | – | 97 | 97 | 20 | 20 | – | – | ||||||

| Rawhide (US) | 51.0 | 82 | 42 | 64 | 32 | 50 | 25 | ||||||

| Rio Tinto Zimbabwe (Zimbabwe) (t) | – | 38 | 21 | 25 | 14 | 11 | 6 | ||||||

| Others | – | 17 | 8 | 14 | 7 | 13 | 7 | ||||||

| Rio Tinto total | 3,135 | 2,731 | 1,552 | ||||||||||

| GOLD (refined) (’000 ounces) | |||||||||||||

| Kennecott Utah Copper (US) | 100.0 | 488 | 488 | 308 | 308 | 300 | 300 | ||||||

| IRON ORE (’000 tonnes) | |||||||||||||

| Channar (Australia) | 60.0 | 10,594 | 6,356 | 10,347 | 6,208 | 9,759 | 5,855 | ||||||

| Corumbá (Brazil) | 100.0 | 858 | 858 | 1,074 | 1,074 | 1,301 | 1,301 | ||||||

| Eastern Range (Australia) (u) | – | – | – | – | – | 2,970 | 2,970 | ||||||

| Hamersley Iron (Australia) | 100.0 | 57,563 | 57,563 | 63,056 | 63,056 | 65,407 | 65,407 | ||||||

| Iron Ore Company of Canada (Canada) (v) | 58.7 | 12,758 | 7,168 | 14,225 | 8,353 | 11,139 | 6,541 | ||||||

| Robe River (Australia) | 53.0 | 35,860 | 19,006 | 45,136 | 23,922 | 48,459 | 25,684 | ||||||

| Rio Tinto total | 90,951 | 102,613 | 107,757 | ||||||||||

| See notes on page 20 | |||||||||||||

Rio Tinto 2004 Form 20-F 18

| 2002 | 2003 | 2004 | ||||||||||||

| Production (a) | Production (a) | Production (a) | ||||||||||||

| Rio Tinto | Total | Rio Tinto | Total | Rio Tinto | Total | Rio Tinto | ||||||||

| % share (b) | share | share | share | |||||||||||

| LEAD (’000 tonnes) | ||||||||||||||

| Greens Creek (US) | 70.3 | 22.3 | 15.7 | 22.5 | 15.8 | 19.8 | 13.9 | |||||||

| Zinkgruvan (Sweden) (w) | – | 24.7 | 24.7 | 31.8 | 31.8 | 11.2 | 11.2 | |||||||

| Rio Tinto total | 40.4 | 47.6 | 25.1 | |||||||||||

| MOLYBDENUM (’000 tonnes) | ||||||||||||||

| Bingham Canyon (US) | 100.0 | 6.1 | 6.1 | 4.6 | 4.6 | 6.8 | 6.8 | |||||||

| NICKEL (mined) (’000 tonnes) | ||||||||||||||

| Fortaleza (Brazil) (x) | – | 6.3 | 6.3 | 6.0 | 6.0 | – | – | |||||||

| NICKEL (refined) (’000 tonnes) | ||||||||||||||

| Empress (Zimbabwe) (t) | – | 6.4 | 3.6 | 6.2 | 3.5 | 2.9 | 1.6 | |||||||

| SALT (’000 tonnes) | ||||||||||||||

| Dampier Salt (Australia) | 64.9 | 7,186 | 4,667 | 7,135 | 4,633 | 7,380 | 4,792 | |||||||

| SILVER (mined) (’000 ounces) | ||||||||||||||

| Bingham Canyon (US) | 100.0 | 3,663 | 3,663 | 3,548 | 3,548 | 3,584 | 3,584 | |||||||

| Escondida (Chile) | 30.0 | 2,981 | 894 | 4,728 | 1,418 | 5,747 | 1,724 | |||||||

| Grasberg – FCX (Indonesia) (n) | – | 3,795 | 804 | 3,659 | 745 | 3,077 | 79 | |||||||

| Grasberg – Joint Venture (Indonesia) (n) | 40.0 | 2,607 | 1,043 | 2,815 | 1,126 | 1,961 | 784 | |||||||

| Greens Creek (US) | 70.3 | 10,912 | 7,668 | 11,707 | 8,226 | 9,707 | 6,821 | |||||||

| Zinkgruvan (Sweden) (w) | – | 1,554 | 1,554 | 1,841 | 1,841 | 651 | 651 | |||||||

| Others | – | 3,231 | 1,582 | 2,511 | 1,407 | 2,025 | 1,187 | |||||||

| Rio Tinto total | 17,207 | 18,311 | 14,830 | |||||||||||

| SILVER (refined) (’000 ounces) | ||||||||||||||

| Kennecott Utah Copper (US) | 100.0 | 4,037 | 4,037 | 2,963 | 2,963 | 3,344 | 3,344 | |||||||

| TALC (’000 tonnes) | ||||||||||||||

| Luzenac Group (Australia/Europe/N. America) (y) | 99.9 | 1,328 | 1,327 | 1,358 | 1,357 | 1,444 | 1,443 | |||||||

| TIN (tonnes) | ||||||||||||||

| Neves Corvo (Portugal) (o) | – | 345 | 169 | 203 | 100 | 120 | 59 | |||||||

| TITANIUM DIOXIDE FEEDSTOCK (‘000 tonnes) | ||||||||||||||

| Rio Tinto Iron & Titanium (Canada/South Africa) (z) | 100.0 | 1,274 | 1,274 | 1,192 | 1,192 | 1,192 | 1,192 | |||||||

| URANIUM (tonnes U3O8) | ||||||||||||||

| Energy Resources of Australia (Australia) | 68.4 | 4,486 | 3,068 | 5,134 | 3,512 | 5,143 | 3,517 | |||||||

| Rössing (Namibia) | 68.6 | 2,751 | 1,887 | 2,401 | 1,647 | 3,582 | 2,457 | |||||||

| Rio Tinto total | 4,955 | 5,158 | 5,974 | |||||||||||

| ZINC (mined) (’000 tonnes) | ||||||||||||||

| Greens Creek (US) | 70.3 | 66.5 | 46.7 | 69.1 | 48.5 | 62.7 | 44.1 | |||||||

| Zinkgruvan (Sweden) (w) | – | 48.0 | 48.0 | 64.5 | 64.5 | 29.7 | 29.7 | |||||||

| Rio Tinto total | 94.7 | 113.0 | 73.8 | |||||||||||

| See notes on page 20 | ||||||||||||||

Rio Tinto 2004 Form 20-F 19

| Production data notes | |

| (a) | Mine production figures for metals refer to the total quantity of metal produced in concentrates or doré bullion irrespective of whether these products are then refined onsite, except for the data for iron ore and bauxite which represent production of saleable quantities of ore. |

| (b) | Rio Tinto percentage share, shown above, is as at the end of 2004 and has applied over the period 2002 – 2004 except for those operations where the share has varied during the year and the weighted average for them is shown below. The Rio Tinto share varies at individual mines and refineries in the “others” category and thus no value is shown. |

| Rio Tinto share % | ||||||||

| Operation | See Note | 2002 | 2003 | 2004 | ||||

| Atlantic Copper | (n) | 16.5 | 15.4 | 12.0 | ||||

| Argyle | (p) | 99.9 | 100.0 | 100.0 | ||||

| Bengalla | (i) | 29.4 | 30.3 | 30.3 | ||||

| Boyne Island | (d) | 56.6 | 59.4 | 59.4 | ||||

| Grasberg | (n) | 15.0 | 13.9 | 10.8 | ||||

| Hail Creek | (h) | – | 92.0 | 90.8 | ||||

| Hunter Valley Operations | (i) | 73.6 | 75.7 | 75.7 | ||||

| Iron Ore Company of Canada | (v) | 56.2 | 58.7 | 58.7 | ||||

| Lihir | (r) | 16.3 | 16.0 | 14.5 | ||||

| Mount Thorley Operations | (i) | 58.9 | 60.6 | 60.6 | ||||

| Moura | (i) (j) | 40.0 | – | – | ||||

| Narama | (i) (j) | 36.4 | – | – | ||||

| Ravensworth East | (i) (j) | 72.7 | – | – | ||||

| Warkworth | (i) | 41.2 | 42.1 | 42.1 | ||||

| (c) | Comalco Alumina Refinery started production in October 2004. |

| (d) | Rio Tinto acquired an approximately five per cent additional interest in production from the Boyne Island smelter with effect from August 2002. |

| (e) | Rio Tinto completed the sale of its four per cent interest in the Boké mine on 25 June 2004. Production data are shown up to the date of sale. |

| (f) | Borate quantities are expressed as B2O3 |

| (g) | Rio Tinto Coal Australia was previously known as Pacific Coal. |

| (h) | Hail Creek commenced production in the third quarter of 2003. Rio Tinto reduced its shareholding in Hail Creek from 92.0 per cent to 82.0 per cent on 15 November 2004. |

| (i) | Rio Tinto increased its stake in Coal & Allied Industries from 72.7 per cent to 75.7 per cent during September 2002. |

| (j) | On 14 March 2002, Coal & Allied completed the sale of its interests in Narama and Ravensworth. Coal & Allied sold its interest in the Moura coal mine with effect from 24 May 2002. Production data are shown up to the dates of sale. |

| (k) | Rio Tinto had a 50 per cent share in Kaltim Prima and, under the terms of its Coal Agreement, the Indonesian Government was entitled to a 13.5 per cent share of Kaltim Prima’s production. Rio Tinto’s share of production shown is before deduction of the Government share. Rio Tinto completed the sale of its interest in PT Kaltim Prima Coal on 10 October 2003. Production data are shown up to the date of sale. |

| (l) | Kennecott Energy has a partnership interest in the Colowyo mine but, as it is responsible under a management agreement for the operation of the mine, all of Colowyo’s output is included in Rio Tinto’s share of production. |

| (m) | Rio Tinto completed the sale of its 25 per cent interest in Minera Alumbrera together with its wholly owned Peak gold mine on 17 March 2003. Production data are shown up to the date of sale. |

| (n) | From mid 1995 until 30 March 2004, Rio Tinto held 23.93 million shares of Freeport-McMoRan-Copper & Gold (FCX) common stock from which it derived a share of production. This interest was sold on 30 March 2004. Also, through a joint venture agreement with FCX, Rio Tinto is entitled, as shown separately in the above tables, to 40 per cent of additional material mined as a consequence of expansions and developments of the Grasberg facilities since 1998. |

| (o) | Rio Tinto completed the sale of its 49 per cent interest in Somincor on 18 June 2004. Production data are shown up to the date of sale. |

| (p) | Rio Tinto’s interest in Argyle Diamonds increased from 99.8 per cent to 100 per cent on 29 April 2002, following the purchase of the outstanding units in the Western Australian Diamond Trust. |

| (q) | Ore mining and processing at Murowa commenced during the third quarter of 2004. |

| (r) | Following a placement of shares on 13 November 2003, Rio Tinto’s interest in Lihir moved from 16.3 per cent to 14.5 per cent. |

| (s) | Rio Tinto sold its interest in Morro do Ouro on 31 December 2004. Production data are shown up to the date of sale. |

| (t) | As a result of the corporate restructuring completed on 8 July 2004, Rio Tinto has ceased to be an ordinary shareholder in the renamed RioZim but will retain a reduced cash participation in its gold and nickel assets for a period of ten years. |

| (u) | Rio Tinto’s share of production includes 100 per cent of the production from the Eastern Range mine, which commenced production in March 2004. Under the terms of the joint venture agreement, Hamersley Iron manages the operation and is obliged to purchase all mine production from the joint venture. |

| (v) | Rio Tinto increased its shareholding in Iron Ore Company of Canada from 56.1 per cent to 58.7 per cent on 20 December 2002. |

| (w) | Rio Tinto completed the sale of its 100 per cent interest in the Zinkgruvan mine on 2 June 2004. Production data are shown up to the date of sale. |

| (x) | Rio Tinto completed the sale of its 100 per cent interest in the Fortaleza nickel mine on 16 January 2004. This was effective from 1 January 2004. |

| (y) | Talc production includes some products derived from purchased ores. |

| (z) | Quantities comprise 100 per cent of QIT and 50 per cent of Richards Bay Minerals’ production. |

ORE RESERVES

Ore reserves prepared in accordance with Industry Guide 7 under the Unites States Securities Act of 1933 have been set out on pages A-85 to A-95.

Rio Tinto 2004 Form 20-F 20

GROUP OPERATIONS (wholly owned unless stated otherwise)

|

| ALUMINIUM | COPPER AND GOLD | IRON ORE | TALC | ||||

| Operating sites | Operating sites | Operating sites | Operating sites | ||||

| 1 | Anglesey Aluminium (51%) | 20 | Bougainville (not operating) | 33 | Corumbá | (only major sites are | |