LITHIA MOTORS INC0001023128False00010231282023-02-092023-02-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

February 9, 2023

Date of Report (date of earliest event reported)

LITHIA MOTORS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Oregon | 001-14733 | 93-0572810 |

| (State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | |

| 150 N. Bartlett Street | Medford | Oregon | 97501 |

| (Address of principal executive offices) | (Zip Code) |

(541) 776-6401

Registrant's telephone number, including area code

Not Applicable

(Former Name or Former Address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock without par value | | LAD | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On February 9, 2023, Lithia Motors, Inc. (the “Company”) entered into a Fourth Amendment (the “Fourth Amendment”) to its Fourth Amended and Restated Loan Agreement (the “Loan Agreement”) with U.S. Bank National Association as agent for the lenders, and each of the lenders party to the Loan Agreement, as lenders (collectively, the “Lenders”). Among other changes, the Fourth Amendment increases the total financing commitment from $3.75 billion to $4.5 billion, which may be further expanded, subject to Lender approval and the satisfaction of other conditions, up to a total of $5.5 billion.

A copy of the Fourth Amendment is set forth as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference. The description of the Fourth Amendment in this Report is only a summary and is qualified in its entirety by reference to the actual terms of the Fourth Amendment.

Item 2.02. Results of Operations and Financial Condition

On February 15, 2023 Lithia Motors, Inc. issued a press release announcing financial results for the fourth quarter of 2022. A copy of the press release is attached as Exhibit 99.1

Item 8.01. Other Events

On February 15, 2023, Lithia Motors, Inc. announced a $0.42 per share cash dividend, to be paid on March 24, 2023 to shareholders of record as of March 10, 2023.

The information furnished in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the " Exchange Act"), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits | | | | | |

| Press Release of Lithia Motors, Inc. dated Fourth Amendment to Fourth Amended and Restated Loan Agreement, dated February 9, 2023, among Lithia Motors, Inc., the subsidiaries of Lithia Motors, Inc. listed on the signature pages of the agreement or that thereafter become borrowers thereunder, the lenders party thereto from time to time, and U.S. Bank National Association.* |

| Press Release of Lithia Motors, Inc. dated February 15, 2023 |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

•Certain confidential and immaterial terms redacted pursuant to Item 601(b)(10)(iv) of Regulation S-K.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Dated: | February 15, 2023 | | LITHIA MOTORS, INC. |

| | By: | /s/ Tina Miller |

| | | Tina Miller |

| | | Senior Vice President and Chief Financial Officer |

Execution Version 45784076v8 118306793.2 0063724-00082 FOURTH AMENDMENT TO FOURTH AMENDED AND RESTATED LOAN AGREEMENT This Fourth Amendment to Fourth Amended and Restated Loan Agreement (this “Amendment”), dated as of February 9, 2023, is entered into among Lithia Motors, Inc., an Oregon corporation (the “Company”), each of the Subsidiaries of the Company listed on the signature pages of this Amendment (together with the Company, each a “Borrower” and any two or more “Borrowers”), the Lenders under the Loan Agreement described below that are signatories to this Amendment, and U.S. Bank National Association, as Agent for the Lenders (in such capacity, “Agent”). R E C I T A L S: A. The Company, certain of its Subsidiaries, the Lenders and Agent have entered into a Fourth Amended and Restated Loan Agreement dated as of April 29, 2021 (as amended by that certain First Amendment to Fourth Amended and Restated Loan Agreement, dated as of February 7, 2022, that certain Second Amendment to Fourth Amended and Restated Loan Agreement, dated as of June 2, 2022, that certain Third Amendment to Fourth Amended and Restated Loan Agreement, dated as of November 21, 2022 and as may be further amended, restated, supplemented or otherwise modified, the “Loan Agreement”). Capitalized terms not otherwise defined herein shall have the meanings given to such terms in the Loan Agreement. B. The Company has requested that (a) certain Lenders set forth on the signature pages hereto as Increasing Lenders increase the amount of the Aggregate Commitment by $750,000,000 pursuant to Section 6.12.1 of the Loan Agreement (the “Incremental Increase”) and (b) the Agent and the Lenders party hereto agree to amend certain provisions of the Loan Agreement set forth herein. C. The Increasing Lenders are willing to provide the Incremental Increase and the Lenders that are signatories to this Amendment, constituting the Required Lenders under the Loan Agreement, have agreed to the amendments to the Loan Agreement set forth herein. For valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows: 1. Amendments to the Loan Agreement. From and after the date hereof (the “Fourth Amendment Effective Date”): 1.1 Cover Page. The cover page to the Loan Agreement is amended by adding American Honda Finance Corporation and TD Bank, N.A. as Co-Syndication Agents and removing them as Co-Documentation Agents. 1.2 Recitals. Clause “B” of the Recitals to the Loan Agreement is deleted and replaced with the following:

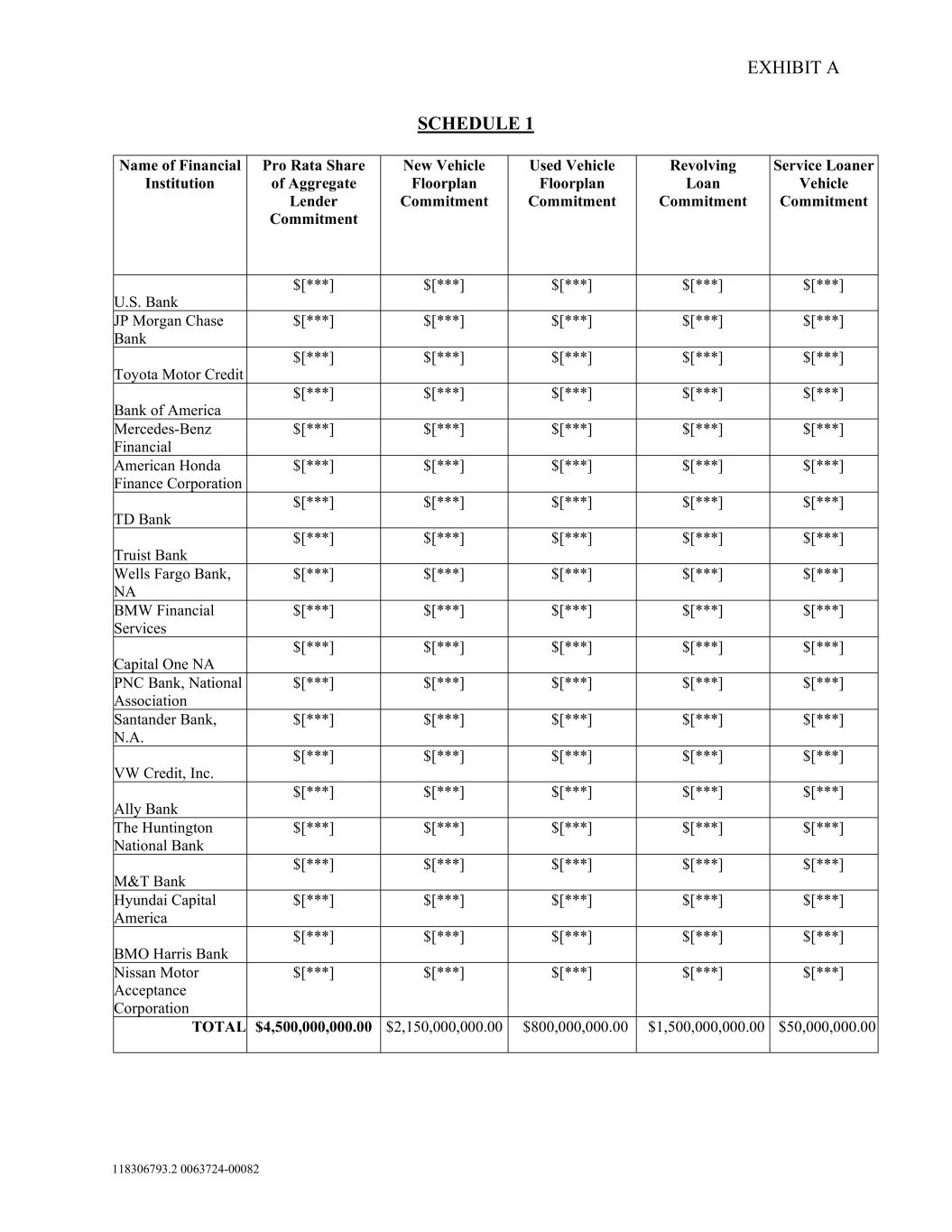

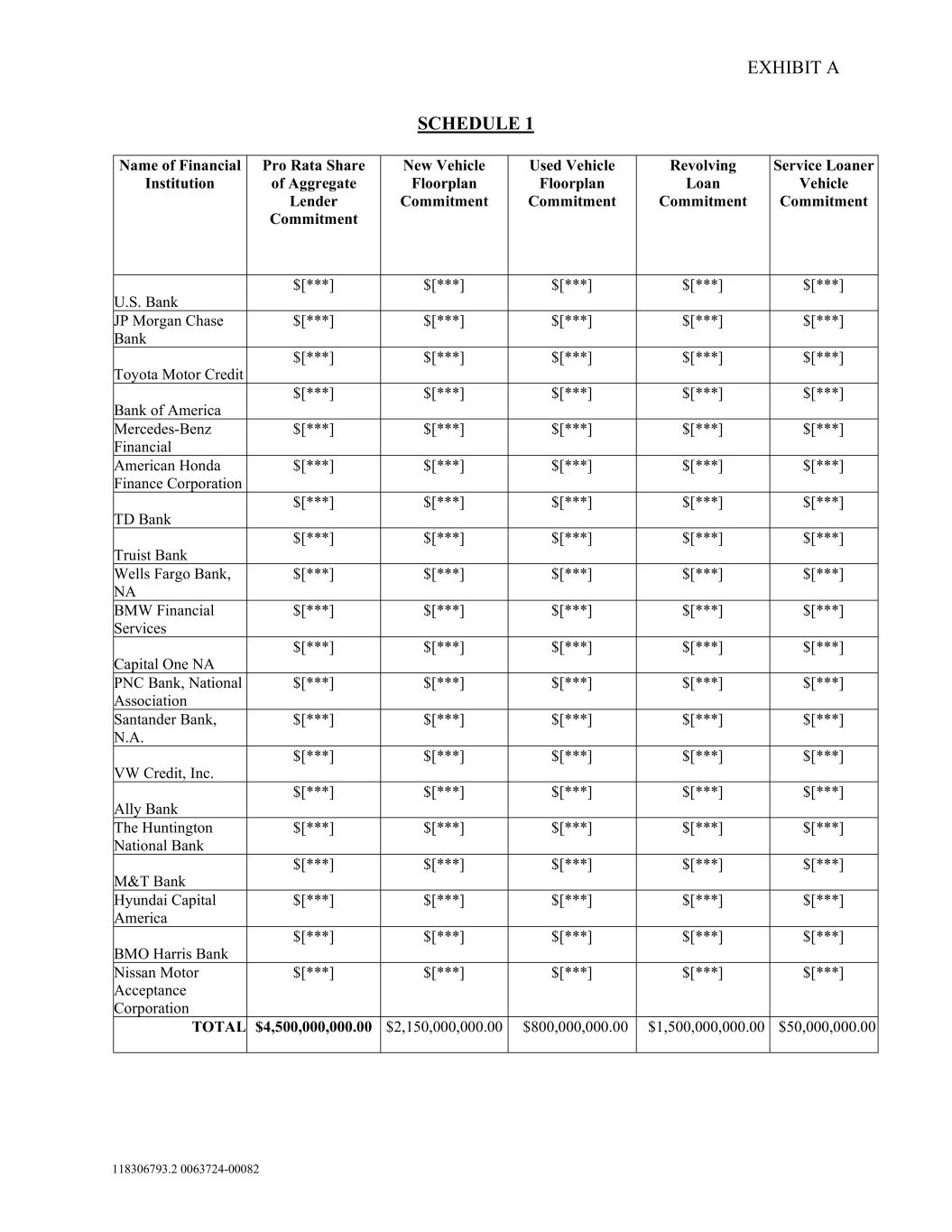

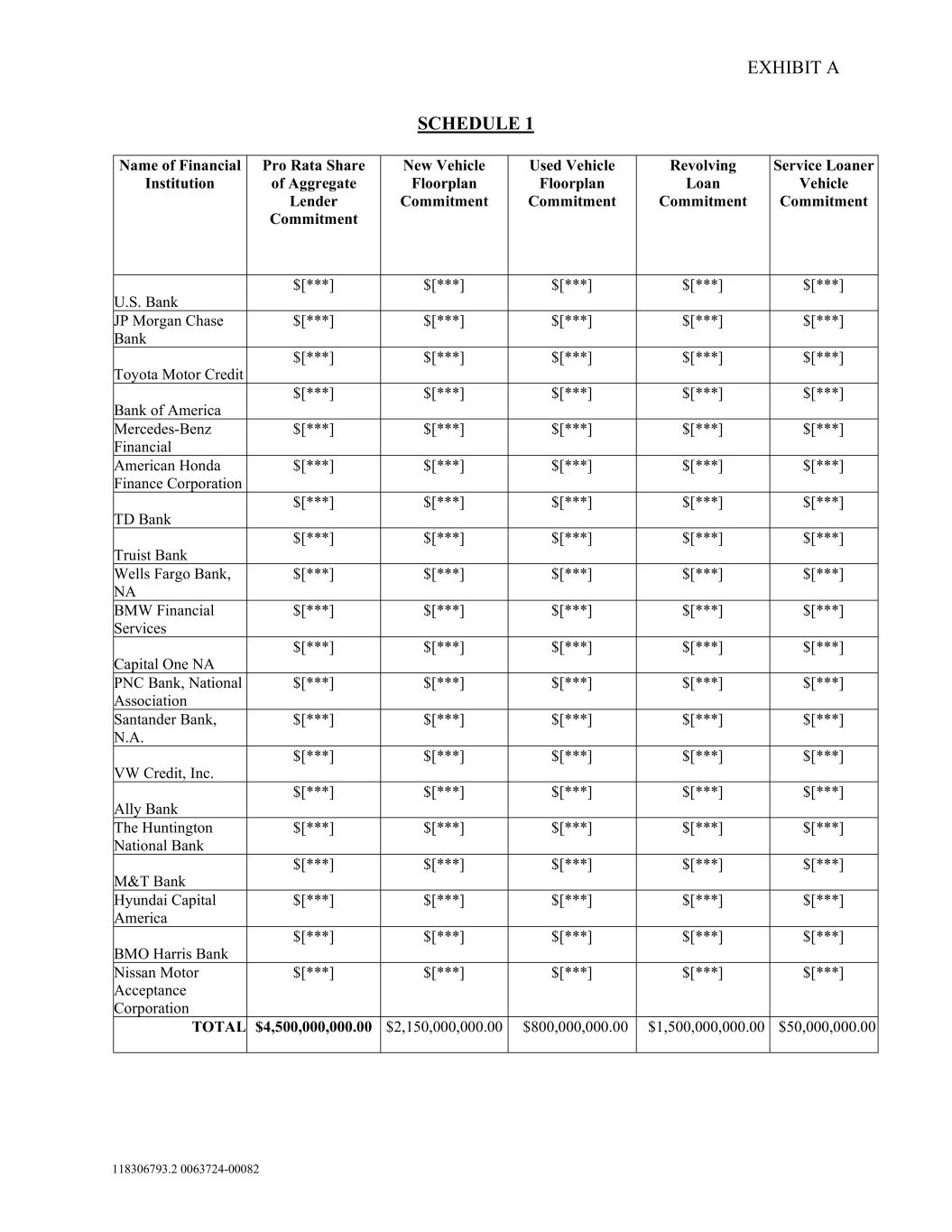

- 2 - 45784076v8 118306793.2 0063724-00082 B. The Company and the other Borrowers have asked the Lenders and the Agent to further amend and restate the Existing Loan Agreement as set forth herein. 1.3 Definitions. The definition of “Aggregate Commitment” in the Loan Agreement is deleted and replaced with the following: “Aggregate Commitment” means, at any time, the sum of the Aggregate New Vehicle Floorplan Commitment, plus the Aggregate Used Vehicle Floorplan Commitment, plus the Aggregate Service Loaner Vehicle Floorplan Commitment, plus the Aggregate Revolving Loan Commitment, as adjusted from time to time pursuant to the terms hereof, provided that, except as provided in Section 6.12, the Aggregate Commitment shall not be more than $4,500,000,000. 1.4 Definitions. Section 1.01 of the Loan Agreement is amended by inserting therein, in alphabetical order, a new definition for the term “Fourth Amendment Effective Date”, which shall read as follows: “Fourth Amendment Effective Date” means February 9, 2023. 1.5 Increase Option. Sections 6.12.1 and 6.12.2 of the Loan Agreement are deleted and replaced with the following: 6.12.1. The Company may from time to time request an increase in the Aggregate New Vehicle Floorplan Commitment, in minimum increments of $50,000,000 or such lower amount as is agreed to between the Company and the Agent, so long as, after giving effect thereto, (a) the aggregate amount of all such increases requested after the Fourth Amendment Effective Date does not exceed $1,000,000,000, and (b) the Aggregate Commitment does not exceed $5,500,000,000. 6.12.2. The Company may arrange for any such increase to be provided by one or more Lenders (each Lender so agreeing to an increase in its Commitment, an “Increasing Lender”), or by one or more new banks, financial institutions (each such new bank, financial institution or other entity, an “Additional Lender”), which Lender or Lenders shall increase their existing Commitments, or extend Commitments, as the case may be; provided that (a) each Additional Lender and each Increasing Lender and the amount of the increase of each Additional Lender and Increasing Lender shall be subject to the reasonable approval of the Company, the Agent and the LC Issuer, (b) (i) in the case of an Increasing Lender, unless the increase occurs simultaneously with the closing of an amendment to this Agreement, the Agent, Borrowers and such Increasing Lender shall execute an Increasing Lender Agreement substantially in the form of Exhibit N hereto, and (ii) in the case of an Additional Lender, the Agent, Borrowers and such Additional Lender shall execute an Additional Lender Agreement substantially in the form of Exhibit M hereto, and (c) the applicable Borrower or Borrowers, Increasing Lender, Additional Lender and any other Loan Party shall each deliver to the Agent such other documents or amendments to existing Loan Documents as the Agent reasonably deems necessary. 1.6 Schedule 1 to the Loan Agreement is hereby amended by deleting such exhibit in its entirety and replacing it with Exhibit A attached hereto. Each of the parties

- 3 - 45784076v8 118306793.2 0063724-00082 hereto agrees that, after giving effect to this Amendment, the revised Aggregate Commitment of each Lender shall be as set forth on Exhibit A attached hereto. In connection with this Amendment, the outstanding Loans and participation interests shall be reallocated by causing such fundings and repayments (which shall not be subject to any processing and/or recordation fees) among the Lenders of the Loans as necessary such that, after giving effect to the Incremental Increase, each Lender will hold Loans and participation interests based on its pro rata share of Loans after giving effect to such Incremental Increase. 1.7 Except as set forth in clause 1.6 above, all other Exhibits and Schedules to the Loan Agreement shall not be amended, modified, supplemented or otherwise affected. 2. Condition Precedent. The effectiveness of this Amendment is subject to satisfaction of the following conditions: 2.1 The receipt by Agent of executed originals of this Amendment signed by Agent, each Borrower, each Guarantor, and the Required Lenders; 2.2 The receipt by Agent of documentation satisfactory to the Agent to establish the due organization, valid existence and (if applicable) good standing of each Loan Party; its authority to execute, deliver and perform the Amendment and the identity, authority and capacity of each Person authorized to act on its behalf, which may, without limitation, include certified copies of articles or certificates of incorporation and amendments thereto, bylaws and amendments thereto, certificates of good standing, existence and/or qualification to engage in business, corporate resolutions, incumbency certificates, and the like; 2.3 No Default has occurred and is continuing or will exist after giving effect to the Incremental Increase; 2.4 All representations and warranties in the Loan Agreement are true and correct in all material respects; and 2.5 The Company and its Subsidiaries are in compliance (on a Pro Forma Basis reasonably acceptable to the Agent) with the financial covenants in Section 11.1 of the Loan Agreement after giving effect to the Incremental Increase. 3. Reaffirmation; Release. By signing this Amendment or the attached Acknowledgment: 3.1 Each Loan Party affirms that the representations and warranties in each of the existing Loan Documents are true and correct in all material respects as of the date hereof (except that such representations and warranties that speak as of a specified date or period of time shall be true and correct in all material respects only as of such date or period of time), and agree that (i) except as amended previously or in connection herewith, each Loan Document is valid and enforceable in accordance with its terms (except as may be limited by bankruptcy, insolvency, reorganization, moratorium, fraudulent transfer or similar laws relating to or limiting creditors’ rights generally or by equitable principles) and (ii) such Loan Party has no claims, defenses, setoffs, counterclaims or claims for recoupment against Agent, the Lenders, the other

- 4 - 45784076v8 118306793.2 0063724-00082 Indemnified Persons or the indebtedness and obligations represented by the Notes, Guaranties, Collateral Documents and other Loan Documents. 3.2 Each Loan Party hereby releases, acquits, and forever discharges Agent, each Lender, their respective parent corporations, affiliates, subsidiaries, successors, assigns, officers, directors, employees, agents, attorneys and advisors (collectively, “Indemnified Persons”), and each of them, of and from any and all liability, claims, demands, damages, actions, causes of action, defenses, counterclaims, setoffs, or claims for recoupment of whatsoever nature, whether known or unknown, from the beginning of time to the date of this Amendment, whether in contract or tort or otherwise, arising directly or indirectly from, or in any way related to the Loan Agreement, this Amendment, the Notes, Collateral Documents and the other Loan Documents, any other indebtedness or obligations of any Loan Party to Agent or any one or more of the Lenders or to the relationship between any Loan Party and Agent, any Lender, or the Indemnified Persons. 3.3 This Amendment is not a novation of the Loan Agreement or of any credit facility or guaranty provided thereunder or in respect thereof. Notwithstanding that the cover page of the Loan Agreement is dated “as of April 29, 2021” and Section 9.01 of the Loan Agreement contains those conditions which were applicable to the initial Closing Date of April 29, 2021, the changes to the Loan Agreement effected by this Amendment shall be effective as of the satisfaction to the conditions effectiveness set forth in Section 2 of this Amendment. 4. References. On and after the Fourth Amendment Effective Date, all references in the Loan Agreement and the other Loan Documents to the Loan Agreement shall be deemed to refer to the Loan Agreement as amended hereby. 5. Representations and Warranties. By signing this Amendment or the attached Acknowledgment, each Loan Party represents and warrants to Agent and the Lenders as follows: 5.1 Authorization. (a) It has all requisite power and authority to enter into this Amendment and to carry out the transactions contemplated by, and perform its obligations under, the Loan Agreement as amended by this Amendment (the “Amended Agreement”), (b) its execution, delivery and performance of this Amendment and the other Loan Documents to be executed, delivered or performed by it have been duly authorized by all necessary entity action, do not require the approval of any governmental agency or other Person, do not contravene any law, regulation, rule, order, or restriction of any Governmental Body binding on it or its articles of incorporation or other organizational documents, and do not contravene the provisions of or constitute a default under any agreement or instrument to which it is a party or by which it may be bound or affected, and (c) this Amendment has been duly executed and delivered by each Loan Party and this Amendment and the Amended Agreement are the legally valid and binding obligations of each Loan Party, enforceable against such Loan Party in accordance with their respective terms, except as may be limited by bankruptcy, insolvency, reorganization, moratorium, fraudulent transfer or similar laws relating to or limiting creditors’ rights generally or by equitable principles.

- 5 - 45784076v8 118306793.2 0063724-00082 5.2 Absence of Default. No Default or Event of Default has occurred and is continuing or will exist after giving effect to the transactions contemplated by this Amendment. 5.3 Each of the representations and warranties made by any Loan Party in or pursuant to the Loan Documents are true and correct in all material respects on and as of the Fourth Amendment Effective Date, except to the extent such representations and warranties expressly relate to an earlier date, in which case such representations and warranties are true and correct in all material respects as of such earlier date (except that, in each case, any representation and warranty that is qualified as to “materiality” or “Material Adverse Effect” are true and correct in all respects). 6. Expenses. Borrowers shall pay all reasonable costs, fees and expenses (including without limitation, reasonable attorney fees of Agent’s counsel) incurred by Agent in connection with the preparation, negotiation, execution, and delivery of this Amendment and any other document required to be furnished herewith. 7. Recitals. The Recitals are hereby incorporated herein. 8. Counterparts. This Amendment may be executed in any number of counterparts, each of which shall be deemed to be an original, and all of said counterparts taken together shall be deemed to constitute but one document. 9. Disclosure. Under Oregon law, most agreements, promises and commitments made by a lender concerning loans and other credit extensions which are not for personal, family or household purposes or secured solely by the borrower’s residence must be in writing, express consideration and be signed by the lender to be enforceable. 10. Governing Law. THIS AMENDMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF OREGON. [Signature pages follow]

FOURTH AMENDMENT 118306793.2 0063724-00082 DCH MISSION VALLEY LLC DCH MONMOUTH LLC DCH MONTCLAIR LLC DCH MOTORS LLC DCH NANUET LLC DCH NY MOTORS LLC DCH OXNARD 1521 IMPORTS INC. DCH RIVERSIDE-S, INC. DCH TEMECULA IMPORTS LLC DCH TEMECULA MOTORS LLC DCH TORRANCE IMPORTS INC. DENVER EXOTICS, LLC DESERT-CJD, LLC DORAL-A, LLC DORAL-K, LLC DORAL-VW, LLC FARMINGTON HILLS IMPORTS, LLC FARMINGTON HILLS-CJD, LLC FARMINGTON HILLS-H, LLC FARMINGTON HILLS-N, LLC FARMINGTON HILLS-T, LLC FERNDALE-BG, LLC FLORIDA CITY-H, LLC FONTANA-H, INC. FORT WORTH-CJD, LLC FREEHOLD NISSAN LLC FRISCO-K, INC. GARDEN CITY-CJD, LLC HOUSTON-A, INC. HOUSTON-H, INC. HOUSTON-I, INC. HUTCHINS EUGENE NISSAN, INC. HUTCHINS IMPORTED MOTORS, INC. JACKSON-T, LLC KATY-H, INC. KNOXVILLE-CJD, LLC LAD CARSON-N, LLC LAD MISSION VIEJO-JLR, INC. LAD-AU, LLC LAD-MB, LLC LAD-N, LLC LAD-P, LLC LAD-T, LLC

FOURTH AMENDMENT 118306793.2 0063724-00082 LAD-V, LLC LAS VEGAS-CJD, LLC LAS VEGAS-J, LLC LAUDERDALE-A, LLC LBMP, LLC LEAGUE CITY-H, INC LEXINGTON-CJD, LLC LGPAC, INC. LITHIA ACDM, INC. LITHIA ANCHORAGE-C, LLC LITHIA ANCHORAGE-H, LLC LITHIA BAIERL-S, LLC LITHIA BRYAN TEXAS, INC. LITHIA CDH, INC. LITHIA CIMR, INC. LITHIA CJDO, INC. LITHIA CJDSA, INC. LITHIA CJDSF, INC. LITHIA CM, INC. LITHIA CO, INC. LITHIA CRATER LAKE-M, INC. LITHIA CSA, INC. LITHIA DE, INC. LITHIA DES MOINES-VW, LLC LITHIA DMID, INC. LITHIA DODGE OF TRI-CITIES, INC. LITHIA FRESNO, INC. LITHIA HAMILTON-H, LLC LITHIA HAZLETON-H, LLC LITHIA HDM, INC. LITHIA HGF, INC. LITHIA HMID, INC. LITHIA IMPORTS OF ANCHORAGE, INC. LITHIA JEF, INC. LITHIA KLAMATH, INC. LITHIA KLAMATH-T, INC. LITHIA MBDM, INC. LITHIA MEDFORD HON, INC. LITHIA MIDDLETOWN-L, LLC LITHIA MOON-S, LLC LITHIA MOON-V, LLC LITHIA MORGANTOWN-CJD, LLC LITHIA MORGANTOWN-S, LLC

FOURTH AMENDMENT 118306793.2 0063724-00082 LITHIA MTLM, INC. LITHIA NA, INC. LITHIA NC, INC. LITHIA ND ACQUISITION CORP. #3 LITHIA NDM, INC. LITHIA NF, INC. LITHIA OF ANCHORAGE, INC. LITHIA OF BEND #1, LLC LITHIA OF BEND #2, LLC LITHIA OF BENNINGTON – 3, LLC LITHIA OF BENNINGTON – 4, LLC LITHIA OF BILLINGS II LLC LITHIA OF BILLINGS, INC. LITHIA OF DES MOINES, INC. LITHIA OF EUREKA, INC. LITHIA OF FAIRBANKS, INC. LITHIA OF GREAT FALLS, INC. LITHIA OF HELENA, INC. LITHIA OF HONOLULU-A, INC. LITHIA OF HONOLULU-BGMCC, LLC LITHIA OF HONOLULU-V, LLC LITHIA OF KILLEEN, LLC LITHIA OF LODI, INC. LITHIA OF MAUI-H, LLC LITHIA OF MISSOULA II, LLC LITHIA OF MISSOULA, INC. LITHIA OF POCATELLO, INC. LITHIA OF PORTLAND I, LLC LITHIA OF PORTLAND, LLC LITHIA OF ROBSTOWN, LLC LITHIA OF ROSEBURG, INC. LITHIA OF SEATTLE, INC. LITHIA OF SOUTH CENTRAL AK, INC. LITHIA OF STOCKTON, INC. LITHIA OF STOCKTON-V, INC. LITHIA OF TF, INC. LITHIA OF TROY, LLC LITHIA OF UTICA – 3, LLC LITHIA OF UTICA – 4, LLC LITHIA OF WALNUT CREEK, INC. LITHIA OF WASILLA, LLC LITHIA OF YORKVILLE – 1, LLC LITHIA OF YORKVILLE – 2, LLC

FOURTH AMENDMENT 118306793.2 0063724-00082 LITHIA OF YORKVILLE – 3, LLC LITHIA OF YORKVILLE – 5, LLC LITHIA ORCHARD PARK-H, LLC LITHIA PARAMUS-M, LLC LITHIA PITTSBURGH-S, LLC LITHIA RAMSEY-B, LLC LITHIA RAMSEY-L, LLC LITHIA RAMSEY-M, LLC LITHIA RAMSEY-T, LLC LITHIA RENO SUB-HYUN, INC. LITHIA RENO-CJ, LLC LITHIA RENO-VW, LLC LITHIA SALMIR, INC. LITHIA SEA P, INC. LITHIA SEASIDE, INC. LITHIA SOC, INC. LITHIA SPOKANE-B, LLC LITHIA SPOKANE-S, LLC LITHIA TA, INC. LITHIA TO, INC. LITHIA TR, INC. LITHIA VAUDM, INC. LITHIA WEXFORD-H, LLC LLL SALES CO LLC LMBB, LLC LMBP, LLC LMOP, LLC LOS ANGELES-M, INC. MADISON-H, INC. MESQUITE-K, INC. MIAMI GARDENS-BG, LLC MIAMI GARDENS-M, LLC MIAMI GARDENS-S, LLC MISSION HILLS-H, INC. MOBILE-S, LLC NEW PORT RICHEY-V, LLC NOVI-I, LLC ORLANDO-JLR, LLC PARAMUS WORLD MOTORS LLC PHILADELPHIA-F, LLC PHOENIX-T, INC. PLYMOUTH-C, LLC ROCKWALL-H, INC.

FOURTH AMENDMENT 118306793.2 0063724-00082 ROCKWALL-K, INC. ROSEVILLE-C, INC ROSEVILLE-K, INC ROSEVILLE-T, INC ROUND ROCK-K, INC. SACRAMENTO-L, INC. SALEM-B, LLC SALEM-H, LLC SALEM-V, LLC SAN FRANCISCO-B, INC. SANFORD-CJD, LLC SHARLENE REALTY LLC SHERMAN OAKS-A, INC. SHERMAN OAKS-AC, INC. SHERMAN OAKS-B, INC. STERLING-BM, LLC STERLING-RLM, LLC TAMPA-H, LLC THOUSAND OAKS-S, INC. TROY EXOTICS, LLC TROY-BG, LLC TROY-C, LLC TROY-CJD, LLC TROY-H, LLC TROY-I, LLC TROY-JLR, LLC TROY-M, LLC TROY-N, LLC TROY-S, LLC TROY-T, LLC TROY-V, LLC TROY-VW, LLC TUSTIN MOTORS INC. UNION-H, LLC URBANDALE-S, LLC VALENCIA-A, INC. VAN NUYS-C, INC. VAN NUYS-H, INC. VAN NUYS-L, INC. VAN NUYS-T, INC. WAUKESHA-H, INC. WAUKESHA-S, INC. WAUKESHA-CJD, INC.

JPMORGAN CHASE BANK, N.A., as Lender and Increasing Lender By: __ -'---v------�"t- Name: Jeff alder Title: E ecutive Director FOURTH AMENDMENT

FOURTH AMENDMENT MERCEDES-BENZ FINANCIAL SERVICES USA LLC, as Lender and Increasing Lender By: Name: Farrah Vaughn-Dixon Title: Regional Dealer Credit Manager-National Accounts

FOURTH AMENDMENT NISSAN MOTOR ACCEPTANCE CORPORATION, as Lender By: Name: Title: Todd Voorhies Sr. Manager, Dealer Credit

Ally Proprietary ALLY BANK, as Lender and Increasing Lender By: q?= Name: :I e.f I'./"( 1 /Lit ,r"1 <=re.. o/ Title: A,.,,;/4. or� "l.e..d fkrr.,.w-J .... -h'vL- Ally Proprietary FOURTH AMENDMENT

HYUNDAI CAPITAL,AMERICA, as Lender and Increasing Lender /1,,// ... �::,�---\ By: � ·;./ Name: Andrew Leone Title: VP, Commercial Mobility Services FOURTH Arv!ENDMENT l

FOURTH AMENDMENT TRUIST BANK, as Lender and Increasing Lender By: Name: John P. Wofford Title: Authorized Officer

FOURTH AMENDMENT 118306793.2 0063724-00082 ACKNOWLEDGMENT AND CONSENT OF GUARANTORS Each undersigned Guarantor hereby acknowledges, consents, and agrees to all terms and conditions of the foregoing Amendment. 797 VALLEY STREET LLC ANN ARBOR-B, LLC ANN ARBOR-CC, LLC ANN ARBOR-CJD, LLC ANN ARBOR-M, LLC AUSTIN-H, INC. AUSTIN-KI, INC. AVONDALE-N, INC. BAIERL AUTO PARTS, LLC BAIERL AUTOMOTIVE CORPORATION BAIERL CHEVROLET, INC. BAIERL HOLDING, LLC BEND-CDJR, LLC BEND-N, LLC BELLEVUE-S, LLC BELLEVUE-T, LLC CADILLAC OF PORTLAND LLOYD CENTER, LLC CAMP AUTOMOTIVE, INC. CARBONE AUTO BODY, LLC CENTENNIAL-HY, LLC CHAMBLEE-H, LLC CLEAR LAKE-I, INC. CLINTON-C, LLC CORAL SPRINGS-A, LLC COSTA MESA-CJD, INC. CRANBERRY AUTOMOTIVE, INC. DAH CHONG HONG CA TRADING LLC DAH CHONG HONG TRADING CORPORATION DALLAS COLLISION, INC. DALLAS-H, INC. DALLAS-K, INC. DALLAS-T, INC. DARON MOTORS LLC DCH (OXNARD) INC. DCH AUTO GROUP (USA) INC. DCH BLOOMFIELD LLC DCH CA LLC DCH CALABASAS-A, LLC

FOURTH AMENDMENT 118306793.2 0063724-00082 DCH CALIFORNIA INVESTMENTS LLC DCH CALIFORNIA MOTORS INC. DCH DEL NORTE, INC. DCH DMS NJ, LLC DCH ESSEX INC. DCH FINANCIAL NJ, LLC DCH FREEHOLD LLC DCH HOLDINGS LLC DCH INVESTMENTS INC. (NEW JERSEY) DCH INVESTMENTS INC. (NEW YORK) DCH KOREAN IMPORTS LLC DCH MAMARONECK LLC DCH MISSION VALLEY LLC DCH MONMOUTH LLC DCH MONTCLAIR LLC DCH MOTORS LLC DCH NANUET LLC DCH NORTH AMERICA INC. DCH NY MOTORS LLC DCH OXNARD 1521 IMPORTS INC. DCH RIVERSIDE-S, INC. DCH SUPPORT SERVICES, LLC DCH TEMECULA IMPORTS LLC DCH TEMECULA MOTORS LLC DCH THOUSAND OAKS-F, INC. DCH TL HOLDINGS LLC DCH TL NY HOLDINGS LLC DCH TORRANCE IMPORTS INC. DENVER EXOTICS, LLC DESERT-CJD, LLC DORAL-A, LLC DORAL-G, LLC DORAL-HY, LLC DORAL-K, LLC DORAL-VW, LLC DRIVEWAY MOTORS, LLC ELK GROVE-F, INC. FARMINGTON HILLS IMPORTS, LLC FARMINGTON HILLS-CJD, LLC FARMINGTON HILLS-H, LLC FARMINGTON HILLS-N, LLC FARMINGTON HILLS-T, LLC FERNDALE COLLISION, LLC

FOURTH AMENDMENT 118306793.2 0063724-00082 FERNDALE-BG, LLC FERNDALE-F, LLC FH COLLISION, LLC FLORIDA CITY-H, LLC FLORIDA SS, LLC FONTANA-H, INC. FORT WORTH-CJD, LLC FREEHOLD NISSAN LLC FRISCO-K, INC. GARDEN CITY-CJD, LLC GREENCARS, INC. HENDERSON-HY, LLC HOUSTON-A, INC. HOUSTON-H, INC. HOUSTON-I, INC. HUTCHINS EUGENE NISSAN, INC. HUTCHINS IMPORTED MOTORS, INC. JACKSON-T, LLC KATY-H, INC. KNOXVILLE-CJD, LLC LA MOTORS HOLDING, LLC LAD ADVERTISING, INC. LAD CARSON-N, LLC LAD MISSION VIEJO-JLR, INC. LAD MOBU, INC. LAD-AU, LLC LAD-F, INC. LAD-MB, LLC LAD-N, LLC LAD-P, LLC LAD-T, LLC LAD-V, LLC LAS VEGAS-CJD, LLC LAS VEGAS-J, LLC LAS VEGAS-G, LLC LAS VEGAS-HY, LLC LATHAM FORD-F, LLC LAUDERDALE-A, LLC LBMP, LLC LEAGUE CITY-H, INC. LEXINGTON-CJD, LLC LFKF, LLC LGPAC, INC.

FOURTH AMENDMENT 118306793.2 0063724-00082 LITHIA ACDM, INC. LITHIA AIRCRAFT, INC. LITHIA ANCHORAGE-C, LLC LITHIA ANCHORAGE-H, LLC LITHIA ARMORY GARAGE, LLC LITHIA AUCTION & RECON, LLC LITHIA AUTO SERVICES, INC. LITHIA BA HOLDING, INC. LITHIA BAIERL-S, LLC LITHIA BNM, INC. LITHIA BRYAN TEXAS, INC. LITHIA CDH, INC. LITHIA CIMR, INC. LITHIA CJDO, INC. LITHIA CJDSA, INC. LITHIA CJDSF, INC. LITHIA CM, INC. LITHIA CO, INC. LITHIA CRATER LAKE-F, INC. LITHIA CRATER LAKE-M, INC. LITHIA CSA, INC. LITHIA DE, INC. LITHIA DES MOINES-VW, LLC LITHIA DM, INC. LITHIA DMID, INC. LITHIA DODGE OF TRI-CITIES, INC. LITHIA EATONTOWN-F, LLC LITHIA FINANCIAL CORPORATION LITHIA FLCC, LLC LITHIA FLORIDA HOLDING, INC. LITHIA FMF, INC. LITHIA FORD OF BOISE, INC. LITHIA FRESNO, INC. LITHIA HAMILTON-H, LLC LITHIA HAZLETON-H, LLC LITHIA HDM, INC. LITHIA HGF, INC. LITHIA HMID, INC. LITHIA HPI, INC. LITHIA IDAHO FALLS-F, INC. LITHIA IMPORTS OF ANCHORAGE, INC. LITHIA JEF, INC. LITHIA KLAMATH, INC.

FOURTH AMENDMENT 118306793.2 0063724-00082 LITHIA KLAMATH-T, INC. LITHIA MBDM, INC. LITHIA McMURRAY-C, LLC LITHIA MEDFORD HON, INC. LITHIA MICHIGAN HOLDING, INC. LITHIA MIDDLETOWN-L, LLC LITHIA MONROEVILLE-A, LLC LITHIA MONROEVILLE-C, LLC LITHIA MONROEVILLE-F, LLC LITHIA MOON-S, LLC LITHIA MOON-V, LLC LITHIA MORGANTOWN-CJD, LLC LITHIA MORGANTOWN-F, LLC LITHIA MORGANTOWN-S, LLC LITHIA MOTORS SUPPORT SERVICES, INC. LITHIA MTLM, INC. LITHIA NA, INC. LITHIA NC, INC. LITHIA ND ACQUISITION CORP. #1 LITHIA ND ACQUISITION CORP. #3 LITHIA NDM, INC. LITHIA NF, INC. LITHIA NORTHEAST REAL ESTATE, LLC LITHIA NORTHWEST REAL ESTATE, LLC LITHIA OF ANCHORAGE, INC. LITHIA OF BEND #1, LLC LITHIA OF BEND #2, LLC LITHIA OF BENNINGTON – 1, LLC LITHIA OF BENNINGTON – 3, LLC LITHIA OF BENNINGTON – 4, LLC LITHIA OF BILLINGS II LLC LITHIA OF BILLINGS, INC. LITHIA OF CASPER, LLC LITHIA OF CORPUS CHRISTI, INC. LITHIA OF DES MOINES, INC. LITHIA OF EUREKA, INC. LITHIA OF FAIRBANKS, INC. LITHIA OF GREAT FALLS, INC. LITHIA OF HELENA, INC. LITHIA OF HONOLULU-A, INC. LITHIA OF HONOLULU-BGMCC, LLC LITHIA OF HONOLULU-F, LLC LITHIA OF HONOLULU-V, LLC

FOURTH AMENDMENT 118306793.2 0063724-00082 LITHIA OF KILLEEN, LLC LITHIA OF LODI, INC. LITHIA OF MAUI-H, LLC LITHIA OF MISSOULA II, LLC LITHIA OF MISSOULA III, INC. LITHIA OF MISSOULA, INC. LITHIA OF POCATELLO, INC. LITHIA OF PORTLAND I, LLC LITHIA OF PORTLAND, LLC LITHIA OF ROBSTOWN, LLC LITHIA OF ROSEBURG, INC. LITHIA OF SEATTLE, INC. LITHIA OF SOUTH CENTRAL AK, INC. LITHIA OF SPOKANE II, INC. LITHIA OF SPOKANE, INC. LITHIA OF STOCKTON, INC. LITHIA OF STOCKTON-V, INC. LITHIA OF TF, INC. LITHIA OF TROY, LLC LITHIA OF UTICA – 2, LLC LITHIA OF UTICA – 3, LLC LITHIA OF UTICA – 4, LLC LITHIA OF WALNUT CREEK, INC. LITHIA OF WASILLA, LLC LITHIA OF YORKVILLE – 1, LLC LITHIA OF YORKVILLE – 2, LLC LITHIA OF YORKVILLE – 3, LLC LITHIA OF YORKVILLE – 5, LLC LITHIA ORCHARD PARK-H, LLC LITHIA PARAMUS-M, LLC LITHIA PITTSBURGH-S, LLC LITHIA RAMSEY-B, LLC LITHIA RAMSEY-L, LLC LITHIA RAMSEY-M, LLC LITHIA RAMSEY-T, LLC LITHIA REAL ESTATE, INC. LITHIA RENO SUB-HYUN, INC. LITHIA RENO-CJ, LLC LITHIA RENO-VW, LLC LITHIA ROSE-FT, INC. LITHIA SALMIR, INC. LITHIA SEA P, INC. LITHIA SEASIDE, INC.

FOURTH AMENDMENT 118306793.2 0063724-00082 LITHIA SOC, INC. LITHIA SPOKANE-B, LLC LITHIA SPOKANE-S, LLC LITHIA SSP, LLC LITHIA TA, INC. LITHIA TENNESSEE HOLDING, INC. LITHIA TO, INC. LITHIA TR, INC. LITHIA UNIONTOWN-C, LLC LITHIA VA REAL ESTATE, LLC LITHIA VAUDM, INC. LITHIA VIRGINIA HOLDING, INC. LITHIA WEXFORD-H, LLC LLL SALES CO LLC LMBB, LLC LMBP, LLC LMOP, LLC LOS ANGELES-M, INC. LSTAR, LLC MADISON-H, INC. MEDFORD INSURANCE, LLC MESQUITE-K, INC. MIAMI GARDENS-BG, LLC MIAMI GARDENS-G, LLC MIAMI GARDENS-HY, LLC MIAMI GARDENS-M, LLC MIAMI GARDENS-S, LLC MISSION HILLS-H, INC. MOBILE-S, LLC NEW PORT RICHEY-H, LLC NEW PORT RICHEY-V, LLC NORTHLAND FORD INC. NOVI-I, LLC ORLANDO-JLR, LLC PA REAL ESTATE, LLC PA SUPPORT SERVICES, LLC PARAMUS COLLISION, LLC PARAMUS WORLD MOTORS LLC PERSONALIZED MARKETING, LLC PHILADELPHIA-F, LLC PHOENIX-T, INC. PLYMOUTH-C, LLC RAMSEY HOLDINGCO, INC.

FOURTH AMENDMENT 118306793.2 0063724-00082 REDWOOD-HY, LLC RFA HOLDINGS, LLC ROCKWALL-H, INC. ROCKWALL-K, INC. ROSEVILLE-C, INC. ROSEVILLE-K, INC. ROSEVILLE-T, INC ROUND ROCK-K, INC. SACRAMENTO-L, INC. SALEM-B, LLC SALEM-H, LLC SALEM-V, LLC. SAN FRANCISCO-B, INC. SANFORD-CJD, LLC SHARLENE REALTY LLC SHERMAN OAKS-A, INC. SHERMAN OAKS-AC, INC. SHERMAN OAKS-B, INC. SHIFT PORTLAND, LLC STERLING HEIGHTS-F, LLC STERLING-BM, LLC STERLING-RLM, LLC TAMPA-F, LLC TAMPA-H, LLC THOUSAND OAKS-S, INC. TN REAL ESTATE, LLC TROY COLLISION, LLC TROY EXOTICS, LLC TROY-BG, LLC TROY-C, LLC TROY-CJD, LLC TROY-F, LLC TROY-H, LLC TROY-I, LLC TROY-JLR, LLC TROY-M, LLC TROY-N, LLC TROY-S, LLC TROY-T, LLC TROY-V, LLC TROY-VW, LLC TUSTIN MOTORS INC. UNION-H, LLC

EXHIBIT A 118306793.2 0063724-00082 SCHEDULE 1 Name of Financial Institution Pro Rata Share of Aggregate Lender Commitment New Vehicle Floorplan Commitment Used Vehicle Floorplan Commitment Revolving Loan Commitment Service Loaner Vehicle Commitment U.S. Bank $[***] $[***] $[***] $[***] $[***] JP Morgan Chase Bank $[***] $[***] $[***] $[***] $[***] Toyota Motor Credit $[***] $[***] $[***] $[***] $[***] Bank of America $[***] $[***] $[***] $[***] $[***] Mercedes-Benz Financial $[***] $[***] $[***] $[***] $[***] American Honda Finance Corporation $[***] $[***] $[***] $[***] $[***] TD Bank $[***] $[***] $[***] $[***] $[***] Truist Bank $[***] $[***] $[***] $[***] $[***] Wells Fargo Bank, NA $[***] $[***] $[***] $[***] $[***] BMW Financial Services $[***] $[***] $[***] $[***] $[***] Capital One NA $[***] $[***] $[***] $[***] $[***] PNC Bank, National Association $[***] $[***] $[***] $[***] $[***] Santander Bank, N.A. $[***] $[***] $[***] $[***] $[***] VW Credit, Inc. $[***] $[***] $[***] $[***] $[***] Ally Bank $[***] $[***] $[***] $[***] $[***] The Huntington National Bank $[***] $[***] $[***] $[***] $[***] M&T Bank $[***] $[***] $[***] $[***] $[***] Hyundai Capital America $[***] $[***] $[***] $[***] $[***] BMO Harris Bank $[***] $[***] $[***] $[***] $[***] Nissan Motor Acceptance Corporation $[***] $[***] $[***] $[***] $[***] TOTAL $4,500,000,000.00 $2,150,000,000.00 $800,000,000.00 $1,500,000,000.00 $50,000,000.00

Lithia & Driveway (LAD) Increases Revenue 11% and Reports Diluted EPS of $9.00

________________________________________________

Announces Dividend of $0.42 per Share for Fourth Quarter

Medford, Oregon, February 15, 2023 - Lithia & Driveway (NYSE: LAD) today reported the highest fourth quarter revenue in company history.

Fourth quarter 2022 revenue increased 11% to $7.0 billion from $6.3 billion in the fourth quarter of 2021.

Fourth quarter 2022 net income attributable to LAD per diluted share was $9.00, a 6% decrease from $9.57 per diluted share reported in the fourth quarter of 2021. Adjusted fourth quarter 2022 net income attributable to LAD per diluted share was $9.05, a 21% decrease compared to $11.39 per diluted share in the same period of 2021. Unrealized foreign currency gains positively impacted earnings per share by $0.13.

Fourth quarter 2022 net income was $250 million, a 15% decrease compared to net income of $293 million in the same period of 2021. Adjusted fourth quarter 2022 net income was $251 million, a 28% decrease compared to adjusted net income of $348 million for the same period of 2021.

As shown in the attached non-GAAP reconciliation tables, the 2022 fourth quarter adjusted results exclude a $0.05 per diluted share impact resulting from non-core charges, specifically non-cash unrealized investment loss, insurance reserves, and acquisition expenses, partially offset by a net gain on the sale of stores. The 2021 fourth quarter adjusted results were $1.82 per diluted share, net of non-core charges related to a non-cash unrealized investment loss, acquisition expenses, and insurance reserves, partially offset by a net gain on sale of stores.

Fourth Quarter-Over-Quarter Comparisons and 2022 Performance Highlights:

•Revenues increased 11%

•New and used unit growth was 5% and 9%, respectively

•Total vehicle gross profit per unit of $5,691, down $1,191

•Driveway averaged more than 2 million monthly unique visitors in Q4

•Driveway Finance penetration rate rose to over 13% in Q4, originated over $600 million

•Service, body, and parts revenues increased 18%

•Adjusted SG&A as a percentage of gross profit was 62.8%

•Total outstanding share count was reduced by 10%

“The Lithia & Driveway team had another great year with a solid finish in the final quarter of 2022 across all our businesses. Operational excellence is critical across our core in-store operations, growing omnichannel offerings and captive finance arm. We are nimbly adjusting to the environment and focused on achieving our 2025 Plan. Our balance sheet is well capitalized and we’re executing on the growth initiatives across our segments. With the significant capital engine we have built, we are well positioned for further consolidation in our sector,” said Bryan DeBoer, Lithia & Driveway, President and CEO.

Full year 2022 revenue increased 24% to a record $28.2 billion from $22.8 billion in 2021.

Full year 2022 net income attributable to LAD per diluted share increased 21% to $44.17 from $36.54 for 2021. Adjusted net income attributable to LAD per diluted share increased 11% to $44.42 from $40.03 for 2021. Unrealized foreign currency losses negatively impacted earnings per share by $0.54. Full year 2022 net income attributable to LAD increased 19% to $1.3 billion from $1.1 billion for 2021. Adjusted net income attributable to LAD increased 9% to $1.3 billion for 2022 from $1.2 billion for 2021.

As shown in the attached non-GAAP reconciliation tables, the 2022 adjusted results exclude a $0.25 per diluted share net non-core charge related to a non-cash unrealized investment loss, acquisition expenses, and insurance reserves, partially offset by a net gain on sale of stores. The 2021 adjusted results exclude a $3.49 per diluted share net non-core charge related to a non-cash unrealized investment loss, acquisition expenses, loss on redemption of senior notes, insurance reserves, and asset impairment.

Full Year-over-Year Operating Highlights:

•Record full year revenues of $28.2 billion

•Used vehicle retail sales increased 29.9%

•F&I per unit increased 12.3% to $2,203

•Total vehicle gross profit per unit increased 7.6% to $6,300

•Driveway transactions increased by 272% to nearly 38,000

•Driveway Finance scaled portfolio to over $2 billion

Corporate Development

During the fourth quarter, LAD acquired a total of nine stores. These stores are expected to generate more than $560 million in annualized revenues. Notably in the quarter, we entered into two new states with Glenn’s Freedom, our first store in Kentucky and expanded our footprint to Colorado, acquiring Ferrari of Denver. Finally, we added to our network in Texas, acquiring Meador Chrysler, Dodge, Jeep, Ram (CDJR), the second largest CDJR store in Dallas/Fort Worth. In the same period, we divested a total of four stores, for a combined $160 million in annualized revenues. In 2022, Lithia acquired thirty-one stores, for a total of $3.5 billion in acquired revenues, offset by thirteen sales, totaling $663 million in revenues. In 2023, Lithia acquired one store in February expected to add $50 million in annual revenues. Since announcing the 2025 Plan in July 2020, we have acquired a total of $13.9 billion in annualized revenues.

Balance Sheet Update

LAD ended the fourth quarter with approximately $1.6 billion in cash and availability on our revolving lines of credit. In addition, unfinanced real estate could provide additional liquidity of approximately $0.5 billion.

Dividend Payment and Share Repurchases

The Board of Directors approved a dividend of $0.42 per share related to fourth quarter 2022 financial results. The dividend is expected to be paid on March 24, 2023 to shareholders of record on March 10, 2023.

During Q4, we repurchased just over 174,000 shares at a weighted average price of $198. In 2022, LAD repurchased approximately 2.4 million shares at a weighted average price of approximately $276. Under the current share repurchase authorization, approximately $501 million remains available.

Fourth Quarter Earnings Conference Call and Updated Presentation

The fourth quarter 2022 conference call may be accessed at 10:00 a.m. ET today by telephone at 877-407-8029. An updated presentation highlighting the fourth quarter 2022 results has been added to our investor relations website. To listen live on our website or for replay, visit investors.lithiadriveway.com and click on quarterly earnings.

About Lithia & Driveway (LAD)

Lithia & Driveway (NYSE: LAD) is the premier automotive retailer in North America, offers a wide selection of vehicles across global manufacturers and provides a full suite of financing, leasing, repair, and maintenance options. Purchasing and owning a vehicle is easy and hassle-free with convenient solutions offered through our comprehensive network of locations, e-commerce platforms, and captive finance division. We deliver profitable growth through consolidating the largest retail sector in North America as we modernize the retail experience wherever, whenever and however consumers desire.

Sites

www.lithia.com

investors.lithiadriveway.com

www.lithiacareers.com

www.driveway.com

www.greencars.com

www.drivewayfinancecorp.com

Lithia & Driveway on Facebook

https://www.facebook.com/LithiaMotors

https://www.facebook.com/DrivewayHQ

Lithia & Driveway on Twitter

https://twitter.com/lithiamotors

https://twitter.com/DrivewayHQ

https://twitter.com/GreenCarsHQ

Contact:

Tina Miller

SVP and Chief Financial Officer

IR@lithia.com

(541) 864-1748

Forward-Looking Statements

Certain statements in this presentation, and at times made by our officers and representatives, constitute forward-looking statements within the meaning of the “Safe Harbor”provisions of the Private Securities Litigation Reform Act of 1995. Generally, you can identify forward-looking statements by terms such as “project,” “outlook,” “target,” “may,” “will,” “would,” “should,” “seek,” “expect,” “plan,” “intend,” “forecast,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “likely,” “goal,” “strategy,” “future,” “maintain,” and “continue” or the negative of these terms or other comparable terms. Examples of forward-looking statements in this presentation include, among others, statements regarding:

•Future market conditions, including anticipated car and other sales levels and the supply of inventory

•Our business strategy and plans, including our 2025 Plan and related targets

•The growth, expansion, make-up and success of our network, including finding accretive acquisitions and acquiring additional stores

•Annualized revenues from acquired stores

•The growth and performance of our Driveway e-commerce home solution and Driveway Finance Corporation (“DFC”), their synergies and other impacts on our business and our ability to meet Driveway and DFC-related targets

•The impact of sustainable vehicles and other market and regulatory changes on our business

•Our capital allocations and uses and levels of capital expenditures in the future

•Expected operating results, such as improved store performance, continued improvement of selling, general and administrative expenses as a percentage of gross profit and any projections

•Our anticipated financial condition and liquidity, including from our cash and the future availability of our credit facilities, unfinanced real estate and other financing sources

•Our continuing to purchase shares under our share repurchase program

•Our compliance with financial and restrictive covenants in our credit facilities and other debt agreements

•Our programs and initiatives for employee recruitment, training, and retention

•Our strategies for customer retention, growth, market position, financial results and risk management

Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Forward-looking statements are not guarantees of future performance, and our actual results of operations, financial condition and liquidity and development of the industry in which we operate may differ materially from those made in or suggested by the forward-looking statements in this presentation. Therefore, you should not rely on any of these forward-looking statements. The risks and uncertainties that could cause actual results to differ materially from estimated or projected results include, without limitation:

•Future national and local economic and financial conditions, including as a result of regional or global public health issues, inflation and governmental programs, and spending

•The market for dealerships, including the availability of stores to us for an acceptable price

•Changes in customer demand, our relationship with, and the financial and operational stability of, OEMs and other suppliers

•Changes in the competitive landscape, including through technology and our ability to deliver new products, services and customer experiences and a portfolio of in-demand and available vehicles

•Risks associated with our indebtedness, including available borrowing capacity, interest rates, compliance with financial covenants and ability to refinance or repay indebtedness on favorable terms

•The adequacy of our cash flows and other conditions which may affect our ability to fund capital expenditures, obtain favorable financing and pay our quarterly dividend at planned levels

•Disruptions to our technology network including computer systems, as well as natural events such as severe weather or man-made or other disruptions of our operating systems, facilities or equipment

•Government regulations and legislation

•The risks set forth throughout “Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and in “Part I, Item 1A. Risk Factors” of our most recent Annual Report on Form 10-K, and in “Part II, Item 1A. Risk Factors” of our Quarterly Reports on Form 10-Q, and from time to time in our other filings with the SEC.

Any forward-looking statement made by us in this presentation is based only on information currently available to us and speaks only as of the date on which it is made. Except as required by law, we undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

Non-GAAP Financial Measures

This presentation contains non-GAAP financial measures such as adjusted net income and diluted earnings per share, adjusted SG&A as a percentage of revenue and gross profit, adjusted operating margin, adjusted operating profit as a percentage of revenue and gross profit, adjusted pre-tax margin and net profit margin, EBITDA, adjusted EBITDA, leveraged EBITDA and adjusted total debt. Non-GAAP measures do not have definitions under GAAP and may be defined differently by and not comparable to similarly titled measures used by other companies. As a result, we review any non-GAAP financial measures in connection with a review of the most directly comparable measures calculated in accordance with GAAP. We caution you not to place undue reliance on such non-GAAP measures, but also to consider them with the most directly comparable GAAP measures. We present cash flows from operations in the attached tables, adjusted to include the change in non-trade floor plan debt to improve the visibility of cash flows related to vehicle financing. As required by SEC rules, we have reconciled these measures to the most directly comparable GAAP measures in the attachments to this release. We believe the non-GAAP financial measures we present improve the transparency of our disclosures; provide a meaningful presentation of our results from core business operations, because they exclude items not related to core business operations and other non-cash items; and improve the period-to-period comparability of our results from core business operations. These presentations should not be considered an alternative to GAAP measures.

LAD

Consolidated Statements of Operations (Unaudited)

(In millions except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended December 31, | | | | % | | Twelve months ended December 31, | | | | % |

| | | | | Increase | | | | | Increase |

| | 2022 | | 2021 | | | | (Decrease) | | 2022 | | 2021 | | | | (Decrease) |

| Revenues: | | | | | | | | | | | | | | | | |

| New vehicle retail | | $ | 3,275.1 | | | $ | 2,960.0 | | | | | 10.6 | % | | $ | 12,894.5 | | | $ | 11,197.7 | | | | | 15.2 | % |

| Used vehicle retail | | 2,229.5 | | | 2,018.7 | | | | | 10.4 | | | 9,426.4 | | | 7,255.3 | | | | | 29.9 | |

| Used vehicle wholesale | | 336.0 | | | 343.6 | | | | | (2.2) | | | 1,467.5 | | | 957.1 | | | | | 53.3 | |

| Finance and insurance | | 308.4 | | | 286.3 | | | | | 7.7 | | | 1,285.4 | | | 1,051.3 | | | | | 22.3 | |

| Service, body and parts | | 716.2 | | | 607.6 | | | | | 17.9 | | | 2,738.8 | | | 2,110.9 | | | | | 29.7 | |

| Fleet and other | | 125.0 | | | 93.3 | | | | | 34.0 | | | 418.9 | | | 259.4 | | | | | 61.5 | |

Total revenues | | 6,990.2 | | | 6,309.5 | | | | | 10.8 | % | | 28,231.5 | | | 22,831.7 | | | | | 23.7 | % |

| Cost of sales: | | | | | | | | | | | | | | | | |

| New vehicle retail | | 2,910.9 | | | 2,561.2 | | | | | 13.7 | | | 11,314.8 | | | 9,979.2 | | | | | 13.4 | |

| Used vehicle retail | | 2,067.4 | | | 1,793.3 | | | | | 15.3 | | | 8,601.0 | | | 6,428.6 | | | | | 33.8 | |

| Used vehicle wholesale | | 351.3 | | | 326.9 | | | | | 7.5 | | | 1,482.9 | | | 913.7 | | | | | 62.3 | |

| Service, body and parts | | 329.9 | | | 296.1 | | | | | 11.4 | | | 1,275.8 | | | 1,000.4 | | | | | 27.5 | |

| Fleet and other | | 121.5 | | | 88.2 | | | | | 37.8 | | | 404.6 | | | 250.8 | | | | | 61.3 | |

Total cost of sales | | 5,781.0 | | | 5,065.7 | | | | | 14.1 | | | 23,079.1 | | | 18,572.7 | | | | | 24.3 | |

| Gross profit | | 1,209.2 | | | 1,243.8 | | | | | (2.8) | % | | 5,152.4 | | | 4,259.0 | | | | | 21.0 | % |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Financing operations (loss) income | | (7.7) | | | (3.6) | | | | | 113.9 | % | | (4.0) | | | 11.0 | | | | | (136.4) | % |

| | | | | | | | | | | | | | | | |

| Asset impairments | | — | | | — | | | | | NM | | — | | | 1.9 | | | | | (100.0) | |

| SG&A expense | | 753.4 | | | 705.7 | | | | | 6.8 | | | 3,044.1 | | | 2,480.8 | | | | | 22.7 | |

| Depreciation and amortization | | 48.2 | | | 33.4 | | | | | 44.3 | | | 163.2 | | | 124.8 | | | | | 30.8 | |

| Income from operations | | 399.9 | | | 501.1 | | | | | (20.2) | % | | 1,941.1 | | | 1,662.5 | | | | | 16.8 | % |

| Floor plan interest expense | | (19.3) | | | (5.4) | | | | | 257.4 | | | (38.8) | | | (22.3) | | | | | 74.0 | |

| Other interest expense | | (38.3) | | | (26.6) | | | | | 44.0 | | | (129.1) | | | (103.4) | | | | | 24.9 | |

| Other income (expense), net | | (6.1) | | | (37.4) | | | | | NM | | (43.2) | | | (52.0) | | | | | NM |

| Income before income taxes | | 336.2 | | | 431.7 | | | | | (22.1) | % | | 1,730.0 | | | 1,484.8 | | | | | 16.5 | % |

| Income tax expense | | (86.3) | | | (139.2) | | | | | (38.0) | | | (468.4) | | | (422.1) | | | | | 11.0 | |

| Income tax rate | | 25.7 | % | | 32.2 | % | | | | | | 27.1 | % | | 28.4 | % | | | | |

| Net income | | $ | 249.9 | | | $ | 292.5 | | | | | (14.6) | % | | $ | 1,261.6 | | | $ | 1,062.7 | | | | | 18.7 | % |

| Net income attributable to non-controlling interests | | (0.9) | | | (0.9) | | | | | —% | | (4.8) | | | (1.7) | | | | | 182.4% |

| Net income attributable to redeemable non-controlling interest | | (1.3) | | | (0.6) | | | | | 116.7% | | (5.8) | | | (0.9) | | | | | 544.4% |

| Net income attributable to LAD | | $ | 247.7 | | | $ | 291.0 | | | | | (14.9) | % | | $ | 1,251.0 | | | $ | 1,060.1 | | | | | 18.0 | % |

| | | | | | | | | | | | | | | | |

| Diluted earnings per share attributable to LAD: | | | | | | | | | | | | | | | | |

| Net income per share | | $ | 9.00 | | | $ | 9.57 | | | | | (6.0) | % | | $ | 44.17 | | | $ | 36.54 | | | | | 20.9 | % |

| | | | | | | | | | | | | | | | |

| Diluted shares outstanding | | 27.5 | | | 30.4 | | | | | (9.5) | % | | 28.3 | | | 29.0 | | | | | (2.4) | % |

NM - not meaningful

LAD

Key Performance Metrics (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended December 31, | | | | % | | Twelve months ended December 31, | | | | % |

| | | | | Increase | | | | | Increase |

| | 2022 | | 2021 | | | | (Decrease) | | 2022 | | 2021 | | | | (Decrease) |

| Gross margin | | | | | | | | | | | | | | | | |

| New vehicle retail | | 11.1 | % | | 13.5 | % | | | | (240) | bps | | 12.3 | % | | 10.9 | % | | | | 140 | bps |

| Used vehicle retail | | 7.3 | | | 11.2 | | | | | (390) | | | 8.8 | | | 11.4 | | | | | (260) | |

| | | | | | | | | | | | | | | | |

| Finance and insurance | | 100.0 | | | 100.0 | | | | | — | | | 100.0 | | | 100.0 | | | | | — | |

| Service, body and parts | | 53.9 | | | 51.3 | | | | | 260 | | | 53.4 | | | 52.6 | | | | | 80 | |

| | | | | | | | | | | | | | | | |

| Gross profit margin | | 17.3 | | | 19.7 | | | | | (240) | | | 18.3 | | | 18.7 | | | | | (40) | |

| | | | | | | | | | | | | | | | |

| Unit sales | | | | | | | | | | | | | | | | |

| New vehicle retail | | 68,159 | | | 64,812 | | | | | 5.2 | % | | 271,596 | | | 260,738 | | | | | 4.2 | % |

| Used vehicle retail | | 75,834 | | | 69,914 | | | | | 8.5 | | | 311,764 | | | 275,495 | | | | | 13.2 | |

| | | | | | | | | | | | | | | | |

| Average selling price | | | | | | | | | | | | | | | | |

| New vehicle retail | | $ | 48,051 | | | $ | 45,671 | | | | | 5.2 | % | | $ | 47,477 | | | $ | 42,946 | | | | | 10.6 | % |

| Used vehicle retail | | 29,399 | | | 28,874 | | | | | 1.8 | | | 30,236 | | | 26,336 | | | | | 14.8 | |

| | | | | | | | | | | | | | | | |

| Average gross profit per unit | | | | | | | | | | | | | | | | |

| New vehicle retail | | $ | 5,344 | | | $ | 6,153 | | | | | (13.1) | % | | $ | 5,816 | | | $ | 4,673 | | | | | 24.5 | % |

| Used vehicle retail | | 2,137 | | | 3,224 | | | | | (33.7) | | | 2,648 | | | 3,001 | | | | | (11.8) | |

| Finance and insurance | | 2,142 | | | 2,125 | | | | | 0.8 | | | 2,203 | | | 1,961 | | | | | 12.3 | |

Total vehicle(1) | | 5,691 | | | 6,882 | | | | | (17.3) | | | 6,300 | | | 5,855 | | | | | 7.6 | |

| | | | | | | | | | | | | | | | |

| Revenue mix | | | | | | | | | | | | | | | | |

| New vehicle retail | | 46.9 | % | | 46.9 | % | | | | | | 45.7 | % | | 49.0 | % | | | | |

| Used vehicle retail | | 31.9 | | | 32.0 | | | | | | | 33.4 | | | 31.8 | | | | | |

| Used vehicle wholesale | | 4.8 | | | 5.4 | | | | | | | 5.2 | | | 4.2 | | | | | |

| Finance and insurance, net | | 4.4 | | | 4.5 | | | | | | | 4.6 | | | 4.6 | | | | | |

| Service, body and parts | | 10.2 | | | 9.6 | | | | | | | 9.7 | | | 9.2 | | | | | |

| Fleet and other | | 1.8 | | | 1.6 | | | | | | | 1.4 | | | 1.2 | | | | | |

| | | | | | | | | | | | | | | | |

| Gross Profit Mix | | | | | | | | | | | | | | | | |

| New vehicle retail | | 30.1 | % | | 32.1 | % | | | | | | 30.7 | % | | 28.6 | % | | | | |

| Used vehicle retail | | 13.4 | | | 18.1 | | | | | | | 16.0 | | | 19.4 | | | | | |

| Used vehicle wholesale | | (1.3) | | | 1.3 | | | | | | | (0.3) | | | 1.0 | | | | | |

| Finance and insurance, net | | 25.5 | | | 23.0 | | | | | | | 24.9 | | | 24.7 | | | | | |

| Service, body and parts | | 32.0 | | | 25.1 | | | | | | | 28.4 | | | 26.1 | | | | | |

| Fleet and other | | 0.3 | | | 0.4 | | | | | | | 0.3 | | | 0.2 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Adjusted | | As reported | | Adjusted | | As reported |

| | Three months ended December 31, | | Three months ended December 31, | | Twelve months ended December 31, | | Twelve months ended December 31, |

| Other metrics | | 2022 | | 2021 | | 2022 | | 2021 | | 2022 | | 2021 | | 2022 | | 2021 |

| SG&A as a % of revenue | | 10.9 | % | | 11.2 | % | | 10.8 | % | | 11.2 | % | | 10.9 | % | | 10.8 | % | | 10.8 | % | | 10.9 | % |

| SG&A as a % of gross profit | | 62.8 | | | 56.9 | | | 62.3 | | | 56.7 | | | 60.0 | | | 57.6 | | | 59.1 | | | 58.2 | |

| Operating profit as a % of revenue | | 5.6 | | | 7.9 | | | 5.7 | | | 7.9 | | | 6.7 | | | 7.4 | | | 6.9 | | | 7.3 | |

| Operating profit as a % of gross profit | | 32.5 | | | 40.1 | | | 33.1 | | | 40.3 | | | 36.8 | | | 39.7 | | | 37.7 | | | 39.0 | |

| Pretax margin | | 4.8 | | | 7.5 | | | 4.8 | | | 6.8 | | | 6.1 | | | 7.0 | | | 6.1 | | | 6.5 | |

| Net profit margin | | 3.6 | | | 5.5 | | | 3.6 | | | 4.6 | | | 4.5 | | | 5.1 | | | 4.5 | | | 4.7 | |

(1)Includes the sales and gross profit related to new, used retail, used wholesale and finance and insurance and unit sales for new and used retail

LAD

Same Store Operating Highlights (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended December 31, | | | | % | | Twelve months ended December 31, | | | | % |

| | | | | Increase | | | | | Increase |

| | 2022 | | 2021 | | | | (Decrease) | | 2022 | | 2021 | | | | (Decrease) |

| Revenues | | | | | | | | | | | | | | | | |

| New vehicle retail | | $ | 2,869.8 | | | $ | 2,894.5 | | | | | (0.9) | % | | $ | 10,129.1 | | | $ | 10,729.8 | | | | | (5.6) | % |

| Used vehicle retail | | 2,013.1 | | | 1,973.5 | | | | | 2.0 | | | 7,888.0 | | | 6,997.9 | | | | | 12.7 | |

| | | | | | | | | | | | | | | | |

| Finance and insurance | | 269.5 | | | 279.1 | | | | | (3.4) | | | 1,027.2 | | | 1,010.7 | | | | | 1.6 | |

| Service, body and parts | | 642.7 | | | 592.6 | | | | | 8.5 | | | 2,232.9 | | | 2,032.9 | | | | | 9.8 | |

| | | | | | | | | | | | | | | | |

| Total revenues | | 6,218.1 | | | 6,166.1 | | | | | 0.8 | | | 22,692.8 | | | 21,941.2 | | | | | 3.4 | |

| | | | | | | | | | | | | | | | |

| Gross profit | | | | | | | | | | | | | | | | |

| New vehicle retail | | $ | 317.1 | | | $ | 391.1 | | | | | (18.9) | % | | $ | 1,231.4 | | | $ | 1,175.9 | | | | | 4.7 | % |

| Used vehicle retail | | 144.6 | | | 220.6 | | | | | (34.5) | | | 674.7 | | | 798.0 | | | | | (15.5) | |

| | | | | | | | | | | | | | | | |

| Finance and insurance | | 269.5 | | | 279.1 | | | | | (3.4) | | | 1,027.2 | | | 1,010.7 | | | | | 1.6 | |

| Service, body and parts | | 346.5 | | | 304.0 | | | | | 14.0 | | | 1,205.3 | | | 1,069.9 | | | | | 12.7 | |

| | | | | | | | | | | | | | | | |

| Total gross profit | | 1,066.6 | | | 1,216.0 | | | | | (12.3) | | | 4,125.2 | | | 4,105.4 | | | | | 0.5 | |

| | | | | | | | | | | | | | | | |

| Gross margin | | | | | | | | | | | | | | | | |

| New vehicle retail | | 11.0 | % | | 13.5 | % | | | | (250) | bps | | 12.2 | % | | 11.0 | % | | | | 120 | bps |

| Used vehicle retail | | 7.2 | | | 11.2 | | | | | (400) | | | 8.6 | | | 11.4 | | | | | (280) | |

| | | | | | | | | | | | | | | | |

| Finance and insurance | | 100.0 | | | 100.0 | | | | | — | | | 100.0 | | | 100.0 | | | | | — | |

| Service, body and parts | | 53.9 | | | 51.3 | | | | | 260 | | | 54.0 | | | 52.6 | | | | | 140 | |

| | | | | | | | | | | | | | | | |

| Gross profit margin | | 17.2 | | | 19.7 | | | | | (250) | | | 18.2 | | | 18.7 | | | | | (50) | |

| | | | | | | | | | | | | | | | |

| Unit sales | | | | | | | | | | | | | | | | |

| New vehicle retail | | 59,175 | | | 63,347 | | | | | (6.6) | % | | 210,558 | | | 248,821 | | | | | (15.4) | % |

| Used vehicle retail | | 68,137 | | | 68,196 | | | | | (0.1) | | | 261,857 | | | 264,305 | | | | | (0.9) | |

| | | | | | | | | | | | | | | | |

| Average selling price | | | | | | | | | | | | | | | | |

| New vehicle retail | | $ | 48,498 | | | $ | 45,694 | | | | | 6.1 | % | | $ | 48,106 | | | $ | 43,123 | | | | | 11.6 | % |

| Used vehicle retail | | 29,545 | | | 28,939 | | | | | 2.1 | | | 30,123 | | | 26,477 | | | | | 13.8 | |

| | | | | | | | | | | | | | | | |

| Average gross profit per unit | | | | | | | | | | | | | | | | |

| New vehicle retail | | $ | 5,359 | | | $ | 6,175 | | | | | (13.2) | % | | $ | 5,848 | | | $ | 4,726 | | | | | 23.7 | % |

| Used vehicle retail | | 2,122 | | | 3,234 | | | | | (34.4) | | | 2,576 | | | 3,019 | | | | | (14.7) | |

| Finance and insurance | | 2,117 | | | 2,121 | | | | | (0.2) | | | 2,174 | | | 1,970 | | | | | 10.4 | |

Total vehicle(1) | | 5,631 | | | 6,897 | | | | | (18.4) | | | 6,159 | | | 5,900 | | | | | 4.4 | |

(1)Includes the sales and gross profit related to new, used retail, used wholesale and finance and insurance and unit sales for new and used retail

LAD

Other Highlights (Unaudited)

| | | | | | | | | | | | | | | | | | | |

| As of |

| December 31, | | December 31, | | | | December 31, |

| 2022 | | 2021 | | | | 2020 |

Days Supply(1) | | | | | | | |

| New vehicle inventory | 47 | | 24 | | | | 50 |

| Used vehicle inventory | 55 | | 61 | | | | 65 |

(1) Days supply calculated based on current inventory levels, including in-transit vehicles, and a 30-day historical cost of sales level.

Selected Financing Operations Financial Information

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31, | | Twelve months ended December 31, | |

| ($ in millions) | 2022 | | % (1) | | 2021 | | % (1) | | 2022 | | % (1) | | 2021 | | % (1) | |

| Interest margin: | | | | | | | | | | | | | | | | |

| Interest, fee, and lease income | $ | 51.9 | | | 10.2 | | | $ | 18.7 | | | 10.2 | | | $ | 134.1 | | | 8.7 | | | $ | 45.9 | | | 9.2 | | |

| Interest expense | (28.9) | | | (5.7) | | | (2.0) | | | (1.1) | | | (52.2) | | | (3.4) | | | (4.8) | | | (1.0) | | |

| Total interest margin | $ | 23.0 | | | 4.5 | | | $ | 16.7 | | | 9.1 | | | $ | 81.9 | | | 5.3 | | | $ | 41.1 | | | 8.2 | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Provision for loan and lease losses | $ | (18.9) | | | (3.7) | | | $ | (7.2) | | | (3.9) | | | $ | (44.4) | | | (2.9) | | | $ | (9.4) | | | (1.9) | | |

| | | | | | | | | | | | | | | | |

| Financing operations income (loss) | $ | (7.7) | | | (1.5) | | | $ | (3.6) | | | (2.0) | | | $ | (4.0) | | | (0.3) | | | $ | 11.0 | | | 2.2 | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Total average managed finance receivables | $ | 2,039.2 | | | | | $ | 732.5 | | | | | $ | 1,542.6 | | | | | $ | 501.5 | | | | |

(1)Annualized percentage of total average managed finance receivables.

| | | | | | | | | | | |

| Financial covenants | Requirement | | As of December 31, 2022 |

| Fixed charge coverage ratio | Not less than 1.20 to 1 | | 5.81 to 1 |

| Leverage ratio | Not more than 5.75 to 1 | | 1.36 to 1 |

LAD

Condensed Consolidated Balance Sheets (Unaudited)

(In millions)

| | | | | | | | | | | | | | |

| | December 31, 2022 | | December 31, 2021 |

| Cash, restricted cash, and cash equivalents | | $ | 246.7 | | | $ | 174.8 | |

| Trade receivables, net | | 813.1 | | | 685.5 | |

| Inventories, net | | 3,409.4 | | | 2,385.5 | |

| | | | |

| Other current assets | | 161.7 | | | 63.9 | |

| | | | |

| Total current assets | | $ | 4,630.9 | | | $ | 3,309.7 | |

| | | | |

| Property and equipment, net | | 3,574.6 | | | 3,052.6 | |

| | | | |

| | | | |

| Finance receivables, net | | 2,187.6 | | | 803.3 | |

| Intangibles | | 3,316.9 | | | 1,776.4 | |

| | | | |

| Other non-current assets | | 1,296.6 | | | 2,204.9 | |

| Total assets | | $ | 15,006.6 | | | $ | 11,146.9 | |

| | | | |

| | | | |

| | | | |

| Floor plan notes payable | | 2,116.6 | | | 1,190.1 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Other current liabilities | | 1,061.6 | | | 1,212.7 | |

| Total current liabilities | | $ | 3,178.2 | | | $ | 2,402.8 | |

| | | | |

| Long-term debt | | 5,088.3 | | | 2,868.1 | |

| | | | |

| | | | |

| | | | |

| | | | |

| Non-recourse notes payable | | 422.2 | | | 317.6 | |

| Other long-term liabilities and deferred revenue | | 1,066.8 | | | 895.2 | |

| Total liabilities | | $ | 9,755.5 | | | $ | 6,483.7 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Equity | | 5,251.1 | | | 4,663.2 | |

| Total liabilities & equity | | $ | 15,006.6 | | | $ | 11,146.9 | |

LAD

Summarized Cash Flow from Operations (Unaudited)

(In millions)

| | | | | | | | | | | | | | |

| | Twelve months ended December 31, |

| | 2022 | | 2021 |

| Net income | | $ | 1,261.6 | | | $ | 1,062.7 | |

| Adjustments to reconcile net income to net cash (used in) provided by operating activities: | | | | |

| Asset impairments | | — | | | 1.9 | |

| Depreciation and amortization | | 172.7 | | | 127.3 | |

| Stock-based compensation | | 41.1 | | | 34.7 | |

| Loss on redemption of senior notes | | — | | | 10.3 | |

| Gain on disposal of assets | | (0.1) | | | (2.5) | |

| Net disposal gain on sale of stores | | (66.0) | | | — | |

| Unrealized investment loss (gain) | | 39.2 | | | 66.4 | |

| Deferred income taxes | | 95.2 | | | 43.1 | |

| Amortization of operating lease right-of-use assets | | 55.4 | | | 39.0 | |

| (Increase) decrease: | | | | |

| Trade receivables, net | | (131.6) | | | (147.1) | |

| Inventories | | (923.0) | | | 674.6 | |

| Finance receivables, net | | (1,363.0) | | | (640.8) | |

| Other assets | | (138.3) | | | 61.0 | |

| Increase: | | | | |

| Floor plan notes payable, net | | 273.3 | | | 116.1 | |

| Trade payables | | 25.3 | | | 78.4 | |

| Accrued liabilities | | (2.3) | | | 233.0 | |

| Other long-term liabilities and deferred revenue | | 50.4 | | | 39.1 | |

| Net cash (used in) provided by operating activities | | $ | (610.1) | | | $ | 1,797.2 | |

LAD

Reconciliation of Non-GAAP Cash Flow from Operations (Unaudited)

(In millions)

| | | | | | | | | | | | | | |

| | Twelve months ended December 31, |

| Net cash provided by operating activities | | 2022 | | 2021 |

| As reported | | $ | (610.1) | | | $ | 1,797.2 | |

| Floor plan notes payable, non-trade, net | | 737.9 | | | (685.3) | |

| Adjust: finance receivables activity | | 1,363.0 | | | 640.8 | |

| | | | |

| Less: Borrowings on floor plan notes payable, non-trade associated with acquired new vehicle inventory | | (116.5) | | | (355.5) | |

| Adjusted | | $ | 1,374.3 | | | $ | 1,397.2 | |

| | | | |

LAD

Reconciliation of Certain Non-GAAP Financial Measures (Unaudited)

(In millions, except for per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, 2022 | |

| | As reported | | Net disposal gain on sale of stores | | | | Investment loss | | Insurance reserves | | Acquisition expenses | | | | | | Adjusted | |

| | | | | | | | | | | | | | | | | | | |

| Selling, general and administrative | | $ | 753.4 | | | $ | 16.4 | | | | | $ | — | | | $ | (4.9) | | | $ | (5.0) | | | | | | | $ | 759.9 | | |

| Operating income | | 399.9 | | | (16.4) | | | | | — | | | 4.9 | | | 5.0 | | | | | | | 393.4 | | |

| Other income (expense), net | | (6.1) | | | — | | | | | 6.5 | | | — | | | — | | | | | | | 0.4 | | |

| | | | | | | | | | | | | | | | | | | |

| Income before income taxes | | 336.2 | | | (16.4) | | | | | 6.5 | | | 4.9 | | | 5.0 | | | | | | | 336.2 | | |

| Income tax (provision) benefit | | (86.3) | | | 5.9 | | | | | — | | | (1.3) | | | (3.5) | | | | | | | (85.2) | | |

| Net income | | $ | 249.9 | | | $ | (10.5) | | | | | $ | 6.5 | | | $ | 3.6 | | | $ | 1.5 | | | | | | | $ | 251.0 | | |

| Net income attributable to non-controlling interests | | (0.9) | | | — | | | | | — | | | — | | | — | | | | | | | (0.9) | | |

| Net income attributable to redeemable non-controlling interest | | (1.3) | | | — | | | | | — | | | — | | | — | | | | | | | (1.3) | | |

| Net income attributable to LAD | | $ | 247.7 | | | $ | (10.5) | | | | | $ | 6.5 | | | $ | 3.6 | | | $ | 1.5 | | | | | | | $ | 248.8 | | |

| | | | | | | | | | | | | | | | | | | |

| Diluted earnings per share attributable to LAD | | $ | 9.00 | | | $ | (0.38) | | | | | $ | 0.24 | | | $ | 0.13 | | | $ | 0.06 | | | | | | | $ | 9.05 | | |

| Diluted share count | | 27.5 | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, 2021 | |

| | As reported | | Net disposal gain on sale of stores | | | | Investment loss | | Insurance reserves | | Acquisition expenses | | | | | | Adjusted | |

| | | | | | | | | | | | | | | | | | | |

| Selling, general and administrative | | $ | 705.7 | | | $ | 5.2 | | | | | $ | — | | | $ | (0.8) | | | $ | (2.3) | | | | | | | $ | 707.8 | | |

| Operating income | | 501.1 | | | (5.2) | | | | | — | | | 0.8 | | | 2.3 | | | | | | | 499.0 | | |

| Other income (expense), net | | (37.4) | | | — | | | | | 44.1 | | | — | | | — | | | | | | | 6.7 | | |

| | | | | | | | | | | | | | | | | | | |

| Income before income taxes | | 431.7 | | | (5.2) | | | | | 44.1 | | | 0.8 | | | 2.3 | | | | | | | 473.7 | | |

| Income tax (provision) benefit | | (139.2) | | | 1.4 | | | | | 12.6 | | | (0.2) | | | (0.6) | | | | | | | (126.0) | | |

| Net income | | $ | 292.5 | | | $ | (3.8) | | | | | $ | 56.7 | | | $ | 0.6 | | | $ | 1.7 | | | | | | | $ | 347.7 | | |

| Net income attributable to non-controlling interests | | $ | (0.9) | | | $ | — | | | | | $ | — | | | $ | — | | | $ | — | | | | | | | $ | (0.9) | | |

| Net income attributable to redeemable non-controlling interest | | $ | (0.6) | | | $ | — | | | | | $ | — | | | $ | — | | | $ | — | | | | | | | $ | (0.6) | | |

| Net income attributable to LAD | | $ | 291.0 | | | $ | (3.8) | | | | | $ | 56.7 | | | $ | 0.6 | | | $ | 1.7 | | | | | | | $ | 346.2 | | |

| | | | | | | | | | | | | | | | | | | |

| Diluted earnings per share attributable to LAD | | $ | 9.57 | | | $ | (0.12) | | | | | $ | 1.86 | | | $ | 0.02 | | | $ | 0.06 | | | | | | | $ | 11.39 | | |

| Diluted share count | | 30.4 | | | | | | | | | | | | | | | | | | |

LAD

Reconciliation of Certain Non-GAAP Financial Measures (Unaudited)

(In millions, except for per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Twelve Months Ended December 31, 2022 | |

| | As reported | | Net disposal gain on sale of stores | | | | Investment loss | | Insurance reserves | | Acquisition expenses | | | | | | Adjusted | |

| | | | | | | | | | | | | | | | | | | |

| Selling, general and administrative | | $ | 3,044.1 | | | $ | 66.0 | | | | | $ | — | | | $ | (4.9) | | | $ | (15.0) | | | | | | | $ | 3,090.2 | | |

| Operating income | | 1,941.1 | | | (66.0) | | | | | — | | | 4.9 | | | 15.0 | | | | | | | 1,895.0 | | |

| Other income (expense), net | | (43.2) | | | — | | | | | 39.2 | | | — | | | — | | | | | | | (4.0) | | |

| | | | | | | | | | | | | | | | | | | |

| Income before income taxes | | 1,730.0 | | | (66.0) | | | | | 39.2 | | | 4.9 | | | 15.0 | | | | | | | 1,723.1 | | |

| Income tax (provision) benefit | | (468.4) | | | 19.1 | | | | | — | | | (1.3) | | | (4.0) | | | | | | | (454.6) | | |

| Net income | | $ | 1,261.6 | | | $ | (46.9) | | | | | $ | 39.2 | | | $ | 3.6 | | | $ | 11.0 | | | | | | | $ | 1,268.5 | | |

| Net income attributable to non-controlling interests | | (4.8) | | | — | | | | | — | | | — | | | — | | | | | | | (4.8) | | |

| Net income attributable to redeemable non-controlling interest | | (5.8) | | | — | | | | | — | | | — | | | — | | | | | | | (5.8) | | |

| Net income attributable to LAD | | $ | 1,251.0 | | | $ | (46.9) | | | | | $ | 39.2 | | | $ | 3.6 | | | $ | 11.0 | | | | | | | $ | 1,257.9 | | |

| | | | | | | | | | | | | | | | | | | |

| Diluted earnings per share attributable to LAD | | $ | 44.17 | | | $ | (1.65) | | | | | $ | 1.38 | | | $ | 0.13 | | | $ | 0.39 | | | | | | | $ | 44.42 | | |

| Diluted share count | | 28.3 | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Twelve Months Ended December 31, 2021 | |

| | As reported | | | | Asset impairment | | Investment loss | | Insurance reserves | | Acquisition expenses | | Loss on redemption of senior notes | | | | Adjusted | |

| Asset impairments | | $ | 1.9 | | | | | $ | (1.9) | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | | | $ | — | | |

| Selling, general and administrative | | 2,480.8 | | | | | — | | | — | | | (5.8) | | | (20.2) | | | — | | | | | 2,454.8 | | |

| Operating income | | 1,662.5 | | | | | 1.9 | | | — | | | 5.8 | | | 20.2 | | | — | | | | | 1,690.4 | | |

| Other income (expense), net | | (52.0) | | | | | — | | | 66.4 | | | — | | | — | | | 10.3 | | | | | 24.7 | | |

| | | | | | | | | | | | | | | | | | | |

| Income before income taxes | | 1,484.8 | | | | | 1.9 | | | 66.4 | | | 5.8 | | | 20.2 | | | 10.3 | | | | | 1,589.4 | | |

| Income tax (provision) benefit | | (422.1) | | | | | (0.5) | | | 6.6 | | | (1.6) | | | (5.1) | | | (2.7) | | | | | (425.4) | | |

| Net income | | $ | 1,062.7 | | | | | $ | 1.4 | | | $ | 73.0 | | | $ | 4.2 | | | $ | 15.1 | | | $ | 7.6 | | | | | $ | 1,164.0 | | |

| Net income attributable to non-controlling interests | | (1.7) | | | | | — | | | — | | | — | | | — | | | — | | | | | (1.7) | | |

| Net income attributable to redeemable non-controlling interest | | (0.9) | | | | | — | | | — | | | — | | | — | | | — | | | | | (0.9) | | |

| Net income attributable to LAD | | $ | 1,060.1 | | | | | $ | 1.4 | | | $ | 73.0 | | | $ | 4.2 | | | $ | 15.1 | | | $ | 7.6 | | | | | $ | 1,161.4 | | |

| | | | | | | | | | | | | | | | | | | |

| Diluted earnings per share attributable to LAD | | $ | 36.54 | | | | | $ | 0.05 | | | $ | 2.52 | | | $ | 0.14 | | | $ | 0.52 | | | $ | 0.26 | | | | | $ | 40.03 | | |

| Diluted share count | | 29.0 | | | | | | | | | | | | | | | | | | |

LAD

Adjusted EBITDA and Net Debt to Adjusted EBITDA (Unaudited)

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended December 31, | | | | % | | Twelve months ended December 31, | | | | % |

| | | | | Increase | | | | | Increase |

| | 2022 | | 2021 | | | | (Decrease) | | 2022 | | 2021 | | | | (Decrease) |

| EBITDA and Adjusted EBITDA | | | | | | | | | | | | | | | | |

| Net income | | $ | 249.9 | | | $ | 292.5 | | | | | (14.6) | % | | $ | 1,261.6 | | | $ | 1,062.7 | | | | | 18.7 | % |

| Flooring interest expense | | 19.3 | | | 5.4 | | | | | 257.4 | | | 38.8 | | | 22.3 | | | | | 74.0 | |

| Other interest expense | | 38.3 | | | 26.6 | | | | | 44.0 | | | 129.1 | | | 103.4 | | | | | 24.9 | |

| Financing operations interest expense | | 28.9 | | | 2.0 | | | | | 1,345.0 | | | 52.2 | | | 4.8 | | | | | 987.5 | |

| Income tax expense | | 86.3 | | | 139.2 | | | | | (38.0) | | | 468.4 | | | 422.1 | | | | | 11.0 | |

| Depreciation and amortization | | 48.2 | | | 33.4 | | | | | 44.3 | | | 163.2 | | | 124.8 | | | | | 30.8 | |

| Financing operations depreciation expense | | 2.5 | | | 2.5 | | | | | — | % | | 9.5 | | | 2.5 | | | | | 280.0 | % |

| EBITDA | | $ | 473.4 | | | $ | 501.6 | | | | | (5.6) | % | | $ | 2,122.8 | | | $ | 1,742.6 | | | | | 21.8 | % |

| | | | | | | | | | | | | | | | |

| Other adjustments: | | | | | | | | | | | | | | | | |

| Less: flooring interest expense | | $ | (19.3) | | | $ | (5.4) | | | | | 257.4 | | | $ | (38.8) | | | $ | (22.3) | | | | | 74.0 | |

| Less: financing operations interest expense | | (28.9) | | | (2.0) | | | | | 1,345.0 | | (52.2) | | | (4.8) | | | | | 987.5 |

| Less: used vehicle line of credit interest | | (4.7) | | | — | | | | | NM | | (9.6) | | | (0.1) | | | | | 9,500.0 |

| Add: acquisition expenses | | 5.0 | | | 2.3 | | | | | 117.4 | | | 15.0 | | | 20.2 | | | | | (25.7) | |

| Add: loss (gain) on divestitures | | (16.4) | | | (5.2) | | | | | 215.4 | | (66.0) | | | — | | | | | NM |

| Add: investment loss (gain) | | 6.5 | | | 44.1 | | | | | (85.3) | | 39.2 | | | 66.4 | | | | | NM |

| Add: insurance reserves | | 4.9 | | | 0.8 | | | | | NM | | 4.9 | | | 5.8 | | | | | NM |

| Add: loss on redemption of senior notes | | — | | | — | | | | | NM | | — | | | 10.3 | | | | | NM |

| Add: asset impairment | | — | | | — | | | | | NM | | — | | | 1.9 | | | | | NM |

| Adjusted EBITDA | | $ | 420.5 | | | $ | 536.2 | | | | | (21.6) | % | | $ | 2,015.3 | | | $ | 1,820.0 | | | | | 10.7 | % |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

NM - not meaningful

| | | | | | | | | | | | | | | | | | | | | | |

| | As of | | | | % |

| | December 31, | | | | Increase |

| Net Debt to Adjusted EBITDA | | 2022 | | 2021 | | | | (Decrease) |

| Floor plan notes payable: non-trade | | $ | 1,489.4 | | | $ | 835.9 | | | | | 78.2 | % |

| Floor plan notes payable | | 627.2 | | | 354.2 | | | | | 77.1 | |

| Used and service loaner vehicle inventory financing facility | | 877.2 | | | 500.0 | | | | | 75.4 |

| Revolving lines of credit | | 927.6 | | | 129.9 | | | | | 614.1 |

| Warehouse facilities | | 930.0 | | | 90.0 | | | | | 933.3 | |

| Non-recourse notes payable | | 422.2 | | | 317.6 | | | | | — |

| Real estate mortgages | | 580.1 | | | 592.9 | | | | | (2.2) | |

| Finance lease obligations | | 56.4 | | | 53.6 | | | | | 5.2 | |

| 4.625% Senior notes due 2027 | | 400.0 | | | 400.0 | | | | | — | |