UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form 10-Q

☒

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the quarterly period ended December 31, 2024

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from to

Commission

file number: 001-38426

SENMIAO

TECHNOLOGY LIMITED

(Exact

name of registrant as specified in its charter)

| Nevada | | 35-2600898 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

16F, Shihao Square, Middle Jiannan Blvd.,

High-Tech Zone Chengdu,

Sichuan, People’s Republic of China | | 610000 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s

telephone number, including area code: +86 28 61554399

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class: | | Trading Symbol | | Name of each exchange on which registered: |

| Common Stock, par value $0.0001 per share | | AIHS | | The Nasdaq Stock Market LLC |

Securities

registered pursuant to Section 12(g) of the Act: None

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit and post such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”,

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check One):

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☒ | Smaller reporting company ☒ |

| | Emerging growth company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b 2 of the Exchange Act). Yes ☐ No ☒

As of February 10, 2025,

there were 10,518,040 shares of issuer’s common stock, par value $0.0001 per share, issued and outstanding.

TABLE

OF CONTENTS

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

Quarterly Report on Form 10-Q (the “Report”), including, without limitation, statements under the heading “Management’s

Discussion and Analysis of Financial Condition and Results of Operations,” includes forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”). These forward-looking statements can be identified by the use of forward-looking

terminology, including the words “believes,” “estimates,” “anticipates,” “expects,” “intends,”

“plans,” “may,” “will,” “potential,” “projects,” “predicts,”

“continues,” or “should,” or, in each case, their negative or other variations or comparable terminology. There

can be no assurance that actual results will not materially differ from expectations. Such statements include, but are not limited to,

any statements relating to our ability to consummate any acquisition or other business combination and any other statements that are

not statements of current or historical facts. These statements are based on management’s current expectations, but actual results

may differ materially due to various factors, including, but not limited to:

| |

● |

our goals and strategies,

including our ability to maintain our automobile transaction and related services business in China; |

| |

● |

our management’s

ability to properly develop and achieve any future business growth and any improvements in our financial condition and results of

operations; |

| |

● |

the regulations and the

impact by public health epidemics in China on the industries we operate in and our business, results of operations and financial

condition; |

| |

● |

the growth or lack of growth

in China of disposable household income and the availability and cost of credit available to finance car purchases; |

| |

● |

the growth or lack of growth

of China’s online ride-hailing, automobile financing and leasing industries; |

| |

● |

changes in online ride-hailing,

transportation networks, and other fundamental changes in transportation pattern in China; |

| |

● |

our expectations regarding

demand for and market acceptance of our products and services; |

| |

● |

our expectations

regarding our customer base; |

| |

● |

our ability

to maintain positive relationships with our business partners; |

| |

● |

competition

in the online ride-hailing, automobile financing and leasing industries in China; |

| |

● |

macro-economic

and political conditions affecting the global economy generally and the market in China specifically; and |

| |

● |

relevant

Chinese government policies and regulations relating to the industries in which we operate. |

You

should read this Report and the documents that we refer to in this Report with the understanding that our actual future results may be

materially different from and worse than what we expect. Other sections of this Report and our other reports filed with the Securities

and Exchange Commission (the “SEC”) include additional factors which could adversely impact our business and financial performance.

Moreover, we operate in an evolving environment. New risk factors and uncertainties emerge from time to time and it is not possible for

our management to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent

to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking

statements. We qualify all of our forward-looking statements by these cautionary statements.

You

should not rely upon forward-looking statements as predictions of future events. We undertake no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events or otherwise.

This

Report also contains statistical data and estimates that we obtained from industry publications and reports generated by third-parties.

Although we have not independently verified the data, we believe that the publications and reports are reliable. The market data contained

in this Report involves a number of assumptions, estimates and limitations. The ride-hailing and automobile financing markets in China

may not grow at the rates projected by market data, or at all. The failure of these markets to grow at the projected rates may have a

material adverse effect on our business and the market price of our common stock. If any one or more of the assumptions underlying the

market data turns out to be incorrect, actual results may differ from the projections based on these assumptions. In addition, projections,

assumptions and estimates of our future performance and the future performance of the industries in which we operate are necessarily

subject to a high degree of uncertainty and risk due to a variety of factors, including those described herein or our other reports filed

with the SEC. You should not place undue reliance on these forward-looking statements.

PART

I – FINANCIAL INFORMATION

Item

1. Unaudited Condensed Consolidated Financial Statements

SENMIAO

TECHNOLOGY LIMITED

UNAUDITED

CONDENSED CONSOLIDATED BALANCE SHEETS

(Expressed

in U.S. dollar, except for the number of shares)

| | |

December 31, | | |

March 31, | |

| | |

2024 | | |

2024 | |

| | |

(Unaudited) | | |

| |

| ASSETS | |

| | |

| |

| Current assets | |

| | |

| |

| Cash and cash equivalents | |

$ | 949,224 | | |

$ | 737,719 | |

| Restricted cash | |

| — | | |

| 2,337 | |

| Accounts receivable, net | |

| 40,300 | | |

| 19,883 | |

| Finance lease receivables, current | |

| 177,807 | | |

| 144,166 | |

| Prepayments, other receivables and other current assets, net | |

| 622,881 | | |

| 678,369 | |

| Prepayment - a related party | |

| 34,825 | | |

| — | |

| Due from related parties, net, current | |

| 163,701 | | |

| 648,594 | |

| Current assets - discontinued operations | |

| — | | |

| 420,092 | |

| Total current assets | |

| 1,988,738 | | |

| 2,651,160 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 1,887,833 | | |

| 2,675,257 | |

| Property and equipment, net - discontinued operations | |

| — | | |

| 1,267 | |

| Total Property and equipment, net | |

| 1,887,833 | | |

| 2,676,524 | |

| | |

| | | |

| | |

| Other assets | |

| | | |

| | |

| Operating lease right-of-use assets, net | |

| — | | |

| 60,862 | |

| Operating lease right-of-use assets, net, a related party | |

| 17,025 | | |

| 47,128 | |

| Financing lease right-of-use assets, net | |

| 175,768 | | |

| 355,383 | |

| Intangible assets, net | |

| 393,750 | | |

| 450,029 | |

| Finance lease receivable, non-current | |

| 29,951 | | |

| 92,524 | |

| Due from a related party, net, non-current | |

| 2,765,537 | | |

| 2,747,313 | |

| Other non-current assets | |

| 632,937 | | |

| 639,863 | |

| Other assets - discontinued operations | |

| — | | |

| 140,698 | |

| Total other assets | |

| 4,014,968 | | |

| 4,533,800 | |

| | |

| | | |

| | |

| Total assets | |

$ | 7,891,539 | | |

$ | 9,861,484 | |

| | |

| | | |

| | |

| LIABILITIES, MEZZANNIE EQUITY AND EQUITY | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 171,226 | | |

$ | 96,404 | |

| Advances from customers | |

| 103,838 | | |

| 122,461 | |

| Income tax payable | |

| 19,802 | | |

| 20,019 | |

| Accrued expenses and other liabilities | |

| 3,778,455 | | |

| 2,976,539 | |

| Due to related parties | |

| 253,622 | | |

| 170,986 | |

| Operating lease liabilities, current | |

| — | | |

| 14,007 | |

| Operating lease liabilities - a related party | |

| 10,155 | | |

| 51,741 | |

| Financing lease liabilities, current | |

| 373,193 | | |

| 279,768 | |

| Derivative liabilities | |

| 182,933 | | |

| 288,833 | |

| Current liabilities - discontinued operations | |

| 533,466 | | |

| 1,322,452 | |

| Total current liabilities | |

| 5,426,690 | | |

| 5,343,210 | |

| | |

| | | |

| | |

| Other liabilities | |

| | | |

| | |

| Operating lease liabilities, non-current | |

| — | | |

| 20,430 | |

| Financing lease liabilities, non-current | |

| — | | |

| 126,637 | |

| Other liabilities - discontinued operations | |

| — | | |

| 82,839 | |

| Total other liabilities | |

| — | | |

| 229,906 | |

| | |

| | | |

| | |

| Total liabilities | |

| 5,426,690 | | |

| 5,573,116 | |

| | |

| | | |

| | |

| Commitments and contingencies (note 17) | |

| | | |

| | |

| | |

| | | |

| | |

| Mezzanine Equity | |

| | | |

| | |

| Series A convertible preferred stock (par value $1,000 per share, 5,000 shares authorized; 991 shares issued and outstanding at December 31, 2024 and March 31, 2024) | |

| 234,364 | | |

| 234,364 | |

| | |

| | | |

| | |

| Stockholders' (deficit) equity | |

| | | |

| | |

| Common stock (par value $0.0001 per share, 500,000,000 shares authorized; 10,518,040 shares issued and outstanding at December 31, 2024 and March 31, 2024) | |

| 1,051 | | |

| 1,051 | |

| Additional paid-in capital | |

| 43,950,123 | | |

| 43,950,123 | |

| Accumulated deficit | |

| (43,334,452 | ) | |

| (41,384,268 | ) |

| Accumulated other comprehensive loss | |

| (1,783,267 | ) | |

| (1,672,005 | ) |

| Total Senmiao Technology Limited stockholders' (deficit) equity | |

| (1,166,545 | ) | |

| 894,901 | |

| | |

| | | |

| | |

| Non-controlling interests | |

| 3,397,030 | | |

| 3,159,103 | |

| | |

| | | |

| | |

| Total equity | |

| 2,230,485 | | |

| 4,054,004 | |

| | |

| | | |

| | |

| Total liabilities, mezzanine equity and equity | |

$ | 7,891,539 | | |

$ | 9,861,484 | |

The

accompanying notes are an integral part of the unaudited condensed consolidated financial statements

SENMIAO

TECHNOLOGY LIMITED

UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(Expressed

in U.S. dollar, except for the number of shares)

| | |

For the Three Months Ended December 31, | | |

For the Nine Months Ended December 31, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

(Unaudited) | | |

(Unaudited) | | |

(Unaudited) | | |

(Unaudited) | |

| Revenues | |

| | |

| | |

| | |

| |

| Revenues | |

$ | 916,954 | | |

$ | 1,101,074 | | |

$ | 2,532,978 | | |

$ | 3,451,173 | |

| Revenues, a related party | |

| 2,882 | | |

| 7,133 | | |

| 11,747 | | |

| 29,280 | |

| Total revenues | |

| 919,836 | | |

| 1,108,207 | | |

| 2,544,725 | | |

| 3,480,453 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of revenues | |

| | | |

| | | |

| | | |

| | |

| Cost of revenues | |

| (698,970 | ) | |

| (738,784 | ) | |

| (1,955,029 | ) | |

| (2,265,373 | ) |

| Cost of revenues, a related party | |

| (44,479 | ) | |

| (80,973 | ) | |

| (63,440 | ) | |

| (473,317 | ) |

| Total cost of revenues | |

| (743,449 | ) | |

| (819,757 | ) | |

| (2,018,469 | ) | |

| (2,738,690 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 176,387 | | |

| 288,450 | | |

| 526,256 | | |

| 741,763 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administrative expenses | |

| (515,366 | ) | |

| (746,514 | ) | |

| (1,899,515 | ) | |

| (2,434,146 | ) |

| Provision for credit losses | |

| (367,245 | ) | |

| — | | |

| (722,681 | ) | |

| (680,396 | ) |

| Stock-based compensation | |

| — | | |

| (444,300 | ) | |

| — | | |

| (444,300 | ) |

| Total operating expenses | |

| (882,611 | ) | |

| (1,190,814 | ) | |

| (2,622,196 | ) | |

| (3,558,842 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (706,224 | ) | |

| (902,364 | ) | |

| (2,095,940 | ) | |

| (2,817,079 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense) | |

| | | |

| | | |

| | | |

| | |

| Other income, net | |

| 4,897 | | |

| 159,933 | | |

| 444,761 | | |

| 275,736 | |

| Interest expense | |

| — | | |

| — | | |

| — | | |

| (525 | ) |

| Interest expense on finance leases | |

| (3,365 | ) | |

| (6,791 | ) | |

| (12,723 | ) | |

| (23,107 | ) |

| Change in fair value of derivative liabilities | |

| 121,314 | | |

| 46,188 | | |

| 105,900 | | |

| 410,027 | |

| Total other income, net | |

| 122,846 | | |

| 199,330 | | |

| 537,938 | | |

| 662,131 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss before income tax expense | |

| (583,378 | ) | |

| (703,034 | ) | |

| (1,558,002 | ) | |

| (2,154,948 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax expense | |

| — | | |

| — | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss from continuing operations | |

| (583,378 | ) | |

| (703,034 | ) | |

| (1,558,002 | ) | |

| (2,154,948 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss from discontinued operations | |

| — | | |

| (190,894 | ) | |

| (213,647 | ) | |

| (367,779 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| (583,378 | ) | |

| (893,928 | ) | |

| (1,771,649 | ) | |

| (2,522,727 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss (income) attributable to non-controlling interests from operations | |

| 18,063 | | |

| (40,070 | ) | |

| (178,535 | ) | |

| 234,944 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss attributable to the Company's stockholders | |

$ | (565,315 | ) | |

$ | (933,998 | ) | |

$ | (1,950,184 | ) | |

$ | (2,287,783 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (583,378 | ) | |

$ | (893,928 | ) | |

$ | (1,771,649 | ) | |

$ | (2,522,727 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive income (loss) | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation adjustment | |

| (138,657 | ) | |

| 172,393 | | |

| (51,870 | ) | |

| (318,529 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Comprehensive loss | |

| (722,035 | ) | |

| (721,535 | ) | |

| (1,823,519 | ) | |

| (2,841,256 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| less: Total comprehensive income (loss) attributable to non-controlling interests | |

| (14,722 | ) | |

| 27,449 | | |

| 237,927 | | |

| (206,596 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Total comprehensive loss attributable to stockholders | |

$ | (707,313 | ) | |

$ | (748,984 | ) | |

$ | (2,061,446 | ) | |

$ | (2,634,660 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of common stock | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

| 10,521,222 | | |

| 9,446,494 | | |

| 10,521,222 | | |

| 8,463,858 | |

| Net loss per share - basic and diluted | |

| (0.05 | ) | |

| (0.10 | ) | |

| (0.19 | ) | |

| (0.27 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share - basic and diluted | |

| | | |

| | | |

| | | |

| | |

| Continuing

operations | |

$ | (0.05 | ) | |

$ | (0.08 | ) | |

$ | (0.17 | ) | |

$ | (0.23 | ) |

| Discontinued

operations | |

$ | — | | |

$ | (0.02 | ) | |

$ | (0.02 | ) | |

$ | (0.04 | ) |

The

accompanying notes are an integral part of the unaudited condensed consolidated financial statements

SENMIAO

TECHNOLOGY LIMITED

UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

For

the Nine Months Ended December 31, 2024 and 2023

(Expressed

in U.S. dollar, except for the number of shares)

| | |

For the Nine Months Ended December 31, 2023 | |

| | |

| | |

| | |

| | |

| | |

Accumulated | | |

| | |

| |

| | |

Common stock | | |

Additional paid-in | | |

Accumulated | | |

other comprehensive | | |

Non-controlling | | |

Total | |

| | |

Shares | | |

Par value | | |

capital | | |

deficit | | |

loss | | |

interest | | |

equity | |

| BALANCE, March 31, 2023 | |

| 7,743,040 | | |

$ | 773 | | |

$ | 43,355,834 | | |

$ | (37,715,294 | ) | |

$ | (1,247,099 | ) | |

$ | 3,833,466 | | |

$ | 8,227,680 | |

| Net income (loss) | |

| — | | |

| — | | |

| — | | |

| (427,828 | ) | |

| — | | |

| 6,481 | | |

| (421,347 | ) |

| Conversion of preferred stock into common stock | |

| 250,000 | | |

| 25 | | |

| 26,914 | | |

| — | | |

| — | | |

| — | | |

| 26,939 | |

| Foreign currency translation adjustments | |

| — | | |

| — | | |

| — | | |

| — | | |

| (496,137 | ) | |

| 42,812 | | |

| (453,325 | ) |

| BALANCE, June 30, 2023 (Unaudited) | |

| 7,993,040 | | |

$ | 798 | | |

$ | 43,382,748 | | |

$ | (38,143,122 | ) | |

$ | (1,743,236 | ) | |

$ | 3,882,759 | | |

$ | 7,379,947 | |

| Net loss | |

| — | | |

| — | | |

| — | | |

| (925,957 | ) | |

| — | | |

| (281,495 | ) | |

| (1,207,452 | ) |

| Conversion of preferred stock into common stock | |

| 75,000 | | |

| 8 | | |

| 8,075 | | |

| — | | |

| — | | |

| — | | |

| 8,083 | |

| Foreign currency translation adjustments | |

| — | | |

| — | | |

| — | | |

| — | | |

| (35,754 | ) | |

| (1,843 | ) | |

| (37,597 | ) |

| BALANCE, September 30, 2023 (Unaudited) | |

| 8,068,040 | | |

$ | 806 | | |

$ | 43,390,823 | | |

$ | (39,069,079 | ) | |

$ | (1,778,990 | ) | |

$ | 3,599,421 | | |

$ | 6,142,981 | |

| Net income (loss) | |

| — | | |

| — | | |

| — | | |

| (933,998 | ) | |

| — | | |

| 40,070 | | |

| (893,928 | ) |

| Issuance of common stock for consulting services | |

| 1,500,000 | | |

| 150 | | |

| 444,150 | | |

| — | | |

| — | | |

| — | | |

| 444,300 | |

| Foreign currency translation adjustment | |

| — | | |

| — | | |

| — | | |

| — | | |

| 185,014 | | |

| (12,621 | ) | |

| 172,393 | |

| BALANCE, December 31, 2023 (Unaudited) | |

| 9,568,040 | | |

$ | 956 | | |

$ | 43,834,973 | | |

$ | (40,003,077 | ) | |

$ | (1,593,976 | ) | |

$ | 3,626,870 | | |

$ | 5,865,746 | |

| | |

For the Nine Months Ended December 31, 2024 | |

| | |

| | |

| | |

| | |

| | |

Accumulated | | |

| | |

| |

| | |

Common stock | | |

Additional paid-in | | |

Accumulated | | |

other comprehensive | | |

Non-controlling | | |

Total | |

| | |

Shares | | |

Par value | | |

capital | | |

deficit | | |

loss | | |

interest | | |

equity | |

| BALANCE, March 31, 2024 | |

| 10,518,040 | | |

$ | 1,051 | | |

$ | 43,950,123 | | |

$ | (41,384,268 | ) | |

$ | (1,672,005 | ) | |

$ | 3,159,103 | | |

$ | 4,054,004 | |

| Net loss | |

| — | | |

| — | | |

| — | | |

| (673,420 | ) | |

| — | | |

| (89,398 | ) | |

| (762,818 | ) |

| Foreign currency translation adjustments | |

| — | | |

| — | | |

| — | | |

| — | | |

| (62,320 | ) | |

| 29,284 | | |

| (33,036 | ) |

| BALANCE, June 30, 2024 (Unaudited) | |

| 10,518,040 | | |

$ | 1,051 | | |

$ | 43,950,123 | | |

$ | (42,057,688 | ) | |

$ | (1,734,325 | ) | |

$ | 3,098,989 | | |

$ | 3,258,150 | |

| Net income (loss) | |

| — | | |

| — | | |

| — | | |

| (711,449 | ) | |

| — | | |

| 285,996 | | |

| (425,453 | ) |

| Foreign currency translation adjustments | |

| — | | |

| — | | |

| — | | |

| — | | |

| 93,056 | | |

| 26,767 | | |

| 119,823 | |

| BALANCE, September 30, 2024 (Unaudited) | |

| 10,518,040 | | |

$ | 1,051 | | |

$ | 43,950,123 | | |

$ | (42,769,137 | ) | |

$ | (1,641,269 | ) | |

$ | 3,411,752 | | |

$ | 2,952,520 | |

| Net loss | |

| — | | |

| — | | |

| — | | |

| (565,315 | ) | |

| — | | |

| (18,063 | ) | |

| (583,378 | ) |

| Foreign currency translation adjustment | |

| — | | |

| — | | |

| — | | |

| — | | |

| (141,998 | ) | |

| 3,341 | | |

| (138,657 | ) |

| BALANCE, December 31, 2024 (Unaudited) | |

| 10,518,040 | | |

| 1,051 | | |

| 43,950,123 | | |

| (43,334,452 | ) | |

| (1,783,267 | ) | |

| 3,397,030 | | |

| 2,230,485 | |

The

accompanying notes are an integral part of the unaudited condensed consolidated financial statements

SENMIAO

TECHNOLOGY LIMITED

UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Expressed

in U.S. dollar, except for the number of shares)

| | |

For the Nine Months Ended December 31, | |

| | |

2024 | | |

2023 | |

| | |

(Unaudited) | | |

(Unaudited) | |

| Cash Flows from Operating Activities: | |

| | |

| |

| Net loss | |

$ | (1,771,649 | ) | |

$ | (2,522,727 | ) |

| Net loss from discontinued operations | |

| (213,647 | ) | |

| (367,779 | ) |

| Net loss from continuing operations | |

| (1,558,002 | ) | |

| (2,154,948 | ) |

| Adjustments to reconcile net loss to net cash provided by operating activities: | |

| | | |

| | |

| Depreciation and amortization of property and equipment | |

| 689,794 | | |

| 697,485 | |

| Stock-based compensation | |

| — | | |

| 444,300 | |

| Amortization of right-of-use assets | |

| 221,879 | | |

| 322,904 | |

| Amortization of intangible assets | |

| 56,278 | | |

| 86,201 | |

| Provision for credit losses | |

| 722,681 | | |

| 680,396 | |

| Gain on disposal of equipment | |

| (4,030 | ) | |

| (32,076 | ) |

| Gain from deconsolidation | |

| (397,775 | ) | |

| — | |

| Change in fair value of derivative liabilities | |

| (105,900 | ) | |

| (410,027 | ) |

| Loss from lease modification | |

| 20,449 | | |

| — | |

| Change in operating assets and liabilities | |

| | | |

| | |

| Accounts receivable | |

| (20,924 | ) | |

| 4,239 | |

| Accounts receivable, a related party | |

| — | | |

| 608 | |

| Inventories | |

| — | | |

| 64,257 | |

| Finance lease receivables | |

| 106,866 | | |

| 133,988 | |

| Prepayments, other receivables and other assets | |

| 48,710 | | |

| 89,596 | |

| Prepayment - a related party | |

| (35,315 | ) | |

| — | |

| Due from a related party | |

| 69,463 | | |

| — | |

| Accounts payable | |

| 76,936 | | |

| 175,742 | |

| Advances from customers | |

| (17,541 | ) | |

| (3,577 | ) |

| Accrued expenses and other liabilities | |

| 792,948 | | |

| 615,472 | |

| Due to a related party | |

| 4,543 | | |

| — | |

| Operating lease liabilities | |

| (7,574 | ) | |

| (53,776 | ) |

| Operating lease liabilities - related parties | |

| (41,603 | ) | |

| (57,705 | ) |

| Net Cash Provided by Operating Activities from Continuing Operations | |

| 621,883 | | |

| 603,079 | |

| Net Cash Used in Operating Activities from Discontinued Operations | |

| (73,441 | ) | |

| (348,330 | ) |

| Net Cash Provided by Operating Activities | |

| 548,442 | | |

| 254,749 | |

| | |

| | | |

| | |

| Cash Flows from Investing Activities: | |

| | | |

| | |

| Purchases of property and equipment | |

| (1,607 | ) | |

| (643,376 | ) |

| Cash received from disposal of property and equipment | |

| 16,804 | | |

| 102,013 | |

| Loan to a related party | |

| (320,703 | ) | |

| — | |

| Cash released upon disposal of subsidiaries | |

| (142,751 | ) | |

| — | |

| Net Cash Used in Investing Activities from Continuing Operations | |

| (448,257 | ) | |

| (541,363 | ) |

| Net Cash Provided by Investing Activities from Discontinued Operations | |

| 49 | | |

| 159 | |

| Net Cash Used in Investing Activities | |

| (448,208 | ) | |

| (541,204 | ) |

| | |

| | | |

| | |

| Cash Flows from Financing Activities: | |

| | | |

| | |

| Borrowings from a related party | |

| 79,872 | | |

| — | |

| Repayments from a related party | |

| 13,893 | | |

| 321,229 | |

| Repayment of current borrowings to a financial institution | |

| — | | |

| (8,453 | ) |

| Repayments to related parties and affiliates | |

| — | | |

| (572,113 | ) |

| Principal payments of finance lease liabilities | |

| (29,219 | ) | |

| (171,388 | ) |

| Net Cash (Used in) Provided by Financing Activities from Continuing Operations | |

| 64,546 | | |

| (430,725 | ) |

| Net Cash (Used in) Provided by Financing Activities from Discontinued Operations | |

| (82,074 | ) | |

| 236,202 | |

| Net Cash Used in Financing Activities | |

| (17,528 | ) | |

| (194,523 | ) |

| | |

| | | |

| | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | |

| 71,882 | | |

| (61,915 | ) |

| | |

| | | |

| | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | |

| 154,588 | | |

| (542,893 | ) |

| Cash, cash equivalents and restricted cash, beginning of the period | |

| 794,636 | | |

| 1,610,090 | |

| Cash, cash equivalents and restricted cash, end of the period | |

| 949,224 | | |

| 1,067,197 | |

| Less: Cash and cash equivalents from discontinued operations | |

| — | | |

| (44,087 | ) |

| Cash, Cash equivalents and Restricted Cash from continuing operations, end of Period | |

| 949,224 | | |

| 1,023,110 | |

| | |

| | | |

| | |

| Supplemental Cash Flow Information | |

| | | |

| | |

| Cash paid for interest expense | |

$ | — | | |

$ | 525 | |

| Cash paid for income tax | |

$ | — | | |

$ | — | |

| | |

| | | |

| | |

| Non-cash Transaction in Investing and Financing Activities | |

| | | |

| | |

| Recognition of right-of-use assets and lease liabilities, related parties | |

$ | — | | |

$ | 349,532 | |

| Termination of right-of use assets and lease liabilities, related parties | |

$ | 46,762 | | |

$ | — | |

The following tables provides a reconciliation

of cash, cash equivalent and restricted cash reported within the unaudited condensed consolidated balance sheets that sum to the total

of the same amounts shown in the unaudited condensed consolidated statements of cash flows:

| | |

December 31, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| | |

(Unaudited) | | |

(Unaudited) | |

| Cash and cash equivalent from continuing operations, end of the period | |

$ | 949,224 | | |

$ | 1,020,735 | |

| Restricted cash from continuing operations, end of the period | |

$ | — | | |

$ | 2,375 | |

| Cash and cash equivalent from discontinued operations, end of the period | |

$ | — | | |

$ | 44,087 | |

| | |

December 31, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| | |

| (Unaudited) | | |

| (Unaudited) | |

| Cash and cash equivalent from continuing operations, beginning of the period | |

$ | 737,719 | | |

$ | 1,485,100 | |

| Restricted cash from continuing operations, beginning of the period | |

$ | 2,337 | | |

$ | — | |

| Cash and cash equivalent from discontinued operations, beginning of the period | |

$ | 54,580 | | |

$ | 124,990 | |

The

accompanying notes are an integral part of the unaudited condensed consolidated financial statements

SENMIAO

TECHNOLOGY LIMITED

NOTES

TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

1. ORGANIZATION

AND PRINCIPAL ACTIVITIES

Senmiao

Technology Limited (the “Company”) is a U.S. holding company incorporated in the State of Nevada on June 8, 2017.

The Company operates its business in one segment: automobile transaction and related services focusing on the online ride-hailing

industry in the People’s Republic of China (“PRC” or “China”) through the Company’s wholly owned

subsidiary, Chengdu Corenel Technology Co., Ltd., a PRC limited liability company (“Corenel”), and its majority owned subsidiaries,

Chengdu Jiekai Yunli Technology Co., Ltd. (“Jiekai”), and Hunan Ruixi Financial Leasing Co., Ltd., a PRC limited liability

company (“Hunan Ruixi”), and its equity investee company (an entity 35% owned by Hunan Ruixi), Sichuan Jinkailong Automobile

Leasing Co., Ltd., a PRC limited liability company (“Jinkailong”).

Hunan

Ruixi holds a business license for automobile sales and financial leasing and has been engaged in automobile financial leasing services

and automobile sales since March 2019 and January 2019, respectively. The Company also has been engaged in operating leasing services

through Hunan Ruixi, Jiekai and its equity investee company, Jinkailong since March 2019. Jinkailong used to facilitate automobile sales

and financing transactions for its clients, who are primarily ride-hailing drivers and provides them operating lease and relevant after-transaction

services.

The

Company also used to operate online ride-hailing platform services through its own platform (known as Xixingtianxia) from October

2020 to August 2024, through Hunan Xixingtianxia Technology Co., Ltd., a PRC limited liability company (“XXTX”), which was

a wholly owned subsidiary of Sichuan Senmiao Zecheng Business Consulting Co., Ltd. (“Senmiao Consulting”), a PRC limited

liability company and wholly-owned subsidiary of the Company. The Company’s ride hailing platform enabled qualified ride-hailing

drivers to provide transportation services in several cities in China. On August 8, 2024, Senmiao Consulting entered into a certain Acquisition

Agreement with Debt Assumption Takeover (the “Acquisition Agreement”) with Jiangsu Yuelaiyuexing Technology Co., Ltd. (the

“Purchaser”), and other parties thereto, in connection with the acquisition (the “Acquisition”) by the Purchaser

of 100% of the Company’s equity interest in XXTX and its subsidiaries. On August 20, 2024, the Acquisition was completed and Senmiao

Consulting disposed its 100% equity interest in XXTX and its subsidiaries (refer to Note 4). After the disposition, the Company operates

its business in one segment.

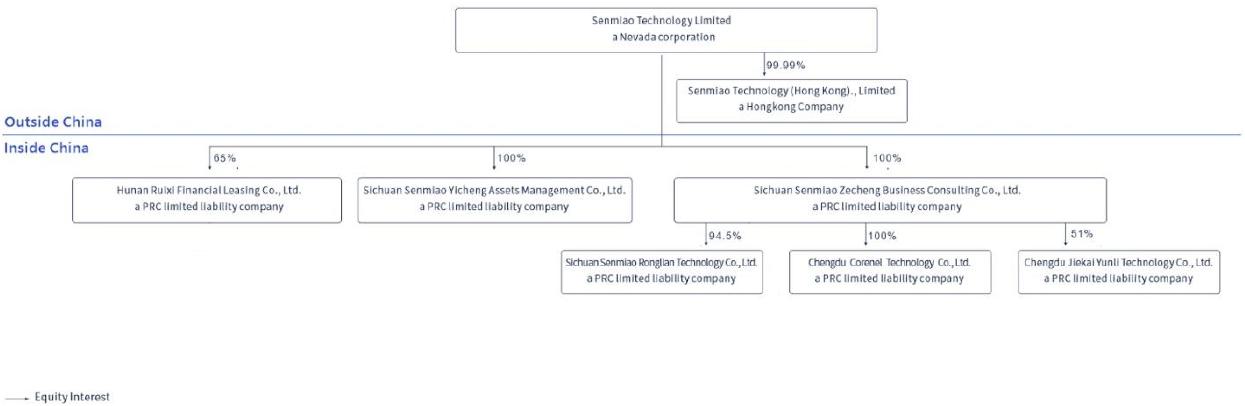

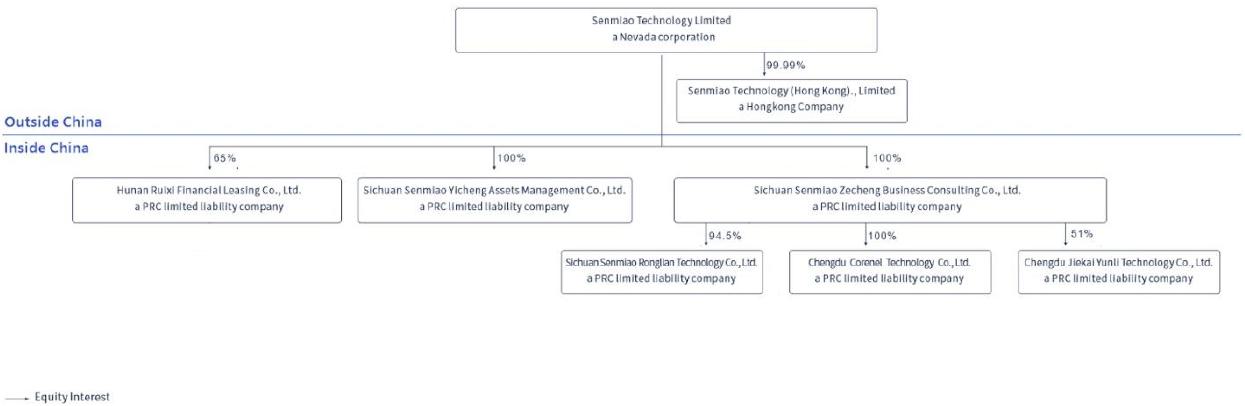

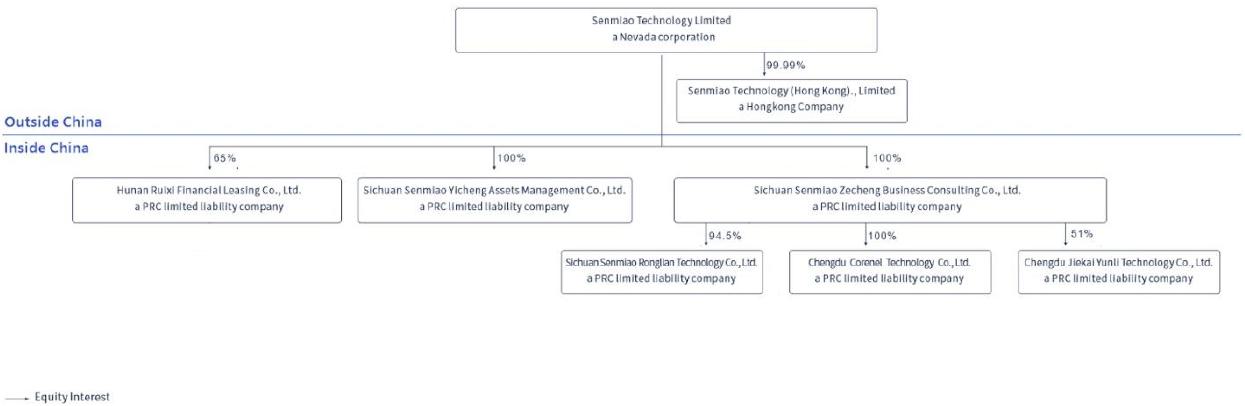

The

following diagram illustrates the Company’s corporate structure as of the filing date of these unaudited condensed consolidated

financial statements:

Former

Voting Agreements with Jinkailong’s Other Shareholders

Hunan

Ruixi entered into two voting agreements signed in August 2018 and February 2020, respectively, as amended (the “Voting Agreements”),

with Jinkailong and other Jinkailong’s shareholders holding an aggregate of 65% equity interests. Pursuant to the Voting Agreements,

all other Jinkailong’s shareholders will vote in concert with Hunan Ruixi on all fundamental corporate transactions in the event

of a disagreement for periods of 20 years and 18 years, respectively, ending on August 25, 2038.

On

March 31, 2022, Hunan Ruixi entered into an Agreement for the Termination of the Agreement for Concerted Action by Shareholders of Jinkailong

(the “Termination Agreement”), pursuant to which the Voting Agreements mentioned above was terminated as of the date of the

Termination Agreement. The termination will not impair the past and future legitimate rights and interests of all parties in Jinkailong.

Starting from April 1, 2022, the parties no longer maintain a concerted action relationship with respect to the decision required to

take concerted action at its shareholders meetings as stipulated in the Voting Agreements. Each party shall independently express opinions

and exercise various rights such as voting rights and perform relevant obligations in accordance with the provisions of laws, regulations,

normative documents and the Jinkailong’s articles of association.

As

a result of the Termination Agreement, the Company no longer has a controlling financial interest in Jinkailong and has determined that

Jinkailong was deconsolidated from the Company’s Unaudited condensed consolidated financial statements effective as of March 31,

2022. However, as Hunan Ruixi still holds 35% equity interests in Jinkailong, Jinkailong is the equity investee company of the Company

since then.

As of December 31, 2024, the Company has outstanding

balance due from Jinkailong amounted to $2,847,738 net of allowance for credit losses, of which, $2,765,537 is to be repaid over a period

from January 2026 to December 2026, classified as due from a related party, net, non-current. As of March 31, 2024, the Company

has outstanding balance due from Jinkailong amounted to $3,245,907, net of allowance for credit losses, of which, $2,747,313 is to be

repaid over a period from April 2025 to December 2026, classified as due from a related party, net, non-current. (refer to Note 15).

As

of December 31, 2024 and March 31, 2024, allowance for credit losses due from Jinkailong amounted to $3,778,815 and $3,099,701, respectively.

During the three and nine months ended December 31, 2024, the Company recorded provision for credit losses against the balance due from

Jinkailong of $367,245 and $722,681, respectively.

During

the three and nine months ended December 31, 2023, the Company recorded provision for credit losses against the balance due from Jinkailong

of $0 and $680,396, respectively.

2. GOING

CONCERN

In

assessing the Company’s liquidity, the Company monitors and analyzes its cash on-hand and its operating and capital expenditure

commitments. The Company’s liquidity needs are to meet its working capital requirements, operating expenses and capital expenditure

obligations. Debt financing from financial institutions and equity financings have been utilized to finance the working capital requirements

of the Company.

The

Company’s business is capital intensive. The Company’s management has considered whether there is substantial doubt about

its ability to continue as a going concern due to (1) the net loss of approximately $1.8 million for the nine months ended December

31, 2024; (2) accumulated deficit of approximately $43.3 million as of December 31, 2024; (3) the working capital deficit of approximately

$3.4 million as of December 31, 2024; and (4) one purchase commitment of approximately $0.9 million for 100 automobiles.

As of the filing date of these unaudited condensed consolidated financial statements, the Company has entered into one purchase contract

with an automobile dealer to purchase a total of 100 automobiles in the amount of approximately $1.5 million, of which approximately

$0.6 million has been remitted as purchase prepayments. The remaining purchase commitment of approximately $0.9 million shall

be remitted in installment to be completed before March 31, 2025.

Management

has determined there is substantial doubt about its ability to continue as a going concern. If the Company is unable to generate significant

revenue, the Company may be required to curtail or cease its operations. Management is trying to alleviate the going concern risk through

the following sources:

| |

● |

Equity

financing to support its working capital; |

| |

● |

Other available sources

of financing (including debt) from PRC banks and other financial institutions; and |

| |

● |

Financial support and credit

guarantee commitments from the Company’s related parties. |

There

is no assurance that the Company will be successful in implementing the foregoing plans or that additional financing will be available

to the Company on commercially reasonable terms, or at all. There are a number of factors that could potentially arise that could undermine

the Company’s plans, such as (i) changes in the demand for the Company’s services, (ii) PRC government policies, (iii) economic

conditions in China and worldwide, (iv) competitive pricing in the automobile transaction and related service and ride-hailing industries,

(v) changes in the Company’s relationships with key business partners, (vi) the ability of financial institutions in China to provide

continued financial support to the Company’s customers, and (vii) the perception of PRC-based companies in the U.S. capital markets.

The Company’s inability to secure needed financing when required could require material changes to the Company’s business

plans and could have a material adverse effect on the Company’s ability to continue as a going concern and results of operations.

The unaudited condensed consolidated financial statements have been prepared on a going concern basis, which contemplates the realization

of assets and liquidation of liabilities in the normal course of business. The unaudited condensed consolidated financial statements

do not include any adjustments that might result from the outcome of such uncertainties.

3. SUMMARY

OF SIGNIFICANT ACCOUNTING POLICIES

(a)

Basis of presentation

The unaudited condensed consolidated financial

statements, including the unaudited condensed consolidated balance sheets as of December 31, 2024, the unaudited condensed consolidated

statements of operations and comprehensive loss, the unaudited condensed consolidated statements of changes in equity, and the unaudited

condensed consolidated statements of cash flows for the nine months ended December 31, 2024 and 2023, as well as other information disclosed

in the accompanying notes, have been prepared in accordance with accounting principles generally accepted in the United States of America

(“U.S. GAAP”), and pursuant to the rules and regulations of the SEC and pursuant to Regulation S-X. The interim unaudited

condensed consolidated financial statements and accompanying notes should be read in conjunction with the audited consolidated financial

statements and the notes thereto, included in the Form 10-K for the fiscal year ended March 31, 2024, which was filed with the SEC on

June 27, 2024.

The

interim unaudited condensed consolidated financial statements and the accompanying notes have been prepared on the same basis as the

annual consolidated financial statements and, in the opinion of management, reflect all adjustments, which include only normal

recurring adjustments, necessary for a fair statement of the results of operations for the periods presented. The consolidated

results of operations for any interim period are not necessarily indicative of the results to be expected for the full year or for

any other future years or interim periods.

(b)

Foreign currency translation

Transactions

denominated in currencies other than the functional currency are translated into the functional currency at the exchange rates prevailing

on the dates of the transaction. Monetary assets and liabilities denominated in currencies other than the functional currency are translated

into the functional currency using the applicable exchange rates on the date of the balance sheet. The resulting exchange differences

are recorded in the statement of operations.

The

reporting currency of the Company and its subsidiaries is U.S. dollars (“US$”) and the unaudited condensed consolidated financial

statements have been expressed in US$. However, the Company maintains the books and records in its functional currency, Chinese Renminbi

(“RMB”), being the functional currency of the economic environment in which its operations are conducted.

In general, for consolidation purposes, assets

and liabilities of the Company and its subsidiaries whose functional currency is not the US$, are translated into US$, using the exchange

rate on the balance sheet date. Revenues and expenses are translated at average rates prevailing during the period. The gains and losses

resulting from translation of financial statements of the Company and its subsidiaries are recorded as a separate component of accumulated

other comprehensive loss within the unaudited condensed consolidated statements of changes in equity.

Translation

of amounts from RMB into US$ has been made at the following exchange rates for the respective periods:

| | |

December 31, | | |

March 31, | |

| | |

2024 | | |

2024 | |

| Balance sheet items, except for

equity accounts – RMB: US$1: | |

| 7.2993 | | |

| 7.2203 | |

| | |

For

the three months ended

December 31, | |

| | |

2024 | | |

2023 | |

| Items in the statements of operations

and comprehensive loss, and cash flows – RMB: US$1: | |

| 7.1896 | | |

| 7.2247 | |

| | |

For

the nine months ended

December 31, | |

| | |

2024 | | |

2023 | |

| Items in the statements of operations

and comprehensive loss, and cash flows – RMB: US$1: | |

| 7.1981 | | |

| 7.1600 | |

(c)

Use of estimates

In

presenting the unaudited condensed consolidated financial statements in accordance with U.S. GAAP, management makes estimates and assumptions

that affect the amounts reported and related disclosures. Estimates, by their nature, are based on judgment and available information.

Accordingly, actual results could differ from those estimates. On an ongoing basis, management reviews these estimates and assumptions

using the currently available information. Changes in facts and circumstances may cause the Company to revise its estimates. The Company

bases its estimates on past experience and on various other assumptions that are believed to be reasonable, the results of which form

the basis for making judgments about the carrying values of assets and liabilities. Estimates are used when accounting for items and

matters including, but not limited to, revenue recognition, residual values of property and equipment, lease liabilities, right-of-use

assets, determinations of the useful lives and valuation of long-lived assets, estimates of allowances for credit losses for receivables

and due from related parties, estimates of impairment of long-lived assets, and valuation of deferred tax assets.

(d)

Fair values of financial instruments

Accounting

Standards Codification (“ASC”) Topic 825, Financial Instruments (“Topic 825”) requires disclosure of fair value

information of financial instruments, whether or not recognized in the balance sheets, for which it is practicable to estimate that value.

In cases where quoted market prices are not available, fair values are based on estimates using present value or other valuation techniques.

Those techniques are significantly affected by the assumptions used, including the discount rate and estimates of future cash flows.

Topic 825 excludes certain financial instruments and all nonfinancial assets and liabilities from its disclosure requirements. Accordingly,

the aggregate fair value amounts do not represent the underlying value of the Company. The three levels of valuation hierarchy are defined

as follows:

Level

1 Inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets.

Level

2 Inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are

observable for the assets or liability, either directly or indirectly, for substantially the full term of the financial instruments.

Level

3 Inputs to the valuation methodology are unobservable and significant to the fair value.

The

following table sets forth by level within the fair value hierarchy our financial assets and liabilities that were accounted for at fair

value on a recurring basis as of December 31, 2024 and March 31, 2024:

| | |

Carrying

Value as of | | |

Fair Value Measurement as

of | |

| | |

December 31, | | |

December

31, 2024 | |

| | |

2024 | | |

Level 1 | | |

Level 2 | | |

Level 3 | |

| | |

(Unaudited) | | |

| | |

| | |

| |

| Derivative liabilities | |

$ | 182,933 | | |

$ | — | | |

$ | — | | |

$ | 182,933 | |

| | |

Carrying

Value as of | | |

Fair Value Measurement as

of | |

| | |

March

31, | | |

March

31, 2024 | |

| | |

2024 | | |

Level 1 | | |

Level 2 | | |

Level 3 | |

| Derivative liabilities | |

$ | 288,833 | | |

$ | — | | |

$ | — | | |

$ | 288,833 | |

The

following is a reconciliation of the beginning and ending balance of the assets and liabilities measured at fair value on a recurring

basis for the nine months ended December 31, 2024 and for the year ended March 31, 2024:

| | |

2019

Registered Direct Offering | | |

August

2020

Underwritten

Public | | |

February

2021

Registered

Direct | | |

May

2021

Registered Direct Offering | | |

November

2021

Private Placement | | |

| |

| | |

Series A

Warrants | | |

Placement

Warrants | | |

Offering

Warrants | | |

Offering

Warrants | | |

Investors

Warrants | | |

Placement

Warrants | | |

Investors

Warrants | | |

Placement

Warrants | | |

Total | |

| BALANCE

as of March 31, 2023 | |

$ | 1 | | |

$ | 5 | | |

$ | 8,450 | | |

$ | 11,491 | | |

$ | 161,961 | | |

$ | 12,147 | | |

$ | 284,762 | | |

$ | 22,965 | | |

$ | 501,782 | |

| Change

in fair value of derivative liabilities | |

| — | | |

| — | | |

| (5,231 | ) | |

| (7,158 | ) | |

| (81,325 | ) | |

| (6,099 | ) | |

| (105,242 | ) | |

| (7,888 | ) | |

| (212,943 | ) |

| Warrant

forfeited due to expiration | |

| (1 | ) | |

| (5 | ) | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (6 | ) |

| BALANCE

as of March 31, 2024 | |

| — | | |

| — | | |

| 3,219 | | |

| 4,333 | | |

| 80,636 | | |

| 6,048 | | |

| 179,520 | | |

| 15,077 | | |

| 288,833 | |

| Change

in fair value of derivative liabilities | |

| — | | |

| — | | |

| (2,654 | ) | |

| (3,125 | ) | |

| (41,939 | ) | |

| (3,146 | ) | |

| (51,320 | ) | |

| (3,716 | ) | |

| (105,900 | ) |

| BALANCE

as of December 31, 2024 (Unaudited) | |

$ | — | | |

$ | — | | |

$ | 565 | | |

$ | 1,208 | | |

$ | 38,697 | | |

$ | 2,902 | | |

$ | 128,200 | | |

$ | 11,361 | | |

$ | 182,933 | |

The August 2020 Underwriters’ Warrants, the February 2021 Placement Agent Warrants, the February 2021 ROFR Warrants, the May 2021

Investors Warrants, the May 2021 Placement Agent Warrants, and the November 2021 Investors Warrants and November 2021 Placement Agent

Warrants (all discussed below) are not traded in an active securities market; therefore, the Company estimates the fair value to those

warrants using the Black-Scholes valuation model as of December 31, 2024 and March 31, 2024.

| | | As of December 31, 2024 | |

| | | August 4,

2020 | | | February 10, 2021 | | | May 13, 2021 | | | November 10, 2021 | |

| | | | | | Placement | | | | | | | | | Placement | | | | | | Placement | |

| | | Underwriters’ | | | Agent | | | ROFR | | | Investor | | | Agent | | | Investor | | | Agent | |

| Granted Date | | Warrants | | | Warrants | | | Warrants | | | Warrants | | | Warrants | | | Warrants | | | Warrants | |

| | | (Unaudited) | | | (Unaudited) | | | (Unaudited) | | | (Unaudited) | | | (Unaudited) | | | (Unaudited) | | | (Unaudited) | |

| # of shares exercisable | | | 31,808 | | | | 38,044 | | | | 15,218 | | | | 553,192 | | | | 41,490 | | | | 5,310,763 | | | | 55,148 | |

| Valuation date | | | 12/31/2024 | | | | 12/31/2024 | | | | 12/31/2024 | | | | 12/31/2024 | | | | 12/31/2024 | | | | 12/31/2024 | | | | 12/31/2024 | |

| Exercise price | | $ | 6.25 | | | $ | 13.80 | | | $ | 17.25 | | | $ | 10.50 | | | $ | 10.50 | | | $ | 1.13 | | | $ | 6.80 | |

| Stock price | | $ | 1.07 | | | $ | 1.07 | | | $ | 1.07 | | | $ | 1.07 | | | $ | 1.07 | | | $ | 1.07 | | | $ | 1.07 | |

| Expected term (years) | | | 0.59 | | | | 1.11 | | | | 1.11 | | | | 1.36 | | | | 1.36 | | | | 1.86 | | | | 1.86 | |

| Risk-free interest rate | | | 4.24 | % | | | 4.15 | % | | | 4.15 | % | | | 4.15 | % | | | 4.15 | % | | | 4.08 | % | | | 4.08 | % |

| Expected volatility | | | 113 | % | | | 113 | % | | | 113 | % | | | 113 | % | | | 113 | % | | | 113 | % | | | 113 | % |

| | | As of March 31, 2024 | |

| | | August 4,

2020 | | | February 10, 2021 | | | May 13, 2021 | | | November 10, 2021 | |

| | | | | | Placement | | | | | | | | | Placement | | | | | | Placement | |

| | | Underwriters’ | | | Agent | | | ROFR | | | Investor | | | Agent | | | Investor | | | Agent | |

| Granted Date | | Warrants | | | Warrants | | | Warrants | | | Warrants | | | Warrants | | | Warrants | | | Warrants | |

| # of shares exercisable | | | 31,808 | | | | 38,044 | | | | 15,218 | | | | 553,192 | | | | 41,490 | | | | 5,310,763 | | | | 55,148 | |

| Valuation date | | | 3/31/2024 | | | | 3/31/2024 | | | | 3/31/2024 | | | | 3/31/2024 | | | | 3/31/2024 | | | | 3/31/2024 | | | | 3/31/2024 | |

| Exercise price | | $ | 6.25 | | | $ | 13.80 | | | $ | 17.25 | | | $ | 10.50 | | | $ | 10.50 | | | $ | 1.13 | | | $ | 6.80 | |

| Stock price | | $ | 0.90 | | | $ | 0.90 | | | $ | 0.90 | | | $ | 0.90 | | | $ | 0.90 | | | $ | 0.90 | | | $ | 0.90 | |

| Expected term (years) | | | 1.35 | | | | 1.87 | | | | 1.87 | | | | 2.12 | | | | 2.12 | | | | 2.61 | | | | 2.61 | |

| Risk-free interest rate | | | 4.88 | % | | | 4.65 | % | | | 4.65 | % | | | 4.57 | % | | | 4.57 | % | | | 4.47 | % | | | 4.47 | % |

| Expected volatility | | | 117 | % | | | 117 | % | | | 117 | % | | | 117 | % | | | 117 | % | | | 117 | % | | | 117 | % |

| * | Giving retroactive effect to the 1-for-10 reverse stock split effected on April 6, 2022. |

As

of December 31, 2024 and March 31, 2024, financial instruments of the Company comprised primarily current assets and current liabilities

including cash and cash equivalents, restricted cash, accounts receivable, finance lease receivables, prepayments, other receivables

and other assets, due from related parties, accounts payable, advance from customers, lease liabilities, accrued expenses and other liabilities,

due to related parties, and operating and financing lease liabilities, which approximate their fair values because of the short-term

nature of these instruments, and current liabilities of borrowings from a financial institution, which approximate their fair values

because of the stated loan interest rate to the rate charged by similar financial institutions.

The

non-current portion of finance lease receivables, operating and financing lease liabilities were recorded at the gross amount adjusted

for the interest using the effective interest rate method. The Company believes that the effective interest rates underlying these instruments

approximate their fair values because the Company used its incremental borrowing rate to recognize the present value of these instruments

as of December 31, 2024 and March 31, 2024.

Other

than as listed above, the Company did not identify any assets or liabilities that are required to be presented on the balance sheet at

fair value.

(e)

Segment reporting

Operating

segments are reported in a manner consistent with the internal reporting provided to the chief operating decision maker (the “CODM”),

which is comprised of certain members of the Company’s management team. During the years ended March 31, 2019 and 2021, the Company

acquired Hunan Ruixi and XXTX, respectively, and disposed XXTX in August 2024. The Company evaluated how the CODM manages the businesses

of the Company to maximize efficiency in allocating resources and assessing performance. The Company has one operating and reportable

segment of automobile transaction and related services as set forth in Note 1, after discontinued the online ride-hailing platform services

on August 20, 2024.

(f)

Cash and cash equivalents

Cash

and cash equivalents primarily consist of bank deposits with original maturities of three months or less, which are unrestricted as to

withdrawal and use. Cash and cash equivalents also consist of funds received from automobile purchasers as payments for automobiles,

funds received from automobile lessees as payments for rentals, which were held at the third-party platforms’ fund accounts and

which are unrestricted and immediately available for withdrawal and use.

(g)

Accounts receivable, net

Accounts

receivable are recorded at the invoiced amount less an allowance for any uncollectible accounts and do not bear interest, and are due

on demand. The carrying value of accounts receivable is reduced by an allowance that reflects the Company’s best estimate of the

amounts that will not be collected. An allowance for credit losses is recorded in the period when a loss is probable based on an assessment

of specific evidence indicating collection is unlikely, historical bad debt rates, accounts aging, financial conditions of the customer

and industry trends. Starting from April 1, 2023, the Company adopted ASU No.2016-13 “Financial Instruments – Credit Losses

(Topic 326): Measurement of Credit Losses on Financial Instruments” (“ASC Topic 326”). Management also periodically

evaluates individual customer’s financial condition, credit history, and the current economic conditions to make adjustments in

the allowance when it is considered necessary. Account balances are charged off against the allowance after all means of collection have

been exhausted and the potential for recovery is considered remote. The Company’s management continues to evaluate the reasonableness

of the valuation allowance policy and update it if necessary. As of December 31, 2024 and March 31, 2024,

the Company record allowance for credit losses of $1,529 and $1,545 against accounts receivable, respectively.

(h)

Finance lease receivables

Finance

lease receivables, which result from sales-type leases, are measured at discounted present value of (i) future minimum lease payments,

(ii) any residual value not subject to a bargain purchase option as finance lease receivables on its balance sheet and (iii) accrued

interest on the balance of the finance lease receivables based on the interest rate inherent in the applicable lease over the term of

the lease. Management also periodically evaluates individual customer’s financial condition, credit history and the current economic

conditions to make adjustments in the allowance for credit losses when necessary. Finance lease receivables is charged off against the

allowance for credit losses after all means of collection have been exhausted and the potential for recovery is considered remote. As

of December 31, 2024 and March 31, 2024, the Company determined no allowance for credit losses was necessary for finance lease

receivables.

As

of December 31, 2024 and March 31, 2024, finance lease receivables consisted of the following:

| | |

December 31, | | |

March 31, | |

| | |

2024 | | |

2024 | |

| | |

(Unaudited) | | |

| |

| Minimum lease payments receivable | |

$ | 310,183 | | |

$ | 354,617 | |

| Less: Unearned interest | |

| (102,425 | ) | |

| (117,927 | ) |

| Financing

lease receivables | |

$ | 207,758 | | |

$ | 236,690 | |

| Finance lease receivables, current | |

$ | 177,807 | | |

$ | 144,166 | |

| Finance lease receivables, non-current | |

$ | 29,951 | | |

$ | 92,524 | |

Future

scheduled minimum lease payments for investments in sales-type leases as of December 31, 2024 are as follows:

| | |

Minimum

future

payments

receivable | |

| Twelve months ending December 31, 2025 | |

$ | 246,115 | |

| Twelve months ending December 31, 2026 | |

| 61,294 | |

| Twelve months ending December 31, 2027 | |

| 2,774 | |

| Total | |

$ | 310,183 | |

(i)

Property and equipment, net

Property

and equipment primarily consist of leasehold improvements, computer equipment, office equipment, fixtures and furniture and automobiles,

which are stated at cost less accumulated depreciation and amortization less any provision required for impairment in value. Depreciation

and amortization is computed using the straight-line method with no residual value based on the estimated useful life. The useful

life of property and equipment is summarized as follows:

| Categories | | Useful life |

| Leasehold improvements | | Shorter of the remaining lease terms or estimated useful lives |

| Computer equipment | | 2 - 5 years |

| Office equipment, fixture and furniture | | 3 - 5 years |

| Automobiles | | 3 - 5 years |

The

Company reviews property and equipment for impairment whenever events or changes in circumstances indicate that the carrying amount of

an asset may not be recoverable. An asset is considered impaired if its carrying amount exceeds the future net undiscounted cash flows

that the asset is expected to generate. If such asset is considered to be impaired, the impairment recognized is the amount by which

the carrying amount of the asset, if any, exceeds its fair value determined using a discounted cash flow model. For the three and nine

months ended December 31, 2024 and 2023, the Company did not recognize impairment for property and equipment.

Costs

of repairs and maintenance are expensed as incurred and asset improvements are capitalized. The cost and related accumulated depreciation

and amortization of assets disposed of or retired are removed from the accounts, and any resulting gain or loss is reflected in the unaudited

condensed consolidated statements of operations and comprehensive loss.

(j)

Loss per share

Basic

loss per share is computed by dividing net loss attributable to stockholders by the weighted average number of outstanding shares of

common stock, adjusted for outstanding shares of common stock that are subject to repurchase.

For

the calculation of diluted loss per share, net loss attributable to stockholders for basic loss per share is adjusted by the effect of

dilutive securities, including share-based awards, under the treasury stock method and convertible securities under the if-converted

method. Potentially dilutive securities, of which the amounts are insignificant, have been excluded from the computation of diluted net

loss per share if their inclusion is anti-dilutive.

As

of December 31, 2024, the Company’s dilutive securities from the outstanding series A convertible preferred stock are convertible

into 495,706 shares of common stock. This amount is not included in the computation of dilutive loss per share because their

impact is anti-dilutive.

(k)

Derivative liabilities

A

contract is designated as an asset or a liability and is carried at fair value on the Company’s balance sheet, with any changes

in fair value recorded in the Company’s results of operations. The Company then determines which options, warrants and embedded

features require liability accounting and records the fair value as a derivative liability. The changes in the values of these instruments

are shown in the unaudited condensed consolidated statements of operations and comprehensive loss as “change in fair value of derivative

liabilities”.

(l)

Revenue recognition

The

Company recognized its revenue under Accounting Standards Codification (ASC) Topic 606, Revenue from Contracts with Customers (ASC 606).

ASC 606 establishes principles for reporting information about the nature, amount, timing and uncertainty of revenue and cash flows arising

from the entity’s contracts to provide goods or services to customers. The core principle requires an entity to recognize revenue

to depict the transfer of goods or services to customers in an amount that reflects the consideration that it expects to be entitled

to receive in exchange for those goods or services recognized as performance obligations are satisfied. It also requires the Company

to identify contractual performance obligations and determine whether revenue should be recognized at a point in time or over time, based

on when control of goods and services transfers to a customer.

To

achieve that core principle, the Company applies the five steps defined under ASC 606: (i) identify the contract(s) with a customer,

(ii) identify the performance obligations in the contract, (iii) determine the transaction price, (iv) allocate the transaction price

to the performance obligations in the contract, and (v) recognize revenue when (or as) the entity satisfies a performance obligation.

The

Company accounts for a contract with a customer when the contract is entered into by the parties, the rights of the parties, including

payment terms, are identified, the contract has commercial substance and consideration to collect is substantially probable.

Disaggregated

information of revenues by business lines are as follows:

| | |

For the Three

Months Ended | | |

For the Nine

Months Ended | |

| | |

December

31, | | |

December

31, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

(Unaudited) | | |

(Unaudited) | | |

(Unaudited) | | |

(Unaudited) | |

| Automobile Transaction and Related Services | |

| | |

| | |

| | |

| |

| - Operating lease revenues from

automobile rentals | |

$ | 747,253 | | |

$ | 992,071 | | |

$ | 2,087,986 | | |

$ | 3,069,458 | |

| - Service fees from NEVs leasing | |

| 68,963 | | |

| 8,412 | | |

| 142,751 | | |

| 33,309 | |

| - Monthly services commissions | |

| 43,755 | | |

| 51,388 | | |

| 100,690 | | |

| 168,199 | |

| - Financing revenues | |

| 23,668 | | |

| 12,195 | | |

| 72,697 | | |

| 37,135 | |

| - Service fees from automobile purchase services | |

| 2,959 | | |

| 19,122 | | |

| 29,862 | | |

| 31,354 | |

| - Other revenues | |

| 33,238 | | |

| 25,019 | | |

| 110,739 | | |

| 140,998 | |

| Total

Revenues | |

$ | 919,836 | | |

$ | 1,108,207 | | |

$ | 2,544,725 | | |

$ | 3,480,453 | |

Automobile

transaction and related services

Operating

lease revenues from automobile rentals –The Company generates revenue from sub-leasing automobiles to some online ride-hailing

drivers or third-parties and leasing its own automobiles. The Company recognizes revenue wherein an automobile is transferred to the

lessees and the lessees has the ability to control the asset, is accounted for under ASC Topic 842. Rental transactions are satisfied

over the rental period and is recognized over time. As the operating lease revenue are variable in nature which is based on online ride-hailing

drivers or third-parties’ performance for a certain period, the Company recognized the revenue from operating lease by using the

output method based on periodic settlement between the Company and the online ride-hailing drivers or third-parties when such revenue

is probable that a significant reversal in the amount of cumulative revenue recognized will not occur. Rental periods are short term

in nature, generally are twelve months or less.

Service

fees from NEVs leasing and automobile purchase services - Services fees from NEVs leasing are paid by some lessees who rent new energy

electric vehicles from the Company, which based on the product solutions.

Automobile

purchase services are paid by automobile purchasers for a series of the services provided to them throughout the purchase process such

as credit assessment, installment of GPS devices, ride-hailing driver qualification and other administrative procedures, which is based

on the sales price of the automobiles and relevant services provided.

Monthly

services commissions – Commissions from the services generated from the management and related services provided to Partner Platforms

and other companies, which are settled on a monthly basis. The Company recognizes revenues at a point in time when performance obligations

are completed and the commission amount is confirmed by the Partner Platforms and other companies, based on their evaluations on the

services provided by the Company.

Financing

revenues – Interest income from the lease arising from the Company’s sales-type leases and bundled lease arrangements are

recognized as financing revenues over the lease term based on the effective rate of interest in the lease.

The

Company recognizes those revenues at a point in time when above mentioned services are completed, and corresponding an automobile is

delivered to the lessee or purchaser. Accounts receivable related to the revenue from NEVs leasing and automobile purchase services is

collected upon the automobiles are delivered to lessees or purchaser.

Other

revenues – The Company generated other revenues such as miscellaneous service fees charged to its customers for

some supporting services provided to online ride-hailing drivers and sales of automobiles. The Company recognizes revenues at a

point in time when performance obligations are completed and the collectability is probable from the customers.

Leases

- Lessor

The

Company recognized revenue as lessor in accordance with ASC 842. The two primary accounting provisions the Company uses to classify transactions

as sales-type or operating leases are: (i) a review of the lease term to determine if it is for the major part of the economic life of

the underlying equipment (defined as greater than 75)%; and (ii) a review of the present value of the lease payments to determine

if they are equal to or greater than substantially all of the fair market value of the equipment at the inception of the lease (defined

as greater than 90%). Automobiles included in arrangements meeting these conditions are accounted for as sales-type leases. Interest

income from the lease is recognized in financing revenues over the lease term. Automobile included in arrangements that do not meet these

conditions are accounted for as operating leases and revenue is recognized over the term of the lease.

The

Company excludes from the measurement of its lease revenues any tax assessed by a governmental authority that is both imposed on and

concurrent with a specific revenue-producing transaction and collected from a customer.

The

Company considers the economic life of most of the automobiles to be three to five years, since this represents the

most common long-term lease term for its automobiles and the automobiles will be used for online ride-hailing services. The Company believes

three to five years is representative of the period during which an automobile is expected to be economically usable,

with normal service, for the purpose for which it is intended.

The

Company’s lease pricing interest rates, which are used in determining customer payments in a bundled lease arrangement, are developed

based upon the local prevailing rates in the marketplace where its customer will be able to obtain an automobile loan under similar terms

from the bank. The Company reassesses its pricing interest rates quarterly based on changes in the local prevailing rates in the marketplace.

As of December 31, 2024, the Company’s pricing interest rate was 6.0% per annum.

(m)

Discontinued operations

A

discontinued operation may include a component of an entity or a group of components of an entity, or a business or nonprofit activity.

A disposal of a component of an entity or a group of components of an entity is required to be reported in discontinued operation if

the disposal represents a strategic shift that has (or will have) a major effect on an entity’s operations and financial results

when any of the following occurs: (1) the component of an entity or group of components of an entity meets the criteria to be classified

as held for sale; (2) the component of an entity or group of components of an entity is disposed of by sale; (3) the component of an

entity or group of components of an entity is disposed of other than by sale (for example, by abandonment or in a distribution to owners

in a spinoff).

(n)

Significant risks and uncertainties