Exhibit 99.7

BUDGET 2023

Fiscal Plan

Securing Alberta’s

Future

2023–26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 18-K/A

For Foreign Governments and Political Subdivisions Thereof

AMENDMENT NO. 3

TO

ANNUAL REPORT

of

PROVINCE OF ALBERTA

CANADA

(Name of Registrant)

Date of end of last fiscal year: March 31, 2022

SECURITIES REGISTERED *

(As of close of fiscal year)

|

| ||||

| Title of Issue | Amounts as to which registration is effective |

Names of exchanges on which registered | ||

| N/A |

N/A | N/A | ||

|

| ||||

|

| ||||

Names and addresses of persons authorized to receive notices

and communications from the Securities and Exchange Commission:

James Rajotte

Alberta’s Senior Representative to the United States

Alberta Washington D.C. Office

Canadian Embassy

501 Pennsylvania Avenue N.W.

Washington, D.C. 20001

Phone: 202-448-6475

Copies to:

| LOWELL EPP Assistant Deputy Minister, Treasury and Risk Management Treasury Board and Finance 8th fl Federal Building, 9820 — 107 Street Edmonton, Alberta T5K 1E7 (780) 422-4052 |

CHRISTOPHER J. CUMMINGS Paul, Weiss, Rifkind, Wharton & Garrison LLP Toronto-Dominion Centre 77 King Street West, Suite 3100 Toronto, ON Canada M5K 1J3 (416) 504-0520 |

| * | The Registrant is filing this annual report on a voluntary basis. |

PROVINCE OF ALBERTA

The undersigned registrant hereby amends the following items, financial statements, exhibits or other portions of its Annual Report (the “Annual Report”) for the fiscal year ended March 31, 2022 on Form 18-K as set forth below:

The following additional exhibit is added to the Annual Report:

| 99.7 | Budget 2023 (Fiscal Plan 2023-26). | |

| 99.8 | 2023-24 Government Estimates. | |

| 99.9 | 2023-24 Offices of the Legislative Assembly Estimates. | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this amendment to be signed on its behalf by the undersigned, thereunto duly authorized, at Edmonton, Alberta, Canada on the 7th day of March, 2023.

| Province of Alberta | ||

| By: | /s/ Lowell Epp | |

| Name: | Lowell Epp | |

| Title: | Assistant Deputy Minister, Treasury and Risk Management, Treasury Board and Finance | |

EXHIBIT INDEX

| Exhibit Number |

Description | |

| 99.7 | Budget 2023 (Fiscal Plan 2023-26). | |

| 99.8 | 2023-24 Government Estimates. | |

| 99.9 | 2023-24 Offices of the Legislative Assembly Estimates. | |

Exhibit 99.7

BUDGET 2023

Fiscal Plan

Securing Alberta’s

Future

2023–26

Alberta Treasury Board and Finance

Communications

9th floor, Edmonton Queen Elizabeth II Building

9820 – 107 Street NW

Edmonton, Alberta, T5K 1E7

Telephone: 780 427-5364

Toll-free within Alberta: 310-0000 then 780-427-5364

TBF.Communications@gov.ab.ca

For electronic copies of Budget 2023: Fiscal Plan visit our website at:

alberta.ca/budget-documents.aspx

ISBN 978-1-4601-5633-9

ISSN 2369-0127

Copyright © 2023 President of Treasury Board and Minister of Finance and its licensors. All rights reserved.

BUDGET 2023

GOVERNMENT OF ALBERTA | 2023–26

2023–26

Fiscal Plan

PRESENTED BY

TRAVIS TOEWS

PRESIDENT OF TREASURY BOARD

AND MINISTER OF FINANCE

in the Legislative Assembly of Alberta

February 28, 2023

Accountability Statement

The government’s Fiscal Plan for the three years commencing April 1, 2023 was prepared under my direction in accordance with the Fiscal Planning and Transparency Act and the government’s accounting policies. All of the government’s policy decisions as of February 13, 2023 with material economic or fiscal implications have been considered in preparing the three year Fiscal Plan.

Original signed by

Travis Toews

President of Treasury Board and Minister of Finance

February 13, 2023

| 2 | Fiscal Plan 2023 – 26 |

Fiscal Plan 2023 – 26

| Overview |

5 | |||

| Economic Outlook |

23 | |||

| Revenue |

55 | |||

| Expense |

75 | |||

| Capital Plan |

99 | |||

| Tax Plan |

119 | |||

| Debt |

137 | |||

| Fiscal Plan Tables |

147 | |||

| Response to the Auditor General |

165 | |||

Note: Amounts presented in tables may not add to totals due to rounding.

| Fiscal Plan 2023 – 26 | 3 |

BLANK PAGE

| 4 |

BUDGET 2023

GOVERNMENT OF ALBERTA | 2023–26

Fiscal Plan

Overview

| 5 |

Table of Contents

| Overview |

7 | |||

| Securing Alberta’s Future |

7 | |||

| Boosting Alberta’s Advantage |

8 | |||

| Strengthening Health Care |

8 | |||

| Supporting Albertans |

9 | |||

| Keeping Albertans and Communities Safe |

9 | |||

| Fiscal Management |

9 | |||

| Energy and Economic Assumptions |

10 | |||

| Revenue |

11 | |||

| Expense |

12 | |||

| Capital Plan |

13 | |||

| Debt and Debt Servicing |

14 | |||

| Fiscal Summary |

15 | |||

| Fiscal Framework |

17 | |||

| Alberta Context |

17 | |||

| Sustainable Fiscal Planning and Reporting |

17 | |||

Note: Amounts presented in tables may not add to totals due to rounding.

| 6 | Overview | Fiscal Plan 2023 – 26 |

Overview

Securing Alberta’s Future

Alberta is the best place to live, work and raise a family. We have come through some challenging years and our economy has momentum. Budget 2023 is securing Alberta’s future by strengthening health care, addressing affordability, growing the economy, supporting job creation, and keeping Albertans and communities safe.

Alberta’s government is committed to responsible fiscal management. Budget 2023 introduces a new fiscal framework to help deal with Alberta’s unique economic and revenue volatility. The framework will secure Alberta’s future by requiring balanced budgets, limiting operating expense growth, and setting out rules to pay down maturing debt, save for the future, and invest in areas and services important to Albertans.

Amendments will also be introduced for the Alberta Heritage Savings Trust Fund to retain 100 per cent of its net income instead of the current requirement to retain only an amount for inflation proofing. This will result in significant increases to the annual growth in Heritage Fund assets. Fiscal responsibility matters and these impacts will be felt by current and future Albertans.

Budget 2023 – Key Fiscal Metrics

(billions of dollars)

| 2021-22 | 2022-23 | 2023-24 | 2024-25 | 2025-26 | ||||||||||||||||||

| Actual | Budget | Forecast | Estimate | Target | Target | |||||||||||||||||

| Revenue |

68.3 | 62.6 | 76.0 | 70.7 | 71.7 | 72.6 | ||||||||||||||||

| Expense |

||||||||||||||||||||||

| Operating expense |

52.3 | 51.5 | 55.4 | 57.0 | 58.0 | 59.2 | ||||||||||||||||

| Other expense |

9.0 | 8.9 | 8.9 | 9.7 | 10.1 | 10.5 | ||||||||||||||||

| Total Expense (before provisions and allowances) |

61.3 | 60.3 | 64.3 | 66.8 | 68.2 | 69.7 | ||||||||||||||||

| Contingency / disaster assistance / COVID-19 |

3.1 | 1.8 | 1.3 | 1.5 | 1.5 | 1.5 | ||||||||||||||||

| Surplus / (Deficit) |

3.9 | 0.5 | 10.4 | 2.4 | 2.0 | 1.4 | ||||||||||||||||

| Other Key Metrics: |

||||||||||||||||||||||

| Capital / Other Non-financial assets |

58.6 | 60.5 | 59.5 | 61.2 | 62.4 | 62.2 | ||||||||||||||||

| Heritage Fund Year-end Balances |

17.1 | 17.5 | 18.9 | 20.0 | 21.3 | 22.8 | ||||||||||||||||

| Taxpayer Supported Debt |

93.1 | 94.7 | 79.7 | 78.3 | 78.3 | 79.7 | ||||||||||||||||

| Net Financial Debt |

57.0 | 65.1 | 47.4 | 46.5 | 45.6 | 44.1 | ||||||||||||||||

| Net Debt to GDP |

15.2% | 16.7% | 10.2% | 10.2% | 9.7% | 9.1% | ||||||||||||||||

Note: See table on page 15 for amounts in millions.

| Overview | Fiscal Plan 2023 – 26 | 7 |

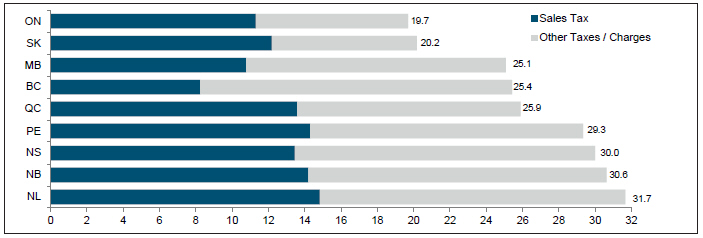

| Boosting Alberta’s Advantage | ||

| Alberta has the best economic fundamentals in the country. We have a young, highly skilled workforce, the highest weekly earnings among provinces, some of the lowest home prices and rents of large Canadian urban centres, and the lowest overall taxes in Canada. With one of the lowest corporate tax rates in North America, more businesses across many sectors are choosing Alberta, creating family supporting jobs, further diversifying the economy, and maintaining our high quality of life. | ||

|

Budget 2023 creates opportunities for Albertans by supporting economic growth and job creation. |

Alberta’s long-term prosperity is dependent on improving competitiveness, attracting business investment, and creating jobs. Alberta’s government continues to support key and emerging sectors, reduce unnecessary government oversight to save time and money for Albertans and Alberta businesses, and eliminate barriers for job creators. Budget 2023 builds on the success of the Alberta at Work initiatives introduced in Budget 2022 to assist Albertans – no matter where they are on their career path – in participating in the labour market with jobs that support their aspirations and improve their lives. | |

| Budget 2023 also includes targeted investments to address critical shortages in key areas such as health care, non-trade construction, energy, technology, business, and the aviation sector. | ||

| Strengthening Health Care | ||

|

Budget 2023 invests in strengthening Alberta’s health care system to provide the right supports when and where Albertans need them. |

Alberta’s government is building a stronger health-care system that has the right supports in place for Albertans to get the care they need, when and where they need it.

Budget 2023 supports the Healthcare Action Plan with investments to strengthen the Emergency Medical Services (EMS) system and reduce surgical and emergency department wait times. At the same time, government is empowering frontline workers to provide improved services to Albertans. A targeted, measured approach will be followed to evaluate the outcomes of the Healthcare Action Plan.

Alberta has the best front line health care workers in the world. Budget 2023 includes funding to address health care staffing challenges through initiatives to train, recruit, and retain more health care professionals, including specific challenges in remote and rural communities. Budget 2023 will fund additional seats for physician training at Alberta’s medical schools, and the government will attract internationally educated nurses by addressing barriers they face including navigating complex regulatory requirements, assessment and licensing processes, and access to clinical placements. | |

| 8 | Overview | Fiscal Plan 2023 – 26 |

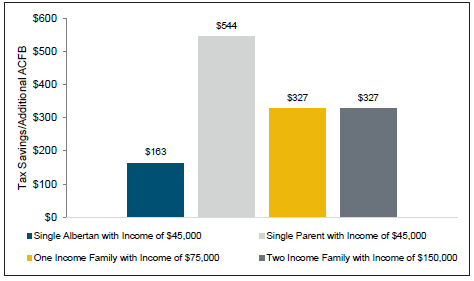

Supporting Albertans

The government is taking immediate action to make life more affordable for Albertans. Alberta’s government is delivering targeted relief for families, seniors and the most vulnerable through the Affordability Action Plan. Assistance is being provided to seniors, families, low income, and vulnerable Albertans through direct affordability payments and the indexation of core benefits programs to inflation.

Alberta’s government is indexing personal income taxes to inflation and fully pausing the collection of the 13-cent provincial fuel tax until June 30, 2023. We are also helping all Albertans with the rising costs of everyday necessities through electricity and heating rebates, and pausing passenger vehicle insurance rate increases.

Budget 2023 makes post-secondary education more affordable by capping tuition at two per cent annually effective 2024-25, reducing interest rates on student loans, and providing more support for former students repaying their loans.

Keeping Albertans and Communities Safe

All Albertans have the right to safety and security in their homes, at school, or at work, whether they live in large cities or on farms, in smaller, rural, or Indigenous communities. The government is taking a fair, firm, and compassionate approach to keeping communities safe while also treating mental health and addiction as health care issues. We are securing Alberta’s future by building safe, resilient communities supported by strong police services, crisis response teams, mental health, addictions and social services, and emergency responders.

Budget 2023 includes increases for the Ministry of Public Safety and Emergency Services for community policing, correctional services, custody operations, victims’ services, and Alberta Sheriffs. The budget also adds more funding to increase capacity and ensure timely access to the justice system for Albertans.

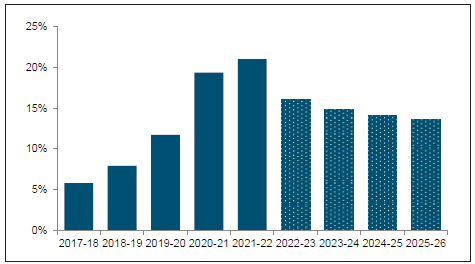

Fiscal Management

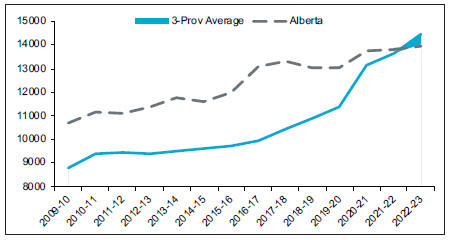

Alberta’s government remains committed to fiscal responsibility. In 2019 the MacKinnon Panel identified that Alberta spent more than Canada’s three largest provinces on a per capita basis but did not achieve better outcomes. The government has worked to bring spending in-line with the average of British Columbia, Ontario and Quebec, and Budget 2023 shows that Alberta’s will be at or below the range of the three comparator province average on a per capita basis.

| Overview | Fiscal Plan 2023 – 26 | 9 |

Per Capita Total Expense excluding Debt Servicing Costs: Alberta Versus Big-3 Provincial Average (ON, QB, BC)

| ‘Source: | Statistics Canada Government Finance Statistics to 2021-22 (preliminary). Alberta Budget 2023 used to derive growth rates for the projection years. For other provinces, range reflects a variety of possible spending growth trajectories. Program expense calculated as total expense less debt servicing cost. Not adjusted for COVID-19 related expense. In Alberta, expense excludes Crude-by-rail. |

Energy and Economic Assumptions

Alberta’s economy is continuing to expand following two years of robust post-pandemic recovery, albeit at a more moderate pace. Real GDP growth is forecast to rise 2.8 per cent and lead the country in 2023. With last year’s strong pace of 4.8 per cent, real GDP fully recovered from the COVID-19 downturn and surpassed the 2014 peak, while incomes in the province hit a record high. This puts the province in a good position to face the challenges coming from last year’s rapid rise in prices, interest rates, and slower global growth.

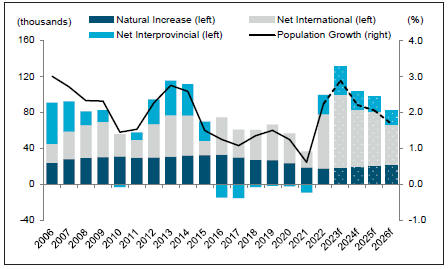

The oil and gas sector will take the lead in 2023, underpinned by solid energy prices and strong cash flows from last year. With more people choosing to call Alberta home, population growth is projected to rise to its fastest pace since 2006, which should support residential construction activity. However, rising borrowing costs and elevated prices will continue to weigh on consumer spending and non-energy business investment. Inflation will continue to abate this year but will be slow to return to pre-pandemic levels.

Growth is forecast to accelerate over the medium term and become more broad-based as business investment and consumer spending pick up. Alberta’s competitive taxes, regulatory environment and access to abundant and low-cost natural resources will continue to encourage investment in the province. Consumer spending and residential construction activity are also expected to gain traction as inflation subsides further and interest rates come down. Solid fundamentals – such as strong population growth, a relatively young population and lower cost of living – will support Alberta’s continued expansion.

| 10 | Overview | Fiscal Plan 2023 – 26 |

| Energy and Economic Assumptionsa | ||||||||||||||||||||||||||||

|

2020-21

Actuals |

2021-22

Actuals |

2022-23

Estimate |

2023-24

Forecast |

2024-25

Forecast |

2025-26

Forecast |

|||||||||||||||||||||||

| WTI Oil (US$/bbl)b |

42.32 | 77.03 | 90.50 | 79.00 | 76.00 | 73.50 | ||||||||||||||||||||||

| Light-Heavy Differential (US$/bbl)b |

10.58 | 13.56 | 20.00 | 19.50 | 16.80 | 16.40 | ||||||||||||||||||||||

| WCS@Hardisty (Cdn$/bbl)b |

41.42 | 79.63 | 92.60 | 78.00 | 75.90 | 72.10 | ||||||||||||||||||||||

| Natural Gas (Cdn$/GJ)b |

2.10 | 3.48 | 5.10 | 4.10 | 3.60 | 3.80 | ||||||||||||||||||||||

| Conventional Crude Oil Production (000s barrels/day) |

401 | 444 | 497 | 497 | 497 | 490 | ||||||||||||||||||||||

| Raw Bitumen Production (000s barrels/day) |

2,969 | 3,197 | 3,281 | 3,345 | 3,436 | 3,529 | ||||||||||||||||||||||

| Exchange Rate (US¢/Cdn$)b |

75.7 | 79.8 | 75.7 | 76.2 | 78.2 | 79.5 | ||||||||||||||||||||||

| Interest Rate (10-year Canada bonds, %) |

0.74 | 1.56 | 3.10 | 3.60 | 3.40 | 3.40 | ||||||||||||||||||||||

| 2020

Actuals |

2021

Actuals |

2022

Estimate |

2023

Forecast |

2024

Forecast |

2025

Forecast |

2026

Forecast |

||||||||||||||||||||||

| Real GDP (% change) |

(8.0 | ) | 4.8 | 4.8 | 2.8 | 3.0 | 2.9 | 2.8 | ||||||||||||||||||||

| Employment (% change)c |

(7.1 | ) | 5.4 | 5.2 | 2.3 | 2.7 | 2.5 | 2.3 | ||||||||||||||||||||

| Unemployment Rate (%)c |

11.3 | 8.6 | 5.8 | 6.4 | 6.3 | 6.1 | 5.7 | |||||||||||||||||||||

| Primary Household Income (% change) |

(4.8 | ) | 5.8 | 8.8 | 5.9 | 6.7 | 6.4 | 6.1 | ||||||||||||||||||||

| Net Corporate Operating Surplus (% change) |

(60.3 | ) | 284.9 | 54.9 | (13.9 | ) | 7.9 | 6.9 | 4.4 | |||||||||||||||||||

| Alberta Consumer Price Index (% change)c |

1.1 | 3.2 | 6.4 | 3.3 | 2.2 | 2.2 | 2.2 | |||||||||||||||||||||

| Population (% change)c |

1.2 | 0.6 | 2.2 | 2.9 | 2.2 | 2.1 | 1.7 | |||||||||||||||||||||

a Forecast was finalized on January 30, 2023

b Forecasts have been rounded

c Actual

| Revenue | ||

| Total revenue is estimated at $70.7 billion in 2023-24, $5.4 billion lower than the record $76 billion forecast for 2022-23. | ||

| Alberta government revenue has increased substantially over the last two years, after the global impacts of COVID-19 on economic activity and energy prices caused a sharp drop in 2020-21. As pandemic restrictions began easing in 2021, energy prices began rising. Revenue reached a record $68 billion in 2021-22. Oil and natural gas prices were unexpectedly high in 2022-23 mainly due to Russia’s invasion of Ukraine in February of 2022. Alberta government revenue reached a new record of $76 billion as a result. At the same time, the global economy has been hit with severe inflation, interest rate hikes, and the risk of recession. This has dampened energy prices and weighted down financial markets. | ||

| The Budget 2023 revenue forecast is based on many of these issues gradually easing during 2023 and 2024. Energy prices trend down and financial markets recover. Resource revenue is forecast to decline $9.2 billion in 2023-24, while investment income is expected to increase by $2.1 billion. Alberta’s government provided significant assistance to help Albertans with inflation pressures, sharing the boost in energy revenue. Fuel tax relief in 2022-23 and for part of 2023-24 and full indexation of the personal income tax system in 2022 restrain revenue growth in 2023-24. Federal transfers increase mainly due to re-profiling a one-time $707 million Fiscal Stabilization payment from 2022-23 into 2023-24. Revenue is forecast to grow by $2 billion by 2025-26, reaching $72.6 billion. Energy prices and resource revenue trend down |

Corporate income tax revenue is down $0.5 billion from its 2022-23 record level, but remains higher than ever before. | |

| Overview | Fiscal Plan 2023 – 26 | 11 |

| while income and other tax revenue climbs, and investment income recovers. Recent negotiations on federal contributions to health care funding have so far resulted in a small one time payment in 2023-24 and an adjustment to the Canada Health Care formula that impacts revenue in 2025-26, both of which are included in Budget 2023. Further federally-directed transfers were still being discussed during the finalization of this budget therefore only agreed to funding has been incorporated.

The forecast is based on a moderate decline in energy prices, with improving global economic growth, but a great deal of uncertainty remains. The West Texas Intermediate oil price is expected to average US$79 per barrel (/bbl) in 2023-24, and US$73.50/bbl by 2025-26, while the Alberta Reference natural gas price is forecast to average Cdn$4.10 per gigajoule in 2023-24 and Cdn$3.80 by 2025-26. |

Budget 2023 Revenue

(millions of dollars)

| 2021-22 | 2022-23 | 2023-24 | 2024-25 | 2025-26 | ||||||||||||||||||||

| Actual | Budget | Forecast | Estimate | Target | Target | |||||||||||||||||||

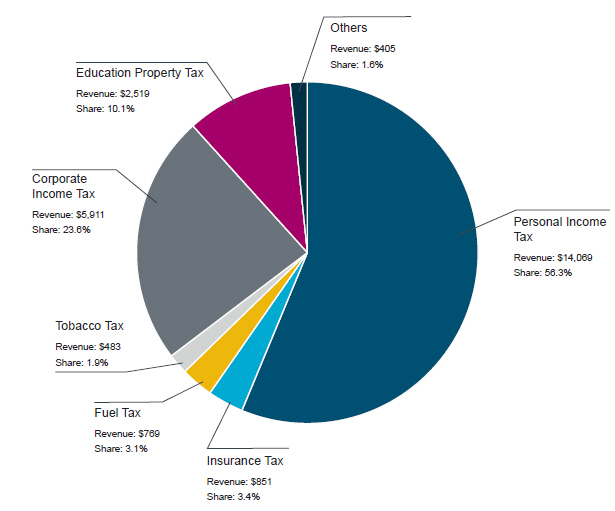

| Personal Income Tax |

13,335 | 13,382 | 13,806 | 14,069 | 15,034 | 16,071 | ||||||||||||||||||

| Corporate Income Tax |

4,718 | 4,040 | 6,413 | 5,911 | 6,254 | 6,590 | ||||||||||||||||||

| Other Taxes |

5,453 | 5,612 | 4,361 | 5,012 | 5,767 | 5,948 | ||||||||||||||||||

| Resource revenue – Bitumen royalties |

11,605 | 10,349 | 18,750 | 12,555 | 12,028 | 10,736 | ||||||||||||||||||

| Resource revenue – Other |

4,565 | 3,491 | 8,794 | 5,806 | 5,256 | 5,006 | ||||||||||||||||||

| Transfers from Government of Canada |

11,595 | 12,054 | 11,765 | 12,552 | 12,475 | 13,113 | ||||||||||||||||||

| Investment Income |

3,579 | 3,173 | 1,035 | 3,154 | 3,273 | 3,407 | ||||||||||||||||||

| Net Income from Government Business Enterprises |

4,810 | 2,435 | 2,449 | 2,727 | 2,422 | 2,647 | ||||||||||||||||||

| Premiums, Fees and Licences |

4,520 | 4,490 | 4,796 | 5,040 | 5,289 | 5,360 | ||||||||||||||||||

| Other |

4,142 | 3,581 | 3,856 | 3,827 | 3,926 | 3,730 | ||||||||||||||||||

| Total Revenue |

68,322 | 62,607 | 76,025 | 70,653 | 71,724 | 72,608 | ||||||||||||||||||

| Expense

In 2023-24, operating expense will be three per cent, or $1.7 billion, higher than the 2022-23 forecast and will grow by approximately two per cent per year over the following two years. These targeted increases fund important investments to strengthen health care, grow the economy and support job creation, address affordability and keep Albertans and communities safe.

In 2022-23, the total expense forecast increased by $3.5 billion from Budget 2022 mainly due to measures to help Albertans deal with the rising cost of living, funding for the Alberta Medical Association (AMA) Agreement and collective bargaining agreements with teachers and other public sector unions, justice system and public safety enhancements, disaster expense related to wildfire fighting and agriculture indemnities and income support, and health care costs. |

| 12 | Overview | Fiscal Plan 2023 – 26 |

| With the introduction of the new fiscal framework in Budget 2023, the contingency will increase to $1.5 billion per year. The contingency amount is intended to address unanticipated spending, including disasters and emergencies, and emerging priorities that may arise during the year and that are not practical to delay until the next budget. |

Budget 2023 Expense

(millions of dollars)

| 2021-22 | 2022-23 | 2023-24 | 2024-25 | 2025-26 | ||||||||||||||||||||

| Actual | Budget | Forecast | Estimate | Target | Target | |||||||||||||||||||

| Operating expense |

52,343 | 51,487 | 55,384 | 57,038 | 58,049 | 59,200 | ||||||||||||||||||

| Capital grants |

2,503 | 2,429 | 1,845 | 2,821 | 3,209 | 3,274 | ||||||||||||||||||

| Amortization / disposal loss / inventory consumption |

4,186 | 4,057 | 4,480 | 4,397 | 4,460 | 4,509 | ||||||||||||||||||

| Debt servicing costs |

2,641 | 2,662 | 2,715 | 2,848 | 2,805 | 3,103 | ||||||||||||||||||

| Pension provisions |

(365 | ) | (289 | ) | (111 | ) | (322 | ) | (336 | ) | (347 | ) | ||||||||||||

| Contingency / disaster assistance / COVID-19 |

3,076 | 1,750 | 1,322 | 1,500 | 1,500 | 1,500 | ||||||||||||||||||

| Total Expense |

64,378 | 62,096 | 65,635 | 68,282 | 69,687 | 71,239 | ||||||||||||||||||

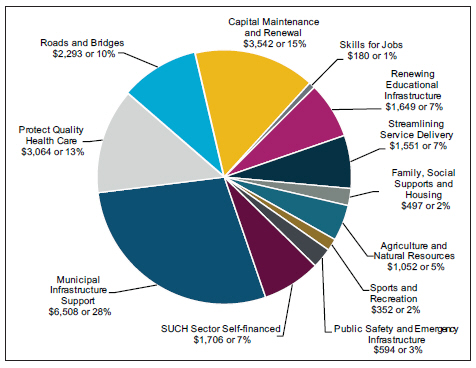

| Capital Plan

The Budget 2023 Capital Plan invests almost $23 billion to build and maintain public infrastructure that Albertans, communities, and businesses need and that contribute to the high standard of living that Albertans enjoy. This includes investments in infrastructure projects that help strengthen our health care system, attract private sector investment, enhance Albertans’ safety and security, and provide essential services.

The Budget 2023 Capital Plan includes:

• $6.5 billion for municipal infrastructure;

• $3.5 billion for capital maintenance and renewal;

• $3.1 billion for health facilities;

• $2.3 billion for roads and bridges;

• $1.6 billion for schools;

• $1.1 billion for agriculture and natural resources;

• $3.2 billion for other Capital Plan envelopes; and

• $1.7 billion in SUCH sector self-financed capital spending.

Alberta has vibrant communities that are a key factor in Alberta’s Advantage and reflect our high standard of living. Budget 2023 includes important infrastructure priorities in communities all across the province. Budget 2023 amends the Local Government Fiscal Framework so that municipalities share fully in both increases and decreases in provincial revenues. The government will continue to work with municipalities to finalize the allocation formula and consider ways to facilitate a smooth transition to the new framework. |

| Overview | Fiscal Plan 2023 – 26 | 13 |

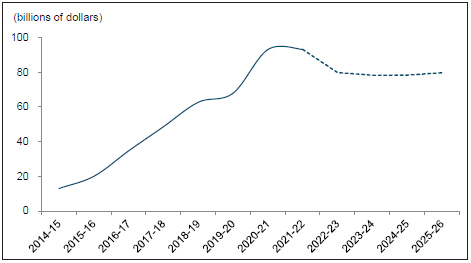

Taxpayer-support debt is

estimated to be lower than what

was estimated in Budget 2022 by

$15 billion in 2022-23 and

$17.3 billion in 2023-24.

The Budget 2023 Capital Plan also increases the Community Facility Enhancement Program to $50 million per year. This important program works in partnership with eligible non-profit organizations to provide funding for sports, recreational, cultural, or other related public-use community facility enhancement needs.

The Capital Plan provides funding for the design and construction of new and modernized schools, as well as planning funds for 14 potential schools across the province. The government continues to invest in charter and collegiate schools to support choice and create clear pathways to post-secondary education and careers.

Budget 2023 invests $2.3 billion to enhance and expand Alberta’s road and bridge network. Key highlights include: $117 million for the twinning of Highway 63 north of Fort McMurray, $51 million to replace the interchange at the Queen Elizabeth II Highway and Highway 566 at Balzac, $75 million for 23 engineering projects all across the province, $60 million for the Vinca Bridge Replacement, and $22 million to address safety concerns at the intersection of Highway 16A and Range Road 20.

Recovery communities offer long term residential addiction treatment and are an important part of the government’s recovery-oriented system of care. Budget 2023 includes $155 million over three years for these important projects. Recovery communities in Red Deer and Lethbridge are expected to open in early 2023. Additional facilities are planned in Gunn, on the Blood Tribe First Nation, in Edmonton and Calgary. Budget 2023 includes funding for three new recovery communities; two in Northern Alberta and one in Central Alberta.

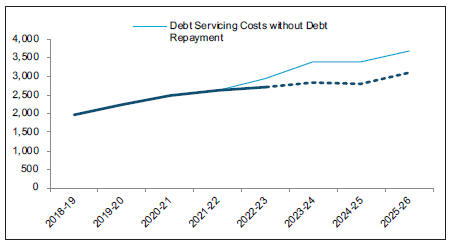

Debt and Debt Servicing

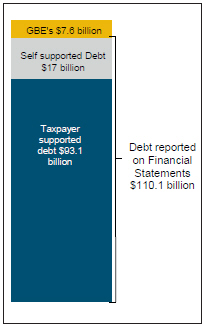

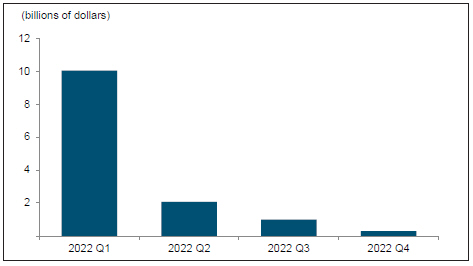

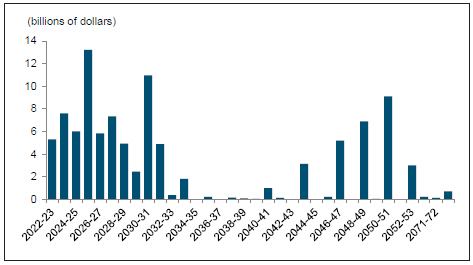

Taxpayer-supported debt outstanding is estimated to total $79.7 billion at the end of 2022-23 and $78.3 billion at the end of 2023-24.

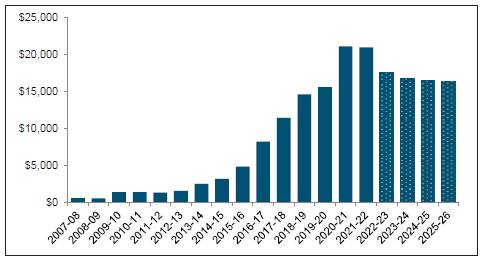

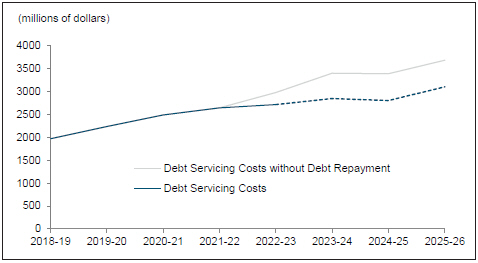

Debt servicing costs are expected to be $2.8 billion in 2023-24. Until the debt is eliminated, resources will continue to be used to pay interest costs rather than being directed to delivering government programs and services that Albertans rely on.

The new fiscal framework sets out rules for using surplus cash to pay down debt as it matures. In 2022-23, $13.4 billion of maturing debt was repaid using surplus cash and $1.4 billion is expected to be repaid in 2023-24.

| 14 | Overview | Fiscal Plan 2023 – 26 |

Debt Servicing Costs

(millions of dollars)

Fiscal Summary

| Budget 2023 Fiscal Summary | ||||||||||||||||||||||||

| (millions of dollars) | ||||||||||||||||||||||||

| 2021-22 | 2022-23 | 2023-24 | 2024-25 | 2025-26 | ||||||||||||||||||||

| Actual | Budget | Forecast | Estimate | Target | Target | |||||||||||||||||||

| Revenue |

||||||||||||||||||||||||

| Income and Other Taxes |

23,506 | 23,034 | 24,580 | 24,992 | 27,055 | 28,609 | ||||||||||||||||||

| Resource revenue – Bitumen royalties |

11,605 | 10,349 | 18,750 | 12,555 | 12,028 | 10,736 | ||||||||||||||||||

| Resource revenue – other |

4,565 | 3,491 | 8,794 | 5,806 | 5,256 | 5,006 | ||||||||||||||||||

| Transfers from Government of Canada |

11,595 | 12,054 | 11,765 | 12,552 | 12,475 | 13,113 | ||||||||||||||||||

| Investment Income |

3,579 | 3,173 | 1,035 | 3,154 | 3,273 | 3,407 | ||||||||||||||||||

| Net Income from Government Business Enterprises |

4,810 | 2,435 | 2,449 | 2,727 | 2,422 | 2,647 | ||||||||||||||||||

| Premiums, Fees and Licences |

4,520 | 4,490 | 4,796 | 5,040 | 5,289 | 5,360 | ||||||||||||||||||

| Other |

4,142 | 3,581 | 3,856 | 3,827 | 3,926 | 3,730 | ||||||||||||||||||

| Total Revenue |

68,322 | 62,607 | 76,025 | 70,653 | 71,724 | 72,608 | ||||||||||||||||||

| Expense |

||||||||||||||||||||||||

| Operating expense |

52,343 | 51,487 | 55,384 | 57,038 | 58,049 | 59,200 | ||||||||||||||||||

| % change from prior year |

3.2% | (1.6)% | 5.8 % | 3.0 % | 1.8 % | 2.0 % | ||||||||||||||||||

| Capital grants |

2,503 | 2,429 | 1,845 | 2,821 | 3,209 | 3,274 | ||||||||||||||||||

| Amortization / disposal loss / inventory consumption |

4,186 | 4,057 | 4,480 | 4,397 | 4,460 | 4,509 | ||||||||||||||||||

| Debt servicing costs |

2,641 | 2,662 | 2,715 | 2,848 | 2,805 | 3,103 | ||||||||||||||||||

| Pension provisions |

(365 | ) | (289 | ) | (111 | ) | (322 | ) | (336 | ) | (347 | ) | ||||||||||||

| Contingency / disaster assistance / COVID-19 |

3,076 | 1,750 | 1,322 | 1,500 | 1,500 | 1,500 | ||||||||||||||||||

| Total Expense |

64,378 | 62,096 | 65,635 | 68,282 | 69,687 | 71,239 | ||||||||||||||||||

| Surplus / (deficit) |

3,944 | 511 | 10,390 | 2,371 | 2,037 | 1,369 | ||||||||||||||||||

| Overview | Fiscal Plan 2023 – 26 | 15 |

Overview

Fiscal Framework

| 16 | Overview | Fiscal Plan 2023 – 26 |

Fiscal Framework

Alberta Context

The historical volatility of Alberta’s economy and government revenues have long created unique fiscal planning challenges for the province. The tendency to move operational spending well in excess of sustainable levels during years of high commodity prices and robust government revenues is well documented. Now that we have returned to balanced budgets, it is timely and prudent to implement a fiscal framework. We are securing Alberta’s future by implementing fiscal rules to guide decision making and ensure spending growth is sustainable in the long run.

Alberta, along with the rest of the world, has emerged from some difficult years. Resource revenue has hit record levels, accentuated by the Russian invasion of Ukraine, global oil and gas shortages, the unwinding of COVID-19 health restrictions, and uncertainty related to climate concerns. It is timely and prudent to introduce a new fiscal framework. Fiscal rules help secure Alberta’s future by preventing short-term, temporary spikes in resource revenue from leading to permanent increases to spending.

Fiscal responsibility matters and the impacts of fiscal decisions are felt by all Albertans, now and into the future. Taxpayer-supported debt is expected to be $78.3 billion on March 31, 2024 and debt servicing costs are expected to be $2.8 billion in 2023-24 diverting resources away from important programs.

Sustainable Fiscal Planning and Reporting

Alberta’s current Fiscal Planning and Transparency Act includes rules for the budget and fiscal plan, strategic plan, business plans, quarterly fiscal updates, annual report, and Alberta Infrastructure Report.

In Budget 2023, Alberta’s government is introducing a new fiscal framework with four key components:

| • | Require annual balanced budgets, with certain exceptions; |

| • | Limit year-over-year increases in operating expense to population growth and inflation; |

| • | Limit in-year expense growth to a budgeted and voted contingency; and |

| • | Set out policies for the allocation of surplus cash to repayment of maturing debt, saving for the future, or one-time initiatives that do not lead to permanent increases in government spending. |

Amendments will also be introduced for the Alberta Heritage Savings Trust Fund to retain 100 per cent of its net income instead of the current requirement to retain only an amount for inflation proofing. This will result in significant increases to the annual growth in Heritage Fund assets. In 2022-23, $1.8 billion will have been added to the Heritage Fund.

| Overview | Fiscal Plan 2023 – 26 | 17 |

Balanced Budgets

The new fiscal framework will require annual balanced budgets with certain exceptions.

In the consolidated fiscal plan, the budget will only be permitted to be in deficit if:

| • | Revenue declines by $1 billion or more from the prior-year third quarter (Q3) revenue forecast; or |

| • | Revenue is expected to decline to an amount that is below the prior-year Q3 total expense forecast. |

At year-end, a deficit is only allowed in the consolidated financial statements if:

| • | A deficit is forecast in the budget as permitted by the exceptions; |

| • | Actual revenue has declined by $500 million or more from the current year budget amount; or |

| • | The budgeted, voted contingency is exceeded due to unanticipated costs beyond the government’s control due to disasters or emergencies declared by Cabinet; expense increases required under the Alberta Petrochemicals Incentive Program (APIP); non-cash, non-recurring expense increases required under accounting standards; and/or expense increases by $500 million or more for payments related to litigation or settlements not anticipated in the budget. |

When a year-end deficit is permitted under the exceptions, the government will have two full years to return to balance. The framework will prohibit deficits for year-end actual results in the audited consolidated financial statements for more than three consecutive years.

For the purposes of the framework, adjusted total revenue and expense excludes changes when government receives dedicated revenue that automatically requires a related increase to expense (dedicated revenue-expense). For example, this would include revenue from the federal government that is required to be spent on a specific initiative or program. It also excludes non-cash, non-recurring expense variations required by accounting standards. These are one-time adjustments required by accounting standards that impact the government’s surplus or deficit but do not require cash. For example, the expense impact of the write-down of the value of an asset would be excluded from the balanced budget requirement.

Year-over-Year Expense Growth

The second component of the framework is to limit year-over-year adjusted operating expense increases to population plus inflation. Adjusted operating expense excludes dedicated revenue-expense items and non-recurring, non-cash expense variations required by accounting standards.

In Budget 2023, operating expense in 2023-24 is limited to the 2022-23 Q3 operating expense forecast adjusted for the previous year’s population growth plus the change in the Alberta Consumer Price Index (CPI) as reported at Q3. For 2024-25 and subsequent fiscal years, the projected operating expense

| 18 | Overview | Fiscal Plan 2023 – 26 |

ceiling in the consolidated fiscal plan must not exceed the prior year’s operating expense ceiling adjusted for population growth plus inflation as set out in the Q3 fiscal outlook for the previous calendar year.

Since November 2020, Alberta’s government has used the fiscal anchor of maintaining per capita expense at or below the range of the average of British Columbia, Ontario and Quebec. This fiscal anchor has served government well and will remain as a guiding policy for government decision-making.

In-Year Expense Growth

The third component of the framework is to limit in-year adjusted operating expense increases to the budgeted and voted contingency except when increases are due to:

| • | Dedicated revenue-expense increases; |

| • | Non-recurring, non-cash expense variations required by accounting standards; |

| • | Emergencies or disasters declared by Cabinet; |

| • | Expenses under the Alberta Petrochemicals Incentive Program (APIP); and |

| • | Payments related to litigation or settlements of $500 million or more not projected in the budget. |

In Budget 2023, the budgeted and voted contingency is increased to $1.5 billion per year to allow the government the flexibility to address issues as they arise during the year while upholding the new fiscal framework.

The dedicated revenue-expense table below outlines the main dedicated revenue-expense programs and initiatives for the purposes of calculating the operating expense ceiling and for total expense under the new framework, by excluding revenue received by government entities directly or revenue received for specific programs / initiatives.

The operating expense ceiling limits year-over-year increases to operating expense, adjusted to exclude dedicated revenue-expense, to the prior-calendar-year population growth plus rate of inflation. The 2022-23 forecast for Q3 operating expense is the initial base, after deducting $1.3 billion in non-continuing affordability operating expense measures and $8 billion in dedicated revenue. Population growth plus inflation in 2022 is estimated at 8.7 per cent, resulting in a $50.1 billion 2023-24 operating expense base. The annual ceiling is calculated by adding the current-year (2023-24) forecast for dedicated revenue-operating expense to the base.

| Overview | Fiscal Plan 2023 – 26 | 19 |

Budget 2023 Dedicated Revenue and Related Expense

(millions of dollars)

| 2022-23 Q3 | 2023-24 Estimate | 2024-25 Target | 2025-26 Target | |||||||||||||||||||||||||||||

| Operating | Other | Operating | Other | Operating | Other | Operating | Other | |||||||||||||||||||||||||

| expense | expense | expense | expense | expense | expense | expense | expense | |||||||||||||||||||||||||

| Transfers from Government of Canada |

||||||||||||||||||||||||||||||||

| Infrastructure support (capital grant expense) |

- | 709 | - | 858 | - | 1,085 | - | 1,000 | ||||||||||||||||||||||||

| Labour market agreements |

324 | - | 325 | - | 325 | - | 325 | - | ||||||||||||||||||||||||

| Early learning child care agreements |

734 | - | 937 | - | 1,062 | - | 1,226 | - | ||||||||||||||||||||||||

| SUCH sector / Alberta Innovates Corporation |

624 | - | 617 | - | 623 | - | 635 | - | ||||||||||||||||||||||||

| Other |

259 | - | 239 | - | 233 | - | 233 | - | ||||||||||||||||||||||||

| Investment Income |

||||||||||||||||||||||||||||||||

| Loans to local authorities (debt servicing costs) |

- | 424 | - | 659 | - | 555 | - | 493 | ||||||||||||||||||||||||

| SUCH sector |

307 | - | 326 | - | 342 | - | 352 | - | ||||||||||||||||||||||||

| Premiums, Fees and Licences |

||||||||||||||||||||||||||||||||

| SUCH sector |

2,372 | - | 2,525 | - | 2,658 | - | 2,734 | - | ||||||||||||||||||||||||

| Energy industry levies (AER, AUC) |

313 | - | 384 | - | 392 | - | 399 | - | ||||||||||||||||||||||||

| Other |

113 | - | 113 | - | 113 | - | 113 | - | ||||||||||||||||||||||||

| Other |

||||||||||||||||||||||||||||||||

| SUCH sector |

1,553 | - | 1,577 | - | 1,590 | - | 1,617 | - | ||||||||||||||||||||||||

| AIMCO investment management charges |

765 | - | 877 | - | 904 | - | 931 | - | ||||||||||||||||||||||||

| Tech. Innov. & Emiss. Reduction Fund |

571 | 61 | 460 | 58 | 505 | 58 | 174 | 129 | ||||||||||||||||||||||||

| Alberta Innovates Corporation / other |

63 | - | 62 | - | 62 | - | 62 | - | ||||||||||||||||||||||||

| Total dedicated revenue - related expense |

7,998 | 1,194 | 8,442 | 1,575 | 8,809 | 1,698 | 8,801 | 1,622 | ||||||||||||||||||||||||

| Note: | For the in-year rules, dedicated revenue must automatically cause changes in the related expense, either up or down, mirroring the change in revenue, so that there is no impact on the surplus /.deficit. In instances where the revenue and related expense are not exactly matching, the lesser of the revenue or expense is used. |

Operating Expense Ceiling - 2023-24 and Future Years

| 2022-23 | 2023-24 | 2024-25 | 2025-26 | |||||||||||||||||||||||||

| 2022-23 third quarter operating expense (less $1,329 million affordability measures expense) |

54,055 | |||||||||||||||||||||||||||

| Less dedicated revenue - related expense |

(7,998 | ) | ||||||||||||||||||||||||||

| 46,057 | ||||||||||||||||||||||||||||

| 2023-24 and future years operating expense ceiling |

46,057 | |||||||||||||||||||||||||||

| 2022-23 base |

||||||||||||||||||||||||||||

| Adjusted for prior-year population plus inflation |

8.7 | % (2022) | 50,064 | 6.2 | % | 53,168 | 4.4 | % | 55,507 | |||||||||||||||||||

| Plus dedicated revenue - related expense |

8,442 | 8,809 | 8,801 | |||||||||||||||||||||||||

| 2023-24 and future years operating expense ceiling | 58,506 | 61,977 | 64,308 | |||||||||||||||||||||||||

| Allocation of Surplus Cash

The final component of the framework sets out policies for the allocation of surplus cash available from fiscal results. At least 50 per cent of the available surplus cash must go to the repayment of debt maturing in that fiscal year with the remaining cash allocated to the new Alberta Fund. The Alberta Fund allows the government to set aside surplus cash while it decides the best use of this cash. There are three allowable uses of cash from the Alberta Fund:

• Debt repayment;

• Additional deposits into the Heritage Fund; or

• One-time initiatives that do not lead to permanent increases in government spending. |

| 20 | Overview | Fiscal Plan 2023 – 26 |

| Since the government follows accounting standards that are on an accrual basis, the surplus has to be adjusted to determine the surplus cash available from fiscal results. Some examples of these adjustments include excluding income retained by agencies and funds, changes in pension obligations, and for capital cash requirements. A list of cash adjustments can be found on page 157.

Budget 2023 is securing Alberta’s future by legislating a set of fiscal rules that work together by providing prudence and flexibility to guide government decision-making in both good times and bad so Alberta’s finances remain sustainable now and in the future. |

Annual Debt Maturities

(millions of dollars)

| 2021-22 | 2022-23 | 2023-24 | 2024-25 | 2025-26 | 2026-27 | |||||||||||||||||||

| Long-term debt maturities |

4,922 | 5,292 | 7,522 | 5,971 | 13,199 | 5,825 | ||||||||||||||||||

| Short-term debt maturities |

- | 8,062 | - | - | - | - | ||||||||||||||||||

| Total Annual Debt Maturities |

4,922 | 13,354 | 7,522 | 5,971 | 13,199 | 5,825 | ||||||||||||||||||

| Overview | Fiscal Plan 2023 – 26 | 21 |

BLANK PAGE

| 22 | Overview | Fiscal Plan 2023 – 26 |

BUDGET 2023

GOVERNMENT OF ALBERTA | 2023–26

Fiscal Plan

Economic Outlook

| 23 |

Table of Contents

| Key Energy and Economic Assumptions |

26 | |||

| Economic Outlook 2023–26 |

27 | |||

| Chart 1: Income gains to support activity |

27 | |||

| Chart 2: Real GDP to grow at a solid pace |

28 | |||

| Global economy |

29 | |||

| Chart 3: Core inflation remains elevated in advanced economies |

29 | |||

| Chart 4: Bank of Canada’s monetary tightening is downshifting |

30 | |||

| Chart 5: Growth to slow in advanced economies this year |

31 | |||

| Chart 6: Tight global oil market to support prices |

32 | |||

| Alberta Economy |

33 | |||

| Chart 7: Light-heavy differential to improve over the medium term |

33 | |||

| Chart 8: Investment and production set to rise in 2023 |

34 | |||

| Chart 9: Business investment continues to diversify |

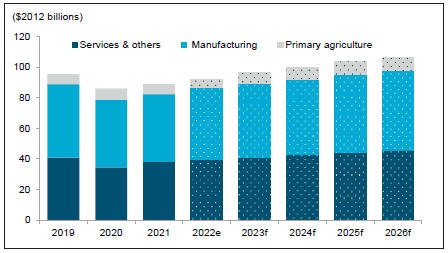

36 | |||

| Chart 10: Non-energy exports to advance |

38 | |||

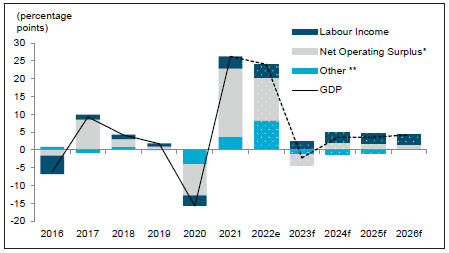

| Chart 11: Lower corporate profits weighing on income this year |

39 | |||

| Chart 12: Strong population growth to continue in 2023 |

40 | |||

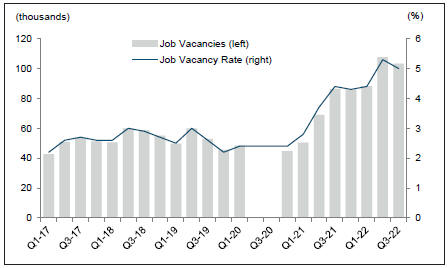

| Chart 13: Job vacancies remain high |

41 | |||

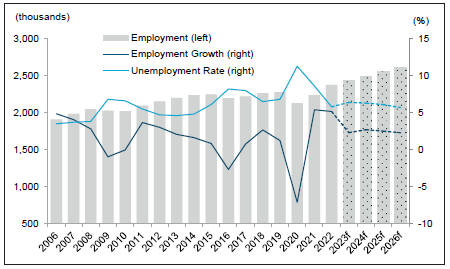

| Chart 14: Unemployment rate to tick up this year |

41 | |||

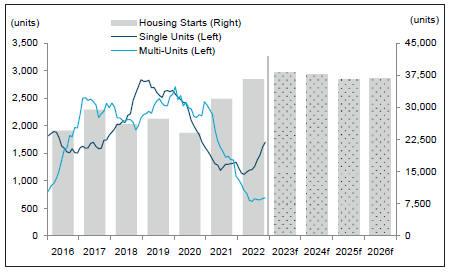

| Chart 15: Housing starts strong amid low inventories |

42 | |||

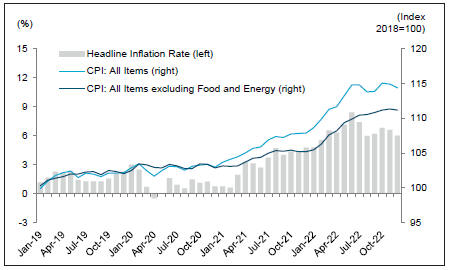

| Chart 16: Consumer prices remain high even as inflation eases |

43 | |||

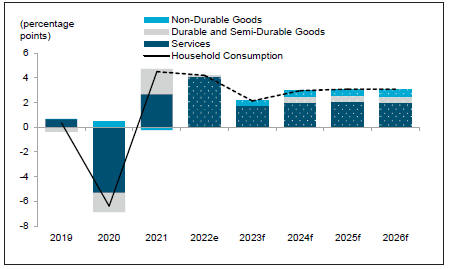

| Chart 17: Household spending subdued in 2023 |

44 | |||

| Table 1: Scenario Impacts |

46 | |||

| 24 | Economic Outlook | Fiscal Plan 2023 – 26 |

Table of Contents, continued

| Annex |

47 | |||

| Oil Price Benchmark |

48 | |||

| How Oil Price Forecasters Fared in Budget 2022 |

48 | |||

| Light-Heavy Oil Price Differential Benchmark |

49 | |||

| Natural Gas Price Benchmark |

50 | |||

| How Natural Gas Price Forecasters Did in Budget 2022 |

50 | |||

| United States / Canada Exchange Rate Benchmark |

51 | |||

| Canadian Long-Term Interest Rate Benchmark |

51 | |||

| Alberta Real Gross Domestic Product Benchmark |

52 | |||

| Alberta Nominal Gross Domestic Product Benchmark |

52 | |||

| Alberta Employment Benchmark |

53 | |||

| Alberta Unemployment Rate Benchmark |

53 | |||

| Alberta Housing Starts Benchmark |

54 | |||

| Economic Outlook | Fiscal Plan 2023 – 26 | 25 |

Key Energy and Economic Assumptions

| Fiscal Year Assumptionsa | 2020-21 Actuals |

2021-22 Actuals |

2022-23 Estimate |

2023-24 Forecast |

2024-25 Forecast |

2025-26 Forecast | ||||||||||||||||||||||||||

| Crude Oil Pricesb |

||||||||||||||||||||||||||||||||

| WTI (US$/bbl) |

42.32 | 77.03 | 90.50 | 79.00 | 76.00 | 73.50 | ||||||||||||||||||||||||||

| Light-Heavy Differential (US$/bbl) |

10.58 | 13.56 | 20.00 | 19.50 | 16.80 | 16.40 | ||||||||||||||||||||||||||

| WCS @ Hardisty (Cdn$/bbl) |

41.42 | 79.63 | 92.60 | 78.00 | 75.90 | 72.10 | ||||||||||||||||||||||||||

| Natural Gas Priceb |

||||||||||||||||||||||||||||||||

| Alberta Reference Price (Cdn$/GJ) |

2.10 | 3.48 | 5.10 | 4.10 | 3.60 | 3.80 | ||||||||||||||||||||||||||

| Production |

||||||||||||||||||||||||||||||||

| Conventional Crude Oil (thousands of barrels/day) |

401 | 444 | 497 | 497 | 497 | 490 | ||||||||||||||||||||||||||

| Raw Bitumen (thousands of barrels/day) |

2,969 | 3,197 | 3,281 | 3,345 | 3,436 | 3,529 | ||||||||||||||||||||||||||

| Natural Gas (billions of cubic feet) |

3,857 | 4,027 | 4,226 | 4,275 | 4,304 | 4,347 | ||||||||||||||||||||||||||

| Interest Rates |

||||||||||||||||||||||||||||||||

| 3-month Canada Treasury Bills (%) |

0.14 | 0.19 | 3.20 | 4.20 | 2.90 | 2.80 | ||||||||||||||||||||||||||

| 10-year Canada Bonds (%) |

0.74 | 1.56 | 3.10 | 3.60 | 3.40 | 3.40 | ||||||||||||||||||||||||||

| Exchange Rate (US¢/Cdn$) |

75.7 | 79.8 | 75.7 | 76.2 | 78.2 | 79.5 | ||||||||||||||||||||||||||

| Calendar Year Assumptionsa | 2020 Actuals |

2021 Actuals |

2022 Estimate |

2023 Forecast |

2024 Forecast |

2025 Forecast |

2026 Forecast | |||||||||||||||||||||

| Gross Domestic Product |

||||||||||||||||||||||||||||

| Nominal (billions of dollars) |

296.7 | 374.5 | 464.3 | 454.0 | 470.1 | 487.1 | 507.5 | |||||||||||||||||||||

| % change |

-15.7 | 26.2 | 24.0 | -2.2 | 3.5 | 3.6 | 4.2 | |||||||||||||||||||||

| Real (billions of 2012 dollars) |

320.3 | 335.6 | 351.6 | 361.4 | 372.3 | 383.2 | 393.9 | |||||||||||||||||||||

| % change |

-8.0 | 4.8 | 4.8 | 2.8 | 3.0 | 2.9 | 2.8 | |||||||||||||||||||||

| Other Indicators |

||||||||||||||||||||||||||||

| Employment (thousands) |

2,144 | 2,260 | 2,376c | 2,431 | 2,497 | 2,560 | 2,619 | |||||||||||||||||||||

| % change |

-7.1 | 5.4 | 5.2c | 2.3 | 2.7 | 2.5 | 2.3 | |||||||||||||||||||||

| Unemployment Rate (%) |

11.3 | 8.6 | 5.8c | 6.4 | 6.3 | 6.1 | 5.7 | |||||||||||||||||||||

| Average Weekly Earnings (% change) |

3.2 | 2.1 | 2.4 | 3.3 | 3.7 | 3.7 | 3.5 | |||||||||||||||||||||

| Primary Household Income (% change) |

-4.8 | 5.8 | 8.8 | 5.9 | 6.7 | 6.4 | 6.1 | |||||||||||||||||||||

| Net Corporate Operating Surplus (% change) |

-60.3 | 284.9 | 54.9 | -13.9 | 7.9 | 6.9 | 4.4 | |||||||||||||||||||||

| Housing Starts (thousands of units) |

24.0 | 31.9 | 36.5c | 38.1 | 37.7 | 36.4 | 36.7 | |||||||||||||||||||||

| Alberta Consumer Price Index (% change) |

1.1 | 3.2 | 6.4 | 3.3 | 2.2 | 2.2 | 2.2 | |||||||||||||||||||||

| Retail Sales (% change) |

-2.1 | 11.5 | 6.4 | 4.2 | 4.8 | 4.8 | 5.0 | |||||||||||||||||||||

| Population (thousands) |

4,417 | 4,444 | 4,543c | 4,674 | 4,777 | 4,875 | 4,957 | |||||||||||||||||||||

| % change |

1.2 | 0.6 | 2.2c | 2.9 | 2.2 | 2.1 | 1.7 | |||||||||||||||||||||

| Net Migration (thousands) |

30.5 | 8.2 | 81.7c | 112.3 | 83.1 | 77.1 | 60.2 | |||||||||||||||||||||

| a | Forecast was finalized on January 30, 2023. |

| b | Forecasts have been rounded |

| c | Actual |

| 26 | Economic Outlook | Fiscal Plan 2023 – 26 |

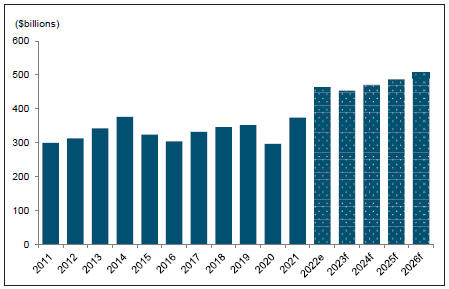

Economic Outlook 2023–26

Alberta is well-positioned to face the challenges coming from last year’s rapid rise in prices, higher interest rates, and slowing global growth. Following two years of robust post-pandemic recovery, Alberta’s real gross domestic product (GDP) growth will moderate to a solid clip of 2.8 per cent this year and lead the country. With last year’s strong pace of 4.8 per cent, real GDP fully recovered from the COVID-19 downturn and surpassed the 2014 peak. Soaring energy prices and strong economic activity propelled incomes to a record high and boosted provincial government revenues. This is expected to support business and household spending this year, even as incomes pull back from last year’s record high (Chart 1).

Chart 1: Income gains to support activity

Nominal GDP, actual and forecast

| Sources: | Statistics Canada, Haver Analytics and Alberta Treasury Board and Finance; e-estimate, f-forecast |

Alberta’s oil and gas sector is expected to take the lead in 2023. Solid energy prices and strong cash flows from 2022 will support drilling activity, production and investment in the sector. The province’s population is expected to rise at its highest pace since 2006, which will provide relief to Alberta’s tight labour market and support employment. Residential construction activity will also benefit from rising in-migration and a healthy labour market. However, slowing momentum in the global economy will weigh on non-energy manufacturing and service exports. High interest rates and elevated prices will continue to keep a lid on household spending. Rising borrowing costs, slower export demand and higher construction costs may also limit expansion and investment plans by some companies outside the oil and gas sector.

Nominal GDP, a broad measure of

income in the province, is expected

to retreat this year but remain high

over the forecast period.

| Economic Outlook | Fiscal Plan 2023 – 26 | 27 |

Alberta’s economy to expand over

the medium term on the back of

accelerating business investment

and a rebound in consumer

spending.

Alberta’s economic growth will become more broad-based over the medium term. Real GDP is forecast to rise to 3.0 per cent in 2024 and average 2.9 per cent between 2025 and 2026 (Chart 2). Business investment is set to accelerate and grow around 10 per cent per year in nominal terms. It will be underpinned by rising investment in the energy sector and large-scale investments in clean technology, manufacturing and other emerging sectors. Alberta’s competitive taxes, regulatory environment, and access to abundant and low-cost natural resources will continue to encourage investment in the province. Construction activity will also get a boost from higher capital spending by the provincial government. Consumer spending and residential construction activity are expected to gain traction as inflation subsides further and interest rates come down. A pick up in global growth should fuel gains in manufacturing and services exports. Solid fundamentals – including strong population growth, a relatively young population, lower cost of living, and high wages – will support Alberta’s continued expansion.

Chart 2: Real GDP to grow at a solid pace

Real GDP, level and growth

| Sources: | Statistics Canada, Haver Analytics and Alberta Treasury Board and Finance; e-estimate, f-forecast |

With business investment and consumer spending gathering momentum, Alberta’s growth will become increasingly driven by domestic demand. This marks a shift in the composition of Alberta’s real GDP compared with the years prior to the pandemic. From 2016 to 2019, exports accounted for nearly all of Alberta’s real GDP growth. This was driven by a period of exceptional growth in oil production as several large oil sands projects ramped up. More modest gains in oil production means the contribution of real exports to GDP growth will decline from around 85 per cent in 2023 to 57 per cent by 2026.

| 28 | Economic Outlook | Fiscal Plan 2023 – 26 |

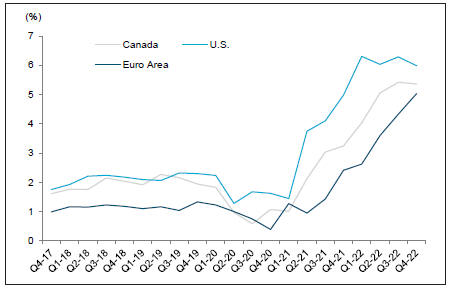

Global economy

Inflation abating but still elevated

Consumer prices appear to be levelling off in most advanced economies following sharp increases over the past year. In Canada and the U.S., headline inflation – measured as the year-over-year percentage change in the consumer price index – has cooled significantly after hitting 40-year highs in mid-2022. Inflation in the euro area and the U.K. has also moderated in recent months. Goods inflation, which was a significant driver of inflation last year, has retreated amid a steep pullback in energy prices, easing supply chain disruptions and shifting demand from goods to services. This trend is expected to continue in 2023 as consumer demand for goods weakens further.

While pressures are easing, inflation and consumer prices remain high in most advanced economies. Core inflation, which excludes the volatile components of food and energy, has yet to show signs of peaking (Chart 3). Shelter costs continue to increase, particularly in Canada, as higher interest rates add to owned accommodation costs. Tight labour market conditions and rising wages have also pushed up core inflation. As a result, headline inflation is expected to decline gradually over the next two years in advanced economies.

Chart 3: Core inflation remains elevated in advanced economies

Annual rate of core inflation, selected countries

| Sources: | Statistics Canada, Bureau of Labor Statistics, Statistical Office of the European Communities and Haver Analytics |

Core inflation remains stubbornly

high as elevated shelter costs and

rising wages put upward pressure

on prices.

| Economic Outlook | Fiscal Plan 2023 – 26 | 29 |

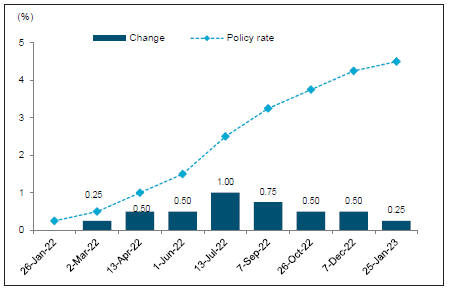

Some central banks are

approaching the end of the

monetary tightening cycle, with

the Bank of Canada announcing a

conditional pause on rate hikes.

Monetary policy shifting gears

With headline inflation turning a corner, some central banks have begun to slow the pace of rate increases. The Bank of Canada (BoC) raised its overnight target rate by a quarter of percentage point in January – the smallest rate hike since March 2022 – and indicated that it is taking a conditional pause to assess the full impact of cumulative rate hikes on the economy (Chart 4). The Bank of England implemented a half of a percentage point hike in early February, but signaled that further tightening will depend on whether price pressures remain persistent. The U.S. Federal Reserve lifted its key policy rate in February by a quarter-point after aggressive hikes through 2022. The Fed anticipates more increases are needed to bring inflation back to target, albeit at a slower pace than last year. In contrast, the European Central Bank, which began to raise interest rates later than other central banks, is expected to continue with aggressive increases given ongoing elevated inflation in Europe. While the pace of monetary tightening is slowing in some countries, interest rates will stay high until inflation falls to levels targeted by central banks. The BoC is not expected to begin cutting interest rates until early 2024, when inflation returns to its mid-point target of 2 per cent and the economy improves.

Chart 4: Bank of Canada’s monetary tightening is downshifting

Policy rate and change by BoC meeting date

Sources: Bank of Canada and Haver Analytics

Global growth to slow in the near term

Global economic activity is forecast to pull back considerably this year before improving in 2024 and over the medium term. Central banks’ efforts are helping to quell inflation. However, the lagged effects of higher interest rates and increasing borrowing costs for businesses and consumers are expected to cool demand further this year. In addition, persistently high prices and ongoing geopolitical tensions will continue to weigh on global growth. After advancing

| 30 | Economic Outlook | Fiscal Plan 2023 – 26 |

an estimated 3.4 per cent in 2022, the International Monetary Fund (IMF) is projecting global growth to decelerate to 2.9 per cent in 2023.

The slowdown in growth will be led by advanced economies (Chart 5). It will be most notable in the euro area, where aggressive monetary tightening and the ongoing impact of the energy shock exacerbated by Russia’s invasion of Ukraine will remain a drag on activity. The U.S. economy is expected to see muted growth this year as the impact of rising interest rates and high consumer prices restrain houshold spending. A strong labour market and healthy balance sheets will cushion the impact. In China, growth is set to pick up this year after posting its weakest expansion in four decades in 2022 due to COVID-19 lockdowns.

Chart 5: Growth to slow in advanced economies this year

Actual and IMF forecast for real GDP growth

| Source: | IMF World Economic Outlook, January 2023 Update; e-estimate, f-forecast |

As the impact of monetary tightening fades, global economic growth is forecast to rise slightly to 3.1 per cent in 2024, although it will remain weak by historical standards.

Momentum slowing in the Canadian economy

The Canadian economy will face similar headwinds as other advanced economies in 2023. Momentum slowed considerably at the end of last year as consumer spending, residential investment, and the housing market weakened. As a result, Canada’s real GDP growth in the fourth quarter fell to an estimated annualized rate of 1.6 per cent. The weakness will carry through into this year and restrict GDP growth to 0.6 per cent before it improves in 2024. Lower energy prices will reduce the value of Canada’s energy exports and be a drag on incomes this year. Following extremely tight conditions last year, the labour market is projected to become more balanced in 2023 and 2024 as demand cools and immigration normalizes.

Rising interest rates and elevated

consumer prices will weigh on

growth in advanced economies this

year.

| Economic Outlook | Fiscal Plan 2023 – 26 | 31 |

Limited supply increases will keep

the oil supply-demand balance

tight over the medium term.

The Canadian dollar is forecast to strengthen over the forecast horizon. It persistently underperformed the U.S. dollar in 2022, as global economic uncertainties and actions by the U.S. Federal Reserve led to a surge in demand for safe-haven U.S. dollar. This is expected to reverse gradually in 2023, with the Loonie projected to rise to an average US¢76.20/Cdn$ in 2023-24 and US¢78.20/Cdn$ in 2024-25.

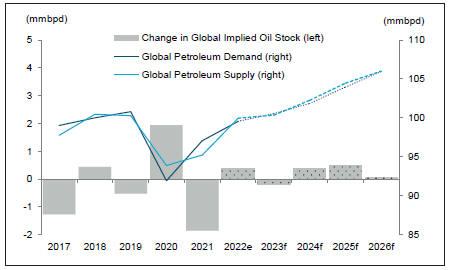

Global oil prices to moderate

The backdrop of slower world economic growth and a tight oil market is creating a lot of uncertainty and price volatility. West Texas Intermediate (WTI) tumbled in early December after the G7 and its allies imposed sanctions and a price cap on Russian oil supplies. Fears of a looming global recession and a surge in COVID-19 cases in China further depressed prices heading into the new year. WTI dipped to a low of US$71 per barrel (/bbl) in early December before bouncing back to around US$80/bbl more recently.

Against this backdrop, global oil prices are forecast to soften this year but remain at solid levels. Slower global growth is expected to dampen petroleum demand, although a tight supply-demand balance will continue to buoy oil prices (Chart 6). WTI is forecast to average US$79.00/bbl in 2023-24, down from US$90.50/bbl in 2022-23. Price volatility is expected to persist this year amid ongoing geopolitical tensions.

Chart 6: Tight global oil market to support prices

Global oil supply and demand, actual and forecast

| Sources: | U.S. EIA, Haver Analytics and Alberta Treasury Board and Finance calculations; e-estimate and f-forecast |

The medium term outlook for oil prices is higher compared with previous budget expectations following Russia’s invasion of Ukraine last year. Petroleum demand is expected to improve alongside a pick up in global growth, while restrained investment in the oil and gas sector worldwide will limit supply increases. This will keep prices above US$70/bbl over the forecast period.

| 32 | Economic Outlook | Fiscal Plan 2023 – 26 |

Alberta Economy

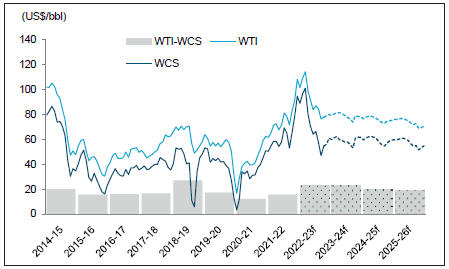

Increased export capacity to buoy Alberta energy prices

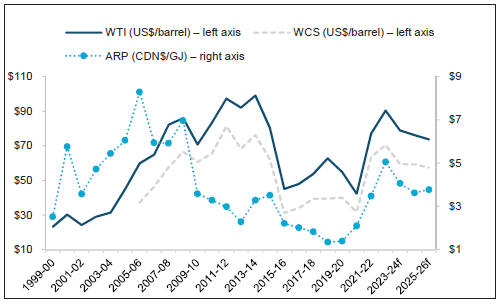

The spread between WTI and Western Canadian Select (WCS) oil prices is expected to narrow as factors that weighed on the differential in late 2022 dissipate and additional pipeline capacity comes online later this year. Higher processing costs at the U.S. Gulf Coast (USGC) due to spiking natural gas prices and a heavy refinery maintenance season in the U.S. reduced demand for Alberta’s heavy oil last year. The release of heavy oil barrels from the U.S. Strategic Petroleum Reserve (SPR) also weighed on prices. The full restart of the Keystone pipeline in late December, along with improving U.S. refinery demand, have already led to an improvement in the differential so far this year. With natural gas prices coming down, heavy oil should become more economic to refine at the USGC. Additional support to prices will also come from U.S. government’s decision to begin rebuilding its strategic reserves by purchasing crude off the market. After widening to a monthly average of $29.00/bbl in December, the WTI-WCS differential is forecast to average US$19.50/bbl in 2023-24 (Chart 7).

Chart 7: Light-heavy differential to improve over the medium term

Oil prices

| Sources: | Alberta Energy and Alberta Treasury Board and Finance, f-forecast |

The completion of Trans Mountain Expansion (TMX) in late 2023 will boost the province’s takeaway capacity by 590,000 barrels per day. This will help reduce the light-heavy differential to around US$16-17/bbl in the next three fiscal years, in line with pipeline transportation costs. A narrower differential, along with solid global oil prices, will keep WCS above C$70/bbl over the medium term.

The WTI-WCS differential is

expected to return to pipeline

transportation costs in 2024

following TMX completion.

| Economic Outlook | Fiscal Plan 2023 – 26 | 33 |

Oil and gas investment will continue

to advance this year, underpinned

by solid energy prices and more

tempered cost increases.

Strong fundamentals are expected to support natural gas prices in Western Canada. North American natural gas prices have retreated from elevated 2022 levels, with prices at Henry Hub trading below US$4.00/MMBtu since late December. Mild winter weather in the U.S. and Europe, strong U.S. gas production and the delayed restart of the Freeport LNG export facility all contributed to weaker exports and rising inventories. However, some of these temporary factors are expected to fade and should translate to an improvement in the price of Western Canadian natural gas. The Alberta Reference Price (ARP) is forecast to average C$4.10/GJ in 2023-24 before moderating to C$3.80/GJ in 2025-26. Even so, ARP is expected to remain above pre-pandemic levels. Growing oil sands production along with increasing demand from coal-to-gas power plant conversions and new gas-fired power plants will continue to buoy demand and price for natural gas in the province.

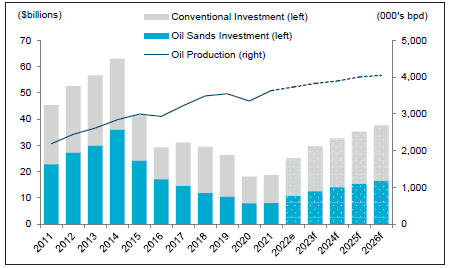

Solid prospects for oil and gas extraction

Oil and gas producers are poised to increase spending, supported by healthy cash flows and balance sheets. Drilling activity in the province ramped up to an eight-year high last year in response to elevated energy prices and strong demand. This, coupled with escalating input costs, propelled investment in the conventional oil and gas extraction sector to rise by more than 36 per cent to an estimated $14.3 billion in 2022. With strong momentum expected to carry through this year, investment is forecast to increase at a solid pace amid favourable oil prices. Conventional investment is forecast to grow 19 per cent (or $2.7 billion) in 2023 before moderating to an average of about 7 per cent in the next three years (Chart 8). Rising costs will also continue to drive spending higher for oil and gas producers this year, although the pace of increase will be slower compared to 2022.

Chart 8: Investment and production set to rise in 2023

Nominal oil and gas investment and crude oil production in Alberta

| Sources: | Statistics Canada and Alberta Treasury Board and Finance, e-estimate, f-forecast |

| 34 | Economic Outlook | Fiscal Plan 2023 – 26 |

Rising bitumen production and moderate growth in costs are also expected to lift oil sands investment higher this year. After increasing by an estimated 31 per cent in 2022, non-conventional investment is forecast to grow nearly 17 per cent (or $2.7 billion) in 2023 before rising at an average of about 9 per cent over the medium term. However, without any greenfield projects on the horizon, oil sands producers will continue to focus spending on clean energy projects, debottlenecking, and optimizing existing infrastructure. In particular, the Pathways Alliance – a group of Canada’s largest oil sands producers – announced plans to collectively invest $16.5 billion by 2030 to build carbon capture, utilization and storage (CCUS) facilities. Detailed engineering evaluation and regulatory work on the project will be underway this year.

Oil exports to grow moderately over the medium term

While investment is set to gain momentum over the next few years, growth in exports is anticipated to slow on the back of more modest gains in oil production. After reaching an all-time high of 3.7 million barrels per day (bpd) in 2022, Alberta’s oil production is forecast to grow 100,000 bpd (or 2.7 per cent) this year and 220,000 bpd between 2023 and 2026. This represents annual average growth of 1.9 per cent, a more moderate pace compared to the last decade when oil production rose at an annual rate of 4.0 per cent. As a result, real exports are forecast to slow from 3.9 per cent in 2023 to 2.6 per cent in 2026. With production reaching almost 4.1 million bpd by the end of the forecast period, however, oil exports will continue to be an important driver of incomes in the province and maintain Alberta’s position as one of the largest oil-producing jurisdictions globally. The completion of TMX in late 2023 will pave the way for further expansion in oil production in the coming years. Natural gas will continue to be a source of growth for exports, supported by robust demand and expanding export pipeline capacity.

Business investment looking up

Investment outside oil and gas extraction is expected to moderate this year before gaining momentum over the medium term. Non-energy investment rose by an estimated 14 per cent (or $4.4 billion) last year on the back of soaring construction costs and progress on large-scale industrial projects in renewable energy, transportation, petrochemicals and telecommunications. As some of these projects wind down and cost pressures ease further, growth in non-energy investment is forecast to moderate at 5.6 per cent (or $2 billion) this year. Higher borrowing costs may also limit expansion plans in some sectors. Over the medium term, however, growth is anticipated to accelerate to 9.4 per cent (or $3.6 billion in 2024) and about 10 per cent on average in 2025 and 2026. The share of non-energy to total business investment is expected to remain above its 10-year historical average of about 47 per cent (Chart 9).

| Economic Outlook | Fiscal Plan 2023 – 26 | 35 |

Investment outside oil and gas

extraction is expected to get a

boost from increased spending on

clean technology and emissions-

reduction initiatives.

Chart 9: Business investment continues to diversify

Alberta nominal non-residential investment by category

| Sources: | Statistics Canada and Alberta Treasury Board and Finance; e-estimate, f-forecast |

Clean Technology

Alberta’s positive investment climate and abundant natural resources are paving the way for strong investment intentions in clean technology. In addition to the Pathways Alliance, a wave of CCUS projects have been proposed over the past year. A total of 25 projects have been selected by the Alberta government for further evaluation in the development of storage hubs. Among these is the Atlas Carbon Sequestration Hub that builds on the success of the Quest Carbon Capture and Storage project, which has now stored seven million tonnes of CO2 since late 2015. The first phase of the project will capture and store 750,000 tonnes of carbon from Shell’s Scotford refinery and chemical plant.

In addition, a number of industrial projects will rely on CCUS to lower emissions. Capital Power is adding carbon capture to its existing Genesee power plant station. Construction is already underway on Air Products $1.6-billion new net-zero hydrogen energy complex, which is expected to come on stream in 2024. Once completed, the facility will be supplying low-carbon hydrogen to Imperial Oil’s recently announced renewable diesel production facility, the largest of its kind in Canada. The $720-million facility is expected to become operational in 2025 and will produce a billion litres of diesel using biofeedstock and hydrogen. In addition to providing 600 construction jobs over the next two years, this project is anticipated to create spinoffs for other industries. A number of investment projects announced over last two years may also provide significant potential upside to investment, including Dow Chemicals $10 billion net-zero emissions ethylene and derivatives facility.

| 36 | Economic Outlook | Fiscal Plan 2023 – 26 |

Technology and aviation sectors

Alberta’s economy is diversifying with investments in emerging industries such as tech and aviation. De Havilland is set to build a new aircraft manufacturing facility near Calgary, with construction to commence in late 2023. Dura-line, a U.S. based tech firm that specializes in developing Internet connection systems, is investing in a new state-of-the-art manufacturing facility in the province that will come online in spring 2023. While Alberta has not been immune to the global layoffs in the tech sector, some companies in the province are choosing to expand their workforce. Garmin Canada is planning to double its staffing size and grow operations in its Cochrane headquarters, while Amazon Web Services is slated to open a cloud computing hub in Calgary in late 2023 or early 2024. Meanwhile, TELUS announced last year that it is investing $17.0 billion in network infrastructure and operations across Alberta over the next four years.

Commercial building construction

The industrial real estate market is expected to lend support to Alberta’s non-residential construction sector. Construction activity for warehousing, distribution and other industrial spaces in both Edmonton and Calgary is anticipated to remain strong, as vacancy rates in this segment are at multi-year lows following last year’s record-setting positive net absorption. According to CBRE Canada, Edmonton and Calgary were among the cities leading activity in Canada at the end of 2022, with positive net absorption at 2.9 million square feet and one million square feet, respectively. Alberta’s higher levels of available space and lower average market rents compared to other provinces will continue to boost demand. Industrial activity will help to offset ongoing challenges in the office market segment, where elevated vacancies in Edmonton and Calgary continue to persist.

Food processing sector

The agri-food sector continues to be a source of strength for the province. Several investment projects announced over the past year are expected to boost Alberta’s value-added agricultural processing capacity. PIP International successfully commissioned its $20 million pilot plant and commercial testing facility in Lethbridge. The company also announced plans to build a second, larger $150 million yellow pea protein facility, which will handle 126,000 tonnes of yellow peas annually from local and regional growers. The new Alberta Agri-processing Investment Tax Credit is expected to spur additional, large-scale investment projects that will help grow the province’s value-added agriculture sector and make the province a preferred destination for these types of investments.

| Economic Outlook | Fiscal Plan 2023 – 26 | 37 |

Manufacturing and services exports

to expand at a softer pace this year

amid slower global growth.

Capacity expansions to support non-energy exports

Export growth outside of oil and gas is expected to pick up following a near-term slowdown. Alberta’s real manufacturing exports are forecast to decelerate from an estimated 5.2 per cent in 2022 to 2.6 per cent in 2023. Continued weakness in residential construction activity in North America will weigh on wood manufacturing sales, while a slowdown in global industrial activity will dampen export demand for durable goods manufacturing in the near term. Demand for machinery and equipment, however, is expected to hold up better as it benefits from solid drilling activity in the U.S. and across Canada. Services exports are also forecast to slow, from an estimated 5 per cent in 2022 to 3.5 per cent in 2023 before easing further to 2.9 per cent by 2026. Travel and tourism-related services should continue recovering following last year’s post-pandemic rebound, although growth will likely be constrained as high interest rates continue to dampen consumer demand. In addition, staffing shortages in the U.S. airline industry, which hampered the recovery in air capacity from the U.S. to Canada last year, could linger in the short term.

Chart 10: Non-energy exports to advance

Alberta real non-energy exports by component

Sources: Statistics Canada and Alberta Treasury Board and Finance; e-estimate, f-forecast

Recent and upcoming capacity expansions in petrochemicals and other emerging sectors should support manufacturing exports as global demand improves (Chart 10). Inter Pipeline’s Heartland Polymers – Canada’s first integrated propane dehydrogenation and polypropylene facility – began commercial production in the third quarter of last year. It is expected to produce 525,000 tonnes of polypropylene annually. Real manufacturing exports are expected to accelerate to around 3 per cent between 2024 and 2026. Meanwhile, growing service exports will be supported by enhanced air capacity and connectivity in Alberta’s major airports, which should bolster domestic and

| 38 | Economic Outlook | Fiscal Plan 2023 – 26 |

international visits to and from the province. Demand for Alberta’s engineering and technical services are also expected to benefit from rising business investment. Employment in professional, scientific, and technical services rose steadily to record highs last year and led the recovery in job gains.

Alberta’s agri-food sector will be a bright spot this year. Better growing and harvesting conditions contributed to above-average yields and higher crop production in 2022. Although crop prices have moderated from the record highs of last spring, historically strong prices continue for most crops. Domestic and export crop demand remains solid, and despite high crop input costs, the crop sector is expected to experience another year of high net returns. Live cattle exports are also expected to benefit from robust prices and tighter supply in the U.S. Meanwhile, prospects for Alberta’s food manufacturing sector remain positive, buoyed by a growing global population and improving demand.

Corporate profits slide from elevated levels