|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

(I.R.S. Employer Identification No.)

|

|

|

||

|

|

|

|

|

(Address of Principal Executive Office)

|

(Zip Code)

|

|

Title of Each Class

|

Trading Symbol(s)

|

Name of Each Exchange on Which

Registered

|

|

None

|

N/A

|

N/A

|

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

|

☒

|

Smaller reporting company

|

|

|

Emerging growth company

|

|

|

Page

|

||

|

Part I

|

||

|

Item 1.

|

4

|

|

|

Item 1A.

|

21

|

|

|

Item 1B.

|

38

|

|

|

Item 2.

|

38

|

|

|

Item 3.

|

38 | |

|

Item 4.

|

38

|

|

|

Part II

|

||

|

Item 5.

|

38

|

|

|

Item 6.

|

40

|

|

|

Item 7.

|

40

|

|

|

Item 7A.

|

50

|

|

|

Item 8.

|

51

|

|

|

Item 9.

|

51

|

|

|

Item 9A.

|

51 | |

|

Item 9B.

|

52

|

|

|

Item 9C.

|

52

|

|

|

PART III

|

||

|

Item 10.

|

53

|

|

|

Item 11.

|

53

|

|

|

Item 12.

|

53

|

|

|

Item 13.

|

53

|

|

|

Item 14.

|

53

|

|

|

PART IV

|

||

|

Item 15.

|

53

|

|

|

Item 16.

|

55

|

|

|

55

|

||

| • |

the Company’s future operating results;

|

| • |

increasing interest rates and interest rate volatility, including volatility associated with the decommissioning of London Interbank Offered Rate (“LIBOR”) and the transition to new reference rates;

|

| • |

inflation could adversely affect the business, results of operations and financial condition of the Company’s portfolio companies;

|

| • |

the Company’s business prospects and the prospects of the Company’s prospective portfolio companies;

|

| • |

the impact of increased competition;

|

| • |

the Company’s contractual arrangements and relationships with third parties;

|

| • |

the dependence of the Company’s future success on the general economy and its impact on the industries in which the Company invests;

|

| • |

the ability of the Company’s prospective portfolio companies to achieve their objectives;

|

| • |

the relative and absolute performance of the Advisor;

|

| • |

the ability of the Advisor and its affiliates to retain talented professionals;

|

| • |

the Company’s expected financings and investments;

|

| • |

the Company’s ability to pay dividends or make distributions;

|

| • |

the adequacy of the Company’s cash resources;

|

| • |

risks associated with possible disruptions in the Company’s operations or the economy generally due to war or terrorism or other disruptive geopolitical events domestically and/or globally;

|

| • |

the ongoing conflict in Ukraine and Russia, including sanctions and market volatility related to such conflict, may adversely impact the industries and portfolio companies in which the Company invests;

|

| • |

the impact of future acquisitions and divestitures;

|

| • |

the Company’s regulatory structure as a business development company (“BDC”) and tax status as a regulated investment company (a “RIC”); and

|

| • |

future changes in laws or regulations and conditions in the Company’s operating areas.

|

| Item 1. |

Business

|

| (a) |

General Development of Business

|

| (b) |

Description of Business

|

| • |

A diversified portfolio of credit investments with equity upside to SMBs, generally not owned by large private equity firms.

|

| • |

Current income distributions.

|

| • |

Capital protection through defensive structures with affirmative, negative and financial maintenance covenants and active portfolio management.

|

| • |

Targeted diversification of assets by vintage, industry and geography through direct originations and acquisitions of loan portfolios.

|

| • |

Generally low volatility and low correlation to public market indices.

|

| (i) |

the Company will not acquire any assets other than “qualifying assets” as defined in the 1940 Act (and summarized in “Regulation as a Business Development Company”) unless, at the time of and

after giving effect to such acquisition, at least 70% of the Company’s total assets are qualifying assets;

|

| (ii) |

the Company will offer, and must provide upon request, significant managerial assistance to its portfolio companies that constitute qualifying assets (as described in greater detail in “Regulation as a

Business Development Company” below);

|

|

(iii)

|

the Company generally must have at least 150% asset coverage for its debt after incurring any new indebtedness; and

|

|

(iv)

|

except for shares of registered money market funds, the Company generally cannot acquire more than 3% of the voting stock of any registered investment company or BDC (either, an “Investment Company”),

invest more than 5% of the value of its total assets in the securities of one Investment Company or invest more than 10% of the value of its total assets in the securities of Investment Companies in the aggregate. Subject to certain

exemptive rules, including Rule 12d1-4, the Company may, subject to certain conditions, invest in other Investment Companies in excess of such thresholds.

|

| (i) |

Income Incentive Fee

|

| • |

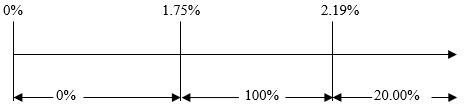

no Income Incentive Fee in any calendar quarter in which the Company’s Pre- Incentive Fee Net Investment Income does not exceed the Hurdle Amount;

|

| • |

100% of that portion of the Company’s Pre-Incentive Fee Net Investment Income, if any, that exceeds the Hurdle Amount but is less than or equal to a “Catch-up Amount.” The Catch-up Amount is equal to the product of (i) 2.19% per quarter

(8.75% annualized) and (ii) the Company’s net assets at the end of the immediately preceding quarter. The Catch-up Amount is meant to provide the Advisor with approximately 20% of the Company’s Pre- Incentive Fee Net Investment Income as if

a hurdle rate did not apply; and

|

| • |

20% of the Company’s Pre-Incentive Fee Net Investment Income, if any, that exceeds the Catch-up Amount. This reflects that once the Hurdle Amount and the Catch-up Amount are achieved, 20% of all Pre-Incentive Fee Net Investment Income

thereafter is allocated to the Advisor.

|

|

(ii)

|

Capital Gains Incentive Fee

|

| (1) |

Represents 7.0% annualized hurdle rate.

|

| (2) |

The “catch-up” provision is intended to provide our Advisor with an incentive fee of approximately 20% on all of our pre- incentive fee net investment income when our net investment income exceeds 2.19% in any calendar quarter.

|

| • |

whether any Stockholders have requested to tender shares to the Company;

|

| • |

the liquidity of the Company’s assets (including fees and costs associated with redeeming or otherwise withdrawing from investment funds);

|

| • |

the investment plans and working capital and reserve requirements of the Company;

|

| • |

the relative economies of scale of the tenders with respect to the size of the Company;

|

| • |

the history of the Company in repurchasing shares;

|

| • |

the availability of information as to the value of the Company’s shares in investment funds;

|

| • |

the existing conditions of the securities markets and the economy generally, as well as political, national or international developments or current affairs;

|

| • |

any anticipated tax consequences to the Company of any proposed repurchases of shares; and

|

| • |

the recommendations of the Advisor.

|

| • |

Each repurchase offer will generally commence approximately 90 days prior to the applicable repurchase date or as disclosed in the Company’s tender offer. A Stockholder choosing to tender shares for repurchase must do so by the

applicable deadline, which generally will be five days before the applicable quarter end repurchase date. Stockholders will be informed in each repurchase offer that tendered Shares will be valued at the net asset value per share calculated

as of the applicable valuation date. The valuation dates are generally expected to be March 31, June 30, September 30 or December 31. Tenders will be revocable upon written notice to the Company until the end of the Notice Period. Payments

will be made to Stockholders within 60 days of the end of the Notice Period.

|

| • |

Promptly after the Notice Period, the Company will give to each Stockholder whose shares have been accepted for repurchase a promissory note (the “Promissory Note”) entitling the Stockholder to be paid an amount equal to the value,

determined as of the valuation date, of the repurchased shares.

|

| • |

The Promissory Note will be non-interest bearing and non-transferable.

|

| • |

Securities purchased in transactions not involving any public offering from the issuer of such securities, which issuer (subject to certain limited exceptions) is an “eligible portfolio company” (as defined in the 1940 Act), or from any

person who is, or has been during the preceding 13 months, an affiliated person of an eligible portfolio company, or from any other person, subject to such rules as may be prescribed by the SEC. An eligible portfolio company is defined in

the 1940 Act as any issuer which:

|

| • |

is organized under the laws of, and has its principal place of business in, the United States;

|

| • |

is not an investment company (other than a small business investment company wholly owned by the Company) or a company that would be an investment company but for certain exclusions under the 1940 Act; and

|

| • |

satisfies any of the following:

|

| • |

has an equity capitalization of less than $250 million or does not have any class of securities listed on a national securities exchange;

|

| • |

is controlled by a BDC or a group of companies including a BDC, the BDC actually exercises a controlling influence over the management or policies of the eligible portfolio company, and, as a result thereof, the BDC has an affiliated

person who is a director of the eligible portfolio company; or

|

| • |

is a small and solvent company having total assets of not more than $4 million and capital and surplus of not less than $2 million.

|

| • |

Securities of any eligible portfolio company that the Company controls.

|

| • |

Securities purchased in a private transaction from a U.S. issuer that is not an investment company or from an affiliated person of the issuer, or in transactions incident thereto, if the issuer is in bankruptcy and subject to

reorganization or if the issuer, immediately prior to the purchase of its securities was unable to meet its obligations as they came due without material assistance other than conventional lending or financing arrangements.

|

| • |

Securities of an eligible portfolio company purchased from any person in a private transaction if there is no ready market for such securities and the Company already owns 60% of the outstanding equity of the eligible portfolio company.

|

| • |

Securities received in exchange for or distributed on or with respect to securities described above, or pursuant to the exercise of options, warrants or rights relating to such securities.

|

| • |

Cash, cash equivalents, “U.S. Government securities” (as defined in the 1940 Act) or high-quality debt securities maturing in one year or less from the time of investment.

|

| • |

pursuant to Rule 13a-14 of the Exchange Act, the President and Chief Financial Officer must certify the accuracy of the financial statements contained in the Company’s periodic reports;

|

| • |

pursuant to Item 307 of Regulation S-K, the Company’s periodic reports must disclose the Company’s conclusions about the effectiveness of the Company’s disclosure controls and procedures;

|

| • |

pursuant to Rule 13a-15 of the Exchange Act, the Company’s management must prepare an annual report regarding its assessment of the Company’s internal control over financial reporting and (once the Company ceases to be an emerging growth

company under the JOBS Act or, if later, for the year following the Company’s first annual report required to be filed with the SEC) must obtain an audit of the effectiveness of internal control over financial reporting performed by the

Company’s independent registered public accounting firm; and

|

| • |

pursuant to Item 308 of Regulation S-K and Rule 13a-15 of the Exchange Act, the Company’s periodic reports must disclose whether there were significant changes in the Company’s internal controls over financial reporting or in other

factors that could significantly affect these controls subsequent to the date of their evaluation, including any corrective actions with regard to significant deficiencies and material weaknesses.

|

| (a) |

at all times during each taxable year maintain its election under the 1940 Act to be treated as a BDC;

|

| (b) |

derive in each taxable year at least 90% of its gross income from dividends, interest, gains from the sale or other disposition of stock or securities and other specified categories of investment income; and

|

| (c) |

diversify its holdings so that, subject to certain exceptions and cure periods, at the end of each quarter of its taxable year,

|

| (i) |

at least 50% of the value of its total assets is represented by cash and cash items, U.S. government securities, the securities of other RICs and “other securities,” provided that such “other securities” shall not include any amount of

any one issuer, if its holdings of such issuer are greater in value than 5% of its total assets or greater than 10% of the outstanding voting securities of such issuer, and

|

| (ii) |

no more than 25% of the value of its assets may be invested in securities of any one issuer, the securities of any two or more issuers that are controlled by the Company and are engaged in the same or similar or related trades or

business (excluding U.S. government securities and securities of other RICs), or the securities of one or more “qualified publicly traded partnerships.”

|

| (1) |

at least 98% of its ordinary income (not taking into account any capital gains or losses) for the calendar year;

|

| (2) |

at least 98.2% of its capital gains in excess of its capital losses (adjusted for certain ordinary losses) for a one-year period generally ending on October 31 of the calendar year; and

|

| (3) |

any undistributed amounts from previous years on which the Company paid no U.S. federal income tax.

|

| (1) |

The Company may make investments that are subject to tax rules that require it to include amounts in income before cash corresponding to that income is received, or that defer or limit the Company’s ability to claim the benefit of

deductions or losses. For example, if the Company holds securities issued with original issue discount, such discount will be included in income in the taxable year of accrual and before any corresponding cash payments are received.

|

| (2) |

In cases where the Company’s taxable income exceeds its available cash flow, the Company will need to fund distributions with the proceeds of sale of securities or with borrowed money, and will raise funds for this purpose

opportunistically over the course of the year.

|

| Item 1A. |

Risk Factors

|

| • |

We have a limited operating history.

|

| • |

Shares of the Company’s Common Stock are an illiquid investment.

|

| • |

Investments in private and middle-market companies involves a number of significant risks.

|

| • |

We are dependent upon Star Mountain’s access to its investment professionals for our success.

|

| • |

Economic recessions or downturns could impair the portfolio companies, and defaults by the portfolio companies will harm the Company’s operating results.

|

| • |

Increasing interest rates and interest rate volatility, including volatility associated with the decommissioning of London InterBank Offered Rate (“LIBOR”) and the transition to new reference rates may adversely affect the value of the

financial obligations to be held or issued by us.

|

| • |

Inflation could adversely affect the business, results of operations and financial condition of the Company’s portfolio companies.

|

| • |

Our investment portfolio is and will continue to be recorded at fair value as determined in good faith by our Board of Directors and, as a result, there is and will continue to be uncertainty as to the value of our portfolio investments.

|

| • |

We operate in a highly competitive market for investment opportunities, which could reduce returns and result in losses.

|

| • |

There are potential conflicts of interest, including the management of other investment funds and accounts by the Advisor and Star Mountain, which could impact our investment returns.

|

| • |

The fee structure under the Advisory Agreement may induce the Advisor to pursue speculative investments and incur leverage, which may not be in the best interests of our stockholders.

|

| • |

Regulations governing our operation as a BDC will affect our ability to, and the way in which we, raise additional capital.

|

| • |

Our financing agreements contain various covenants, which, if not complied with, could accelerate our repayment obligations thereunder, thereby materially and adversely affecting our liquidity, financial condition, results of operations

and ability to pay distributions.

|

| • |

The information and technology systems of the Company, the Adviser and their respective service providers may be vulnerable to cyber-attacks.

|

| • |

Stockholders may be subject to significant adverse consequences in the event such a Stockholder defaults on its capital commitment to the Company.

|

| • |

There is no public market for shares of our common stock, and we do not expect there to be a market for our shares.

|

| • |

The ongoing conflict in Ukraine and Russia, including sanctions and market volatility related to such conflict, may adversely impact the industries and portfolio companies in which the Company invests.

|

| • |

The higher yields and interest rates on PIK securities reflects the payment deferral and increased credit risk associated with such instruments and that such investments may represent a significantly higher credit risk than coupon loans.

|

| • |

PIK securities may have unreliable valuations because their continuing accruals require continuing judgments about the collectability of the deferred payments and the value of any associated collateral.

|

| • |

PIK interest has the effect of generating investment income and increasing the incentive fees payable at a compounding rate. In addition, the deferral of PIK interest also reduces the loan-to-value ratio at a compounding rate.

|

| • |

PIK securities create the risk that incentive fees will be paid to the Advisor based on non-cash accruals that ultimately may not be realized, but the Advisor will be under no obligation to reimburse the Company for these fees.

|

| • |

increase or maintain in whole or in part the Company’s equity ownership percentage;

|

| • |

exercise warrants, options or convertible securities that were acquired in the original or subsequent financing; or

|

| • |

attempt to preserve or enhance the value of the Company’s investment.

|

| Item 1B. |

Unresolved Staff Comments

|

| Item 2. |

Properties

|

| Item 3. |

Legal Proceedings

|

| Item 4. |

Mine Safety Disclosures

|

| Item 5. |

Market for Registrant’s Common Equity Related Stockholder Matters and Issuer Purchase of Equity Securities

|

| • |

Securities for which no such market prices are available or reliable will be preliminarily valued at such value as the Advisor may reasonably determine, which may include third-party valuations;

|

| • |

The Audit Committee of the Board will then review these preliminary valuations;

|

| • |

At least once annually, the valuation for each investment that constitutes a material portion of the Company’s portfolio and that does not have a readily available market quotation will be reviewed by an independent valuation firm; and

|

| • |

The Board will then discuss valuations and determine the fair value of each investment in the Company’s portfolio in good faith, based on the input of the Advisor, the respective independent valuation firms and the Audit Committee.

|

|

Total Number of

Shares Purchased

|

Average Price per share

|

Total Number of Shares Purchased as Part

of Publicly Announced Plans or Programs

|

||||||||||

|

October 1, 2022 - October 31, 2022

|

-

|

-

|

-

|

|||||||||

|

November 1, 2022 - November 30, 2022

|

99,486.137

|

$

|

25.78

|

99,486.137

|

||||||||

|

December 1, 2022 - December 31, 2022

|

-

|

-

|

-

|

|||||||||

|

Total

|

99,486.137

|

$

|

25.78

|

99,486.137

|

||||||||

| ITEM 6. |

[Reserved]

|

| ITEM 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

December 31, 2022

|

December 31, 2021

|

|||||||||||||||

|

Fair Value:

|

||||||||||||||||

|

First Lien Senior Secured Loan

|

$

|

260,982,122

|

86.10

|

%

|

$

|

79,686,882

|

76.90

|

%

|

||||||||

|

Second Lien Senior Secured Loan

|

6,250,270

|

2.10

|

9,748,549

|

9.40

|

||||||||||||

|

Preferred Equity Securities

|

27,088,732

|

8.90

|

10,604,516

|

10.20

|

||||||||||||

|

Warrants and Other Equity Securities

|

5,829,429

|

1.90

|

3,600,418

|

3.50

|

||||||||||||

|

Fund Investments

|

3,045,128

|

1.00

|

-

|

-

|

||||||||||||

|

Total

|

$

|

303,195,681

|

100.00

|

%

|

$

|

103,640,365

|

100.00

|

%

|

||||||||

|

December 31, 2022

|

December 31, 2021

|

|||||||||||||||

|

Fair Value:

|

||||||||||||||||

|

Aerospace & Defense

|

$

|

5,877,696

|

1.80

|

%

|

$

|

3,406,449

|

3.30

|

%

|

||||||||

|

Commercial Services & Supplies

|

10,629,012

|

3.50

|

9,446,485

|

9.10

|

||||||||||||

|

Construction & Engineering

|

36,895,770

|

12.20

|

21,566,475

|

20.90

|

||||||||||||

|

Consumer Finance

|

3,836,822

|

1.30

|

2,872,016

|

2.80

|

||||||||||||

|

Distributors

|

14,383,702

|

4.70

|

-

|

-

|

||||||||||||

|

Diversified Consumer Services

|

14,502,291

|

4.80

|

4,707,478

|

4.50

|

||||||||||||

|

Diversified Financials

|

3,045,128

|

1.00

|

-

|

-

|

||||||||||||

|

Diversified Telecommunication Services

|

17,241,546

|

5.70

|

8,835,342

|

8.50

|

||||||||||||

|

Electrical Equipment

|

9,836,785

|

3.20

|

-

|

-

|

||||||||||||

|

Entertainment

|

19,165,339

|

6.30

|

9,903,617

|

9.60

|

||||||||||||

|

Food Products

|

6,953,360

|

2.30

|

-

|

-

|

||||||||||||

|

Healthcare Providers & Services

|

15,185,883

|

5.00

|

1,464,446

|

1.40

|

||||||||||||

|

Hotels, Restaurants & Leisure

|

4,919,446

|

1.60

|

-

|

-

|

||||||||||||

|

Household Durables

|

2,586,687

|

0.90

|

4,229,816

|

4.10

|

||||||||||||

|

Household Products

|

4,073,972

|

1.30

|

3,716,607

|

3.60

|

||||||||||||

|

IT Services

|

14,001,990

|

4.60

|

1,999,150

|

1.90

|

||||||||||||

|

Leisure Products

|

4,793,707

|

1.60

|

4,632,103

|

4.50

|

||||||||||||

|

Machinery

|

6,635,785

|

2.20

|

-

|

-

|

||||||||||||

|

Media

|

25,659,236

|

8.50

|

7,094,439

|

6.80

|

||||||||||||

|

Personal Products

|

4,335,304

|

1.40

|

4,590,821

|

4.40

|

||||||||||||

|

Professional Services

|

34,425,860

|

11.40

|

8,029,455

|

7.70

|

||||||||||||

|

Road & Rail

|

14,752,716

|

4.90

|

1,013,686

|

1.00

|

||||||||||||

|

Software

|

5,961,468

|

2.00

|

6,131,980

|

5.90

|

||||||||||||

|

Specialty Retail

|

6,318,303

|

2.10

|

-

|

-

|

||||||||||||

|

Trading Companies & Distributors

|

17,177,873

|

5.70

|

-

|

-

|

||||||||||||

|

Total

|

$

|

303,195,681

|

100.00

|

%

|

$

|

103,640,365

|

100.00

|

%

|

||||||||

|

Investment

Performance

Risk Rating

|

Summary Description

|

|

|

Grade 1

|

Investment is performing above expectations. Full return of principal, interest and dividend income is expected.

|

|

|

Grade 2

|

Investment is performing in-line with expectations. Risk factors remain neutral or favorable compared with initial underwriting. All investments are given a “2” at the time of origination

|

|

|

Grade 3

|

Investment is performing below expectations. Capital impairment or payment delinquency is not anticipated. The investment may also be out of compliance with certain financial covenants.

|

|

|

Grade 4

|

Investment is performing below expectations. Quantitative or qualitative risks have increased materially. Delinquency of interest and / or dividend payments is anticipated. No loss of principal anticipated.

|

|

|

Grade 5

|

Investment is performing substantially below expectations. It is anticipated that the Company will not recoup its initial cost basis and may realize a loss upon exit. Most or all of the debt covenants are out of

compliance. Amortization, interest and / or dividend payments are substantially delinquent.

|

|

December 31, 2022

|

December 31, 2021

|

|||||||||||||||

|

Investment Performance Risk Rating

|

Investments at

Fair Value |

Percentage of

Total Investments |

Investments at

Fair Value |

Percentage of

Total Investments |

||||||||||||

|

1

|

$

|

24,011,980

|

7.90

|

%

|

$

|

-

|

-

|

%

|

||||||||

|

2

|

230,159,492

|

75.90

|

92,427,602

|

89.20

|

||||||||||||

|

3

|

39,811,785

|

13.10

|

11,212,763

|

10.80

|

||||||||||||

|

4

|

6,625,737

|

2.20

|

-

|

-

|

||||||||||||

|

5

|

2,586,687

|

0.90

|

-

|

-

|

||||||||||||

|

Total

|

$

|

303,195,681

|

100.00

|

%

|

$

|

103,640,365

|

100.00

|

%

|

||||||||

|

For the year ended

December 31, 2022 |

For the period

May 14, 2021* to December 31, 2021 |

|||||||

|

Total investment income

|

$

|

21,975,603

|

$

|

4,499,992

|

||||

|

Total expenses

|

13,673,237

|

2,493,580

|

||||||

|

Net investment income before fee waivers

|

8,302,366

|

2,006,412

|

||||||

|

Management fee waiver

|

279,725

|

-

|

||||||

|

Incentive fee waiver

|

2,185,968

|

-

|

||||||

|

Net investment income after fee waivers

|

10,768,059

|

2,006,412

|

||||||

|

Net realized gain (loss) on investments

|

43,607

|

240,492

|

||||||

|

Net change in unrealized gain (loss) on investments

|

(817,733

|

)

|

67,642

|

|||||

|

Net increase (decrease) in net assets resulting from operations

|

$

|

9,993,933

|

$

|

2,314,546

|

||||

|

For the year ended

December 31, 2022 |

For the period

May 14, 2021* to December 31, 2021 |

|||||||

|

Non-controlled/non-affiliate investment income

|

||||||||

|

Interest income

|

$

|

20,937,595

|

$

|

4,091,514

|

||||

|

PIK interest income

|

495,426

|

249,427

|

||||||

|

Dividend income

|

181,458

|

94,628

|

||||||

|

Other income

|

257,368

|

-

|

||||||

|

Controlled/affiliate investment income

|

||||||||

|

Interest income

|

103,756

|

64,423

|

||||||

|

Total investment income

|

$

|

21,975,603

|

$

|

4,499,992

|

||||

|

For the year ended

December 31, 2022 |

For the period

May 14, 2021* to December 31, 2021 |

|||||||

|

Interest and other financing fees

|

$

|

5,798,315

|

$

|

325,901

|

||||

|

Management fees

|

3,467,163

|

757,520

|

||||||

|

Incentive fees

|

1,960,085

|

225,883

|

||||||

|

Professional fees

|

1,356,001

|

387,308

|

||||||

|

General and administrative fees

|

609,391

|

206,855

|

||||||

|

Legal expenses

|

393,131

|

266,709

|

||||||

|

Directors' expenses

|

89,151

|

50,849

|

||||||

|

Organizational expenses

|

-

|

272,555

|

||||||

|

Expenses

|

13,673,237

|

2,493,580

|

||||||

|

Management fee waiver

|

(279,725

|

)

|

-

|

|||||

|

Incentive fee waiver

|

(2,185,968

|

)

|

-

|

|||||

|

Total Expenses

|

$

|

11,207,544

|

$

|

2,493,580

|

||||

|

Secured Credit Facility Lender

|

Commitment

|

|||

|

Webster Bank

|

$

|

67,500,000

|

||

|

Blue Ridge Bank

|

25,000,000

|

|||

|

First Foundation Bank

|

20,000,000

|

|||

|

Mitsubishi HC Capital America, Inc.

|

20,000,000

|

|||

|

Woodforest National Bank

|

20,000,000

|

|||

|

Forbright Bank

|

17,500,000

|

|||

|

Apple Bank

|

15,000,000

|

|||

|

Peapack-Gladstone Bank

|

15,000,000

|

|||

|

Total Commitment

|

$

|

200,000,000

|

||

| • |

the quarterly valuation process commences with each portfolio company or investment being initially evaluated by the investment professionals of the Advisor responsible for the monitoring of the portfolio investment;

|

| • |

the Advisor’s Valuation Committee reviews the valuations provided by the independent third-party valuation firm and develops a valuation recommendation. Valuation recommendations are presented to the audit committee of the Board;

|

| • |

the audit committee of the Board reviews valuation recommendations of the Advisor incorporating any adjustments or further supplements by the Advisor to the valuations; and

|

| • |

the Board discusses these valuations and determines the fair value of each investment in the portfolio in good faith, based on the input of the Advisor, the independent valuation firm, and the audit committee.

|

| • |

Level 1 - Quoted prices are available in active markets/exchanges for identical investments as of the reporting date.

|

| • |

Level 2 - Pricing inputs are observable inputs including, but not limited to, prices quoted for similar assets or liabilities in active markets/exchanges or prices quoted for identical or similar assets or liabilities in markets that

are not active, and fair value is determined through the use of models or other valuation methodologies.

|

| • |

Level 3 - Pricing inputs are unobservable for the investment and include activities where there is little, if any, market activity for the investment. The inputs into determination of fair value require significant management judgment

and estimation.

|

| ITEM 7A. |

Quantitative and Qualitative Disclosures About Market Risk

|

|

Change in Interest Rates

|

Increase (decrease) in

interest income

|

Increase (decrease) in

interest expense

|

Net increase (decrease) in

net investment income

|

|||||||||

|

Down 25 basis points

|

$

|

(687,629

|

)

|

$

|

(382,500

|

)

|

$

|

(305,129

|

)

|

|||

|

Up 100 basis points

|

2,750,515

|

1,530,000

|

1,220,515

|

|||||||||

|

Up 200 basis points

|

5,501,031

|

3,060,000

|

2,441,031

|

|||||||||

|

Up 300 basis points

|

8,251,546

|

4,590,000

|

3,661,546

|

|||||||||

| ITEM 8. |

Financial Statements and Supplementary Data

|

| ITEM 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

| ITEM 9A. |

Controls and Procedures

|

| ITEM 9B. |

Other Information

|

| ITEM 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections

|

| ITEM 10. |

Directors, Executive Officers and Corporate Governance

|

| ITEM 11. |

Executive Compensation

|

| ITEM 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

| ITEM 13. |

Certain Relationships and Related Transactions, and Director Independence.

|

| ITEM 14. |

Principal Accountant Fees and Services

|

| ITEM 15. |

Exhibits and Financial Statement Schedules

|

|

Certificate of Incorporation (1)

|

||

|

Certificate of Conversion to a Corporation (2)

|

||

|

Bylaws (3)

|

||

|

Form of Subscription Agreement (4)

|

||

|

Investment Advisory Agreement between Star Mountain Credit Opportunities Fund, LP and Star Mountain Fund Management, LLC (5)

|

||

|

Administration Agreement between Star Mountain Credit Opportunities Fund, LP, and Star Mountain Fund Management LLC (6)

|

||

|

Loan and Servicing Agreement, dated as of July 2, 2021, by and among Star Mountain Lower Middle-Market Capital Corp., as borrower, the lenders party thereto and Sterling National Bank, in its capacities as collateral agent and

administrative agent (7)

|

|

First Amendment to Revolving Credit Agreement, dated as of November 10, 2021, by and among the Company, as Borrower, and Sterling National Bank, as Administrative Agent and the Letter of Credit Issuer, and the Lenders party thereto.

(8)

|

||

|

Second Amendment to Revolving Credit Agreement, dated as of January 12, 2022, by and among the Company, as Borrower, and Sterling National Bank, as Administrative Agent and the Letter of Credit Issuer, and the Lenders party thereto.

(9)

|

||

|

Amendment to Loan and Servicing Agreement and Joinder Agreement, dated as of May 6, 2022, by and among the Company, as Borrower, and Webster Bank, N.A. (f/k/a Sterling National Bank), as Administrative Agent and the Letter of Credit

Issuer, and the Lenders party thereto (10)

|

||

|

Loan and Security Agreement, dated as of June 22, 2022, by and among the Company, as Borrower, and East West Bank, as Lender (11)

|

||

|

Second Amendment to Loan and Servicing Agreement, dated as of September 16, 2022, by and among the Company, as Borrower, and Webster Bank, N.A. (f/k/a Sterling National Bank), as Collateral Agent, Administrative Agent, Swing Lender,

and Sole Lead Arranger, and the Lenders party thereto (12)

|

||

|

Code of Ethics (13)

|

||

|

Certification of Chief Executive Officer pursuant to Rule 13a-14(a)/15d-14(a) of the Securities Exchange Act of 1934, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 *

|

||

|

Certification of Chief Financial Officer pursuant to Rule 13a-14(a)/15d-14(a) of the Securities Exchange Act of 1934, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 *

|

||

|

Certification of Chief Executive Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 *

|

||

|

Certification of Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 *

|

||

|

(1)

|

Previously filed as Exhibit 3.1 to the Company’s Registration Statement on Form 10 (File No. 000-56259), filed with the SEC on May 7, 2021.

|

|

|

(2)

|

Previously filed as Exhibit 10.4 to the Company’s Registration Statement on Form 10 (File No. 000-56259), filed with the SEC on May 7, 2021.

|

|

|

(3)

|

Previously filed as Exhibit 3.2 to the Company’s Registration Statement on Form 10 (File No. 000-56259), filed with the SEC on May 7, 2021.

|

|

|

(4)

|

Previously filed as Exhibit 10.3 to the Company’s Registration Statement on Form 10 (File No. 000-56259), filed with the SEC on May 7, 2021.

|

|

|

(5)

|

Previously filed as Exhibit 10.1 to the Company’s Registration Statement on Form 10 (File No. 000-56259), filed with the SEC on May 7, 2021.

|

|

|

(6)

|

Previously filed as Exhibit 10.2 to the Company’s Registration Statement on Form 10 (File No. 000-56259), filed with the SEC on May 7, 2021.

|

|

|

(7)

|

Previously filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K, filed with the SEC on July 15, 2021.

|

|

|

(8)

|

Previously filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K, filed with the SEC on November 12, 2021.

|

|

|

(9)

|

Previously filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K, filed with the SEC on January 14, 2022.

|

|

|

(10)

|

Previously filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K, filed with the SEC on May 12, 2022.

|

|

|

(11)

|

Previously filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K, filed with the SEC on June 23, 2022.

|

|

|

(12)

|

Previously filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K, filed with the SEC on September 20, 2022.

|

|

|

(13)

|

Previously filed as Exhibit 14.1 to the Company’s Annual Report on Form 10-K, filed with the SEC on March 31, 2022.

|

|

|

*

|

Filed herewith

|

|

Page

|

|

|

F-2

|

|

|

Financial Statements:

|

|

|

F-3

|

|

|

F-4

|

|

|

F-5

|

|

|

F-6

|

|

|

F-7

|

|

|

F-14

|

|

Ernst & Young LLP

One Manhattan West

New York, NY 10001

|

Tel: +1 704 372 6300

www.ey.com

|

|

|

December 31, 2022

|

December 31, 2021

|

|||||||

|

ASSETS

|

||||||||

|

Non-controlled/non-affiliate investments at fair value (amortized cost of $299,401,792 and $99,008,447 as of December 31, 2022 and December 31, 2021, respectively)

|

$

|

301,766,151

|

$

|

102,175,919

|

||||

|

Controlled/affiliate investments at fair value (amortized cost of $1,432,419 and $1,452,715 as of December 31, 2022 and December 31, 2021, respectively)

|

1,429,530

|

1,464,446

|

||||||

|

Cash

|

18,958,445

|

2,491,307

|

||||||

|

Interest receivable

|

2,873,029

|

630,372

|

||||||

|

Deferred financing cost

|

1,474,527

|

291,219

|

||||||

|

Paydown receivable

|

844,269

|

300,968

|

||||||

|

Total assets

|

327,345,951

|

107,354,231

|

||||||

|

LIABILITIES

|

||||||||

|

Credit facility payable

|

153,000,000

|

34,000,000

|

||||||

|

Distributions payable

|

4,351,080

|

1,277,627

|

||||||

|

Credit facility interest payable

|

2,283,546

|

172,096

|

||||||

|

Management fees payable, net of fee waivers (Note 6)

|

1,049,992

|

757,520

|

||||||

|

Professional fees payable

|

195,076

|

111,252

|

||||||

|

Other payables

|

187,230

|

140,409

|

||||||

|

Reimbursement expense payable

|

35,877

|

-

|

||||||

|

Legal fees payable

|

26,377

|

25,132

|

||||||

|

Subscriptions received in advance

|

-

|

482,185

|

||||||

|

Incentive fees payable (Note 6)

|

-

|

225,883

|

||||||

|

Total liabilities

|

161,129,178

|

37,192,104

|

||||||

|

Commitments and contingencies (Note 11)

|

||||||||

|

Net assets

|

$

|

166,216,773

|

$

|

70,162,127

|

||||

|

NET ASSETS

|

||||||||

|

Common shares, $0.001 par value (200,000,000 shares authorized, 6,592,546 and 2,777,449 shares issued and outstanding as of December 31, 2022 and December 31, 2021, respectively)

|

$

|

6,593

|

$

|

2,777

|

||||

|

Contribution receivable

|

(110,891

|

)

|

-

|

|||||

|

Additional paid-in capital

|

164,074,076

|

67,021,165

|

||||||

|

Accumulated undistributed (overdistributed) earnings

|

2,246,995

|

3,138,185

|

||||||

|

Total net assets

|

$

|

166,216,773

|

$

|

70,162,127

|

||||

|

Net asset value per share

|

$

|

25.21

|

$

|

25.26

|

||||

|

For the year ended

December 31, 2022 |

For the period

May 14, 2021* to December 31, 2021 |

|||||||

|

Non-controlled/non-affiliate investment income:

|

||||||||

|

Interest income

|

$

|

20,937,595

|

$

|

4,091,514

|

||||

|

PIK interest income

|

495,426

|

249,427

|

||||||

|

Dividend income

|

181,458

|

94,628

|

||||||

|

Other income

|

257,368

|

-

|

||||||

|

Controlled/affiliate investment income:

|

||||||||

|

Interest income

|

103,756

|

64,423

|

||||||

|

Total investment income:

|

21,975,603

|

4,499,992

|

||||||

|

Operating expenses:

|

||||||||

|

Interest and other financing fees

|

5,798,315

|

325,901

|

||||||

|

Management fees (Note 6)

|

3,467,163

|

757,520

|

||||||

|

Incentive fees (Note 6)

|

1,960,085

|

225,883

|

||||||

|

Professional fees

|

1,356,001

|

387,308

|

||||||

|

General and administrative fees

|

609,391

|

206,855

|

||||||

|

Legal expenses

|

393,131

|

266,709

|

||||||

|

Director expenses

|

89,151

|

50,849

|

||||||

|

Organizational expenses

|

-

|

272,555

|

||||||

|

Total expenses before fee waivers

|

13,673,237

|

2,493,580

|

||||||

|

Management fee waiver (Note 6)

|

(279,725

|

)

|

-

|

|||||

|

Incentive fee waiver (Note 6)

|

(2,185,968

|

)

|

-

|

|||||

|

Total expenses after fee waivers

|

11,207,544

|

2,493,580

|

||||||

|

Net investment income

|

10,768,059

|

2,006,412

|

||||||

|

Net gain (loss):

|

||||||||

|

Net realized gain (loss):

|

||||||||

|

Non-controlled/non-affiliate investments

|

43,607

|

240,492

|

||||||

|

Net realized gain (loss) on investments

|

43,607

|

240,492

|

||||||

|

Net change in unrealized gain (loss):

|

||||||||

|

Non-controlled/non-affiliate investments

|

(803,113

|

)

|

55,911

|

|||||

|

Controlled/affiliate investments

|

(14,620

|

)

|

11,731

|

|||||

|

Net change in unrealized gain (loss) on investments

|

(817,733

|

)

|

67,642

|

|||||

|

Net gain (loss)

|

(774,126

|

)

|

308,134

|

|||||

|

Net increase (decrease) in net assets resulting from operations

|

$

|

9,993,933

|

$

|

2,314,546

|

||||

|

Per common share data:

|

||||||||

|

Net investment income per share - basic and diluted

|

$

|

2.47

|

$

|

0.80

|

||||

|

Net increase (decrease) in net assets resulting from operations per share - basic and diluted

|

$

|

2.29

|

$

|

0.92

|

||||

|

Weighted average shares outstanding - basic and diluted

|

4,351,453

|

2,502,175

|

||||||

|

Common Stock

|

Accumulated

undistributed (overdistributed) earnings

|

|||||||||||||||||||

|

For the period from May 14, 2021* (commencement of operations) to December 31, 2021

|

Number of shares

|

Par value of shares

|

Additional paid-in capital

|

Total net assets

|

||||||||||||||||

|

Balance, May 14, 2021*

|

-

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

-

|

|||||||||||

|

Net investment income

|

-

|

-

|

-

|

2,006,412

|

2,006,412

|

|||||||||||||||

|

Net realized gain (loss)

|

-

|

-

|

-

|

240,492

|

240,492

|

|||||||||||||||

|

Net change in unrealized gain (loss) on investments

|

-

|

-

|

-

|

67,642

|

67,642

|

|||||||||||||||

|

Issuance of common shares

|

3,302,846

|

3,302

|

83,363,852

|

-

|

83,367,154

|

|||||||||||||||

|

Redemption of common shares (1)

|

(543,025

|

)

|

(543

|

)

|

(13,922,611

|

)

|

-

|

(13,923,154

|

)

|

|||||||||||

|

Distributions declared to stockholders

|

-

|

-

|

-

|

(2,042,346

|

)

|

(2,042,346

|

)

|

|||||||||||||

|

Stock issued in connection with dividend reinvestment plan

|

17,628

|

18

|

445,909

|

-

|

445,927

|

|||||||||||||||

|

Return of capital and other tax related adjustments

|

-

|

-

|

(2,865,985

|

)

|

2,865,985

|

-

|

||||||||||||||

|

Balance, December 31, 2021

|

2,777,449

|

$

|

2,777

|

$

|

67,021,165

|

$

|

3,138,185

|

$

|

70,162,127

|

|||||||||||

|

For the year ended December 31, 2022

|

||||||||||||||||||||

|

Balance, December 31, 2021

|

2,777,449

|

$

|

2,777

|

$

|

67,021,165

|

$

|

3,138,185

|

$

|

70,162,127

|

|||||||||||

|

Net investment income

|

-

|

-

|

-

|

10,768,059

|

10,768,059

|

|||||||||||||||

|

Net realized gain (loss)

|

-

|

-

|

-

|

43,607

|

43,607

|

|||||||||||||||

|

Net change in unrealized gain (loss) on investments

|

-

|

-

|

-

|

(817,733

|

)

|

(817,733

|

)

|

|||||||||||||

|

Issuance of common shares

|

3,783,049

|

3,783

|

96,069,648

|

-

|

96,073,431

|

|||||||||||||||

|

Contribution receivable

|

-

|

-

|

(110,891

|

)

|

-

|

(110,891

|

)

|

|||||||||||||

|

Purchases of shares in repurchase offer (2)

|

(99,486

|

)

|

(99

|

)

|

(2,564,654

|

)

|

-

|

(2,564,753

|

)

|

|||||||||||

|

Distributions declared to stockholders

|

-

|

-

|

-

|

(10,682,401

|

)

|

(10,682,401

|

)

|

|||||||||||||

|

Stock issued in connection with dividend reinvestment plan

|

131,534

|

132

|

3,345,195

|

-

|

3,345,327

|

|||||||||||||||

|

Return of capital and other tax related adjustments

|

-

|

-

|

202,722

|

(202,722

|

)

|

-

|

||||||||||||||

|

Balance, December 31, 2022

|

6,592,546

|

$

|

6,593

|

$

|

163,963,185

|

$

|

2,246,995

|

$

|

166,216,773

|

|||||||||||

| * |

Date of Formation of the Company

|

| (1) |

On November 29, 2021, the Company redeemed 543,025 shares of common stock, representing an aggregate value of $13,923,154.

|

| (2) |

For further details please reference Note 10 in the accompanying Notes to Financial Statements.

|

|

For the year ended

December 31, 2022 |

For the period

May 14, 2021* to December 31, 2021 |

|||||||

|

Cash flows from operating activities:

|

||||||||

|

Net increase (decrease) in net assets resulting from operations

|

$

|

9,993,933

|

$

|

2,314,546

|

||||

|

Adjustments to reconcile net increase (decrease) in net assets resulting from operations to net cash provided (used in) operating activities:

|

||||||||

|

Net realized (gain) loss on investments

|

(43,607

|

)

|

(240,492

|

)

|

||||

|

Net change in unrealized (gain) loss on investments

|

817,733

|

(67,642

|

)

|

|||||

|

Net accretion of discounts and amortization of premiums

|

(862,570

|

)

|

(101,958

|

)

|

||||

|

Purchases of investments

|

(217,512,647

|

)

|

(63,820,333

|

)

|

||||

|

Proceeds from sales of investments

|

7,971,150

|

844,010

|

||||||

|

Proceeds from principal payments

|

10,026,750

|

2,559,788

|

||||||

|

Amortization of deferred financing costs

|

440,322

|

37,131

|

||||||

|

Payment-in-kind interest income

|

(495,426

|

)

|

(249,427

|

)

|

||||

|

Changes in operating assets and liabilities:

|

||||||||

|

Interest receivable

|

(2,242,657

|

)

|

(419,381

|

)

|

||||

|

Carried interest payable

|

-

|

(990,732

|

)

|

|||||

|

Management fees payable, net of fee waivers (Note 6)

|

292,472

|

757,520

|

||||||

|

Incentive fees payable (Note 6)

|

(225,883

|

)

|

225,883

|

|||||

|

Credit facility interest payable

|

2,111,450

|

172,096

|

||||||

|

Other payables

|

46,821

|

107,127

|

||||||

|

Professional fees payable

|

83,824

|

117,959

|

||||||

|

Organizational cost payable

|

-

|

(413,685

|

)

|

|||||

|

Legal fees payable

|

1,245

|

(25,132

|

)

|

|||||

|

Reimbursement expense payable

|

35,877

|

-

|

||||||

|

Net cash provided by (used in) operating activities

|

(189,561,213

|

)

|

(59,192,722

|

)

|

||||

|

Cash flows from financing activities:

|

||||||||

|

Proceeds from issuance of common shares, including subscriptions received in advance

|

95,480,355

|

41,634,310

|

||||||

|

Redemption of common shares

|

-

|

(13,923,154

|

)

|

|||||

|

Payments in repurchase of shares

|

(2,564,753

|

)

|

-

|

|||||

|

Proceeds from credit facility

|

188,000,000

|

35,000,000

|

||||||

|

Repayments of credit facility

|

(69,000,000

|

)

|

(1,000,000

|

)

|

||||

|

Distributions paid

|

(4,263,621

|

)

|

(318,792

|

)

|

||||

|

Deferred financing and debt issuance costs paid

|

(1,623,630

|

)

|

(328,350

|

)

|

||||

|

Net cash provided by (used in) financing activities

|

206,028,351

|

61,064,014

|

||||||

|

Net increase (decrease) in Cash

|

16,467,138

|

1,871,292

|

||||||

|

Cash, beginning of period

|

2,491,307

|

620,015

|

||||||

|

Cash, end of period

|

$

|

18,958,445

|

$

|

2,491,307

|

||||

|

Supplemental disclosures of cash flow information:

|

||||||||

|

Non cash operating activities:

|

||||||||

|

Transfer of investments (see Note 1)

|

$

|

-

|

$

|

(42,865,258

|

)

|

|||

|

Transfer of cash (see Note 1)

|

-

|

(620,015

|

)

|

|||||

|

Transfer of carried interest payable (see Note 1)

|

-

|

990,732

|

||||||

|

Transfer of organizational costs payable (see Note 1)

|

-

|

413,685

|

||||||

|

Transfer of other receivables and payables (see Note 1)

|

-

|

(134,173

|

)

|

|||||

|

Interest received in kind

|

495,426

|

249,427

|

||||||

|

Supplemental and non cash financing activities:

|

||||||||

|

Shares issued from BDC conversion (see Note 1)

|

-

|

42,215,029

|

||||||

|

Shares issued from dividend reinvestment plan (see Note 10)

|

3,345,327

|

445,927

|

||||||

|

Supplemental Information:

|

||||||||

|

Cash paid for interest

|

$

|

2,731,891

|

$

|

13,586

|

||||

|

Portfolio Company (1)(2)(3)(4)(5)(6)

|

Footnotes

|

Spread Above Index (7)

|

Interest Rate

|

Acquisition

Date

|

Maturity

|

Principal, Shares,

Units

|

Amortized Cost (8)

|

Fair Value (9)

|

% of Net

Assets |

|||||||||||||||||||||

|

Investments

|

||||||||||||||||||||||||||||||

|

First lien senior secured term loan

|

||||||||||||||||||||||||||||||

|

Aerospace & Defense

|

||||||||||||||||||||||||||||||

|

Consolidated Machine & Tool Holdings, LLC

|

(10)(11

|

) |

L+7.25%

|

12.02

|

%

|

1/15/2020

|

1/15/2025

|

6,175,748

|

$

|

6,094,051

|

$

|

5,844,055

|

3.4

|

%

|

||||||||||||||||

|

|

6,175,748

|

6,094,051

|

5,844,055

|

3.4

|

||||||||||||||||||||||||||

|

Commercial Services & Supplies

|

||||||||||||||||||||||||||||||

|

PPC Event Services, Inc.

|

(20)(21

|

) |

S+6.76%

|

11.35

|

%

|

9/22/2022

|

9/22/2027

|

6,555,917

|

6,470,731

|

6,429,432

|

3.8

|

|||||||||||||||||||

|

Swyft AcquireCo LLC (dba Swyft Filings)

|

(17)(19

|

) |

S+2.75%

|

7.11

|

%

|

12/20/2021

|

12/20/2027

|

306,030

|

301,457

|

304,224

|

0.1

|

|||||||||||||||||||

|

Swyft AcquireCo LLC (dba Swyft Filings)

|

(11)(19

|

) |

S+5.50%

|

9.86

|

%

|

12/20/2021

|

12/20/2027

|

3,682,383

|

3,625,692

|

3,609,840

|

2.1

|

|||||||||||||||||||

|

|

10,544,330

|

10,397,880

|

10,343,496

|

6.0

|

||||||||||||||||||||||||||

|

Construction & Engineering

|

||||||||||||||||||||||||||||||

|

DCCM, LLC

|

(10

|

) |

L+6.90%

|

11.67

|

%

|

8/6/2021

|

12/30/2026

|

18,938,595

|

18,603,528

|

18,838,220

|

11.3

|

|||||||||||||||||||

|

Fremont-Wright, LLC

|

(12

|

) |

L+9.00%

|

13.39

|

%

|

12/2/2020

|

12/2/2024

|

4,615,535

|

4,579,554

|

4,580,171

|

2.8

|

|||||||||||||||||||

|

MechanAir, LLC

|

(10

|

) |

L+10.50%

|

15.27

|

%

|

9/2/2021

|

9/2/2026

|

8,085,096

|

7,904,767

|

6,625,737

|

4.0

|

|||||||||||||||||||

|

Watt Acquisition, LLC

|

(11)(20

|

) |

S+11.25%

|

15.84

|

%

|

4/15/2022

|

4/15/2027

|

3,601,334

|

3,534,629

|

3,588,009

|

2.2

|

|||||||||||||||||||

|

|

35,240,560

|

34,622,478

|

33,632,137

|

20.3

|

||||||||||||||||||||||||||

|

Consumer Finance

|

||||||||||||||||||||||||||||||

|

Microf, LLC

|

(10

|

) |

L+10.75%

|

15.52

|

%

|

3/29/2019

|

6/30/2023

|

3,481,009

|

3,460,009

|

3,481,008

|

2.2

|

|||||||||||||||||||

|

|

3,481,009

|

3,460,009

|

3,481,008

|

2.2

|

||||||||||||||||||||||||||

|

Distributors

|

||||||||||||||||||||||||||||||

|

48forty Intermediate Holdings, Inc.

|

(20

|

) |

S+6.15%

|

10.74

|

%

|

10/11/2022

|

12/1/2026

|

14,962,500

|

14,383,702

|

14,383,702

|

8.7

|

|||||||||||||||||||

|

|

14,962,500

|

14,383,702

|

14,383,702

|

8.7

|

||||||||||||||||||||||||||

|

Diversified Consumer Services

|

||||||||||||||||||||||||||||||

|

Rock Gate Capital, LLC (dba 160 Driving Academy)

|

(10)(21

|

) |

L+7.50%

|

12.27

|

%

|

10/16/2019

|

10/16/2024

|

14,456,337

|

14,281,403

|

14,400,081

|

8.8

|

|||||||||||||||||||

|

|

14,456,337

|

14,281,403

|

14,400,081

|

8.8

|

||||||||||||||||||||||||||

|

Diversified Telecommunication Services

|

||||||||||||||||||||||||||||||

|

Caregility Corporation

|

(10)(18

|

) |

L+9.00%

|

13.77

|

%

|

12/29/2021

|

12/29/2024

|

5,757,839

|

5,362,503

|

4,599,360

|

2.8

|

|||||||||||||||||||

|

Gridsource Incorporated, LLC

|

(10)(20

|

) |

S+8.00%

|

12.59

|

%

|

12/16/2022

|

12/16/2027

|

4,444,444

|

4,281,250

|

4,281,250

|

2.6

|

|||||||||||||||||||

|

YTC Holdings, Inc. (dba Yorktel)

|

(10

|

) |

L+9.75%

|

14.52

|

%

|

9/23/2019

|

9/23/2024

|

3,753,200

|

3,725,056

|

3,753,200

|

2.3

|

|||||||||||||||||||

|

|

13,955,483

|

13,368,809

|

12,633,810

|

7.7

|

||||||||||||||||||||||||||

|

Electrical Equipment

|

||||||||||||||||||||||||||||||

|

Masterwork Electronics, Inc.

|

(20

|

) |

S+7.65%

|

12.24

|

%

|

11/17/2022

|

11/17/2027

|

8,260,870

|

8,099,828

|

8,099,828

|

4.9

|

|||||||||||||||||||

|

|

8,260,870

|

8,099,828

|

8,099,828

|

4.9

|

||||||||||||||||||||||||||

|

Entertainment

|

||||||||||||||||||||||||||||||

|

Chicken Soup For The Soul, LLC

|

(12

|

) |

L+8.50%

|

12.89

|

%

|

10/29/2021

|

3/31/2024

|

6,547,551

|

6,498,009

|

6,547,551

|

3.9

|

|||||||||||||||||||

|

Linden Research, Inc. (dba Linden Labs)

|

(10)(11

|

) |

L+10.59% + 1.62% PIK

|

14.77% Cash + 1.62% PIK

|

12/31/2020

|

12/31/2025

|

4,690,085

|

4,618,458

|

4,703,236

|

2.8

|

||||||||||||||||||||

|

NW Entertainment, LLC

|

(20

|

) |

S+7.76%

|

12.35

|

%

|

11/4/2022

|

11/4/2027

|

6,529,601

|

6,415,333

|

6,415,979

|

3.9

|

|||||||||||||||||||

|

|

17,767,237

|

17,531,800

|

17,666,766

|

10.6

|

||||||||||||||||||||||||||

|

Food Products

|

||||||||||||||||||||||||||||||

|

Uncle John's Pride, LLC

|

(20

|

) |

S+9.11% + 1.00% PIK

|

13.47% Cash + 1.00% PIK

|

3/31/2022

|

3/31/2027

|

5,469,309

|

5,368,762

|

5,370,764

|

3.2

|

||||||||||||||||||||

|

|

5,469,309

|

5,368,762

|

5,370,764

|

3.2

|

||||||||||||||||||||||||||

|

Healthcare Providers & Services

|

||||||||||||||||||||||||||||||

|

Arrow Home Health, LLC (dba Acara Home Health)

|

(10)(13

|

) |

L+8.50%

|

13.27

|

%

|

3/19/2021

|

3/19/2026

|

883,775

|

869,498

|

851,429

|

0.5

|

|||||||||||||||||||

|

Klein Hersh, LLC

|

(11)(20

|

) |

S+7.76%

|

12.35

|

%

|

4/27/2022

|

4/27/2027

|

14,824,494

|

14,582,709

|

13,756,353

|

8.3

|

|||||||||||||||||||

|

|

15,708,269

|

15,452,207

|

14,607,782

|

8.8

|

||||||||||||||||||||||||||

|

Hotels, Restaurants & Leisure

|

||||||||||||||||||||||||||||||

|

The Range NYC, LLC (dba Five Iron Golf)

|

(20)(21

|

) |

S+7.61%

|

12.20

|

%

|

9/15/2022

|

9/15/2027

|

5,042,017

|

4,876,933

|

4,848,856

|

2.9

|

|||||||||||||||||||

|

|

5,042,017

|

4,876,933

|

4,848,856

|

2.9

|

||||||||||||||||||||||||||

|

Household Durables

|

||||||||||||||||||||||||||||||

|

SkyBell Technologies, Inc.

|

(22

|

) |

0.00%

|

0.00

|

%

|

12/13/2019

|

12/13/2024

|

4,839,432

|

4,380,844

|

2,586,687

|

1.6

|

|||||||||||||||||||

|

|

4,839,432

|

4,380,844

|

2,586,687

|

1.6

|

||||||||||||||||||||||||||

|

Household Products

|

||||||||||||||||||||||||||||||

|

Coop Home Goods LLC (dba Coop Home Goods)

|

(11)(20

|

) |

S+8.26%

|

12.85% Cash

|

6/18/2021

|

6/18/2026

|

4,385,303

|

4,319,885

|

3,917,365

|

2.4

|

||||||||||||||||||||

|

|

4,385,303

|

4,319,885

|

3,917,365

|

2.4

|

||||||||||||||||||||||||||

|

IT Services

|

||||||||||||||||||||||||||||||

|

CSI IT, LLC (dba Consulting Solutions)

|

(10

|

) |

L+10.50%

|

15.27

|

%

|

1/29/2021

|

1/29/2026

|

14,100,695

|

13,842,228

|

14,001,990

|

8.4

|

|||||||||||||||||||

|

|

14,100,695

|

13,842,228

|

14,001,990

|

8.4

|

||||||||||||||||||||||||||

|

Leisure Products

|

||||||||||||||||||||||||||||||

|

MPUSA, LLC (dba Mission)

|

(10

|

) |

L+8.50%

|

13.27

|

%

|

12/9/2021

|

12/9/2026

|

4,247,780

|

4,186,414

|

4,229,089

|

2.5

|

|||||||||||||||||||

|

|

4,247,780

|

4,186,414

|

4,229,089

|

2.5

|

||||||||||||||||||||||||||

|

Machinery

|

||||||||||||||||||||||||||||||

|

Texas Contract Manufacturing Group, Inc.

|

(20

|

) |

S+12.11%

|

16.70

|

%

|

4/27/2022