UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

| Date of Report (Date of earliest event reported): | |

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||||

| (Address of principal executive offices) | (Zip Code) | |||||

| Registrant’s telephone number, including area code: | | |||||

_____________________

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) |

Name of each exchange on which registered | ||

| The Capital Market | ||||

| The |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 | Entry into a Material Definitive Agreement. |

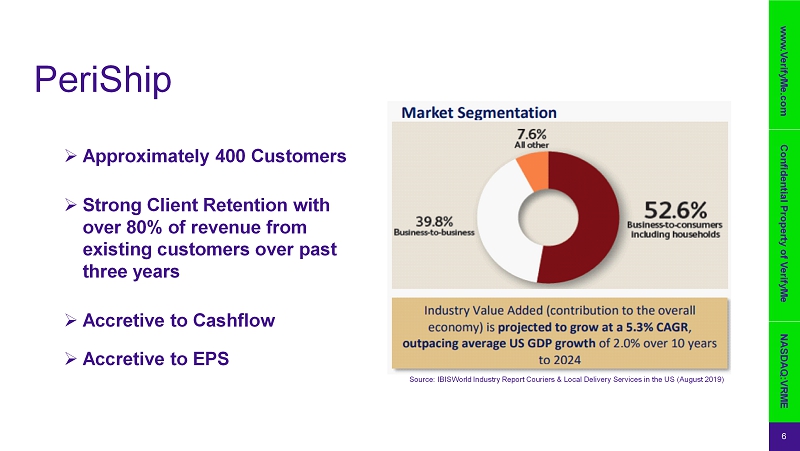

On April 22, 2022, VerifyMe, Inc. (the “Company”) entered into an Asset Purchase Agreement (the “Agreement”) by and among the Company, PeriShip Global, LLC, a Delaware limited liability company and wholly owned subsidiary of the Company (“PeriShip Global”), PeriShip, LLC, a Connecticut limited liability company (“PeriShip” or “Seller”) and Luciano Morra (“Founder”). Pursuant to the terms of the Agreement PeriShip Global agreed to purchase from PeriShip and PeriShip agreed to sell to PeriShip Global substantially all of the assets of PeriShip and certain specified liabilities (the “Transaction”). The Transaction closed simultaneously with the execution of the Agreement on April 22, 2022 (the “Closing”).

The total consideration paid to the Seller in connection with the Transaction was $10,500,000, which consisted of $7,500,000 in cash (the “Cash Consideration”) paid by PeriShip Global; a promissory note issued by PeriShip Global payable to the Seller for $2,000,000 (the “Promissory Note), with a fixed interest rate of 6% per annum on the unpaid principal balance, to be paid in three installments on the sixth, fifteenth, and eighteenth month anniversaries of the Closing and which was guaranteed by the Company (the “Guaranty”); and the issuance of 305,473 shares of restricted common stock of the Company at $3.2736 per share (the “Stock Consideration”) (representing $1,000,000 in Stock Consideration) which was the volume weighted average price (VWAP) of the Company’s Common Stock as reported by Nasdaq for the fifteen (15) trading days ending on the Closing date, inclusive. The amounts due under the Promissory Note may be adjusted as a result of certain post-Closing adjustments or indemnity claims by PeriShip Global pursuant to the Agreement.

The Agreement contains customary confidentiality and indemnification provisions and customary representations, warranties and covenants by the parties for transactions of this type. It also contains a five-year non-compete and non-solicitation provision applicable to the Seller and Founder in favor of the Company and PeriShip Global.

The Promissory Note may be accelerated by the holder upon an Event of Default, as defined in the Promissory Note. Pursuant to the Guaranty, the Company unconditionally guaranteed to the Seller the prompt and unconditional payment of the Promissory Note and any interest thereon, whether at stated maturity, by acceleration or otherwise, any and all sums of money that, at the time, may have become due and payable under the provisions of the Promissory Note, and all expenses that may be paid or incurred by the Seller in the collection of any portion of the Promissory Note or enforcement thereof, including reasonable attorney’s fees.

Also on April 22, 2022, in connection with the closing of the Transaction, PeriShip Global and the Founder entered into a Transition Services Agreement (the “Transition Agreement”) whereby the Founder will provide, or cause Seller’s affiliates, including the Seller, to provide PeriShip Global with all services reasonably necessary in support of completion of the audit of Seller in connection with the public filings required by PeriShip Global and its affiliates, and all services reasonably necessary for the orderly transition of the business from Seller to PeriShip Global, including but not limited to administrative support, marketing support, client relationship management and transition, employee management and transition, and vendor relationship management and transition. The Transition Agreement has an initial term of 90 days and requires payments by PeriShip Global to the Founder of $23,750 per month. PeriShip Global and the Founder may agree to extend the term of the Transition Agreement at which time the compensation for such extended services would be determined.

Also on April 22, 2022, in connection with the closing of the Transaction, PeriShip Global entered into employment agreements with certain executive officers of PeriShip, namely Curt Kole, Fred Volk III and Jack Wang.

Curt Kole, age 68, will serve as PeriShip Global’s Executive Vice President of Sales and Global Strategy. Mr. Kole served as Vice President of Sales and Business Development of the Seller from May 2017 until April 22, 2022 when the Transaction Closed. Mr. Kole has over 30 years of sales, marketing, and leadership experience in the transportation and logistics industry. Having spent over 17 of these years at FedEx® Custom Critical, Mr. Kole was intimately involved in the development of their highly-specialized Cold Chain suite of services and was directly involved in their entry into the Pharmaceutical market. Following his experience at FedEx®, Mr, Kole spent a combined 10 years in the truckload and global cryogenics spaces, has been an established panelist on Cold Chain logistics at numerous industry conferences, and is a current member of both the Parenteral Drug Association and Health and Personal Care Logistics Council.

Fred Volk III, age 54, will continue the role he served at PeriShip and serve as PeriShip Global’s Vice President of Operations. Mr. Volk served as Vice President of Operations of the Seller from September 2001 until April 22, 2022 when the Transaction Closed. As Vice President of Operations Mr. Volk was responsible for PeriShip's system performance and quality control. Mr. Volk has over 22 years of supply chain expertise, which includes many years at FedEx®. Throughout his tenure there, he worked in multiple leadership positions across the Transportation, Logistics, and Customer Service spaces, allowing him to become intimately familiar with the principles required for operational effectiveness. With later experiences in leadership positions at various local law enforcement agencies, Fred's acumen spans from supply chain management to compliance, and beyond.

Jack Wang, age 62, will continue the role he served at PeriShip and serve as PeriShip Global’s Chief Information Officer. Mr. Wang served as Chief Information Officer of the Seller from December 2011 to 2016 and from 2018 until April 22, 2022, when the Transaction Closed. From 2016 to 2018 Mr. Wang served as Chief Information Officer for IMEX Global Solutions, an international logistics company that distributes parcels, publication and business mail worldwide. In addition to the leadership responsibility of daily IT operation, Jack was also responsible for the strategic development of PeriShip's next generation infrastructure and future business plans. Prior to joining PeriShip, Jack served as the head of IT operations and development at the Package Portfolio division of United Parcel Service. At UPS, Jack managed IT services for worldwide package operations. Before UPS, Jack was the managing director of Continental Airlines, where he was responsible for strategic system architecture and development as well as providing IT services for many of the airline's customer facing systems. Many of the core systems that Jack instituted at Continental Airlines were eventually selected as the baseline systems for the new United Airlines. Jack holds a Master's degree in Computer Science from State University of New York at New Paltz.

The Company’s Board of Directors approved Messrs. Kole, Volk and Wang’s appointment subject to Closing of the Transaction and each of them and PeriShip Global entering into his respective employment agreement (each an “Employment Agreement”). Under the Employment Agreements, Messrs. Kole, Volk and Wang’s will receive an annual base salary of $230,000, $200,000 and $189,000, respectively, and a grant of restricted stock units with a grant date value equal to his annual base salary, each such unit representing the contingent right to receive one share of the Company’s common stock, par value $0.001 per share (“Common Stock”), subject to the terms of the Company’s 2020 Equity Incentive Plan (the “Plan”). These restricted stock units, except as otherwise provided in the award agreement, will vest, subject to continuous employment and other conditions, as follows: 50% if the Company’s Common Stock price exceeds $5.00 per share for a period of 20 consecutive days, and the remaining 50% if the Company’s Common Stock price exceeds $7.00 per share for a period of 20 consecutive days, in each case prior to the two-year anniversary of the grant date. The Employment Agreement for Mr. Kole provides for a commission of 1.5% on eligible annual sales in excess of $30,000,000, increasing to 2.0% on eligible annual sales in excess of $32,000,000. The Employment Agreement for Mr. Volk provides for a commission of 1.0% on eligible annual sales in excess of $30,000,000. The Employment Agreement for Mr. Wang provides that he will be eligible for an annual bonus payment at the discretion of the Company. The Employment Agreements each also have an initial term of 2 years, provide for customary indemnification, non-competition, non-disclosure, and severance payments to the executives, along with continuation of employee benefits and disability benefits in the event the executives are terminated under certain circumstances.

None of Messrs. Kole, Volk or Wang have any family relationship with any of the Company's executive officers or members of the Company's Board of Directors. Other than as disclosed herein, there are no arrangements or understandings between Messrs. Kole, Volk or Wang and any other person pursuant to which each was appointed an executive officer of PeriShip Global.

As a condition to the Closing of the Transaction Founder and Seller entered into lock-up agreements, pursuant to which they have agreed not to sell any of the shares of Company common stock constituting Stock Consideration received in the Transaction for a period of 9 months.

Also on April 22, 2022, in connection with the closing of the Transaction, PeriShip Global entered into a lease agreement (the “Lease”), guaranteed by the Company (the “Lease Guarantee”), with Mordo, LLC, a Connecticut limited liability company controlled by the Founder, whereby PeriShip Global will rent the current office space used by the Seller for a term of five years with two options to renew the lease for additional five year terms. Base rent under the Lease is $120,000 per year, payable in equal monthly installments, with annual escalations of 3% for each year following the initial lease year. Rent during any renewal period will be equal to the greater of the base rent as escalated or fair market rental value as provided in the Lease.

The foregoing descriptions of the Agreement, the Promissory Note, the Guaranty, the Transition Agreement, the Employment Agreements, Form of Restricted Stock Unit Award Agreement (Subsidiary Employees), the Lease and Lease Guarantee do not purport to be complete and are qualified in their entirety by reference to the full text of each document, copies of which are included as exhibits to this Current Report on Form 8-K and are incorporated herein by reference.

| Item 2.01 | Completion of Acquisition or Disposition of Assets |

To the extent required by Item 2.01 of Form 8-K, the disclosure in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

| Item 2.03 | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

To the extent required by Item 2.03 of Form 8-K, the disclosure in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

| Item 3.02 | Unregistered Sales of Equity Securities. |

To the extent required by Item 3.02 of Form 8-K, the disclosure in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference. On April 22, 2022, we issued the Stock Consideration to the Seller. The Stock Consideration issued pursuant to the Agreement has not been registered under the Securities Act of 1933 (the “Securities Act”) and has been issued under an exemption from the registration requirements of the Securities Act afforded by Section 4(a)(2) thereof. The Stock Consideration may not be offered or sold in the United States in the absence of an effective registration statement or exemption from applicable registration requirements.

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

To the extent required by Item 5.02 of Form 8-K, the disclosure in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

| Item 7.01 | Regulation FD Disclosure. |

On April 25, 2022, we issued a press release announcing the Transaction. A copy of the press release is being furnished as Exhibit 99.1 to this Current Report on Form 8-K.

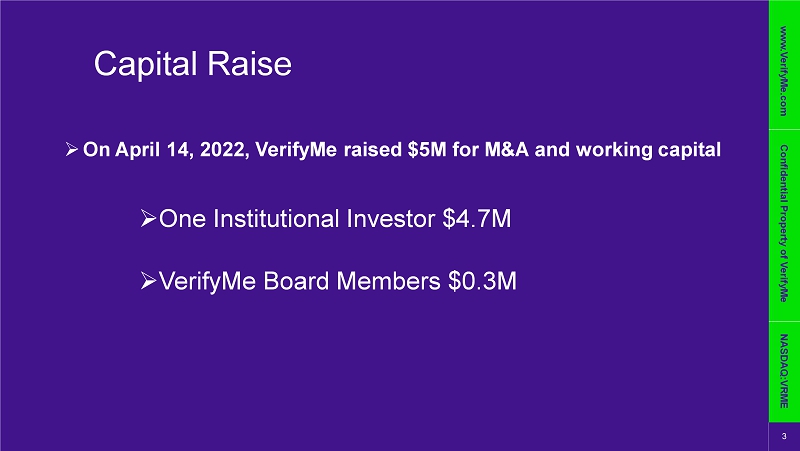

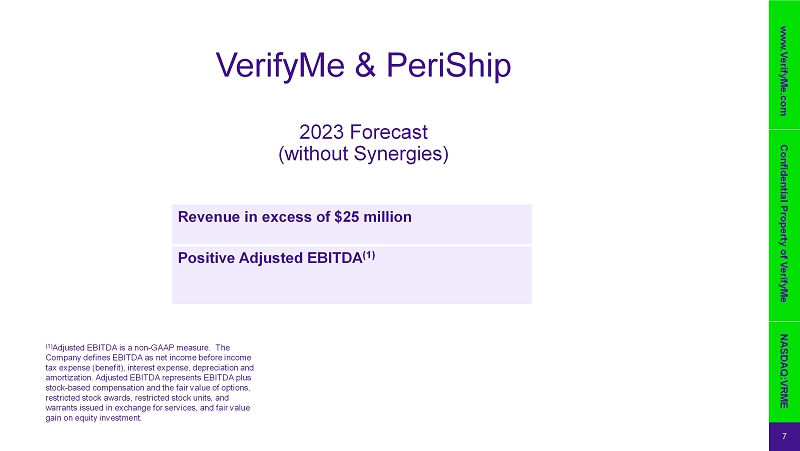

On April 26, 2022, the Company plans to host an Investor Call through a conference call and webcast consisting of a presentation by the Company’s executive management team of the Transaction followed by a question and answer period. The presentation slides and webcast will be archived on the Investors section of the Company’s website and will remain available for 90 days. A copy of the presentation is being furnished as Exhibit 99.2 to this Current Report on Form 8-K.

The information furnished pursuant to this Item 7.01, including Exhibit 99.1 and Exhibit 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under such section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act.

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| VerifyMe, Inc. | |||

| Date: April 26, 2022 | By: | /s/ Patrick White | |

| Patrick White | |||

| Chief Executive Officer | |||

|

ASSET PURCHASE AGREEMENT

by and among

PeriShip Global LLC,

VerifyMe, Inc.,

PeriShip, LLC,

and

Luciano Morra

|

Dated April 22, 2022

| Article I. THE TRANSACTION | 4 | |

| 1.1 | Purchase and Sale of Acquired Assets | 4 |

| 1.2 | Purchase Price | 9 |

| 1.3 | Closing Statement; Adjustment | 10 |

| Article II. CLOSING | 12 | |

| 2.1 | Closing Date | 12 |

| 2.2 | Closing Deliveries | 12 |

| Article III. REPRESENTATIONS AND WARRANTIES OF SELLER AND FOUNDER | 15 | |

| 3.1 | Organization | 15 |

| 3.2 | Authority | 15 |

| 3.3 | No Conflict | 15 |

| 3.4 | Capitalization; Title to Membership Interests | 15 |

| 3.5 | Subsidiaries | 16 |

| 3.6 | Financial Statements; Undisclosed Liabilities | 16 |

| 3.7 | Absence of Certain Changes or Events | 17 |

| 3.8 | Title, Condition and Sufficiency of Assets | 18 |

| 3.9 | Real Property | 19 |

| 3.10 | Accounts Receivable | 20 |

| 3.11 | Intellectual Property; IT Systems | 21 |

| 3.12 | Material Contracts | 22 |

| 3.13 | Consents | 24 |

| 3.14 | Litigation | 24 |

| 3.15 | Compliance with Laws; Permits; Data Security | 24 |

| 3.16 | Environmental Matters | 24 |

| 3.17 | Employee Benefit Matters | 26 |

| 3.18 | Taxes | 28 |

| 3.19 | Anti-Corruption Laws | 30 |

| 3.20 | Employee Relations | 30 |

| 3.21 | Transactions with Related Parties | 32 |

| 3.22 | Insurance | 32 |

| 3.23 | Brokers | 32 |

| 3.24 | Relationship with Significant Customers | 33 |

| 3.25 | Relationship with Significant Suppliers and Vendors | 33 |

| Article IV. REPRESENTATIONS AND WARRANTIES OF BUYER AND PARENT | 33 | |

| 4.1 | Organization | 33 |

| 4.2 | Authority | 34 |

| 4.3 | No Conflict | 34 |

| 4.4 | Consents | 34 |

| 4.5 | Brokers | 35 |

| 4.6 | Sufficiency of Funds; Ability to Satisfy Obligations | 35 |

| Article V. COVENANTS | 35 | |

| 5.1 | Name Change | 35 |

| 5.2 | Confidentiality | 35 |

| 5.3 | Non-Compete | 35 |

| 5.4 | Non-Disparagement | 36 |

| 5.5 | Employee Matters | 36 |

| 5.6 | Further Assurances | 38 |

| 5.7 | Preparation of Audited Financial Statements | 38 |

| 5.8 | Benefit Plan Transition | 39 |

| 5.9 | Qualified Retirement Plans | 39 |

| 5.10 | Parent Guarantee | 39 |

| 5.11 | Stockholder Solicitation | 39 |

| Article VI. Tax Matters | 40 | |

| 6.1 | Allocation | 40 |

| 6.2 | Transfer Taxes | 40 |

| 6.3 | Wage Reporting | 40 |

| 6.4 | Cooperation on Tax Matters | 40 |

| Article VII. SURVIVAL AND INDEMNIFICATION | 41 | |

| 7.1 | Survival | 41 |

| 7.2 | General Indemnification | 41 |

| 7.3 | Process for Indemnification | 43 |

| 7.4 | Mitigation | 44 |

| 7.5 | Right of Offset | 44 |

| 7.6 | Tax Treatment | 44 |

| 7.7 | Release | 44 |

| 7.8 | Exclusive Remedy and Source of Indemnification | 45 |

| Article VIII. MISCELLANEOUS | 45 | |

| 8.1 | Interpretive Provisions | 45 |

| 8.2 | Entire Agreement | 45 |

| 8.3 | Successors and Assigns | 45 |

| 8.4 | Headings | 45 |

| 8.5 | Modification and Waiver | 46 |

| 8.6 | Expenses | 46 |

| 8.7 | Notices | 46 |

| 8.8 | Governing Law; Consent to Jurisdiction | 47 |

| 8.9 | Public Announcements | 47 |

| 8.10 | No Third Party Beneficiaries | 47 |

| 8.11 | Counterparts | 48 |

| 8.12 | Delivery by Facsimile and Email | 48 |

| Article IX. CERTAIN DEFINITIONS | 48 | |

| 9.1 | Defined Terms | 48 |

| 9.2 | Other Definitions | 55 |

| Exhibit A | Form of Bill of Sale; Assignment and Assumption Agreement |

| Exhibit B | Form of Seller’s Note |

| Exhibit C | Form of Transition Services Agreement |

| Exhibit D | Employment Agreements |

THIS ASSET PURCHASE AGREEMENT (this “Agreement”) is made and entered into as of April 22, 2022, by and among PeriShip Global LLC, a Delaware limited liability company (“Buyer”), Buyer’s parent entity, VerifyMe, Inc., a Nevada corporation (“Parent”), PeriShip, LLC, a Connecticut limited liability company taxed as an S-corporation (“Seller”) and Luciano Morra (“Founder”).

RECITALS

A. Seller operates a business specializing in transit management and operational oversight of time and temperature shipments to businesses and consumers.

B. Upon the terms and subject to the conditions set forth herein, Seller proposes to sell and transfer, and Buyer proposes to buy and assume, those assets and liabilities specifically set forth herein, in exchange for the consideration set forth herein.

NOW, THEREFORE, in consideration of the mutual representations, warranties, covenants and agreements contained herein and for other good and valuable consideration, the receipt and adequacy of which are hereby acknowledged, and upon the terms and subject to the conditions hereinafter set forth, the parties hereto, intending to be legally bound hereby, agree as follows:

1.1 Purchase and Sale of Acquired Assets.

(a) Purchase and Sale of Acquired Assets. Subject to the terms and conditions hereof, at the Closing, Seller shall sell, convey, transfer, assign and deliver to Buyer, and Buyer shall purchase from Seller, all of Seller’s right, title and interest in and to all of Seller’s property and assets, real, personal or mixed, tangible and intangible, short-term or long-term of every kind and description, wherever located and whether or not any of such assets have any value for accounting purposes or are carried or reflected on or specifically referred to in Seller’s books of account or financial statements, excluding only the Excluded Assets (the foregoing collectively, the “Acquired Assets”), free and clear of any and all Encumbrances other than Permitted Encumbrances, including all of the following:

(i) all trade and other notes and accounts receivable, advance payments, deposits (including customer deposits), prepaid items and expenses, deferred charges, rights of offset and credits and claims for refund;

(ii) all inventory of raw materials, work in process, parts, subassemblies and finished goods, wherever located and whether or not obsolete or carried on Seller’s books of account, in each case with any transferable warranty and service rights of Seller with respect to such Acquired Assets;

(iii) all personal property and interests therein, wherever located, including all vehicles, tools, parts and supplies, fuel, machinery, equipment, tooling, furniture, furnishings, appliances, fixtures, office equipment and supplies, owned and licensed computer hardware and software and related documentation (including any source code or systems documentation associated therewith), stored data, communication equipment, trade fixtures and leasehold improvements, in each case with any transferable warranty and service rights of Seller with respect to such Acquired Assets;

(iv) all rights under the Contracts set forth on Schedule 1.1(a)(iv) (the “Assumed Contracts”);

(v) telephone and fax numbers, including the ones identified on Schedule 1.1(a)(v);

(vi) all books and records, except as specifically provided by Section 1.1(b)(v);

(vii) all Tax Returns to the extent of, or to the extent maintained for, the Acquired Assets, but excluding any such items if (A) they are included in, or to the extent related to, any Excluded Assets or Retained Liabilities or (B) any Law prohibits their transfer;

(viii) any claims or causes of action of Seller (except those claims or causes of action that are specifically related to and arise in connection with the Retained Liabilities) against any third party relating to the Business or the Acquired Assets, whether choate or inchoate, known or unknown, contingent or non-contingent;

(ix) all trademarks, service marks and trade names of Seller (including the trademarks and trade names “PeriShip”) and any logos, designs, symbols, trade dress or other source indicators associated therewith, any fictitious names, d/b/a’s or similar filings related thereto, or any variant of any of them, all business goodwill associated therewith and any applications therefor or registrations thereof, and any other forms of technology, intangibles, know-how, Intellectual Property or industrial property rights, including any patents, trade secrets, proprietary manufacturing processes, copyrights, rights of publicity, and any licenses, consents or other agreements relating thereto;

(x) any Permits to the extent their transfer is permitted by applicable Law;

(xi) all of Seller’s intangible assets related to the Business, including Seller’s goodwill related to the Business;

(xii) all lists, documents, records and information, in all formats (tangible and intangible) used by Seller and its Affiliates in connection with or otherwise related to the Business, concerning past, present or prospective clients, customers, suppliers, vendors or other business relations of the Business; and

(xiii) all insurance benefits of Seller (except those insurance benefits that are specifically related to and arise in connection with the Retained Liabilities), including rights to make claims and proceeds, arising from or relating to the Business, the Acquired Assets or the Assumed Liabilities prior to the Closing.

| 5 |

Without limiting the generality of the foregoing, the Acquired Assets shall include all of the assets of Seller reflected on the Interim Financial Statements and all assets acquired by Seller since the Balance Sheet Date, except to the extent disposed of in the Ordinary Course of Business since the Balance Sheet Date or except to the extent specifically identified herein as an Excluded Asset.

(b) Excluded Assets. Notwithstanding anything herein to the contrary, from and after the Closing, Seller shall retain all of its right, title and interest in and to, and there shall be excluded from the sale, conveyance, assignment or transfer to Buyer hereunder, and the Acquired Assets shall not include, solely the following assets and properties (such retained assets and properties being the “Excluded Assets”):

(i) all Cash and Restricted Cash;

(ii) all rights under this Agreement and any Ancillary Agreement;

(iii) all of the equity interests in Seller;

(iv) all Benefit Plans, (including all trusts, insurance policies and administration service Contracts related thereto) except for the self-insured medical plan sponsored by Seller and the stop-loss insurance policy associated therewith (“Seller H&W Plans”), and all assets in respect of the Benefit Plans, except for the Seller H&W Plans;

(v) the records pertaining to the organization and existence of Seller;

(vi) any books and records which Seller is required by applicable Law to retain as set forth in Schedule 1.1(b)(vi); provided, however, that Seller shall provide Buyer with copies of all such books and records at or prior to the Closing;

(vii) the assets specifically set forth on Schedule 1.1(b)(vii); and

(viii) the personal assets of Founder immaterial to the operation of the Business in the Ordinary Course.

(c) Assumed Liabilities. Subject to the terms and conditions hereof, at the Closing, Buyer shall, pursuant to a Bill of Sale, Assignment and Assumption Agreement in the form of Exhibit A attached hereto (the “Bill of Sale, Assignment and Assumption Agreement”), assume and agree to fully pay, discharge, satisfy and perform, the following Liabilities of Seller, except in each case to the extent any such Liabilities would have been performed, paid or otherwise discharged on or prior to the Closing Date, but for a breach or default by Seller or Shareholder (the “Assumed Liabilities”):

(i) those working capital liabilities of Seller that were incurred in the Ordinary Course of Business and accrued on the books and records of Seller as of the Closing Date, including accounts payable;

| 6 |

(ii) the Liabilities of Seller arising under or relating to any Assumed Contract to the extent such Liabilities relate to events or occurrences following the Closing Date, were incurred in the ordinary course of business and do not relate to any failure to perform, improper performance, breach of warranty or other breach, default or violation by Seller on or prior to the Closing; and

(iii) the Liabilities under or related to the Seller H&W Plans attributable to the period after the Closing Date, excluding, for the avoidance of doubt (A) any Liabilities attributable to the operational or compliance failures of the Seller H&W Plans arising during the period prior to or on the Closing Date and for claims under the Seller H&W Plans incurred on or prior to the Closing Date to the extent not reimbursed by or paid by a stop loss policy, and (B) notwithstanding (A) above, claims incurred by individuals entitled to COBRA coverage as of the Closing Date (including any “M&A Qualified Beneficiaries” as such term is defined in Treas. Reg. section 54.4980B-9), regardless of when such claim was incurred or paid, to the extent not reimbursed by or paid by a stop loss policy and, only in the case of claims incurred after the Closing Date, less any COBRA premiums (exclusive of the administrative fee) collected from such individual. To the extent that the sum of Liabilities retained by Seller under (A) and (B) exceed $50,000 in the aggregate, the excess shall be an Assumed Liability.

(d) Retained Liabilities. Notwithstanding anything contained herein to the contrary, the Retained Liabilities shall not be assumed by Buyer, but instead shall be retained, performed, paid and discharged by Seller and Shareholder. The term “Retained Liabilities” means all Liabilities of Seller or any of its Affiliates including, without limitation, all Liabilities arising out of the use, ownership, possession or operation of the Acquired Assets or the conduct of the Business on or prior to the Closing Date, excepting only the Assumed Liabilities; provided however that without limiting the foregoing, the Retained Liabilities shall include the following:

(i) except for real or personal property Taxes to the extent reflected as current liabilities on the books and records of Seller as of the Closing Date, any Liability for Taxes incurred by Seller, including the Transfer Taxes as set forth in Section 6.2, and any Liability of Seller for the Taxes of another Person under a contractual indemnity or covenant, as a transferee or otherwise under applicable Tax Laws, regulations or administrative rules;

(ii) any claim or Liability in connection with or arising from or relating to any Excluded Asset, including any Taxes associated therewith;

(iii) any Indebtedness;

(iv) any and all fees, costs and expenses (including legal fees and accounting fees) that have been incurred or that are incurred by Seller or Shareholder in connection with the transactions contemplated by this Agreement, including all fees, costs and expenses incurred in connection with or by virtue of (a) the negotiation, preparation and review of this Agreement (including the exhibits and Schedules hereto) and all Ancillary Agreements (except those between Buyer and current management personnel of Seller), (b) the preparation and submission of any filing or notice required to be made or given in connection with any of the transactions contemplated by this Agreement, and the obtaining of any consent required to be obtained in connection with any of such transactions, and (c) the consummation of the transactions contemplated by this Agreement and the Ancillary Agreements, including any retention bonuses, “success” fees, change of control payments and any other payment obligations payable as a result of or in connection with the consummation of the transactions contemplated by this Agreement and the Ancillary Agreements;

| 7 |

(v) any Liability of Seller to its shareholders respecting dividends, distributions in liquidation, redemptions of interests, option payments or otherwise, and any Liability of Seller pursuant to the agreements and arrangements set forth on Schedule 3.21;

(vi) any Liability of Seller arising out of this Agreement and any Ancillary Agreement;

(vii) any Liability arising out of or relating to any business or property formerly owned or operated by Seller, any Affiliate or predecessor thereof, or by Founder related to the Business, but not presently owned and operated by Seller or Founder;

(viii) (A) any Liability under or related to the Seller H&W Plans attributable to the period on or prior to the Closing Date, including for avoidance of doubt, any Liabilities attributable to the operational or compliance failures of the Seller H&W Plans arising during the period prior to or on the Closing Date and for claims under the Seller H&W Plans incurred on or prior to the Closing Date, (B) any Liability under or related to the Seller H&W Plans for claims incurred by individuals entitled to COBRA coverage as of the Closing Date (including any “M&A Qualified Beneficiaries” as such term is defined in Treas. Reg. section 54.4980B-9), regardless of when such claim was incurred or paid, to the extent not reimbursed by or paid by a stop loss policy and, only in the case of claims incurred after the Closing Date, less any COBRA premiums (exclusive of the administrative fee) collected from such individual, and (C) any Liability under or related to all other Benefit Plans, provided that the maximum aggregate Liability retained by Seller under (A) and (B) shall be $50,000 (such maximum, the “H&W Cap”)

(ix) any Liability of Seller or its predecessors arising out of any Contract, Permit, franchise or claim that is not transferred to Buyer as part of the Acquired Assets or, subject to Section 1.1(e), is not transferred to Buyer because of any failure to obtain any third-party or governmental consent required for such transfer;

(x) any Liability with respect to compensation, severance or benefits of any nature owed to any current or former employee, officer, director, member, partner or independent contractor of Seller or any ERISA Affiliate (or any beneficiary or dependent of any such individual), whether or not employed by Buyer or any of its Affiliates after the Closing, that (A) arises out of or relates to the employment, service provider or other relationship between Seller or ERISA Affiliate and any such individual, including the termination of such relationship, or (B) arises out of or relates to events or conditions occurring on or before the Closing Date;

(xi) any product liability or similar claim for injury to person or property which arises out of or is based upon any express or implied representation, warranty, agreement or guarantee made by Seller or its Affiliates or alleged to have been made by Seller or its Affiliates or which arises out of or is based upon a theory of strict liability under Section 402A of the Restatement (2nd) of Torts or any similar or analogous provision of statutory or common law or which is imposed or asserted to be imposed by operation of law, in connection with any service performed or product manufactured, sold or leased by or on behalf of Seller or its Affiliates, including any claim relating to any product delivered in connection with the performance of such service and any claim seeking recovery for consequential damages, lost revenue or income;

| 8 |

(xii) any general warranty claims against Seller or its Affiliates to the extent not reflected as current liabilities on the books and records of Seller as of the Closing Date;

(xiii) any Seller’s Environmental Liability; and

(xiv) any Liabilities of or relating to the Business (or the operation thereof prior to Closing), ownership or use of the Acquired Assets prior to the Closing.

(e) Nonassignable Assets. Nothing in this Agreement shall be construed as an attempt to assign, and Buyer shall not assume any Liabilities with respect to, any Contract or Permit intended to be included in the Acquired Assets that by applicable Law is non-assignable, or that by its terms is non-assignable without the consent of the other party or parties thereto to the extent such party’s or parties’ consent was not so obtained, or as to which all the remedies for the enforcement thereof enjoyed by Seller would not, as a matter of law, pass to Buyer as an incident of the assignments provided for by this Agreement. Seller and Founder shall, at the request and under the direction of Buyer and in the name of Seller or otherwise (as Buyer shall specify), make commercially reasonable efforts to do or cause to be done all such things as shall in the reasonable judgment of Buyer be necessary or proper (a) to assure that the rights and benefits of Seller under such Contracts or Permits shall be preserved for the benefit of Buyer and (b) to facilitate receipt of the consideration to be received by Seller in and under every such Contract or Permit, which consideration shall be held for the benefit of, and shall be delivered to, Buyer. Notwithstanding the foregoing, provided Seller and/or Founder has exercised commercially reasonable efforts to do so, the failure to receive such consideration shall not be deemed an event of default under this Agreement or any Ancillary Agreement.

1.2 Purchase Price. In full consideration of the purchase of the Acquired Assets, at Closing, Buyer shall:

(a) pay and deliver an amount equal to the Cash Consideration to Seller by wire transfer of immediately available funds to one or more accounts that have been designated in writing by Seller;

(b) issue to Seller the Stock Consideration;

(c) issue to Seller a promissory note in the form attached hereto as Exhibit B made by Buyer in favor of Seller (the “Seller’s Note”);

(d) pay and deliver an amount equal to the Estimated Indebtedness by wire transfer of immediately available funds to the accounts designated by Seller in the Estimated Closing Statement; and

| 9 |

(e) pay and deliver an amount equal to the Estimated Transaction Expenses by wire transfer of immediately available funds to the accounts designated by Seller in the Estimated Closing Statement.

The Seller acknowledges and agrees that Buyer shall be entitled to reduce any cash payments to Seller by all applicable deductions and tax withholdings in respect of the payments pursuant to this Section 1.2.

1.3 Closing Statement; Adjustment.

(a) Delivery of Closing Statement. Within 90 days after the Closing Date, Buyer shall cause to be prepared and shall deliver to Seller a balance sheet of Seller as of the Effective Time prepared in good faith in accordance with the Accounting Methods and a statement (collectively, the “Closing Statement”) setting forth in reasonable detail Closing Indebtedness and Closing Transaction Expenses, with the components thereof prepared in accordance with Accounting Methods.

(b) Cooperation. Each of Seller and Buyer agrees that it will, and it will use reasonable efforts to cause its respective Affiliates, agents and representatives to, cooperate and assist in the preparation of the Closing Statement and the calculation of Closing Indebtedness and Closing Transaction Expenses and in the conduct of the reviews and dispute resolution process referred to in this Section 1.3.

(c) Review Period. During the 30-day period following Seller’s receipt of the Closing Statement, Seller shall be permitted to review the working papers of Buyer relating to the Closing Statement. The Closing Statement and the calculation of Closing Indebtedness and Closing Transaction Expenses shall become final and binding upon the parties on the 30th day following delivery thereof, unless Seller gives written notice of its disagreement with the Closing Statement (“Notice of Disagreement”) to Buyer prior to such date, which notice, to be valid, must comply with this Section 1.3. Any Notice of Disagreement shall (i) specify in reasonable detail the nature of any disagreement so asserted, and include all supporting schedules, analyses, working papers and other documentation, (ii) include only disagreements based on Closing Indebtedness or Closing Transaction Expenses not being calculated in accordance with Section 1.3, (iii) specify the line item or items in the calculation of Closing Indebtedness or Closing Transaction Expenses with which Seller disagrees and the amount of each such line item or items as calculated by Seller, and (iv) include Seller’s calculation of Closing Indebtedness or Closing Transaction Expenses. Seller shall be deemed to have agreed with all items and amounts included in the calculation of the Closing Indebtedness and Closing Transaction Expenses delivered pursuant to Section 1.1(a) except such items that are specifically disputed in the Notice of Disagreement.

| 10 |

(d) Resolution of Disputes. If Seller delivers, in a timely manner, a Notice of Disagreement pursuant to this Section 1.1(c), then the Closing Statement (as revised in accordance with this Section 1.1(d)), and the resulting calculation of Closing Indebtedness and Closing Transaction Expenses resulting therefrom, shall become final and binding upon the parties on the earlier of (a) the date any and all matters specified in the Notice of Disagreement are finally resolved in writing by Seller and Buyer and (b) the date any and all matters specified in the Notice of Disagreement not resolved by Seller and Buyer are finally resolved in writing by the Arbiter. The Closing Statement shall be revised to the extent necessary to reflect any resolution by Seller and Buyer and any final resolution made by the Arbiter in accordance with this Section 1.1(d). During the 30-day period following the delivery of a timely Notice of Disagreement or such longer period as Seller and Buyer shall mutually agree, Seller and Buyer shall seek in good faith to resolve in writing any differences that they may have with respect to the matters specified in the Notice of Disagreement. If, at the end of such 30-day period (or such longer period as mutually agreed by Seller and Buyer), Seller and Buyer have not so resolved such differences, Seller and Buyer shall submit the dispute for resolution to an independent accounting or valuation firm (the “Arbiter”) for review and resolution of any and all matters which remain in dispute and which were included in the Notice of Disagreement in accordance with this Section 1.3. The Arbiter shall be a mutually acceptable nationally recognized independent public accounting or valuation firm agreed upon by Seller and Buyer in writing; provided, that in the event the parties are not able to mutually agree on an accounting or valuation firm, the Arbiter shall be The Bonadio Group. Seller and Buyer shall use reasonable efforts to cause the Arbiter to render a decision resolving the matters in dispute within 30 days following the submission of such matters to the Arbiter, or such longer period as Seller and Buyer shall mutually agree. Seller and Buyer agree that the determination of the Arbiter shall be final and binding upon the parties and that judgment may be entered upon the determination of the Arbiter in any court having jurisdiction over the party against which such determination is to be enforced; provided, that the scope of the disputes to be resolved by the Arbiter is limited to only such items included in the Closing Statement that Seller has properly disputed in the Notice of Disagreement based upon Closing Indebtedness or Closing Transaction Expenses not having been calculated in accordance with this Section 1.3. The Arbiter shall determine, based solely on presentations by Buyer and Seller and their respective representatives, and not by independent review, only those issues in dispute specifically set forth on the Notice of Disagreement and shall render a written report as to the dispute and the resulting calculation of Closing Indebtedness and Closing Transaction Expenses which shall be conclusive and binding upon the parties. In resolving any disputed item, the Arbiter: (i) shall be bound by the principles set forth in this Section 1.3, (ii) shall limit its review to the line items and items specifically set forth in and properly raised in the Notice of Disagreement and (iii) shall not assign a value to any line item or items greater than the greatest value for such item claimed by either party or less than the smallest value for such item claimed by either party. The fees, costs, and expenses of the Arbiter (i) shall be borne by Seller in the proportion that the aggregate dollar amount of such disputed items so submitted that are unsuccessfully disputed by Seller (as finally determined by the Arbiter) bears to the aggregate dollar amount of such items so submitted and (ii) shall be borne by Buyer in the proportion that the aggregate dollar amount of such disputed items so submitted that are successfully disputed by Seller (as finally determined by the Arbiter) bears to the aggregate dollar amount of such items so submitted. The fees, costs and expenses of Buyer’s independent accountants incurred in connection with the preparation of the Closing Statement and review of any Notice of Disagreement shall be borne by Buyer, and the fees, costs and expenses of Seller’s independent accountants incurred in connection with their review of the Closing Statement and preparation of any Notice of Disagreement shall be borne by Seller.

| 11 |

(e) Closing Consideration Adjustment.

(i) If the Final Closing Consideration is greater than the Estimated Closing Consideration, then the principal amount of the Seller’s Note shall be increased by an amount equal to such excess.

(ii) If the Final Closing Consideration is less than the Estimated Closing Consideration, then the principal amount of the Seller’s Note shall be decreased by an amount equal to such deficiency.

2.1 Closing Date. The closing of the transactions contemplated hereby (the “Closing”) shall take place at the offices of Harter Secrest & Emery LLP in Rochester, New York (or at such other place as is agreed in writing by Buyer and Seller Parties), or via electronic transmittal of documents, on the date hereof (the “Closing Date”). For financial accounting and tax purposes, to the extent permitted by Law, the Closing shall be deemed to have become effective as of 11:59 p.m. on the Closing Date (the “Effective Time”).

(a) Deliveries by Buyer. At the Closing, Buyer shall deliver or cause to be delivered the following to Seller:

(i) this Agreement, duly executed by Buyer;

(ii) the amounts set forth in Section 1.1;

(iii) the Seller’s Note, duly executed by Buyer;

(iv) a guaranty of the Seller’s Note, in the form mutually acceptable to Parent and the Seller (the “Note Guaranty”), duly executed by Parent;

(v) the Bill of Sale; Assignment and Assumption Agreement, duly executed by Buyer;

(vi) the Transition Services Agreement in the form of Exhibit C attached hereto (the “Transition Services Agreement”) by and between Buyer and Founder, duly executed by Buyer;

(vii) the Employment Agreements, each duly executed by Buyer;

(viii) a lease agreement, in the form mutually acceptable to Buyer and the landlord of the Seller’s premises (the “Lease Agreement”), duly executed by Buyer;

| 12 |

(ix) a guaranty of the Lease Agreement, in the form mutually acceptable to Parent and the landlord of the Seller’s premises (the “Lease Guaranty”), duly executed by Parent;

(x) certificates of a duly authorized officer of each of Buyer and Parent, dated as of the Closing Date, (A) attaching true and correct copies of Buyer’s and Parent’s respective formation and organizational documents as of the Closing Date; (B) attaching resolutions of the manager (or other governing body) of each of Buyer and Parent authorizing the execution, delivery and performance of this Agreement, the Guaranteed Obligations (as defined in Section 5.10) and each of the other transaction documents and the consummation of the transactions contemplated hereby and thereby; and (C) certifying that such resolutions have not been amended, terminated or superseded;

(xi) with respect to each of Buyer and Parent, a certificate of good standing or legal existence dated not more than ten (10) days prior to the Closing Date from the Secretary of State of the state in which such entity was formed or organized, attesting to the good standing in such state;

(xii) such transaction documents, agreement or instruments executed by Parent as may be reasonably necessary to effectuate or evidence the Guaranteed Obligations (as defined in Section 5.10); and

(xiii) such other agreements, certificates and documents as may be reasonably requested by Seller to effectuate or evidence the transactions contemplated hereby.

(b) Deliveries by Seller. At the Closing, Seller shall deliver or cause to be delivered the following to Buyer:

(i) this Agreement, duly executed by Seller and Founder;

(ii) the Bill of Sale; Assignment and Assumption Agreement, duly executed by Seller;

(iii) a trademark assignment, in a form acceptable to Buyer, duly executed by Seller;

(iv) the Transition Services Agreement, duly executed by Founder;

(v) the Employment Agreements, each duly executed by the respective Key Employee;

(vi) duly executed lock up agreements, in a form acceptable to Buyer (the “Lock Up Agreements”);

(vii) the Lease Agreements, duly executed by the landlord of Seller’s premises;

| 13 |

(viii) a certificate of the sole member and manager of Seller, dated as of the Closing Date, (A) attaching true and correct copies of the certificate of organization and operating agreement of Seller as of the Closing Date; (B) attaching resolutions of the manager (or other governing body) of Seller authorizing the execution, delivery and performance of this Agreement and each of the other transaction documents and the consummation of the transactions contemplated hereby and thereby; and (C) certifying that such resolutions have not been amended, terminated or superseded;

(ix) a certificate of legal existence dated not more than ten (10) days prior to the Closing Date from (i) the Secretary of State of the State of Connecticut, attesting to the legal existence in Connecticut of Seller, and (ii) the secretary of state of each other state attesting to the good standing of Seller in each other state where Seller is qualified to do business;

(x) a duly executed non foreign affidavit by Seller, dated as of the Closing Date, sworn under penalty of perjury and in form and substance reasonably satisfactory to Buyer and required under the Treasury Regulations issued pursuant to Section 1445 and Section 1446(f) of the Code, certifying that such issuer is a not a “foreign person” as defined in Section 1445(f)(3) of the Code;

(xi) such lien releases or other written evidence reasonably satisfactory to Buyer, evidencing the release of all Encumbrances on the assets of Seller that are not Permitted Encumbrances;

(xii) offer letters of Buyer executed by no less than 90% of Seller’s employees;

(xiii) subject to confirmation that Buyer’s 401(k) plan allows for the rollover of account balances and participant loans, evidence that Seller has exercised reasonable commercial efforts to allow for the rollover of account balances (including outstanding loans) under the PeriShip, LLC 401(k) Plan (the “401(k) Plan”) to the Buyer’s 401(k) plan and to avoid all outstanding loans under the 401(k) Plan from defaulting as a result of the transaction and/or the termination of employment by participants in connection with the transaction; and

(xiv) subject to Section 1.1(e), the consents, if any, set forth on Schedule 3.3 of the Disclosure Schedules in forms reasonably acceptable to Buyer;

(xv) such payoff letters, lien releases or other written evidence reasonably satisfactory to Buyer, evidencing the release of all Encumbrances on the Acquired Assets that are not Permitted Encumbrances;

(xvi) the requisite documents required to effectuate the transfer of the sponsorship of the Seller H&W Plans and the rights under the Contracts set forth in Schedule 3.12(a)(xiv) to Buyer; and

(xvii) such other agreements, certificates and documents as may be reasonably requested by Buyer to effectuate or evidence the transactions contemplated hereby.

| 14 |

Article III.

REPRESENTATIONS AND WARRANTIES OF SELLER AND FOUNDER

Subject to the terms and conditions of this Agreement, including, without limitation, Article VII, each of Seller and Founder, jointly and severally, hereby represents and warrants to Buyer as follows:

3.1 Organization. Seller is a limited liability company duly organized and validly existing under the laws of the State of Connecticut. Seller has all requisite entity power and authority to carry on the Business. Seller is duly qualified to do business and is in good standing as a foreign limited liability in all jurisdictions where the nature of the property owned or leased by it or the nature of the business conducted by it makes such qualification necessary, except where the failure to be so qualified can be cured without material expense and will not render any Material Contract of Seller unenforceable. Seller has delivered true and complete copies of the articles of organization, operating agreement and all other organizational or governance documents of Seller, all as amended to date, to Buyer.

3.2 Authority. Each of Seller and Founder has all requisite power, authority and capacity to execute, deliver, and perform this Agreement and each Ancillary Agreement to which Seller or Founder is a party, and to consummate the transactions contemplated hereby and thereby. This Agreement, and each Ancillary Agreement to which Seller or Founder is a party, has been duly and validly executed and delivered by Seller or Founder and constitutes the valid and binding obligation of Seller or Founder, enforceable against Seller or Founder in accordance with its respective terms, except as such enforcement shall be limited by bankruptcy, insolvency, moratorium or similar law affecting creditors’ rights generally and subject to general principles of equity.

3.3 No Conflict. The execution, delivery and performance by Seller and Founder of this Agreement and the Ancillary Agreements to which each of Seller or Founder is a party, and the consummation by Seller and Founder of the transactions contemplated hereby and thereby does not and will not, with or without the giving of notice or the lapse of time, or both, (x) violate any provision of any Law to which Seller or Founder is subject, (y) violate any provision of the articles of organization, operating agreement or other organizational or governance documents of Seller, or (z) violate or result in a breach of or constitute a default (or an event which might, with the passage of time or the giving of notice, or both, constitute a default) under, or require the consent of any third party under, or result in or permit the termination or amendment of any provision of, or result in or permit the acceleration of the maturity or cancellation of performance of any obligation under, or result in the creation or imposition of any Encumbrance of any nature whatsoever upon any of the assets of Seller or Founder or give to others any interests or rights therein under, any Contract or Permit to which Seller or Founder is a party or by which Seller or Founder may be bound or affected.

3.4 Capitalization; Title to Membership Interests.

(a) Seller is a single-member limited liability company, and Founder is the sole member. All issued and outstanding membership interests of Seller have been duly authorized, are validly issued, fully paid and non-assessable, and are owned of record and beneficially by Founder, as the sole member, free and clear of all Encumbrances.

| 15 |

(b) There are no outstanding or authorized options, warrants, convertible securities or other rights, agreements, arrangements or commitments of any character relating to the capital stock of Seller or obligating Seller or Founder to issue or sell any shares of capital stock of, or any other interest in, Seller. Seller does not have outstanding or authorized any stock appreciation, phantom stock, profit participation, equity grant or ownership plans or similar rights. There are no voting trusts, stockholder agreements, proxies or other agreements or understandings in effect with respect to the voting or transfer of any of the Acquired Assets.

3.5 Subsidiaries. Seller does not (i) directly or indirectly own any stock of, equity interest in, or other investment in any other corporation, joint venture, partnership, trust or other Person or (ii) have any subsidiaries or any predecessors in interest by merger, liquidation, reorganization, acquisition or similar transaction.

3.6 Financial Statements; Undisclosed Liabilities.

(a) The books of account and related records of Seller fairly reflect in all material respects Seller’s assets, liabilities and transactions. Schedule 3.6 sets forth the following financial statements (the “Financial Statements”): (x) the balance sheets of Seller as of December 31, 2020, 2019 and 2018 and the related statements of income and stockholder’s equity and cash flows for the years ended December 31, 2020, 2019 and 2018, and (y) the balance sheet of Seller as of the Balance Sheet Date, and the related statements of income and Founder’s equity and cash flows for the three (3)-month period ended on the Balance Sheet Date (the “Interim Financial Statements”). The Financial Statements and Interim Financial Statements fairly present, in all material respects, the financial position of Seller and the results of its operations and cash flows as of the respective dates and for the respective periods indicated therein and have been prepared consistent with Seller’s historical accounting methods, applied in a manner consistent with past principles and practices, including with respect to the preparation of the Financial Statements. The Interim Financial Statements fairly present, in all material respects, the financial position of Seller and the results of its operations and cash flows as of the respective dates and for the respective periods indicated therein and have been prepared consistent with Seller’s historical accounting methods, applied in a manner consistent with past principles and practices, except that the Interim Financial Statements are subject to normal year-end adjustments, none of which are expected to be material in amount or nature. The Financial Statements and Interim Financial Statements have been prepared from and are in accordance with the books and records of Seller.

(b) Seller does not have any liabilities except for (a) liabilities reflected on or accrued and reserved against in the Balance Sheet, or (b) liabilities incurred in the Ordinary Course of Business after the Balance Sheet Date (none of which is material or results from, arises out of, or relates to any material breach or violation of, or default under, a contractual obligation or requirement of Law).

(c) Seller is not a party to, nor has it any commitment to become a party to: (i) any joint venture, off-balance sheet partnership, or any similar Contract or arrangement (including any Contract or arrangement relating to any transaction or relationship between or among Seller, on the one hand, and any other Person, including any structured finance, special purpose, or limited purpose Person, on the other hand); or (ii) any “off-balance sheet arrangements” (as defined in Item 303(a) of Regulation S-K promulgated by the U.S. Securities and Exchange Commission).

| 16 |

3.7 Absence of Certain Changes or Events. Except as set forth on Schedule 3.7, since December 31, 2020, Seller has conducted its business only in the Ordinary Course of Business and there has not been a Material Adverse Effect. Without limiting the foregoing, except as set forth on Schedule 3.7, since December 31, 2020, Seller has not

(a) issued, purchased or redeemed any of its equity securities, or granted or issued any option, warrant or other right to purchase or acquire any such equity securities;

(b) incurred or discharged any liabilities, except liabilities incurred or discharged in the Ordinary Course of Business;

(c) encumbered any of its properties or assets, tangible or intangible, except for Encumbrances incurred in the Ordinary Course of Business;

(d) (i) granted any increase in the salaries (other than normal increases for employees averaging not in excess of five percent per annum made in the Ordinary Course of Business) or other compensation or benefits payable or to become payable to, or any advance (excluding advances for ordinary business expenses consistent with past practice) or loan to, any officer, director, shareholder, member, partner, employee or independent contractor of Seller, (ii) made any payments to any pension, retirement, profit-sharing, bonus or similar plan except payments in the Ordinary Course of Business made pursuant to the Benefit Plans, (iii) granted or made any other payment of any kind to or on behalf of any officer, director, member, partner, shareholder, employee or independent contractor other than payment of base compensation and reimbursement for reasonable expenses in the Ordinary Course of Business or (iv) adopted, amended or terminated any employee benefit plan (including any Benefit Plan) or any stay bonus, retention bonus, transaction bonus or change in control bonus plan or arrangement, other than, in any case, amendments required by applicable Law;

(e) suffered any change or, to the knowledge of Seller, received any written threat of any change in any of its relations with, or any loss or, to the knowledge of Seller, written threat of loss of, any of the suppliers, clients, distributors, customers or employees that in the aggregate are material to the Business;

(f) disposed of or has failed to keep in effect any rights in, to or for the use of any Permit material to the Business;

(g) changed any method of keeping of their respective books of account or accounting practices;

| 17 |

(h) disposed of or failed to keep in effect any rights in, to or for the use of any of the Intellectual Property material to the Business;

(i) sold, transferred or otherwise disposed of any assets, properties or rights of the Business, except inventory sold in the Ordinary Course of Business;

(j) entered into any transaction, Contract or event outside the Ordinary Course of Business or with any partner, shareholder, member, officer, director or other Affiliate of Seller;

(k) made nor authorized any single capital expenditure in excess of $10,000, or capital expenditures in excess of $50,000 in the aggregate outside the Ordinary Course of Business;

(l) changed or modified in any manner its existing credit, collection and payment policies, procedures and practices with respect to accounts receivable and accounts payable, respectively, including acceleration of collections of receivables, failure to make or delay in making collections of receivables (whether or not past due), acceleration of payment of payables or failure to pay or delay in payment of payables;

(m) incurred any material damage, destruction, theft, loss or business interruption;

(n) made any declaration, payment or setting aside for payment of any distribution (whether in equity or property) with respect to any securities or interests of Seller;

(o) made (except as consistent with past practice) or revoked any Tax election or settled or compromised any material Tax liability with any Taxing Authority; or

(p) waived or released any material right or claim of Seller or incurred any modifications, amendments or terminations of any Contracts which are in the aggregate materially adverse to Seller or the Business.

3.8 Title, Condition and Sufficiency of Assets.

(a) Schedule 3.8(a) sets forth a true and correct list of all equipment leases that have been or should be, in accordance with the Accounting Methods, recorded as capital leases including the amount required to pay in full all obligations in respect of each such lease as of the Closing Date (“Equipment Leases”). Seller has good and valid title to, or a valid leasehold interest in, all property and other assets used in the operation of the Business, reflected in the Financial Statements or acquired after the Balance Sheet Date, other than properties and assets sold, consumed or otherwise disposed of in the Ordinary Course of Business since the Balance Sheet Date, free and clear of all Encumbrances, except for Permitted Encumbrances.

(b) Except as set forth on Schedule 3.8(b), the buildings, plants, structures, fixtures, machinery, equipment, vehicles and other items of tangible personal property of Seller are in a condition and repair (except for ordinary wear and tear and routine maintenance in the Ordinary Course of Business), are adequate for the purposes for which they are presently used in the conduct of the Business and are usable in a manner consistent with their current use, and, to the knowledge of Seller, comply in all material respects with all applicable Laws. The buildings, plants, structures, fixtures, machinery, equipment, vehicles and other items of tangible personal property of Seller currently owned or leased by Seller constitute all of the assets, properties and rights necessary for the operation of the Business as the Business is currently conducted. Except as set forth on Schedule 3.8(b), no other Person other than Seller owns any assets, properties and rights used in the Business, other than assets owned by third parties and used in the Business pursuant to a Material Contract identified on Schedule 3.12.

| 18 |

(a) Seller does not own any real property.

(b) Schedule 3.9(b)(i) sets forth a true, correct and complete description of all written or oral leases, subleases, or other occupancies of real property used by Seller (collectively, the “Leases”) to which Seller is a party (as lessee, sublessee, licensee or otherwise) (collectively, the “Leased Real Property”) with a brief description of such lease or sublease including, without limitation, the parties to the lease, the term of the lease, the current expiration date of the lease, the renewal options, the basic rent, and any monthly payments of additional rent. Seller does not operate and has never operated its Business at any location other the Leased Real Property. Seller has delivered to Buyer a true, correct and complete copy of the Leases and all amendments, modifications and supplemental agreements thereto. Each of the Leases is in full force and effect and is binding and enforceable against Seller and, to the knowledge of Seller, each of the other parties thereto, in accordance with its terms and has not been modified or amended since the date of delivery to Buyer.

(c) Except as set forth on Schedule 3.9(c), there are no Encumbrances affecting the Leased Real Property, other than Permitted Encumbrances. No party to any Lease has sent written notice to the other claiming that such party is in default thereunder. There has not occurred any event which would constitute a breach of or default in the performance of any covenant, agreement or condition contained in any Lease, nor has there occurred any event which with the passage of time or the giving of notice or both would constitute such a breach or default. There is no current or pending event or circumstance that would permit the termination of any Lease or the increase of any liabilities or restrictions of Seller under any Lease. Neither Seller nor Founder has received any written notice from the other party to any Lease of the termination or proposed termination thereof. No construction, alteration or other leasehold improvement work with respect to any Lease remains to be paid for or to be performed by Seller. Seller does not have any obligations to provide deposits, letters of credit or other credit enhancements to retain its rights under any Lease or otherwise operate the Business at the Leased Real Property.

(d) Seller presently enjoys peaceful and undisturbed possession of the Leased Real Property. No Person other than Seller has any right to use, occupy, or lease any portion of the Leased Real Property. Neither Seller nor Founder has received written notice of any eminent domain, condemnation or other similar proceedings pending or threatened against Seller with respect to, or otherwise affecting any portion of, the Leased Real Property. The current use of the Leased Real Property in the conduct of the Business does not violate any Lease in any respect. Seller has not received any written notice that there is a violation of any covenant, condition, restriction, easement or order of any Authority having jurisdiction over the Leased Real Property or the use or occupancy thereof. To the knowledge of Seller, the Leased Real Property is in compliance in all material respects with all applicable building, zoning, subdivision, health and safety and other land use and similar applicable Laws, rules and regulations, permits, licenses and certificates of occupancy affecting the Leased Real Property, and neither Seller nor Founder has received any written notice of any violation or claimed violation Seller of any such Laws, rules and regulations with respect to the Leased Real Property which have not been resolved or for which any obligation of Seller remains to be fulfilled, including but not limited to payments of monetary damages, fines or penalties, or completion of any remedial or corrective measures. The Leased Real Property is served by proper utilities, sufficient parking and other building services necessary for its current use.

| 19 |

(e) Each use of the Leased Real Property by Seller is and has been valid, permitted and conforming uses in accordance with the current zoning classification of the Leased Real Property, and there are no outstanding variances or special use permits affecting the Leased Real Property or their uses.

(f) The transaction contemplated by this Agreement does not constitute an assignment of Seller’s rights under any Lease and does not require the consent of any Person under any Lease.

(g) The Leased Real Property is in good repair, ordinary wear and tear excepted, and fit for the purposes for which it is presently used. Seller has rights of egress and ingress with respect to the Leased Real Property that are sufficient for it to conduct its Business as presently conducted consistent with past practice.

(a) All of Seller’s accounts and notes receivable reflected on the Balance Sheet and the accounts and notes receivable arising after the date thereof (collectively, the “Accounts Receivable”) represent amounts receivable for products actually delivered or services actually provided (or, in the case of non-trade accounts or notes represent amounts receivable in respect of other bona-fide business transactions), have arisen in the Ordinary Course of Business and have been or will be billed and are generally due within thirty (30) days after such billing. Except as set forth on Schedule 3.10(a), all of the Accounts Receivable are and will be fully collectible within the time period set forth in each applicable invoice, purchase order or other sales contract, net of the reserves shown on the Balance Sheet (or in the books of Seller if such Accounts Receivable were created after the Balance Sheet Date). The reserve for bad debts shown on the Balance Sheet or, with respect to Accounts Receivable arising after the Balance Sheet Date, in the books of Seller, have been determined in accordance with the Accounting Methods, consistently applied, subject to normal year-end adjustments and the absence of disclosures normally made in footnotes. To the knowledge of Seller, there is no contest, claim, or right of set-off under any Contract with any obligor of a material Account Receivable relating to the amount or validity of such Account Receivable.

(b) Except as set forth on Schedule 3.10(b), since December 31, 2020, there have not been any write-offs as uncollectible of Seller’s accounts receivable except for write-offs in the Ordinary Course of Business and not in excess of $10,000 in the aggregate.

| 20 |

3.11 Intellectual Property; IT Systems.

(a) Schedule 3.11(a)(i) sets forth a list of all patents, patent applications (including any provisional applications, divisions, continuations or continuations in part), material unregistered trademarks, registered trademarks and applications for registration for trademarks, copyright registrations and applications for registration of copyrights, and domain name registrations in each case owned by or held in the name of Seller, specifying as to each such item, as applicable, (i) the item (with respect to trademarks), or title (with respect to all other items), (ii) the owner of the item, (iii) the jurisdiction in which the item is issued or registered or in which any application for issuance or registration has been filed, including the respective issuance, registration or application number and (iv) the date of application and issuance or registration of the item (the “Material Owned Intellectual Property”). Except as set forth on Schedule 3.11(a)(ii), (A) each item of Intellectual Property owned by Seller including the Material Owned Intellectual Property is valid and in full force and effect and is owned by Seller free and clear of all Encumbrances and other claims, including any claims of joint ownership or inventorship, (B) the registrations and applications for registration of the Material Owned Intellectual Property are held of record in Seller’s name, and (C) none of the Material Owned Intellectual Property is the subject of any proceeding contesting its validity, enforceability or Seller’s ownership thereof. All issuance, renewal, maintenance and other payments that are or have become due as of the date hereof with respect to the Material Owned Intellectual Property have been timely paid by or on behalf of Seller. Schedule 3.11(a)(iii) sets forth a true and complete list of all Intellectual Property licensed to Seller and the license or agreement pursuant to which Seller obtained a license to such Intellectual Property. Except as set forth on Schedule 3.11(a)(iii): (u) Seller owns or possesses adequate licenses or other valid rights to use all patents, patent applications, trademarks, trademark applications, copyrights, industrial designs, software, databases, data compilations, domain names, know-how, trade secrets, product formulas, inventions, rights-to-use and other industrial and intellectual property rights (collectively, “Intellectual Property”) used in the conduct of the Business, (v) to the knowledge of Seller, the conduct of the Business of Seller does not infringe, misappropriate, dilute or conflict with, and has not conflicted with any Intellectual Property of any other Person, (w) neither Seller nor Founder has received any written notice alleging that the conduct of the Business, including the marketing, sale and distribution of the products and services of the Business, infringes, dilutes, misappropriates or otherwise violates any Person’s Intellectual Property (including, for the avoidance of doubt, any cease and desist letter or offer of license), (x) no current or former employee of Seller and no other Person owns or has any proprietary, financial or other interest, direct or indirect, in whole or in part, and including any rights to royalties or other compensation, in any of Intellectual Property owned or purported to be owned by Seller, (y) there is no agreement or other contractual restriction affecting the use by Seller of any of the Intellectual Property owned or purported to be owned by Seller, and (z) Seller has not received any written notice concerning any present claim of infringement, dilution, misappropriation or other violation of any of the Intellectual Property owned or purported to be owned by Seller by any Person, and neither Seller nor Founder has asserted or threatened any written claim or objection against any Person for any such infringement or misappropriation nor, to the knowledge of Seller or Founder, is there any basis in fact for any such objection or claim.

| 21 |

(b) Except as set forth on Schedule 3.11(b), the information technology systems owned, leased, licensed or otherwise used in the conduct of the Business, including all computer software, hardware, firmware, process automation systems and telecommunications systems used in the Business (the “IT Systems”) perform in material conformance with the documentation and specifications for such systems. The IT Systems are adequate for the operation of the Business. Seller has taken commercially reasonable steps to protect the IT Systems against viruses, “worms,” disabling or malicious code, or other anomalies that would materially impair the functionality of the IT Systems. Seller has taken commercially reasonable steps to provide for the backup, archival and recovery of the critical business data of Seller. Seller has taken commercially reasonable measures to maintain the confidentiality of all trade secrets. Neither Seller’s trade secrets nor any other confidential information of Seller has been disclosed by Seller to, or, to the knowledge of Seller and/or Founder, discovered by, any other Person except pursuant to non-disclosure agreements or to Persons entitled to receive such trade secrets or other confidential information that are legally obligated to maintain their confidentiality. Neither Seller nor Founder has received written notice that, or otherwise has knowledge that, any employee, consultant or agent of Seller is in default or breach of any employment agreement, non-disclosure agreement, assignment of invention agreement or similar agreement relating to the protection, ownership, development, use or transfer of Intellectual Property owned by Seller. Except as set forth in Schedule 3.11(b), each employee and consultant of Seller has executed a written agreement expressly assigning to Seller all right, title and interest in any Intellectual Property invented, created, developed, conceived or reduced to practice during the term of such employee’s employment or consultant’s service relationship and related to the work performed by such person for Seller, and all Intellectual Property rights therein. Each item of Intellectual Property owned or licensed by Seller will be owned or available for use by Seller immediately following the Closing on substantially identical terms and conditions as it was immediately prior to the Closing.