DENNY’S CORPORATION INVESTOR PRESENTATION AUGUST THROUGH OCTOBER 2025

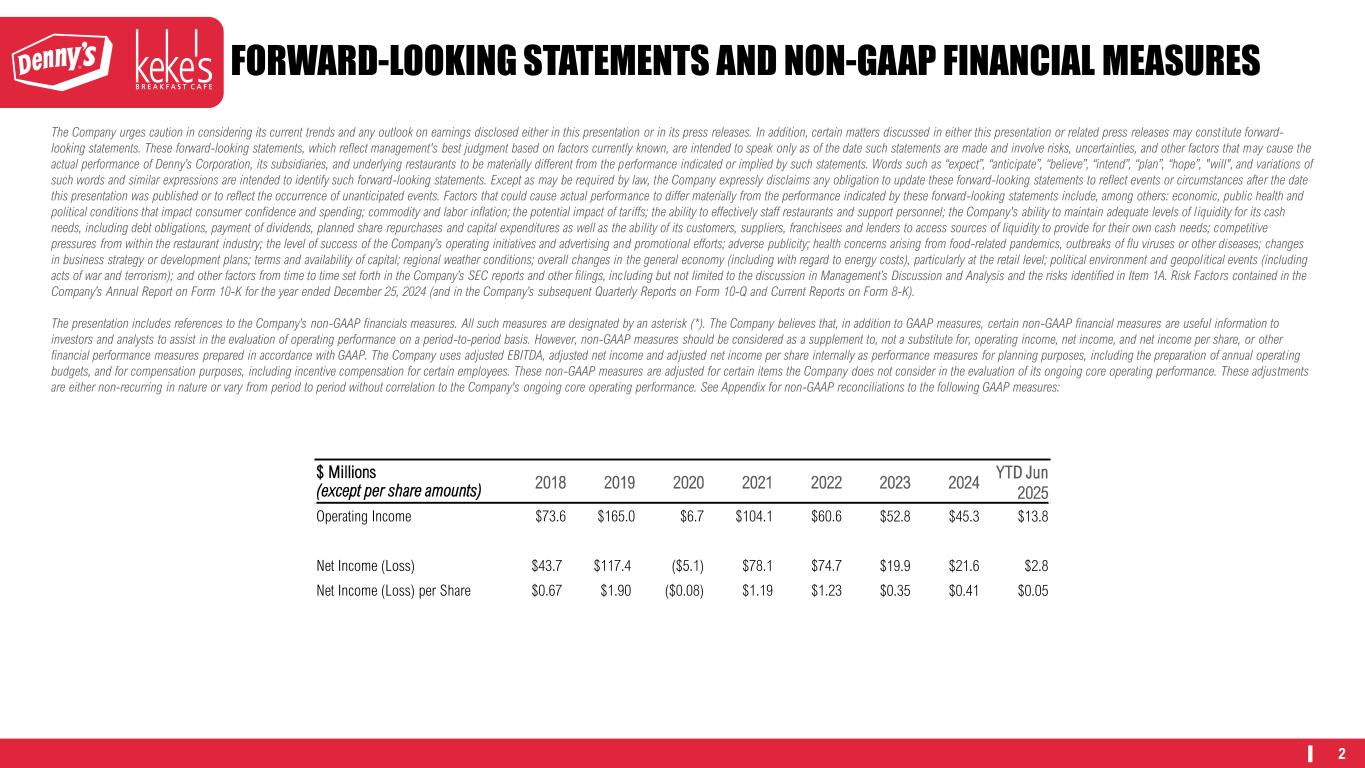

2 The Company urges caution in considering its current trends and any outlook on earnings disclosed either in this presentation or in its press releases. In addition, certain matters discussed in either this presentation or related press releases may constitute forward- looking statements. These forward-looking statements, which reflect management's best judgment based on factors currently known, are intended to speak only as of the date such statements are made and involve risks, uncertainties, and other factors that may cause the actual performance of Denny’s Corporation, its subsidiaries, and underlying restaurants to be materially different from the performance indicated or implied by such statements. Words such as “expect”, “anticipate”, “believe”, “intend”, “plan”, “hope”, "will", and variations of such words and similar expressions are intended to identify such forward-looking statements. Except as may be required by law, the Company expressly disclaims any obligation to update these forward-looking statements to reflect events or circumstances after the date this presentation was published or to reflect the occurrence of unanticipated events. Factors that could cause actual performance to differ materially from the performance indicated by these forward-looking statements include, among others: economic, public health and political conditions that impact consumer confidence and spending; commodity and labor inflation; the potential impact of tariffs; the ability to effectively staff restaurants and support personnel; the Company's ability to maintain adequate levels of l iquidity for its cash needs, including debt obligations, payment of dividends, planned share repurchases and capital expenditures as well as the ability of its customers, suppliers, franchisees and lenders to access sources of liquidity to provide for their own cash needs; competitive pressures from within the restaurant industry; the level of success of the Company’s operating initiatives and advertising and promotional efforts; adverse publicity; health concerns arising from food-related pandemics, outbreaks of flu viruses or other diseases; changes in business strategy or development plans; terms and availability of capital; regional weather conditions; overall changes in the general economy (including with regard to energy costs), particularly at the retail level; political environment and geopolitical events (including acts of war and terrorism); and other factors from time to time set forth in the Company’s SEC reports and other filings, inc luding but not limited to the discussion in Management’s Discussion and Analysis and the risks identified in Item 1A. Risk Factors contained in the Company’s Annual Report on Form 10-K for the year ended December 25, 2024 (and in the Company’s subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K). The presentation includes references to the Company’s non-GAAP financials measures. All such measures are designated by an asterisk (*). The Company believes that, in addition to GAAP measures, certain non-GAAP financial measures are useful information to investors and analysts to assist in the evaluation of operating performance on a period-to-period basis. However, non-GAAP measures should be considered as a supplement to, not a substitute for, operating income, net income, and net income per share, or other financial performance measures prepared in accordance with GAAP. The Company uses adjusted EBITDA, adjusted net income and adjusted net income per share internally as performance measures for planning purposes, including the preparation of annual operating budgets, and for compensation purposes, including incentive compensation for certain employees. These non-GAAP measures are adjusted for certain items the Company does not consider in the evaluation of its ongoing core operating performance. These adjustments are either non-recurring in nature or vary from period to period without correlation to the Company's ongoing core operating performance. See Appendix for non-GAAP reconciliations to the following GAAP measures: FORWARD-LOOKING STATEMENTS AND NON-GAAP FINANCIAL MEASURES $ Millions (except per share amounts) 2018 2019 2020 2021 2022 2023 2024 YTD Jun 2025 Operating Income $73.6 $165.0 $6.7 $104.1 $60.6 $52.8 $45.3 $13.8 Net Income (Loss) $43.7 $117.4 ($5.1) $78.1 $74.7 $19.9 $21.6 $2.8 Net Income (Loss) per Share $0.67 $1.90 ($0.08) $1.19 $1.23 $0.35 $0.41 $0.05

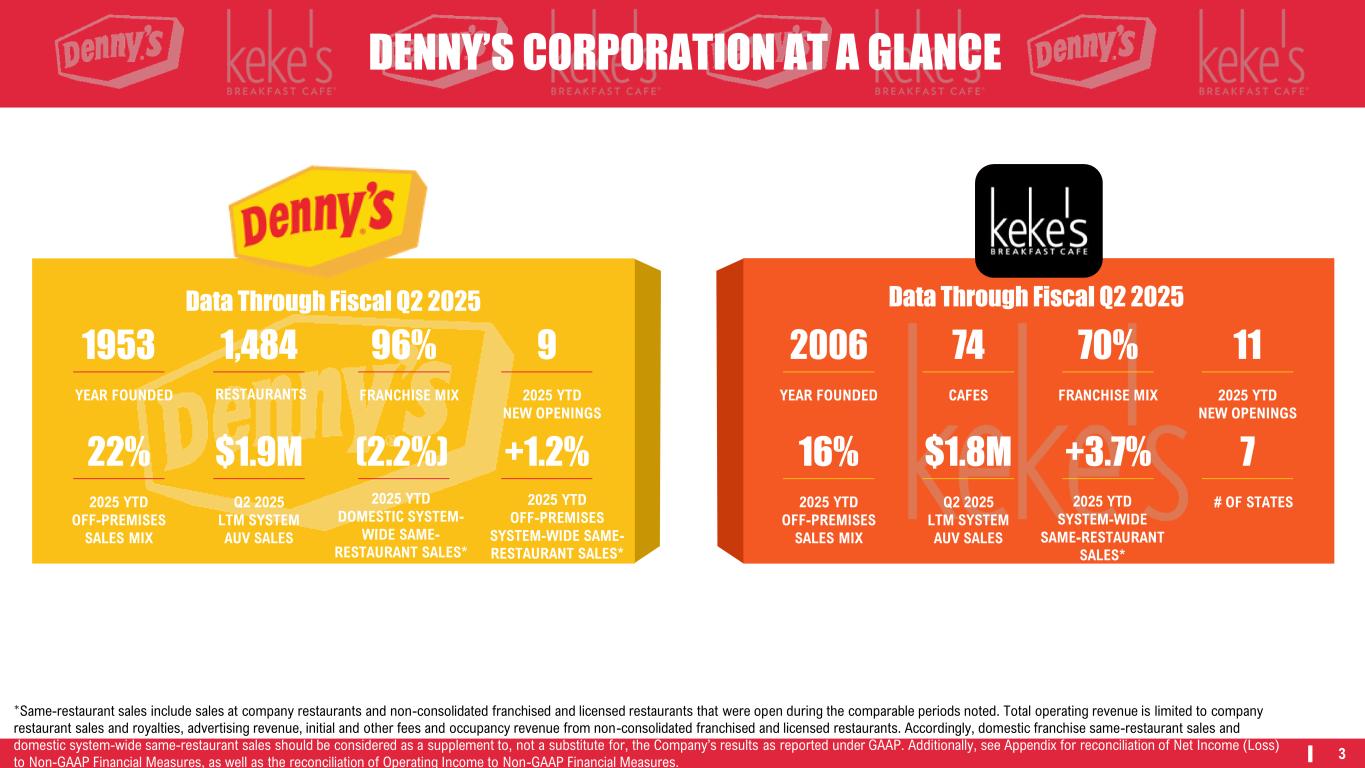

Main logo and presentation color Yellow from IR Presentation Black from IR Presentation Orange from IR presentation Slide Background from IR presentation Blue from IR Presentation Grey Second Grey Black text from website White Yellow from logo SE C O N D A R Y C O LO R S R0 G0 B0 P R IM A R Y C O LO R S R224 G38 B61 R64 G64 B64 R246 G184 B37 R243 G119 B33 R243 G244 B244 TE X T R255 G255 B255 R0 G0 B0 R250 G192 B23 R255 G252 B245 R62 G188 B166 3 +3.7% 2025 YTD SYSTEM-WIDE SAME-RESTAURANT SALES* 7 # OF STATES 11 2025 YTD NEW OPENINGS $1.8M Q2 2025 LTM SYSTEM AUV SALES 2006 YEAR FOUNDED 70% FRANCHISE MIX 16% 2025 YTD OFF-PREMISES SALES MIX 74 CAFES (2.2%) 2025 YTD DOMESTIC SYSTEM- WIDE SAME- RESTAURANT SALES* +1.2% 2025 YTD OFF-PREMISES SYSTEM-WIDE SAME- RESTAURANT SALES* 9 2025 YTD NEW OPENINGS $1.9M Q2 2025 LTM SYSTEM AUV SALES 1953 YEAR FOUNDED 96% FRANCHISE MIX 22% 2025 YTD OFF-PREMISES SALES MIX 1,484 RESTAURANTS *Same-restaurant sales include sales at company restaurants and non-consolidated franchised and licensed restaurants that were open during the comparable periods noted. Total operating revenue is limited to company restaurant sales and royalties, advertising revenue, initial and other fees and occupancy revenue from non-consolidated franchised and licensed restaurants. Accordingly, domestic franchise same-restaurant sales and domestic system-wide same-restaurant sales should be considered as a supplement to, not a substitute for, the Company’s results as reported under GAAP. Additionally, see Appendix for reconciliation of Net Income (Loss) to Non-GAAP Financial Measures, as well as the reconciliation of Operating Income to Non-GAAP Financial Measures. Data Through Fiscal Q2 2025 Data Through Fiscal Q2 2025 DENNY’S CORPORATION AT A GLANCE

4 Q2 2025 HIGHLIGHTS • Domestic system-wide same- restaurant sales* of (1.3%). • Represents a 170bps sequential improvement. • Outperformed BBI Family Dining in California for the 6th consecutive quarter. • Total value incidence of ~21% during Q2. • Launched new BOGO $1 offer at the end of Q1 to drive incremental dine-in traffic. • 70% of BOGO transactions were from new/lapsed users. • Launched new 4 Slams® Under $10 promotion featuring in early June featuring more seasonal flavors. • Total off-premises sales of 21%. • Off-premises benefited same-restaurant sales* by +1.5%. • Digital guest experience enhancements improved conversion rates by over 14%. • Company restaurants testing new virtual brand which benefited company same-restaurant sales* by +0.5%. • Opened three new franchised restaurants. • Completed 14 remodels including five company restaurants. • Nearly 55% of company fleet has been remodeled under the new image. *Same-restaurant sales include sales at company restaurants and non-consolidated franchised and licensed restaurants that were open during the comparable periods noted. Total operating revenue is limited to company restaurant sales and royalties, advertising revenue, initial and other fees and occupancy revenue from non-consolidated franchised and licensed restaurants. Accordingly, domestic franchise same-restaurant sales and domestic system-wide same-restaurant sales should be considered as a supplement to, not a substitute for, the Company’s results as reported under GAAP.

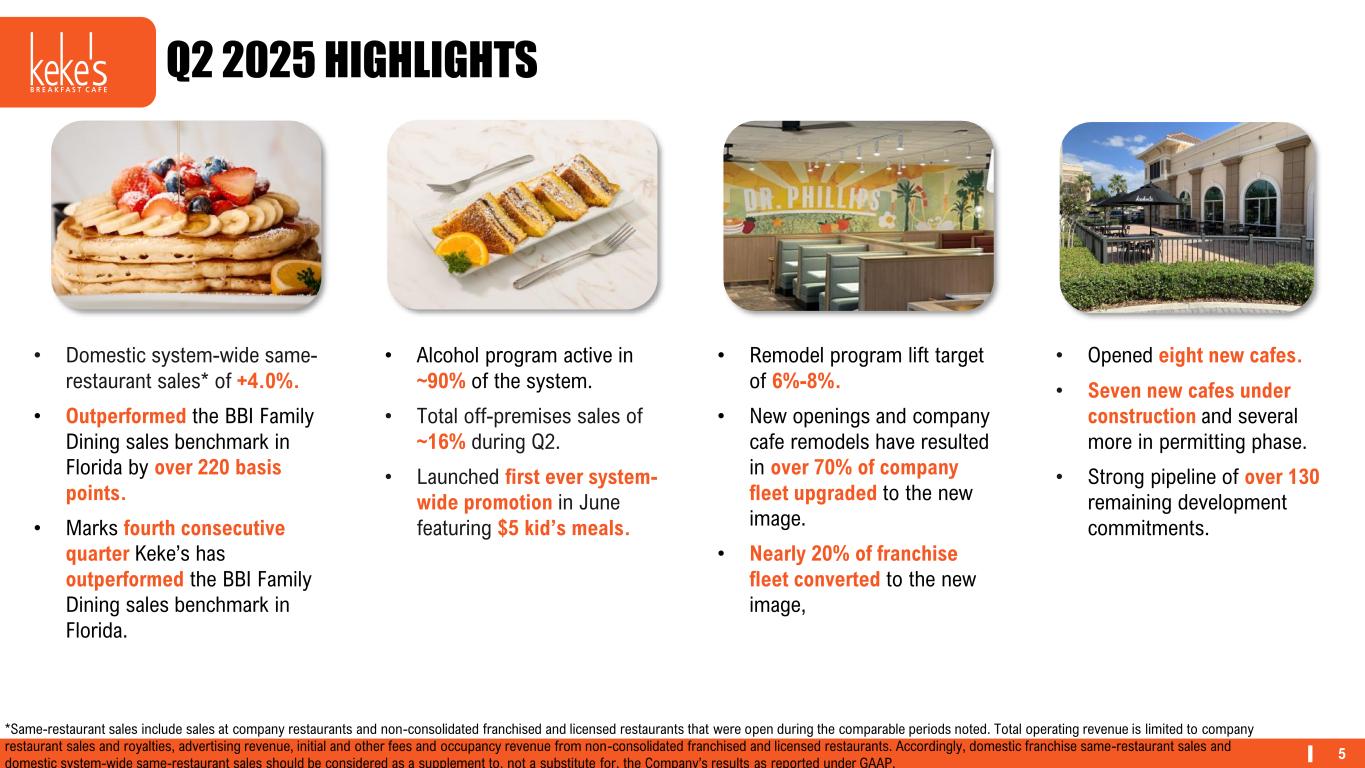

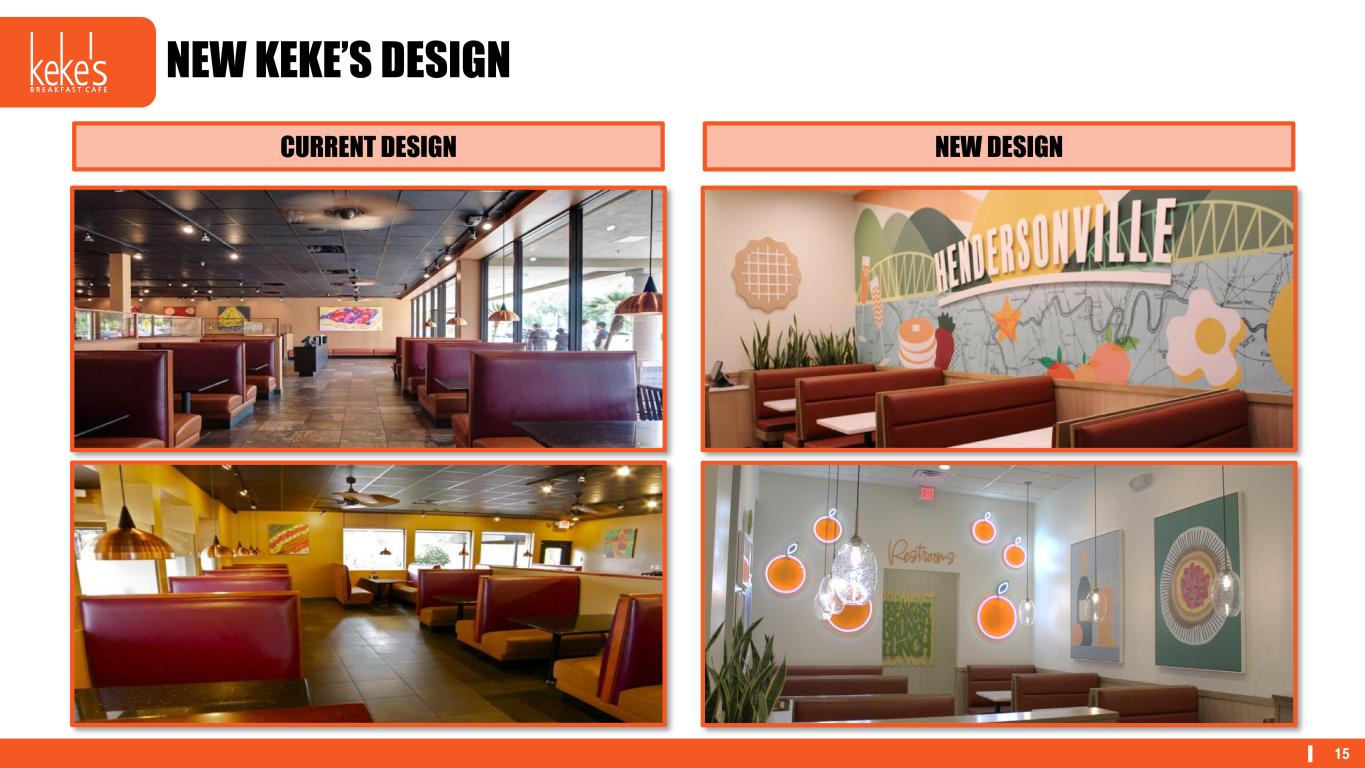

5 Q2 2025 HIGHLIGHTS • Alcohol program active in ~90% of the system. • Total off-premises sales of ~16% during Q2. • Launched first ever system- wide promotion in June featuring $5 kid’s meals. • Opened eight new cafes. • Seven new cafes under construction and several more in permitting phase. • Strong pipeline of over 130 remaining development commitments. • Domestic system-wide same- restaurant sales* of +4.0%. • Outperformed the BBI Family Dining sales benchmark in Florida by over 220 basis points. • Marks fourth consecutive quarter Keke’s has outperformed the BBI Family Dining sales benchmark in Florida. • Remodel program lift target of 6%-8%. • New openings and company cafe remodels have resulted in over 70% of company fleet upgraded to the new image. • Nearly 20% of franchise fleet converted to the new image, *Same-restaurant sales include sales at company restaurants and non-consolidated franchised and licensed restaurants that were open during the comparable periods noted. Total operating revenue is limited to company restaurant sales and royalties, advertising revenue, initial and other fees and occupancy revenue from non-consolidated franchised and licensed restaurants. Accordingly, domestic franchise same-restaurant sales and domestic system-wide same-restaurant sales should be considered as a supplement to, not a substitute for, the Company’s results as reported under GAAP.

DENNY’S We Love to Feed People – Body, Mind and Soul

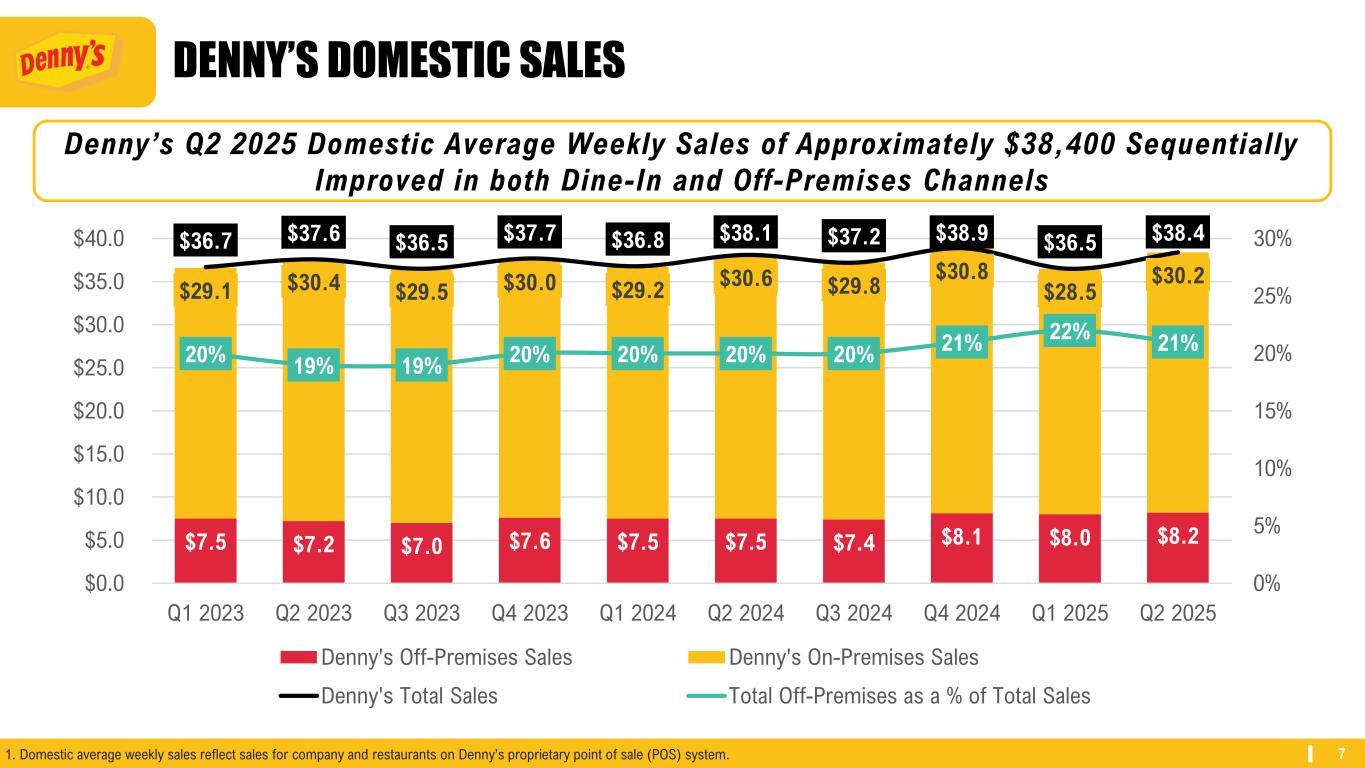

7 DENNY’S DOMESTIC SALES Denny’s Q2 2025 Domestic Average Weekly Sales of Approximately $38,400 Sequentially Improved in both Dine-In and Off-Premises Channels 1. Domestic average weekly sales reflect sales for company and restaurants on Denny’s proprietary point of sale (POS) system. $7.5 $7.2 $7.0 $7.6 $7.5 $7.5 $7.4 $8.1 $8.0 $8.2 $29.1 $30.4 $29.5 $30.0 $29.2 $30.6 $29.8 $30.8 $28.5 $30.2 $36.7 $37.6 $36.5 $37.7 $36.8 $38.1 $37.2 $38.9 $36.5 $38.4 20% 19% 19% 20% 20% 20% 20% 21% 22% 21% 0% 5% 10% 15% 20% 25% 30% $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Denny's Off-Premises Sales Denny's On-Premises Sales Denny's Total Sales Total Off-Premises as a % of Total Sales

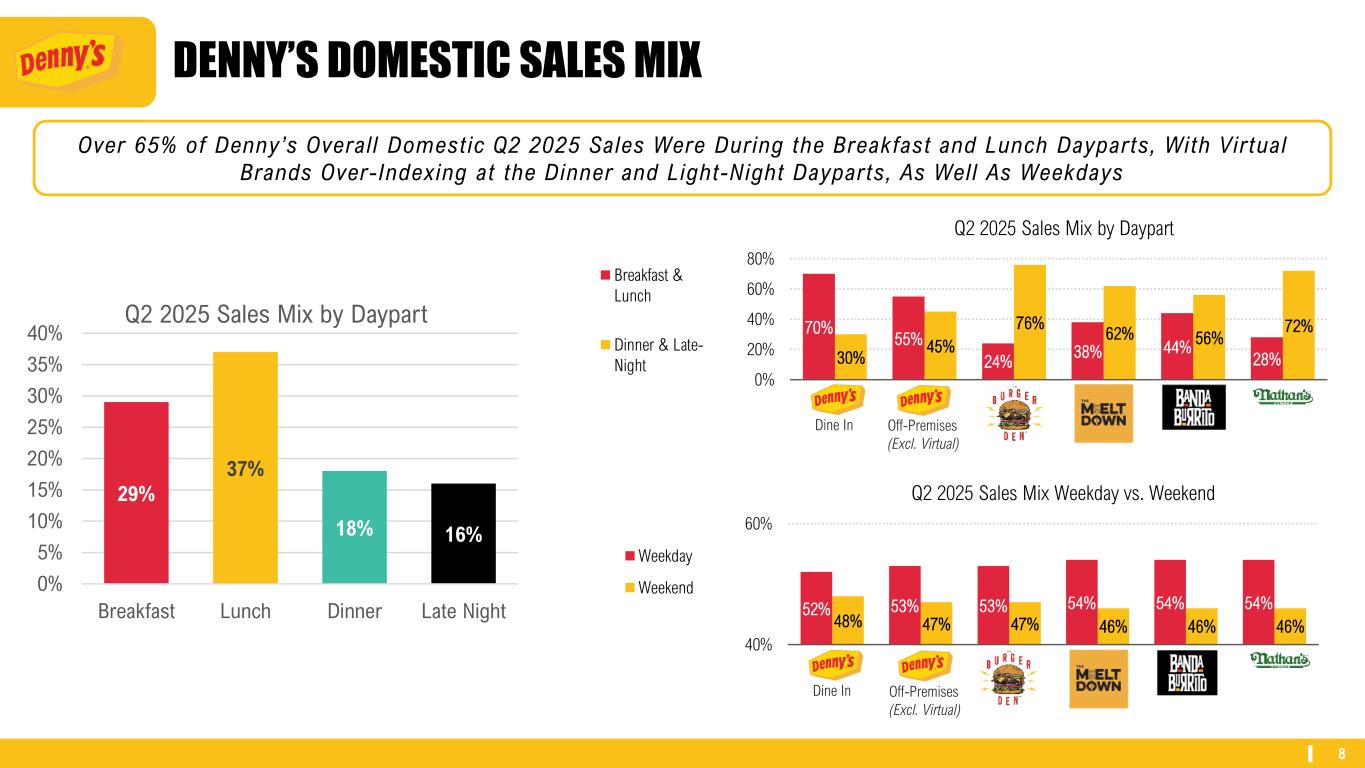

8 DENNY’S DOMESTIC SALES MIX Over 65% of Denny’s Overall Domestic Q2 2025 Sales Were During the Breakfast and Lunch Dayparts, With Virtual Brands Over-Indexing at the Dinner and Light-Night Dayparts, As Well As Weekdays 52% 53% 53% 54% 54% 54% 48% 47% 47% 46% 46% 46% 40% 60% Dine In Off-Premise The Burger Den The Meltdown Banda Burrito Nathan's Famous® Q2 2025 Sales Mix Weekday vs. Weekend Weekday Weekend ine In Off-Pre ises (Excl. Virtual) 70% 55% 24% 38% 44% 28%30% 45% 76% 62% 56% 72% 0% 20% 40% 60% 80% Dine In Off-Premise The Burger Den The Meltdown Banda Burrito Nathan's Famous® Q2 2025 Sales Mix by Daypart Breakfast & Lunch Dinner & Late- Night i In ff-Premises (Excl. Virtual) 29% 37% 18% 16% 0% 5% 10% 15% 20% 25% 30% 35% 40% Breakfast Lunch Dinner Late Night Q2 2025 Sales Mix by Daypart

9 DINER 2.0 REMODEL PROGRAM Results based on APT pre/post vs. control analysis. +6.4% SALES LIFT DURING TESTING +6.5% TRAFFIC LIFT DURING TESTING ~$250k AVERAGE INVESTMENT ~55% COMPANY FLEET REMODLED TO NEW IMAGE >10% FRANCHISE FLEET REMODLED TO NEW IMAGE

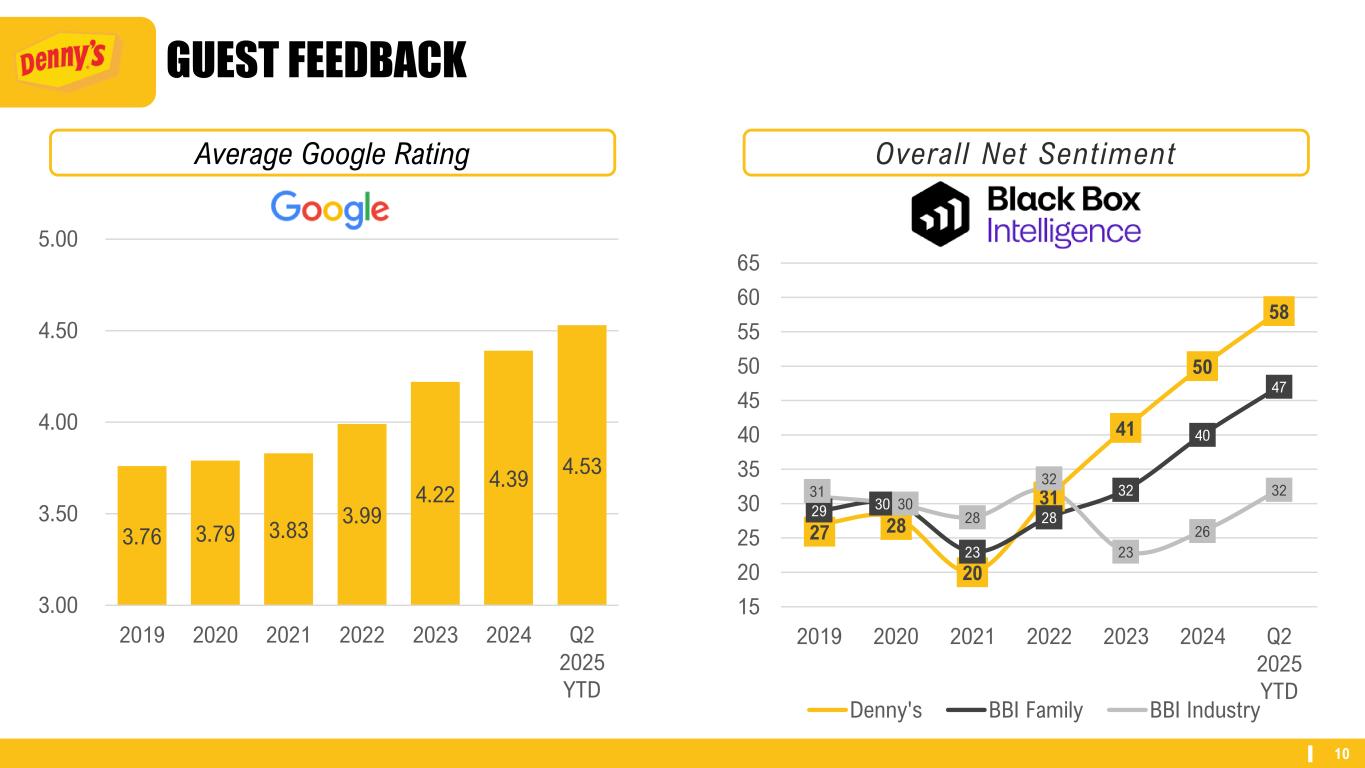

10 GUEST FEEDBACK Average Google Rating 3.76 3.79 3.83 3.99 4.22 4.39 4.53 3.00 3.50 4.00 4.50 5.00 2019 2020 2021 2022 2023 2024 Q2 2025 YTD Overall Net Sentiment 27 28 20 31 41 50 58 29 30 23 28 32 40 47 31 30 28 32 23 26 32 15 20 25 30 35 40 45 50 55 60 65 2019 2020 2021 2022 2023 2024 Q2 2025 YTD Denny's BBI Family BBI Industry

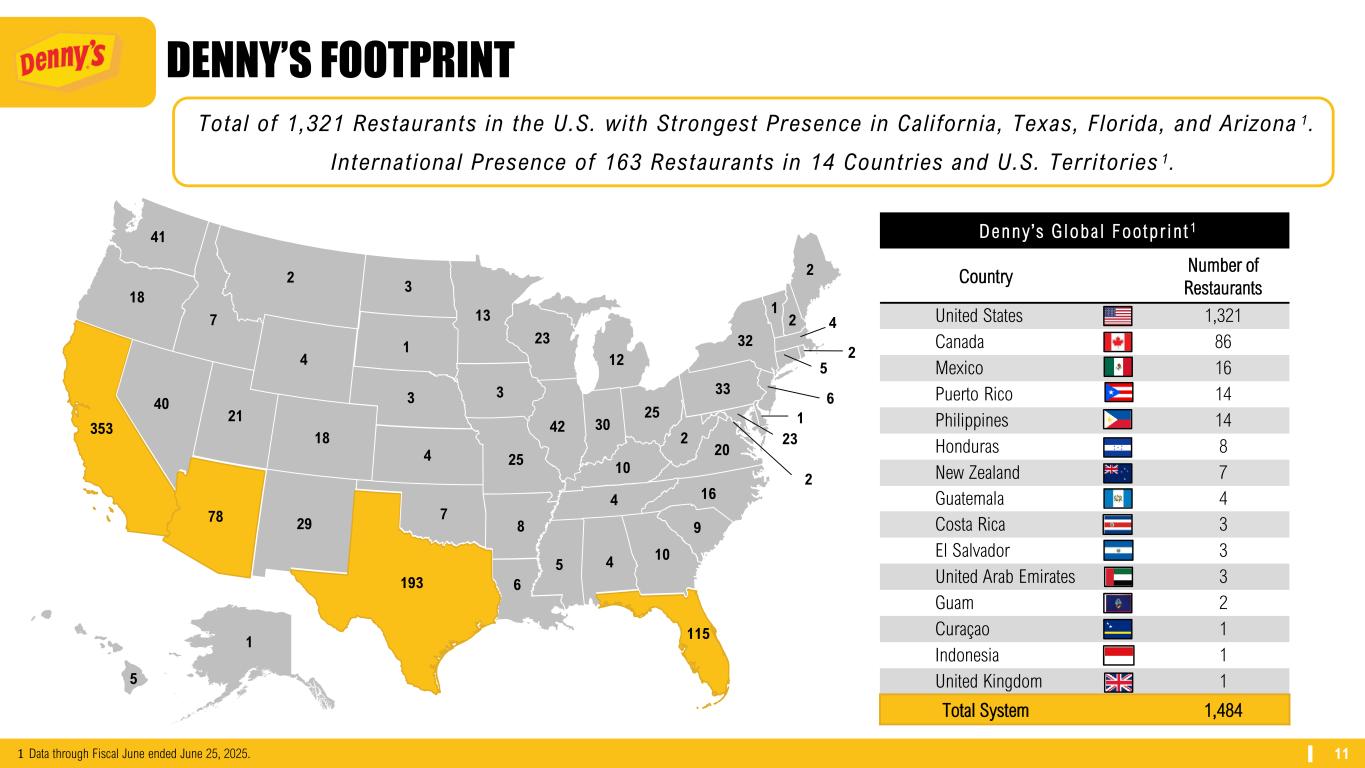

11 1 Total of 1,321 Restaurants in the U.S. with Strongest Presence in California, Texas, Florida, and Arizona 1. International Presence of 163 Restaurants in 14 Countries and U.S. Territories 1. 353 78 29 193 6 5 4 10 115 9 164 8 7 40 21 18 4 25 10 20 2 18 7 4 3 3 42 30 25 33 32 41 2 3 1 13 23 12 2 1 2 4 2 5 6 1 23 DENNY’S FOOTPRINT Denny ’ s G loba l Foo tp r i n t 1 Country Number of Restaurants United States 1,321 Canada 86 Mexico 16 Puerto Rico 14 Philippines 14 Honduras 8 New Zealand 7 Guatemala 4 Costa Rica 3 El Salvador 3 United Arab Emirates 3 Guam 2 Curaçao 1 Indonesia 1 United Kingdom 1 Total System 1,484 1 Data through Fiscal June ended June 25, 2025. 5 2

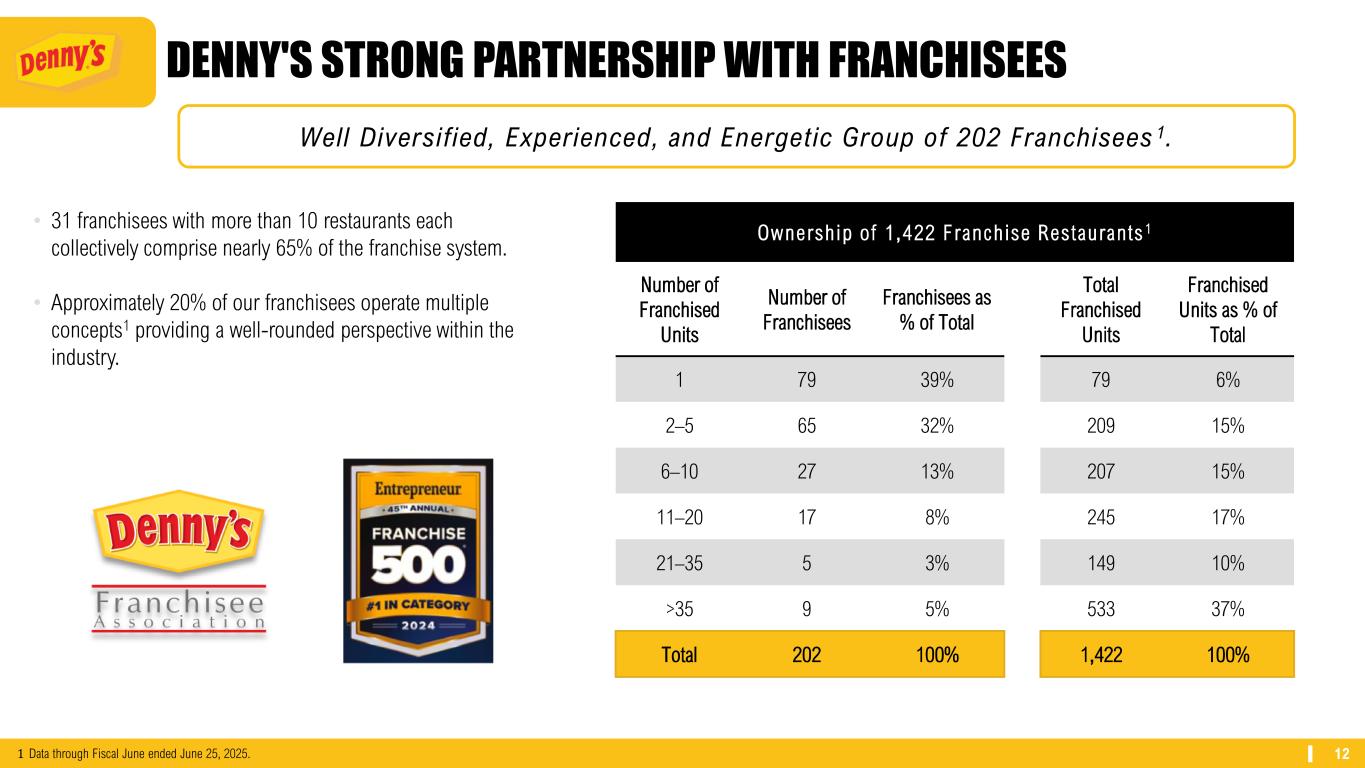

12 Well Diversified, Experienced, and Energetic Group of 202 Franchisees 1. • 31 franchisees with more than 10 restaurants each collectively comprise nearly 65% of the franchise system. • Approximately 20% of our franchisees operate multiple concepts1 providing a well-rounded perspective within the industry. Ownership o f 1 ,422 Franchise Res taurants 1 Number of Franchised Units Number of Franchisees Franchisees as % of Total Total Franchised Units Franchised Units as % of Total 1 79 39% 79 6% 2–5 65 32% 209 15% 6–10 27 13% 207 15% 11–20 17 8% 245 17% 21–35 5 3% 149 10% >35 9 5% 533 37% Total 202 100% 1,422 100% DENNY'S STRONG PARTNERSHIP WITH FRANCHISEES 1 Data through Fiscal June ended June 25, 2025.

KEKE’S BREAKFAST CAFE We Create Fresh Starts for Everyone, Every day

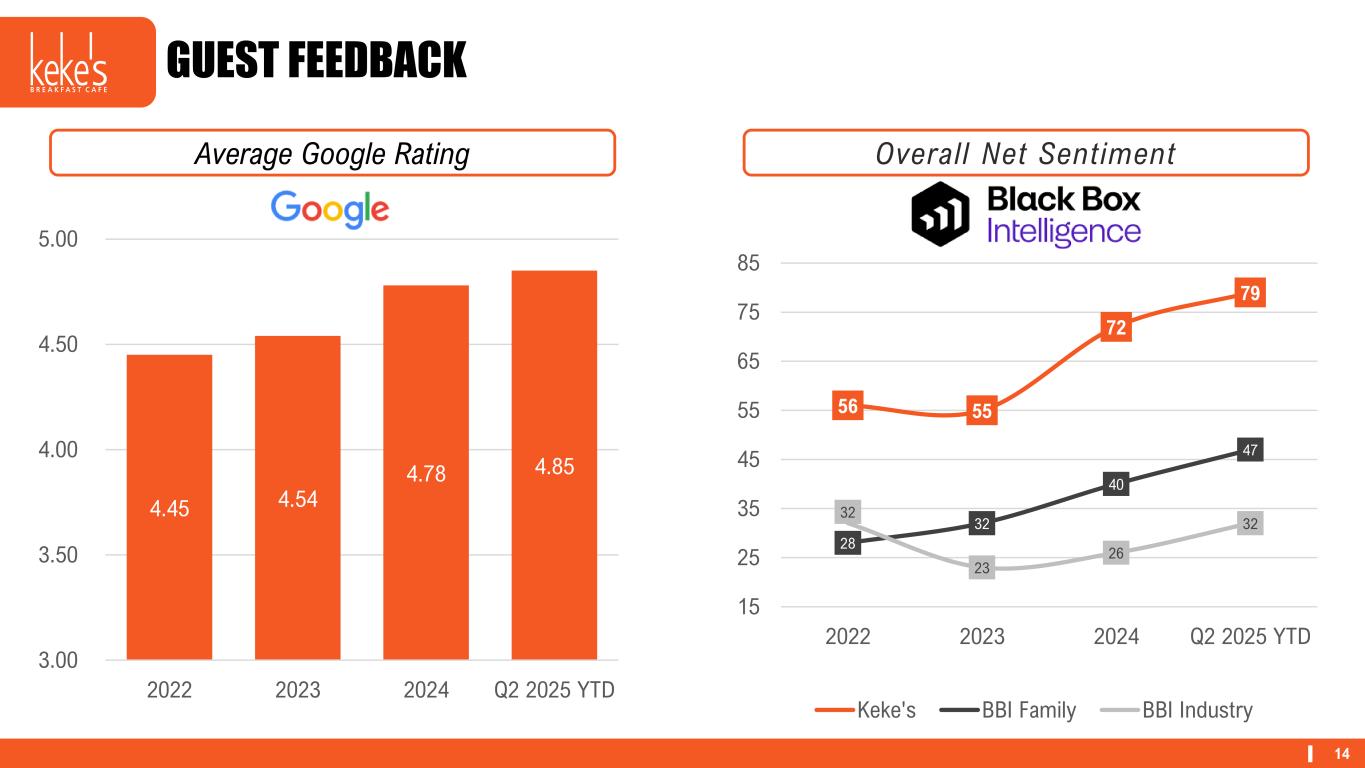

14 GUEST FEEDBACK Average Google Rating 4.45 4.54 4.78 4.85 3.00 3.50 4.00 4.50 5.00 2022 2023 2024 Q2 2025 YTD Overall Net Sentiment 56 55 72 79 28 32 40 47 32 23 26 32 15 25 35 45 55 65 75 85 2022 2023 2024 Q2 2025 YTD Keke's BBI Family BBI Industry

15 CURRENT DESIGN NEW DESIGN NEW KEKE’S DESIGN

16 REMODEL PROGRAM TARGETS +6%-8% TARGET SALES LIFT +30% TARGET IRR ~25%+ TARGET CASH ON CASH $150K+ TARGET CAPEX >70% COMPANY FLEET UPGRADED TO NEW IMAGE ~20% FRANCHISE FLEET UPGRADED TO NEW IMAGE

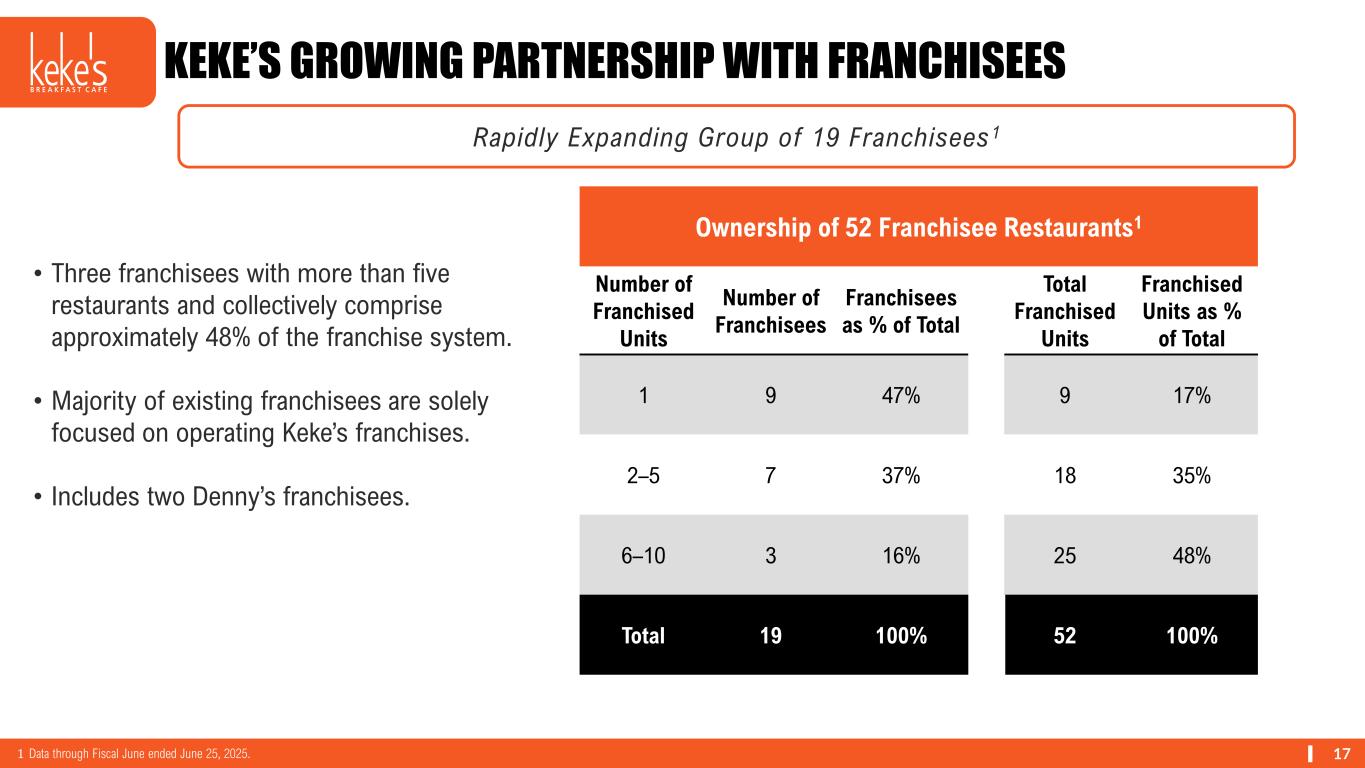

17 KEKE’S GROWING PARTNERSHIP WITH FRANCHISEES Ownership of 52 Franchisee Restaurants1 Number of Franchised Units Number of Franchisees Franchisees as % of Total Total Franchised Units Franchised Units as % of Total 1 9 47% 9 17% 2–5 7 37% 18 35% 6–10 3 16% 25 48% Total 19 100% 52 100% Rapidly Expanding Group of 19 Franchisees1 • Three franchisees with more than five restaurants and collectively comprise approximately 48% of the franchise system. • Majority of existing franchisees are solely focused on operating Keke’s franchises. • Includes two Denny’s franchisees. 1 Data through Fiscal June ended June 25, 2025.

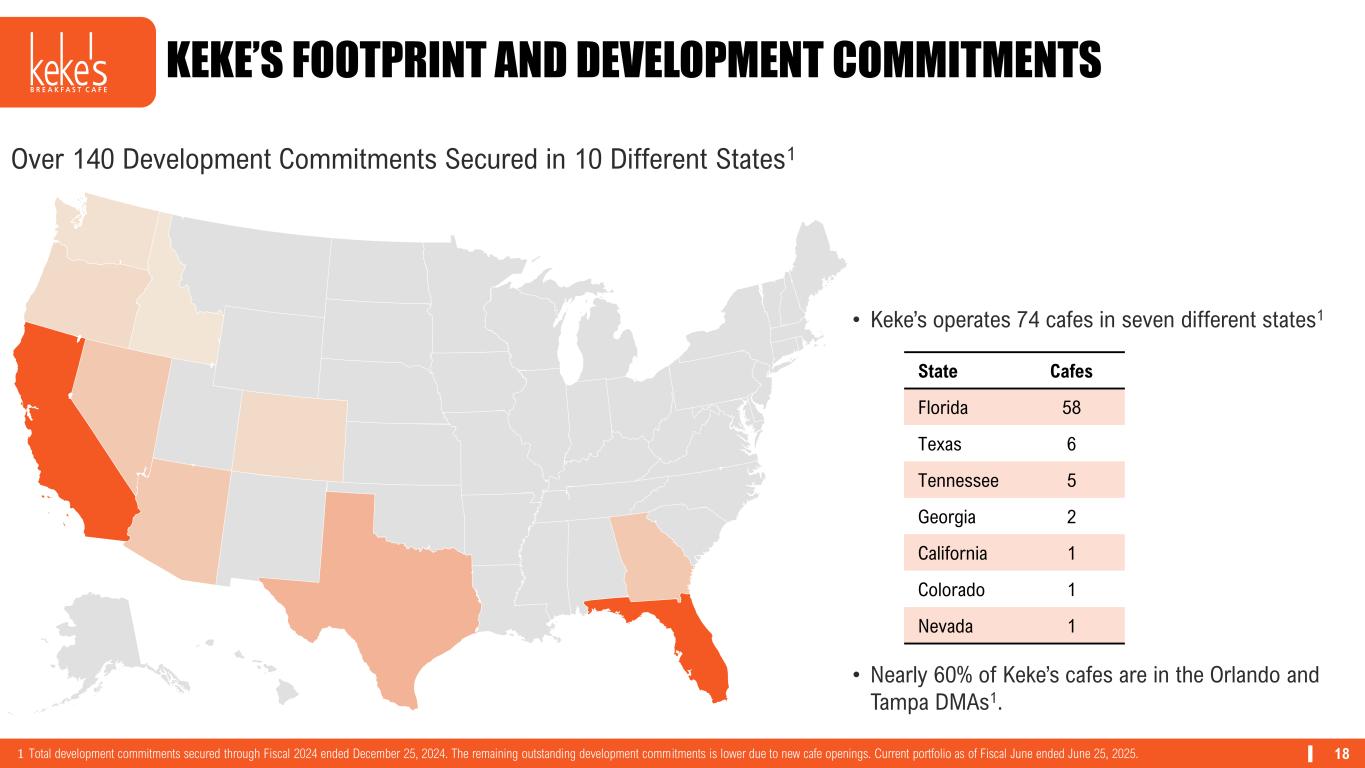

18 KEKE’S FOOTPRINT AND DEVELOPMENT COMMITMENTS © GeoNames, Microsoft, TomTom Powered by Bing Over 140 Development Commitments Secured in 10 Different States1 1 Total development commitments secured through Fiscal 2024 ended December 25, 2024. The remaining outstanding development commitments is lower due to new cafe openings. Current portfolio as of Fiscal June ended June 25, 2025. • Keke’s operates 74 cafes in seven different states1 • Nearly 60% of Keke’s cafes are in the Orlando and Tampa DMAs1. State Cafes Florida 58 Texas 6 Tennessee 5 Georgia 2 California 1 Colorado 1 Nevada 1

DENNY’S CORPORATION

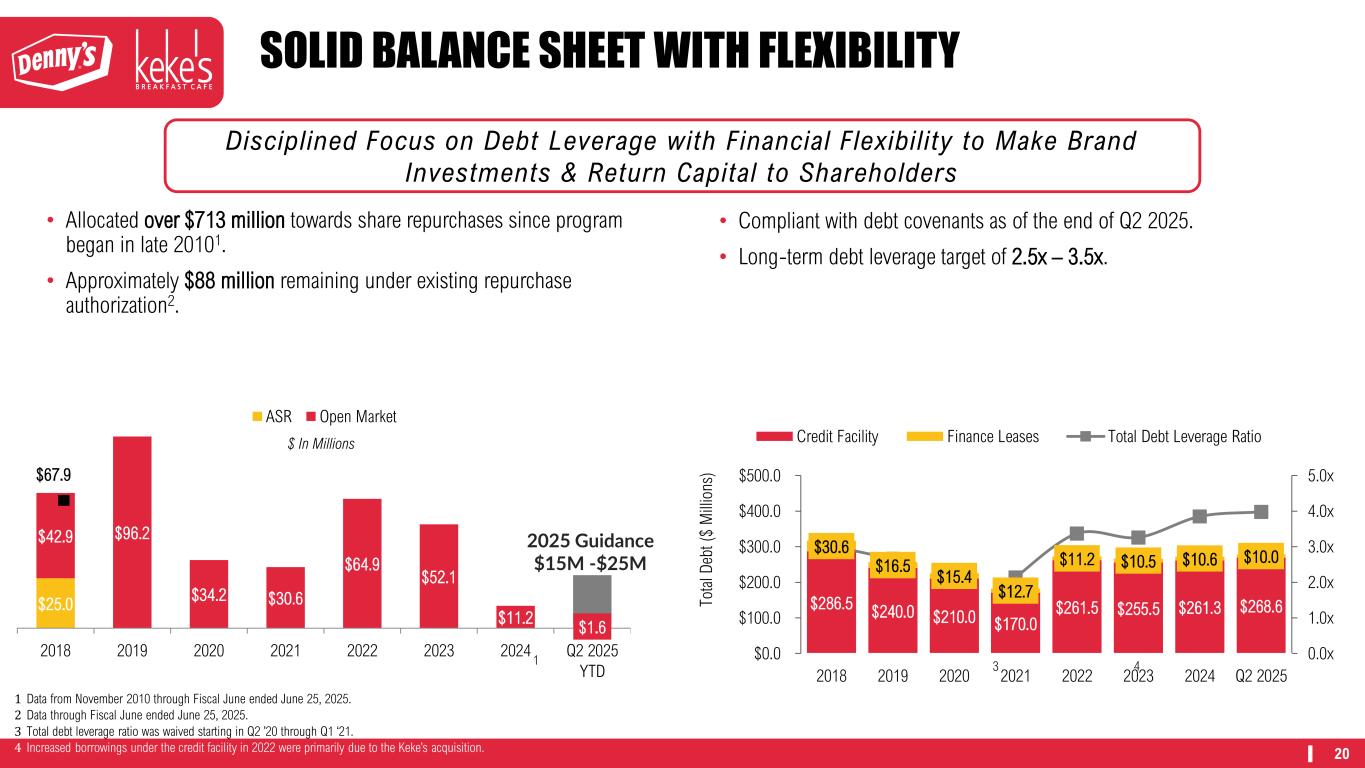

20 $286.5 $240.0 $210.0 $170.0 $261.5 $255.5 $261.3 $268.6 $30.6 $16.5 $15.4 $12.7 $11.2 $10.5 $10.6 $10.0 0.0x 1.0x 2.0x 3.0x 4.0x 5.0x 2018 2019 2020 2021 2022 2023 2024 Q2 2025 $0.0 $100.0 $200.0 $300.0 $400.0 $500.0 To ta l D eb t ( $ M ill io ns ) Credit Facility Finance Leases Total Debt Leverage Ratio 3 SOLID BALANCE SHEET WITH FLEXIBILITY $25.0 $1.6 $42.9 $96.2 $34.2 $30.6 $64.9 $52.1 $11.2 $67.9 2018 2019 2020 2021 2022 2023 2024 Q2 2025 YTD ASR Open Market $ In Millions Disciplined Focus on Debt Leverage with Financial Flexibility to Make Brand Investments & Return Capital to Shareholders • Allocated over $713 million towards share repurchases since program began in late 20101. • Approximately $88 million remaining under existing repurchase authorization2. 4 1 Data from November 2010 through Fiscal June ended June 25, 2025. 2 Data through Fiscal June ended June 25, 2025. 3 Total debt leverage ratio was waived starting in Q2 ’20 through Q1 ‘21. 4 Increased borrowings under the credit facility in 2022 were primarily due to the Keke’s acquisition. 1 2025 Guidance $15M -$25M • Compliant with debt covenants as of the end of Q2 2025. • Long-term debt leverage target of 2.5x – 3.5x.

21 C-R-A-V-E STRATEGIC FRAMEWORK Va l ida te & Op t imize the Bus iness Mode l to Max imize Res taurant Marg ins E l eva te Pro f i t ab le Tra f f ic Through the Gues t Exper ience & Un iquely Craveable Food C rea te Lead ing Edge So lu t ions With Technology & Innova t ion Robust New Res taurant G row th as the Franchisor o f Cho ice Assemble Bes t In Class Peop le and Teams Through Cu l tu re, Too ls & Sys tems

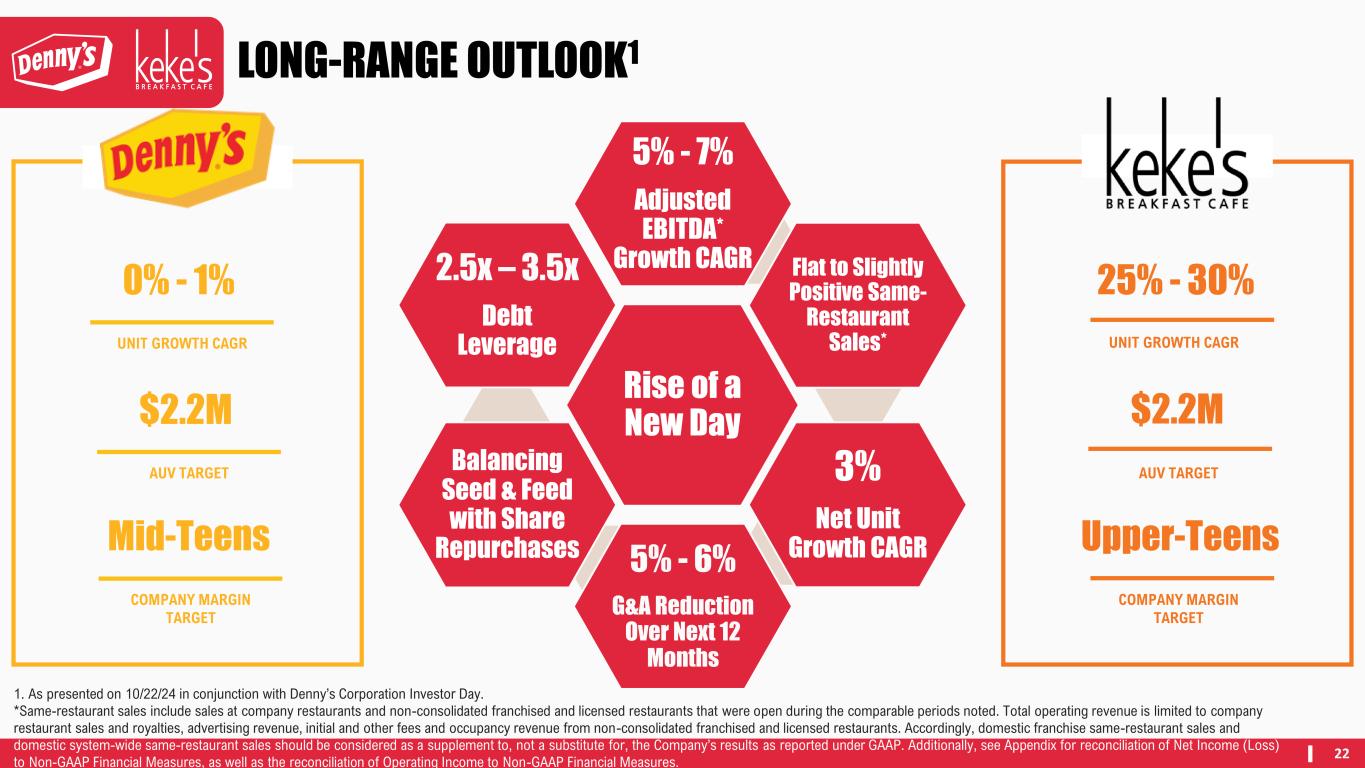

22 Rise of a New Day 5% - 7% Adjusted EBITDA* Growth CAGR Flat to Slightly Positive Same- Restaurant Sales* 3% Net Unit Growth CAGR5% - 6% G&A Reduction Over Next 12 Months Balancing Seed & Feed with Share Repurchases 2.5x – 3.5x Debt Leverage LONG-RANGE OUTLOOK1 0% - 1% UNIT GROWTH CAGR $2.2M AUV TARGET Mid-Teens COMPANY MARGIN TARGET 25% - 30% UNIT GROWTH CAGR $2.2M AUV TARGET Upper-Teens COMPANY MARGIN TARGET 1. As presented on 10/22/24 in conjunction with Denny’s Corporation Investor Day. *Same-restaurant sales include sales at company restaurants and non-consolidated franchised and licensed restaurants that were open during the comparable periods noted. Total operating revenue is limited to company restaurant sales and royalties, advertising revenue, initial and other fees and occupancy revenue from non-consolidated franchised and licensed restaurants. Accordingly, domestic franchise same-restaurant sales and domestic system-wide same-restaurant sales should be considered as a supplement to, not a substitute for, the Company’s results as reported under GAAP. Additionally, see Appendix for reconciliation of Net Income (Loss) to Non-GAAP Financial Measures, as well as the reconciliation of Operating Income to Non-GAAP Financial Measures.

APPENDIX

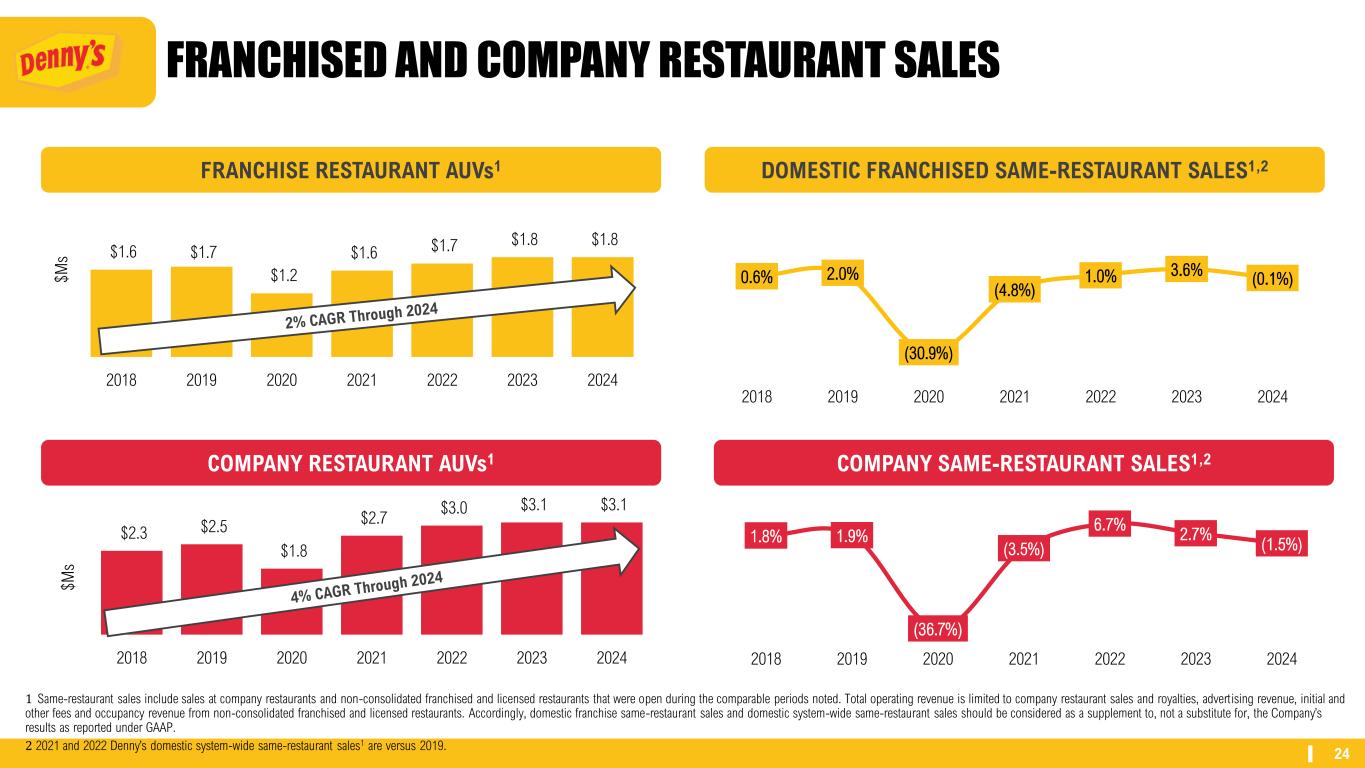

24 FRANCHISED AND COMPANY RESTAURANT SALES 1 Same-restaurant sales include sales at company restaurants and non-consolidated franchised and licensed restaurants that were open during the comparable periods noted. Total operating revenue is limited to company restaurant sales and royalties, advertising revenue, initial and other fees and occupancy revenue from non-consolidated franchised and licensed restaurants. Accordingly, domestic franchise same-restaurant sales and domestic system-wide same-restaurant sales should be considered as a supplement to, not a substitute for, the Company’s results as reported under GAAP. 2 2021 and 2022 Denny’s domestic system-wide same-restaurant sales1 are versus 2019. 1.8% 1.9% (36.7%) (3.5%) 6.7% 2.7% (1.5%) 2018 2019 2020 2021 2022 2023 2024 0.6% 2.0% (30.9%) (4.8%) 1.0% 3.6% (0.1%) 2018 2019 2020 2021 2022 2023 2024 $1.6 $1.7 $1.2 $1.6 $1.7 $1.8 $1.8 2018 2019 2020 2021 2022 2023 2024 $M s $2.3 $2.5 $1.8 $2.7 $3.0 $3.1 $3.1 2018 2019 2020 2021 2022 2023 2024 $M s FRANCHISE RESTAURANT AUVs1 DOMESTIC FRANCHISED SAME-RESTAURANT SALES1,2 COMPANY RESTAURANT AUVs1 COMPANY SAME-RESTAURANT SALES1,2

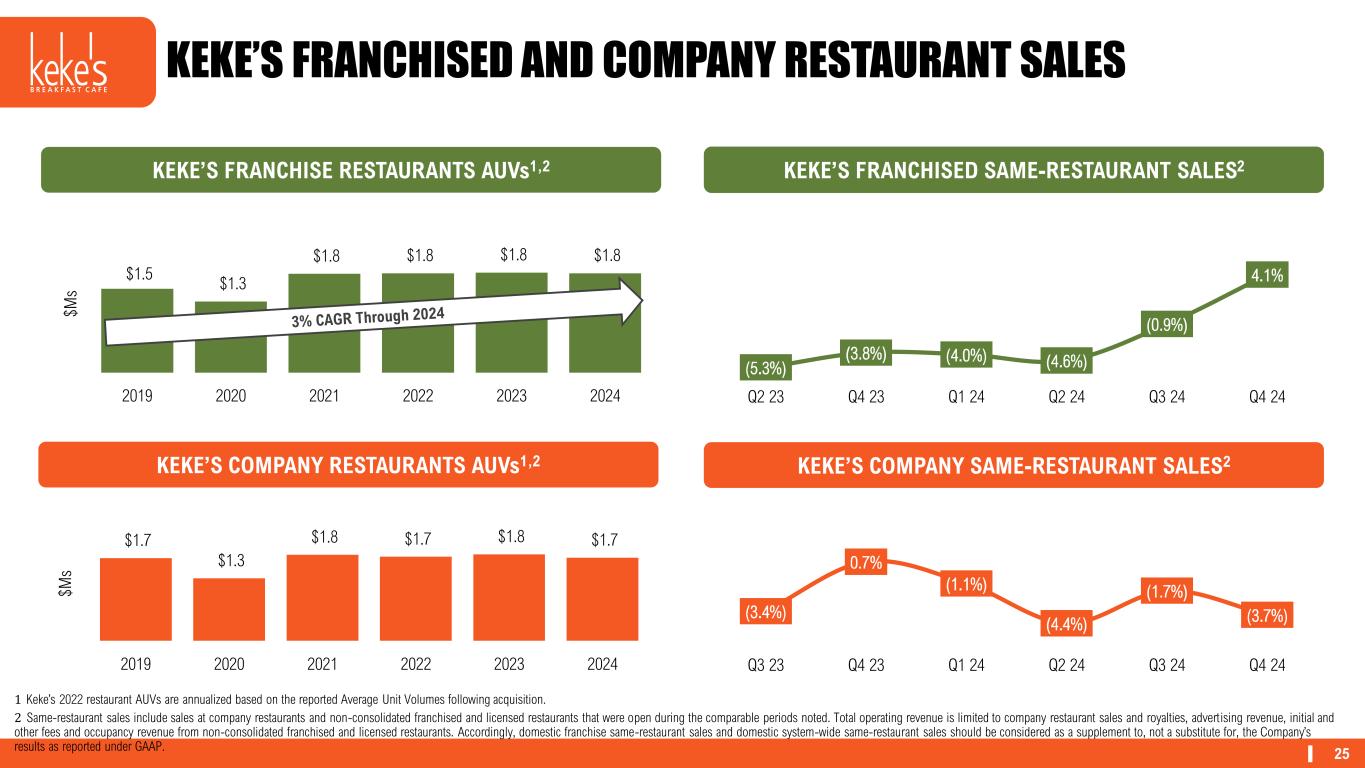

25 (5.3%) (3.8%) (4.0%) (4.6%) (0.9%) 4.1% Q2 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 (3.4%) 0.7% (1.1%) (4.4%) (1.7%) (3.7%) Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 KEKE’S FRANCHISED AND COMPANY RESTAURANT SALES 1 Keke’s 2022 restaurant AUVs are annualized based on the reported Average Unit Volumes following acquisition. 2 Same-restaurant sales include sales at company restaurants and non-consolidated franchised and licensed restaurants that were open during the comparable periods noted. Total operating revenue is limited to company restaurant sales and royalties, advertising revenue, initial and other fees and occupancy revenue from non-consolidated franchised and licensed restaurants. Accordingly, domestic franchise same-restaurant sales and domestic system-wide same-restaurant sales should be considered as a supplement to, not a substitute for, the Company’s results as reported under GAAP. $1.5 $1.3 $1.8 $1.8 $1.8 $1.8 2019 2020 2021 2022 2023 2024 $M s $1.7 $1.3 $1.8 $1.7 $1.8 $1.7 2019 2020 2021 2022 2023 2024 $M s KEKE’S FRANCHISE RESTAURANTS AUVs1,2 KEKE’S FRANCHISED SAME-RESTAURANT SALES2 KEKE’S COMPANY RESTAURANTS AUVs1,2 KEKE’S COMPANY SAME-RESTAURANT SALES2

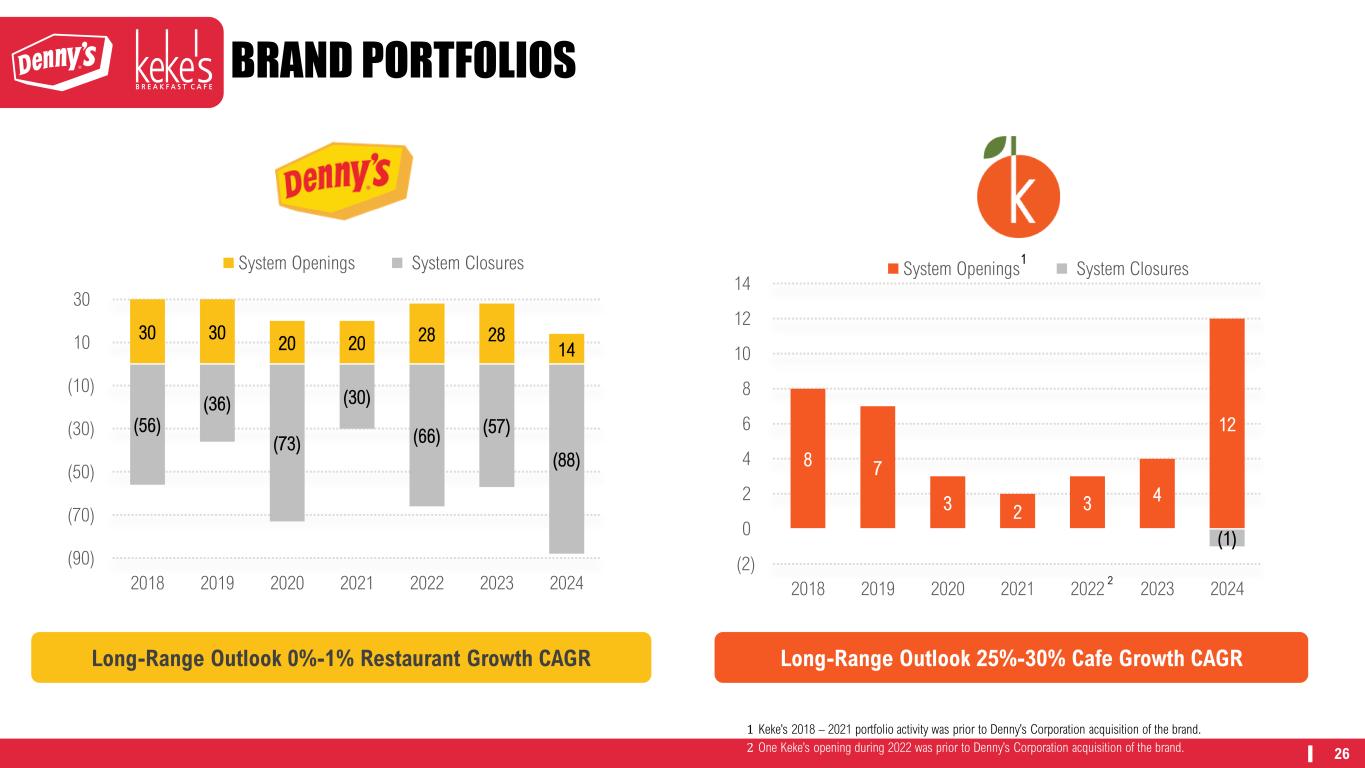

26 BRAND PORTFOLIOS 30 30 20 20 28 28 14 (56) (36) (73) (30) (66) (57) (88) (90) (70) (50) (30) (10) 10 30 2018 2019 2020 2021 2022 2023 2024 System Openings System Closures 8 7 3 2 3 4 12 (1) (2) 0 2 4 6 8 10 12 14 2018 2019 2020 2021 2022 2023 2024 System Openings System Closures 1 Keke’s 2018 – 2021 portfolio activity was prior to Denny’s Corporation acquisition of the brand. 2 One Keke’s opening during 2022 was prior to Denny’s Corporation acquisition of the brand. 2 1 Long-Range Outlook 25%-30% Cafe Growth CAGRLong-Range Outlook 0%-1% Restaurant Growth CAGR

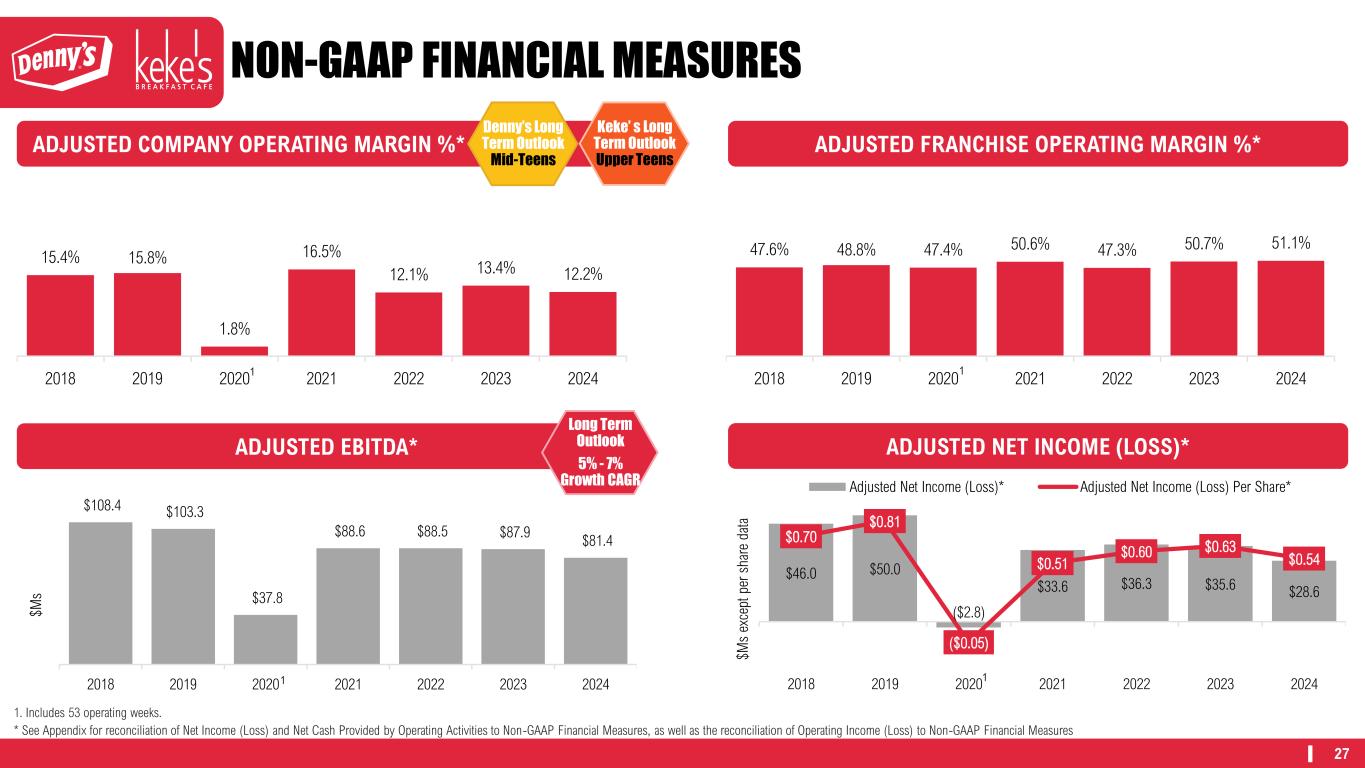

27 NON-GAAP FINANCIAL MEASURES 1. Includes 53 operating weeks. * See Appendix for reconciliation of Net Income (Loss) and Net Cash Provided by Operating Activities to Non-GAAP Financial Measures, as well as the reconciliation of Operating Income (Loss) to Non-GAAP Financial Measures 15.4% 15.8% 1.8% 16.5% 12.1% 13.4% 12.2% 2018 2019 2020 2021 2022 2023 2024 $108.4 $103.3 $37.8 $88.6 $88.5 $87.9 $81.4 2018 2019 2020 2021 2022 2023 2024 $M s $46.0 $50.0 ($2.8) $33.6 $36.3 $35.6 $28.6 $0.70 $0.81 ($0.05) $0.51 $0.60 $0.63 $0.54 2018 2019 2020 2021 2022 2023 2024 Adjusted Net Income (Loss)* Adjusted Net Income (Loss) Per Share* 47.6% 48.8% 47.4% 50.6% 47.3% 50.7% 51.1% 2018 2019 2020 2021 2022 2023 2024 ADJUSTED COMPANY OPERATING MARGIN %* ADJUSTED FRANCHISE OPERATING MARGIN %* ADJUSTED EBITDA* ADJUSTED NET INCOME (LOSS)* $M s ex ce pt p er s ha re d at a Long Term Outlook 5% - 7% Growth CAGR Denny’s Long Term Outlook Mid-Teens Keke’ s Long Term Outlook Upper Teens 1 1 1 1

28 EXPERIENCED AND COMMITTED LEADERSHIP TEAM KELLI F. VALADE Chief Executive Officer CHRISTOPHER D. BODE President and Chief Operating Officer, Denny’s Inc. DAVID P. SCHMIDT President, Keke’s Inc. STEPHEN C. DUNN Executive Vice President, Chief Global Development Officer GAIL SHARPS MYERS Executive Vice President, Chief Legal & Administrative Officer MONIGO G. SAYGBAY-HALLIE Executive Vice President, Chief People Officer ROBERT P. VEROSTEK Executive Vice President, Chief Financial Officer JAY C. GILMORE Senior Vice President, Chief Accounting Officer & Corporate Controller MINH LE Senior Vice President, Chief Technology Officer

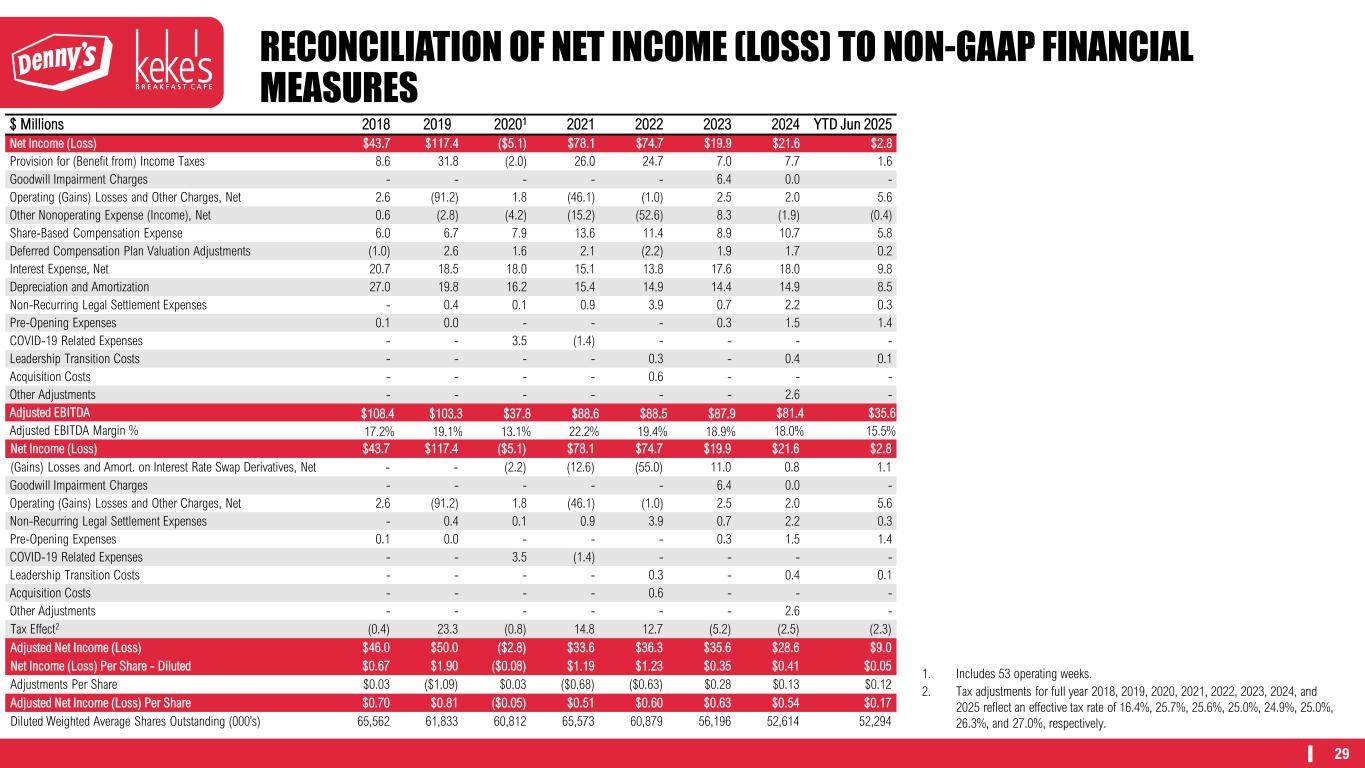

29 $ Millions 2018 2019 20201 2021 2022 2023 2024 YTD Jun 2025 Net Income (Loss) $43.7 $117.4 ($5.1) $78.1 $74.7 $19.9 $21.6 $2.8 Provision for (Benefit from) Income Taxes 8.6 31.8 (2.0) 26.0 24.7 7.0 7.7 1.6 Goodwill Impairment Charges - - - - - 6.4 0.0 - Operating (Gains) Losses and Other Charges, Net 2.6 (91.2) 1.8 (46.1) (1.0) 2.5 2.0 5.6 Other Nonoperating Expense (Income), Net 0.6 (2.8) (4.2) (15.2) (52.6) 8.3 (1.9) (0.4) Share‐Based Compensation Expense 6.0 6.7 7.9 13.6 11.4 8.9 10.7 5.8 Deferred Compensation Plan Valuation Adjustments (1.0) 2.6 1.6 2.1 (2.2) 1.9 1.7 0.2 Interest Expense, Net 20.7 18.5 18.0 15.1 13.8 17.6 18.0 9.8 Depreciation and Amortization 27.0 19.8 16.2 15.4 14.9 14.4 14.9 8.5 Non-Recurring Legal Settlement Expenses - 0.4 0.1 0.9 3.9 0.7 2.2 0.3 Pre-Opening Expenses 0.1 0.0 - - - 0.3 1.5 1.4 COVID-19 Related Expenses - - 3.5 (1.4) - - - - Leadership Transition Costs - - - - 0.3 - 0.4 0.1 Acquisition Costs - - - - 0.6 - - - Other Adjustments - - - - - - 2.6 - Adjusted EBITDA $108.4 $103.3 $37.8 $88.6 $88.5 $87.9 $81.4 $35.6 Adjusted EBITDA Margin % 17.2% 19.1% 13.1% 22.2% 19.4% 18.9% 18.0% 15.5% Net Income (Loss) $43.7 $117.4 ($5.1) $78.1 $74.7 $19.9 $21.6 $2.8 (Gains) Losses and Amort. on Interest Rate Swap Derivatives, Net - - (2.2) (12.6) (55.0) 11.0 0.8 1.1 Goodwill Impairment Charges - - - - - 6.4 0.0 - Operating (Gains) Losses and Other Charges, Net 2.6 (91.2) 1.8 (46.1) (1.0) 2.5 2.0 5.6 Non-Recurring Legal Settlement Expenses - 0.4 0.1 0.9 3.9 0.7 2.2 0.3 Pre-Opening Expenses 0.1 0.0 - - - 0.3 1.5 1.4 COVID-19 Related Expenses - - 3.5 (1.4) - - - - Leadership Transition Costs - - - - 0.3 - 0.4 0.1 Acquisition Costs - - - - 0.6 - - - Other Adjustments - - - - - - 2.6 - Tax Effect2 (0.4) 23.3 (0.8) 14.8 12.7 (5.2) (2.5) (2.3) Adjusted Net Income (Loss) $46.0 $50.0 ($2.8) $33.6 $36.3 $35.6 $28.6 $9.0 Net Income (Loss) Per Share - Diluted $0.67 $1.90 ($0.08) $1.19 $1.23 $0.35 $0.41 $0.05 Adjustments Per Share $0.03 ($1.09) $0.03 ($0.68) ($0.63) $0.28 $0.13 $0.12 Adjusted Net Income (Loss) Per Share $0.70 $0.81 ($0.05) $0.51 $0.60 $0.63 $0.54 $0.17 Diluted Weighted Average Shares Outstanding (000’s) 65,562 61,833 60,812 65,573 60,879 56,196 52,614 52,294 RECONCILIATION OF NET INCOME (LOSS) TO NON-GAAP FINANCIAL MEASURES 1. Includes 53 operating weeks. 2. Tax adjustments for full year 2018, 2019, 2020, 2021, 2022, 2023, 2024, and 2025 reflect an effective tax rate of 16.4%, 25.7%, 25.6%, 25.0%, 24.9%, 25.0%, 26.3%, and 27.0%, respectively.

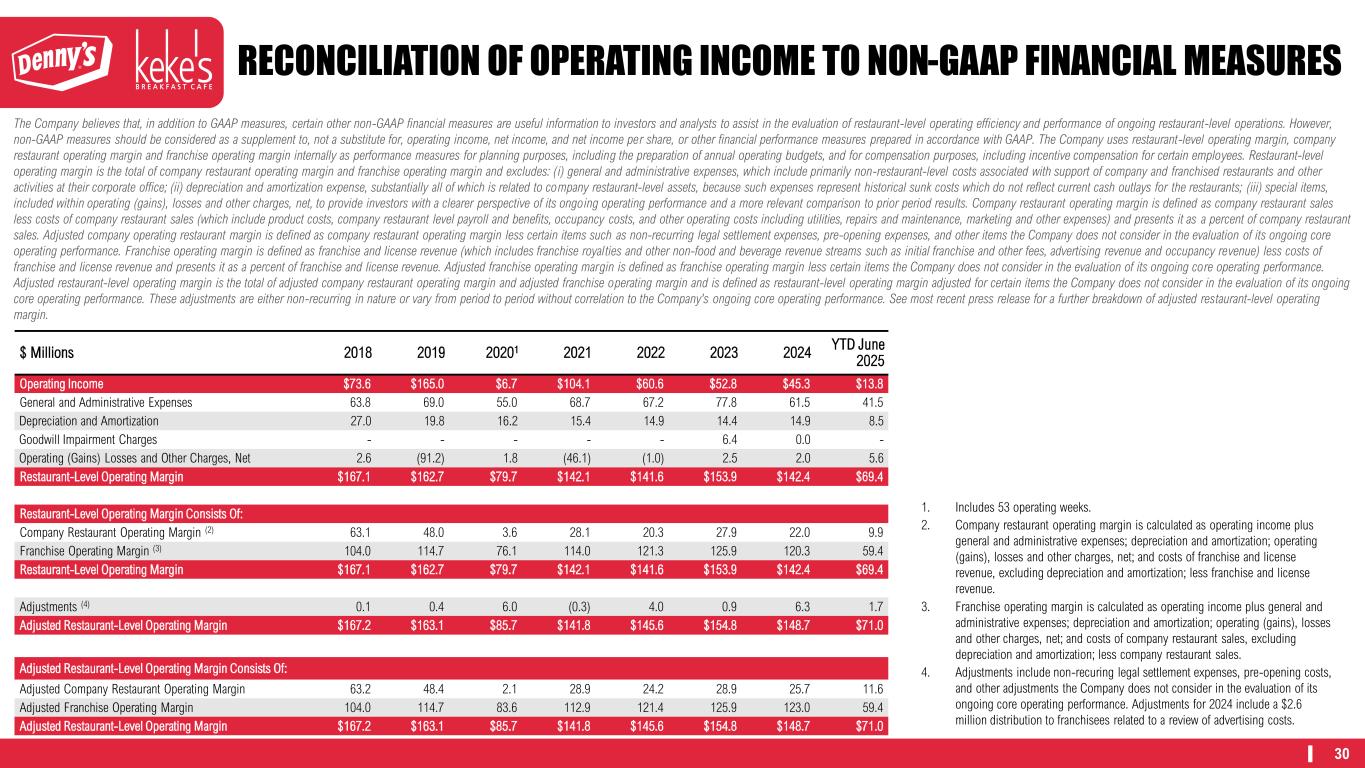

30 $ Millions 2018 2019 20201 2021 2022 2023 2024 YTD June 2025 Operating Income $73.6 $165.0 $6.7 $104.1 $60.6 $52.8 $45.3 $13.8 General and Administrative Expenses 63.8 69.0 55.0 68.7 67.2 77.8 61.5 41.5 Depreciation and Amortization 27.0 19.8 16.2 15.4 14.9 14.4 14.9 8.5 Goodwill Impairment Charges - - - - - 6.4 0.0 - Operating (Gains) Losses and Other Charges, Net 2.6 (91.2) 1.8 (46.1) (1.0) 2.5 2.0 5.6 Restaurant-Level Operating Margin $167.1 $162.7 $79.7 $142.1 $141.6 $153.9 $142.4 $69.4 Restaurant-Level Operating Margin Consists Of: Company Restaurant Operating Margin (2) 63.1 48.0 3.6 28.1 20.3 27.9 22.0 9.9 Franchise Operating Margin (3) 104.0 114.7 76.1 114.0 121.3 125.9 120.3 59.4 Restaurant-Level Operating Margin $167.1 $162.7 $79.7 $142.1 $141.6 $153.9 $142.4 $69.4 Adjustments (4) 0.1 0.4 6.0 (0.3) 4.0 0.9 6.3 1.7 Adjusted Restaurant-Level Operating Margin $167.2 $163.1 $85.7 $141.8 $145.6 $154.8 $148.7 $71.0 Adjusted Restaurant-Level Operating Margin Consists Of: Adjusted Company Restaurant Operating Margin 63.2 48.4 2.1 28.9 24.2 28.9 25.7 11.6 Adjusted Franchise Operating Margin 104.0 114.7 83.6 112.9 121.4 125.9 123.0 59.4 Adjusted Restaurant-Level Operating Margin $167.2 $163.1 $85.7 $141.8 $145.6 $154.8 $148.7 $71.0 The Company believes that, in addition to GAAP measures, certain other non-GAAP financial measures are useful information to investors and analysts to assist in the evaluation of restaurant-level operating efficiency and performance of ongoing restaurant-level operations. However, non-GAAP measures should be considered as a supplement to, not a substitute for, operating income, net income, and net income per share, or other financial performance measures prepared in accordance with GAAP. The Company uses restaurant-level operating margin, company restaurant operating margin and franchise operating margin internally as performance measures for planning purposes, including the preparation of annual operating budgets, and for compensation purposes, including incentive compensation for certain employees. Restaurant-level operating margin is the total of company restaurant operating margin and franchise operating margin and excludes: (i) general and administrative expenses, which include primarily non-restaurant-level costs associated with support of company and franchised restaurants and other activities at their corporate office; (ii) depreciation and amortization expense, substantially all of which is related to company restaurant-level assets, because such expenses represent historical sunk costs which do not reflect current cash outlays for the restaurants; (iii) special items, included within operating (gains), losses and other charges, net, to provide investors with a clearer perspective of its ongoing operating performance and a more relevant comparison to prior period results. Company restaurant operating margin is defined as company restaurant sales less costs of company restaurant sales (which include product costs, company restaurant level payroll and benefits, occupancy costs, and other operating costs including utilities, repairs and maintenance, marketing and other expenses) and presents it as a percent of company restaurant sales. Adjusted company operating restaurant margin is defined as company restaurant operating margin less certain items such as non-recurring legal settlement expenses, pre-opening expenses, and other items the Company does not consider in the evaluation of its ongoing core operating performance. Franchise operating margin is defined as franchise and license revenue (which includes franchise royalties and other non-food and beverage revenue streams such as initial franchise and other fees, advertising revenue and occupancy revenue) less costs of franchise and license revenue and presents it as a percent of franchise and license revenue. Adjusted franchise operating margin is defined as franchise operating margin less certain items the Company does not consider in the evaluation of its ongoing core operating performance. Adjusted restaurant-level operating margin is the total of adjusted company restaurant operating margin and adjusted franchise operating margin and is defined as restaurant-level operating margin adjusted for certain items the Company does not consider in the evaluation of its ongoing core operating performance. These adjustments are either non-recurring in nature or vary from period to period without correlation to the Company's ongoing core operating performance. See most recent press release for a further breakdown of adjusted restaurant-level operating margin. RECONCILIATION OF OPERATING INCOME TO NON-GAAP FINANCIAL MEASURES 1. Includes 53 operating weeks. 2. Company restaurant operating margin is calculated as operating income plus general and administrative expenses; depreciation and amortization; operating (gains), losses and other charges, net; and costs of franchise and license revenue, excluding depreciation and amortization; less franchise and license revenue. 3. Franchise operating margin is calculated as operating income plus general and administrative expenses; depreciation and amortization; operating (gains), losses and other charges, net; and costs of company restaurant sales, excluding depreciation and amortization; less company restaurant sales. 4. Adjustments include non-recuring legal settlement expenses, pre-opening costs, and other adjustments the Company does not consider in the evaluation of its ongoing core operating performance. Adjustments for 2024 include a $2.6 million distribution to franchisees related to a review of advertising costs.