http://fasb.org/us-gaap/2023#SecuredDebtCurrenthttp://fasb.org/us-gaap/2023#SecuredDebtCurrenthttp://fasb.org/us-gaap/2023#SecuredDebtCurrenthttp://fasb.org/us-gaap/2023#SecuredDebtCurrenthttp://fasb.org/us-gaap/2023#SecuredDebtCurrenthttp://fasb.org/us-gaap/2023#SecuredDebtCurrenthttp://fasb.org/us-gaap/2023#SecuredDebtCurrenthttp://fasb.org/us-gaap/2023#SecuredDebtCurrenthttp://jdcc.deere.com/20231029#ForeignDebtSecuritiesMember25002500http://jdcc.deere.com/20231029#LongTermDebtAndFinanceLeasesNoncurrentDEERE JOHN CAPITAL CORP0000027673--10-292023FYfalsehttp://fasb.org/us-gaap/2023#InterestExpense http://fasb.org/us-gaap/2023#SellingGeneralAndAdministrativeExpensehttp://fasb.org/us-gaap/2023#InterestExpense http://fasb.org/us-gaap/2023#SellingGeneralAndAdministrativeExpensehttp://fasb.org/us-gaap/2023#InterestExpense http://fasb.org/us-gaap/2023#SellingGeneralAndAdministrativeExpensehttp://fasb.org/us-gaap/2023#OtherAssetshttp://fasb.org/us-gaap/2023#OtherAssetshttp://fasb.org/us-gaap/2023#OtherAssetshttp://jdcc.deere.com/20231029#UltimateParentCompanyAndItsWhollyOwnedSubsidiariesMemberhttp://jdcc.deere.com/20231029#UltimateParentCompanyAndItsWhollyOwnedSubsidiariesMember0http://fasb.org/us-gaap/2023#SecuredDebtCurrenthttp://fasb.org/us-gaap/2023#SecuredDebtCurrenthttp://fasb.org/us-gaap/2023#SecuredDebtCurrenthttp://jdcc.deere.com/20231029#UltimateParentCompanyAndItsWhollyOwnedSubsidiariesMemberhttp://jdcc.deere.com/20231029#UltimateParentCompanyAndItsWhollyOwnedSubsidiariesMemberhttp://jdcc.deere.com/20231029#UltimateParentCompanyAndItsWhollyOwnedSubsidiariesMember0.005http://jdcc.deere.com/20231029#UltimateParentCompanyAndItsWhollyOwnedSubsidiariesMemberhttp://jdcc.deere.com/20231029#UltimateParentCompanyAndItsWhollyOwnedSubsidiariesMemberhttp://jdcc.deere.com/20231029#UltimateParentCompanyAndItsWhollyOwnedSubsidiariesMemberP1Mhttp://jdcc.deere.com/20231029#UltimateParentCompanyAndItsWhollyOwnedSubsidiariesMemberhttp://jdcc.deere.com/20231029#UltimateParentCompanyAndItsWhollyOwnedSubsidiariesMemberhttp://jdcc.deere.com/20231029#UltimateParentCompanyAndItsWhollyOwnedSubsidiariesMemberhttp://fasb.org/us-gaap/2023#SecuredDebtCurrenthttp://jdcc.deere.com/20231029#UltimateParentCompanyAndItsWhollyOwnedSubsidiariesMemberhttp://jdcc.deere.com/20231029#UltimateParentCompanyAndItsWhollyOwnedSubsidiariesMemberhttp://jdcc.deere.com/20231029#UltimateParentCompanyAndItsWhollyOwnedSubsidiariesMemberhttp://jdcc.deere.com/20231029#UltimateParentCompanyAndItsWhollyOwnedSubsidiariesMemberhttp://jdcc.deere.com/20231029#UltimateParentCompanyAndItsWhollyOwnedSubsidiariesMemberhttp://jdcc.deere.com/20231029#UltimateParentCompanyAndItsWhollyOwnedSubsidiariesMemberhttp://jdcc.deere.com/20231029#UltimateParentCompanyAndItsWhollyOwnedSubsidiariesMemberhttp://jdcc.deere.com/20231029#UltimateParentCompanyAndItsWhollyOwnedSubsidiariesMemberhttp://jdcc.deere.com/20231029#UltimateParentCompanyAndItsWhollyOwnedSubsidiariesMemberhttp://jdcc.deere.com/20231029#UltimateParentCompanyAndItsWhollyOwnedSubsidiariesMemberhttp://jdcc.deere.com/20231029#UltimateParentCompanyAndItsWhollyOwnedSubsidiariesMemberhttp://jdcc.deere.com/20231029#UltimateParentCompanyAndItsWhollyOwnedSubsidiariesMemberhttp://jdcc.deere.com/20231029#ForeignDebtSecuritiesMemberhttp://jdcc.deere.com/20231029#LongTermDebtAndFinanceLeasesNoncurrenthttp://jdcc.deere.com/20231029#CorrectionOfTimingOfExpenseAndClassificationForFinancingIncentivesProgramToDealersMember0000027673us-gaap:RetainedEarningsMember2023-10-290000027673us-gaap:NoncontrollingInterestMember2023-10-290000027673us-gaap:CommonStockMember2023-10-290000027673us-gaap:RetainedEarningsMember2022-10-300000027673us-gaap:NoncontrollingInterestMember2022-10-300000027673us-gaap:CommonStockMember2022-10-300000027673us-gaap:RetainedEarningsMember2021-10-310000027673us-gaap:NoncontrollingInterestMember2021-10-310000027673us-gaap:CommonStockMember2021-10-310000027673srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccountingStandardsUpdate201613Memberus-gaap:RetainedEarningsMember2020-11-010000027673us-gaap:RetainedEarningsMember2020-11-010000027673us-gaap:NoncontrollingInterestMember2020-11-010000027673us-gaap:CommonStockMember2020-11-010000027673us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-11-010000027673us-gaap:AccumulatedTranslationAdjustmentMember2023-10-290000027673us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-10-290000027673us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-10-290000027673us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-10-290000027673us-gaap:AccumulatedTranslationAdjustmentMember2022-10-300000027673us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-300000027673us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-10-300000027673us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-10-300000027673us-gaap:AccumulatedTranslationAdjustmentMember2021-10-310000027673us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-10-310000027673us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2021-10-310000027673us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-10-310000027673jdcc:CommercialPaperAndOtherNotesPayableMember2023-10-290000027673us-gaap:SecuredDebtMember2022-10-300000027673jdcc:CommercialPaperAndOtherNotesPayableMember2022-10-300000027673us-gaap:NonUsMember2022-10-312023-10-290000027673country:US2022-10-312023-10-290000027673us-gaap:NonUsMember2021-11-012022-10-300000027673country:US2021-11-012022-10-300000027673us-gaap:NonUsMember2020-11-022021-10-310000027673country:US2020-11-022021-10-310000027673us-gaap:PropertySubjectToOperatingLeaseMemberus-gaap:RelatedPartyMember2022-10-312023-10-290000027673us-gaap:CommercialPortfolioSegmentMemberus-gaap:RelatedPartyMember2022-10-312023-10-290000027673jdcc:RetailRevolvingChargeAccountsPortfolioSegmentMemberus-gaap:RelatedPartyMember2022-10-312023-10-290000027673jdcc:RetailNotesPortfolioSegmentMemberus-gaap:RelatedPartyMember2022-10-312023-10-290000027673jdcc:FinancingLeasesPortfolioSegmentMemberus-gaap:RelatedPartyMember2022-10-312023-10-290000027673us-gaap:PropertySubjectToOperatingLeaseMemberus-gaap:RelatedPartyMember2021-11-012022-10-300000027673us-gaap:CommercialPortfolioSegmentMemberus-gaap:RelatedPartyMember2021-11-012022-10-300000027673jdcc:RetailRevolvingChargeAccountsPortfolioSegmentMemberus-gaap:RelatedPartyMember2021-11-012022-10-300000027673jdcc:RetailNotesPortfolioSegmentMemberus-gaap:RelatedPartyMember2021-11-012022-10-300000027673jdcc:FinancingLeasesPortfolioSegmentMemberus-gaap:RelatedPartyMember2021-11-012022-10-300000027673us-gaap:PropertySubjectToOperatingLeaseMemberus-gaap:RelatedPartyMember2020-11-022021-10-310000027673us-gaap:CommercialPortfolioSegmentMemberus-gaap:RelatedPartyMember2020-11-022021-10-310000027673jdcc:RetailRevolvingChargeAccountsPortfolioSegmentMemberus-gaap:RelatedPartyMember2020-11-022021-10-310000027673jdcc:RetailNotesPortfolioSegmentMemberus-gaap:RelatedPartyMember2020-11-022021-10-310000027673jdcc:FinancingLeasesPortfolioSegmentMemberus-gaap:RelatedPartyMember2020-11-022021-10-310000027673srt:ScenarioPreviouslyReportedMember2021-10-310000027673srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2021-10-310000027673srt:ScenarioPreviouslyReportedMember2020-11-010000027673srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2020-11-010000027673jdcc:RetailNotesPortfolioSegmentMember2022-10-312023-10-290000027673jdcc:RetailNotesPortfolioSegmentMember2021-11-012022-10-300000027673jdcc:RetailNotesPortfolioSegmentMember2020-11-022021-10-310000027673us-gaap:NoncontrollingInterestMember2022-10-312023-10-290000027673us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2022-10-312023-10-290000027673us-gaap:NoncontrollingInterestMember2021-11-012022-10-300000027673us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2021-11-012022-10-300000027673us-gaap:NoncontrollingInterestMember2020-11-022021-10-310000027673us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2020-11-022021-10-310000027673us-gaap:NonrelatedPartyMember2022-10-312023-10-290000027673us-gaap:NonrelatedPartyMember2021-11-012022-10-300000027673us-gaap:NonrelatedPartyMember2020-11-022021-10-310000027673us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-312023-10-290000027673us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-11-012022-10-300000027673us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-11-022021-10-310000027673us-gaap:InterestRateSwapMember2022-10-312023-10-290000027673us-gaap:InterestRateSwapMember2021-11-012022-10-300000027673us-gaap:InterestRateSwapMember2020-11-022021-10-310000027673us-gaap:AccumulatedTranslationAdjustmentMember2022-10-312023-10-290000027673us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-10-312023-10-290000027673us-gaap:AccumulatedTranslationAdjustmentMember2021-11-012022-10-300000027673us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2021-11-012022-10-300000027673us-gaap:AccumulatedTranslationAdjustmentMember2020-11-022021-10-310000027673us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2020-11-022021-10-310000027673us-gaap:AssetPledgedAsCollateralWithRightMember2023-10-290000027673us-gaap:AssetPledgedAsCollateralWithRightMember2022-10-300000027673us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-10-312023-10-290000027673us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-11-012022-10-300000027673us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-11-022021-10-310000027673us-gaap:NotesPayableOtherPayablesMember2022-10-300000027673jdcc:BancoJohnDeereSaMemberus-gaap:RelatedPartyMember2023-10-290000027673jdcc:JohnDeereAgriculturalHoldingsIncMemberus-gaap:RelatedPartyMember2022-10-300000027673jdcc:BancoJohnDeereSaMemberus-gaap:RelatedPartyMember2022-10-300000027673jdcc:LineOfCreditFacilityAgreementExpiringSecondQuarter2028Member2023-10-290000027673jdcc:LineOfCreditFacilityAgreementExpiringSecondQuarter2027Member2023-10-290000027673jdcc:LineOfCreditFacility364DayAgreementExpiringSecondQuarter2024Member2023-10-290000027673jdcc:MarketableSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-10-290000027673jdcc:MarketableSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-10-300000027673us-gaap:InterestRateSwapMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-10-312023-10-290000027673us-gaap:InterestRateSwapMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-11-012022-10-300000027673us-gaap:InterestRateSwapMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-11-022021-10-310000027673us-gaap:InterestRateSwapMember2023-10-290000027673us-gaap:InterestRateSwapMember2022-10-300000027673us-gaap:FinancialGuaranteeMemberjdcc:JohnDeereFinancialIncMemberus-gaap:CommercialPaperMember2023-10-290000027673country:AR2020-11-022021-10-310000027673srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2023-01-302023-01-300000027673srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2023-01-300000027673jdcc:JohnDeereFinancialSSMember2023-10-290000027673srt:ParentCompanyMemberus-gaap:SubsequentEventMember2023-12-072023-12-070000027673srt:ParentCompanyMemberus-gaap:RelatedPartyMember2022-10-312023-10-290000027673us-gaap:RetainedEarningsMember2022-10-312023-10-290000027673srt:ParentCompanyMemberus-gaap:RelatedPartyMember2021-11-012022-10-300000027673us-gaap:RetainedEarningsMember2021-11-012022-10-300000027673srt:ParentCompanyMemberus-gaap:RelatedPartyMember2020-11-022021-10-310000027673us-gaap:RetainedEarningsMember2020-11-022021-10-310000027673us-gaap:FinancialGuaranteeMemberjdcc:JohnDeereFinancialIncMemberus-gaap:DerivativeMember2023-10-290000027673us-gaap:InterestRateSwapMemberus-gaap:InterestExpenseMember2022-10-312023-10-290000027673us-gaap:ForeignExchangeContractMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2022-10-312023-10-290000027673us-gaap:InterestRateSwapMemberus-gaap:InterestExpenseMember2021-11-012022-10-300000027673us-gaap:ForeignExchangeContractMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2021-11-012022-10-300000027673us-gaap:InterestRateSwapMemberus-gaap:InterestExpenseMember2020-11-022021-10-310000027673us-gaap:ForeignExchangeContractMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2020-11-022021-10-310000027673jdcc:UltimateParentCompanyAndItsWhollyOwnedSubsidiariesMemberus-gaap:RelatedPartyMember2021-11-012022-10-300000027673jdcc:UltimateParentCompanyAndItsWhollyOwnedSubsidiariesMemberus-gaap:RelatedPartyMember2020-11-022021-10-310000027673us-gaap:InterestRateSwapMemberus-gaap:FairValueHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-10-290000027673us-gaap:InterestRateCapMemberus-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMemberus-gaap:ShortMember2023-10-290000027673us-gaap:AccountsPayableAndAccruedLiabilitiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-10-290000027673jdcc:OtherPayablesToRelatedPartyMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-10-290000027673us-gaap:InterestRateSwapMemberus-gaap:FairValueHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-10-300000027673us-gaap:InterestRateCapMemberus-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMemberus-gaap:ShortMember2022-10-300000027673us-gaap:AccountsPayableAndAccruedLiabilitiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-10-300000027673jdcc:OtherPayablesToRelatedPartyMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-10-300000027673us-gaap:OtherAssetsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-10-290000027673us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-10-290000027673us-gaap:InterestRateCapMemberus-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMemberus-gaap:LongMember2023-10-290000027673jdcc:ReceivablesFromRelatedPartyMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-10-290000027673us-gaap:InterestRateSwapMemberus-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMember2023-10-290000027673us-gaap:ForeignExchangeContractMemberus-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMember2023-10-290000027673us-gaap:CrossCurrencyInterestRateContractMemberus-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMember2023-10-290000027673us-gaap:OtherAssetsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-10-300000027673us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-10-300000027673us-gaap:InterestRateCapMemberus-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMemberus-gaap:LongMember2022-10-300000027673jdcc:ReceivablesFromRelatedPartyMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-10-300000027673us-gaap:InterestRateSwapMemberus-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMember2022-10-300000027673us-gaap:ForeignExchangeContractMemberus-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMember2022-10-300000027673us-gaap:CrossCurrencyInterestRateContractMemberus-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMember2022-10-300000027673jdcc:UnrelatedExternalCounterpartiesMember2023-10-290000027673jdcc:UltimateParentCompanyAndItsWhollyOwnedSubsidiariesMemberus-gaap:RelatedPartyMember2022-10-300000027673jdcc:UnrelatedExternalCounterpartiesMember2022-10-300000027673us-gaap:PensionPlansDefinedBenefitMember2022-10-312023-10-290000027673us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-10-312023-10-290000027673us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-11-012022-10-300000027673us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-11-022021-10-310000027673us-gaap:FinancialGuaranteeMemberjdcc:JohnDeereFinancialIncMemberus-gaap:MediumTermNotesMember2023-10-290000027673jdcc:MediumTermNotesDueInNextTenYearsMember2023-10-290000027673jdcc:MediumTermNotesDueInNextTenYearsMember2022-10-300000027673us-gaap:RelatedPartyMember2022-10-312023-10-290000027673us-gaap:RelatedPartyMember2021-11-012022-10-300000027673us-gaap:RelatedPartyMember2020-11-022021-10-310000027673country:USus-gaap:AccountsReceivableMemberus-gaap:GeographicConcentrationRiskMember2022-10-312023-10-290000027673us-gaap:AccountingStandardsUpdate202202Member2023-10-290000027673us-gaap:AccountingStandardsUpdate202201Member2023-10-290000027673us-gaap:AccountingStandardsUpdate202110Member2023-10-290000027673us-gaap:AccountingStandardsUpdate202108Member2023-10-290000027673us-gaap:AccountingStandardsUpdate202105Member2023-10-290000027673us-gaap:AccountingStandardsUpdate202104Member2023-10-290000027673us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-10-290000027673us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-10-300000027673us-gaap:RelatedPartyMemberjdcc:TaxSharingAgreementMember2023-10-290000027673us-gaap:NonrelatedPartyMember2023-10-290000027673us-gaap:RelatedPartyMemberjdcc:TaxSharingAgreementMember2022-10-300000027673srt:ScenarioPreviouslyReportedMemberus-gaap:NonrelatedPartyMember2022-10-300000027673srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMemberus-gaap:NonrelatedPartyMember2022-10-300000027673us-gaap:NonrelatedPartyMember2022-10-300000027673srt:MinimumMemberus-gaap:CommercialPortfolioSegmentMember2022-10-312023-10-290000027673srt:MaximumMemberus-gaap:CommercialPortfolioSegmentMember2022-10-312023-10-290000027673us-gaap:SecuredDebtMember2023-10-290000027673jdcc:ConstructionAndForestryEquipmentMember2023-10-290000027673jdcc:AgricultureAndTurfEquipmentMember2023-10-290000027673jdcc:ConstructionAndForestryEquipmentMember2022-10-300000027673jdcc:AgricultureAndTurfEquipmentMember2022-10-300000027673us-gaap:UnfundedLoanCommitmentMember2023-10-290000027673srt:MinimumMemberjdcc:RetailNotesPortfolioSegmentMember2022-10-312023-10-290000027673srt:MinimumMemberjdcc:RetailNotesPortfolioSegmentMember2021-11-012022-10-300000027673us-gaap:SecuredDebtMember2022-10-312023-10-290000027673country:AR2022-10-312023-10-290000027673country:AR2021-11-012022-10-300000027673us-gaap:ConstructionSectorMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:FinancialAssetPastDueMember2023-10-290000027673us-gaap:AgriculturalSectorMemberus-gaap:NonperformingFinancingReceivableMemberus-gaap:CommercialPortfolioSegmentMember2023-10-290000027673us-gaap:AgriculturalSectorMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:FinancialAssetPastDueMember2023-10-290000027673us-gaap:NonUsMember2023-10-290000027673jdcc:FinancingLeasesPortfolioSegmentMember2023-10-290000027673country:US2023-10-290000027673us-gaap:ConstructionSectorMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:FinancialAssetPastDueMember2022-10-300000027673us-gaap:AgriculturalSectorMemberus-gaap:NonperformingFinancingReceivableMemberus-gaap:CommercialPortfolioSegmentMember2022-10-300000027673srt:ScenarioPreviouslyReportedMemberjdcc:RetailNotesPortfolioSegmentMemberus-gaap:AssetNotPledgedAsCollateralMember2022-10-300000027673srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMemberjdcc:RetailNotesPortfolioSegmentMemberus-gaap:AssetNotPledgedAsCollateralMember2022-10-300000027673us-gaap:NonUsMember2022-10-300000027673jdcc:FinancingLeasesPortfolioSegmentMember2022-10-300000027673country:US2022-10-300000027673us-gaap:NonUsMember2021-10-310000027673country:US2021-10-310000027673us-gaap:FairValueInputsLevel3Memberus-gaap:AssetPledgedAsCollateralWithRightMember2023-10-290000027673us-gaap:FairValueInputsLevel3Memberus-gaap:AssetNotPledgedAsCollateralMember2023-10-290000027673us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:AssetPledgedAsCollateralWithRightMember2023-10-290000027673us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:AssetNotPledgedAsCollateralMember2023-10-290000027673us-gaap:FairValueInputsLevel3Memberus-gaap:AssetPledgedAsCollateralWithRightMember2022-10-300000027673us-gaap:FairValueInputsLevel3Memberus-gaap:AssetNotPledgedAsCollateralMember2022-10-300000027673us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:AssetPledgedAsCollateralWithRightMember2022-10-300000027673us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:AssetNotPledgedAsCollateralMember2022-10-300000027673srt:ScenarioPreviouslyReportedMember2022-10-300000027673srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2022-10-300000027673us-gaap:RelatedPartyMember2023-10-290000027673us-gaap:RelatedPartyMember2022-10-300000027673country:AR2023-10-290000027673country:AR2022-10-300000027673us-gaap:FairValueInputsLevel2Member2023-10-290000027673us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-10-290000027673us-gaap:FairValueInputsLevel2Member2022-10-300000027673us-gaap:CarryingReportedAmountFairValueDisclosureMember2022-10-300000027673srt:MinimumMemberus-gaap:AgriculturalSectorMemberjdcc:RetailNotesPortfolioSegmentMember2022-10-312023-10-290000027673srt:MaximumMemberus-gaap:AgriculturalSectorMemberjdcc:RetailNotesPortfolioSegmentMember2022-10-312023-10-290000027673jdcc:UltimateParentCompanyAndItsWhollyOwnedSubsidiariesMemberus-gaap:DerivativeMemberus-gaap:RelatedPartyMember2023-10-290000027673jdcc:UltimateParentCompanyAndItsWhollyOwnedSubsidiariesMemberus-gaap:DerivativeMemberus-gaap:RelatedPartyMember2022-10-300000027673srt:ScenarioPreviouslyReportedMember2021-11-012022-10-300000027673srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2021-11-012022-10-300000027673srt:ScenarioPreviouslyReportedMember2020-11-022021-10-310000027673srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2020-11-022021-10-310000027673jdcc:LongTermDebtNoncurrentMemberus-gaap:InterestRateSwapMember2023-10-290000027673jdcc:DebtCurrentMemberus-gaap:InterestRateSwapMember2023-10-290000027673jdcc:LongTermDebtNoncurrentMemberus-gaap:InterestRateSwapMember2022-10-300000027673jdcc:DebtCurrentMemberus-gaap:InterestRateSwapMember2022-10-300000027673us-gaap:FinancialGuaranteeMemberjdcc:JohnDeereFinancialIncMemberus-gaap:MediumTermNotesMember2022-10-312023-10-290000027673us-gaap:UnfundedLoanCommitmentMember2022-10-312023-10-290000027673us-gaap:UnfundedLoanCommitmentMember2021-11-012022-10-300000027673us-gaap:UnfundedLoanCommitmentMember2020-11-022021-10-310000027673us-gaap:AgriculturalSectorMemberus-gaap:CommercialPortfolioSegmentMemberus-gaap:FinancialAssetPastDueMember2022-10-300000027673us-gaap:ConstructionSectorMemberus-gaap:ConsumerPortfolioSegmentMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2023-10-290000027673us-gaap:ConstructionSectorMemberus-gaap:ConsumerPortfolioSegmentMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2022-10-300000027673us-gaap:AgriculturalSectorMemberus-gaap:ConsumerPortfolioSegmentMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2022-10-300000027673us-gaap:ConstructionSectorMemberus-gaap:PerformingFinancingReceivableMemberus-gaap:CommercialPortfolioSegmentMember2022-10-300000027673us-gaap:ConstructionSectorMemberus-gaap:PerformingFinancingReceivableMemberus-gaap:ConsumerPortfolioSegmentMember2023-10-290000027673us-gaap:ConstructionSectorMemberus-gaap:PerformingFinancingReceivableMemberus-gaap:CommercialPortfolioSegmentMember2023-10-290000027673us-gaap:ConstructionSectorMemberus-gaap:NonperformingFinancingReceivableMemberus-gaap:ConsumerPortfolioSegmentMember2023-10-290000027673us-gaap:ConstructionSectorMemberus-gaap:ConsumerPortfolioSegmentMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2023-10-290000027673us-gaap:ConstructionSectorMemberus-gaap:ConsumerPortfolioSegmentMemberus-gaap:FinancingReceivables30To59DaysPastDueMember2023-10-290000027673us-gaap:AgriculturalSectorMemberus-gaap:PerformingFinancingReceivableMemberus-gaap:ConsumerPortfolioSegmentMember2023-10-290000027673us-gaap:AgriculturalSectorMemberus-gaap:PerformingFinancingReceivableMemberus-gaap:CommercialPortfolioSegmentMember2023-10-290000027673us-gaap:AgriculturalSectorMemberus-gaap:NonperformingFinancingReceivableMemberus-gaap:ConsumerPortfolioSegmentMember2023-10-290000027673us-gaap:AgriculturalSectorMemberus-gaap:ConsumerPortfolioSegmentMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2023-10-290000027673us-gaap:AgriculturalSectorMemberus-gaap:ConsumerPortfolioSegmentMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2023-10-290000027673us-gaap:AgriculturalSectorMemberus-gaap:ConsumerPortfolioSegmentMemberus-gaap:FinancingReceivables30To59DaysPastDueMember2023-10-290000027673us-gaap:ConsumerPortfolioSegmentMember2023-10-290000027673us-gaap:ConstructionSectorMemberus-gaap:PerformingFinancingReceivableMemberus-gaap:ConsumerPortfolioSegmentMember2022-10-300000027673us-gaap:ConstructionSectorMemberus-gaap:NonperformingFinancingReceivableMemberus-gaap:ConsumerPortfolioSegmentMember2022-10-300000027673us-gaap:ConstructionSectorMemberus-gaap:ConsumerPortfolioSegmentMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2022-10-300000027673us-gaap:ConstructionSectorMemberus-gaap:ConsumerPortfolioSegmentMemberus-gaap:FinancingReceivables30To59DaysPastDueMember2022-10-300000027673us-gaap:AgriculturalSectorMemberus-gaap:PerformingFinancingReceivableMemberus-gaap:ConsumerPortfolioSegmentMember2022-10-300000027673us-gaap:AgriculturalSectorMemberus-gaap:PerformingFinancingReceivableMemberus-gaap:CommercialPortfolioSegmentMember2022-10-300000027673us-gaap:AgriculturalSectorMemberus-gaap:NonperformingFinancingReceivableMemberus-gaap:ConsumerPortfolioSegmentMember2022-10-300000027673us-gaap:AgriculturalSectorMemberus-gaap:ConsumerPortfolioSegmentMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2022-10-300000027673us-gaap:AgriculturalSectorMemberus-gaap:ConsumerPortfolioSegmentMemberus-gaap:FinancingReceivables30To59DaysPastDueMember2022-10-300000027673us-gaap:ConsumerPortfolioSegmentMember2022-10-300000027673us-gaap:ConsumerPortfolioSegmentMember2022-10-312023-10-290000027673jdcc:UsedEquipmentMemberus-gaap:ConstructionSectorMemberjdcc:RetailNotesPortfolioSegmentMemberus-gaap:AssetPledgedAsCollateralWithRightMember2023-10-290000027673jdcc:UsedEquipmentMemberus-gaap:ConstructionSectorMemberjdcc:RetailNotesPortfolioSegmentMemberus-gaap:AssetNotPledgedAsCollateralMember2023-10-290000027673jdcc:UsedEquipmentMemberus-gaap:AgriculturalSectorMemberjdcc:RetailNotesPortfolioSegmentMemberus-gaap:AssetPledgedAsCollateralWithRightMember2023-10-290000027673jdcc:UsedEquipmentMemberus-gaap:AgriculturalSectorMemberjdcc:RetailNotesPortfolioSegmentMemberus-gaap:AssetNotPledgedAsCollateralMember2023-10-290000027673jdcc:NewEquipmentMemberus-gaap:ConstructionSectorMemberjdcc:RetailNotesPortfolioSegmentMemberus-gaap:AssetPledgedAsCollateralWithRightMember2023-10-290000027673jdcc:NewEquipmentMemberus-gaap:ConstructionSectorMemberjdcc:RetailNotesPortfolioSegmentMemberus-gaap:AssetNotPledgedAsCollateralMember2023-10-290000027673jdcc:NewEquipmentMemberus-gaap:AgriculturalSectorMemberjdcc:RetailNotesPortfolioSegmentMemberus-gaap:AssetPledgedAsCollateralWithRightMember2023-10-290000027673jdcc:NewEquipmentMemberus-gaap:AgriculturalSectorMemberjdcc:RetailNotesPortfolioSegmentMemberus-gaap:AssetNotPledgedAsCollateralMember2023-10-290000027673jdcc:RetailNotesPortfolioSegmentMemberus-gaap:AssetPledgedAsCollateralWithRightMember2023-10-290000027673jdcc:RetailNotesPortfolioSegmentMemberus-gaap:AssetNotPledgedAsCollateralMember2023-10-290000027673jdcc:UsedEquipmentMemberus-gaap:ConstructionSectorMemberjdcc:RetailNotesPortfolioSegmentMemberus-gaap:AssetPledgedAsCollateralWithRightMember2022-10-300000027673jdcc:UsedEquipmentMemberus-gaap:ConstructionSectorMemberjdcc:RetailNotesPortfolioSegmentMemberus-gaap:AssetNotPledgedAsCollateralMember2022-10-300000027673jdcc:UsedEquipmentMemberus-gaap:AgriculturalSectorMemberjdcc:RetailNotesPortfolioSegmentMemberus-gaap:AssetPledgedAsCollateralWithRightMember2022-10-300000027673jdcc:UsedEquipmentMemberus-gaap:AgriculturalSectorMemberjdcc:RetailNotesPortfolioSegmentMemberus-gaap:AssetNotPledgedAsCollateralMember2022-10-300000027673jdcc:NewEquipmentMemberus-gaap:ConstructionSectorMemberjdcc:RetailNotesPortfolioSegmentMemberus-gaap:AssetPledgedAsCollateralWithRightMember2022-10-300000027673jdcc:NewEquipmentMemberus-gaap:ConstructionSectorMemberjdcc:RetailNotesPortfolioSegmentMemberus-gaap:AssetNotPledgedAsCollateralMember2022-10-300000027673jdcc:NewEquipmentMemberus-gaap:AgriculturalSectorMemberjdcc:RetailNotesPortfolioSegmentMemberus-gaap:AssetPledgedAsCollateralWithRightMember2022-10-300000027673jdcc:NewEquipmentMemberus-gaap:AgriculturalSectorMemberjdcc:RetailNotesPortfolioSegmentMemberus-gaap:AssetNotPledgedAsCollateralMember2022-10-300000027673jdcc:RetailNotesPortfolioSegmentMemberus-gaap:AssetPledgedAsCollateralWithRightMember2022-10-300000027673jdcc:RetailNotesPortfolioSegmentMemberus-gaap:AssetNotPledgedAsCollateralMember2022-10-300000027673us-gaap:CommercialPortfolioSegmentMember2021-11-012022-10-300000027673us-gaap:CommercialPortfolioSegmentMember2020-11-022021-10-310000027673us-gaap:ConstructionSectorMemberjdcc:RetailNotesAndFinanceLeasesPortfolioSegmentMember2022-10-312023-10-290000027673us-gaap:AgriculturalSectorMemberjdcc:RetailNotesAndFinanceLeasesPortfolioSegmentMember2022-10-312023-10-290000027673us-gaap:CommercialPortfolioSegmentMember2022-10-312023-10-290000027673jdcc:RetailRevolvingChargeAccountsPortfolioSegmentMember2022-10-312023-10-290000027673jdcc:RetailNotesAndFinanceLeasesPortfolioSegmentMember2022-10-312023-10-290000027673us-gaap:ConstructionSectorMemberjdcc:RetailNotesAndFinanceLeasesPortfolioSegmentMember2021-11-012022-10-300000027673us-gaap:AgriculturalSectorMemberjdcc:RetailNotesAndFinanceLeasesPortfolioSegmentMember2021-11-012022-10-300000027673jdcc:RetailRevolvingChargeAccountsPortfolioSegmentMember2021-11-012022-10-300000027673jdcc:RetailNotesAndFinanceLeasesPortfolioSegmentMember2021-11-012022-10-300000027673us-gaap:ConstructionSectorMemberjdcc:RetailNotesAndFinanceLeasesPortfolioSegmentMember2020-11-022021-10-310000027673us-gaap:AgriculturalSectorMemberjdcc:RetailNotesAndFinanceLeasesPortfolioSegmentMember2020-11-022021-10-310000027673jdcc:RetailRevolvingChargeAccountsPortfolioSegmentMember2020-11-022021-10-310000027673jdcc:RetailNotesAndFinanceLeasesPortfolioSegmentMember2020-11-022021-10-310000027673us-gaap:CommercialPortfolioSegmentMember2023-10-290000027673jdcc:RetailRevolvingChargeAccountsPortfolioSegmentMember2023-10-290000027673jdcc:RetailNotesAndFinanceLeasesPortfolioSegmentMember2023-10-290000027673us-gaap:CommercialPortfolioSegmentMember2022-10-300000027673jdcc:RetailRevolvingChargeAccountsPortfolioSegmentMember2022-10-300000027673jdcc:RetailNotesAndFinanceLeasesPortfolioSegmentMember2022-10-300000027673us-gaap:CommercialPortfolioSegmentMember2021-10-310000027673jdcc:RetailRevolvingChargeAccountsPortfolioSegmentMember2021-10-310000027673jdcc:RetailNotesAndFinanceLeasesPortfolioSegmentMember2021-10-3100000276732021-10-310000027673srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccountingStandardsUpdate201613Memberus-gaap:CommercialPortfolioSegmentMember2020-11-010000027673srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccountingStandardsUpdate201613Memberjdcc:RetailRevolvingChargeAccountsPortfolioSegmentMember2020-11-010000027673srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccountingStandardsUpdate201613Memberjdcc:RetailNotesAndFinanceLeasesPortfolioSegmentMember2020-11-010000027673srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccountingStandardsUpdate201613Member2020-11-010000027673us-gaap:CommercialPortfolioSegmentMember2020-11-010000027673jdcc:RetailRevolvingChargeAccountsPortfolioSegmentMember2020-11-010000027673jdcc:RetailNotesAndFinanceLeasesPortfolioSegmentMember2020-11-0100000276732020-11-010000027673us-gaap:NonperformingFinancingReceivableMember2022-10-312023-10-290000027673us-gaap:NonperformingFinancingReceivableMember2021-11-012022-10-300000027673us-gaap:NonperformingFinancingReceivableMember2020-11-022021-10-310000027673currency:ARS2023-10-290000027673currency:ARS2022-10-300000027673us-gaap:SubsequentEventMember2023-12-072023-12-070000027673us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2023-10-290000027673us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2022-10-3000000276732021-11-012022-10-3000000276732020-11-022021-10-3100000276732022-10-300000027673us-gaap:CommonStockMember2022-10-312023-10-290000027673jdcc:BankConduitFacilitiesRevolvingCreditAgreementMemberus-gaap:SubsequentEventMember2023-11-260000027673jdcc:BankConduitFacilitiesRevolvingCreditAgreementMember2023-10-290000027673jdcc:UltimateParentCompanyAndItsWhollyOwnedSubsidiariesMemberus-gaap:RelatedPartyMember2023-10-290000027673jdcc:UltimateParentCompanyAndItsWhollyOwnedSubsidiariesMemberus-gaap:RelatedPartyMember2022-10-312023-10-2900000276732023-10-2900000276732023-12-1500000276732022-10-312023-10-29xbrli:sharesiso4217:USDxbrli:purejdcc:itemiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark one)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended October 29, 2023

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____ to ____

Commission file number 1-6458

JOHN DEERE CAPITAL CORPORATION

(Exact name of registrant as specified in its charter)

| | |

Delaware | | 36-2386361 |

(State of incorporation) | | (IRS Employer Identification No.) |

| | | | |

P.O. Box 5328 Madison, Wisconsin | | 53705-0328 | | (800) 438-7394 |

(Address of principal executive offices) | | (Zip Code) | | (Telephone number) |

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

| | | | |

Title of each class | | Trading symbol | | Name of each exchange on which registered |

2.00% Senior Notes Due 2031 | | JDCC 31 | | New York Stock Exchange |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | |

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☒ | Smaller reporting company ☐ |

| | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☒

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

At December 15, 2023, 2,500 shares of common stock, without par value, of the registrant were outstanding, all of which were owned by John Deere Financial Services, Inc., a wholly-owned subsidiary of Deere & Company.

The registrant meets the conditions set forth in General Instruction I(1)(a) and (b) of Form 10-K and is therefore filing this Annual Report on Form 10-K with certain reduced disclosures as permitted by Instruction I(2).

PART I

Item 1. Business.

This Annual Report on Form 10-K contains forward-looking statements that are subject to risks and uncertainties. All statements other than statements of historical fact included in this Annual Report on Form 10-K are forward-looking statements. Forward-looking statements provide our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance, and business. You can identify forward-looking statements as they do not relate to historical or current facts and by words such as “believe,” “expect,” “estimate,” “anticipate,” “will,” “should,” “plan,” “forecast,” “target,” “guide,” “project,” “intend,” “could,” and similar words or expressions.

All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected. Important factors that could cause actual results to differ materially from our expectations, or cautionary statements, and other important information about forward-looking statements are disclosed under Item 1A, “Risk Factors,” and Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations–Forward-Looking Statements” in this Annual Report on Form 10-K.

Presentation of Amounts

All amounts are presented in millions of dollars, unless otherwise specified.

The Company

John Deere Capital Corporation (Capital Corporation) and its subsidiaries are collectively called “we,” “us,” “our” or “the Company.” John Deere Financial Services, Inc. (JDFS), a wholly-owned finance holding subsidiary of Deere & Company, owns all of the outstanding common stock of Capital Corporation. See “Our Relationships with John Deere” for additional information regarding agreements between us and Deere & Company. We conduct business in Australia, New Zealand, the United States (U.S.), and in several countries in Africa, Asia, Europe, and Latin America, including Argentina and Mexico. Capital Corporation was incorporated under the laws of Delaware and commenced operations in 1958.

We provide and administer financing for retail purchases of new equipment manufactured by Deere & Company’s production and precision agriculture operations, small agriculture and turf operations, and construction and forestry operations and used equipment taken in trade for this equipment. References to “agriculture and turf” include both production and precision agriculture and small agriculture and turf. We generally purchase retail installment sales and loan contracts (retail notes) from Deere & Company and its wholly-owned subsidiaries (collectively called John Deere). John Deere generally acquires these retail notes through independent John Deere retail dealers. We also purchase and finance a limited amount of non-John Deere retail notes. In addition, we finance and service revolving charge accounts, in most cases acquired from and offered through merchants in the agriculture and turf and construction and forestry markets (revolving charge accounts). We also provide wholesale financing to dealers of John Deere agriculture and turf equipment and construction and forestry equipment, primarily to finance inventories of equipment for those dealers (wholesale receivables). Further, we lease John Deere equipment and a limited amount of non-John Deere equipment to retail customers (financing and operating leases). We also offer credit enhanced international export financing to select customers and dealers, which primarily involves John Deere products. Retail notes, revolving charge accounts, and financing leases are collectively called “Customer Receivables.” Customer Receivables and wholesale receivables are collectively called “Receivables.” Receivables and equipment on operating leases are collectively called “Receivables and Leases.” We generally secure our Receivables, other than certain revolving charge accounts, by retaining as collateral security in the goods associated with those Receivables or with the use of other collateral.

Deere & Company’s internet address is https://www.deere.com. The information contained on John Deere’s website is not included in, nor incorporated by reference into, this Annual Report on Form 10-K.

Business of John Deere

John Deere’s operations are categorized into four business segments:

The production and precision agriculture segment defines, develops, and delivers global equipment and technology solutions for production-scale growers of crops like large grains (such as corn and soy), small grains (such as wheat, oats, and barley), cotton, and sugarcane. Equipment manufactured and distributed by the segment includes large and certain mid-size tractors, combines, cotton pickers, cotton strippers, sugarcane harvesters, related harvesting front-end equipment, and pull-behind scrapers. In addition, the segment includes tillage, seeding, and application equipment, including sprayers and nutrient management and soil preparation machinery.

The small agriculture and turf segment defines, develops, and delivers global equipment and technology solutions designed to unlock customer value for dairy and livestock producers, high-value crop producers, and turf and utility customers. Equipment manufactured and distributed by the segment include certain mid-size, small and utility tractors, and related loaders and attachments; turf and utility equipment, including riding lawn equipment, commercial mowing equipment, golf course equipment, utility vehicles, implements for mowing, tiling, snow and debris handling, aerating, and other residential, commercial, golf, and sports turf care applications; and hay and forage equipment, including self-propelled forage harvesters and attachments, balers, and mowers.

The construction and forestry segment delivers a robust portfolio of construction, roadbuilding, and forestry products with precision technology solutions. The segment’s primary construction products include excavators, wheel loaders, motor graders, dozers, backhoes, articulated dump trucks, compact construction equipment including skid steers, compact excavators, and compact truck loaders, along with a variety of attachments. The segment’s primary roadbuilding products include milling machines, pavers, compactors, rollers, crushers, screens and asphalt plants, and the primary forestry products include skidders, feller bunchers, forwarders, knuckleboom loaders, harvesters, swing machines, and precision forestry technology solutions.

The products and services produced by the segments above are marketed primarily through independent retail dealer networks and major retail outlets. For roadbuilding products in certain markets outside the U.S. and Canada, the products are sold through John Deere-owned sales and service subsidiaries.

The financial services segment includes our operations (described herein) and additional operations in the U.S., Canada, Brazil, China, India, and Thailand. The operations in Russia were sold in the second quarter of fiscal year 2023. The segment primarily finances sales and leases by John Deere dealers of new and used production and precision agriculture equipment, small agriculture and turf equipment, and construction and forestry equipment. In addition, the financial services segment provides wholesale financing to dealers of the foregoing equipment, finances retail revolving charge accounts, and offers extended equipment warranties.

John Deere’s worldwide production and precision agriculture operations, small agriculture and turf operations, and construction and forestry operations are sometimes collectively referred to as the “equipment operations.” The financial services segment is sometimes referred to as the “financial services operations.” Receivables and Leases managed by us are evaluated by market (agriculture and turf or construction and forestry).

For fiscal 2023, worldwide net income attributable to Deere & Company was $10.166 billion, or $34.63 per share, compared with $7.131 billion, or $23.28 per share, in fiscal 2022.

Deere & Company’s consolidated net sales and revenues increased 16 percent to $61.251 billion in 2023, compared with $52.577 billion in 2022. Net sales of the equipment operations increased in fiscal 2023 to $55.565 billion, compared with $47.917 billion last year, due to favorable industry fundamentals and strong demand for farm and construction equipment.

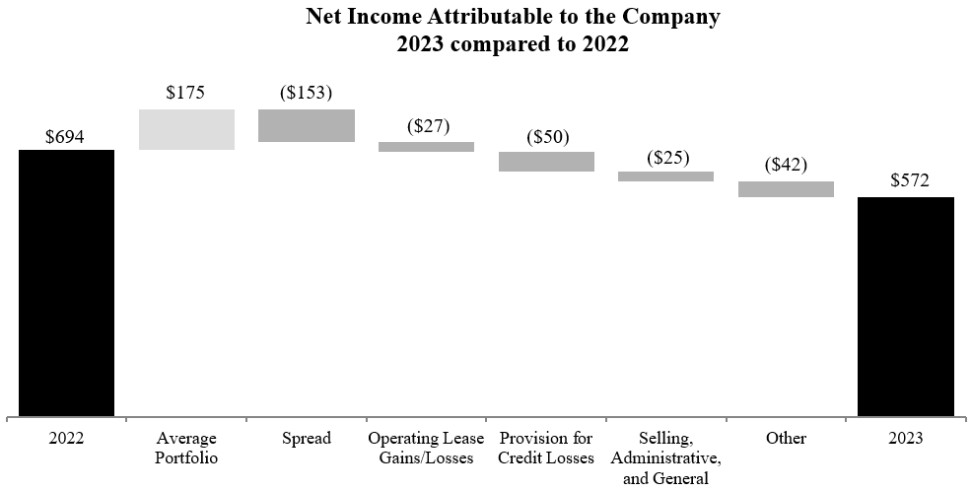

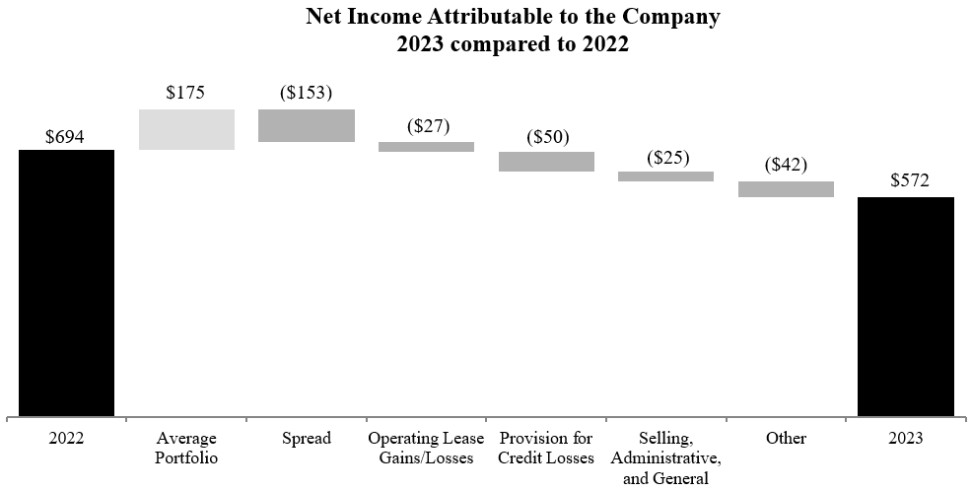

The financial services operations reported net income of $619 for fiscal 2023 compared with $880 in fiscal 2022. Net income declined as a result of the unfavorable impact of higher interest rates on financing spreads and a correction of the accounting treatment for financing incentives offered to John Deere dealers. In 2022, financial services increased the provision for credit losses in Russia and recorded an intercompany benefit from the equipment operations, which guarantees financial services’ investments in certain international markets, including Russia.

Smart Industrial Operating Model and Leap Ambitions

John Deere announced the Smart Industrial Operating Model in 2020. This operating model is based on three focus areas:

| (a) | Production systems: A strategic alignment of products and solutions around John Deere customers’ operations. |

| (b) | Technology stack: Investments in technology, as well as research and development, that deliver intelligent solutions to John Deere customers through digital capabilities, automation, autonomy, and alternative power technologies. |

| (c) | Lifecycle solutions: The integration of John Deere’s aftermarket and support capabilities to more effectively manage customer equipment, service, and technology needs across the full lifetime of a John Deere product. |

John Deere’s Leap Ambitions were launched in 2022. These ambitions are designed to boost economic value and sustainability. The ambitions align across the production systems of John Deere customers, seeking to optimize their operations to deliver better outcomes with fewer resources. As an enabling business, we are fully integrated with John Deere’s Smart Industrial Operating Model and are focused on providing financial solutions to help John Deere achieve its Leap Ambitions.

Our Relationships with John Deere

Our results of operations are affected by our relationships with John Deere, including, among other items, the terms on which we acquire Receivables and borrow funds from John Deere, the reimbursement for interest waiver and low-rate finance programs from John Deere, the compensation paid by John Deere in connection with our purchase of trade receivables from John Deere, and the payment to John Deere for various expenses applicable to our operations. In addition, we have joint access with John Deere to certain lines of credit.

Our volume of Receivables and Leases is largely dependent upon the level of retail sales and leases of John Deere products. The level of John Deere retail sales and leases is responsive to a variety of economic, financial, geopolitical, climatic, legislative, and other factors that influence supply and demand for its products. The majority of our business is affected by changes in interest rates, demand for credit, and competition.

We bear substantially all of the credit risk (net of recovery from withholdings from certain John Deere dealers and merchants) associated with our holding of Receivables and Leases. A small portion of the Receivables and Leases held (less than 5 percent) is guaranteed by certain subsidiaries of Deere & Company. We also perform substantially all servicing and collection functions. Servicing and collection functions for a small portion of the Receivables and Leases held (less than 5 percent) are provided by John Deere. John Deere is reimbursed for staff and other administrative services at estimated cost and for credit lines provided to us based on utilization of those lines.

The terms and the basis on which we acquire retail notes and certain wholesale receivables from John Deere are governed by agreements with John Deere, generally terminable by either John Deere or us on 30 days’ notice. As provided in these agreements, we agree to the terms and conditions for purchasing the retail notes and wholesale receivables from John Deere. Under these agreements, John Deere is not obligated to sell notes to us, and we are obligated to purchase notes from John Deere only if the notes comply with the terms and conditions set by us.

The basis on which John Deere acquires retail notes and wholesale receivables from John Deere dealers is governed by agreements with those dealers, which may be terminated in accordance with their terms and applicable law. In acquiring these notes from dealers, the terms and conditions, as set forth in agreements with the dealers, conform with the terms and conditions adopted by us in determining the acceptability of retail and certain wholesale receivables to be purchased from John Deere. The dealers are not obligated to sell these notes to John Deere and John Deere is not obligated to accept these notes from the dealers. In practice, retail and wholesale receivables are acquired from dealers only if the terms of these notes and the creditworthiness of the customers are acceptable to us. We act on behalf of both ourselves and John Deere in determining the acceptability of the notes and in acquiring acceptable notes from dealers.

The basis on which we enter into leases with retail customers through John Deere dealers is governed by agreements between those dealers and us. Leases are accepted based on the terms and conditions, the lessees’ creditworthiness, the anticipated residual values of the equipment, and the intended use of the equipment.

Deere & Company has an agreement with us pursuant to which it has agreed to continue to own, directly or through one or more wholly-owned subsidiaries, at least 51 percent of the voting shares of capital stock of Capital Corporation and to maintain our consolidated tangible net worth at not less than $50.0. This agreement also obligates Deere & Company to make payments to us such that our consolidated ratio of earnings to fixed charges is not less than 1.05 to 1 for any four consecutive fiscal quarterly periods. Deere & Company’s obligations to make payments to us under the agreement are independent of whether we are in default on our indebtedness, obligations, or other liabilities. Further, Deere & Company’s obligations under the agreement are not measured by the amount of our indebtedness, obligations, or other liabilities. Deere & Company’s obligations to make payments under this agreement are expressly stated not to be a guarantee of any specific indebtedness, obligation, or liability of ours and are enforceable only by or in the name of Capital Corporation. No payments were required under this agreement during the periods included in the consolidated financial statements. At October 29, 2023, Deere & Company indirectly owned 100 percent of the voting shares of Capital Corporation’s capital stock and our consolidated tangible net worth was $5,901.6.

We purchase certain wholesale trade receivables from John Deere. These trade receivables arise from John Deere’s sales of goods to independent dealers. Under the terms of the sales to dealers, interest is primarily charged to dealers on outstanding balances from the earlier of the date when goods are sold to retail customers by the dealer or the expiration of certain interest-free periods granted at the time of the sale to the dealer, until payment is received by us. Dealers cannot cancel purchases after John Deere recognizes a sale and are responsible for payment even if the equipment is not sold to retail customers. The interest-free periods are determined based on the type of equipment sold and the time of year of the sale. These periods range from one to twelve months for most equipment. Interest-free periods may not be extended. Interest charged may not be forgiven and the past due interest rates exceed market rates. We receive compensation from John Deere at approximate market interest rates for these interest-free periods. We compute the compensation from John Deere for interest-free periods based on our estimated funding costs, administrative and operating expenses, credit losses, and required return on equity.

A portion of finance income earned by us arises from financing of retail sales of John Deere equipment on which finance charges are waived or reduced by John Deere for a period from the date of the retail sale to a specified subsequent date. We receive compensation from John Deere equal to competitive market interest rates for periods during which finance charges have been waived or reduced. We compute the compensation from John Deere for waived or reduced finance charges based on our estimated funding costs, administrative and operating expenses, credit losses, and required return on equity. The financing rate following the waiver or interest reduction period is not significantly different from the compensation rate from John Deere.

Description of Receivables and Leases

Receivables and Leases arise mainly from retail and wholesale sales and leases of John Deere products and used equipment accepted in trade for them, and from retail sales of equipment of unrelated manufacturers. Receivables and Leases also include revolving charge receivables. At October 29, 2023 and October 30, 2022, at least 90 percent of the Receivables and Leases administered by us were for financing that facilitated the purchase or lease of John Deere products.

John Deere Financial, f.s.b. (Thrift) is a wholly-owned subsidiary of Capital Corporation. It holds a federal thrift charter and is regulated by the Office of the Comptroller of the Currency (OCC). The U.S. Federal Reserve Board has oversight of us, as the owner of the Thrift. The Thrift is headquartered in Wisconsin and offers the following revolving charge products throughout the U.S.:

| ● | John Deere Financial Multi-Use AccountTM is used by farmers and ranchers to finance their purchases of production inputs from agribusiness merchants, including seed, fertilizer, and crop protection. It is also used by agriculture and turf customers to finance the purchase of parts and service from John Deere dealers. |

| ● | PowerPlanTM is used by construction and forestry customers to finance the purchase of equipment parts, equipment rentals, and service work performed at John Deere construction and forestry dealers. |

| ● | John Deere Financial Revolving Plan is used by retail customers of John Deere dealers to finance purchases of turf and utility equipment. |

We provide wholesale financing to John Deere dealers, primarily to finance agriculture and turf and construction and forestry equipment inventories. A large portion of the wholesale financing is provided by us to dealers from whom we also purchase agriculture and turf and construction and forestry retail notes.

We generally require that theft and physical damage insurance be carried on all goods leased or securing retail notes and wholesale receivables. In certain markets, the customer may, at the customer’s own expense, have us or the seller of the goods purchase this insurance or obtain it from other sources. Insurance is not required for goods purchased under revolving charge accounts.

Receivables and Leases are eligible for acceptance if they conform to prescribed finance and lease plan terms. In limited circumstances, Receivables and Leases may be accepted even though they do not conform in all respects to the established guidelines. We determine whether Receivables and Leases should be accepted and how they should be serviced. Acceptance of these Receivables and Leases is dependent on having one or more risk mitigation enhancements that may include larger down payments or advance lease payments, additional co-borrowers or guarantors, the pledge of additional collateral as security, the assignment of specific earnings to us, or the acceptance of accelerated payment schedules. Our officers are responsible for establishing policies and reviewing our performance in accepting and collecting Receivables and Leases. We perform substantially all of our own routine collections, settlements, and repossessions on Receivables and Leases.

John Deere retail notes and wholesale receivables are generally supported by perfected security interests in goods financed under laws such as the Uniform Commercial Code (UCC), certain federal statutes, and state motor vehicle laws in the U.S. and by security in goods or other security under applicable laws in other countries and jurisdictions. UCC financing statements are also prepared and filed on leases; however, these filings for operating leases are made for informational purposes only.

Finance Rates on Retail Notes

As of October 29, 2023 and October 30, 2022, over 95 percent of the retail notes held by us bore a fixed finance rate. A portion of the finance income earned by us arises from reimbursements from John Deere in connection with financing the retail sales of John Deere equipment on which finance charges are waived or reduced by John Deere for a period from the date of sale to a specified subsequent date. See Note 3 to the Consolidated Financial Statements for additional information.

Average Original Term and Average Actual Life of Retail Notes and Leases

Due to prepayments (often from trade-ins and refinancing), the average actual life of retail notes and leases is considerably shorter than the average original term. The following table shows the average original term for retail notes and leases acquired during the year and the average actual life for retail notes and leases liquidated during the year (in months):

| | | | | | | | |

| | Average Original Term | | Average Actual Life |

| | 2023 | | 2022 | | 2023 | | 2022 |

Retail notes: | | 57 | | 58 | | 34 | | 35 |

New equipment: | | | | | | | | |

Agriculture and turf | | 57 | | 58 | | 32 | | 34 |

Construction and forestry | | 52 | | 51 | | 38 | | 36 |

Used equipment: | | | | | | | | |

Agriculture and turf | | 60 | | 61 | | 35 | | 37 |

Construction and forestry | | 52 | | 51 | | 31 | | 29 |

Financing leases | | 26 | | 28 | | 23 | | 26 |

Equipment on operating leases | | 45 | | 46 | | 33 | | 35 |

Maturities

The following table presents the contractual maturities of Receivables and Leases owned by us at October 29, 2023 and a summary of Receivables and Leases owned by us at October 30, 2022:

| | | | | | | | | | | | | | | | | | | | | |

| | One year | | | | | | | | | | | | | | | | | | |

| | or less | | One to five years | | Five to fifteen years | | Total | | | |

| | | | | Fixed | | Variable | | Fixed | | Variable | | | | | | |

| | | | rate | | rate | | rate | | rate | | 2023 | | 2022 |

Retail notes: | | | | | | | | | | | | | | | | | | | | | |

Agriculture and turf | | $ | 8,110.7 | | $ | 17,587.8 | | $ | 353.8 | | $ | 649.5 | | $ | 6.5 | | $ | 26,708.3 | | $ | 23,796.5 |

Construction and forestry | | | 2,057.3 | | | 3,207.9 | | | 6.0 | | | 18.4 | | | | | | 5,289.6 | | | 4,954.1 |

Total retail notes | | | 10,168.0 | | | 20,795.7 | | | 359.8 | | | 667.9 | | | 6.5 | | | 31,997.9 | | | 28,750.6 |

Revolving charge accounts | | | 4,435.2 | | | 63.4 | | | 95.8 | | | | | | | | | 4,594.4 | | | 4,165.8 |

Wholesale receivables | | | 12,893.7 | | | 157.5 | | | 277.1 | | | 1.8 | | | | | | 13,330.1 | | | 8,404.5 |

Financing leases | | | 874.9 | | | 537.2 | | | | | | 9.7 | | | | | | 1,421.8 | | | 1,120.7 |

Equipment on operating leases | | | 988.7 | | | 3,952.2 | | | | | | 110.6 | | | | | | 5,051.5 | | | 4,853.5 |

Total Receivables and Leases | | $ | 29,360.5 | | $ | 25,506.0 | | $ | 732.7 | | $ | 790.0 | | $ | 6.5 | | $ | 56,395.7 | | $ | 47,295.1 |

Net Write-offs

Receivable balances are written off to the allowance for credit losses when, in the judgment of management, they are considered uncollectible. Write-offs generally occur when Customer Receivables are 120 days delinquent, and on a case-by-case basis when wholesale receivables are 60 days delinquent.

Total net (write-offs) recoveries, by product, were as follows:

| | | | | | | | | | | | | | | | |

| | 2023 | | 2022 | | 2021 | |

| | Dollars | | Percent | | Dollars | | Percent | | Dollars | | Percent | |

Net write-offs: | | | | | | | | | | | | | | | | |

Retail notes and financing leases: | | | | | | | | | | | | | | | | |

Agriculture and turf | | $ | (22.9) | | (.09) | % | $ | (11.2) | | (.04) | % | $ | (9.4) | | (.04) | % |

Construction and forestry | | | (25.0) | | (.47) | | | (15.1) | | (.30) | | | (15.7) | | (.36) | |

Total retail notes and financing leases | | | (47.9) | | (.16) | | | (26.3) | | (.10) | | | (25.1) | | (.10) | |

Revolving charge accounts | | | (22.6) | | (.59) | | | 2.9 | | .09 | | | 7.7 | | .23 | |

Wholesale receivables | | | .4 | | .01 | | | (.2) | | | | | (.3) | | | |

Total net write-offs | | $ | (70.1) | | (.15) | % | $ | (23.6) | | (.06) | % | $ | (17.7) | | (.05) | % |

Net write-offs as a percent of portfolio increased in 2023 from near record lows in 2022 and 2021, but remain below the 10 year average of .18 percent.

Allowance for Credit Losses

The total allowance for credit losses, by product, at October 29, 2023 and October 30, 2022, and the portfolio, by product, as a percent of total portfolio are presented below:

| | | | | | | | | | | |

| | 2023 | | 2022 | |

| | Dollars | | Percent | | Dollars | | Percent | |

Retail notes and financing leases: | | | | | | | | | | | |

Agriculture and turf | | $ | 55.4 | | 54 | % | $ | 43.1 | | 58 | % |

Construction and forestry | | | 59.5 | | 11 | | | 52.3 | | 12 | |

Total retail notes and financing leases | | | 114.9 | | 65 | | | 95.4 | | 70 | |

Revolving charge accounts | | | 20.4 | | 9 | | | 21.9 | | 10 | |

Wholesale receivables | | | 11.1 | | 26 | | | 11.1 | | 20 | |

Total | | $ | 146.4 | | 100 | % | $ | 128.4 | | 100 | % |

Key credit quality metrics and related portfolio balances at October 29, 2023 and October 30, 2022 were as follows:

| | | | | | | |

| | 2023 | | 2022 | |

| | Dollars | | Dollars | |

Receivables 30 days or more past due | | $ | 514.1 | | $ | 404.9 | |

Non-performing Receivables | | | 383.1 | | | 263.2 | |

Allowance for credit losses | | | 146.4 | | | 128.4 | |

Total Receivables | | | 51,344.2 | | | 42,441.6 | |

| | | | | | | |

| | 2023 | | 2022 | |

| | Percent | | Percent | |

Receivables 30 days or more past due to total Receivables | | | 1.00 | % | | .95 | % |

Non-performing Receivables to total Receivables | | | .75 | | | .62 | |

Allowance for credit losses to total Receivables | | | .29 | | | .30 | |

Allowance for credit losses to non-performing Receivables | | | 38.21 | | | 48.78 | |

The Receivables portfolio continued to perform well in 2023. While certain portfolio quality metrics summarized above have diminished slightly from the prior year, past due and non-performing Receivables remain at historically healthy levels. The allowance for credit losses as a percent of total portfolio was relatively stable in 2023, as the impact of portfolio growth in wholesale receivables offset the impact of higher allowances on turf and construction customer accounts.

Competition

The businesses in which we are engaged are highly competitive. We primarily compete for customers with commercial banks and finance and leasing companies based upon our service, finance rates charged, and other finance terms. In addition, the competitive landscape is evolving as technology is unlocking new capabilities for traditional competitors and enabling new digital entrants that could be either technology partners or potential competitors. The proportion of John Deere equipment retail sales and leases financed by us is influenced by conditions prevailing in the agriculture and turf equipment and construction and forestry equipment markets, in the financial markets, and in business generally. We financed a significant portion of John Deere equipment retail sales and leases in many of the countries in which we operated during 2023 and 2022.

We emphasize convenient service to customers and endeavor to offer terms desired in our specialized markets, such as seasonal schedules of repayment and rentals. Our retail finance rates and lease rates are generally believed to be in the range offered by other sales finance and leasing companies, although not as low as those of some banks and other lenders and lessors.

Regulation

In several U.S. states, state law limits the maximum finance rate on receivables. The present state limitations have not significantly limited variable-rate finance charges or the fixed-rate finance charges established by us. However, if interest rate levels should increase significantly, maximum state rates could affect us by preventing the variable rates on outstanding variable-rate retail notes from increasing above the maximum state rate and by limiting the fixed rates on new notes. In some states, we may be able to qualify new retail notes for a higher maximum rate limit by using retail installment sales contracts (rather than loan contracts) or by using fixed-rate rather than variable-rate contracts.

In addition to rate regulations, various U.S. state and federal laws and regulations apply to some Receivables and Leases, principally retail notes for goods sold for personal, family, or household use and John Deere Financial Revolving Plan, John Deere Financial Multi-Use AccountTM, and PowerPlanTM products and receivables. To date, these laws and regulations have not had a significant adverse effect on us.

The Thrift holds a federal thrift charter and is subject to regulation and examination by the OCC. The U.S. Federal Reserve Board has oversight of us, as the owner of the Thrift.

Our financing offers outside the U.S. are affected by a variety of country specific laws, regulations, and customs, including those governing property rights and debtor obligations, and are subject to changes that may introduce greater risks to us.

In fiscal year 2023, compliance with the regulations applicable to us did not have a material effect on our capital expenditures, earnings, or competitive position. We do not expect to incur material capital expenditures related to compliance with regulations during fiscal year 2024. Additional information about the impact of government regulations on our business is included in Item 1A, “Risk Factors” under the headings “Strategic Risks” and “Legal and Compliance Risks.”

Human Capital

Higher Purpose

Our employees are guided by John Deere’s higher purpose: We run so life can leap forward. Employees are further guided by John Deere’s Code of Business Conduct (Code), which helps them to uphold and strengthen the standards of honor and integrity that have defined John Deere since its founding. Our world and business may change, yet we continue to be guided by our core values—integrity, quality, commitment and innovation.

Employees

At October 29, 2023, we had 1,508 full-time and part-time employees. We also retain consultants, independent contractors, and temporary workers.

Code of Business Conduct

We are committed to conducting business in accordance with the highest ethical standards. We require all employees to complete training on our Code and, where permitted by law, also require that employees regularly certify compliance with the Code. The Code provides specific guidance to all our employees, outlining how they can and must uphold and strengthen the integrity that has defined John Deere since its founding. In addition, we maintain a global compliance hotline to allow for concerns of potential violations of the Code, global policies, or the law to be brought forward.

Diversity, Equity, and Inclusion (DEI)

We adhere to the principle of equal employment opportunity and we believe that a diverse workforce is essential to our long-term success and solving our customers’ most pressing challenges. We strive to foster a diverse, equitable, and inclusive culture. We embrace employees’ differences in race, color, religion, age, sex, sexual orientation, gender, gender identity and expression, marital or partnership status, family status, citizenship, national origin, ancestry, geographic background, military or veteran status, disability (mental or physical), and any other characteristics that make our employees unique.

Our leadership team works to set a consistent and transparent tone on DEI issues and strategy. We also create spaces for open conversations and learning through our Employee Resource Groups (ERGs) speaker series and micro-learnings. John Deere sponsors 13 ERGs that are run by employees, open to all employees, and are a key driver of inclusion. ERGs build organization-wide networks that allow employees to come together and discuss shared interests. The global chapters work with local teams to support our efforts to attract, retain, and develop the best talent. In addition, our global DEI strategy focuses on embedding DEI into world-wide business operations and people processes.

In addition to recruiting from a wide array of colleges and universities, John Deere partners with several professional organizations to support our diversity recruitment strategy, including AnitaB.org. – a global organization for women in technology, Minorities in Agriculture Natural Resources and Related Sciences, the National Association of Black Accountants, Inc., the National Black MBA Association, Inc., the National Society of Black Engineers, the Society of Women Engineers, the Thurgood Marshall College Fund Leadership Institute, and the Society of Hispanic Professional Engineers. Our broad recruiting strategy helps us identify talent from diverse backgrounds.

Compensation & Benefits

Our total rewards are intended to be competitive, meet the varied needs of our global workforce, and reinforce our values. We are committed to providing comprehensive and competitive pay and benefits to our employees. We invested, and continue to invest, in employees through growth and development and well-being initiatives.

Our work environment is designed to promote innovation, well-being, and reward performance. Our total rewards for employees include a variety of components that aim to support sustainable employment and the ability to build a strong financial future, including competitive market-based pay and comprehensive benefits. In addition to earning base pay, eligible employees are compensated for their contributions to our goals with both short-term cash incentives and long-term equity-based incentives.

Eligible full-time employees in the U.S. have access to medical, dental, and vision plans; savings and retirement plans; parental leave and paid time off; and other resources, such as the Employee Assistance Program, which provides mental health and wellness services. We also offer a variety of working arrangements to eligible employees, including flexible schedules, remote work, and job sharing to help employees manage home and work-life situations. Programs and benefits differ internationally for a variety of reasons, such as local legal requirements, market practices, and negotiations with works councils and other employee representative bodies.

Training and Development

Employees are critical to the long-term success of our business. We encourage employees to identify the paths that can build the skills, experience, knowledge, and competencies needed for career advancement. We support employees by creating purpose-driven work opportunities, comprehensive performance reviews and development plans, mentoring opportunities, and professional and personal development opportunities.

We encourage employees to provide feedback across the enterprise through our internal voluntary employee experience survey, ad-hoc “pulse” surveys, and new-hire and exit surveys. Reports from these surveys help equip us to address needs across the employee lifecycle to improve the overall experience and engagement of our workforce.

Around the world, we offer internships, training, upskilling, apprenticeships, and leadership development at all stages of an employee’s career. Training programs are tailored to different geographic regions and job functions and include topics such as relationships with customers and dealers, our culture and values, compliance with the Code, compliance with anti-bribery/corruption laws and policies, compliance with management of private data and cybersecurity, regulatory compliance, conflicts of interest, discrimination and workplace harassment policies, sexual harassment policies, and leadership development.

Human Rights and Our Code of Conduct

We honor human rights and respect the individual dignity of all persons globally. Our commitment to human rights requires that we understand and fulfill our responsibilities consistent with our values and practices. We strive to ensure that human rights are upheld for our employees and employees of John Deere dealers. Our commitment to human rights is defined in the Code, the John Deere dealer Code of Conduct, related policies and procedures, and John Deere’s statement “Support of Human Rights in our Business Practice,” each of which is available on John Deere’s website under “Governance.” These documents establish guidelines for our employees and John Deere dealers. We do not tolerate human rights abuses, such as forced labor, unlawful child labor, and human trafficking.

Item 1A. Risk Factors.

The results of our operations are affected by our relationships with John Deere. See “Our Relationships with John Deere” for additional information regarding our relationships with John Deere.

The following risks are considered material to our business based upon current knowledge, information, and assumptions. This discussion of risk factors should be considered closely in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” (MD&A), including the risks and uncertainties described in the “Forward-Looking Statements,” the Notes to Consolidated Financial Statements, and the risk factors of Deere & Company included in Exhibit 99 to this Annual Report on Form 10-K and incorporated herein by reference. These risk factors and

other forward-looking statements relate to future events, expectations, trends, and operating periods. They involve certain factors that are subject to change and important risks and uncertainties that could cause actual results to differ materially. Although the risks are organized by headings, and each risk is discussed separately, many are interrelated. The risks described in this Annual Report on Form 10-K and the “Forward-Looking Statements” in this report are not the only risks we face.

STRATEGIC RISKS

Our profitability and the financial condition of our operations are dependent upon the operations of John Deere.

Our volume of Receivables and Leases is largely dependent upon the level of retail sales and leases of John Deere products. The results of our operations are affected by our relationship with John Deere, including, among other items, the terms on which we acquire Receivables and borrow funds from John Deere, the reimbursement for interest waiver and low-rate finance programs from John Deere, the compensation paid by John Deere in connection with our purchase of trade receivables from John Deere, and the payment to John Deere for various expenses applicable to our operations. In addition, we have joint access to certain lines of credit with John Deere.

If there were significant changes in the production or sales of John Deere products; the quality or resale value of John Deere equipment; John Deere’s liquidity, capital position, debt ratings, and access to capital markets; the reputation of John Deere; or high inflation, higher interest rates, supply chain constraints, or other factors impacting John Deere or its products, such changes could significantly affect our profitability, financial condition, and access to capital markets. In addition, if there were changes to sales incentive programs offered by John Deere to retail customers, in which we receive reimbursement for interest waiver and low-rate finance programs, this could decrease our market share of John Deere financed equipment, volumes, and profitability.

We may be impacted by general negative economic conditions and outlook causing weakened demand for John Deere’s equipment and services, limiting access to funding, and resulting in higher funding costs for us and John Deere.

The demand for John Deere’s and our products and services depends on the fundamentals in the markets in which we operate and can be significantly reduced in an economic environment characterized by high unemployment, high interest rates, cautious consumer spending, inflation, lower corporate earnings, and lower business investment. Negative or uncertain economic conditions that cause John Deere’s customers to lack confidence in the general economic outlook can significantly reduce their likelihood of purchasing John Deere’s equipment. These economic events adversely affected and may continue to adversely affect John Deere and our operations.