As filed with the U.S. Securities and Exchange Commission on February 10, 2023.

Registration No. 333-[--]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

WEBUS INTERNATIONAL LIMITED

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

| Cayman Islands | 7389 | Not Applicable |

| (State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

| incorporation or organization) | Classification Code Number) | Identification number) |

25/F, UK Center, EFC, Yuhang District

Hangzhou, China 311121

Tel: + 86(571) 58000026

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Fang Liu, Esq. | Lawrence Venick, Esq. | |

| VCL Law LLP | Loeb & Loeb LLP | |

| 1945 Old Gallows Road, Suite 630 | 2206-19 Jardine House | |

| Vienna, VA 22182 | 1 Connaught Place | |

| (703) 919-7285 | Central, Hong Kong SAR 852-3923-1111 |

Approximate date of commencement of proposed sale to the public: as soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933. Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to section 7(a)(2)(B) of the Securities Act. ¨

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, as amended, or until the registration statement shall become effective on such date as the U.S. Securities and Exchange Commission, acting pursuant to said Section 8(a) may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS (Subject to Completion) Dated February 10, 2023

[--] Ordinary Shares

WEBUS INTERNATIONAL LIMITED

This is the initial public offering of the ordinary shares of Webus International Limited, a Cayman Islands exempted company (the “ordinary shares”). We are offering [●] ordinary shares, par value $0.0001 per share, on a firm commitment basis. We expect the initial public offering price of the ordinary shares to be between $[--] and $[--] per share. Currently, no public market exists for our ordinary shares. We have applied to have our ordinary shares listed on the Nasdaq Capital Market (“Nasdaq”) under the symbol “WETO.” We will not complete this offering unless we are so listed.

We are an “emerging growth company,” as that term is used in the Jumpstarts Our Business Startups Act of 2012 and will be subject to reduced public company reporting requirements.

We are, and following the completion of this offering, will continue to be a “controlled company” as defined under the Nasdaq Stock Market Rules because Mr. Zheng Jiahua, the chairman of our board of directors and his son, Mr. Zheng Nan our chief executive officer, will beneficially own 81.5% of our then issued and outstanding Ordinary Shares. Therefore, we may elect not to comply with certain corporate governance requirements of Nasdaq. Currently, we do not plan to utilize the “controlled company” exemptions with respect to our corporate governance practice after we complete this offering.

Investing in our ordinary shares is highly speculative and involves a significant degree of risk. See “Risk Factors” beginning on page 26 of this prospectus for a discussion of information that should be considered before making a decision to purchase our ordinary shares.

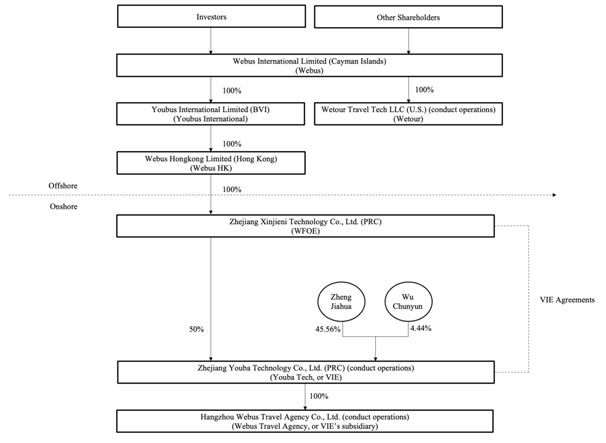

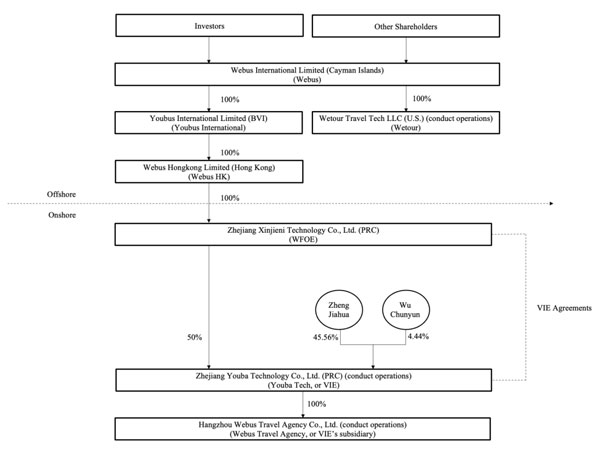

Webus International Limited (“Webus”, “we”, or the “Company”) is a Cayman Islands exempted company without any operation and our operations are conducted by (1) our wholly owned subsidiary Wetour Tech, LLC in the United States; and (2) through 50% equity interest held by Zhejiang Xinjieni Technology Co., Ltd. (“WFOE”) in Zhejiang Youba Technology Co., Ltd., a limited liability company established under PRC law (the “VIE” or “Youba Tech”) and as beneficiary of the remaining 50% interests in Youba Tech through contractual arrangements with Youba Tech and Individual Registered Shareholders (“50% VIE Interests”). VIE interests are not considered as equal to equity interest and, this structure involves unique risks to investors. See “Risk Factors— Risks Related to Doing Business in China —Changes in China’s economic, political or social conditions or government policies could have a material adverse effect on our business and results of operations; — Uncertainties and quick change in the interpretation and enforcement of Chinese laws and regulations with little advance notice could result in a material and negative impact our business operation, decrease the value of our ordinary shares and limit the legal protections available to us, and — The Chinese legal system embodies uncertainties which could negatively affect our listing on Nasdaq and limit the legal protections available to you and us.”

In addition, the VIE is consolidated for accounting purpose only and Webus owns 50% equity interests and 50% VIE Interests in the VIE. Webus is not a Chinese operating company and does not conduct operations directly. PRC laws, regulations, and rules restrict and impose conditions on foreign investment in certain types of business, including value added telecommunication business, and we therefore operate these businesses in China through the VIE structure which provides investors with exposure to foreign investment in the Chinese operating companies where foreign investors are restricted by Chinese law from holding more than 50% equity interests in the operating companies. For a summary of these contractual arrangements, see “Corporate History and Structure — Contractual Arrangements with the VIE and Individual Registered Shareholders.” Investors are purchasing equity interests in Webus, the Cayman Islands exempted company, and are not purchasing, and may never directly hold, equity interests in the VIE. As used in this prospectus, “we,” “us,” or “our” refers to Webus and its subsidiaries and do not include the VIE and its subsidiary.

Our corporate structure is subject to risks relating to our contractual arrangements with the VIE and its individual shareholders. Such contractual arrangements have not been tested in any of the PRC courts. There are substantial uncertainties regarding the interpretation and application of current and future PRC laws, regulations, and rules relating to these contractual arrangements. If the PRC government finds these contractual arrangements non-compliant with the restrictions on direct foreign investment in the relevant industries, or if the relevant PRC laws, regulations, and rules or the interpretation thereof change in the future, we could be subject to severe penalties or be forced to relinquish our interests in the VIE or forfeit our rights under the contractual arrangements. Webus and investors in the ordinary shares face uncertainty about potential future actions by the PRC government, which could affect the enforceability of our contractual arrangements with the VIE and, consequently, significantly affect the financial condition and results of operations of Webus. If we are unable to claim our right to control the assets of the VIE, the ordinary shares may decline in value as we hold 50% equity interests and 50% VIE Interests in the VIE. The PRC government could even disallow the VIE structure completely, which would likely result in a material adverse change in our operations and the ordinary shares may significantly decline in value. See “Risk Factors — Risks Related to Corporate Structure.”

There are legal and operational risks associated with being based in and having all operations in China through the VIE structure. The Chinese government recently took regulatory actions on certain U.S. listed Chinese companies and made statement that it will exert more oversight and control over offerings and listings by Chinese companies that are conducted overseas, such as those related to the use of variable interest entities and data security or anti-monopoly concerns. On July 6, 2021, the General Office of the Communist Party of China Central Committee and the General Office of the State Council jointly issued an announcement to crack down on illegal activities in the securities market and promote the high-quality development of the capital market, which, among other things, requires the relevant governmental authorities to strengthen cross-border oversight of law-enforcement and judicial cooperation, to enhance supervision over China-based companies listed overseas, and to establish and improve the system of extraterritorial application of the PRC securities laws. On December 28, 2021, Cybersecurity Review Measures was published by Cyberspace Administration of China or the CAC, National Development and Reform Commission, Ministry of Industry and Information Technology, Ministry of Public Security, Ministry of State Security, Ministry of Finance, Ministry of Commerce, People’s Bank of China, State Administration of Radio and Television, China Securities Regulatory Commission, State Secrecy Administration and State Cryptography Administration, became effective on February 15, 2022, which provides that, Critical Information Infrastructure Operators (“CIIOs”) that purchase internet products and services and Data Processing Operators (“DPOs”) engaging in data processing activities that affect or may affect national security shall be subject to the cybersecurity review by the Cybersecurity Review Office. On November 14, 2021, CAC published the Administration Measures for Cyber Data Security (Draft for Public Comments), or the “Cyber Data Security Measure (Draft)”, which requires cyberspace operators with personal information of more than one million users who want to list abroad to file a cybersecurity review with the Office of Cybersecurity Review. As of the date of this prospectus, these new laws and guidelines have not impacted the Company’s ability to conduct its business, accept foreign investments, or list and trade on a U.S. or other foreign exchange as the VIE and its PRC subsidiary hold far less than one million users’ personal information. The VIE and its PRC subsidiary provide customized car rental services and travel-related services and we believe the new data security or anti-monopoly laws and regulations in China do not apply to the Company, its subsidiaries, the VIE and its PRC subsidiary. However, any change in foreign investment regulations, and other policies in China or related enforcement actions by China government could result in a material change in the operations of the VIE and its PRC subsidiary and the value of our ordinary shares and could significantly limit our ability to offer our ordinary shares to investors or cause the value of our ordinary shares to significantly decline.

The VIE and its PRC subsidiary are located in China, and are subject to complex and evolving PRC laws and regulations. For example, we face regulatory risks relating to listings in the U.S., oversight on cybersecurity and data privacy. Uncertainties in the PRC legal system and the interpretation and enforcement of PRC laws and regulations could limit the legal protection available to you and us, hinder our ability to offer or continue to offer our ordinary shares, result in a material adverse effect on our business operations, and damage our reputation, which might further cause our ordinary shares to significantly decline in value. Our auditor, Marcum Asia CPAs LLP (formerly Marcum Bernstein & Pinchuk LLP), an independent registered public accounting firm headquartered in the United States, was not included in the determinations made by the Public Company Accounting Oversight Board (United States), or the PCAOB, on December 16, 2021. Additionally, on August 26, 2022, the PCAOB announced that it had signed a Statement of Protocol (the “Protocol”) with the China Securities Regulatory Commission (the “CSRC”) and the Ministry of Finance (“MOF”) of the People's Republic of China, governing inspections and investigations of audit firms based in mainland China and Hong Kong. On December 15, 2022, the PCAOB determined that the PCAOB was able to secure complete access to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong and voted to vacate its previous determinations to the contrary. On December 29, 2022, the Accelerating Holding Foreign Companies Accountable Act (“AHFCAA”) was signed into law, which reduced the number of consecutive non-inspection years required for triggering the listing and trading prohibitions under the Holding Foreign Company Accountable Act ("HFCAA") from three years to two years. Our auditor is subject to inspection by the PCAOB on a regular basis with the last inspection in 2020. As a result, we do not expect to be identified as a “Commission-Identified Issuer” under the HFCAA as of the date of this prospectus. However, whether the PCAOB will continue to conduct inspections and investigations completely to its satisfaction of PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong is subject to uncertainty and depends on a number of factors out of our, and our auditor’s, control, including positions taken by authorities of the PRC. The PCAOB is expected to continue to demand complete access to inspections and investigations against accounting firms headquartered in mainland China and Hong Kong in the future and states that it has already made plans to resume regular inspections in early 2023 and beyond. The PCAOB is required under the HFCAA to make its determination on an annual basis with regards to its ability to inspect and investigate completely accounting firms based in the mainland China and Hong Kong. The possibility of being a “Commission-Identified Issuer” and risk of delisting could continue to adversely affect the trading price of our securities. Should the PCAOB again encounter impediments to inspections and investigations in mainland China or Hong Kong as a result of positions taken by any authority in either jurisdiction, the PCAOB will make determinations under the HFCAA as and when appropriate. Although we believe that the Holding Foreign Companies Accountable Act and the related regulations do not currently affect us, we cannot assure you that there will not be any further implementations and interpretations of the Holding Foreign Companies Accountable Act or the related regulations, which might pose regulatory risks to and impose restrictions on us because of our operations in mainland China. See “Risk Factors — Risks Related to Doing Business in China.”

The VIE and its PRC subsidiary mainly conduct design, marketing, operation, and research and development activities in China, and we hold 50% equity interests and 50% VIE Interests in the VIE. As a result, almost all of the sales revenues are received by the VIE and its PRC subsidiary. Transfers of funds among the WFOE, the VIE and its PRC subsidiary are free of restrictions. Remittances of funds from the WFOE, the VIE and its PRC subsidiary to Webus are subject to review and conversion of Renminbi Yuan (“RMB”) to U.S. Dollar (“$”) through banks in China, which represents the State Administration of Foreign Exchange (“SAFE”) to monitor foreign exchange activities. Under the existing PRC foreign exchange regulations, payments of current account items, such as profit distributions and trade and service-related foreign exchange transactions, can be made in foreign currencies without prior approval from SAFE by complying with certain procedural requirements with the banks. We have not declared or paid dividends in the past, nor any dividends or distributions were made by subsidiaries to us. Furthermore, as of the date of this prospectus, no transfers, dividends, or distributions have been made among us, our subsidiaries, and the VIE and its subsidiary. Our board of directors has complete discretion on whether to distribute dividends, subject to applicable laws. Currently, we do not have any current plan to declare or pay any cash dividends to the U.S. investors in the foreseeable future after this offering, or settle amounts owed to our agreements, including the VIE agreements, except to the agreements entered under normal business operation as discussed hereof. See “VIE Consolidation Schedule” and “Note 14 Condensed financial information of the parent company – Condensed statements of cash flows” in our financial statements appearing elsewhere in this prospectus. Please also refer to “Dividend Policy” on page 64. The cash transfer among us and our subsidiaries is intended to be made through dividends, capital contributions or intercompany loans between the holding company and its subsidiaries, if needed in the future. Funds may be paid by the VIE and its subsidiary to the WFOE as service fees according to the VIE agreements. The WFOE may remit cash to the VIE subject to review and conversion of RMB to U.S. Dollars through WFOE’s bank in China. As of the date of this prospectus, none of our subsidiaries has made any dividend payment or distribution to the holding company, and we have not made any dividends or distributions to U.S. investors. No cash generated from one subsidiary is used to fund another subsidiary’s operations, and we do not anticipate any difficulties or limitations on our ability to transfer cash between us and our subsidiaries outside mainland China. However, the transfer of cash in and out of mainland China is subject to review and procedures according to the requirements of the SAFE. Other than discussed above, we don’t have any cash management policies that dictate the amount of such funding among the Group and the VIE and its subsidiary.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total Without Over- Allotment Option | Total With Over- Allotment Option | ||||||||||

| Public offering price | $ | $ | $ | |||||||||

| Underwriting discount(1) | $ | $ | $ | |||||||||

| Proceeds to us, before expenses(2) | $ | $ | $ | |||||||||

| (1) | Represents underwriting discounts equal to 6% per Ordinary Share. |

| (2) | In addition to the underwriting discounts listed above, we have agreed to issue, upon closing of this offering, warrants to Network 1 Financial Securities, Inc., as representative of the several underwriters (the “Representative”), exercisable six (6) months after the date of closing of this offering and for a three-year period after the date of commencement of sales of Ordinary Shares in this offering, entitling the representative to purchase 15% of the total number of Ordinary Shares sold in this offering (including any Ordinary Shares sold as a result of the exercise of the underwriters’ over-allotment option) at a per share price equal to 115% of the public offering price (the “Representative’s Warrants”). The registration statement of which this prospectus is a part also covers the Representative’s Warrants and the Ordinary Shares issuable upon the exercise thereof. See “Underwriting” for additional information regarding total underwriter compensation. |

This offering is being conducted on a firm commitment basis. The underwriter is obligated to take and pay for all of the shares if any such shares are taken. The total underwriting discounts and commissions payable will be $[--] based on an offering price of $[--] per share, and the total proceeds to us, before expenses, will be $[--]. If we complete this offering, net proceeds will be delivered to our company on the closing date.

The underwriter expects to deliver the ordinary shares against payment as set forth under “Underwriting”, on or about ●, 2023.

The date of this prospectus is [●], 2023

About this Prospectus

This prospectus is part of a registration statement we filed with the SEC. We and the underwriter have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses prepared by us or on our behalf or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the Ordinary Shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted or where the person making the offer or sale is not qualified to do so or to any person to whom it is not permitted to make such offer or sale. The information contained in this prospectus is current only as of the date on the front cover of the prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

Other Pertinent Information

Unless otherwise indicated or the context requires otherwise, references in this prospectus to:

| ● | "A&R memorandum and articles of association" are to the second amended and restated memorandum and articles of association of Webus to be adopted upon effectiveness of this prospectus; |

| ● | “China” or “PRC” are to the People’s Republic of China, including Hong Kong and Macau; however the only time such jurisdictions are not included in the definition of PRC and China is when we reference to the specific laws that have been adopted by the PRC. The term “Chinese” has a correlative meaning for the purpose of this prospectus; |

| ● | “Ordinary Shares” are to our ordinary shares, par value $0.0001 per share; |

| ● | “Webus,” “we,” “us,” “our,” “the holding company,” or the “Company” are to the registrant Webus International Limited., an exempted company incorporated under the laws of the Cayman Islands; |

| ● | “Youbus International” is to Youbus International Limited, a company formed under the laws of British Virgin Islands and a wholly-owned subsidiary of Webus; |

| ● | “Webus HK” is to Webus Hongkong Limited., a company formed under the laws of Hong Kong and a wholly-owned subsidiary of Youbus International; |

| ● | “WFOE” or “Xinjieni Tech” are to Zhejiang Xinjieni Technology Co., Ltd., a company formed under the laws of the PRC and a wholly owned subsidiary of Webus HK; |

| ● | “Youba Tech” or “VIE” are to Zhejiang Youba Technology Co., Ltd., a company organized under the laws of the PRC and the operating entity which has entered into the VIE Agreement with WFOE; |

| ● | “Individual Registered Shareholders” are to Zheng Jiahua and Wu Chunyun who collectively hold 50% of the equity interest of Youba Tech; |

| ● | “VIE and its subsidiary” are to Youba Tech and Webus Travel Agency; |

| ● | “Webus Travel Agency” is to Hangzhou Webus Travel Agency Co., Ltd., a company formed under the PRC and a wholly owned subsidiary of Youba Tech; |

| ● | “Wetour” is to Wetour Tech, LLC, a Delaware company and a wholly-owned subsidiary of Webus; |

| ● | “shares”, “Shares” or “Ordinary Shares” as of the date hereof refer to our ordinary shares, par value $0.0001 per share; |

| ● | The “Group” is to Webus, Youbus International, Webus HK, and the WFOE, as a group; |

| ● | “RMB” or “¥” are to the legal currency of China; and |

| ● | “$”, “US$”, “USD” or “U.S. Dollars” are to the legal currency of the United States. |

Substantially all our business is conducted by Youba Tech, the VIE in the PRC, and its subsidiary Webus Travel Agency, using Chinese yuan (the “RMB”), the legal currency of mainland China. Our consolidated financial statements are presented in RMB. The amounts for the fiscal year ended June 30, 2022 and unaudited condensed consolidated financial statements for the six months ended December 31, 2022 are presented in U.S. dollars for convenience purpose. These dollar references are based on the exchange rate of RMB to United States dollars, determined as of a specific date or for a specific period. Changes in the exchange rate will affect the amount of our obligations and the value of our assets in terms of United States dollars which may result in an increase or decrease in the amount of our obligations and the value of our assets, including accounts receivable.

For the sake of clarity, this prospectus follows the Chinese naming convention of last name followed by first name. For example, the name of our Chairman will be presented as “Zheng Jiahua”.

| i |

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or in any related free writing prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus or any free writing prospectus. We are offering to sell, and seeking offers to buy, the ordinary shares only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is current only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the ordinary shares.

| ii |

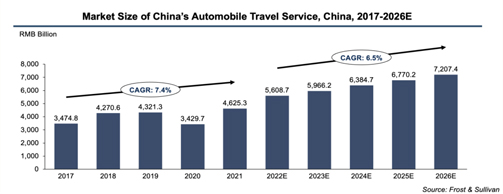

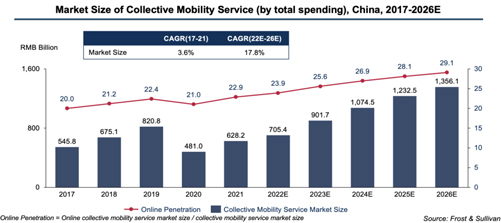

This summary highlights certain information contained elsewhere in this prospectus. You should read the entire prospectus carefully, including our financial statements and related notes and the risks described under “Risk Factors” beginning on page 26. We note that our actual results and future events may differ significantly based upon a number of factors. The reader should not put undue reliance on the forward-looking statements in this document, which speak only as of the date on the cover of this prospectus. This prospectus contains information from an industry report commissioned by us and prepared by Frost & Sullivan, an independent research firm, to provide information regarding our industry and our market position in China. We refer to this report as the F&S report.

Who We Are

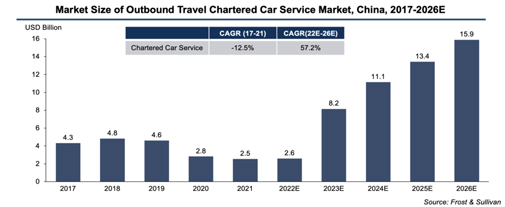

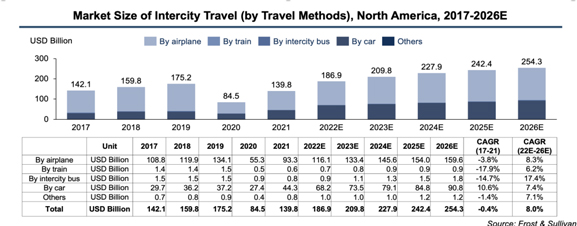

We are an emerging leader in China’s Collective Mobility Service (“CMS”) market that provides hassle-free and cost-effective mobility solutions with real-time AI-augmented online support and 24-7 itinerary management support through the VIE and its subsidiary and Wetour. The CMS utilizes privately-operated vans and buses to offer customers an alternative way to public transportation when traveling in large groups. Customers come to our platform for any type of CMS, from day-to-day commute, inter-city trips, business visits, and cross-provinces travel to guided tours and tailored vacation packages. Our diverse products and service portfolio covers budget, high-end, and customized offerings that appeal to both our individual and corporate customers. Established in 2019, we experienced rapid growth and ranked as the second largest online CMS provider in terms of revenue generated in the first half of 2022 by Frost & Sullivan.

Our Mission

Our mission is to make mobility easier and smarter by providing customized commuting, charted car service, and travel services through our global platform powered by big data and advanced algorisms.

Our Business

We are an exempted company incorporated in the Cayman Islands. As a holding company with no material operations, our operations were conducted by 1) our wholly-owned subsidiary Wetour in the United States; 2) our direct investment in Youba Tech and its subsidiary; and 3) through VIE Agreements with Youba Tech. This is an offering of the ordinary shares of the exempted company incorporated in the Cayman Islands. You are not 100% investing in, the VIE, as we hold 50% equity interests in Youba Tech and 50% VIE Interests in Youba Tech through VIE agreements. VIE Interests are not equity interest. Through the VIE Agreements among WFOE, Youba Tech and Individual Registered Shareholders, which have not been tested in a court of law, we are regarded as the primary beneficiary of Youba Tech for accounting purpose, and, therefore, we are able to consolidate the financial results of Youba Tech in our consolidated financial statements in accordance with U.S. GAAP. However, the VIE structure cannot completely replicate a foreign investment in China-based companies, as we only hold 50% equity interest in the VIE and its subsidiary and do not and may never hold the equity interests over 50% in the VIE and its subsidiary. Instead, the VIE structure provides contractual exposure to foreign investment in us. See “Corporate History and Structure — Contractual Arrangements with the VIE and Individual Registered Shareholders” for a summary of these VIE Agreements.

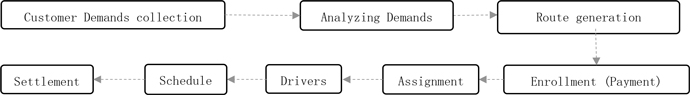

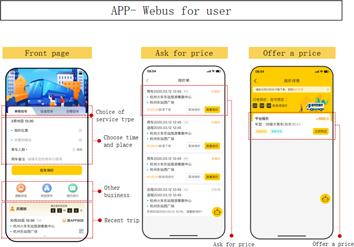

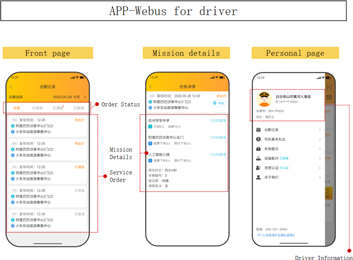

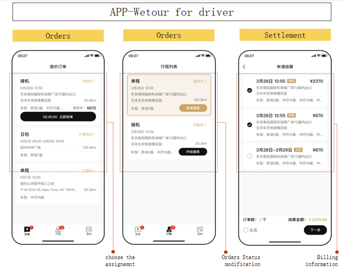

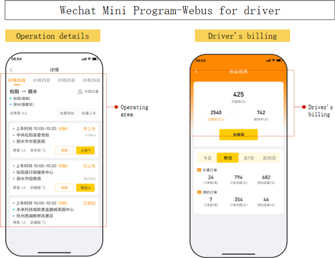

We operate on a business model of “Mobility-as-a-Service” (MaaS”) to identify and solve inefficiencies associated with inflexible or low-quality public transportation and provide cost-efficient and customized mass transportation services under different scenarios with our comprehensive digital platforms. We offer commute shuttle service, customized chartered bus service, packaged tour service and other service to our customers.

Commute shuttle service

We provide customized commute shuttle service with digital platform monitoring, delivering daily transportation service from predetermined departure to destination during the contract period. For the year ended June 30, 2022 and for the six months ended December 31, 2022, our revenue from the commute shuttle service were RMB19,625,172 ($2,845,382) and RMB7,650,720 ($1,109,250), respectively.

| 3 |

Customized chartered bus service

We also provide customized chartered bus service to support a more flexible and less preplanned group travel demand which ranges from one day to several months. For the year ended June 30, 2022 and for the six months ended December 31, 2022, our revenue from the customized chartered bus service were RMB61,906,594 ($8,975,612) and RMB45,976,621 ($6,665,983), respectively.

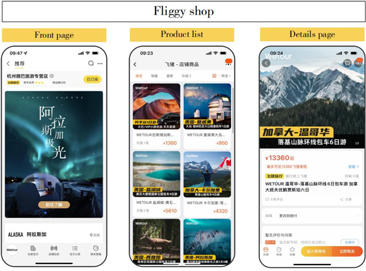

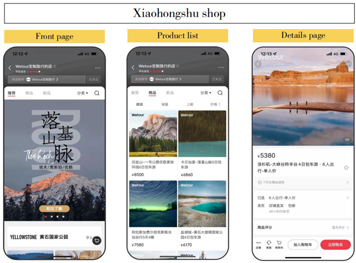

Packaged tour service

We offer packaged tour service to customers inclusive of services like chartered bus service, itinerary route schedule, sightseeing tour guidance, accommodation arrangement, etc., and cater to different budgets and preferences. For the year ended June 30, 2022 and for the six months ended December 31, 2022, our revenue from the packaged tour service were RMB48,310,313 ($7,004,337) and RMB40,067,745 ($5,809,277), respectively.

Others

We also provide our platform (“Webus Travel mini program”) users with cross-city ride-hailing service under relevant regulations in the PRC. For the year ended June 30, 2022 and for the six months ended December 31, 2022, our revenue from other service were RMB103,654 ($15,029) and RMB25,999 ($3,770), respectively.

Our Business Strategies

We intend to drive the growth of our business by executing on the following strategies:

| · | Further integrate our platform to a comprehensive ecosystem. We plan to continuously develop our platform into a comprehensive travel and commute ecosystem by building vertical integration within the platform for information flow and capital flow, external horizontal integration between our corporate customers, and end-to-end integration for complete product life cycle value chain. |

| · | Enhance Big Data and AI innovation. Strengthening technological innovation is one of our main strategic priorities to enhance the user experience. We will continue to attract, train and retain more talent in technology, research and development. As technologies and means for human-machine interactions continue to advance, we will strive to adapt to new technologies and formats with a view to becoming an intelligent travel assistant for our users. |

| · | Expand our customized tour service in the North American market. In March 2022, we have started offering customized tour service in North America under the brand name “Wetour”. We plan to vigorously develop the “Wetour” brand to build our global online customized chartered car and bus travel platform. We will focus on expanding services for Chinese outbound tourists after the pandemic and meeting the needs of overseas Chinese for car use and private customized travel. |

| · | Improve product content innovation capabilities. We will launch diversified and creative content formats: images, short videos, live broadcasts, and recommend the most relevant customized product content to our users. We plan to provide innovative content production tools and an efficient content reward mechanism to encourage users, professional travelers, Internet celebrities and the third party social media platforms to jointly develop different customized travel itineraries and further increase user stickiness order rate of users on the platform. |

| · | Broaden our geographic coverage for chartered bus service beyond Zhejiang province. We plan to expand our service beyond Zhejiang by continuing to maintain strategic collaborations with large online travel platforms as their vertical business supplier, cooperating with local bus and car rental companies, and increasing online marketing and short video traffic advertising. |

| · | Pursue strategic alliances, acquisitions and investments. We plan to selectively seek acquisitions, investments, joint ventures and collaborations highly strategic and complementary to our business and operations. In particular, we may consider acquiring some customized travel service brands to complement our existing offerings and services. We will also strengthen our vertical integration and strategic partnerships with content providers to further expand our partner network. |

| 4 |

Our Strengths

We believe the following strengths have contributed to our success:

| · | High degree of digitalization. Our self-developed internal business and user management platform enables all departments to better coordinate their work and effectively complete automatic online process of each order entry, order dispatch, settlement and invoicing. Our in-depth analysis of these accumulated data not only enables us to better understand user preferences and behavior and develop user-friendly products to assist users in making informed decisions, it also assists us in identifying potential target marketing and cross-selling opportunities. |

| · | Abundant and integrated resources. Our online channels include mobile apps; official websites; mini programs based on WeChat and Alipay, which have the two largest user base in China; interfaces with three major online travel agency platforms in China, Ctrip, Fliggy, and Tongcheng; and certified partnership with the prominent content publishing platform Xiaohongshu. Our offline channels include business strategic cooperation with more than 50 local first- and second-tier and lower-tier cities and counties in Zhejiang Province; group travel agencies and key customer organizations; large traditional travel agencies in the United States; and online bus booking platform gotobus. We also set up on-sight service desks at transportation sites, such as Hangzhou high-speed railway stations and airports. In addition, in mainland China, we have more than 11,000 dispatchable vehicles to satisfy our customers’ demand under different scenarios. Outside China, we have around 8,000 drivers providing chartered bus services. |

| · | User-Centered Services. Since our inception, we have continued to focus on building user trust, and constantly improving the platform interface to provide users with a smooth, efficient and transparent booking experience. We provide 24/7 Chinese and English itinerary butler support to serve users in every aspect. We also provide one-stop after-sale support, including pre-trip alerts, major accident compensation, refund policy for special circumstances, and emergency support. |

| · | Diverse and highly customizable travel solutions for different service scenarios. Our diverse travel solutions can satisfy differentiated needs and requirements and assist us to attract increasing number of customers. We work closely with a wealth of drivers to design products that meet the individual needs of our customers and use our proprietary historical travel product pricing data, combined with car usage time, mileage, road conditions, and local consumption expenses to update and optimize our product pricing model in real time. |

| · | Experienced team. Our management team is experienced in corporate management with international vision and our operation team has specialized experience in collective mobility service market. Members of our technical team came from internet technology companies, travel agencies, and online travel platform companies. They bring their years of experiences with deep understanding of the industry and provide resources for customers and suppliers in various fields. |

Our Challenges

In 2020, we experienced the sudden impact caused by the COVID-19 global pandemic. In 2021, COVID-19 pandemic continued to impact our operations. In 2022, there have been outbreaks of the Omicron variant of the COVID-19 in China, and the government restrictions and temporary lockdowns in combating the pandemic. Our net revenues increased from RMB10,652,136 for the year ended June 30, 2021 to RMB129,945,733 ($18,840,360) for the year ended June 30, 2022. Our net revenues increased by 100.0% from RMB46,862,135 for the six months ended December 31, 2021 to RMB93,721,085 ($13,588,280) for the six months ended December 31, 2022. China began to modify its zero-COVID policy at the end of 2022, and most of the travel restrictions and quarantine requirements were lifted in December 2022, causing cases of COVID-19 to remain elevated across China and straining local healthcare systems. We have adjusted various aspects of our operations to adapt to travel demand fluctuations decreasing with elevated cases and surging with lifted restrictions.

To broaden our geographic coverage in China, we need to partner with local vehicle fleet providers and access to driver resources in other provinces. The VIE and its subsidiary’s current supplier resources of drivers and bus fleets in other parts of the country do not have much advantage compared to other competitive platforms. We believe that we will need to invest funds for brand promotion and offer short-term incentives to obtain customers in provinces other than Zhejiang.

| 5 |

To expand our market into the North America region, we may face intensive competition on price, quality of services, and technology. We may not be able to compete with traditional North America local travel agencies for customers, driver resources, strategic partners such as travel agencies, airlines, hotels and tourist attraction sites. We may be required to invest significant capital to access customers, driver resources and quality travel product supplier information.

Overall, we require additional capital to develop new products, enter into new markets and drive our future growth. However, we have difficulty obtaining sufficient financing from commercial banks in China as these traditional commercial banks prefer having real assets as collaterals for their loans. We have also assessed the capital market of China, and we believe that it is difficult for a company like us to seek for financing in China.

Our Competition

There are around a hundred online collective mobility service platforms in China and online collective mobility service market is highly fragmented. According to the F&S report, in terms of revenue in the first half of calendar year 2022, the Company ranked in second place among top online collective mobility service platforms in China, with revenue of RMB 61.1 million ($9.1 million) generated.

Risk Factor Summary

Risks Related to Our Business and Industry

| · | The recent global coronavirus COVID-19 outbreak has caused significant disruptions to the travel industry, which we expect may have negative impact on our business, results of operations and financial condition. See “Risk Factors – Risks Related to Our Business and Industry - Pandemics (such as COVID-19), epidemics, or fear of spread of contagious diseases could disrupt the travel industry and our operations, which could materially and adversely affect our business, financial condition, and results of operations” on page 26 and “Our business may be negatively affected by the trend of remote working and flexible working schedules” on page 36. |

| · | We have a limited operating history in a competitive and rapidly evolving industry and incurred losses for the years ended June 30, 2021 and 2022 and for the six months ended December 31, 2022. See “Risk Factors – Risks Related to Our Business and Industry - We have a limited operating history in a competitive and rapidly evolving industry; it may be difficult to evaluate our prospects, and we may not be able to effectively manage our growth on page 27 and “We incurred net losses for the years ended June 30 2021 and 2022 and for the six months ended December 31, 2022. We may not be able to generate sufficient operating cash flows and working capital. Failure to manage our liquidity and cash flows may materially and adversely affect our financial condition and results of operations. As a result, we may need additional capital, and financing may not be available on terms acceptable to us, or at all” on page 27. |

| · | The growth of our business depends on our ability to accurately predict consumer trends and demand and successfully introduce new products and services and improve existing services.. See “Risk Factors – Risks Related to Our Business and Industry - The growth of our business depends on our ability to accurately predict consumer trends and demand and successfully introduce new products and services and improve existing services” on page 28. |

| · | Any damage to our reputation or our brands may materially adversely affect our business, financial condition and results of operations. See “Risk Factors – Risks Related to Our Business and Industry - Any damage to our reputation or our brands may materially adversely affect our business, financial condition and results of operations” on page 30. |

| · | Our operation mainly concentrates in one geographic area and we have a substantial customer concentration. See “Risk Factors – Risks Related to Our Business and Industry - We are mainly concentrated in one geographic area, which increases our exposure to many of the risks enumerated herein. We have a substantial customer concentration, with a limited number of customers accounting for a substantial portion of our revenues” on page 31. |

| 6 |

| · | The successful operation of our business depends on cooperation with third parties. See “Risk Factors – Risks Related to Our Business and Industry - The successful operation of our business depends substantially upon the cooperation of third parties that are not under our control” on page 28; “We rely on search engines, social networking sites and online streaming services to attract a meaningful portion of our users, and if those search engines, social networking sites and online streaming services change their listings or policies regarding advertising, or increase their pricing or suffer problems, it may limit our ability to attract new users” on page 28, and “Because we rely upon a third party to perform the payment processing for our customers, the failure or inability of the third party to provide these services could impair our ability to operate” on page 29. |

| · | Our projections, budgets, and revenues would be adversely affected by increases in labor costs, oil and natural gas prices. See “Risk Factors – Risks Related to Our Business and Industry - Increases in labor costs in the PRC may adversely affect the business and results of operations of us and the VIE” and “The price of oil and natural gas has historically been volatile. The ongoing Russian-Ukrainian War has increased the oil and natural gas prices substantially. If the price continues to increase, our drivers and bus fleet providers may be forced to adjust their prices upward. Our projections, budgets, and revenues would be adversely affected, potentially forcing us to make changes in our operations” on page 32. |

| · | · | Newly developed public transportation infrastructure may reduce the demand for our commute shuttle and chartered bus services. See “Risk Factors – Risks Related to Our Business and Industry - Newly developed public transportation infrastructure may reduce the demand for our commute shuttle and chartered bus services” on page 37. |

See “Risk Factors— Risks Related to Our Business” on page 26 for more detailed disclosures on these risks and uncertainties.

Risks Related to Corporate Structure

| · | We are an exempted company incorporated in the Cayman Islands. As a holding company with no material operations, our operations were conducted by 1) our wholly-owned subsidiary Wetour in the United States; 2) our direct investment in Youba Tech and its subsidiary; and 3) through VIE Agreements with Youba Tech. There are substantial uncertainties regarding such corporate structure. See “Risk Factors – Risks Related to Corporate Structure - Webus is a Cayman Islands exempted company operating in the United States and in China partially through its subsidiaries and partially through contractual arrangements with the VIE. Investors in the Ordinary Shares thus are not purchasing, and may never directly hold, 50% VIE Interests in the VIE. There are substantial uncertainties regarding the interpretation and application of current and future PRC laws, regulations, and rules relating to the agreements that establish the VIE structure for the majority of our and the VIE’s operations in China, including potential future actions by the PRC government, which could affect the enforceability of our contractual arrangements with the VIE and, consequently, significantly affect the financial condition and results of operations of Webus. If the PRC government finds such agreements non-compliant with relevant PRC laws, regulations, and rules, or if these laws, regulations, and rules or the interpretation thereof change in the future, we could be subject to severe penalties or be forced to relinquish our interests in the VIE, which may materially and adversely affect our and the VIE’s operations and the value of your investment” on page 38. |

| · | We rely on contractual arrangements with the VIE and Individual Registered Shareholders for our and the VIE’s operations in China, which may not be as effective in providing operational control as direct ownership, and the VIE’s shareholders may fail to perform their obligations under the contractual arrangements. See “Risk Factors – Risks Related to Corporate Structure - We rely on contractual arrangements with the VIE and Individual Registered Shareholders for our and the VIE’s operations in China, which may not be as effective in providing operational control as direct ownership, and the VIE’s shareholders may fail to perform their obligations under the contractual arrangements” on page 39. |

| 7 |

| · | The shareholders of the VIE may have conflicts of interests with us, which may materially and adversely affect our and the VIE’s business. See “Risk Factors – Risks Related to Corporate Structure - The shareholders of the VIE may have conflicts of interests with us, which may materially and adversely affect our and the VIE’s business.” on page 39. |

| · | Certain terms of the Contractual Arrangements may not be enforceable under PRC laws. See “Risk Factors – Risks Related to Corporate Structure - Certain terms of the Contractual Arrangements may not be enforceable under PRC laws” on page 41. |

| · | Our Contractual Arrangements may be subject to scrutiny of PRC tax authorities and additional tax may be imposed which may materially and adversely affect our and the VIE’s results of operation and value of your investment. See “Risk Factors – Risks Related to Corporate Structure - Our Contractual Arrangements may be subject to scrutiny of PRC tax authorities and additional tax may be imposed which may materially and adversely affect our and the VIE’s results of operation and value of your investment” on page 42. |

| · | We and the investors may face significant liquidity risks if the laws, regulations or government policies governing our corporate structure or operations change in the future. See “Risk Factors – Risks Related to Corporate Structure – The investors may face significant liquidity risks because of the VIE structure and being based in and having the majority of the Company’s operations in China” and “Risk Factors – Risks Related to Doing Business in China – To the extent cash or assets of our business, or of our PRC or Hong Kong subsidiaries, is in the PRC or Hong Kong, such cash or assets may not be available to fund operations or for other use outside of the PRC or Hong Kong, due to interventions in or the imposition of restrictions and limitations by the PRC government to the transfer of cash or assets” on page 47. |

| · | If we exercise the option to acquire equity ownership and assets of the VIE, the ownership or asset transfer may subject us to certain limitations and substantial costs. See “Risk Factors – Risks Related to Corporate Structure - If we exercise the option to acquire equity ownership and assets of the VIE, the ownership or asset transfer may subject us to certain limitations and substantial costs” on page 40. |

| · | Substantial uncertainties exist with respect to the interpretation and implementation of the Foreign Investment Law and how it may impact the viability of the current corporate structure, corporate governance and business operations of us and the VIE. See “Risk Factors – Risks Related to Corporate Structure - Substantial uncertainties exist with respect to the interpretation and implementation of the Foreign Investment Law and how it may impact the viability of the current corporate structure, corporate governance and business operations of us and the VIE” on page 41. |

| · | We are a holding company and the investors will have ownership in a holding company that does not directly own all of its operation in China. We primarily rely on our WFOE and the VIE for the operation in PRC. We may rely on dividends to be paid by the WFOE to fund our cash and financing requirements, including the funds necessary to pay dividends and other cash distributions to our shareholders, if needed in the future. Any limitation on the ability of WFOE to pay dividends to us could have a material adverse effect on our ability to pay dividends to our shareholders. See “Risk Factors – Risks Related to Corporate Structure - We are a holding company and the investors will have ownership in a holding company that does not directly own all of its operation in China. We primarily rely on our WFOE and the VIE for the operation in PRC. We may rely on dividends to be paid by the WFOE to fund our cash and financing requirements, including the funds necessary to pay dividends and other cash distributions to our shareholders, if needed in the future. Any limitation on the ability of WFOE to pay dividends to us could have a material adverse effect on our ability to pay dividends to our shareholders” on page 42. |

See “Risk Factors— Risks Related to Corporate Structure” on page 38 for more detailed disclosures on these risks and uncertainties.

Risks Related to Doing Business in China

· |

Uncertainties exist as to our ability to use foreign currency, including the proceeds we received from this offering, and to capitalize or otherwise fund our PRC operations, which could materially and adversely affect our liquidity and our ability to fund and expand our business. See “Risk Factors – Risks Related to Doing Business in China - We must remit the offering proceeds to China before they may be used to benefit our business in China, the process of which may be time-consuming, and we cannot assure that we can finish all necessary governmental registration processes in a timely manner, which could materially and adversely affect our liquidity and our ability to fund and expand our business” on page 37. | |

| · | Changes in China’s economic, political or social conditions or government policies could have a material adverse effect on our business and results of operations. See “Risk Factors – Risks Related to Doing Business in China - Changes in China’s economic, political or social conditions or government policies could have a material adverse effect on our business and results of operations” on page 43. |

| · | Uncertainties and quick change in the interpretation and enforcement of Chinese laws and regulations with little advance notice could result in a material and negative impact on our business operation, decrease the value of our ordinary shares and limit the legal protections available to us. See “Risk Factors – Risks Related to Doing Business in China - Uncertainties and quick change in the interpretation and enforcement of Chinese laws and regulations with little advance notice could result in a material and negative impact on our business operation, decrease the value of our ordinary shares and limit the legal protections available to us” on page 43. |

| 8 |

| · | The approval and/or other requirements of the CSRC or other PRC governmental authorities may be required in connection with this transaction under PRC rules, regulations or policies, and, if required, Webus cannot predict whether or how soon it will be able to obtain such approval. See “Risk Factors – Risks Related to Doing Business in China - The approval and/or other requirements of the CSRC or other PRC governmental authorities may be required in connection with this transaction under PRC rules, regulations or policies, and, if required, Webus cannot predict whether or how soon it will be able to obtain such approval” on page 44. |

| · | The Chinese government exerts substantial influence over the manner in which the VIE and its subsidiary must conduct their business activities. See “Risk Factors – Risks Related to Doing Business in China - The Chinese government exerts substantial influence over the manner in which the VIE and its subsidiary must conduct their business activities. If the Chinese government significantly regulates these entities’ business operations in the future and they are not able to substantially comply with such regulations, these entities’ business operations may be materially adversely affected and the value of Webus’ ordinary shares may significantly decrease” on page 45. |

| · | Substantial uncertainties exist with respect to the interpretation and implementation of the newly enacted PRC Foreign Investment Law and how it may impact the viability of our current corporate structure, corporate governance, business operations and financial results. See “Risk Factors – Risks Related to Doing Business in China - Substantial uncertainties exist with respect to the interpretation and implementation of the newly enacted PRC Foreign Investment Law and how it may impact the viability of our current corporate structure, corporate governance, business operations and financial results” on page 52. |

| · | Any failure to comply with PRC regulations regarding the registration requirements for employee stock incentive plans may subject the PRC plan participants or us to fines and other legal or administrative sanctions. See “Risk Factors – Risks Related to Doing Business in China - Any failure to comply with PRC regulations regarding the registration requirements for employee stock incentive plans may subject the PRC plan participants or us to fines and other legal or administrative sanctions” on page 49. |

| · | If we are classified as a PRC resident enterprise for PRC income tax purposes, such classification could result in unfavorable tax consequences to us and our non-PRC shareholders. See “Risk Factors – Risks Related to Doing Business in China - If we are classified as a PRC resident enterprise for PRC income tax purposes, such classification could result in unfavorable tax consequences to us and our non-PRC shareholders” on page 49. |

| · | Regulatory bodies of the United States may be limited in their ability to conduct investigations or inspections of our operations in China. See “Risk Factors – Risks Related to Doing Business in China - Regulatory bodies of the United States may be limited in their ability to conduct investigations or inspections of our operations in China” on page 50. |

| · | The Holding Foreign Companies Accountable Act, or HFCAA and the related regulations might pose regulatory risks to and impose restrictions on us because of our operations in mainland China. See “Risk Factors – Risks Related to Doing Business in China - The Holding Foreign Companies Accountable Act, or the HFCAA, and the related regulations are evolving quickly. Further implementations and interpretations of or amendments to the HFCAA or the related regulations, or a PCOAB’s determination of its lack of sufficient access to inspect our auditor, might pose regulatory risks to and impose restrictions on us because of our operations in mainland China. A potential consequence is that our ordinary shares may be delisted by the exchange. The delisting of our ordinary shares, or the threat of our ordinary shares being delisted, may materially and adversely affect the value of your investment. Additionally, the inability of the PCAOB to conduct full inspections of our auditor deprives our investors of the benefits of such inspections” on page 50. |

| 9 |

· |

The Chinese government may intervene or influence our operations at any time or may exert more control over offerings conducted overseas and/or foreign investment in China-based issuers and that such actions by the Chinese government could cause the value of our securities to significantly decline or be worthless. See “Risk Factors – Risks Related to Doing Business in China - Any change of regulations and rules by Chinese government including potential additional requirements on cybersecurity review, personal information protection, moving technology in and out of the PRC, or outbound data transfer may intervene or influence our operations in China at any time and any additional control over offerings conducted overseas and/or foreign investment in issuers with Chinese operations could result in a material change in our business operations and/or the value of our ordinary shares and could also significantly limit or completely hinder our ability to offer our ordinary shares to investors and cause the value of such securities to significantly decline or be worthless” on page 53. |

See “Risk Factors—Risks Related to Doing Business in China” on page 43 for more detailed disclosures on these risks and uncertainties.

Risks Related to Our Ordinary Shares and This Offering

| · | There has been no previous public market for our shares prior to this offering, and if an active trading market does not develop you may not be able to resell our shares at or above the price you paid, or at all. See “Risk Factors—Risks Related to Our Ordinary Shares and This Offering - There has been no previous public market for our shares prior to this offering, and if an active trading market does not develop you may not be able to resell our shares at or above the price you paid, or at all” on page 55. |

| · | You may face difficulties in protecting your interests as a shareholder, as Cayman Islands law provides substantially less protection when compared to the laws of the United States and it may be difficult for a shareholder of ours to effect service of process or to enforce judgements obtained in the United States courts. See “Risk Factors—Risks Related to Our Ordinary Shares and This Offering - You may face difficulties in protecting your interests as a shareholder, as Cayman Islands law provides substantially less protection when compared to the laws of the United States and it may be difficult for a shareholder of ours to effect service of process or to enforce judgements obtained in the United States courts” on page 57. |

See “Risk Factors—Risks Related to Our Ordinary Shares and This Offering” on page 55 for more detailed disclosures on these risks and uncertainties.

In addition, please see “Risk Factors” beginning on page 26 of this prospectus, and other information included in this prospectus, for a discussion of these and other risks and uncertainties that we face.

Corporate History and Structure

Webus commenced its operations in August 2019 through Zhejiang Youba Technology Co., Ltd., a limited liability company formed in the PRC. Through Youba Tech and its subsidiary, Webus mainly offers customers travel related services, including commute shuttle service, customized chartered bus service, packaged tour service and other services, through our comprehensive online platforms. Webus expanded its operations to United States in March 2022 through Wetour Travel Tech LLC, a limited liability company formed in United States. Webus formed its wholly-owned subsidiary Xinjieni Tech as a limited liability company in the PRC in August 2022. Through Xinjieni Tech’s direct investment in and contractual arrangements with Youba Tech, Webus conducts business operations in China.

| 10 |

Webus underwent a series of restructuring transactions, which primarily included:

| • | In February 2022, Webus International Limited, Webus’ current ultimate holding company, was incorporated under the laws of the Cayman Islands. |

| • | In February 2022, Youbus International Limited was incorporated in the British Virgin Islands as a BVI business company. |

| • | In February 2022, Webus Hongkong Limited was incorporated in Hong Kong under the laws of Hong Kong. |

| • | In August 2022, Zhejiang Xinjieni Technology Co., Ltd., or Xinjieni Tech, was formed in the PRC as a wholly-owned subsidiary of Webus Hongkong Limited. |

| • | In September 2022, Xinjieni Tech acquired 50% equity interests in Youba Tech and entered into a series of contractual arrangements for 50% VIE Interests, with Youba Tech, as well as Individual Registered Shareholders. Through Xinjieni Tech, Webus obtained control over Youba Tech and its subsidiary Webus Travel Agency. |

The use of the VIE structure was to comply with applicable PRC laws and regulations that restrict foreign investment of companies involved in internet content provider services, including value-added telecommunications services in China. We can hold up to 50% equity interests in the VIE.

Corporate Structure

The following diagram illustrates our corporate structure, including our subsidiaries, the VIE and its subsidiary as of the date of this prospectus:

Contractual Arrangements with the VIE and Individual Registered Shareholders

Current PRC laws and regulations impose certain restrictions or prohibitions on foreign ownership of companies that engage in value-added telecommunication business. We are a company registered in the Cayman Islands. Our PRC subsidiary, Xinjieni Tech, is considered a foreign-invested enterprise. To comply with PRC laws and regulations, the VIE primarily conduct business in China through the VIE and its subsidiary, based on a series of Contractual Arrangements. As a result of these Contractual Arrangements, we exert control over, and are deemed as the primary beneficiary of the VIE and its subsidiary and consolidate their operating results in our financial statements subject to the conditions that we have satisfied for consolidation of the VIE and its subsidiary under U.S. GAAP. Such conditions include that (i) we control the VIE through power to govern the activities which most significantly impact the VIE’s economic performance, (ii) we are contractually obligated to absorb losses of the VIE that could potentially be significant to the VIE, and (iii) we are entitled to receive benefits from the VIE that could potentially be significant to the VIE.

| 11 |

The following is a summary of the Contractual Arrangements by and among WFOE, the VIE, and Individual Registered Shareholders. These Contractual Arrangements enable us to (i) exercise control over the VIE, (ii) receive substantially all of the economic benefits of the VIE, and (iii) have an exclusive option to purchase all or part of the equity interests in the VIE held by the VIE’s shareholders other than WFOE when and to the extent permitted by PRC law. Our control over the VIE and its subsidiary and our position of being the primary beneficiary of the VIE and its subsidiary for the accounting purpose are limited to the aforementioned conditions that we met for consolidation of the VIE and its subsidiary under U.S. GAAP.

• Exclusive Business Cooperation Agreement

Pursuant to the Exclusive Business Cooperation Agreement, the VIE is obliged to pay service fee to WFOE for the exclusive services such as technical services, Internet technology support, business consulting, software development, information consulting, marketing consulting, product development and system maintenance. The service fee shall consist of 100% of the profit before tax of the VIE, after the deduction of all costs, expenses, taxes and other fee required under PRC laws and regulations. The VIE agrees not to accept the same or any similar services provided by any third party and shall not establish cooperation relationships similar to that formed by the Exclusive Business Cooperation Agreement with any third party, except with the prior written consent of WFOE. The VIE has unconditionally and irrevocably authorized WFOE or its designated person as its agent to (i) sign any necessary documents with third parties (including but not limited to customers and suppliers) on behalf of the VIE; and (ii) to handle all necessary documents and matters which will enable WFOE to exercise all or part of its rights under the Exclusive Business Cooperation Agreement on behalf of the VIE. WFOE shall have exclusive proprietary rights to and interests in any and all intellectual property rights developed or created by itself and the VIE. The Exclusive Business Cooperation Agreement shall remain effective unless terminated (i) in accordance with the provisions of the Exclusive Business Cooperation Agreement; or (ii) the entire equity interests held by Individual Registered Shareholders in the VIE have been transferred to WFOE or its designated person.

• Exclusive Call Option Agreement

Pursuant to the Exclusive Call Option Agreement, the Individual Registered Shareholders have unconditionally and irrevocably granted WFOE or its designated purchaser the right to purchase all or part of their equity interests in the VIE (“Equity Call Option”). The purchase price payable by WFOE in respect of the transfer of equity interests upon exercise of the Equity Call Option shall be the higher of (a) the lowest price permitted under PRC laws and regulations or (b) the capital contribution in relation to the equity interests. If appraisal is required by the PRC laws and regulations at the time when WFOE exercises the Option, WFOE and the Individual Registered Shareholders shall make necessary adjustment to purchase price so that it complies with any and all then applicable PRC laws and regulations. WFOE or its designated purchaser shall have the right to purchase such proportion of equity interests in the VIE as it decides at any time. The Individual Registered Shareholders shall return any amount of purchase price they received in the event that WFOE acquires the equity interests in the VIE.

The Individual Registered Shareholders and the VIE have jointly and severally further undertaken to WFOE that, without the prior written consent of WFOE, they shall not (i) in any manner supplement, change or amend the constitutional documents of the VIE, increase or decrease its share capital, or change the structure of its registered capital in other manner; (ii) sell, pledge, transfer or otherwise dispose of any assets, business or lawful revenue or create encumbrance over the VIE; (iii) incur, inherit, guarantee or assume any debt, except for debts incurred in the ordinary course of business other than payables incurred by a loan and for debts disclosed to and agreed in writing by WFOE; (iv) cause the VIE to execute any material contract with a value above RMB100,000, except the contracts executed in the ordinary course of business; (v) cause the VIE to provide any person with any loan, credit or guarantee; (vi) cause or permit the VIE to merge, consolidate with, acquire or invest in any person, or sell assets of the VIE with a value above RMB100,000; (vii) cause the VIE to enter into any transaction which may have substantial impact on the assets, liabilities, business operation, shareholding structure and other legal rights of the VIE, except the contracts executed in the ordinary course of business; and (viii) in any manner distribute dividends to their shareholders, provided that upon the written request of WFOE, the VIE shall immediately distribute all distributable profits to its shareholders.

| 12 |

The Exclusive Call Option Agreement shall remain effective unless terminated (i) in accordance with the provisions of the Exclusive Call Option Agreement or any other supplemental agreements; or (ii) the entire equity interests held by Individual Registered Shareholders in the VIE have been transferred to WFOE or its designated person.

• Exclusive Assets Option Agreement

Pursuant to the Exclusive Assets Option Agreement, the VIE unconditionally and irrevocably granted an exclusive option to WFOE or its designated person to purchase all or any of its assets at the higher price of (a) the lowest price permitted under PRC laws and regulations or (b) the net book value of the assets. WFOE shall have absolute discretion as to when and in what manner to exercise the option to purchase assets of the VIE permitted by PRC laws and regulations. The Exclusive Assets Option Agreement shall remain effective unless terminated (i) in accordance with the provisions of the Exclusive Assets Option Agreement or any other supplemental agreements; or (ii) the entire equity interests held by the Individual Registered Shareholders in the VIE have been transferred to WFOE or its designated person.

• Power of Attorney

Pursuant to the Power of Attorney, each of the Individual Registered Shareholders, irrevocably appoints WFOE, the authorized person or entity to exercise such shareholder’s rights in the VIE in accordance with PRC laws and the articles of the VIE, including without limitation to, the rights to (i) participate in shareholders meetings; (ii) the sale, transfer, pledge or disposition of the equity interest such shareholder holds in part or in whole; and (iii) designate and appoint, on behalf of such shareholder, the legal representative, the chairman, the executive director(s) and/or director(s), the supervisor(s), the general manger and other senior management members of the VIE. Without limiting the generality of the powers granted to WFOE, WFOE shall have the power and authority hereunder, on behalf of such shareholder, to execute the share transfer contracts stipulated in the Exclusive Call Option Agreement entered into among the VIE, WFOE and such shareholder and effect the terms of the Exclusive Call Option Agreement and Share Pledge Agreement. All the actions in connection with the equity interest held by such shareholder as conducted by WFOE shall be deemed as the actions of such shareholder, and all the documents related to the shareholding executed by WFOE shall be deemed to be executed by such shareholder.

• Share Pledge Agreement

Pursuant to the Share Pledge Agreement, each of the Individual Registered Shareholders unconditionally and irrevocably pledged and granted first priority security interests over all of his/her/its equity interests in the VIE together with all related rights thereto to WFOE as security for performance of the Contractual Arrangements and all direct, indirect or consequential damages and foreseeable loss of interest incurred by WFOE as a result of any event of default on the part of the Individual Registered Shareholders, the VIE and all expenses incurred by WFOE as a result of enforcement of the obligations of the Individual Registered Shareholders and/or the VIE under the Contractual Arrangements. Upon the occurrence and during the continuance of an event of default (as defined in the Share Pledge Agreement), WFOE shall have the right to (i) require the Individual Registered Shareholders to immediately pay any amount payable under the Contractual Arrangements; or (ii) to exercise all such rights as a secured party under any applicable PRC law and the Share Pledge Agreement, including without limitations, being paid in priority with the equity interests.

The said share pledge under the Share Pledge Agreement takes effect upon the completion of registration with the relevant administrative department of industry and commerce and shall remain valid until after all the contractual obligations of the Individual Registered Shareholders and the VIE under the relevant Contractual Arrangements have been fully performed and all the outstanding debts of the Individual Registered Shareholders and/or the VIE under the relevant Contractual Arrangements have been fully paid.

| 13 |

• Spousal Consent

Pursuant to each Spousal Consent, the respective spouse of the Individual Registered Shareholders has irrevocably undertaken that, including without limitation to, the spouse (i) has full knowledge of and has consented to the entering into of the Contractual Arrangements by the relevant Individual Registered Shareholder; (ii) is not entitled to any right with respect to the shares in the VIE and undertakes not to make any claims on the equity interest in the VIE; (iii) confirms that the Individual Registered Shareholders’ performance of the Contractual Arrangements and further modification or termination of the Contractual Arrangements will not require the respective spouse’s separate authorization or consent;; (iv) undertakes to execute all necessary documents and take all necessary actions to ensure the Contractual Arrangements (as amended from time to time) to be properly performed; (v) undertakes that if the respective spouse obtains any equity interest in the VIE for any reason, the respective spouse shall be bound by the Contractual Arrangements and abide by the obligations of the shareholders of the VIE under the Contractual Arrangements, and upon WFOE's or its designate third-party request, the respective spouse shall execute a series of written documents with substantially the same form and content as the Contractual Arrangements。

In the opinion of our PRC legal counsel, Allbright Law Offices

| • | the ownership structures of the VIE and our WFOE in China, both currently and immediately after giving effect to this offering, are not in violation of applicable PRC laws and regulations currently in effect; and |

| • | the contractual arrangements among our WFOE, the VIE and its shareholders governed by PRC law are currently valid and binding in accordance with applicable PRC laws and regulations currently in effect and do not result in any violation of the applicable PRC laws or regulations currently in effect. |

However, our PRC legal counsel has also advised us that there are substantial uncertainties regarding the interpretation and application of current or future PRC laws and regulations. Accordingly, the PRC regulatory authorities may ultimately take a view contrary to or otherwise different from the opinion of our PRC legal counsel. It is uncertain whether any new PRC laws or regulations relating to variable interest entity structures will be adopted or if adopted, what they would provide.

If we or the VIE are found to be in violation of any existing or future PRC laws or regulations, or fail to obtain or maintain any of the required permits or approvals, the relevant PRC regulatory authorities would have broad discretion to take action in dealing with such violations or failures. See “Risk Factors — Risks Related to Corporate Structure — Substantial uncertainties exist with respect to the interpretation and implementation of the Foreign Investment Law and how it may impact the viability of the current corporate structure, corporate governance and business operations of us and the VIE”.

Transfer of Cash to and From Our Subsidiaries and the VIE