An offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this preliminary offering circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the Commission is qualified. This Preliminary offering circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a final offering circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the final offering circular or the offering statement in which such Final offering circular was filed may be obtained.

Preliminary Offering Circular Dated April 25, 2022

AERIS BIOTECHNOLOGIES, INC.

8105 Rasor Boulevard, Suite 129

Plano, TX 75024

1-214-436-2986

www.aerisbiotech.com

OFFERING SUMMARY

Up to 15,000,000 shares of Common Stock, par value $0.0001

Minimum investment 500 shares at $500

SEE “SECURITIES BEING OFFERED” AT PAGE 36

| Price to Public | Underwriting discount and commissions (1) | Proceeds, Before Expenses, to Issuer (2) | |||||

| Per Share | $1.00 | $0.01 | $0.99 | ||||

| Total Maximum | $15,000,000.00 | $150,000.00 | $14,850,000 |

| (1) | Aeris Biotechnologies, Inc. (the “Company”) has engaged Dalmore Group, member FINRA/SIPC (“Dalmore”), to act as the broker-dealer of record in connection with this offering, but not for underwriting or placement agent services. This includes a 1% commission, but it does not include the one-time set-up fee and consulting fee payable by the Company to Dalmore. See “Plan of Distribution” for details. |

| (2) | The Company expects that, not including state filing fees, the maximum amount of expenses of the offering that it will pay will be approximately $1.7 million assuming that the maximum number of shares are sold in this offering. |

The Company is offering shares of its common stock, par value $0.0001 per share. This offering (the “Offering”) will terminate at the earlier of: (1) the date at which the maximum offering amount has been sold, (2) one year from the qualification of this circular or ______, 2023, or (3) the date at which the Offering is earlier terminated by the Company at its sole discretion. Funds will be deposited into a segregated account maintained at Dalmore, who acts as the funds collection agent for the Offering. Dalmore is an online platform administering this Offering for the benefit of the Company. The Offering is being conducted on a best-efforts basis with the targeted maximum offering amount (the “Maximum Offering Amount”) of $15,000,000. There is no minimum offering amount in this Offering. The Company may undertake one or more closings on a rolling basis, and the proceeds of this Offering will not be placed into an escrow account. After each closing, funds tendered by investors will be made available to the Company assuming the Company has accepted the investors’ subscription for the shares. After the initial closing of this offering, we expect to hold closings on at least a monthly basis.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OR GIVE ITS APPROVAL OF ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(d)(2)(i)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO www.investor.gov.

This offering is inherently risky. See “Risk Factors” on page 2.

Sales of these securities will commence on approximately , 2022.

The Company is following the “Offering Circular” format of disclosure under Regulation A.

The date of this offering circular is , 2022.

TABLE OF CONTENTS

In this offering circular, the terms “Aeris,” “we,” “us, “our” or the “Company” refer to Aeris Biotechnologies, Inc., a Delaware corporation.

Please read this offering circular carefully. It describes our business, our financial condition and results of operations. We have prepared this offering circular so that you will have the information necessary to make an informed investment decision.

You should rely only on the information contained in this offering circular. We have not authorized anyone to provide you with any information other than that contained in this offering circular. We are offering to sell, and seeking offers to buy, the securities covered hereby only in jurisdictions where offers and sales are permitted. The information in this offering circular is accurate only as of the date of this offering circular, regardless of the time of delivery of this offering circular or any sale of the securities covered hereby. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: We have not taken any action that would permit this offering or possession or distribution of this offering circular in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this offering circular must inform themselves about, and observe any restrictions relating to, the offering of the securities covered hereby or the distribution of this offering circular outside the United States.

This offering circular includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. We believe that the data obtained from these industry publications and third-party research, surveys and studies are reliable.

THIS OFFERING CIRCULAR MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY’S MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS “ESTIMATE,” “PROJECT,” “BELIEVE,” “ANTICIPATE,” “INTEND,” “EXPECT” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS, WHICH CONSTITUTE FORWARD LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT’S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE. THE COMPANY DOES NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS OR CIRCUMSTANCES AFTER SUCH DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

i

This summary highlights information contained elsewhere in this offering circular. This summary is not complete and does not contain all of the information that you should consider before investing in our shares of common stock. You should carefully read the entire offering circular, especially concerning the risks associated with the investment in the securities covered by this offering circular discussed under the “Risk Factor” section beginning on page 2.

The Company

Aeris Biotechnologies, Inc. is a health and biomedical technology company based in the United States seeking to provide a novel “green” approach to the control of a key cause of and trigger for asthma, based on the acquisition of multiple awarded patents and an established technology platform.

The Offering

| Securities offered by us | Up to 15,000,000 shares of common stock, par value $0.0001 per share (the “Shares”) | |

| Common Stock outstanding before the Offering | 16,080,500 | |

| Share price | $1.00 per Share | |

| Minimum Investment | 500 Shares for $500 |

Use of Proceeds

Proceeds from this offering will be used to pay our licensor for the rights to the intellectual property underlying our planned products, support establishment of the planned core research and development facility and the progression of development work through to commercialization of our first product offering, and general corporate and operational expenses. See “Use of Proceeds” section of this offering circular.

1

Investing in our Shares involves a high degree of risk. In addition to the other information provided in this offering circular, you should carefully consider the following risk factors in evaluating our business and before purchasing any of our securities. We are subject to a number of risks, including risks that may prevent us from achieving our business objectives or that may adversely affect our business, financial condition, results of operations, cash flows and prospects.

Risks Related to Our Business

We are a development stage company with a limited operating history and no revenue, making it difficult for you to evaluate our business and your investment.

Our operations are subject to all of the risks inherent in the establishment of a new business enterprise, including but not limited to the absence of an operating history, lack of fully-developed or commercialized products, insufficient capital, expected substantial and continual losses for the foreseeable future, limited experience in dealing with regulatory issues, lack of manufacturing, distribution and marketing experience, need to rely on third parties for the development and commercialization of our proposed products, a competitive environment characterized by well-established and well-capitalized competitors and reliance on key personnel.

We may not be successful in carrying out our business objectives. The revenue and income potential of our business and operations are unproven as the lack of operating history makes it difficult to evaluate the future prospects of our business. There is nothing at this time on which to base an assumption that our business operations will prove to be successful or that we will ever be able to operate profitably. Accordingly, we have no track record of successful business activities, strategic decision-making by management, fund-raising ability, and other factors that would allow an investor to assess the likelihood that we will be successful in our business. There is a substantial risk that we will not be successful in fully implementing our business plan, or if initially successful, in thereafter generating material operating revenues or in achieving profitable operations.

Even if we successfully develop and market our proposed products, we may not generate sufficient or sustainable revenue to achieve or sustain profitability, which could cause us to cease operations and cause you to lose all of your investment. Because we are subject to these risks, you may have a difficult time evaluating our business and your investment in our Company.

We are at an early stage of marketing, and we have no sales history.

While our intent is to deliver a commercially viable product by 2025, our efforts may not lead to commercially successful products, for a number of reasons, including that:

| ● | Our products may not be accepted by the individuals or commercial customers; |

| ● | We may not have adequate financial or other resources to complete the development and commercialization of our products; and any products that are sold may not be accepted or may have significant competition in the marketplace; and |

| ● | If sales of our projects are delayed, we may have to raise additional capital or reduce or cease our operations. |

Our ability to continue our operations requires that we raise additional capital and our operations could be curtailed if we are unable to obtain the additional funding as or when needed.

The continued growth of our business, including the development and commercialization of our proposed products, will significantly increase our expenses going forward, regardless of our revenues. As a result, we will likely be required to seek substantial additional funds to continue and fully commercialize our business. Our future capital requirements will depend on many factors, including:

| ● | the cost of developing our proposed products; |

| ● | the costs associated with commercializing our proposed products; |

2

| ● | any change in our development priorities; |

| ● | the revenue generated by sales of our proposed products, if commercialization is reached; |

| ● | the costs associated with expanding our sales and marketing infrastructure for commercialization of our proposed products, if commercialization is reached; |

| ● | any change in our plans regarding the manner in which we choose to commercialize any product in the United States or internationally; |

| ● | the cost of ongoing compliance with regulatory requirements, if any; |

| ● | the costs to develop additional intellectual property; |

| ● | anticipated or unanticipated capital expenditures; and |

| ● | unanticipated general and administrative expenses. |

We may not be able to raise additional capital on terms acceptable to us, or at all. Any failure to raise additional capital could compromise our ability to execute on our business plan, and we may be forced to liquidate our assets. In such a scenario, the values we receive for our assets in liquidation or dissolution could be significantly lower than the values reflected in our financial statements.

If we issue equity or debt securities to raise additional funds, our existing stockholders may experience dilution, and the new equity or debt securities may have rights, preferences and privileges senior to those of our existing stockholders. In addition, if we raise additional funds through collaborations, licensing, joint ventures, strategic alliances, partnership arrangements or other similar arrangements, it may be necessary to relinquish valuable rights to our potential future products or proprietary technologies, or grant licenses on terms that are not favorable to us.

We may never complete the development of the any of our proposed products into marketable products.

We do not know when or whether we will successfully complete the development and commercialization of the “Aeris-Shield,” our planned biological treatment kit to address a key cause of asthma, or any other proposed or contemplated product, for any of our target markets. We continue to seek to improve our technologies before we are able to produce a commercially viable product. Failure to improve on any of our technologies could delay or prevent their successful development for any of our target markets.

Developing any technology into a marketable product is a risky, time consuming and expensive process. You should anticipate that we will encounter setbacks, discrepancies requiring time consuming and costly redesigns and changes and that there is the possibility of outright failure.

We may not meet our product development and commercialization milestones.

We have established milestones, based upon our expectations regarding our technologies at that time, which we use to assess our progress toward developing our products. These milestones relate to technology and design improvements as well as to dates for achieving development goals. If our products exhibit technical defects or are unable to meet cost or performance goals, our commercialization schedule could be delayed and potential purchasers of our initial commercial products may decline to purchase such products or may opt to pursue alternative products.

Generally, we have made technological advances meeting our milestone schedules. We can give no assurance that our commercialization schedule will continue to be met as we further develop the Aeris-Shield or any of our other proposed products.

3

Customers will be unlikely to buy any of our proposed products unless we can demonstrate that they can be produced for sale to consumers at attractive prices.

To date, we have focused primarily on research and development of the first generation version of the Aeris-Shield. Consequently, we have no experience in manufacturing these products on a commercial basis. We may manufacture our products through third-party manufacturers. We can offer no assurance that either we or our manufacturing partners will develop efficient, automated, low-cost manufacturing capabilities and processes to meet the quality, price, engineering, design and production standards or production volumes required to successfully mass market our products. Even if we or our manufacturing partners are successful in developing such manufacturing capability and processes, we do not know whether we or they will be timely in meeting our product commercialization schedule or the production and delivery requirements of potential customers. A failure to develop such manufacturing processes and capabilities could have a material adverse effect on our business and financial results.

The proposed price of our products is expected to be in part dependent on material and other manufacturing costs. We are unable to offer any assurance that either we or a manufacturing partner will be able to reduce costs to a level which will allow production of a competitive product or that any product produced using lower cost materials and manufacturing processes will not suffer from a reduction in performance, reliability and longevity. Furthermore, although we have estimated a pricing structure for our initial product, we can give no assurance that these estimates will be correct in light of any manufacturing process we adopt or distribution channels we use.

Our proposed products may not be accepted in the market.

We cannot be certain that our proposed initial product or any other products we may develop or market will achieve or maintain market acceptance. Market acceptance of our products depends on many factors, including our ability to convince key opinion leaders to provide recommendations regarding our products, convince distributors and customers that our product’s technology is an attractive alternative to alternatives, demonstrate that our products are reliable and supported by us in the field, supply and service sufficient quantities of products directly or through marketing alliances, and price products competitively in light of the current macroeconomic environment, which are becoming increasingly price sensitive.

We are subject to environmental laws and regulations and the risk of environmental liabilities, violations and litigation.

We are subject to numerous U.S. federal, state, local and non-U.S. environmental, health and safety laws and regulations concerning, among other things, the health and safety of our employees, the generation, storage, use and transportation of hazardous materials, emissions or discharges of substances into the environment, and investigation and remediation of hazardous substances or materials at various sites. Our operations involve the use of substances regulated under such laws and regulations, primarily those used in manufacturing processes. If we violate these environmental laws and regulations, we could be fined, criminally charged or otherwise sanctioned by regulators.

In addition, certain environmental laws assess liability on current or previous owners or operators of real property for the costs of investigation, removal or remediation of hazardous substances or materials at their properties or at properties which they have disposed of hazardous substances. Liability for investigative, removal and remedial costs under certain U.S. federal and state laws are retroactive, strict and joint and several. In addition to cleanup actions brought by governmental authorities, private parties could bring personal injury or other claims due to the presence of, or exposure to, hazardous substances. The ultimate cost of site cleanup and timing of future cash outflows is difficult to predict, given the uncertainties regarding the extent of the required cleanup, the interpretation of applicable laws and regulations, and alternative cleanup methods.

We may in the future be subject to additional environmental claims for personal injury or cleanup based on our past, present or future business activities (including the past activities of companies we may acquire). The costs of complying with current or future environmental protection and health and safety laws and regulations, or liabilities arising from past or future releases of, or exposures to, hazardous substances, may exceed our estimates, or have a material adverse effect on the financial condition of our business and our business operations.

4

Quality problems with, and product liability claims in connection with our proposed products could lead to recalls or safety alerts, harm to our reputation, or adverse verdicts or costly settlements, and could have a material adverse effect on our financial condition and business operations.

Quality is extremely important to us due to the serious and costly consequences of product failure and our business exposes us to potential product liability risks. Failures, defects, flaws, off-label use, or inadequate disclosure of product-related risks or product-related information with respect to our proposed products, could result in an unsafe condition or injury to, or death of, a patient or other user of our products. These problems could lead to the recall of, or issuance of a safety alert relating to, our proposed products, and could result in unfavorable judicial decisions or settlements arising out of product liability claims and lawsuits, including class actions, which could negatively affect our financial condition and business operations. In particular, a material adverse event involving one of our products could result in reduced market acceptance and demand for all products offered under our brand, and could harm our reputation and ability to market products in the future.

High quality products are critical to the success of our business. If we fail to meet the high standards we set for ourselves and which our customers expect, and our products are the subject of recalls, safety alerts, or other material adverse events, our reputation could be damaged, we could lose customers, and our revenue and results of operations could decline. In certain situations, we may undertake a voluntary recall of products or temporarily shut down product production lines if we determine, based on performance relative to our own internal safety and quality monitoring and testing data, that we have or may be in danger of failing to meet the high quality standards we have set for ourselves and which our customers expect. Such recalls or cessation of services or product manufacturing may also negatively impact our business.

Any product liability claim brought against us, with or without merit, could be costly to defend and resolve. Any of the foregoing problems, including product liability claims or product recalls in the future, regardless of their ultimate outcome, could harm our reputation and have a material adverse effect on our financial condition and business operations.

We are substantially dependent on patent and other proprietary rights and failing to protect such rights or to be successful in litigation related to our rights or the rights of others may result in our payment of significant monetary damages and/or royalty payments, negatively impact our ability to sell current or future proposed products, or prohibit us from enforcing our patent and other proprietary rights against others.

We are and will continue to be materially dependent on intellectual property protections, such as patents, trade secrets, trademarks, and/or non-disclosure and non-competition agreements, which are expected to enable us to maintain our proprietary competitiveness. Patent litigation against us can result in significant damage awards and injunctions that could prevent our manufacture and sale of affected proposed products or require us to pay significant royalties in order to continue to manufacture or sell affected proposed products. At any given time, we could potentially be involved as a plaintiff and/or as a defendant in a number of patent infringement and/or other contractual or intellectual property related actions, the outcomes of which may not be known for prolonged periods of time. While it is not possible to predict the outcome of such litigation, we acknowledge the possibility that any such litigation could result in our payment of significant monetary damages and/or royalty payments, negatively impact our ability to sell current or future proposed products, or prohibit us from enforcing our patent and proprietary rights against others, which would have a material adverse effect on the financial condition of our business and on our business operations.

In addition, the laws of certain countries in which we market, or intend to market, some or all of our proposed products do not protect our intellectual property rights to the same extent as the laws of the U.S., which could make it easier for competitors to capture market position in such countries by utilizing technologies and other intellectual property that are similar to those developed or licensed by us. Competitors may also harm our sales by designing products or offering services that mirror the capabilities of our proposed products, or the technology contained therein, without infringing our intellectual property rights. If we are unable to protect our intellectual property in these countries, it could have a material adverse effect on our financial condition and business operations.

5

The ability to commercialize and offer our proposed products, and the continuing development of proposed products, depends upon us maintaining strong relationships with our network of collaborators.

If we fail to maintain our working relationships with key professions and organizations, we may have more limited access to developing technology and research. The research, development, marketing, and sales of our proposed products is expected to be dependent upon our maintaining working relationships with such professionals, and the use of our proposed products is expected to often require the participation of these key collaborators. If we are unable to maintain our relationships with these professionals, our proposed products may not be utilized correctly or to their full potential, and our ability to develop, manufacture, and market future proposed products may be significantly stunted.

Laws and regulations governing the export of our proposed products could adversely impact our business.

The U.S. Department of the Treasury’s Office of Foreign Assets Control and the Bureau of Industry and Security at the U.S. Department of Commerce administer certain laws and regulations that restrict U.S. persons and, in some instances, non-U.S. persons, in conducting activities, transacting business with or making investments in certain countries, governments, entities and individuals subject to U.S. economic sanctions. Due to our planned international operations, we expect to be subject to such laws and regulations, which are complex, could restrict our business dealings with certain countries and individuals, and are constantly changing. Further restrictions may be enacted, amended, enforced or interpreted in a manner that adversely impacts our financial condition and business operations.

We operate in a competitive industry and we may be unable to compete effectively.

We expect to compete domestically and internationally in the biomedical and asthma markets. These markets are characterized by fragmentation among treatment approaches such as physical barriers, chemical applications, steam cleaning and vacuuming to control dust mite populations and rapid change resulting from technological advances and scientific discoveries. In the product lines and offered services in which we expect to compete, we face a mixture of competitors ranging from large manufacturers with multiple business lines to small manufacturers that offer a limited selection of niche products. Development by other companies of new or improved products, processes, technologies, or the introduction of reprocessed products or generic versions when our proprietary proposed products lose their patent protection may make our proposed products or proposed products less competitive. In addition, we expect to face competition from providers of alternative medical therapies such as pharmaceutical companies. Competitive factors include product reliability, product performance, product technology, product quality, breadth of product lines, product services, customer support, price, and reimbursement approval from health care insurance providers.

We also face competition for marketing, distribution, and collaborative development agreements, for establishing relationships with health care professionals, medical associations, and academic and research institutions, and for licenses to intellectual property. In addition, academic institutions, governmental agencies and other public and private research organizations also may conduct research, seek patient protection and establish collaborative arrangements for discovery, research, and marketing of products similar to ours. These companies, professionals, and institutions compete with us in recruiting and retaining qualified scientific and management personnel, as well as in acquiring necessary product technologies.

We could be negatively impacted if we are unable to capitalize on research and development spending.

We have and intend to continue to spend a significant amount of time and resources on research and development projects in order to develop and validate new and innovative products. We believe these projects will result in the commercialization of new products and will create additional future sales. However, factors including regulatory delays, safety concerns or patent disputes could delay the introduction or marketing of new products. We may experience an unfavorable impact on our financial condition and business operations if we are unable to capitalize on those efforts by attaining the proper approval or to successfully market new products.

We may be unable to attract and retain key employees.

Our executive, technical, scientific and other key personnel play an integral role in the development, commercialization and selling of our proposed products. If we are unable to recruit, hire, develop and retain a talented, competitive work force, we may not be able to meet our strategic business objectives.

6

Risks Related to the Investment in our Securities

The Offering price has been arbitrarily set by the Company.

We have set the offering price of the Shares at $1.00 per Share. Valuations for companies such as Aeris are purely speculative. The company’s valuation has not been validated by any independent third party and may fall precipitously. It is a question of whether you, the investor, are willing to pay this price for a percentage ownership of a start-up company. You should not invest if you disagree with this valuation.

There is no minimum Offering amount required as a condition to a first closing and using the funds raised in this Offering.

Because this is a “best efforts” offering with no Offering minimum, we will have access to any funds tendered. This means that any investment made could be the only investment in this Offering, leaving the Company without adequate capital to pursue its business plan or even to cover the expenses of this Offering.

There is no current market for our common stock.

There is no formal marketplace for the resale of our securities. Shares of our common stock may eventually be traded to the extent any demand and/or trading platform(s) exists. However, there is no guarantee there will be demand for the Shares, or a trading platform that allows you to sell them. Investors should assume that they may not be able to liquidate their investment or pledge their shares as collateral for some time.

Concentration of ownership of our common stock among our existing executive officers, directors and principal stockholders may prevent new investors from influencing significant corporate decisions.

Our executive officers, directors, significant employees and their affiliates, in the aggregate, beneficially own approximately 96% of our outstanding common stock as of April 25, 2022. As a result, these persons, acting together, would be able to significantly influence all matters requiring stockholder approval, including the election and removal of directors, any merger, consolidation, sale of all or substantially all of our assets, or other significant corporate transactions.

Some of these persons or entities may have interests different than yours. For example, they may be more interested in selling our company to an acquirer than other investors, or they may want us to pursue strategies that deviate from the interests of other stockholders.

We intend to issue more shares to raise capital, which will result in substantial dilution.

Our certificate of incorporation authorizes the issuance of a maximum of 50,000,000 shares of common stock. Any additional financings effected by us may result in the issuance of additional securities without stockholder approval and the substantial dilution in the percentage of common stock held by our then existing stockholders. Moreover, the securities issued in any such transaction may be valued on an arbitrary or non-arm’s-length basis by our management, resulting in an additional reduction in the percentage of common stock held by our current stockholders on an as converted, fully-diluted basis. Our board of directors has the power to issue any or all of such authorized but unissued shares without stockholder approval. To the extent that additional shares of common stock or other securities convertible into or exchangeable for common stock are issued in connection with a financing, dilution to the interests of our stockholders will occur and the rights of the holder of common stock might be materially and adversely affected.

7

As of the date of this Offering Statement, an aggregate of 16,080,500 shares of common stock are issued and outstanding.

If you purchase Shares in this offering, your ownership interest in our Common Stock will be diluted immediately, to the extent of the difference between the offering price for each Share in this Offering and the net tangible book value per share of our common stock after this offering.

Our net tangible book value as of October 31, 2021 was $(71,306), or $(0.0046) per share, based on 15,670,500 shares of common stock outstanding. Net tangible book value per share equals the amount of our total tangible assets less total liabilities, divided by the total number of shares of common stock outstanding, all as of the date specified.

If the Maximum Offering Amount, at an offering price of $1.00 per Share, is sold in this offering, after deducting approximately $1,670,600 at most in offering expenses payable by us, our pro forma as adjusted net tangible book value at October 31, 2021 would be approximately $13,224,852, or $0.4312 per share. This amount represents an immediate increase in pro forma net tangible book value of $0.4358 per share to our existing shareholders as of the date of this Offering Circular, and an immediate dilution in pro forma net tangible book value of approximately $0.5688 per share to new investors purchasing Shares.

The following table illustrates the approximate per share dilution to new investors discussed above, assuming the sale of, respectively, 100%, 50% and 25% of the Shares offered for sale in this Offering (after deducting our estimated offering expenses in various scenarios):

| Funding Level | $ | 15,000,000 | $ | 7,500,000 | $ | 3,750,000 | ||||||

| Net proceeds (after deducting the estimated offering expenses) | 13,329,400 | 6,202,820 | 2,937,950 | |||||||||

| Offering price per Share | 1.00 | 1.00 | 1.00 | |||||||||

| Net tangible book value per share before the Offering | (0.0044 | ) | (0.0044 | ) | (0.0044 | ) | ||||||

| Increase per share attributable to investment in this Offering | 0.4302 | 0.2653 | 0.1516 | |||||||||

| Pro forma net tangible book value per share after the Offering | 0.4258 | 0.2609 | 0.1472 | |||||||||

| Dilution to investors after the Offering | 0.5742 | 0.7391 | 0.8528 |

The following tables set forth, assuming the sale of, respectively, 100%, 50% and 25% of the Shares offered for sale in this Offering, the total number of shares previously sold to existing shareholders during the twelve months prior to the date of this Circular, including shares issued for services, the total consideration paid for the foregoing (based on cash actually received and the value of shares issued for services), and the respective percentages applicable to such purchased shares and consideration paid based on an average price of $0.0001 per share paid by our existing shareholders or as the value of shares issued for services, and $1.00 per Share paid by investors in this offering.

| Shares Purchased | Total Consideration | |||||||||||||||

| Number | Percentage | Amount | Percentage | |||||||||||||

| Assuming 100% of Shares Sold: | ||||||||||||||||

| Existing Shareholders | 16.080,500 | 51.74 | % | $ | 1,608 | 0.01 | % | |||||||||

| New Investors | 15,000,000 | 48.26 | % | $ | 15,000,000 | 99.99 | % | |||||||||

| Total | 31,080,500 | 100.00 | % | $ | 15,001,608 | 100.00 | % | |||||||||

| Shares Purchased | Total Consideration | |||||||||||||||

| Number | Percentage | Amount | Percentage | |||||||||||||

| Assuming 50% of Shares Sold: | ||||||||||||||||

| Existing Shareholders | 16,080,500 | 68.19 | % | $ | 1,608 | 0.02 | % | |||||||||

| New Investors | 7,500,000 | 31.81 | % | $ | 7,500,000 | 99.98 | % | |||||||||

| Total | 23,580,500 | 100.00 | % | $ | 7,501,608 | 100.00 | % | |||||||||

| Shares Purchased | Total Consideration | |||||||||||||||

| Number | Percentage | Amount | Percentage | |||||||||||||

| Assuming 25% of Shares Sold: | ||||||||||||||||

| Existing Shareholders | 16,080,500 | 81.09 | % | $ | 1,608 | 0.04 | % | |||||||||

| New Investors | 3,750,000 | 18.91 | % | $ | 3,750,000 | 99.96 | % | |||||||||

| Total | 19,830,500 | 100.00 | % | $ | 3,751,608 | 100.00 | % | |||||||||

8

Another important way of looking at dilution is the dilution that happens due to future actions by the Company. The investor’s stake in a company could be diluted due to the Company issuing additional shares. In other words, when the Company issues more shares, the percentage of the company that you own will go down, even though the value of the Company may go up. You will own a smaller piece of a larger company. This increase in number of shares outstanding could result from a stock offering (such as an initial public offering, another crowdfunding round, a venture capital round, angel investment), employees exercising stock options, or by conversion of certain instruments (e.g. convertible bonds, preferred shares or warrants) into stock.

If the Company decides to issue more shares, an investor could experience value dilution, with each share being worth less than before, and control dilution, with the total percentage an investor owns being less than before. There may also be earnings dilution, with a reduction in the amount earned per share (though this typically occurs only if the company offers dividends, and most early stage companies are unlikely to offer dividends, preferring to invest any earnings into the company). The tables above do not include 505,500 shares of our common stock issuable to an existing stockholder upon the sale by us of a minimum of $3,000,000 in this offering, and an additional 674,000 shares of our common stock issuable to such stockholder upon a going-public transaction of Aeris.

Dilution might also happen upon conversion of convertible notes into shares. Typically, the terms of convertible notes issued by early-stage companies provide that in the event of another round of financing, the holders of the convertible notes get to convert their notes into equity at a “discount” to the price paid by the new investors, i.e., they get more shares than the new investors would for the same price. Additionally, convertible notes may have a “price cap” on the conversion price, which effectively acts as a share price ceiling. Either way, the holders of the convertible notes get more shares for their money than new investors. In the event that the financing is a “down round” the holders of the convertible notes will dilute existing equity holders, and even more than the new investors do, because they get more shares for their money. Investors should pay careful attention to number of convertible notes that the Company has issued (and may issue in the future), and the terms of those notes. The tables above do not include or take into account the issuance of shares of our common stock that may be issued upon the conversion of outstanding convertible promissory notes.

If you are making an investment expecting to own a certain percentage of the Company or expecting each share to hold a certain amount of value, it’s important to realize how the value of those shares can decrease by actions taken by the Company. Dilution can make drastic changes to the value of each share, ownership percentage, voting control, and earnings per share.

9

The Company is offering a maximum of 15,000,000 Shares on a “best efforts” basis. There is no minimum offering amount in this Offering.

The cash price is $1.00 per Share. We will not issue fractional Shares.

The Company intends to market the Shares in this Offering both through online and offline means. Online marketing may take the form of contacting potential investors through electronic media and posting our offering circular materials on an online investment platform.

The Offering will terminate at the earliest of: (1) the date at which the Maximum Amount has been sold, (2) the date which is one year from this Offering being qualified by the Commission, and (3) the date at which the Offering is earlier terminated by the Company in its sole discretion. Funds will be deposited into a segregated account maintained at Dalmore, which will act as a funds collection agent for the offering. Dalmore is an online platform administering this Offering for the benefit of the Company. The Company will pay Dalmore the fees described below for hosting the Offering materials and be responsible for other expenses due to Dalmore, such as monthly subscription, transaction fees and tranche releases. A copy of the service agreement between the Company and Dalmore is filed herein as Exhibit 6.2.

The Company may undertake one or more closings on an ongoing basis. After each closing, funds tendered by investors will be available to the Company when and if the Company decides to accept the investors’ subscription for the Shares. After the initial closing of this Offering, the Company expects to hold closings on at least a monthly basis.

The proceeds of this Offering will not be placed into an escrow account. As there is no minimum offering, upon the approval of any subscription to this Offering Circular, the Company shall immediately deposit the proceeds into the bank account of the Company and may dispose of the proceeds in accordance with the Use of Proceeds on Page 13.

The Company is offering its securities in all states.

The Company has engaged Dalmore Group, LLC (“Dalmore”), a New York limited liability company and broker-dealer registered with the SEC and a member of FINRA, to act as the broker-dealer of record in connection with this offering, but not for underwriting or placement agent services. Dalmore will:

| ● | Review investor information, including KYC (“Know Your Customer”) data, AML (“Anti Money Laundering”) and other compliance background checks, and provide a recommendation to the company whether or not to accept investor as a customer. |

| ● | Review each investor’s subscription agreement to confirm such investor’s participation in the offering, and provide a determination to the Company whether or not to accept the use of the subscription agreement for the investor’s participation. |

| ● | Contact and/or notify the Company, if needed, to gather additional information or clarification on an investor. |

| ● | Not provide any investment advice nor any investment recommendations to any investor. |

| ● | Keep investor details and data confidential and not disclose to any third-party except as required by regulators or pursuant to the terms of the agreement (e.g. as needed for AML and background checks). |

| ● | Coordinate with third party providers to ensure adequate review and compliance. |

As compensation for the services listed above, the Company has agreed to pay Dalmore $5,000 as a one-time set up fee, plus a commission equal to 1% of the amount raised in the offering to support the offering. In addition, the Company has agreed to engage Dalmore as a consultant to provide ongoing general consulting services relating to the Offering, such as coordination with third party vendors and general guidance with respect to the Offering. The Company will pay a one-time consulting fee of $20,000, which will be due and payable within 30 days after FINRA issues a no-objection letter and the Company receives the SEC Qualification. Assuming that the Maximum Offering Amount is sold, the Company estimates that the total fees the Company will pay to Dalmore will be approximately $175,000.

10

TAX CONSEQUENCES FOR RECIPIENT (INCLUDING FEDERAL, STATE, LOCAL AND FOREIGN INCOME TAX CONSEQUENCES) WITH RESPECT TO THE INVESTMENT BENEFIT PACKAGES ARE THE SOLE RESPONSIBILITY OF THE INVESTOR. INVESTORS MUST CONSULT WITH THEIR OWN PERSONAL ACCOUNTANT(S) AND/OR TAX ADVISOR(S) REGARDING THESE MATTERS.

The Online Platform

The Company has engaged Dalmore to host and administer the Offering of the Shares on its online platform. Dalmore will act as a funds collection agent for the Offering. Dalmore will not directly solicit or communicate with investors with respect to offerings posted on its site, although it does advertise the existence of its platform, which may include identifying issuers listed on the platform. Our offering circular will be furnished to prospective investors in this offering via download 24 hours a day, 7 days a week on a designated website.

Process of Subscribing

You will be required to complete a subscription agreement in order to invest. The subscription agreement includes a representation by the investor to the effect that, if you are not an “accredited investor” as defined under securities law, you are investing an amount that does not exceed the greater of 10% of your annual income or 10% of your net worth (excluding your principal residence).

If you decide to subscribe for the Shares in this Offering, you should complete the following steps:

| 1. | Go to a designated website, and click on the “Offering Circular” button; |

| 2. | After reviewing the Offering Circular, click on the “Invest Now” button; |

| 3. | Complete the online investment form; |

| 4. | Electronically receive, review, execute and deliver to us a subscription agreement. |

| 5. | Deliver funds directly by check, wire, credit card, debit card, or electronic funds transfer via ACH to the specified account; and |

| 6. | Once funds or documentation are received an automated AML check will be performed to verify the identity and status of the investor. |

Any potential investor will have ample time to review the subscription agreement, along with their counsel, prior to making any final investment decision. Dalmore will review all subscription agreements completed by the investor. After Dalmore has completed its review of a subscription agreement for an investment in the Company, the funds may be released from the designated account, provided that the Company has accepted the investment.

If the subscription agreement is not complete or there is other missing or incomplete information, the funds will not be released until the investor provides all required information. Dalmore will generally review all subscription agreements on the same day, but not later than the day after the submission of the subscription agreement.

All funds tendered (by check, wire, credit card, debit card, or electronic funds transfer via ACH to the specified account) by investors will be deposited into a segregated account at Dalmore for the benefit of the Company. The Company has engaged Dalmore to act as a funds collection agent for receipt of funds from investors for this Offering. There is no minimum to disburse funds from the segregated account at Dalmore and the Company will maintain a discretionary schedule for release into its operating accounts. All funds received by wire transfer will be made available immediately while funds transferred by ACH will be restricted for a minimum of three days to clear the banking system prior to deposit into the designated account.

The Company maintains the right to accept or reject subscriptions in whole or in part, for any reason or for no reason, including, but not limited to, in the event that an investor fails to provide all necessary information, even after further requests from the Company, in the event an investor fails to provide requested follow up information to complete background checks or fails background checks, and in the event the Company receives oversubscriptions in excess of the maximum offering amount.

11

In the interest of allowing interested investors as much time as possible to complete the paperwork associated with a subscription, the Company has not set a maximum period of time to decide whether to accept or reject a subscription. If a subscription is rejected, funds will not be accepted by wire transfer or ACH, and payments made by debit card, credit card or check will be returned to subscribers within 30 days of such rejection without deduction or interest. Upon acceptance of a subscription, the Company will send a confirmation of such acceptance to the subscriber.

Dalmore has not investigated the desirability or advisability of investment in the shares nor approved, endorsed or passed upon the merits of purchasing the Shares. Dalmore is not participating as an underwriter and under no circumstance will it solicit any investment in the company, recommend the Company’s securities or provide investment advice to any prospective investor, or make any securities recommendations to investors. Dalmore is not distributing any offering circulars or making any oral representations concerning this offering circular or this offering. Based upon Dalmore’s anticipated limited role in this offering, it has not and will not conduct extensive due diligence of this offering and no investor should rely on the involvement of Dalmore in this offering as any basis for a belief that it has done extensive due diligence. Dalmore does not expressly or impliedly affirm the completeness or accuracy of the offering statement and/or offering circular presented to investors by the Company. All inquiries regarding this offering should be made directly to the Company.

Transfer Agent

We have engaged DealMaker Transfer Agent LLC, a registered transfer agent with the SEC, who will serve as transfer agent to maintain shareholder information on a book-entry basis; there are no set up costs for this service, fees for this service will be limited to secondary market activity, which cannot be quantified at this time.

Upon confirmation that an investor’s funds have cleared, the Company will instruct the Transfer Agent to issue shares to the investor. The Transfer Agent will notify an investor when shares are ready to be issued and the Transfer Agent has set up an account for the investor.

12

The following discussion addresses the use of proceeds from this offering. We currently estimate that, at a per Share price of $1.00, the net proceeds from the sale of the 15,000,000 Shares will be $13,329,400 after deducting the estimated offering expenses of approximately $1,670,600.

We intend to use the net proceeds from this offering for working capital and general corporate purposes. Additional specific uses include:

| 25% | 50% | 75% | 100% | |||||||||||||

| Gross Proceeds | $ | 3,750,000 | $ | 7,500,000 | $ | 11,250,000 | $ | 15,000.000 | ||||||||

| Dalmore (1) | 67,500 | 105,000 | 142,500 | 180,000 | ||||||||||||

| Estimated offering expenses (2) | 744,550 | 1,192,108 | 1,341,390 | 1,490,600 | ||||||||||||

| Estimated net proceeds | $ | 2,937,950 | $ | 6,202,892 | $ | 9,766,110 | $ | 13,329,400 | ||||||||

| Specific use: | ||||||||||||||||

| License Fees to Evolution Limited | $ | 0 | $ | 600,000 | $ | 600,000 | $ | 2,000,000 | ||||||||

| Sales, Marketing and Business Development | 567,818 | 1,151,867 | 1,784,927 | 1,784,927 | ||||||||||||

| IP (Patents) and Legal Services | 179,882 | 366,933 | 402,531 | 402,531 | ||||||||||||

| Research and Development, Product Development | 1,564,894 | 2,114,911 | 3,958,361 | 3,958,361 | ||||||||||||

| Administrative Costs | 518,067 | 940,140 | 2,102,243 | 2,102,243 | ||||||||||||

| Accrued Salary Payments | 54,000 | 118,000 | 182,000 | 246,000 | ||||||||||||

| Working Capital | 53,289 | 911,041 | 736,048 | 2,835,338 |

| (1) | Dalmore Group expenses total an estimated $30,000 up front including FINRA fees plus 1% of Gross Proceeds. |

| (2) | Excluding fees and expenses to Dalmore. |

As of the date of this offering circular, we cannot specify with certainty all of the particular uses of the proceeds from this offering. Pending the use of the net proceeds from this offering as described above, we intend to invest the net proceeds in investment-grade, interest-bearing instruments.

Except with respect to the payment of accrued salaries to our executives as set forth above, no proceeds will be used to compensate, make loans, or otherwise make payments to officers or directors of the issuer or any of its subsidiaries.

The use of the proceeds represents management’s estimates based upon current business and economic conditions. We reserve the right to use of the net proceeds we receive in the offering in any manner we consider to be appropriate. Although we do not contemplate changes in the proposed use of proceeds, to the extent we find that adjustment is required for other uses by reason of existing business conditions, the use of proceeds may be adjusted.

13

Overview

Aeris Biotechnologies is a US-based company developing a novel “green” approach to the control of a key cause of and trigger for asthma, based on the acquisition of multiple awarded patents and an established technology platform.

Asthma is a major health problem with significant unmet need:

| ● | 339 million people worldwide are estimated to suffer from asthma. |

| ● | Approximately 17% are “difficult-to-treat” and require frequent hospitalization. |

| ● | More than 400,000 people every year die as a result of asthma, with a potentially life-threatening asthma attack occurring in the USA every two seconds. |

| ● | Asthma costs, even in 2002, exceeded $85 billion in the US and EU alone, with comparable costs in China; since 2002, asthma rates in the US have increased by 14%. |

| ● | An allergic response to house dust mite allergens is a primary cause and trigger of asthma. |

| ● | Existing control methods are of severely limited efficacy and may involve toxic chemicals. |

| ● | House dust mite control is a fragmented but multibillion dollar global market. |

| ● | An effective control could drive a major reduction in healthcare costs. |

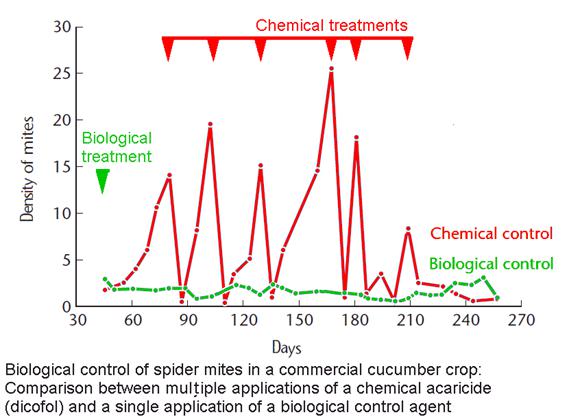

The Aeris approach is based on biological control, building on proven efficacy in agricultural applications, and moving this into high-value biomedical markets.

The first Aeris product line is expected to be a biological control system for house dust mites:

| ● | Our approach is expected to reduce allergen load at the source to limit asthma events. |

| ● | Effective biological control systems amplify at the expense of their target and can treat large areas, including those that are difficult to access, from limited initial applications. |

| ● | The product is expected to be positioned as a biopesticide for domestic use, not as a therapeutic, bypassing the need for expensive and time-consuming clinical trials. |

| ● | Aeris anticipates a favorable commercial and regulatory environment, based on the “green” nature of biological control, with the potential for organic certification. |

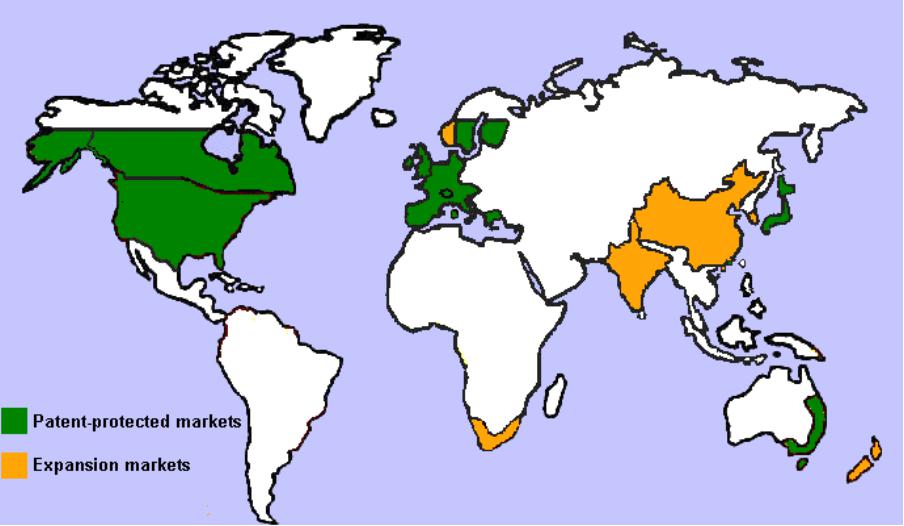

| ● | The projected market for domestic sales alone for the product exceeds $2 billion annually just in markets where we currently hold awarded patents. Additional markets would add to this. |

| ● | Hospitality, travel, and commercial markets could further increase potential sales. |

| ● | Additional health-related products are anticipated based on the core platform technology. |

We have access to a unique skillset to progress the development of such technologies:

| ● | Work to date has already identified potential control agents for the house dust mite product. |

| ● | Patents covering the broad use of house dust mite control technology has been granted by the US, UK, European, Swiss, Hong Kong, Japanese and Australian patent offices, providing protection of this uniquely capable technology in major markets worldwide. |

Aeris is intending to deliver a commercially viable first product in 2025, subject to the availability of funds.

14

History

We were initially organized on July 28, 2021 as a Delaware corporation. Our principal executive office is located at 8105 Rasor Boulevard, Suite 129, Plano, TX 75024, and our telephone number is 1-214-436-2986. Our website address is www.aerisbiotech.com. The information on our website is not part of this circular.

The Problem

Asthma is a chronic and increasing problem. It is estimated that 339 million people worldwide suffer from asthma. Of those, approximately one-sixth will have asthma classed as “difficult to treat”, requiring frequent hospitalization. The number of people with asthma is growing at an average of 2.8% per annum. The U.S. Centers for Disease Control reported over 1.6 million visits annually to emergency departments from 2016 to 2018, with asthma as the primary diagnosis. The World Health Organization notes that more than 400,000 people every year will die worldwide as a result of asthma.

The house dust mite is recognized as a key source of the major allergens responsible for both sensitization (developing asthma) and for triggering asthma attacks. Between 50% and 80% of asthmatics who react to airborne material are sensitive to dust mite allergens.

We believe that current house dust mite controls simply do not work. A 2008 Cochrane systematic review of 56 trials concluded that “Chemical and physical methods aimed at reducing exposure to house dust mite allergens cannot be recommended”.

Aeris believes that there is an alternative. Biological control has been extensively proven in agricultural use, where it is the fastest growing approach, as it is both highly specific and environmentally friendly. There are also examples in other industries, including food service and the oil & gas sector. Despite this, it has not yet been commercially developed in high value biomedical applications.

The Aeris Answer

Any pest has its own diseases. These are highly specific and, if used properly, can be an effective approach to controlling their target. For targets from drug-resistant bacteria to crop destroying insects, biological control is seeing increasing use worldwide.

Biological control using natural agents that can replicate as they are needed, amplifying locally from low initial doses, has unique strengths. These include:

| ● | It is well proven in agricultural applications, including uses for crop mites; |

| ● | Low initial dosing amplifies at the expense of its target; |

| ● | Naturally spreads to (even difficult to access) areas around the initial application site; |

| ● | Can exert long lasting control; |

| ● | The control agent has the ability to adapt (or evolve) to counter any development of resistance; |

| ● | Highly specific for target, reducing risks of unwanted effects, with lower toxicity and environmental impact, making this an environmentally friendly approach; |

| ● | Once the target is cleared, the control agent also reduces, but re-application is easy should the target return; |

| ● | There is a favorable regulatory environment, with the US Environmental Protection Agency stating that “Since biopesticides tend to pose fewer risks than conventional pesticides, EPA generally requires much less data to register a biopesticide than to register a conventional pesticide;” |

| ● | This is a “green” approach with potential for organic certification, which we believe will aid uptake. |

Aeris has a unique skillset in the area of developing such approaches.

15

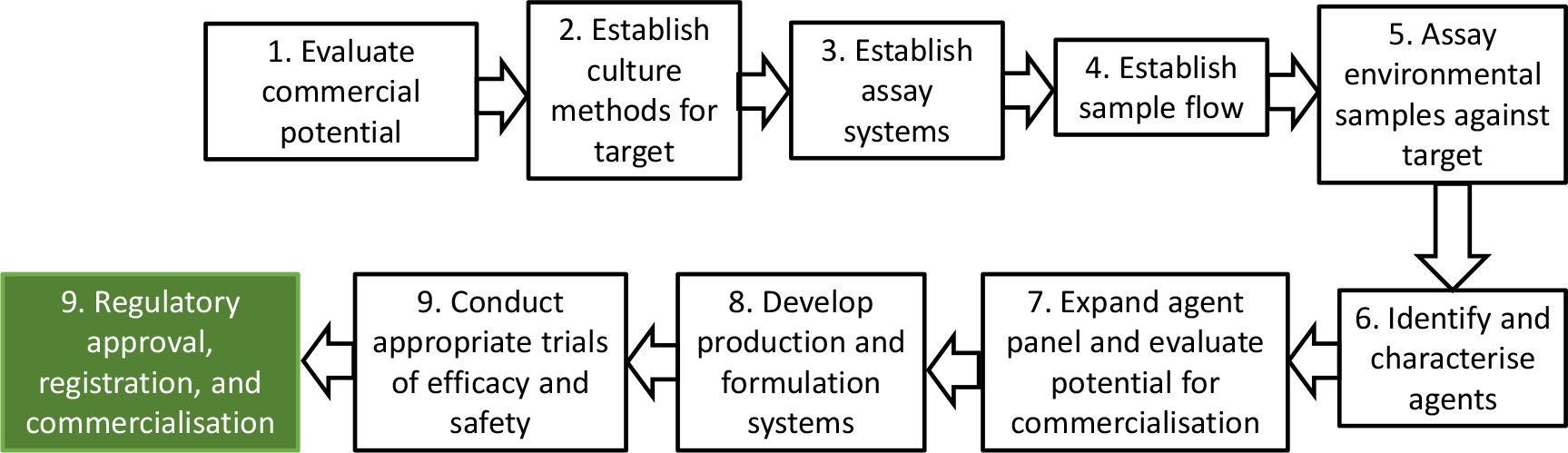

Progression to Market

We currently expect to enter into collaborations or joint ventures with third parties as a go-to market strategy. Examples of potential partners include biopesticide manufacturers, consumer health companies, particularly those that also have divisions dedicated to cleaning products, or companies with an interest in our technological approach. Individual partners with local expertise may be sought for specific markets.

Sales for the domestic sector alone are projected as a maximum of over $4 billion per annum in major markets, with sales of over $2 billion in markets with awarded patent protection. Maximum sales are projected within the lifetime of existing intellectual property. The commercial sector has a potential market for the Aeris-Shield, our first planned product, of over $600 million for the hospitality industry in the U.S., Canada, UK, Western European Union, China, Australia and Japan. It is intended that other future products that the Company is proposing to develop will synergize with the house dust mite product.

Valuation of individual technology streams to be brought to joint venture negotiations reflect established industry comparators which we expect will provide a basis for negotiations. For a biological control technology in the lower value agricultural sector, where margins are lower than in the biomedical fields targeted by Aeris, these ranged from $100 million to $500 million during 2012.

Milestone payments are projected for a proposed joint venture route to market as initiating in the third year of funded operations, with payments projected as $50 million (based on a 50% share of the technology) over three years. A trade sale, if undertaken, would be expected to generate initial revenues considerably higher than this, while reducing future revenue accordingly.

Alongside this, the potential exists for direct marketing through e-commerce enabled websites in approved jurisdictions.

The Strategic Position

We were established to be a long-term technology player focused on acquiring and developing health-related products using biological control methodologies. We plan to continue using a lean-burn funding model to develop multiple products based on the applied use of biological control technologies in areas important to human health. These technologies are expected to be progressed through field trials to maximize value prior to partnering and commercial exploitation. The house dust mite development stream is the first such technology, expected to be followed by additional products, initially through low cost collaborations with expert academic and commercial partners. This low-cost route is based on the development of closely related approaches, and is intended to maximize value creation and to minimize dilution of initial investors.

Technology Development to Date

Aeris has acquired, through a worldwide, exclusive license, technology developed by Evolution Limited, based in the United Kingdom (“Evolution”). Evolution received initial seed funding in 2016 and used this to advance its technology through initial lead identification to the award of multiple patents worldwide. Future developments by the Evolution team are included in the license.

The Technology

Asthma: unmet need in a high value market

Asthma is a chronic and increasing problem. The 2018 Global Asthma Report estimated that 339 million people worldwide suffer from asthma. Of those, approximately one in six will have “difficult to treat” asthma requiring frequent hospitalization. The American Academy of Allergy, Asthma, and Immunology notes that “The number of people with asthma continues to grow. One in 12 people (about 25 million, or 8% of the US population) had asthma in 2009, compared with 1 in 14 (about 20 million, or 7%) in 2001.” Figures from the US Centers for Disease Control are even higher, and report 1.7 million visits to emergency departments with asthma as the primary diagnosis. Asthma prevalence varies, ranging from 5% (e.g., China) to 25% (e.g., Australia) worldwide. The World Health Organization notes that more than 400,000 people every year will die worldwide as a result of asthma.

16

Asthma is a multi-factorial disease that includes a genetic predisposition. While many factors can contribute to symptoms, it is commonly believed that specific allergens can trigger both sensitization and attacks. The house dust mite is recognized as the source of major allergens responsible for both for initial sensitization and the triggering of asthma attacks. The actual cause is proteins present in the feces of dust mites which stimulate a potent allergic response.

Between 50% and 80% of asthmatics who react to airborne material are sensitive to dust mite allergens.

House dust mites are small, approximately 0.3mm in length. One gram of dust can contain 500 mites, while a mattress can hold more than two million. In a carpet, there can be between 1,000 and 10,000 mites per square meter. In the three months of her life, a female house dust mite will lay 25-100 eggs. An average house dust mite will produce 20 feces each day of its life. These adhere to fibers and materials in the environment. Both mites and feces are very difficult to remove, and may generate allergenic dust when such removal is attempted.

Despite the many areas affected, two species are responsible for the vast majority of the problem. These are: Dermatophagoides pteronyssinus and Dermatophagoides farinae. Additional mites are covered by existing awarded and filed patent filings, including Euroglyphus maynei, and Blomia tropicalis, which is a potential target for warmer regions such as China and India.

As well as causing problems in those already suffering from asthma, exposure to house dust mite allergens early in life is also commonly believed to be responsible for sensitizing children. Such sensitization is strongly linked to the future development of asthma. Other conditions linked to house dust mite sensitivity include allergic rhinitis, conjunctivitis, and eczema in human health, as well as related conditions in companion animals.

Since house dust mites require a humid environment, some geographic regions are not as affected as others. However, the main areas which are affected include much of the United States and almost all of western Europe. Billions of people living in these areas are at risk.

In addition, research has shown a similar frequency of sensitization to house dust mite allergens among asthmatics even in very dry environments such as the Persian Gulf States, where even higher asthma-related death rates have been reported, apparently due to humidification and soft furnishings in the indoor environment. At base, when humans make their environment comfortable for themselves, they make it comfortable for house dust mites, extending the range of these persistent pests even to dryer areas.

Asthma costs, even in 2002, exceeded $85 billion in the US and EU alone. Since 2002, asthma rates in the US have increased by 14%. Other areas such as China, Japan, India and Australia will form important targets for the agents being developed by Aeris.

The Aeris house dust mite product has the potential to save lives and improve lives worldwide, while producing a major reduction in asthma-related healthcare costs.

House Dust Mite Control Methods

We believe that control of mites by any of the currently available methods, outlined below, is of strictly limited efficacy. Current approaches only affect areas to which the treatment is directly applied, generally allowing rapid recolonization from untreated nearby areas once the treatment has ended or the active ingredient has dispersed.

Washing or steam cleaning may remove house dust mites but has no long-term preventative effect. Vacuum cleaning is of very limited efficacy and may stir up allergenic dust, as most filters are not able to catch extremely small particles. House dust mites are sensitive to long-term reductions in humidity; however, this is difficult to achieve in domestic environments.

Barrier methods that are intended to block dust mite access to mattresses and bedding are in common use, but are also of limited value. No such barrier method can be used on carpets and other soft furnishings, which are a major source of exposure to allergens, as well as providing for transfer of house dust mites from carpets back to bedding. Despite this, barrier methods are often cited as the best available option, though best used as part of a combination of approaches.

17

Chemical approaches do exist. These include denaturing solutions intended to inactivate allergens or acaricides – a substance poisonous to mites or ticks – intended to kill the mites themselves. The latter include both organophosphates and carbamates. However, use of such chemical pesticides and the persistence of their residues in the domestic environment is problematical. One pesticide used commercially for this purpose in the United Kingdom has been noted as causing “rapid poisoning” of humans. Multiple adverse effects are listed in available toxicology data sheets, and it is noted that asthmatics are at particular risk. One major product in this market was recalled after the U.S. Environmental Protection Agency documented more than 400 cases of adverse side effects among users. Even newer pesticides such as the neonicotinoids have been associated with adverse environmental effects. Additionally, work with other mites, notably storage mites in grain, shows that resistance to chemical pesticides develops rapidly and can become total at acceptable dose levels. Thus, any increased use of chemical acaricides is likely to become compromised even if these are initially effective. Consumer resistance to the use of such pesticides is also a major factor.

We believe that many of the current methods that are in wide use, including chemicals, physical barriers, steam cleaning and vacuuming, do not actually produce reductions large enough to provide any significant clinical effect. The 2008 Cochrane review concluded that “Chemical and physical methods aimed at reducing exposure to house dust mite allergens cannot be recommended.” Despite this and their high cost, in the absence of any better alternative their use is widespread, generating a multi-billion dollar market, supported by manufacturers of the range of products in current use.

A biomedical basis for a reduction in house dust mite populations as a control for asthma is well documented in the scientific literature, although the efficacy of existing controls is controversial. Such a reduction, if it can be achieved, is regarded as beneficial both to established asthmatics and in the prevention of sensitization in children and other potential asthmatics. The latter represents an important target market.

The limitation of individual treatments to specific items or areas can also allow rapid recolonization from nearby untreated areas once treatment regimen is completed. No single current treatment can be used for all infested items, whereas a replicating biological control agent will have the potential to address a broad range of domestic habitats (including hard-to-access areas) from a limited initial application, as demonstrated by agricultural uses.

The potential markets for a novel, proven and environmentally friendly approach are correspondingly large.

Current Methods

Given the fragmentation of the market, accurate estimates of overall spending on house dust mite control measures are difficult to obtain. However, given the costs of existing commercial products it is clear that a multi-billion dollar market exists worldwide. Given the very limited efficacy of existing controls, we believe the Aeris house dust mite product will have the potential to achieve significant market penetration and expansion on the basis of validated efficacy as an acaricide, able to reduce mite numbers and thus allergen production across the domestic environment. It will also benefit from the potential for the product to exert long term control of house dust mites in all domestic locations.

A comparison of “state of the art” approaches to house dust mite control and how the Aeris house dust mite product will go beyond these is described below. Prices are derived from searches of internet-based suppliers for the cited products conducted in February 2021:

18

| Current State of Art | Typical cost | Annual cost per treatment area | Mode of action | Major limitations | Advancement of the Aeris kit beyond current State of the Art |

| Biological

acaricide (Aeris dust mite kit) |

$60-$99 | $60-$396 (whole house) |

Direct killing of mites | Still under development, proprietary technology | First use of biological control for house dust mites |

| Chemical acaricides | $15-$30 | 4x treatments per year: $60-$120 | Direct killing of mites | Limited area of action, toxicities to humans, animals, and to the environment, resistance | Biological agents are able to amplify and spread, have higher specificity and extremely limited toxicity, and can adapt to counter resistance. One Aeris treatment could be equivalent to multiple doses of a chemical acaricide |

| Barrier methods | $30-$100 | Wash frequently, change annually: $30-$100 | Blocking of access for mites and allergens | Usually only protect bedding | Able to exert durable control across multiple dust mite habitats (not just bedding) |

| Steam cleaning | $30-$200 | Low | Direct killing of mites | Can only treat exposed surfaces, very limited penetration, allows immediate recolonization from nearby untreated areas | Does not require elevated temperatures, able to exert durable control across multiple dust mite habitats with far lower levels of user effort. Prevents recolonization |

| Vacuum cleaning | $45-$450 | Filter replacements every 6-24 months: $15-$70 | Removal of mites and allergens | Can only treat accessible surfaces, very limited effect, increases allergen exposure by stirring up dust, allows immediate recolonization from untreated areas | Able to exert control across multiple dust mite habitats and produce durable control with far lower levels of user effort |

| Mite feeding inhibitors | $10-$25 | As denturants | Destroy or denature materials eaten by mites | Limited effects, especially in upholstered materials | Attacks dust mites directly, able to amplify and spread |

| Allergen denaturant | $20-$30 | Repeat original dose every 1-3 months | Denatures mite-produced allergens | Requires frequent re-application, very limited effects | By eliminating the source of the allergen, load is reduced |

| Hot washing (above 60°C) | N/A | Low | Direct killing of mites | Not usable for heat or water sensitive items, allows immediate recolonization from untreated areas | Does not require elevated temperatures, able to exert durable control across most dust mite habitats |

| Anoxic fumigation | Extremely expensive, high-value items only | N/A | Direct killing of mites in treated item only | May require removal of item to specialist facility, lengthy and expensive, allows immediate recolonization | Able to exert control across multiple dust mite habitats and to produce durable control |

19

| Air treatment - dehumidifier | $60-$250 | Low | Reduces humidity in air | Difficult to maintain treated areas at effective levels in the domestic setting | Works regardless of environmental conditions where its target is present |

| Air treatment - filtration | $50-$700 | Filter replacements every 6-24 months: $15-$70 | Removes particulate allergens from air | Difficult to maintain treated areas at effective levels in the domestic setting | Works regardless of environmental conditions where its target is present |

| Ultrasonic emitters | $15-$45 | Low | Claimed to inhibit HDM activity | Very limited data on mode of action or efficacy | Verifiable activity based on validated data |