Exhibit 5.1

90 Park Avenue

New York, NY 10016

212-210-9400 | Fax: 212-210-9444

July 13, 2022

Terra Property Trust, Inc

550 Fifth Avenue, 6th Floor

New York, New York 10036

Re: Terra Property Trust, Inc. — Registration Statement on Form S-4, as amended (File No. 333- 265836)

Ladies and Gentlemen:

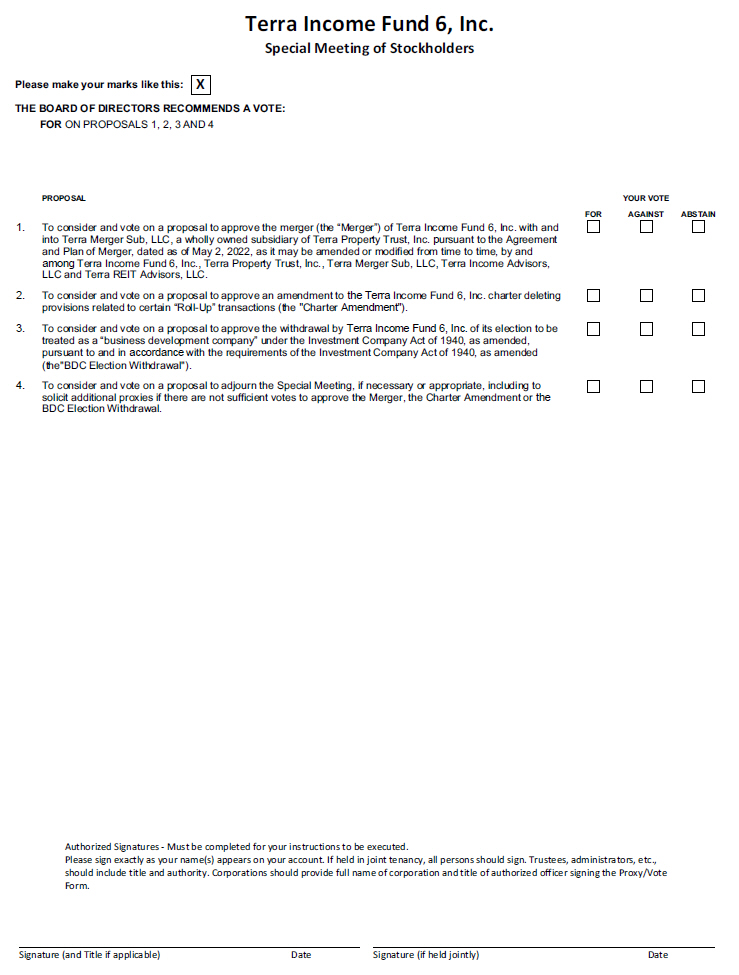

We have acted as counsel to Terra Property Trust, Inc., a Maryland corporation (the “Company”), in connection with the Company’s filing of the above referenced registration statement and related proxy statement prospectus included therein, as amended (the “Registration Statement”), with the Securities and Exchange Commission (the “Commission”) to register under the Securities Act of 1933, as amended (the “Securities Act”): (i) shares of Class B common stock, $0.01 par value per share (the “Class B Shares”), of the Company (estimated to be 4,824,415 Class B Shares, assuming the Merger (as defined here) is completed, but, in any event, not to exceed the authorized but unissued and unreserved shares of the Company’s common stock, par value $0.01 per share (“Common Stock”), as of the date of the Directors’ Resolutions (as defined herein)), which Class B Shares are issuable in respect of the issued and outstanding shares of common stock, par value $0.001 per share, of Terra Income Fund 6, Inc., a Maryland corporation (“Terra BDC”), as contemplated by and in accordance with the Merger Agreement (as defined herein); and (ii) shares of Class A common stock, $0.01 par value per share, of the Company (the “Class A Shares”) (estimated to be 4,824,415 Common Shares but, in any event, not to exceed the authorized but unissued and unreserved shares of Common Stock as of the date of the Directors’ Resolutions), which will, upon the satisfaction of the conditions for such conversion as set forth in the terms of the Charter Amendment (as defined herein), be issuable upon the automatic conversion of the Class B Shares issued pursuant to the Merger Agreement on a one-for-one basis into Class A Shares, with cash paid in lieu of any fractional Class A Shares.

The Class B Shares and the Class A Shares (if any) are to be issued in connection with the merger (the “Merger”) of Terra BDC with and into Terra Merger Sub, LLC (“Merger Sub”), a Delaware limited liability company and wholly owned subsidiary of the Company, and the other transactions contemplated by the Agreement and Plan of Merger, dated as of May 2, 2022 (as amended or restated, the “Merger Agreement”), by and among the Company, Terra BDC, Merger Sub, Terra Income Advisors, LLC, a Delaware limited liability company, and Terra REIT Advisors, LLC, a Delaware limited liability company. This opinion is being furnished in accordance with the requirements of Item 21 of the Commission’s Form S-4 and Item 601(b)(5) of Regulation S-K under the Securities Act.

In the capacity described above, we have considered such matters of law and of fact, including the examination of originals or copies, certified or otherwise identified to our satisfaction, of such records and documents, including, without limitation, resolutions adopted by the board of director of the Company, including the resolutions adopted on April 29, 2022 (the “Directors’ Resolutions”), or other governing