|

Delaware

|

1-11454-03

|

58-1974423

|

||

|

(State

or Other Jurisdiction of

Incorporation)

|

(Commission

File No.)

|

(IRS

Employer Identification No.)

|

|

o

|

Written

communications pursuant to Rule 425 under the Securities Act (17

CFR

230.425)

|

|

o

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

|

o

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR

240.14d-2(b))

|

|

o

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17

CFR

240.13e-4(c))

|

|

2.1*

|

Asset

Purchase Agreement, dated January 10, 2006, by and between vFinance,

Inc.,

vFinance Investments, Inc., Sterling Financial Investment Group,

Inc., and

Sterling Financial Group of Companies,

Inc.

|

| 2.2 |

Amendment

to Asset Purchase Agreement, dated May 11, 2006, by and between vFinance,

Inc., vFinance Investments, Inc., Sterling Financial Investment Group,

Inc., and Sterling Financial Group of Companies,

Inc.

|

| 2.3 |

Second

Amendment to Asset Purchase Agreement, dated May 11, 2006, by and

between

vFinance, Inc., vFinance Investments, Inc., Sterling Financial Investment

Group, Inc., and Sterling Financial Group of Companies,

Inc.

|

|

4.1*

|

Registration

Rights Agreement, dated January 10, 2006, by and among vFinance,

Inc., and

Sterling Financial Group of Companies,

Inc.

|

| 4.2 |

Amendment

to Registration Rights Agreement, dated May 11, 2006, by and among

vFinance, Inc., and Sterling Financial Group of Companies,

Inc.

|

|

10.1*

|

Standstill

Agreement, dated January 10, 2006, by and among vFinance, Inc. and

each of

Sterling Financial Investment Group, Inc., Sterling Financial Group

of

Companies, Inc., Charles Garcia and Alexis

Korybut.

|

|

10.2*

|

Voting

and Lockup Agreement, dated January 10, 2006, by and among vFinance,

Inc.,

vFinance Investments, Inc., Sterling Financial Investment Group,

Inc.,

Sterling Financial Group of Companies, Inc., Charles

Garcia Leonard Sokolow and Timothy

Mahoney.

|

| 10.3 |

Amendment

to Voting and Lockup Agreement, dated May 11, 2006, by and among

vFinance,

Inc., vFinance Investments, Inc., Sterling Financial Investment Group,

Inc., Sterling Financial Group of Companies, Inc., Charles Garcia

Leonard

Sokolow and Timothy Mahoney.

|

|

10.4*

|

Management

Agreement, dated January 10, 2006, by and among vFinance

Investments, Inc., Sterling Financial Investment Group, Inc. and

Sterling

Financial Group of Companies, Inc.

|

|

10.5

|

Amendment

to Management Agreement, dated May 11, 2006, by and among vFinance

Investments, Inc., Sterling Financial Investment Group, Inc. and

Sterling

Financial Group of Companies, Inc.

|

|

10.6

|

Stock

Escrow Agreement dated Mat 11, 2006, by and among vFinance, Inc.,

vFinance

Investments, Inc., Sterling Financial Investment Group, Inc., Sterling

Financial Group of Companies, Inc., and Edwards Angell Palmer & Dodge,

LLP.

|

|

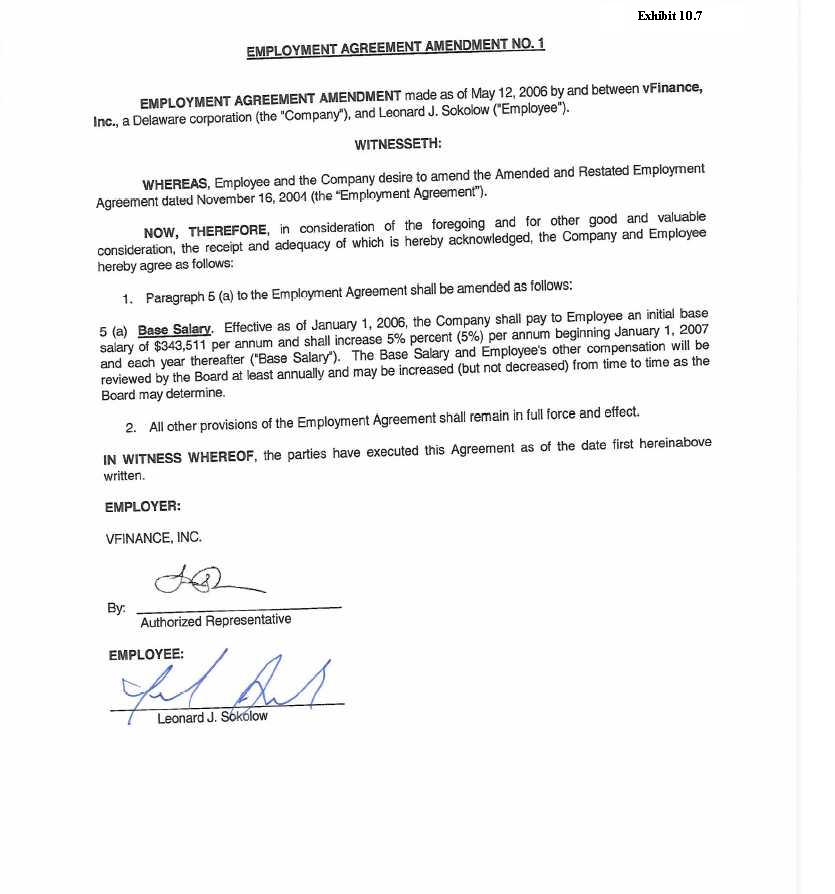

10.7

|

Employment

Agreement Amendment No. 1 dated May 12, 2006 by and among vFinance,

Inc.

and Leonard Sokolow.

|

| vFINANCE, INC. | ||

| |

|

|

| Date: May 16, 2006 | By: | /s/ Leonard J. Sokolow |

|

Name: Leonard J. Sokolow |

||

| Title: Chief Executive Officer | ||

| 2.2 |

Amendment

to Asset Purchase Agreement, dated May 11, 2006, by and between

vFinance,

Inc., vFinance Investments, Inc., Sterling Financial Investment

Group,

Inc., and Sterling Financial Group of Companies,

Inc.

|

| 2.3 |

Second

Amendment to Asset Purchase Agreement, dated May 11, 2006, by and

between

vFinance, Inc., vFinance Investments, Inc., Sterling Financial

Investment

Group, Inc., and Sterling Financial Group of Companies,

Inc.

|

| 4.2 |

Amendment

to Registration Rights Agreement, dated May 11, 2006, by and among

vFinance, Inc., and Sterling Financial Group of Companies,

Inc.

|

| 10.3 |

Amendment

to Voting and Lockup Agreement, dated May 11, 2006, by and among

vFinance,

Inc., vFinance Investments, Inc., Sterling Financial Investment

Group,

Inc., Sterling Financial Group of Companies, Inc., Charles Garcia

Leonard

Sokolow and Timothy Mahoney.

|

|

10.5

|

Amendment

to Management Agreement, dated May 11, 2006, by and among vFinance

Investments, Inc., Sterling Financial Investment Group, Inc. and

Sterling

Financial Group of Companies, Inc.

|

|

10.6

|

Stock

Escrow Agreement dated Mat 11, 2006, by and among vFinance, Inc.,

vFinance

Investments, Inc., Sterling Financial Investment Group, Inc., Sterling

Financial Group of Companies, Inc., and Edwards Angell Palmer & Dodge,

LLP.

|

|

10.7

|

Employment

Agreement Amendment No. 1 dated May 12, 2006 by and among vFinance,

Inc.

and Leonard

Sokolow.

|

| 1. |

The

Parties agree that the Seller shall retain the $500,000 in cash on

deposit

with Fortis Securities, LLC. Therefore, Section 2.1 (ii) of the Asset

Purchase Agreement is deleted in its entirety and such deposit shall

be an

Excluded Asset for all purposes under the Asset Purchase

Agreement.

|

| 2. |

To

adjust the Stock Purchase Price to reflect the amendment to Section

2.1

(ii) of the Asset Purchase Agreement described above and the amendment

to

Section 3.2 of the Asset Purchase Agreement described herein below,

the

Parties agree that:

|

| 3. |

In

light of the adjustment of the Stock Purchase price as described

herein

above, the Parties have agreed not to have a further adjustment to

the

Stock Purchase Price as described in Section 3.2 of the Asset Purchase

Agreement. Therefore, the Parties agree that Section 3.2 of the Asset

Purchase Agreement is deleted in its

entirety.

|

| 4. |

All

other provisions of the Asset Purchase Agreement shall remain in

full

force and effect. The Asset Purchase Agreement is incorporated by

reference herein, as modified by the changes herein. Each term which

is

capitalized but not defined herein shall have the meaning ascribed

thereto

in the Asset Purchase Agreement. The Asset Purchase Agreement, as

amended

by this Amendment constitutes the entire agreement of the Parties

with

respect to the subject matter hereof. In the event of any inconsistency

between the terms of this Amendment and the Asset Purchase Agreement,

the

terms of this Amendment shall govern and

prevail.

|

| 5. |

This

Amendment may be executed in any number of counterparts, each of

which

shall be deemed to be an original and all of which together shall

be

deemed to be one and the same instrument. The Parties to this Amendment

need not execute the same

counterpart.

|

| VFINANCE INVESTMENTS, INC. | ||

| By: | /s/ Leonard Sokolow | |

|

Name: Leonard Sokolow |

||

| Title: Chairman | ||

| VFINANCE, INC. | ||

| By: | /s/ Leonard Sokolow | |

|

Name: Leonard Sokolow |

||

| Title: CEO and President | ||

| STERLING FINANCIAL INVESTMENT GROUP, INC. | ||

| By: | /s/ Charles P. Garcia | |

|

Name: Charles P. Garcia |

||

| Title: CEO | ||

| STERLING FINANCIAL GROUP OF COMPANIES, INC. | ||

| By: | /s/ Charles P. Garcia | |

|

Name: Charles P. Garcia |

||

| Title: CEO | ||

| 1. |

The

Parties agree that Section 10.1 (b) shall be amended to delete the

date

“April 30, 2006” and replace such date with “May 15, 2006”.

|

| 2. |

All

other provisions of the Asset Purchase Agreement shall remain in

full

force and effect. The Asset Purchase Agreement is incorporated by

reference herein, as modified by the changes herein. Each term which

is

capitalized but not defined herein shall have the meaning ascribed

thereto

in the Asset Purchase Agreement. The Asset Purchase Agreement, as

amended

by this Amendment constitutes the entire agreement of the Parties

with

respect to the subject matter hereof. In the event of any inconsistency

between the terms of this Amendment and the Asset Purchase Agreement,

the

terms of this Amendment shall govern and

prevail.

|

| 3. |

This

Amendment may be executed in any number of counterparts, each of

which

shall be deemed to be an original and all of which together shall

be

deemed to be one and the same instrument. The Parties to this Amendment

need not execute the same

counterpart.

|

| VFINANCE INVESTMENTS, INC. | ||

| By: | /s/ Leonard Sokolow | |

|

Name: Leonard Sokolow |

||

| Title: Chairman | ||

| VFINANCE, INC. | ||

| By: | /s/ Leonard Sokolow | |

|

Name: Leonard Sokolow |

||

| Title: CEO and President | ||

| STERLING FINANCIAL INVESTMENT GROUP, INC. | ||

| By: | /s/ Charles P. Garcia | |

|

Name: Charles P. Garcia |

||

| Title: CEO | ||

| STERLING FINANCIAL GROUP OF COMPANIES, INC. | ||

| By: | /s/ Charles P. Garcia | |

|

Name: Charles P. Garcia |

||

| Title: CEO | ||

| 1. |

The

Parties agree that Section 1 shall be amended to delete the stated

definition of “Filing Date” and to replace such definition in its entirety

with the following:

|

| 2. |

All

other provisions of the Registration Rights Agreement shall remain

in full

force and effect. The Registration Rights Agreement is incorporated

by

reference herein, as modified by the changes herein. Each term capitalized

but not defined herein shall have the meaning ascribed thereto in the

Registration Rights Agreement. The Registration Rights Agreement, as

amended by this Amendment constitutes the entire agreement of the Parties

with respect to the subject matter hereof. In the event of any

inconsistency between the terms of this Amendment and the Registration

Rights Agreement, the terms of this Amendment shall govern and

prevail.

|

| 3. |

This

Amendment may be executed in any number of counterparts, each of which

shall be deemed to be an original and all of which together shall be

deemed to be one and the same instrument. The Parties to this Amendment

need not execute the same counterpart.

|

| VFINANCE, INC. | ||

| |

|

|

| By: | /s/ Leonard Sokolow | |

|

Leonard Sokolow |

||

| CEO and President | ||

| STERLING FINANCIAL GROUP OF COMPANIES, INC. | ||

| |

|

|

| By: | /s/ Charles P. Garcia | |

|

Name: Charles P. Garcia |

||

| Title: CEO | ||

| 1. |

(a)

Clause (i) of subsection (a) of Section 2 is deleted in its entirety

and

replaced with the following:

|

| 2. |

All

other provisions of the Lockup Agreement shall remain in full force

and

effect. The Lockup Agreement is incorporated by reference herein,

as

modified by the changes herein. Each term which is capitalized but

not

defined herein shall have the meaning ascribed thereto in the Lockup

Agreement. The Lockup Agreement, as amended by this Amendment constitutes

the entire agreement of the Parties with respect to the subject matter

hereof. In the event of any inconsistency between the terms of this

Amendment and the Lockup Agreement, the terms of this Amendment shall

govern and prevail.

|

| 3. |

This

Amendment may be executed in any number of counterparts, each of

which

shall be deemed to be an original and all of which together shall

be

deemed to be one and the same instrument. The Parties to this Amendment

need not execute the same counterpart.

|

| VFINANCE INVESTMENTS, INC. | ||

| By: | /s/ Leonard Sokolow | |

|

Name: Leonard Sokolow |

||

| Title: Chairman | ||

| VFINANCE, INC. | ||

| By: | /s/ Leonard Sokolow | |

|

Name: Leonard Sokolow |

||

| Title: CEO and President | ||

| STERLING FINANCIAL INVESTMENT GROUP, INC. | ||

| By: | /s/ Charles P. Garcia | |

|

Name: Charles P. Garcia |

||

| Title: CEO | ||

| STERLING FINANCIAL GROUP OF COMPANIES, INC. | ||

| By: | /s/ Charles P. Garcia | |

|

Name: Charles P. Garcia |

||

| Title: CEO | ||

| |

|

|

| By: | /s/ Charles P. Garcia | |

|

CHARLES P. GARCIA |

||

| By: | /s/ Leonard Sokolow | |

|

LEONARD SOKOLOW |

||

| By: | /s/ Timothy Mahoney | |

|

TIMOTHY MAHONEY |

||

| 1. |

The

Parties agree that Section 11. a. iv. of the Management Agreement

shall be

amended to delete the date “April 30, 2005[sic]” and replace such date

with “May 15, 2006”.

|

| 2. |

All

other provisions of the Management Agreement shall remain in full

force

and effect. The Management Agreement is incorporated by reference

herein,

as modified by the changes herein. Each term which is capitalized

but not

defined herein shall have the meaning ascribed thereto in the Management

Agreement. The Management Agreement, as amended by this Amendment

constitutes the entire agreement of the Parties with respect to the

subject matter hereof. In the event of any inconsistency between

the terms

of this Amendment and the Management Agreement, the terms of this

Amendment shall govern and prevail.

|

| 3. |

This

Amendment may be executed in any number of counterparts, each of

which

shall be deemed to be an original and all of which together shall

be

deemed to be one and the same instrument. The Parties to this Amendment

need not execute the same counterpart.

|

|

|

||

| VFINANCE INVESTMENTS, INC. | ||

| By: | /s/ Leonard Sokolow | |

|

Name: Leonard Sokolow |

||

| Title: Chairman | ||

| STERLING FINANCIAL INVESTMENT GROUP, INC. | ||

| By: | /s/ Charles P. Garcia | |

|

Name: Charles P. Garcia |

||

| Title: CEO | ||

| STERLING FINANCIAL GROUP OF COMPANIES, INC. | ||

| By: | /s/ Charles P. Garcia | |

|

Name: Charles P. Garcia |

||

| Title: CEO | ||