Exhibit 4.8

Employee Stock Option Scheme- Grants 2021

Executive Summary

| S.N |

Key Features |

ESOS 2021 (Proposed) | ||

| 1 | Grant Date | 1 November 2021 | ||

| 2 | Vesting Date | 36 months from Date of Grant i.e. 1 November 2024 | ||

| 3 | Coverage | 4000 employees (Around 38%) | ||

| 4 | Grant Price | INR 304/- | ||

| 5 | Total options | 1,20,83,636 Vedanta Limited Stock Options | ||

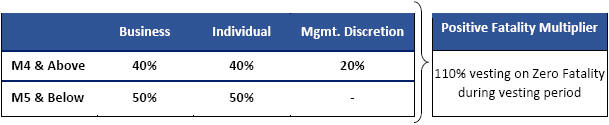

| 6 | Performance Conditions | • Business/SBU Performance (Volume, Cost NSR, EBITDA, FCF, ESG, Carbon Footprint)

• Sustained Individual Performance

• Management Discretion | ||

| 7 | Performance Period | • Business/SBU Performance: Three Financial Year/s during the vesting period i.e. FY 2021-22, FY 2022-23, FY 2023-24

• Sustained Individual Performance: Annual Performance Rating of Three Financial Year/s i.e. FY 2021-22, FY 2022-23, FY 2023-24

• Management Discretion: Vesting period from Date of Grant to Date of Vesting | ||

| 8 | Vesting Schedule | • Business Performance: 50% of the Award shall vest for achieving Threshold performance increasing pro-rata to full vesting for achievement of 100% of Target

• The performance achievement for each business will be evaluated against internal business plan and respective peer comparison on Volume, Cost & NSR

• Sustained Individual Performance: 25% at Threshold increasing to 125% vesting for achievement of top rating in all 3 years

• Multiplier of individual performance ratings to create differentiation at vesting

• Management Discretion: Rewarding real contribution and value addition to business during the vesting period. Committee to finalize the pay-out at vesting based on sustained value addition over the vesting period | ||

| Enhanced coverage for: | ||||

| 9 | Coverage of Key Leaders: |

1. Key leaders focusing on Innovation, Digitalization & Analytics | ||

|

2. High Potential Talent: identified through various platforms such as Workshop leaders, V-Reach Talent, V-Aspire, V-Lead and other hi-po leaders | ||||

|

3. Holding critical roles / successors | ||||

|

4. Critical Functions including Finance, Commercial & Marketing, HR, Legal, Geology, Exploration, Mining, HSE, Digital | ||||

|

5. Freshers joining the group to ensure long term career envisioning (new addition) | ||||

| * | The final grant value and number of options shall be subject to the share price as on 29 October 2021 |