UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of

Report (Date of earliest event reported):

December

18, 2006

CenturyTel,

Inc.

(Exact

name of registrant as specified in its charter)

|

Louisiana

|

1-7784

|

72-0651161

|

|

(State

or other jurisdiction of

|

(Commission

File Number)

|

(I.R.S.

Employer

|

|

incorporation

or organization)

|

|

Identification

No.)

|

|

|

|

|

100

CenturyTel Drive, Monroe, Louisiana 71203

(Address

of principal executive offices) (Zip Code)

Registrant's

telephone number, including area code: (318) 388-9000

Check

the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions:

|

[

]

|

Written

communications pursuant to Rule 425 under the Securities Act (17

CFR

230.425)

|

|

|

|

|

[

]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.

14a-12)

|

|

|

|

|

[

]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR

240.14d-2(b))

|

|

|

|

|

[

]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17

CFR

240.13e-4(c))

|

|

Item

1.01

|

Entry

Into a Material Definitive

Agreement

|

On

December 17, 2006, we entered into a stock purchase agreement with Madison

River

Communications Corp. (“MRCC”) and its owner, Madison River Telephone Company,

LLC. Under this agreement, we agreed to purchase all of the capital stock

of

MRCC in exchange for $830 million cash less

MRCC’s

net indebtedness on the transaction’s closing date (which was approximately $494

million at September 30, 2006), subject to adjustment at closing for changes

in

MRCC’s working capital between September 30, 2006 and closing.

Consummation

of the transaction is subject to (i) the receipt of various governmental

approvals, including approvals from the Federal Communications Commission

and the public utility commissions of Alabama, Georgia, Illinois, North

Carolina, Florida and Louisiana, (ii) compliance with the notification and

waiting period requirements under the Hart-Scott-Rodino Antitrust Improvements

Act of 1976, and (iii) various other customary closing conditions. We currently

expect the transaction to be completed in the second quarter of

2007.

The

parties to the stock purchase agreement have made customary representations,

warranties and covenants, including commitments of MRCC and its owner not

to solicit or pursue alternative transactions and provisions that permit

the

parties to terminate the agreement under certain limited

circumstances.

For

additional information, see Item 8.01 below and the exhibits referred to

therein.

On

December 18, 2006, (i) we announced that we had entered into the stock purchase

agreement described above by press release, a copy of which is attached hereto

as Exhibit 99.1, and (ii) we made a presentation to investors and analysts

using

materials posted to our website on such date, copies of which are attached

hereto as Exhibit 99.2. Exhibits 99.1 and 99.2 are both incorporated by

reference herein in their entirety, including various cautionary statements

that

modify our forward-looking statements made or incorporated herein.

|

Item

9.01

|

Financial

Statements and Exhibits

|

(d)

Exhibits

| 99.1 |

Press

release announcing entry into definitive stock purchase agreement

to

acquire Madison River Communications

Corp.

|

| |

99.2

|

Presentation

to

investors and analysts regarding

above.

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant

has

duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

|

|

CENTURYTEL,

INC.

|

|

|

|

|

|

|

|

|

|

Dated:

December 20, 2006

|

|

By:

/s/

Neil A. Sweasy

|

|

|

|

Neil

A. Sweasy

|

|

|

|

Vice

President and

Controller

|

Exhibit

99.1

|

FOR

IMMEDIATE RELEASE

|

FOR

MORE INFORMATION CONTACT:

|

|

December

18, 2006

|

Media:

Patricia Cameron 318.388.9674

|

|

|

patricia.cameron@centurytel.com

|

|

|

Investors:

Tony Davis 318.388.9525

|

|

|

tony.davis@centurytel.com

|

CenturyTel

to Acquire Madison River for $830 million

| · |

Acquisition

of

176,000 rural access lines with 99% broadband coverage and 30% high

speed

Internet penetration

|

| · |

Accretive

to free cash flow per share in the first year, before

synergies

|

| · |

Expands

CenturyTel’s access line base by

8%

|

| · |

Maintains

CenturyTel’s operational, financial and strategic

flexibility

|

| · |

Continued

commitment to share repurchase

plan

|

MONROE,

LA. - CenturyTel, Inc. (“CenturyTel” or the “Company”) (NYSE Symbol: CTL)

announced today that it has entered into a definitive agreement to acquire

all

of the outstanding stock of Madison River Communications Corp. (“Madison River”)

for $830 million in

a

combination of cash and the assumption of debt.

The

acquisition is expected to close in the second quarter of 2007, subject to

the

satisfaction of certain customary conditions, including necessary approvals

from

federal and state regulators. The final purchase price is subject to certain

customary adjustments which are not expected to be material.

CenturyTel

intends to finance the acquisition with debt and cash generated from operations.

The Company also expects to complete the remainder of its current $1 billion

share repurchase program by mid-year 2007.

CenturyTel’s

balance sheet will remain strong following the transaction, with a pro forma

net

debt to last twelve months ended September 30, 2006 (“LTM”) EBITDA ratio of

approximately 2.6x, before anticipated synergies. On a pro forma basis, the

Company will have approximately 2.3 million access lines and 390,000 high-speed

Internet subscribers.

Strategic

Rationale

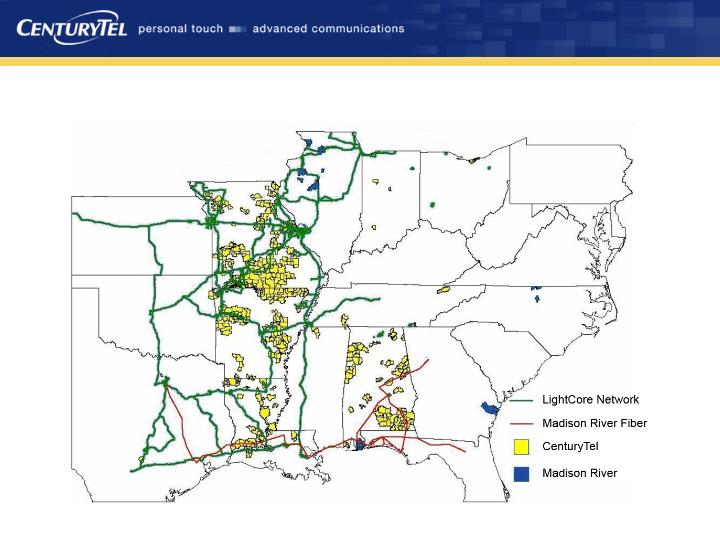

With

this

acquisition, CenturyTel adds attractive markets with good demographics and

growth prospects in Alabama, Georgia, Illinois and North Carolina. Madison

River’s high-quality network is 99% broadband-enabled and includes a 2,400 route

mile fiber network that is complementary to CenturyTel’s existing

operations.

Once

this

acquisition is fully integrated, CenturyTel estimates it will achieve annual

cost synergies of approximately $17 million.

“We

are

pleased to announce the acquisition of Madison River. Under Stephen

Vanderwoude’s and Paul Sunu’s leadership, Madison River has built a great

communications company. Through efficient investment in their network and a

grass-roots approach to their customer base, they have achieved virtually

ubiquitous broadband enablement and strong high-speed Internet penetration,”

said Glen F. Post, III, chairman and chief executive officer of CenturyTel.

“This transaction fits CenturyTel’s acquisition strategy and permits us to

continue our share repurchase initiative while maintaining operational,

financial and strategic flexibility.”

Financial

Summary

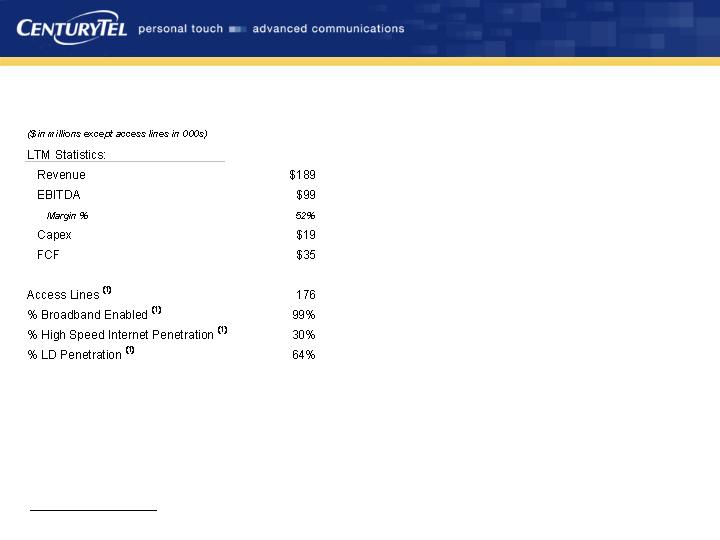

Madison

River generated $189 million of revenue, $99 million of EBITDA and $35 million

of leveraged free cash flow, before anticipated synergies, in the twelve months

ended September 30, 2006. The purchase price represents 9.6x and 7.4x Madison

River’s LTM free cash flow before and after anticipated synergies, respectively,

and 8.4x and 7.2x LTM EBITDA before and after anticipated synergies,

respectively.

CenturyTel

estimates the transaction will be approximately 4%

accretive

to free cash flow per share, before synergies. After synergies, the transaction

is estimated to be approximately 6% accretive to free cash flow per

share.

Additional

Information

Lehman

Brothers Inc. acted as exclusive financial advisor to CenturyTel on the

transaction. Goldman Sachs & Co. and Merrill Lynch & Co. acted as

financial advisors to Madison River.

This

release includes certain non-GAAP financial measures. Reconciliation of non-GAAP

financial measures discussed above or that may be discussed during the

conference call described below will be available in the Investor Relations

portion of CenturyTel’s Web site at www.centurytel.com.

Investors are urged to consider these non-GAAP measures in addition to, and

not

in substitution for, measures prepared in accordance with GAAP.

Conference

Call Information

CenturyTel

will host a conference call today at 9:30 a.m. Central Time. Interested parties

can access the call by dialing 866.847.7860. A live, listen-only webcast will

also be accessible through the Investor Relations portion of CenturyTel’s Web

site at http://www.centurytel.com.

If

you

are unable to participate during the live webcast, the call will be archived

on

the Investor Relations portion of CenturyTel’s Web site through January 8, 2007.

A replay of the conference call will be accessible through December 27, 2006,

by

calling 888.266.2081 and entering the access code: 1016606.

In

addition to historical information, this release includes certain

forward-looking statements, estimates and projections that are based on current

expectations only, and are subject to a number of risks, uncertainties and

assumptions, many of which are beyond the control of the Company. Actual

events

and results may differ materially from those anticipated, estimated or projected

if one or more of these risks or uncertainties materialize, or if underlying

assumptions prove incorrect. Factors that could affect actual results include

but are not limited to: the Company’s ability to effectively manage its

expansion opportunities, including its ability to integrate Madison

River’s business into the Company’s operations and systems, to

realize the synergies expected from this transaction, and to retain and

hire key personnel; higher than anticipated interest rates; the inability

to

receive regulatory approvals related to this transaction in a timely manner

or

at all; the timing, success and overall effects of competition from a wide

variety of competitive providers; the risks inherent in rapid technological

change; the effects of ongoing changes in the regulation of the communications

industry; the Company’s ability to effectively manage its expansion

opportunities, including retaining and hiring key personnel; possible changes

in

the demand for, or pricing of, the Company’s products and services; the

Company’s ability to successfully introduce new product or service offerings on

a timely and cost-effective basis; the Company’s ability to collect its

receivables from financially troubled communications companies; the Company’s

ability to successfully negotiate collective bargaining agreements on

reasonable terms without work stoppages; the effect of adverse weather; other

risks referenced from time to time in the Company’s filings with the Securities

and Exchange Commission (the “SEC”); and the effects of more general factors

such as changes in interest rates, in tax rates, in accounting policies or

practices, in operating, medical or administrative costs, in general market,

labor or economic conditions, or in legislation, regulation or public policy.

These and other uncertainties related to the Company’s business are described in

greater detail in the Company’s Annual Report on Form 10-K for the year ended

December 31, 2005, as updated by the Company’s subsequent SEC reports. You

should be aware that new factors may emerge from time to time and it is not

possible for management to identify all such factors, nor can it predict

the

impact of each such factor on the business or the extent to which any one

or

more factors may cause actual results to differ from those reflected in any

forward-looking statements. You are further cautioned not to place undue

reliance on these forward-looking statements, which speak only as of

the date of this release. The information contained in this release is as

of

December 18, 2006. The Company undertakes no obligation to update any of

its

forward-looking statements for any reason.

About

CenturyTel

CenturyTel

(NYSE: CTL) is a leading provider of communications, high-speed Internet and

entertainment services in small-to-mid-size cities through our broadband and

fiber transport networks. Included in the S&P 500 Index, CenturyTel delivers

advanced communications with a personal touch to customers in 25 states. Visit

us at www.centurytel.com.

About

Madison River

Madison

River operates established rural telephone companies providing communications

services to business and residential customers in Alabama, Georgia, Illinois

and

North Carolina. Its service offerings include local and long distance voice,

high speed broadband and dial-up Internet access services. As of September

30,

2006, Madison River served approximately 238,000 voice and broadband

connections. Madison River is owned by affiliates of Madison Dearborn Partners

Inc., Goldman, Sachs & Co., Providence Equity Partners and

others.

Exhibit

99.2

Acquisition

of Madison River

Chairman

of the Board and

Chief

Executive Officer

Non-GAAP

Financial Measures

Also,

included in our presentation materials are certain non-GAAP financial

measures.

These measures are provided and valid as of December 18, 2006, only and

should

not be relied upon beyond such date. Reconciliation of such non-GAAP

measures to

the most directly comparable GAAP measure or measures are available on

our

company Web site at www.centurytel.com.

Included

in our presentation materials are certain estimates and other forward-looking

statements. They are subject to uncertainties that could cause the actual

results to differ materially. These and other important uncertainties

related to

our business are described in the Company’s filings with the Securities and

Exchange Commission. All information contained herein is current as of

December

18, 2006, and is to be considered valid only as of December 18, 2006,

regardless

of the date reviewed.

-

Chairman

of

the Board and Chief Executive Officer

Executive

Vice President and Chief Financial Officer

-

Highlights

of the Transaction

ö

Acquisition

of 176,000 access lines with strong financial and operating

metrics

-

Expands

CenturyTel’s access line base by 8%

-

99%

broadband enabled, 30% high speed Internet penetration, requiring lower

ongoing

capital

-

Favorable

demographics and attractive market growth prospects

ö

Accretive

to

CenturyTel’s free cash flow before and after synergies

ö

Moderate

increase in leverage

-

Preserves

ability to complete existing share repurchase plan by

mid-2007

-

Maintains

operational and strategic flexibility

ö

Leverages

CenturyTel’s scale and management

-

$17

million

of estimated annual cost synergies

-

Gives

CenturyTel access to Fiber Network capacity which is complementary to

existing

operations

|

Transaction

Value:

|

$830

million,

including assumption of $494 million of net indebtedness as

of

9/30/2006

|

|

Estimated

Transaction Multiples:

|

Free

Cash

Flow Before Synergies: 9.6x LTM

Free

Cash

Flow After Synergies: 7.4x LTM

EBITDA

Before

Synergies: 8.4x LTM

EBITDA

After

Synergies: 7.2x LTM

|

|

Estimated

Accretion:

|

Free

Cash

Flow Before Synergies: approximately 4% LTM

Free

Cash

Flow After Synergies: approximately 6% LTM

|

|

Structure:

|

All

cash

acquisition of stock of Madison River

|

|

Financing:

|

Existing

or

additional borrowing capacity and free cash flow

|

|

Pro

forma Leverage:

|

2.6x

Net Debt

/ LTM EBITDA

|

|

Required

Approvals:

|

FCC,

HSR, and

AL, GA, IL and NC PUCs

|

|

Expected

Closing:

|

Second

Quarter of 2007

|

Overview

of

Madison River

ö

Operations

in

AL, GA, IL, NC

-

64

lines per

square mile

-

Population

density of 107 persons per sq. mile

-

Household

income of ~$59,000 vs. national average of ~$62,500.

ö

High

quality network with attractive margins and strong broadband penetration

rates

ö

Complementary

Fiber Network

ö

Solid

3Q06

Y-o-Y performance:

-

Access

lines

declined 2.7%

-

19%

increase

in high speed Internet customers

ö

Owned

by Madison Dearborn, Goldman Sachs, Providence Equity, and

others

ö

Extremely

attractive acquisition opportunity

-

Strong

operational performance

-

High

broadband penetration and 99% enabled

-

Favorable

market demographics with attractive growth

prospects

ö

Acquisition

meets financial goals

-

Free

cash

flow accretive before synergies

-

Ability

to

acquire with modest additional leverage

-

Maintains

CenturyTel’s flexibility

ö

Expect

to

complete current share repurchase program

ö

Significant

post-integration synergies