Post-Qualification Offering Circular Amendment No. 1

File No. 024-11897

Preliminary Offering Circular dated February 24, 2023

An offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. The Company may elect to satisfy its obligation to deliver a Final Offering Circular by sending Investors a notice within two business days after the completion of the sale that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular was filed may be obtained.

OFFERING CIRCULAR

Roots Real Estate Investment Community I, LLC

Up to $75,000,000 in Units

The United States Securities and Exchange Commission does not pass upon the merits of or give its approval to any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering circular or other solicitation materials. These securities are offered pursuant to an exemption from registration with the Commission; however, the Commission has not made an independent determination that the securities offered are exempt from registration.

The use of projections or forecasts in this offering is prohibited. No one is permitted to make any oral or written predictions about the cash benefits or tax consequences you will receive from your investment in the units of membership interests in the Company.

| Per Unit | Total Minimum(2) | Total Maximum | ||||||||||

| Public Offering Price(1) | $ | 118 | — | $ | 75,000,000.00 | |||||||

| Proceeds to Us from this Offering to the Public | $ | 118 | — | $ | 75,000,000.00 | |||||||

| Proceeds to Us from the Private Placement(3) | $ | 100 | — | $ | 6,477,900.45 | |||||||

| Total Proceeds to Us (Before Expenses) | $ | 81,477,900.45 | ||||||||||

| (1) | The per unit purchase price in this offering will be adjusted at the beginning of each fiscal quarter (or as soon as commercially reasonable thereafter), and will be equal to our new NAV divided by the number of Units outstanding as of the close of business on the last business day of the prior fiscal quarter. The current price per Unit based on the Company’s existing NAV is $118. | |

| (2) | This is a “best efforts” offering. Closings will be held at our Manager’s discretion, but will be held at least once a month. Investors will become members after our Manager holds a closing. See “How to Subscribe”. | |

| (3) | The Sponsor was issued 500 Units upon formation for a nominal $1,000. Subsequently, we commenced a private placement offering and sold 44,790.73 Units at the initial per unit price of $100.00 per Unit, and 18,507.66 Units at the first NAV price per Unit of $108 per Unit, prior to this offering statement being declared “qualified” by the SEC. |

We will offer our units on a best efforts basis primarily through the online investment portal on the Roots Real Estate Investment Community website (though we may distribute our units through other online portals as deemed appropriate by our Manager). Other offerings of our units may be made pursuant to exemptions under the Securities Act other than Regulation A.

Generally, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and nonnatural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

This Offering Circular follows the Form S-11 disclosure format.

The date of this offering circular is February 24, 2023.

The mailing address of our principal executive office is:

Roots Real Estate Investment Community I, LLC

1344 La France Street NE

Atlanta, Georgia 30307

Attn: Investor Relations

Our telephone number is (404)-732-5910 and our website address is www.investwithroots.com.

Investing in the units of membership interests in the Company (the “Units”) is speculative and involves substantial risks. An investor should purchase these securities only if the investor can afford a complete loss of his, her or its investment. Investors should carefully review the “Risk Factors” section of this offering circular, beginning on page 12, which contains a detailed discussion of the material risks that investors should consider before investing in the Units. These risks include the following:

| ● | We depend on our Manager to select our investments and conduct our day-to-day operations. We pay fees and expenses to our Manager and its affiliates that are not determined on an arm’s length basis, and therefore we do not have the benefit of arm’s length negotiations of the type normally conducted between unrelated parties. These fees increase your risk of loss. | |

| ● | This is a “blind pool” offering, and the Company is not committed to acquiring any particular investments with the net proceeds of this offering. | |

| ● | There are conflicts of interest between the Company, the Manager and its affiliates. | |

| ● | The Company may change its investment guidelines without Member consent, which could result in investments that are different from those described in this offering circular. | |

| ● | While the Company’s goal is to pay distributions from its cash flow from operations, the Company may use other sources to fund distributions, including offering proceeds, borrowings or sales of assets. The Company has not established a limit on the amount of proceeds from the public offering that it may use to fund distributions. If the Company pays distributions from sources other than cash flow from operations, it will have fewer funds available for investments and an investor’s overall return may be reduced. In any event, the Company makes distributions as required to comply with the REIT distribution requirements and avoid U.S. federal income and excise taxes on retained income. | |

| ● | The Company calculates its NAV on a quarterly basis using valuation methodologies that involve subjective judgments and estimates. As a result, the Company’s NAV may not accurately reflect the actual prices at which its real estate assets and investments, including related liabilities, could be liquidated on any given day due to the natural fluctuation of values in the real estate market. | |

| ● | The Company’s operating agreement does not require the Manager to seek Member approval to liquidate assets. No public market currently exists for the Units. | |

| ● | If the Company fails to qualify as a REIT for U.S. federal income tax purposes and no relief provisions apply, it will be subject to entity-level U.S. federal income tax and, as a result, cash available for distribution to investors and the value of the Units could materially decrease. | |

| ● | Real estate investments are subject to general downturns in the industry as well as downturns in specific geographic areas. The Company cannot predict what the occupancy level will be in a particular building or that any tenant will remain solvent. It also cannot predict the future value of its properties. Accordingly, the Company cannot guarantee that an investor will receive cash distributions or appreciation of his, her or its investment or that the investor will receive his, her or its initial investment back. | |

| ● | Investing in a limited number of regions carries the risks associated with significant geographical concentration. Geographic concentration of properties exposes the Company’s projects to adverse conditions in the areas where the properties are located, including general economic downturns and natural disasters occurring in such markets. Such major, localized events in areas where the Company’s properties are located could adversely affect its business and revenues, which would adversely affect the results of operations and financial condition. |

Certain market and industry data used in this offering circular has been obtained from independent industry sources and publications and third-party sources, as well as from research reports prepared for other purposes. Any forecasts prepared by such sources are based on data (including third-party data), models and the experience of various professionals, and are based on various assumptions, all of which are subject to change without notice. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and additional uncertainties as other forward-looking statements included in this offering circular.

The information provided by these industry sources should not be construed to sponsor, endorse, offer or promote an investment, nor does it constitute any representation or warranty, express or implied, regarding the advisability of an investment in the Units or the legality of an investment in the Units under appropriate laws.

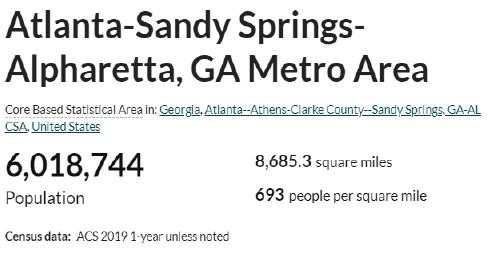

Roots Real Estate Investment Community I, LLC is a Georgia limited liability company which was formed on December 8, 2020. The Company was formed to originate, invest in and manage a diversified portfolio primarily consisting of investments in single family and multifamily residential real estate properties and development projects. Initially, the Company has targeted real estate in the Atlanta-Sandy Springs-Alpharetta Metropolitan Statistical Area (the “Atlanta MSA”) in the State of Georgia that has value-add potential. However, the Company may also invest in other major MSAs across the United States. The Company believes that its targeted properties and geographies have displayed strong performance and are expected to be well positioned to see continued healthy rent growth and value appreciation moving forward. While the Company intends primarily to continue to invest in the targeted properties and target geographies outlined above, it may invest in other asset classes as well as other locations, depending on the availability of suitable investment opportunities that meet its investment guidelines. The Company may make its investments through majority-owned or wholly-owned subsidiaries, and it may acquire minority interests or joint venture interests in subsidiaries. Additionally, affiliates of the Company may be interest holders in the joint ventures and subsidiaries in which the Company holds a majority or minority interest, which could cause potential conflicts of interests.

The use of the terms “RootsCom,” “Company,” “Roots,” “the REIT,” “we,” “us,” or “our” in this offering circular refer to Roots Real Estate Investment Community I, LLC, unless the context indicates otherwise. We intend to qualify as a real estate investment trust, or REIT, for U.S. federal income tax purposes beginning with our taxable year ending December 31, 2022.

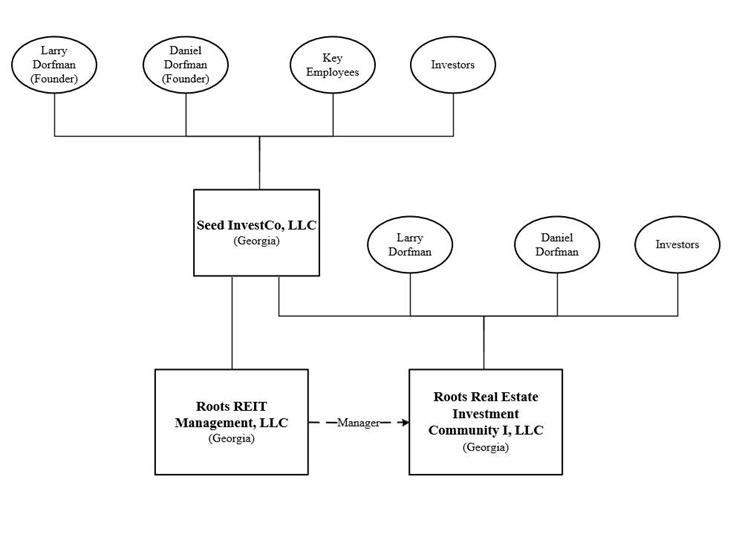

We are externally managed by Roots REIT Management, LLC, a Georgia limited liability company (the “Manager”) which is a wholly owned subsidiary of the Sponsor, Seed InvestCo, LLC, a Georgia limited liability company (the “Sponsor”). Our Manager operates an online investment and educational community that allows investors to become equity holders in real estate opportunities that may have been historically difficult to access for some investors. Through the use of the investment portal on the RootsCom website, investors can view details of an investment in RootsCom and sign legal documents online. This portal also allows tenants of our real estate assets unprecedented ways to engage with the community and the indirect owners of their residence. The primary mission of the Company is to create attractive returns while making a significant positive impact in the lives of the human beings who invest in, provide to, and rent from the Company, as well as on the communities that it serves.

We are offering to the public up to $75,000,000 of units of membership interests in the Company (each a “Unit” and collectively, the “Units”). We expect to offer the Units in this offering until the earlier of June 21, 2025, which is three years from the qualification date of this offering, or the date on which the maximum offering amount has been raised; provided, however, that our Manager may terminate this offering at any time or extend the offering. If we decide to extend this offering beyond three years from the date of this offering circular, we will provide this information in an offering circular supplement; however, in no event will we extend this offering beyond 180 days after the third anniversary of the initial qualification date. Through March 31, 2023, the per Unit purchase price for the Units will be $118.00 per Unit, which is equal to the NAV per Unit calculated at the end of the fourth quarter of 2022. Thereafter, within approximately 30 days after the end of the prior fiscal quarter, the per Unit purchase price will be adjusted and will equal the NAV per Unit calculated as of the close of business on the last day of the prior fiscal quarter. For example, on or about April 30, 2023, the Manager will announce the NAV per Unit calculated as of the close of business on March 31, 2023, on our website, www.investwithroots.com, and will update the per Unit purchase price to reflect the new NAV per Unit. Any investments made at any time will be at the published price of the NAV per Unit on the day the Subscription Agreement is signed.

Although we do not intend to list the Units for trading on an exchange or other trading market, we have adopted a Unit redemption program designed to provide our Members with limited liquidity on a quarterly basis for their investment in our Units. See “Description of Our Units—Quarterly Redemption Program” for more details. The Company has not registered, and does not intend to register, under the U.S. Investment Company Act of 1940, as amended (the “Investment Company Act”), in reliance upon the exemptions described in the “Investment Company Act Considerations” section. Investors will not have the benefits and protections arising out of registration under the Investment Company Act.

SUITABILITY STANDARDS

The Company will consider an investor’s answers to a number of questions soliciting information regarding investing experience, investment horizon, current investment portfolio, investment objectives, risk tolerance and liquidity needs. If an investor does not have investing experience or is in need of liquidity from his, her or its investments, the Company will elicit further information from the investor to determine whether an investment in the Units is suitable. While the Company does not have any specific minimum standards that must be satisfied before accepting an investor as a Member (other than the qualified purchaser requirements discussed elsewhere in this Offering Circular), the Company will evaluate the totality of an investor’s responses to these questions to determine whether, in the Company’s sole discretion, an investment in the Units is reasonable. The Company has implemented these suitability standards due to the volatility associated with investing in real estate, the difficulty of reselling Units and the long-term nature of an investment in the Units. The suitability standards will not apply to resales of the Units.

TABLE OF CONTENTS

| i |

IMPORTANT INFORMATION ABOUT THIS OFFERING CIRCULAR

Please carefully read the information in this offering circular (the “Offering Circular”). Investors should rely only on the information contained in this Offering Circular. The Company has not authorized anyone to provide investors with different information. This Offering Circular may only be used where it is legal to sell these securities. Investors should not assume that the information contained in this Offering Circular is accurate as of any date later than the date hereof or such other dates as are stated herein or as of the respective dates of any documents or other information incorporated herein by reference.

This Offering Circular is part of an offering statement that we filed with the Securities and Exchange Commission (the “SEC”) using a continuous offering process. Periodically, as the Company updates its Net Asset Value (“NAV”) per Unit amount or experiences other material developments, it will provide an offering circular supplement that may add, update or change information contained in this Offering Circular. Any statement that the Company makes in this Offering Circular will be modified or superseded by any inconsistent statement made by it in a subsequent offering circular supplement. The offering statement the Company filed with the SEC includes exhibits that provide more detailed descriptions of the matters discussed in this Offering Circular. Investors should read this Offering Circular and the related exhibits filed with the SEC and any offering circular supplement, together with additional information contained in the Company’s annual reports, semi-annual reports and other reports and information statements that it will file periodically with the SEC. See the section entitled “Additional Information” below for more details.

The offering statement and all supplements and reports that we have filed or will file in the future can be read at the SEC website, www.sec.gov. Also, a copy of the Company’s Offering Circular and all supplements will be posted on the RootsCom website, www.investwithroots.com. The contents of the RootsCom website (other than the Offering Circular and supplements thereto) are not incorporated by reference in or otherwise a part of this Offering Circular.

Those selling Units on our behalf in this Offering, including the Officers of the Company, will be permitted to make a determination that the purchasers of Units in this offering are “qualified purchasers” in reliance on the information and representations provided by an investor regarding the investor’s financial situation. Before making any representation that an investment does not exceed applicable thresholds, we encourage investors to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, the Company encourages investors to refer to www.investor.gov.

The Company includes a copy of Rule 251(d)(2)(i)(C) of Regulation A as an appendix to this Offering Circular and on the RootsCom website.

| ii |

STATE LAW EXEMPTION AND PURCHASE RESTRICTIONS

The Units are being offered and sold only to “qualified purchasers” (as defined in Regulation A under the Securities Act). As a Tier 2 offering pursuant to Regulation A under the Securities Act, this Offering will be exempt from state law “Blue Sky” review, subject to meeting certain state filing requirements and complying with certain anti-fraud provisions, to the extent that the Units offered hereby are offered and sold only to “qualified purchasers” or at a time when the Units are listed on a national securities exchange. “Qualified purchasers” include: (i) “accredited investors” under Rule 501(a) of Regulation D and (ii) all other investors so long as their investment in the Units does not represent more than ten percent (10%) of the greater of their annual income or net worth (for natural persons), or ten percent (10%) of the greater of annual revenue or net assets at fiscal year-end (for non-natural persons). Accordingly, the Company reserves the right to reject any investor’s subscription in whole or in part for any reason, including if the Company determines, in its sole and absolute discretion, that such investor is not a “qualified purchaser” for purposes of Regulation A.

To determine whether a potential investor is an “accredited investor” for purposes of satisfying one of the tests in the “qualified purchaser” definition, the investor must be a natural person:

| 1. | whose individual net worth (total assets less total liabilities), or joint net worth with that person’s spouse or spousal equivalent,1 at the time of such person’s purchase exceeds $1,000,0002; | |

| 2. | who had an individual income in excess of $200,000 in each of the two most recent years or joint income with that person’s spouse or spousal equivalent in excess of $300,000 in each of those years and who reasonably expects the same income level in the current year. For purposes of this section, the term “income” shall mean an individual’s adjusted gross income for federal income tax purposes increased by (i) any deduction for long-term capital gains under Section 1202 of the Internal Revenue Code of 1986, as amended (the “Code”), (ii) any deduction for depletion under Section 611, et seq., of the Code, (iii) any exclusion for interest under Section 103 of the Code and (iv) any losses of a partnership allocated to the individual partner as reported on Schedule E of Form 1040 (or any successor report); | |

| 3. | holding in good standing one or more professional certifications or designations, which as of the date of this offering circular the SEC has limited to FINRA Series 7, Series 82 or Series 65 licenses; or | |

| 4. | who is a “knowledgeable employee,” as defined in rule 3c-5(a)(4) under the Investment Company Act of 1940, as amended (the “Investment Company Act” ), of the Company if the Company were deemed to be an investment company3 (executive officers, directors, trustees, general partners, advisory board member or persons serving in a similar capacity of the investment company or an affiliated management person thereof). |

The list above is non-exhaustive; prospective investors should review Rule 501 of Regulation D for more details on whether they are an “accredited investor.” If the investor is not a natural person, different standards apply. See Rule 501 of Regulation D for more details.

For purposes of determining whether a potential investor is a “qualified purchaser,” annual income and net worth should be calculated as provided in the “accredited investor” definition under Rule 501 of Regulation D.

1 “Spousal equivalent” is defined as any cohabitant occupying a relationship generally equivalent to that of a spouse. Note that the investment does not have to been registered in joint name, even if relying on joint net worth or joint net income to meet the general eligibility criteria.

2 When determining net worth, the value of the investor’s primary residence must be excluded, and the related amount of indebtedness secured by the primary residence up to its fair market value may also be excluded. However, indebtedness (i) secured by the residence in excess of the value of the home and (ii) obtained within the past 60 days for a purpose other than acquiring the primary residence should be considered a liability and deducted from the investor’s net worth.

3 In this context “investment company” is as defined in Section 3 of the Investment Company Act, but for Sections 3(c)(1) or 3(c)(7) of such act.

| iii |

The following information is only a summary of certain information contained elsewhere in this offering circular. Because it is only a summary, it does not contain all of the information that may be important to a prospective investor, and is qualified in its entirety by reference to the more detailed information appearing elsewhere in this offering circular. We reserve the right to change the terms of the offering prior to acceptance of an investor’s subscriptions. Prospective investors will be notified of any such changes that we consider to be material by way of a supplement to this offering circular or by other reasonable means. For a more complete understanding of this offering, we encourage investors to read this offering circular and any other document to which an investor is referred. When we refer to “RootsCom,” “Company,” “Roots,” “the REIT,” “we,” “us,” or “our” or similar words, we refer to Roots Real Estate Investment Community I, LLC.

| The Company | Roots Real Estate Investment Community I, LLC, is a limited liability company which was formed under the laws of the State of Georgia on December 8, 2020 (the “Company”). |

| Manager | We are externally managed by Roots REIT Management, LLC, a Georgia limited liability company, which manages our day-to-day operations, including providing advisory and acquisition services (including performing due diligence on our investments), offering services, asset management services, marketing and advertising services, accounting and other administrative services, Member services, financing services, and disposition services, among others. Our Manager also manages our online portal. In addition, a team of real estate professionals, acting through our Manager, will make all the decisions regarding the selection, negotiation, financing and disposition of our investments, subject to the limitations in our operating agreement. |

| The REIT Sponsor | Our sponsor is Seed InvestCo, LLC, a Georgia limited liability company. Our Manager is a wholly-owned subsidiary of our Sponsor. |

| RootsCom Platform | The RootsCom Platform is an online platform for the residents of our residential properties and investors in the REIT, which is focused on real estate and can be found on the website www.investwithroots.com.

The RootsCom Platform provides the ability to:

● transact entirely online, including digital legal documentation, funds transfer, and ownership recordation;

● find educational materials about financial health, saving, building wealth, lifestyle improvement and real estate in general;

● view information about the Company’s real estate assets and related communities;

● manage and track investments easily through an online dashboard; and

● receive automated distributions and/or interest payments, and regular financial reporting.

As of the date of this offering circular, our Units will be offered exclusively online through the RootsCom Platform, or through direct communication with a member of the RootsCom Investment Team. |

| 1 |

| Investment Objectives | The primary business purpose and principal objectives of the Company are to leverage professional real estate expertise with technology, scale, and local market insights to generate attractive returns for its Members and offer unique opportunities and value to the communities that it serves. RootsCom is built to be “Commercially Motivated, and Community Inspired.” |

| Investment Strategy | The Company’s investment strategy is to acquire and manage a portfolio consisting primarily of single family and multifamily residential real estate investments. The Company targets real estate in the Atlanta-Sandy Springs-Alpharetta Metropolitan Statistical Area (the “Atlanta MSA”) in the State of Georgia that has value-add potential. However, the Manager may also invest in other major MSAs across the United States. The Manager believes that the Company’s targeted properties and geographies have displayed strong performance and are expected to be well positioned to see continued healthy rent growth and value appreciation moving forward. While the Manager intends primarily to continue to invest in residential real estate in the Atlanta MSA, it may invest in other asset classes as well as other locations, depending on the availability of suitable investment opportunities that meet its investment guidelines. The Company may make its investments through wholly- or majority-owned subsidiaries, and it may acquire minority interests or joint venture interests in subsidiaries.

The Manager intends to acquire the properties, facilitate the necessary renovations, repairs, upgrades and/or capital expenditures, as applicable per property, obtain or retain, as applicable, renters, get a third-party certified real property appraisal, and then sell such properties to the Company at or below the appraised fair market value. The Manager may forego payment for up to five percent (5%) of the value of each property in exchange for equity in the Company. The Company’s Members will get the benefit of rental income and portfolio appreciation. The Company’s intention is to hold each asset for as little as one (1) and as many as five (5) years, however market conditions will determine if and when the Company can sell each of its assets. The Company also intends to utilize 1031 exchanges wherever possible when certain assets are liquidated. “Final” liquidation will occur when a 1031 exchange is either not able, or not chosen, to be utilized. |

Recent Acquisitions |

Since the commencement of the Offering, the Company has acquired thirty one (31) additional curated properties from the Sponsor, through the purchase of thirty one (31) single asset limited liability companies wholly-owned by the Sponsor. See “Investment Objections and Strategy—Recent Acquisitions.” |

Recent Incurrence of Debt |

Since commencement of the Offering, the Company incurred $2,134,200 of debt secured by ten (10) properties owned by the Company. It is intended that the debt proceeds will be used for future acquisitions of additional real property. |

| Leverage Policy | The Company expects to use leverage at the portfolio level, and may use asset-level leverage, which, in the aggregate across the portfolio, the Company does not expect to exceed 75% of the cost (before deducting depreciation or other non-cash reserves) of its total assets, capital expenditures and closing costs. In addition, the Manager intends to incur debt both from institutional lenders, as well as the Company, in order to facilitate the acquisition of residential real property and value-add renovations. |

| Investment Company Act Considerations | Although the Company intends to continue to conduct its business such that it is not deemed to be an “investment company,” as defined under the Investment Company Act of 1940, or the Investment Company Act, it also may rely on one or more exemptions from registration under the Investment Company Act potentially including the exemption contained in Section 3(c)(5)(C) thereof and the rules and regulations thereunder. See “Plan of Operation—Investment Company Act Considerations.” |

| 2 |

| The Offering: | The Company is offering through the RootsCom Platform, www.investwithroots.com, a maximum of $75,000,000 of units of membership interests (“Units”) to the public on a “best efforts” basis at the current NAV price per Unit of $118, and on the terms and conditions described herein and, in the Company’s, operating agreement. When the Units are offered to the public on a “best efforts” basis, the Company is only required to use its best efforts to sell Units. The Sponsor currently owns one thousand five hundred (1,500) Units. No party, including the Manager, has a firm commitment or obligation to purchase any additional Units. Upon formation, the Company issued 500 Units to the Sponsor for a nominal $1,000, and subsequently, the Company sold $4,500,07268 of Units, for a total of 45,490.73 Units, through a private placement offering at a price of $100 per Unit, which was the initial offering price before the NAV price per Unit of $108 was established, and the Company sold $996,799.70 of Units for a total of 18,488.89 Units pursuant to the same private placement at the initial NAV price per Unit of $108. Between July 1, 2022 and February 1, 2023, the Company issued 28,199.44 Units at a Unit price of $110.0, 112.00, $115.00, and $118.00, for $3,202,558.73 in proceeds. As of February 1, 2023 the aggregate Units outstanding were 91,774 Units for total proceeds of $9,679,431 (including the 64,234 Units totaling $6,526,828 received in a private placement prior to the initial offering being declared effective).

Through March 31, 2023, the per Unit purchase price for the Units will be $118.00 per Unit, which is equal to the NAV per Unit calculated at the end of the fourth quarter of 2022. Thereafter, within approximately 30 days after the end of the prior fiscal quarter, or as soon as practical thereafter, the per Unit purchase price will be adjusted and will equal the NAV per Unit calculated as of the close of business on the last day of the prior fiscal quarter. For example, on or about April 15, 2023, the Manager will announce the NAV per Unit calculated as of the close of business on March 31, 2023, on our website, www.investwithroots.com, and will update the per Unit purchase price to reflect the new NAV per Unit, which will be reflected in an offering circular supplement filed with the SEC. Any investments made at any time will be at the published price of the NAV per Unit on the day the Subscription Agreement is signed. |

| Capital Structure: | The equity interests in the Company are divided into Units of the Company’s membership interests, which represent a pro-rata ownership interest in the assets, profits, losses and distributions of the Company (the “Units”). |

| Distributions | Distributions of available cash flow related to the Company’s rental activity, as determined by the Manager, are made quarterly. REITs are required to distribute to members at least 90% of their annual REIT taxable income (computed without regard to the dividends paid deduction and excluding net capital gain). Our Manager has, and will continue to, authorize quarterly distributions, payable quarterly in arrears. Our Manager may authorize other periodic distributions as circumstances dictate. Any distributions we make will be at the discretion of our Manager, and will be based on, among other factors, our present and reasonably projected future cash flow. In addition, the Manager’s discretion as to the payment of distributions will be dictated by the REIT distribution requirements. Moreover, even if we make the required minimum distributions under the REIT rules, we are subject to federal income and excise taxes on our undistributed taxable income and gains. As a result, our Manager also may authorize additional distributions, beyond the minimum REIT distribution, to avoid these taxes.

Any distributions that we make will directly impact our NAV, by reducing the amount of our assets. Our goal is to generate returns to our Members in the form of income through regular distributions and capital growth through increases in our NAV per Unit. Over the course of your investment, your distributions plus the change in NAV per Unit (either positive or negative), less any applicable Unit redemption fees, will produce your total return. We may pay distributions from sources other than cash flow from operations, including from the proceeds of this offering, and we have no limit on the amounts we may pay from such sources. If you elect to participate in our distribution reinvestment plan, all distributions we pay to you will be automatically reinvested in Units.

Since qualification of the offering the company has distributed $509,093 to its Unitholders. This amount was distributed quarterly to qualifying Unitholders of the previous quarter at a rate of $1.50 per Unit owned. |

| 3 |

| Unit Redemption Program | While you should view your investment in our Units as a long-term investment with limited liquidity, we have adopted a Unit redemption program. We intend to offer partial liquidity for our Members on a quarterly basis in the form of a redemption of a Member’s Units. Each quarter, no more than five percent (5%) of the issued and outstanding Units may be redeemed (the “Aggregate Redemption Cap”), and no more than $100,000 of an individual Member’s Units may be redeemed, while this offering is ongoing. We also may make redemptions upon the death of a Member, or in special circumstances as determined by the Manager (referred to as “exception redemptions”; all other redemptions are referred to as “ordinary redemptions”).

In the event that a redemption request is made by multiple Members, so that the total redemptions requested would be greater than the applicable Aggregate Redemption Cap, the requested redemptions will be maxed at the Aggregate Redemption Cap and will be split among each requesting Member pro rata based on such Member’s redemption request compared to the aggregate redemptions requested for that quarter. The window to request a redemption will begin on the fifteenth (15th) calendar day prior to the end of the applicable quarter and will end on the last day of such quarter. The redemption price per Unit will be the established cost per Unit to the public for the quarter then-ending, as reflected in this offering circular, as supplemented. The redemption price per Unit will be decreased by 6% if a Member requests a redemption (and participates in such redemption) within the first year of such Member’s ownership of Units. The Manager reserves the right, in its sole and absolute discretion, to suspend the Company’s Unit redemption program at any time, without notice, for any reason or no reason. Each Investor acknowledges and agrees that he, she or it is not purchasing the Units because of the possible quarterly redemptions offered by the Company. |

| Management Compensation | The Manager and its affiliates receive fees and expense reimbursements (including appropriately allocated overhead expenses, including salaries) for services relating to this offering and the investment and management of the Company’s assets, as set forth in a property management agreement. These payments include reimbursement for compensation paid to the Sponsor’s employees who are directly engaged in activities on behalf of the Company, other than property management, including, but not limited to marketing and property acquisitions. The Company will not pay the Manager or its affiliates any selling commissions or dealer manager fees in connection with the offer and sale of the Units. In the event we complete a transaction with a third-party partner, we expect that there will be standard fees charged to us by these third-party partners that will not be paid to the Manager or its affiliates. See below and the “Management Compensation” section of this offering circular for more information. |

| Organization and Offering Expenses | We reimburse our Manager for any third-party costs and future third-party organization and offering costs it may incur on our behalf. |

| Acquisition Fee | 3%. We pay our Manager a one-time 3% acquisition fee per acquisition, calculated on the initial purchase price of each property, which is paid at or shortly after the initial closing on the property. |

| 4 |

| Property Management Fee | 10%. We pay our Manager a monthly 10% property management fee, which is calculated as 10% of all rent collected for each month, and the fee is paid monthly. Investors will not pay upfront carry fees or entry fees, and there will be no fees for liquidation other than in the first twelve (12) months. |

| Maintenance and Repair Reserve | Varied, depending on the specific property. We pay the Manager a fixed dollar amount per month per property that is set at the time the Company purchases/acquires the property from the Manager, and is based on the condition and anticipated needs of that particular property. This fee is paid monthly. This fee will be the maximum amount the Company will have to pay towards repairs and maintenance of each property; any repairs and/or maintenance costs above and beyond this fee will be paid for by the Manager. |

| Capital Improvements and Normal Wear and Tear Conversion Costs | Capital improvements on properties owned by the Company are paid for by the Company, as are the costs of refreshing or renovating properties owned by the Company when leases expire and the properties require updating prior to renting again. These costs may include, but are not limited to, new paint, carpet, minor repairs, and other updates that may be needed to re-lease the property at appropriate market rates, as determined solely by the Manager. |

| Disposition Fee | 3%. We will pay the Manager a one-time 3% disposition fee, per disposition, which will be calculated on the final disposition value when a property is sold, utilized in a 1031 exchange, or otherwise disposed of by the Manager on behalf of the Company, which will be paid at or shortly after closing on the property. |

| Built-in Gain | It is likely that the Sponsor will realize gain when it sells a curated real property asset to the Company. For example, if the Sponsor acquires a single-family home for $100,000, and puts $50,000 into the property, and the subsequent third-party certified real estate appraiser appraises the fair market value of the property at $200,000, the Sponsor will realize gain equal to the difference of the price it sells the curated property to the Company (which will be no more than the fair market value, or in this case $200,000) less the Sponsor’s all-in cost of $150,000. The Sponsor may take some of this gain in the form of Company equity. |

| Operating Expenses | We reimburse our Manager for out-of-pocket expenses incurred on our behalf, including legal fees, license fees, auditing fees, fees associated with SEC reporting requirements, acquisition expenses, interest expenses, insurance costs, tax return preparation fees, marketing costs, taxes and filing fees, administration fees, fees for the services of independent directors, and third-party costs associated with the aforementioned expenses. |

| Term | We expect to offer the Units in this offering until the earlier of June 21, 2025, which is three years from the qualification date of this offering, or the date on which the maximum offering amount has been raised; provided, however, that our Manager may terminate this offering at any time or extend the offering. If we decide to extend this offering beyond three years from the date of this offering circular, we will provide this information in an offering circular supplement; however, in no event will we extend this offering beyond 180 days after the third anniversary of the initial qualification date. |

| Liquidity Event | While we expect to seek a liquidity transaction in the future, there can be no assurance that a suitable transaction will be available or that market conditions for a transaction will be favorable at any time. The Manager has the discretion to consider and execute a liquidity transaction at any time if it determines such event to be in our best interests. A liquidity transaction could include the sale of the Company, the sale of all or substantially all of our assets, a merger or similar transaction, the listing of our Units for trading on a national securities exchange or an alternative strategy that would result in a significant increase in the opportunities for Members to dispose of their Units. Member approval would be required for the sale of all or substantially all of our assets, the sale of the Company or certain mergers of the Company. |

| Member Meetings | The Members may, but shall not be required to, hold an annual, special or other periodic formal meeting. Meetings of the Members may be called at any time or from time to time by the Manager or those Members holding at least fifty percent (50%) of the Units. |

| Member Reports | We will provide you with periodic updates on our business and financial performance, including an annual report, supplements to the offering circular and other reports that we may file or furnish to the SEC from time to time. We will provide this information to you by posting such information on the SEC’s website at www.sec.gov, on the RootsCom Platform at www.investwithroots.com or via e-mail. We will also provide you with Form 1099-DIV tax information, if required, in electronic form by March 15 of the year following each taxable year. |

| 5 |

QUESTIONS AND ANSWERS ABOUT THIS OFFERING

The following questions and answers about this offering highlight material information regarding the Company and this offering, including in some cases information that is not otherwise addressed in the “Offering Summary” section of this offering circular. You should read this entire offering circular, including the section entitled “Risk Factors,” before deciding to purchase the Units.

Questions about Roots Real Estate Investment Community I, LLC

| Q: | What is Roots Real Estate Investment Community I, LLC? |

| A: | Roots Real Estate Investment Community I, LLC (“RootsCom,” the “Company,” “Roots,” “the REIT,” “we,” “us,” or “our”) is a Georgia limited liability company formed to invest in and manage a diversified portfolio of residential real estate investments, including equity in residential real estate ventures and other real estate-related assets. |

| Q: | What is a REIT? |

| A: | In general, a REIT is an entity that: (i) owns or finances income-producing real estate; (ii) allows investors to invest in portfolios of properties through the purchase of stock; (iii) qualifies as a REIT for U.S. federal income tax purposes, and is therefore generally not subject to federal corporate income taxes on its net income that is distributed, which substantially eliminates the “double taxation” treatment (i.e., taxation at both the corporate and stockholder levels) that generally results from investments in a corporation; and (iv) pays distributions to investors of at least 90% of its annual REIT taxable income. |

| Q: | Why should I invest in real estate investments? |

| A: | Potential to generate income and opportunity for capital appreciation — A key feature of real estate investment is the significant proportion of total return accruing from rental income over the long term. Rental income can allow an investor to hold a real estate investment through market cycles without having to liquidate the investment to generate cash flow. In addition, investing in residential real estate may provide an investor with the opportunity for capital appreciation. |

| Asset class diversification with potential to reduce volatility of a portfolio — Adding real estate to an investment mix may increase the investor’s portfolio diversification. According to studies published by the National Council of Real Estate Investment Fiduciaries, real estate has a low or negative correlation to other major asset classes and over time has exhibited less volatility in total returns. | |

| Potential to hedge against inflation — Real estate has the potential to hedge against inflation because property values and rents have historically been positively correlated with growth in inflation. Appreciation in property values can be as significant a part of a real estate investment as cash flow from rental income. Rents are typically tied to inflation, and a property’s value is tied to its rental income. So as inflation drives up rent, the value of the underlying property typically increases as well. Inflation also generally makes new construction more expensive because the cost of building materials rises. Less new construction could also lead to an increase in the value of existing properties. | |

| Q: | Who might benefit from investing in the Company’s Units? |

| A: | An investment in the Units may be beneficial for any investor seeking to diversify a personal portfolio with a real estate investment vehicle focused primarily on residential real estate, who seeks to receive current income, seeks to preserve capital and is able to hold the investment for a time period consistent with the Company’s liquidity strategy. On the other hand, the Company cautions investors who require immediate liquidity or guaranteed income, or who seek a short-term investment, that an investment in the Units will not meet those needs. |

| 6 |

| Q: | Are there any risks involved in buying the Company’s Units? |

| A: | Investing in the Units involves a high degree of risk. If the Company is unable to effectively manage the impact of these risks, it may not meet its investment objectives, and therefore, investors should purchase these securities only if they can afford a complete loss of their investment. See “Risk Factors” for a description of the risks relating to this offering and an investment in the Units. |

| Q: | What will you do with the proceeds from this offering? |

| A: | We expect to use substantially all of the net proceeds from this offering (after paying or reimbursing organization and offering expenses) to own and manage a diversified portfolio of equity investments in single-family and multifamily residential properties located in target markets initially in the State of Georgia. We have loaned, and intend to continue to loan, funds needed for acquisitions to our Sponsor at an interest rate of no less than 6% per year, which will be secured by the real property and will be repaid or cancelled upon the Sponsor’s sale of the curated real property to the Company (or our subsidiary). Any expenses or fees payable to our Manager for its services in connection with managing our daily affairs are typically paid from cash flow from operations. If such fees and expenses are not paid from cash flow, they will reduce the cash available for investment and distribution and will directly impact our NAV. See “Management Compensation” for more details regarding the fees that will be paid to our Manager and its affiliates. |

| We may not be able to promptly invest the net proceeds of this offering in real estate. Additionally, from time to time, we will have excess cash that we need to manage, pending its distribution to our Members or investment by us in accordance with our investment strategy. Our intention is to use any excess cash to provide short term loans to our Manager at interest rates that are at market rate or above, providing the Manager with capital to purchase additional properties to curate for investment by RootsCom. The Company believes that the ability to lend excess cash at market rates or above to our Manager will help stabilize returns for our Members. | |

| Q: | Will the distributions I receive be taxable as ordinary income? |

| A: | REIT distributions, including distributions that are reinvested pursuant to our distribution reinvestment plan, may be treated as ordinary income, capital gains, and return of capital for tax purposes, each of which may be taxed at a different rate for different investors: |

| ● | The majority of recurring REIT distributions will be taxed at your ordinary income rate if they are from current or accumulated earnings and profits. However, currently, taxpayers may also generally deduct 20% of combined qualified business income, which includes “qualified REIT dividends” (through December 31, 2025). | |

| ● | The portion of your distribution in excess of current and accumulated earnings and profits will be considered a return of capital for U.S. federal income tax purposes and will not result in current tax, but will lower the tax basis of your investment until it is reduced to, but not below, zero. Any return of capital in excess of your tax basis will be treated as sales proceeds from the sale of Units and will be taxed accordingly. | |

| ● | Distributions that are designated as capital gain will generally be taxable at the long-term capital gains rate. |

| Because each investor’s tax considerations are different, we recommend that you consult with your tax advisor. You also should review the section of this offering circular entitled “U.S. Federal Income Tax Considerations,” for a discussion of the special rules applicable to distributions in the redemption of Units and liquidating distributions | |

| Q: | Will I be able to reinvest my cash distributions in additional Units? |

| A: | Yes. If you elect to participate in our distribution reinvestment plan, all distributions we pay to you will be automatically reinvested in the Units. See “Description of Our Units – Distribution Reinvestment Plan.” |

| 7 |

| Q: | What amount will you pay for Units redeemed pursuant to the Units redemption program? |

| A: | We intend to offer partial liquidity for our Members on a quarterly basis in the form of a redemption of a Member’s Units. Each quarter, no more than five percent (5%) of the issued and outstanding Units may be redeemed (the “Aggregate Redemption Cap”), and no more than $100,000 of an individual Member’s Units may be redeemed, while this offering is ongoing. We also may make redemptions upon the death of a Member or in other special circumstances as determined by the Manager (referred to as “exception redemptions”; all other redemptions are referred to as “ordinary redemptions”). |

| In the event that a redemption request is made by multiple Members, so that the total redemptions requested would be greater than the applicable Aggregate Redemption Cap, the requested redemptions will be maxed at the Aggregate Redemption Cap and will be split among each requesting Member pro rata based on such Member’s redemption request compared to the aggregate redemptions requested for that quarter. The window to request a redemption will begin on the fifteenth (15th) calendar day prior to the end of the applicable quarter and will end on the last day of such quarter. The redemption price per Unit will be the established cost per Unit to the public for the quarter then-ending, as reflected in this offering circular, as supplemented. The redemption price per Unit will be decreased by 6% if a Member requests a redemption (and participates in such redemption) within the first year of such Member’s ownership of Units. The Manager reserves the right, in its sole and absolute discretion, to suspend the Company’s Unit redemption program at any time, without notice, for any reason or no reason. Each Investor acknowledges and agrees that he, she or it is not purchasing the Units because of the possible quarterly redemptions offered by the Company. | |

| Q: | How is an investment in the Units different from investing in units of a listed REIT? |

| A: | The fundamental difference between our Units and a listed REIT is the daily liquidity available with a listed REIT. Although we have adopted a Unit redemption program that may allow investors to request a redemption of Units on a quarterly basis, for investors with a short-term investment horizon, a listed REIT may be a better alternative than investing in our Units. However, we believe our Units are an alternative way for investors to deploy capital into one or more real estate assets, with a lower correlation to the general stock market than listed REITs. |

| Another fundamental difference between our Units and a listed REIT is that listed REITs tend to align with the volatility of the stock market, whereas our Unit price is tied directly to the NAV of the Company, which is based on the value of the actual real estate. | |

| Q: | How is an investment in your Units different from investing in units of a traditional non-exchange traded REIT? |

| A: | We do not charge any upfront fees for selling our Units, saving investors from expenses as compared to a traditional non-exchange traded REIT. Traditional non-exchange traded REITs use a highly manpower-intensive method with hundreds to thousands of sales brokers calling on investors to sell their offerings. Our Sponsor is primarily using a lower-cost digital platform to conduct this offering, thus reducing the financial burdens to us of offering our Units. Additionally, an investment in our Units creates a community inspired opportunity for the Residents of our properties to participate in actual ownership through a potential investment in the Company. Our “Live in it Like You Own It” program is designed to create real wealth building opportunities for our Residents, and if they become Members of the Company, they also become aligned with the investment objectives of all other Members of the Company. |

| 8 |

| Q: | Who can buy Units? |

| A: | Generally, you may purchase Units if you are a “qualified purchaser” (as defined in Regulation A). “Qualified purchasers” include:· |

| ● | “accredited investors” as defined under Rule 501(a) of Regulation D; and | |

| ● | all other investors so long as their investment in our Units does not represent more than 10% of the greater of their annual income or net worth (for natural persons), or 10% of the greater of annual revenue or net assets at fiscal year-end (for non-natural persons). |

| For purposes of determining whether a potential investor is a “qualified purchaser,” annual income and net worth should be calculated as provided in the “accredited investor” definition under Rule 501 of Regulation D. In particular, net worth in all cases should be calculated excluding the value of an investor’s home. We reserve the right to reject any investor’s subscription in whole or in part for any reason, including if we determine in our sole and absolute discretion that such investor is not a “qualified purchaser” for purposes of Regulation A. See “State Law Exemption and Purchase Restrictions” above for more information. | |

| Q: | How do I buy Units? |

| A: | You may purchase our Units in this offering by creating a new account, or logging into your existing account, at the RootsCom Platform. You will need to fill out a subscription agreement like the one attached as an exhibit to this offering circular and make arrangements to pay for the Units at the time you subscribe. |

| Q: | Is there any minimum investment required? |

| A: | Yes. The minimum initial investment in this offering is $118.00. You should note that an investment in our Units will not, in itself create a retirement plan and that, in order to create a retirement plan, you must comply with all applicable provisions of the Code. In the Manager’s discretion, we may in the future increase or decrease the minimum investment amount for all new purchasers. We will disclose any new minimum investment amount on the RootsCom Platform at least two days in advance of that new minimum amount taking effect. Factors that the Manager may consider in modifying the minimum investment amount include, but are not limited to, our need for additional capital, the success of our prior capital-raising efforts, and the amount of money raised from our investors who invest the minimum amount versus the amount of money we have raised from investors contributing greater amounts. |

| Q: | May I make an investment through my IRA or other tax-deferred retirement account? |

| A: | Yes. Subject to certain restrictions set forth in this offering circular, you will be able to make an investment through your individual retirement account, or IRA, or other tax-deferred account. When making investment decisions, you should consider, at a minimum, (i) whether the investment is in accordance with the documents and instruments governing your IRA or other deferred tax account; (ii) whether the investment is consistent with the fiduciary and other obligations associated with your IRA or other tax deferred account; (iii) whether the investment will generate an unacceptable amount of Unrelated Business Taxable Income, or “UBTI,” for your IRA or other tax deferred account; (iv) whether you will be able to comply with the requirements under the Employee Retirement Income Security Act of 1974, as amended, or ERISA, and the Code that you value the assets of the IRA or other tax deferred account annually; and (v) whether the investment would constitute a prohibited transaction under applicable law. |

| Q: | Are there special considerations that apply to employee benefit plans subject to ERISA or other retirement plans that are investing in Units? |

| A: | Yes. The section of the offering circular entitled “ERISA Considerations” describes the effect the purchase of Units will have on IRAs and retirement plans subject to ERISA, and/or the Code. ERISA is a federal law that regulates the operation of certain tax-advantaged retirement plans. Any retirement plan trustee or individual considering purchasing Units for a retirement plan or an IRA should carefully read that section of the offering circular. We may make some investments that generate UBTI or, in certain circumstances, can result in a tax being imposed on us. Although we do not expect the amount of such income to be significant, there can be no assurance in this regard. |

| 9 |

| Q: | Is there a maximum investment? |

| A: | Yes. You cannot own more than 9.8% in value of our outstanding Units or more than 9.8% in value or number of Units, whichever is more restrictive, of our outstanding Units at any time. Additionally, if you do not qualify as an accredited investor, you may invest no more than the greater of (i) 10% of your annual income, or (ii) 10% of your net worth, as calculated under Rule 501 of Regulation D. If you want to invest more than the limitations set forth in the preceding sentence, you must qualify as an “accredited investor” as defined in Rule 501 of Regulation D. |

| Q: | How is the Company’s NAV per Unit calculated? |

| A: | The Manager calculates our NAV per Unit. The NAV per Unit calculation reflects the total value of our assets minus the total value of our liabilities, divided by the number of Units outstanding as of the close of the last business day of the prior fiscal quarter. Our real estate assets, loans, and investments constitute a significant component of our total assets. We take estimated values of each of our real estate assets, loans, and investments, including related liabilities, based upon performance, market default rates, discount rates, loss severity rates, and, if the Manager deems it necessary, individual appraisal reports of the underlying real estate assets provided periodically by an independent valuation expert. The independent valuation expert is not responsible for and does not prepare our quarterly NAV per Unit. However, we may hire a third party to calculate, or assist with calculating, the quarterly NAV per Unit. See “Description of Our Units—Valuation Policies” for more details about our NAV and how it will be calculated. |

| Q: | How exact will the calculation of the quarterly NAV per Unit be? |

| A: | Our goal is to provide a reasonable estimate of the value of the Units as of the end of each fiscal quarter. Our assets will consist principally of ownership of a diverse portfolio of single family and multifamily properties located in target markets, initially in the State of Georgia (and more specifically, the Atlanta MSA), but also potentially target markets throughout the United States, and real estate backed loans to our Manager and/or Sponsor. The valuation of the real estate investments by our Manager (with the input of our independent valuation expert, as needed) is subject to a number of subjective judgments and assumptions that may not prove to be accurate. The use of different judgments or assumptions would likely result in different estimates of the value of our real estate investments. Moreover, although we evaluate and provide our NAV per Unit on a quarterly basis, our NAV per Unit may fluctuate daily, so that the NAV per Unit in effect for any fiscal quarter does not represent (i) the price at which our Units would trade on a national securities exchange, (ii) the amount per Unit a Member would obtain if he, she or it tried to sell his, her or its Units or (iii) the amount per Unit Members would receive if we liquidated our assets and distributed the proceeds after paying all our expenses and liabilities. Further, for any given quarter, our published NAV per Unit may not fully reflect certain material events to the extent that they are not known or their financial impact on our portfolio is not immediately quantifiable. We will use commercially reasonable efforts to monitor whether a material event occurs in between quarterly updates of NAV that we reasonably believe would cause our NAV per Unit to change by 5% or more from the last disclosed NAV. While this offering is ongoing, if we reasonably believe that such a material event has occurred, we will calculate and disclose the updated NAV per Unit and the reason for the change in an offering circular supplement as promptly as reasonably practicable, and will update the NAV per Unit information provided on our website. Any resulting potential disparity in our NAV per Unit may be in favor of either Members who have their Units redeemed, or Members who buy new Units, or existing Members. See “Description of Our Units—Valuation Policies.” |

| 10 |

| Q: | What is the structure of the REIT? |

| A: | The chart below shows the relationship among the Company and its affiliates, including its Manager and the Sponsor. |

| Q: | Who can help answer an investor’s questions about the offering? |

| A: | If an investor has more questions about the offering or wishes to obtain additional copies of this offering circular, the investor should contact the Company by email at investments@investwithroots.com or by mail or phone at: |

Roots Real Estate Investment Community I, LLC

1344 La France Street NE

Atlanta, GA 30307

(404)-732-5910

Attn: Investor Relations

| 11 |

An investment in the Units involves substantial risks. You should carefully consider the following risk factors in addition to the other information contained in this offering circular before purchasing the Units. You should purchase the Units only if you can afford a complete loss of your investment. The risks and uncertainties discussed below are not the only ones we face, but do represent those risks and uncertainties that we believe are most significant to our business, operating results, prospects and financial condition. Some statements in this offering circular, including statements in the following risk factors, constitute forward-looking statements. See “Cautionary Note Regarding Forward-Looking Information.”

Risks Related to an Investment in Roots Real Estate Investment Community I, LLC

Because no public trading market for our Units currently exists, it will be difficult for you to sell your Units and, if you are able to sell your Units, you will likely sell them at a substantial discount to the public offering price.

Our operating agreement does not require the Manager to seek Member approval to liquidate our assets by a specified date, nor does our operating agreement require the Manager to list our Units for trading on a national securities exchange by a specified date. There is no public market for our Units. While we and our affiliates may explore developing a secondary trading market for our Units, it is possible that we will not be able to, or will decide not to, develop such a market. Our operating agreement prohibits the ownership of more than 9.8% in value of our outstanding Units or more than 9.8% in value or number of Units, whichever is more restrictive, of our outstanding Units unless exempted prospectively or retroactively by the Manager, which may inhibit large investors from purchasing your Units. Following the conclusion of this offering, in its sole discretion, including to protect our operations and our remaining Members, to prevent an undue burden on our liquidity or to preserve our status as a REIT, the Manager could amend, suspend or terminate our Unit redemption program without notice. Further, the Unit redemption program includes numerous restrictions that would limit your ability to sell your Units. We describe these restrictions in more detail under “Description of Our Units — Quarterly Redemption Program.” Therefore, it will be difficult for you to sell your Units promptly or at all. If you are able to sell your Units, you would likely have to sell them at a substantial discount to their public offering price. It is also likely that your Units would not be accepted as the primary collateral for a loan. Because of the illiquid nature of our Units, you should purchase Units only as a long-term investment and be prepared to hold them for an indefinite period of time.

If we are unable to find suitable investments, or are delayed in finding suitable investments we may not be able to achieve our investment objectives or pay distributions in a timely manner, or at all.

Our ability to achieve our investment objectives and to pay distributions depends upon the performance of our Manager, on behalf of the Sponsor, in the acquisition of real estate that meets our investment guidelines. You must rely entirely on the management abilities of our Manager.

Further, because we are raising a “blind pool” whereby we are not committed to investing in any particular assets, it may be difficult for us to invest the net offering proceeds promptly and on attractive terms.

We cannot assure you that our Manager will be successful in continually obtaining suitable investments on financially attractive terms or that our objectives will be achieved. If we are consistently unsuccessful in locating suitable investments, we may ultimately decide to liquidate. In the event we are unable to continually timely locate suitable investments, we may be unable or limited in our ability to pay distributions, and we may not be able to meet our investment objectives.

| 12 |

We may allocate the net proceeds from this offering to investments with which you may not agree.

We will have significant discretion in the types of investments we will make with the net proceeds of this offering. You will be unable to evaluate the manner in which the net proceeds of this offering will be invested or the economic merit of our expected investments and, as a result, we may use the net proceeds from this offering to invest in investments with which you may not agree. The failure of our management to apply these proceeds effectively or find investments that meet our investment criteria in sufficient time or on acceptable terms could result in unfavorable returns and could cause the value of our Units to decline.

We may be unable to pay or maintain cash distributions or increase distributions over time.

There are many factors that can affect the availability and timing of cash distributions to our Members. Distributions are based primarily on anticipated cash flow from operations over time. The amount of cash available for distributions is affected by many factors, such as the performance of our Manager in selecting investments, selecting tenants for our properties and securing financing arrangements, our ability to buy properties as offering proceeds become available, the amount of rental income from our properties, and our operating expense levels, as well as many other variables. We may not always be in a position to pay distributions to you and any distributions we do make may not increase over time. In addition, our actual results may differ significantly from the assumptions used by the Manager in establishing the distribution rate to our Members. There also is a risk that we may not have sufficient cash flow from operations to fund distributions required to qualify as a REIT or maintain our REIT status.

We may pay some of our distributions from sources other than cash flow from operations, including borrowings, proceeds from asset sales or the sale of our securities in this or future offerings, which may reduce the amount of capital we ultimately invest in real estate and may negatively impact the value of your investment in our Units.

To the extent that cash flow from operations is insufficient to fully cover our distributions to our Members, we may pay some of our distributions from sources other than cash flow from operations. Such sources may include borrowings, proceeds from asset sales or the sale of our securities in this or future offerings. We have no limits on the amounts we may pay from sources other than cash flow from operations. The payment of distributions from sources other than cash provided by operating activities may reduce the amount of proceeds available for investment and operations or cause us to incur additional interest expense as a result of borrowed funds, and may cause subsequent investors to experience dilution. This may negatively impact the value of your investment in our Units.

Because we may pay distributions from sources other than our cash flow from operations, distributions at any point in time may not reflect the current performance of our properties or our current operating cash flows.

Our organizational documents permit us to make distributions from any source, including the sources described in the risk factor above. Because the amount we pay out in distributions may exceed our earnings and our cash flow from operations, distributions may not reflect the current performance of our properties or our current operating cash flows. To the extent distributions exceed cash flow from operations, distributions may be treated as a return of your investment and could reduce your basis in our Units. A reduction in a Member’s basis in our Units could result in the Member recognizing more gain upon the disposition of his or her Units, which, in turn, could result in greater taxable income to such Member.

Future disruptions in the financial markets or deteriorating economic conditions could adversely impact the residential real estate market as well as the market for debt-related investments generally, which could hinder our ability to implement our business strategy and generate returns to you.

We intend to acquire a portfolio of single family and multifamily real estate assets, which may be significantly impacted by economic conditions. See “Risk Factors — Risks Related to Our Units and Investments in Real Estate.” The value of our real estate assets or the collateral securing or underlying any debt investment we make could decrease below our investment or outstanding principal amount of such investment. In addition, revenues on the properties and other assets underlying any investments we may make could decrease, making it more difficult for tenants or operators to meet their payment obligations to us. Each of these factors would increase the likelihood of default, which would likely have a negative impact on the value of our investment.

Future disruptions in the financial markets or deteriorating economic conditions may also impact the market for our investments and the volatility of our investments. The returns available to investors in our targeted investments are determined, in part, by: (i) the supply and demand for such investments and (ii) the existence of a market for such investments, which includes the ability to sell or finance such investments. During periods of volatility, the number of investors participating in the market may change at an accelerated pace. If either demand or liquidity increases, the cost of our targeted investments may increase. As a result, we may have fewer funds available to make distributions to investors.

| 13 |

All of the factors described above could adversely impact our ability to implement our business strategy and make distributions to our investors and could decrease the value of an investment in us.

This is a blind pool offering, and we are not committed to acquiring any particular investments with the net proceeds of this offering. You may not have the opportunity to evaluate our investments before we make them, which makes your investment more speculative.

This is a blind pool offering whereby we have not yet acquired and are not committed to acquiring any particular assets or investments with the net proceeds of this offering. Apart from any investments that may be described in supplements to this offering circular, we are not able to provide you with any information to assist you in evaluating the merits of any specific investments that we may make. We will seek to invest substantially all of the offering proceeds available for investment, after the payment of fees and expenses, in residential properties located in target markets throughout the United States. Except as noted above, because you will be unable to evaluate the economic merit of assets before we invest in them, you will have to rely entirely on the ability of our Manager to select suitable and successful investment opportunities. These factors increase the risk that your investment may not generate returns comparable to our competitors.

Because we are limited in the amount of funds we can raise, we will be limited in the number and type of investments we make and the value of your investment in us will fluctuate with the performance of the specific assets we acquire.

This offering is being made on a “best efforts” basis and we have begun to invest net proceeds from this offering since commencement of this offering. Further, under Regulation A, we are only allowed to raise up to $75 million in any 12-month period pursuant to this offering (although we may raise capital in other ways). We expect the size of the residential real estate loans and equity investments that we make will continue to average to about $120,000 to $5.0 million per asset. If we are unable to raise substantial funds, we will make fewer investments resulting in less diversification in terms of the type, number and size of investments that we make. Further, we will have certain fixed operating expenses, including certain filings with the SEC, regardless of whether we are able to raise substantial funds in this offering. Our inability to raise substantial funds would increase our fixed operating expenses as a percentage of gross income, reducing our net income and limiting our ability to make distributions.

Our investments may be concentrated and will be subject to risk of default.

While we intend to diversify our portfolio of investments in the manner described in this offering circular, we are not required to observe specific diversification criteria. To the extent that our portfolio is concentrated in any one geographic region, downturns relating generally to such region may result in tenant defaults with respect to our real estate assets within a short time period, which may reduce our net income and the value of our Units and accordingly may reduce our ability to pay distributions to you.

We are dependent on our Manager’s and Sponsor’s key personnel for our success.