AN OFFERING STATEMENT PURSUANT TO REGULATION A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. INFORMATION CONTAINED IN THIS PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED BEFORE THE OFFERING STATEMENT FILED WITH THE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF SUCH STATE. THE COMPANY MAY ELECT TO SATISFY ITS OBLIGATION TO DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO BUSINESS DAYS AFTER THE COMPLETION OF THE COMPANY’S SALE TO YOU THAT CONTAINS THE URL WHERE THE FINAL OFFERING CIRCULAR OR THE OFFERING STATEMENT IN WHICH SUCH FINAL OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

PRELIMINARY OFFERING CIRCULAR DATED FEBRUARY 4, 2021

INNOVEGA INC

11900 NE 1st St, Ste. 300, Bellevue, WA 98005

(425) 214-7300

www.Innovega-inc.com

UP TO 5,000,000 SHARES OF SERIES A-1 PREFERRED STOCK

UP TO 5,000,000 SHARES OF COMMON STOCK INTO WHICH THE SERIES A-1 PREFERRED STOCK MAY CONVERT

PRICE: $3.00 PER SHARE

| Price to Public | Underwriting discount and commissions* | Proceeds to issuer** | ||||||||||

| Per share | $ | 3.00 | $ | 0.255 | $ | 2.745 | ||||||

| Total Minimum | $ | 750,000 | $ | 63,750 | $ | 686,250 | ||||||

| Total Maximum | $ | 15,000,000 | $ | 1,275,000 | $ | 13,725,00 | ||||||

*The Series A-1 Preferred Stock is convertible into Common Stock either at the discretion of the investor or automatically upon the occurrence of certain events, like effectiveness of a registration statement for the Common Stock in a qualified initial public offering, as hereinafter defined. The total number of shares of the Common Stock into which the Series A-1 Preferred Stock may be converted will be determined by dividing the original issue price per share by the conversion price per share. See “Securities Being Offered” at page 32 for additional details.

** The company has engaged SI Securities, LLC to serve as its sole and exclusive placement agent to assist in the placement of its securities. The company will pay SI Securities, LLC in accordance with the terms of the Issuer Agreement between the company and SI Securities, LLC, a copy of which is filed as an exhibit to the Offering Statement of which this Offering Circular is a part. If the placement agent identifies all the investors and the maximum number of shares is sold, the maximum amount the company would pay SI Securities, LLC is $1,275,000. This does not include transaction fees paid directly to SI Securities, LLC by investors. See “Plan of Distribution and Selling Securityholders” for details of compensation and transaction fees to be paid to the placement agent on page 12. Pursuant to the Issuer Agreement, Company shall pay to SI Securities, in cash, an amount equal to 8.5% of the value of Securities purchased by prospects in the Offering from the proceeds of the Offering (the “Compensation”) at each applicable closing (a “Closing”). SI Securities charges Prospects who make investments through the Online Platform a 2% non-refundable transaction processing fee, up to $300 (the “Transaction Fee”), and which company is not responsible for. The Transaction Fee is broken out as follows: i) 50% is meant to cover the financial and administrative costs associated with the processing of payments via Wire, ACH, and Debit transfers; and ii) the remaining 50% is meant to cover the financial and administrative costs of the related and subsequent reconciliation of cash and securities in Prospects accounts.

The company expects that the amount of expenses of the offering that it will pay will be approximately $75,000, not including commissions or state filing fees.

The company is selling shares of Series A-1 Preferred Stock.

The company has engaged The Bryn Mawr Trust Company of Delaware as an escrow agent (the “Escrow Agent”) to hold funds tendered by investors, and assuming we sell a minimum of $750,000 in shares, may hold a series of closings at which we receive the funds from the Escrow Agent and issue the shares to investors. The offering will terminate at the earlier of: (1) the date at which the maximum offering amount has been sold, (2) one year from the date upon which the Securities and Exchange Commission qualifies the Offering Statement of which this Offering Circular forms a part, or (3) the date at which the offering is earlier terminated by the company in its sole discretion. In the event we have not sold the minimum number of shares by ——————, 2021 or sooner terminated by the company, any money tendered by potential investors will be promptly returned by the Escrow Agent. The company may undertake one or more closings on a rolling basis once the minimum offering amount is sold. After each closing, funds tendered by investors will be available to the company. The offering is being conducted on a best-efforts basis.

INVESTING IN THE SERIES A-1 PREFERRED STOCK OF INNOVEGA INC. IS SPECULATIVE AND INVOLVES SUBSTANTIAL RISKS. YOU SHOULD PURCHASE THESE SECURITIES ONLY IF YOU CAN AFFORD A COMPLETE LOSS OF YOUR INVESTMENT. SEE “RISK FACTORS” BEGINNING ON PAGE 5 TO READ ABOUT THE MORE SIGNIFICANT RISKS YOU SHOULD CONSIDER BEFORE BUYING THE SERIES A-1 PREFERRED STOCK OF THE COMPANY.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OR GIVE ITS APPROVAL OF ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(d)(2)(i)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO www.investor.gov.

Sales of these securities will commence on approximately __________, 2021.

The company is following the “Offering Circular” format of disclosure under Regulation A.

In the event that we become a reporting company under the Securities Exchange Act of 1934, we intend to take advantage of the provisions that relate to “Emerging Growth Companies” under the JOBS Act of 2012. See “Implications of Being an Emerging Growth Company.”

TABLE OF CONTENTS

In this Offering Circular, the term “Innovega”, “we”, “us”, “our” or “the company” refers to Innovega Inc.

THIS OFFERING CIRCULAR MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY’S MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS “ESTIMATE,” “PROJECT,” “BELIEVE,” “ANTICIPATE,” “INTEND,” “EXPECT” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS, WHICH CONSTITUTE FORWARD LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT’S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE. THE COMPANY DOES NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS OR CIRCUMSTANCES AFTER SUCH DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

| 2 |

Overview

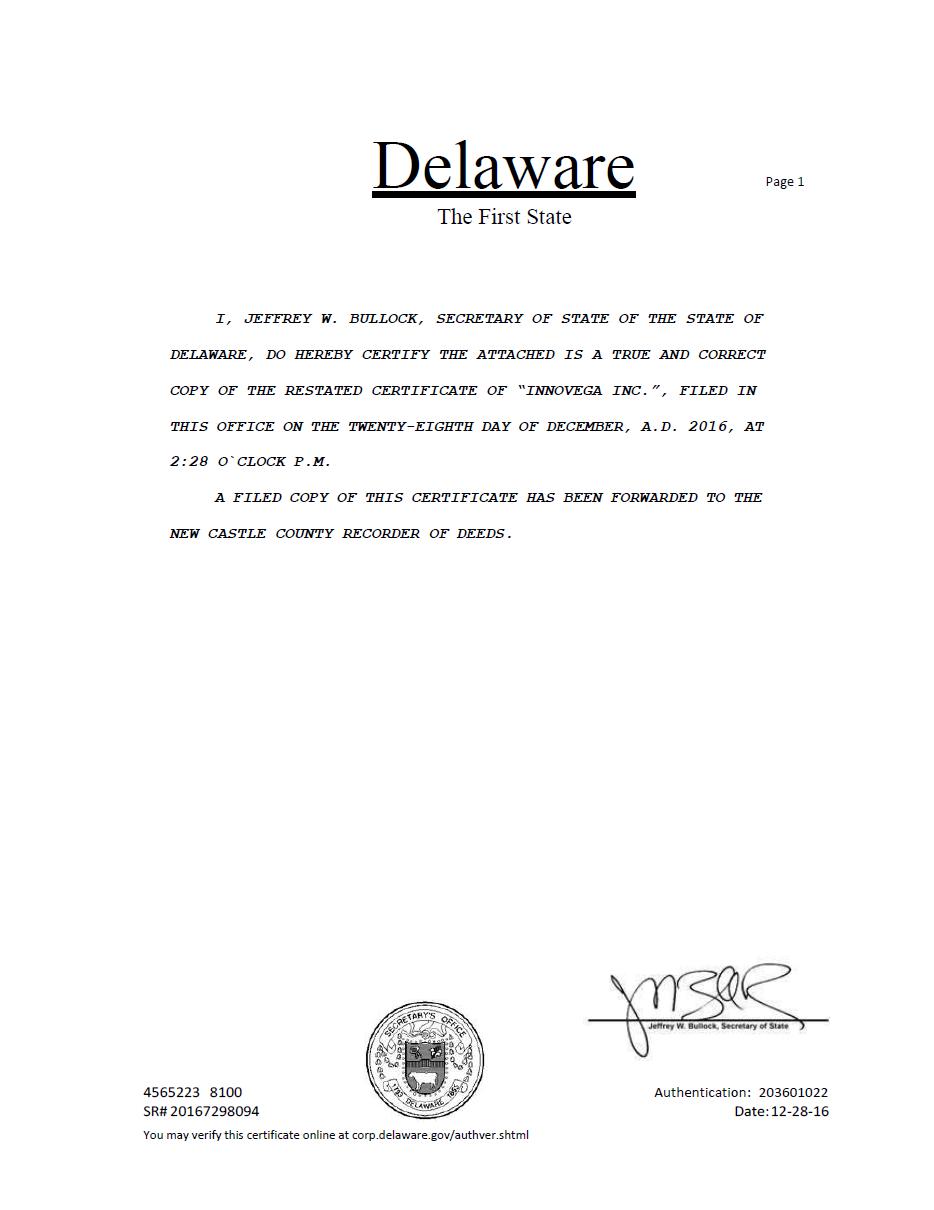

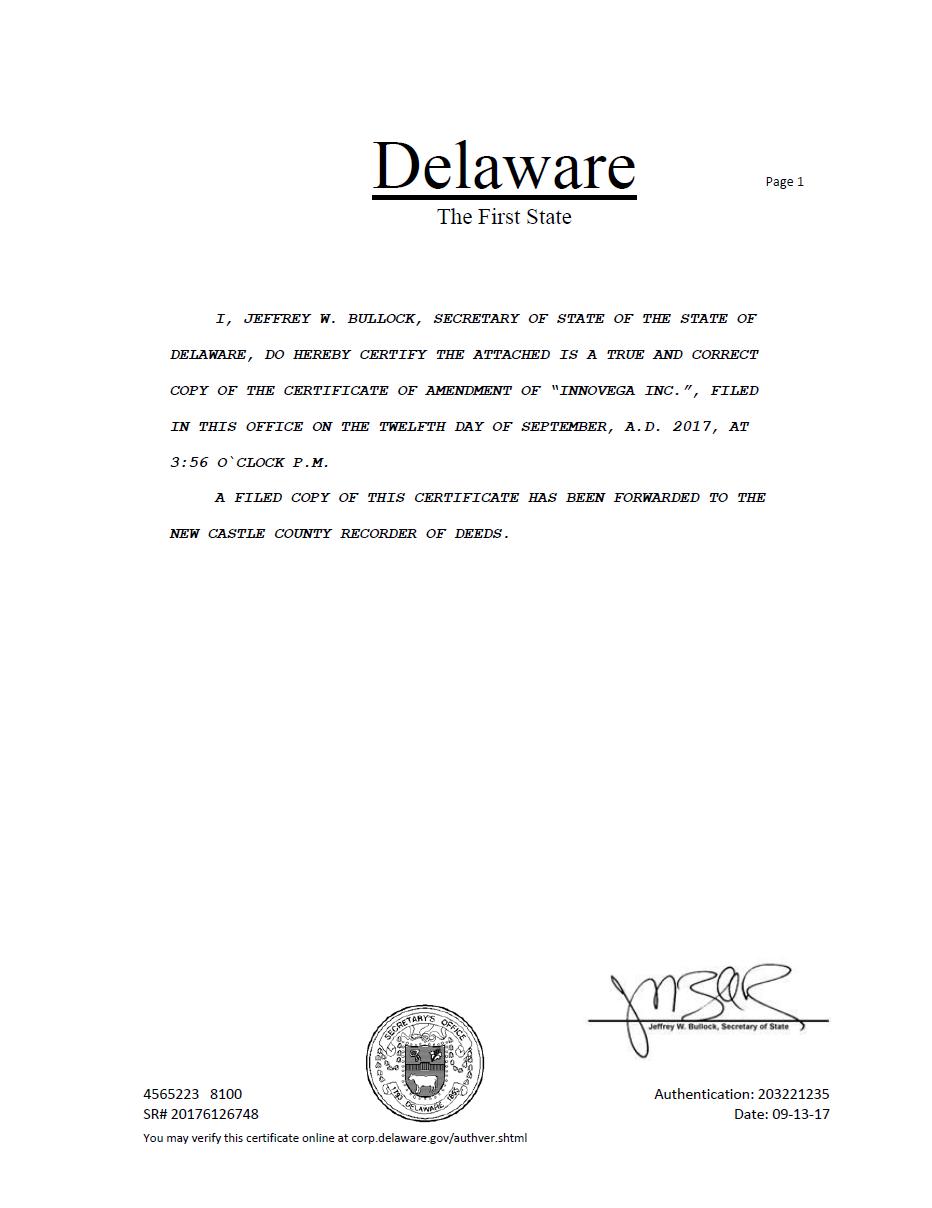

Innovega was incorporated under the laws of the State of Delaware on June 16, 2008 as “Innovega Inc.” Innovega is developing a display eyewear system for Extended Reality (XR) applications, which include Augmented, Virtual and Mixed Reality. Innovega’s Extended Reality eyewear system comprises novel, disposable, smart contact lenses or surgically implanted intraocular lenses, and lightweight, stylish display eyewear. The company has developed prototype contact lenses, intraocular lenses, and display eyewear. Present contact lenses and intraocular lenses include proprietary two-state light polarizing filters and, in the future, may include other filter components. The display eyewear includes a microdisplay screen, electronics, operating software, and depending on the application may include cameras and other sensors. Innovega intends to license its display platform or sell proprietary components to companies that will produce and market Extended Reality lenses and eyewear for applications that could include quality of life enhancement for the sensory impaired, including the visually impaired and legally blind, for the hearing impaired, and for those suffering cognitive or other impairments. Other applications may relate to: anytime and anywhere information and entertainment; telecommunications; video gaming; defense, security and intelligence, and enterprise; surgical visualization and telemedicine; and athlete training and sports analytics.

| Securities offered: | Maximum of 5,000,000 shares of Series A-1 Preferred Stock |

| Securities outstanding before the Offering (as of January 15, 2021) | |

| Common Stock | 9,447,968 shares |

| Preferred Stock – Series Seed | 3,518,238 shares |

Securities outstanding after the Offering:

| Common Stock | 9,447,968 shares |

| Series Seed | 3,518,238 shares |

| Series A-1 Preferred Stock | 5,000,000 shares (1) |

| Series A-2 Preferred Stock | 1,610,514 shares (2) |

| Series A-3 Preferred Stock | 1,123,787 shares (3) |

| (1) | Assumes that all Series A-1 Preferred Stock is sold in this offering. The Board of Directors have approved the Second Amended and Restated Certificate of Incorporation and the Company is in the process of obtaining the requisite shareholder consents to approve it. The Second Amended and Restated Certificate of Incorporation will, among other things, create a new series of Preferred Stock, designated Series A-1 Preferred Stock, consisting of 5,000,000 authorized shares. The Company cannot sell any shares of the Series A-1 Preferred Stock prior to the shareholder approval, the subsequent filing of the Second Amended and Restated Certificate of Incorporation and the receipt of a filed stamped copy. Immediately preceding the initial closing of the offering, the company will file with the State of Delaware, a Second Amended and Restated Certificate of Incorporation to among other things designate the Series A-1 Preferred Stock. | |

| (2) | In 2019, $1,149,592.45 and $1,331,000 convertible notes were sold in two respective offerings. Each note earned an accrued 5% interest. The company expects these notes to convert into a total of 1,610,514 Series A-2 Preferred shares, assuming note interest is earned until a final date of March 31, 2021. | |

| (3) | In 2019 and 2020, the company entered into SAFE agreements for $500,000 and $1,831,875 respectively. The company expects these agreements to convert into a total of 1,123,787 Series A-3 Preferred shares. |

| 3 |

Implications of Being an Emerging Growth Company

As an issuer with less than $1 billion in total annual gross revenues during our last fiscal year, we will qualify as an “emerging growth company” under the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and this status will be significant if and when we become subject to the ongoing reporting requirements of the Exchange Act upon filing a Form 8-A. An emerging growth company may take advantage of certain reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. In particular, as an emerging growth company we:

| ● | will not be required to obtain an auditor attestation on our internal controls over financial reporting pursuant to the Sarbanes-Oxley Act of 2002; | |

| ● | will not be required to provide a detailed narrative disclosure discussing our compensation principles, objectives and elements and analyzing how those elements fit with our principles and objectives (commonly referred to as “compensation discussion and analysis”); | |

| ● | will not be required to obtain a non-binding advisory vote from our shareholders on executive compensation or golden parachute arrangements (commonly referred to as the “say-on-pay,” “say-on-frequency” and “say-on-golden-parachute” votes); | |

| ● | will be exempt from certain executive compensation disclosure provisions requiring a pay-for-performance graph and CEO pay ratio disclosure; | |

| ● | may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations, or MD&A; and | |

| ● | will be eligible to claim longer phase-in periods for the adoption of new or revised financial accounting standards. |

We intend to take advantage of all of these reduced reporting requirements and exemptions, including the longer phase-in periods for the adoption of new or revised financial accounting standards, and hereby elect to do so. Our election to use the phase-in periods may make it difficult to compare our financial statements to those of non-emerging growth companies and other emerging growth companies that have opted out of the phase-in periods under Section 107 of the JOBS Act.

Under the JOBS Act, we may take advantage of the above-described reduced reporting requirements and exemptions for up to five years after our initial sale of common equity pursuant to a registration statement declared effective under the Securities Act of 1933, as amended, or such earlier time that we no longer meet the definition of an emerging growth company. Note that this offering, while a public offering, is not a sale of common equity pursuant to a registration statement, since the offering is conducted pursuant to an exemption from the registration requirements. In this regard, the JOBS Act provides that we would cease to be an “emerging growth company” if we have more than $1 billion in annual revenues, have more than $700 million in market value of our Common Stock held by non-affiliates, or issue more than $1 billion in principal amount of non-convertible debt over a three-year period.

Certain of these reduced reporting requirements and exemptions are also available to us due to the fact that we may also qualify, once listed, as a “smaller reporting company” under the Commission’s rules. For instance, smaller reporting companies are not required to obtain an auditor attestation on their assessment of internal control over financial reporting; are not required to provide a compensation discussion and analysis; are not required to provide a pay-for-performance graph or CEO pay ratio disclosure; and may present only two years of audited financial statements and related MD&A disclosure.

Selected Risks Associated with Our Business

Our business is subject to a number of risks and uncertainties, including those highlighted in the section titled “Risk Factors” immediately following this summary. These risks include, but are not limited to, the following:

| ● | We are a comparatively early-stage company that has incurred operating losses in the past, expect to incur operating losses in the future, and may never achieve or maintain profitability. | |

| ● | Our technology is not yet fully developed, and there is no guarantee that we will ever successfully develop the technology that is essential to our business. | |

| ● | Our business plan is predicated on obtaining market clearance from the Food and Drug Administration (“FDA”) under Section 510(k). Failure to receive market clearance with a first submission will significantly delay the time to first revenue and may require repeating clinical investigations and submissions pursuant to a market clearance. |

| 4 |

| ● | We could be adversely affected by product liability, product recall, personal injury or other health and safety issues. | |

| ● | A lack of third-party reimbursement levels, from private or government agency plans, could materially and adversely affect our results of operations. | |

| ● | We may be subject to patient data protection requirements. | |

| ● | We operate in a highly competitive industry that is dominated by several very large, well-capitalized market leaders and the size and resources of some of our competitors may allow them to compete more effectively than we can. | |

| ● | We rely on third-parties to provide services essential to the success of our business. | |

| ● | We expect to continue to raise additional capital through equity and/or debt offerings to support our working capital requirements and operating losses. | |

| ● | We are controlled by our officers and directors. | |

| ● | In certain circumstances investors will not have dissenters’ rights. | |

| ● | Immediately after this Series A-1 Preferred Stock investment, these holdings will be illiquid. | |

| ● | Investors in this offering may not be entitled to a jury trial with respect to claims arising under the subscription agreement and Amended and Restated Stockholders’ Agreement, which could result in less favorable outcomes to the plaintiff(s) in any action under these agreements. |

The SEC requires the company to identify risks that are specific to its business and its financial condition. The company is still subject to all the same risks that all companies in its business, and all companies in the economy, are exposed to. These include risks relating to economic downturns, political and economic events and technological developments such as cyber-attacks and the ability to prevent such attacks. Additionally, early-stage companies are inherently more risky than more developed companies, and the risk of business failure and complete loss of your investment capital is present. You should consider general risks as well as specific risks when deciding whether to invest.

Risks Related to Our Company

The development and commercialization of the Company’s products and services are highly competitive. We face competition with regard to any products and services that we may seek to develop or commercialize in the future. Our competitors include major companies worldwide. The Augmented and Virtual Reality (AR/VR) markets are an emerging industry where new competitors are entering the market frequently. Many of the Company’s competitors have significantly greater financial, technical and human resources and may have superior expertise in research and development and marketing and may be better equipped than us to develop and commercialize services. These competitors also compete with us in recruiting and retaining qualified personnel and acquiring technologies. Smaller or early-stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies. Accordingly, our competitors may commercialize products more rapidly or effectively than we are able to, which would adversely affect its competitive position, the likelihood that our services will achieve initial market acceptance and our ability to generate meaningful additional revenues from our products and services.

Our expenses will significantly increase as we seek to execute and prove the current licensing business model. Although we estimate that we have enough working capital to fund activities into 2021, our plans are to increase our use of cash to hire additional staff, expand its Research and Development, Clinical and Regulatory efforts, and fund our other operations. Following the closing of this offering we will further increase our activities and expenses. Proving success of our business model will require significant effort and expenses. We will need to raise sufficient working capital to cover these new and higher expenses and if we cannot, we will not be able to execute on our current business model.

| 5 |

Outbreak of the novel coronavirus, COVID-19, has adversely impacted global commercial activity and contributed to significant declines and resulted in volatility in financial markets. The coronavirus pandemic and government responses are creating disruption in global supply chains and adversely impacting many industries. The outbreak could have a continued material adverse impact on economic and market conditions and trigger a period of global economic slowdown. The rapid development and fluidity of this situation precludes any prediction as to the ultimate material adverse impact of the novel coronavirus. Nevertheless, the novel coronavirus presents material uncertainty and risk with respect to our available funds, our performance, and our financial results.

Legislation and regulation have imposed restrictions and requirements on companies operating within the contact lens industry that could have an adverse effect on our business. The contact lens industry is regulated, and regulation may continue to constrain the industry. Rules and regulations may impose additional expenses on us may require the attention of senior management, and may result in fines if they are deemed to have violated any regulations. On the other hand, if regulations are loosened, it may be easier for new entrants to enter the market, which would increase the amount of competition that we face.

Contact lenses require regulatory clearance or approval. Contact lenses are regulated medical devices and require a market clearance or an approval from regulatory bodies. Our contact lens is worn during the waking hours and removed before sleep. Management expects it to be classified as a daily wear contact lens. Daily wear contact lenses are further classified as Class II, non-significant risk medical devices. Our contact lens will have a new indication for viewing a near-eye display. This new indication will require a clinical investigation to derive the evidence to support the claims of the indication. The final determination of the market clearances or approvals and the language of the claims for the indication is made by the respective regulatory bodies and there is no guarantee that the review of the clinical outcomes will result in a favorable granting of the clearance or approval for the new indication.

Our commercialization model depends on partner licensing and investment. Obtaining a significant number of new customer licensees is critical for our continued growth and operation. Because our technology has not previously been deployed in the marketplace, it is uncertain whether it will be accepted by prospective customer licensees and there is a risk that we will be unable to acquire and retain licensees due to a number of factors, including the proposed licensing fee, capital expenditure requirements, or questions surrounding commercial feasibility of our technology.

We are developing and we have yet to finalize the technologies that will allow commercial scale, and we may be unable to solve technical and other challenges that would allow our technology and designs to be economically attractive to prospective partner licensees. Although we have successfully built working prototypes, we have not demonstrated that our technology is viable on a commercial scale. Management has not applied the Company’s technology under commercial conditions or fabricated products in the volumes that will be required to be profitable. We cannot predict all of the difficulties that may arise. If we encounter significant engineering, clinical or other obstacles in preparing and launching its technology at commercial scale, our financial condition, cash flows, and results of operations could be adversely affected, and such effects could be material.

We have accrued approximately one million dollars in deferred compensation. If we choose to repay these deferred wages, the capital required could significantly impact our cash position and liquidity. This action might affect our ability to meet other financial obligations and meet our growth targets.

Widespread Augmented Reality and Virtual Reality adoption has been slower than expected over the past several years. Our success is dependent on consumer adoption of augmented and virtual reality, a relatively unproven market. If the rate of AR/VR adoption does not increase in the coming years, we may find a smaller market than expected for its products. We may incur substantial operating costs, particularly in sales and marketing and research and development, in attempting to develop these markets. If the market for our products develops more slowly than we expect, our growth may slow or stall, and our operating results would be harmed. The market for augmented reality is still evolving, and we depend on continued growth of this market. It is uncertain whether the trend of adoption of augmented reality that we have forecasted will be realized in the future.

| 6 |

Even if we raise the maximum amount of this Offering, we would still need additional capital. In order to achieve our near and long-term goals, we will need to procure funds in addition to the amount raised in the Offering. There is no guarantee that we will be able to raise such funds on acceptable terms or at all. If we are not able to raise sufficient capital in the future, we will not be able to execute our business plan, our continued operations will be in jeopardy and we may be forced to cease operations and sell or otherwise transfer all or substantially all of our remaining assets, which could cause an investor in the Offering to lose all or a portion of their investment.

We rely heavily on our technology and intellectual property; even so, we may be unable to adequately or cost-effectively protect or enforce our intellectual property rights, thereby weakening our competitive position and increasing operating costs. To protect our rights in our services and technology, we will rely on a combination of copyright and trademark laws, patents, trade secrets, confidentiality agreements with employees and third parties, and protective contractual provisions. We will also rely on laws pertaining to trademarks and domain names to protect the value of our corporate brands and reputation. Despite our efforts to protect proprietary rights, unauthorized parties may copy aspects of the services or technology, obtain and use information, marks, or technology that we regard as proprietary, or otherwise violate or infringe our intellectual property rights. In addition, it is possible that others could independently develop substantially equivalent intellectual property. If we do not effectively protect our intellectual property, or if others independently develop substantially equivalent intellectual property, our competitive position could be weakened. Effectively policing the unauthorized use of our services and technology is time-consuming and costly, and the steps taken by us may not prevent misappropriation of our technology or other proprietary assets. The efforts it has taken to protect its proprietary rights may not be sufficient or effective, and unauthorized parties may copy aspects of its services, use similar marks or domain names, or obtain and use information, marks, or technology that we regard as proprietary. We may have to litigate to enforce our intellectual property rights, to protect its trade secrets, or to determine the validity and scope of others’ proprietary rights, which are sometimes not clear or may change. Litigation can be time-consuming and expensive, and the outcome can be difficult to predict.

We may be unable to maintain, promote, and grow our smart lens and smart glasses brand through marketing and communications strategies. It may prove difficult for us to dramatically increase the number of customers that we serve or to establish ourselves as a well-known brand in the competitive, B2B augmented and virtual reality space. In this case we may not be able to successfully execute on our current licensing business model.

Risks Related to the Securities in this Offering

In certain circumstances investors will not have dissenters’ rights. The Amended and Restated Stockholders’ Agreement that investors will execute in connection with the offering contains a “drag-along” provision whereby investors agree to vote any shares they own in the same manner as the majority holders of our other classes of stock. Specifically, and without limitation, if the majority holders of our other classes of stock determine to sell the company, depending on the nature of the transaction, investors will be forced to sell their stock in that transaction regardless of whether they believe the transaction is the best or highest value for their shares, and regardless of whether they believe the transaction is in their best interests.

Investors in this offering may not be entitled to a jury trial with respect to claims arising under the subscription agreement, the Amended and Restated Stockholders’ Agreement, which could result in less favorable outcomes to the plaintiff(s) in any action under these agreements. Investors in this offering will be bound by the subscription agreement and Second Amended and Restated Stockholders’ Agreement both of which include a provision under which investors waive the right to a jury trial of any claim they may have against the company arising out of or relating to these agreements. By signing these agreements, the investor warrants that the investor has reviewed this waiver with his or her legal counsel, and knowingly and voluntarily waives the investor’s jury trial rights following consultation with the investor’s legal counsel.

| 7 |

If we opposed a jury trial demand based on the waiver, a court would determine whether the waiver was enforceable based on the facts and circumstances of that case in accordance with the applicable state and federal law. To our knowledge, the enforceability of a contractual pre-dispute jury trial waiver in connection with claims arising under the federal securities laws has not been finally adjudicated by a federal court. However, we believe that a contractual pre-dispute jury trial waiver provision is generally enforceable, including under the laws of the State of New York, which governs the subscription agreement and under the laws of State of Delaware which governs the Amended and Restated Stockholders’ Agreement. In determining whether to enforce a contractual pre-dispute jury trial waiver provision, courts will generally consider whether the visibility of the jury trial waiver provision within the agreement is sufficiently prominent such that a party knowingly, intelligently and voluntarily waived the right to a jury trial. We believe that this is the case with respect to the subscription agreement and Amended and Restated Stockholders’ Agreement. You should consult legal counsel regarding the jury waiver provision before entering into the subscription agreement and Amended and Restated Stockholders’ Agreement.

If you bring a claim against the company in connection with matters arising under either the Amended and Restated Stockholders’ Agreement or the subscription agreement, including claims under federal securities laws, you may not be entitled to a jury trial with respect to those claims, which may have the effect of limiting and discouraging lawsuits against the company. If a lawsuit is brought against the company under the either of these agreements, it may be heard only by a judge or justice of the applicable trial court, which would be conducted according to different civil procedures and may result in different outcomes than a trial by jury would have had, including results that could be less favorable to the plaintiff(s) in such an action.

Nevertheless, if this jury trial waiver provision is not permitted by applicable law, an action could proceed under the terms of the subscription agreement or Amended and Restated Stockholders’ Agreement with a jury trial. No condition, stipulation or provision of the subscription agreement or Amended and Restated Stockholders’ Agreement serves as a waiver by any holder of the shares or by us of compliance with any substantive provision of the federal securities laws and the rules and regulations promulgated under those laws.

In addition, when the shares are transferred, the transferee is required to agree to all the same conditions, obligations and restrictions applicable to the shares or to the transferor with regard to ownership of the shares, that were in effect immediately prior to the transfer of the Shares, including but not limited to the Amended and Restated Stockholders’ Agreement or subscription agreement.

This investment is illiquid. There is no currently established market for reselling these securities. If you decide that you want to resell these securities in the future, you may not be able to find a buyer. You should assume that you may not be able to liquidate your investment for some time or be able to pledge these shares as collateral.

Upon a closing in this qualified offering, certain outstanding debt will automatically convert into shares of our preferred stock. In 2019, $1,149,592.45 and $1,331,000 convertible notes were sold in two respective offerings. Each note earned an accrued 5% interest. The company expects these notes to convert into a total of 1,610,514 Series A-2 Preferred shares, assuming note interest is earned until a final date of March 31, 2021. In 2019 and 2020, the company entered into SAFE agreements for $500,000 and $1,831,875 respectively. The company expects these agreements to convert into a total of 1,123,787 Series A-3 Preferred shares.

You will need to keep records of your investment for tax purposes. As with all investments in securities, if you sell our Series A-1 Preferred Stock at a profit or loss, you will probably need to pay tax on the long- or short-term capital gains that you realize, or apply the loss to other taxable income. If you do not have a regular brokerage account, or your regular broker will not hold our Series A-1 Preferred Stock for you (and many brokers refuse to hold securities issued under Regulation A) there will be nobody keeping records for you for tax purposes and you will have to keep your own records, and calculate the gain or loss on any sales of the Series A-1 Preferred Stock.

The value of your investment may be diluted if the company issues additional options. A pool of unallocated options is typically reserved for future employees, which affects the fully-diluted pre-money valuation for this offering. The price per share of the Series A-1 Preferred Stock has been calculated assuming a 1.67% post-money option pool, which may not account for all additional options the company will issue after the offering and may not provide adequate protection against the dilution investors may face due to such additional issuances. Any option issuances by the company over the 1.67% pool will lower the value of your shares. There is currently a total of 4,037,347 authorized shares available for option grants under the Company’s stock option plan.

| 8 |

Dilution means a reduction in value, control, or earnings of the shares the investor owns.

Immediate dilution

An early-stage company typically sells its shares (or grants options on its shares) to its founders and early employees at a low cash price, as they are typically putting their “sweat equity” into the company. When the company seeks cash investments from outside investors, the new investors typically pay a higher price for their shares than the founders or earlier investors.

The following table compares the price that new investors are paying for their shares with the effective cash price paid by existing shareholders, giving effect to full conversion of all outstanding convertible notes and assuming that the new shares are sold at $3.00 per share. The schedule presents number of shares and pricing as issued and reflects all transactions since inception, so investors can understand what they will pay for their investment compared to what earlier parties have paid.

The following table presents the approximate effective cash price paid for all shares and potential shares issuable by the company as of December 31, 2020.

| Date Issued | Issued Shares | Potential Shares | Total Issued and Potential Shares | Effective

Cash Price per Share at Issuance or Potential Conversion | ||||||||||||||||

| Common Shares: | ||||||||||||||||||||

| Common Shares | 2008 | 5,000,000 | - | 5,000,000 | $ | 0.0001 | ||||||||||||||

| Common Shares | 2010 | 1,250,000 | - | 1,250,000 | $ | 0.0001 | ||||||||||||||

| Common Shares | 2011 | 145,000 | - | 145,000 | $ | 0.1000 | ||||||||||||||

| Common Shares | 2014 | 3,000,000 | - | 3,000,000 | $ | 0.0500 | ||||||||||||||

| Common Shares | 2015 | 10,000 | - | 10,000 | $ | 0.0500 | ||||||||||||||

| Common Shares (1) | 2018 | 2,968 | - | 2,968 | $ | 0.1120 | ||||||||||||||

| Common Shares (2) | 2020 | 40,000 | - | 40,000 | $ | 0.0100 | ||||||||||||||

| Preferred Shares: | ||||||||||||||||||||

| Preferred Shares | 2016 | 1,998,815 | - | 1,998,815 | $ | 1.6583 | ||||||||||||||

| Preferred Shares | 2017 | 181,122 | - | 181,122 | $ | 1.6583 | ||||||||||||||

| Preferred Shares | 2018 | 1,338,301 | - | 1,338,301 | $ | 1.6583 | ||||||||||||||

| Convertible Notes: | ||||||||||||||||||||

| Convertible Notes (3) | 2019 | - | 1,610,514 | 1,610,514 | $ | 1.6683 | ||||||||||||||

| SAFE Notes | ||||||||||||||||||||

| SAFE Notes (4) | 2019 | - | 240,963 | 240,963 | $ | 2.0750 | ||||||||||||||

| SAFE Notes | 2020 | - | 882,824 | 882,824 | $ | 2.0750 | ||||||||||||||

| Options: | ||||||||||||||||||||

| 2008 Equity Incentive Plan (5) | 1,950,000 | - | 1,950,000 | $ | 0.2506 | |||||||||||||||

| Warrants: | ||||||||||||||||||||

| Warrants (6) | - | 132,514 | 132,514 | $ | 0.0100 | |||||||||||||||

| (1) | In 2019, the company issued 2,968 common shares to an employee exercising their option for their vested shares upon termination. |

| (2) | In 2020, the company issued 40,000 common shares to a warrant holder exercising their right to purchase shares at an exercise price of $0.01 per share. |

| 9 |

| (3) | Assumes conversion of all issued and outstanding convertible notes, plus accrued interest through March 31, 2021. |

| During 2019, the Company issued convertible notes (2019 Notes) for total proceeds, net of issuance costs of $126,772, of $2,402,337. All notes have a maturity date of June 30, 2021, and accrue simple interest at 5% per annum. All notes have a 20% conversion discount of the original issue price of new preferred stock. The notes, and all accrued interest, can either be converted prior to their maturity date in the event of a Qualified Equity Financing with an aggregate sales price of not less than $750,000 (excluding the aggregated amount from the convertible notes), converted at any time by a majority vote of the noteholders, or automatically converts upon the maturity date. | |

| The outstanding principal amount of the 2019 Notes and accrued and unpaid interest is convertible at the option of a Majority in Interest of the Investors at any time into that number of fully paid and nonassessable shares of the Company’s Series A Preferred Stock determined by dividing (x) $32,000,000 by (y) the number of Fully Diluted shares immediately prior to the Conversion. As a result, if the 2019 Notes were converted in full pursuant to this provision, we would issue approximately 1,309,278 shares of our Series A Preferred Stock which shares are convertible into 1,309,278 shares of the Company’s common stock. | |

| Additionally, in the event that as of the Maturity Date of the 2019 Notes or any portion of the 2019 Notes have not been converted, then the outstanding principal amount of and all accrued interest on the 2019 Notes shall automatically convert into that number of fully paid nonassessable shares of Series A Preferred Stock determined by dividing (i) the outstanding principal balance of the 2019 Note plus accrued and unpaid interest thereon as of the Maturity Date by (B) the number of Fully Diluted Shares immediately prior to the Maturity Date, rounded down to the nearest whole share. As a result, if the 2019 Notes were converted in full pursuant to this provision, we would issue approximately 1,324,329 shares of our Series A Preferred Stock which shares are convertible into 1,324,329 shares of the Company’s common stock. | |

| In the event of a Change of Control Transaction the 2019 Note the holder of the note would be entitled to receive at the option of the holder either (i) the principal amount of the note plus accrued and unpaid interest as of the date of the Change of Control Transaction or (ii) that number of fully paid and nonassessable shares of the Company’s most senior preferred stock outstanding of the change of Control Transaction as is determined by dividing the outstanding principal balance of the note plus accrued and unpaid interest thereon through the date of conversion by that amount per share representing a post-money valuation of the Company equal to the sum of 32,000,000 plus the principal amount of the note and any other outstanding notes plus accrued and unpaid interest thereon as of the date of such Change of Control Transaction. | |

| (4) | During 2019, the Company issued a SAFE note for total proceeds of $500,000. During 2020, the Company issued additional SAFE notes for total proceeds, net of issuance costs of $16,158, of $1,831,875 for cumulative total proceeds of $2,331,875. The notes will automatically convert to preferred stock upon either an Equity Financing or Liquidity Event. Preferred shares issued upon an Equity Financing event will convert at the Purchase Amount divided by the Safe Price of $2.075. Proceeds issued to SAFE note holders upon a Liquidity Event is the greater of the Purchase Amount or the amount payable calculated by the number of common shares equal to the Purchase Amount divided by the Liquidity Price of $2.075. If there is a Dissolution Event, the SAFE note holders are entitled to an amount greater to a portion of the proceeds equal to either the Cash-Out Amount (Purchase Amount) or the Conversion Amount (number of Common Shares equal to the Purchase Amount divided by the Liquidity Price). |

| (5) | Options represent options issued and outstanding as of December 31, 2020 net of cancellations and exercises. |

| (6) | In 2018 and 2019, the company issued 132,514 and 40,000 warrants, respectively, to Chardan Capital Markets and IRTH Communications. IRTH Communications exercised their right to purchase common shares in 2020. |

The following table describes the dilution that new investors will experience when they invest in the company and relative to the company’s existing holders of securities. This calculation is based on the net tangible assets of the Company; as such calculations are based on net tangible book value of $(2,608,957), at December 31, 2019, and as summarized in our audited financial statements. Hence this table does not include shares or SAFE agreements issued in 2020.

Offering costs assumed in the following table includes up to $1,275,000 in commissions to SI Securities, LLC, as well as direct legal and accounting fees incurred in support of this Offering.

| 10 |

The table presents three amount raised scenarios: a $750,000 raise from this offering (the minimum offering), a $7,500,000 raise from this offering, and a fully subscribed $15,000,000 raise from this offering (the maximum offering).

| $750,000 Raise |

$7.5

Million Raise |

$15.0

Million Raise |

||||||||||

| Price per Share | $ | 3.00 | $ | 3.00 | $ | 3.00 | ||||||

| Shares Issued | 250,000 | 2,500,000 | 5,000,000 | |||||||||

| Capital Raised | $ | 750,000 | $ | 7,500,000 | $ | 15,000,000 | ||||||

| Less: Offering Costs | $ | 165,750 | $ | 739,500 | $ | 1,377,000 | ||||||

| Net Offering Proceeds | $ | 584,250 | $ | 6,760,500 | $ | 13,623,000 | ||||||

| Net Tangible Book Value Pre-financing as of December 31, 2019 | $ | (2,608,957 | ) | $ | (2,608,957 | ) | $ | (2,608,957 | ) | |||

| Net Tangible Book Value Post-financing | $ | (2,024,707 | ) | $ | 4,151,543 | $ | 11,014,043 | |||||

| Shares issued and outstanding pre-financing as of December 31, 2019 (1) | 17,783,021 | 17,783,021 | 17,783,021 | |||||||||

| Post-financing Shares Issued and Outstanding | 18.033.021 | 20,283,021 | 22,783,021 | |||||||||

| Net Tangible Book Value per Share Prior to Offering | $ | (0.15 | ) | $ | (0.15 | ) | $ | (0.15 | ) | |||

| Increase/(Decrease) per Share Attributable to New Investors | $ | 0.03 | $ | 0.35 | $ | 0.63 | ||||||

| Net Tangible Book Value per Share After Offering | $ | (0.11 | ) | $ | 0.20 | $ | 0.48 | |||||

| Dilution per Share to New Investors ($) | $ | (3.11 | ) | $ | (2.80 | ) | $ | (2.52 | ) | |||

| Dilution per Share to New Investors (%) | -104 | % | -93 | % | -84 | % | ||||||

| (1) | Assumes conversion of all issued Convertible and SAFE Notes issued as of December 31, 2019, resulting in the issuance of an additional 2,734,301 shares. Also includes common shares outstanding and available for the stock option pool. |

Future dilution

Another aspect of dilution is the dilution that happens due to future actions by the company. The investor’s stake in a company could be diluted due to the company issuing additional shares. In other words, when the company issues more shares, the percentage of the company that each investor owns will go down, even though the value of the company may go up. In that event, the investor will own a smaller piece of a larger company. This increase in number of shares outstanding could result from a stock offering (such as an initial public offering, another crowdfunding round, a venture capital round, or angel investment), employees exercising stock options, or by conversion of certain instruments (ex. convertible bonds, preferred shares or warrants) into stock.

If the company decides to issue more shares, an investor could experience value dilution, with each share being worth less than before, and control dilution, with the total percentage an investor owns being less than before. There may also be earnings dilution, with a reduction in the amount earned per share, although earnings per share typically occurs only if the company offers dividends, and most early-stage companies are unlikely to offer dividends, preferring to invest any earnings into the company.

The type of dilution that hurts early-stage investors most occurs when the company sells more shares in a “down round,” meaning at a lower valuation than in earlier offerings. The example provided below is hypothetical and for illustrative purposes only:

| ● | In June 2017 Jane invests $20,000 for shares that represent 2% of a company valued at $1 million. | |

| ● | In December, the company is doing very well and sells $5 million in shares to venture capitalists on a valuation (before the new investment) of $10 million. Jane now owns only 1.3% of the company but her stake is worth $200,000. | |

| ● | In June 2018, the company has serious problems and in order to continue to operate raises $1 million at a valuation of only $2 million (the “down round”). Jane now owns only 0.89% of the company and her stake is worth only $26,660. |

| 11 |

This type of dilution might also happen upon conversion of convertible notes into shares. Typically, the terms of convertible notes issued by early-stage companies provide that in the event of another round of financing, the holders of the convertible notes get to convert their notes into equity at a “discount” to the price paid by the new investors. They receive more shares than the new investors would for the same price because of their earlier investment which may have been associated with greater risk. Additionally, convertible notes may have a “price cap” on the conversion price, which effectively acts as a share price ceiling. Either way, the holders of the convertible notes receive more shares for the same dollar amount of investment than new investors receive. In the event that the financing is a “down round” the holders of the convertible notes will dilute existing equity holders, and even more than the new investors do, because they get more shares for their money. Investors should pay careful attention to the number of convertible notes that the company has issued and may issue in the future, and the terms of those notes.

If you are making an investment expecting to own a certain percentage of the company or expecting each share to hold a certain amount of value, it’s important to realize how the value of those shares can decrease by actions taken by the company. Dilution can make drastic changes to the value of each share, ownership percentage, voting control, and earnings per share.

PLAN OF DISTRIBUTION AND SELLING SECURITYHOLDERS

Plan of Distribution

The company is offering a minimum of 250,000 and up to 5,000,000 shares of Series A-1 Preferred Stock (the “Shares”) on a “best efforts” basis at a price of $3.00 per share. The minimum subscription is $999. SeedInvest Auto Invest participants may subscribe at a lower investment minimum of $198.

The company has engaged SI Securities, LLC as its sole and exclusive placement agent to assist in the placement of its securities. SI Securities, LLC is under no obligation to purchase any securities or arrange for the sale of any specific number or dollar amount of securities.

Commissions and Discounts

The following table shows the total discounts and commissions payable to the placement agents in connection with this offering assuming we raise the maximum amount of offering proceeds:

| Per Share | ||||

| Public offering price | $ | 3.00 | ||

| Placement Agent commissions | $ | 0.255 | (1) | |

| Proceeds, before expenses, to us | $ | 2.745 | ||

| (1) | SI Securities, LLC will receive commissions of 8.5% of the offering proceeds. |

Other Terms

Except as set forth above, the company is not under any contractual obligation to engage SI Securities, LLC to provide any services to the company after this offering, and has no present intent to do so. However, SI Securities, LLC may, among other things, introduce the company to potential target businesses or assist the company in raising additional capital, as needs may arise in the future. If SI Securities, LLC provides services to the company after this offering, the company may pay SI Securities, LLC fair and reasonable fees that would be determined at that time in an arm’s length negotiation.

SI Securities, LLC intends to use an online platform provided by SeedInvest Technology, LLC, an affiliate of SI Securities, LLC, at the domain name www.seedinvest.com (the “Online Platform”) to provide technology tools to allow for the sales of securities in this offering. SI Securities, LLC will charge you a non-refundable transaction fee equal to 2% of the amount you invest (up to $300) at the time you subscribe for our shares. This fee will be refunded in the event the company does not reach its minimum fundraising goal. In addition, SI Securities, LLC may engage selling agents in connection with the offering to assist with the placement of securities.

| 12 |

Selling Security holders

No securities are being sold for the account of security holders; all net proceeds of this offering will go to the company.

Transfer Agent and Registrar

VStock Transfer, LLC has been engaged to be the transfer agent for the Series A-1 Preferred Stock and maintains shareholder information on a book-entry basis. We will not issue shares in physical or paper form.

Investors’ Tender of Funds and Return of Funds

After the Commission has qualified the Offering Statement, the company will accept tenders of funds to purchase the Series A-1 Preferred Stock. The company may close on investments on a “rolling” basis (so not all investors will receive their shares on the same date), provided that the minimum offering amount has been met. Tendered funds will remain in escrow until both the minimum offering amount has been reached and a closing has occurred. However, in the event we have not sold the minimum number of shares by or sooner terminated by the company, any money tendered by potential investors will be promptly returned by the Escrow Agent. Upon closing, funds tendered by investors will be made available to the company for its use.

In the event that it takes some time for the company to raise funds in this offering, the company may rely on cash on hand, or may seek to raise funds by conducting a new offering of equity or debt securities.

In order to invest you will be required to subscribe to the offering via the Online Platform and agree to the terms of the offering, the subscription agreement, Amended and Restated Stockholders’ Agreement and any other relevant exhibits attached thereto.

Provisions of Note in Our Subscription Agreement and Amended and Restated Stockholders’ Agreement

Our subscription agreement and Amended and Restated Stockholders’ Agreement include forum selection provisions that require any claims against the company based on the subscription agreement and/or Amended and Restated Stockholders’ Agreement not arising under the federal securities laws to be brought in a court of competent jurisdiction in the State of New York. These forum selection provisions may limit investors’ ability to bring claims in judicial forums that they find favorable to such disputes and may discourage lawsuits with respect to such claims. The company has adopted these provisions to limit the time and expense incurred by its management to challenge any such claims. As a company with a small management team, this provision allows its officers to not lose a significant amount of time travelling to any particular forum so they may continue to focus on operations of the company.

Jury Trial Waiver

The subscription agreement and Amended and Restated Stockholders’ Agreement provide that subscribers waive the right to a jury trial of any claim they may have against us arising out of or relating to the subscription agreement. By signing the subscription agreement and Amended and Restated Stockholders’ Agreement, the investor warrants that the investor has reviewed this waiver with the investor’s legal counsel, and knowingly and voluntarily waives his or her jury trial rights following consultation with the investor’s legal counsel. If we opposed a jury trial demand based on the waiver, a court would determine whether the waiver was enforceable given the facts and circumstances of that case in accordance with applicable case law.

| 13 |

Assuming a maximum raise of $15,000,000, the net proceeds of this offering would be approximately $13,623,000 after subtracting estimated offering costs of $1,275,000 to SI Securities, LLC in commissions, $22,000 in audit fees, $5,000 in Edgarization fees and $75,000 in legal fees. We intend to use the proceeds respective to this maximum raise to fund receipt of United States Food and Drug Administration (FDA) market clearance of the iOptik® smart contact lens and to support our partners to commercially launch the smart lenses and display eyewear for the visually impaired including the legally blind patient market in the United States. Following these planned events for the US market, we plan to seek market registrations in Europe and the United Kingdom and support our future licensees to commercially launch the smart contact lenses and display eyewear in these respective regions. We plan to deploy more than $4,000,000 for intellectual property and engineering to produce reference designs for applications that extend beyond those for the visually impaired including the legally blind market.

Assuming a raise of $7,500,000, representing 50% of the maximum offering amount, the net proceeds would be approximately $6,760,500 after subtracting estimated offering costs of $637,500 to SI Securities, LLC in commissions, $22,000 in audit fees, $5,000 in Edgarization fees, and $75,000 in legal fees. In such event we would use the proceeds respective to this 50% raise to fund receipt of U.S. FDA market clearance of the iOptik smart contact lens and to support our future licensees to commercially launch the smart contact lenses and display eyewear for the visually impaired including the legally blind patient market in the United States. We would also begin regulatory submissions for market registrations in Europe and the United Kingdom while not budgeting support for the respective launches. We would develop intellectual property for next applications while minimizing engineering costs for reference designs for next applications.

Assuming a raise of the minimum of $750,000, representing 5% of the maximum offering amount, net proceeds would be approximately $584,250 after subtracting estimated offering costs of $63,750 to SI Securities, LLC in commissions, $22,000 in audit fees, $5,000 in Edgarization fees, and $75,000 in legal fees. In such event we would use the proceeds respective to this 5% raise to fund receipt of an initial 510(k) U.S. FDA market clearance while minimizing our expenses related to, (i) final market clearance of the iOptik smart contact lens, (ii) hiring of new staff to support commercial partners, (iii) marketing activities and engineering activities pursuant to reference designs for applications beyond eyewear for the visually impaired including the legally blind patient market. Based on raising the minimum of $750,000, the company does not believe it will have sufficient funds to operate through the end of 2021, and management would need to seek additional forms of financing.

Please see the table below for a summary of the company’s intended use of capital and net proceeds from this offering:

| Percent | Minimum

Offering $750,000 Raise |

$7,500,000 Raise | Maximum

Offering $15,000,000 Raise | |||||||

| Allocation | Use Category | % | Use Category | % | Use Category | |||||

| 28% | Payroll | 23% | Engineering Projects | 26% | Engineering Projects | |||||

| 28% | Clinical Projects | 22% | Payroll | 21% | Clinical Projects | |||||

| 20% | Engineering Projects | 19% | Clinical Projects | 20% | Payroll (1) | |||||

| 9% | General Administrative | 16% | General Administrative | 14% | General Administrative | |||||

| 8% | Offering Expenses | 10% | Offering Expenses | 9% | Offering Expenses | |||||

| 7% | Facilities and Equipment | 6% | Working Capital | 7% | Working Capital | |||||

| 0% | Working Capital | 4% | Facilities and Equipment | 3% | Facilities and Equipment |

| (1) | Upon realization of a minimum raise of at least $10,000,000 before December 31, 2021 (gross proceeds before commissions), we plan to use 5% of the gross proceeds to reduce payroll-related, balance sheet liabilities. Payments may specifically include reduction of Current Accrued Expenses and of reduction of Long-term Accrued Deferred Wages. Certain of these payments may be used to reduce accrued liabilities to company officers. |

| 14 |

The company reserves the right to change the above intended use of proceeds if management believes it is in the best interests of the company.

Overview

Innovega was incorporated under the laws of the State of Delaware on June 16, 2008, as “Innovega Inc.” Innovega is developing a product solution architecture for Extended Reality (XR) eyewear which includes the categories of Augmented, Virtual and Mixed Reality. The Extended Reality eyewear is enabled by a novel smart contact lens or a surgically implanted intraocular lens. We developed and have prototype contact lenses, intraocular lenses and prototype display eyewear. These contact lenses and intraocular lenses include proprietary two-state light polarizing filters and the display eyewear include proprietary features and operating software. Innovega intends to license its technology to companies who will produce and market the Extended Reality system for applications including anytime and anywhere information and entertainment; telecommunications; gaming; defense, security and intelligence, enterprise; surgical visualization and telemedicine; athletic training and sports analytics; and quality of life enhancement for the sensory impaired including the visually impaired and legally blind, hearing impaired and those suffering cognitive impairment.

Our Background

Our business is based on our foundational patent, METHOD AND APPARATUS TO PROCESS DISPLAY AND NON-DISPLAY INFORMATION, US patent number 8,520,309, issued August 27, 2013, and more than 35 additional US and international patent cases. Our founding philosophy is that the resolution, field of view, and 3D potential of a wearable display is enhanced by placing the focusing optics on or in the eye; the bulk and weight of display eyewear is reduced by eliminating the optics from the eyewear; the conflict between the alignment of the eyes (vergence) and the focusing of the eyes (accommodation) is eliminated with the extended depth of field of the eye-borne optics; and, gaze tracking that is required for advanced mixed reality is more efficient with the use of a system based on fiducials placed on or in the contact lens.

We believe that the future of Extended Reality eyewear is dependent on the eyewear being lightweight and stylish and the optics being customized for the majority of potential users. We believe that one-size fits all display eyewear will not be any more successful than one-size-fits-all glasses would be. We hold that the geometric diversity of human facial features and head shapes will significantly impact the success of mass-produced one-size-fits-all display eyewear.

We believe that artificial intelligence systems will facilitate the cost-efficient delivery of customized smart contact lenses and display eyewear. High-precision patient specific contact lenses or intraocular lenses along with display eyewear will provide the performance defined as necessary for user acceptance of display eyewear. It is our assessment that for Innovega eyewear to be truly scalable they require a high degree of advanced engineering and systems for fitting along with novel user centered software and interfaces.

It is our view that patient specific display eyewear will prove to be clinically superior over the long term while also alleviating the known challenges in the acceptance of generic display eyewear. We believe that display eyewear should be designed and optimized to fit each user and in doing so will exceed the capabilities of even the most well-designed generic display systems. We believe that the use of patient specific display eyewear will, over time, reduce complication and failure rates and enhance the forecast growth of Extended Reality eyewear in the post mobile phone era.

Principal Products and Services

Our primary business includes licensing its intellectual property and know-how resulting from the process of design, prototyping, testing and patenting smart contact lenses; smart intraocular lenses; gaze tracking; sound management components; display eyewear; and computer program products that enable high resolution, full field of view, free eye-movement, obstruction free peripheral visual field, lightweight and stylish display eyewear; along with, auditory and visual sensory enhancement systems for display eyewear.

| 15 |

Innovega also provides for fee engineering services and consultation services to display eyewear licensees and to distribution partners in the ophthalmic industry for the purpose of enhancing the success rate with the smart contact lenses and intraocular lenses.

The Innovega technology driven fitting systems will eliminate the subjective differences in the measurement, selection and fitting of contact lenses and eyewear. The Innovega fitting system is intended to result in the selection of the same contact lens and eyewear size parameters at any location or by any personnel who assist the end user who will be wearing the contact lenses and display eyewear. Novel fitting instrumentation is in development by Innovega for the purpose of predicting the contact lens and eyewear parameters as well as presets for the viewing of the images in the eyewear. The contact lenses and display eyewear may be fit without our enabling technology. We believe that higher user satisfaction, better extended eyewear performance, and reduced fitting time will be experienced with our system for fitting the contact lenses and eyewear. The enabling fitting technology may be sold separately to eye care practitioners and fitting centers.

We intend to license the manufacture of the contact lenses and intraocular lenses to large, established ophthalmic industry leaders who are already approved manufacturers and have decades of product specific manufacturing expertise. We intend to license to FDA registered ISO 13485 approved manufacturers with the proper Quality Management Systems and product specific expertise for the contact lenses and intraocular lenses.

We intend to license the manufacture of the display eyewear to industry leaders for the various applications and to their respective original equipment manufacturers when applicable. The potential licensees include providers in the fields of anytime and anywhere information and entertainment; telecommunications; gaming; defense, security and intelligence, enterprise; surgical visualization and telemedicine; athletic training and sports analytics; and quality of life enhancement for the sensory impaired including the visually impaired and legally blind, hearing impaired and those suffering cognitive impairment.

Market

Our first target market is the visually impaired population who are in need of vision enhancement to improve their independence and quality of life. We developed the iOptik® smart contact lens and the eMacula® display eyewear system to provide the widest field of view in a wearable image amplification system. We believe that the eyewear, produced and distributed by a global leader in electronic aids for the visually impaired, will be the leading solution for the significantly growing population of those affected by Age-Related Macular Degeneration (AMD), diabetic retinopathy, and other conditions causing central vision loss.

The majority of visually impaired patients are female and 60 years of age and older and the prevalence accelerates above age 60 because of the impact of AMD. The current number of those suffering from some form of AMD in the United States is approximately 11 million people and expected to reach 22 million people by 2050. As the US population ages, led by the baby boomers who comprise 73 million of the US population, a strong correlative affect in AMD cases is predicted. The risk of vision impairing AMD between the ages of 50-59 is only 2% and increases to over 30% for those over 75. The number of people living with AMD globally is approximately 196 million and set to increase to 288 million by 2040. The substantial increase is due, mainly, to the large aging population as well as the increase in life expectancy.

Visually impaired patients need assistance to maintain employment and independent living. The segment younger than 70 have the greatest need to support their employment and productivity. Those over age 70 have the need for independent living and quality of life.

Most patients who will be using our technology are expected to be over the age of 55 and many of these patients would rely on insurance coverage to pay for their treatment. Partial reimbursement for services is in place for those covered by Medicare. The Medicaid program through States Department of Rehabilitation provide coverage for children through working adults. The two largest vision care plans, Vision Service Plan and EyeMed, provide partial coverage for medically necessary contact lenses and low vision devices for rehabilitation. Further, the Veterans Health Administration report coverage for rehabilitation assessment and training to improve independence and quality of like, low vision devices and training in their use, and electronic and mechanical aids including adaptive computers and computer-assisted devices such as reading machines and electronic aids.

| 16 |

Management believes that the market growth for wearable display aids for the visually impaired will be greater than the growth of the overall population with visual impairment primarily because of the limited market penetration of the current competitors. In particular, we have paid close attention to the market uptake of the current generation of competitive products. While no independent analysis reporting the number of users of competitive products has been sourced, we believe the total of all of the brands combined in use by the visually impaired in the U.S. is approximately 10,000. We believe the low penetration of wearable display devices for the visually impaired is due to the narrow field of view, low resolution, bulky and unattractive appearance, need to employ improved software and user interface technology, and need to personalize the fitting characteristics of the display eyewear.

Our management believes that wearable display image enhancement technology penetration for the visually impaired is inordinately low. Management believes that customized display eyewear with wide field of view and high resolution, with advanced software and user interface design in lightweight and stylish eyewear will significantly change the desire of low vision specialists to prescribe wearable display technology for their visually impaired patients. The demand for vision enhancement is present in the majority of visually impaired individuals who are otherwise healthy and driven to live more active and independent lifestyles or to perform at higher levels in their academic and vocational pursuits. Innovega’s technology is a medical device and will be prescribed by low vision specialists rather than purchased over the counter, online or through less sophisticated delivery systems. We believe we are in a prime position to capitalize on this underserved and growing market with the technology and product infrastructure we are developing.

Competition

The current competitive landscape in the low vision device market is saturated with solutions that have been proven to increase patients’ vision and quality of life albeit in a narrow field of view, high price point, and enclosed in a heavy head mounted device. Currently, the leading brands of competitive products include eSight, IrisVision, Eyedaptic, Acesight, NuEyes and Jordy. IrisVision offers a headset form factor with a wide field of view with the drawback of being heavy and socially isolating. The remainder are in an eyewear form factor while sharing negative performance and appearance limitations including a field of view that is approximately one-half of the Innovega technology, lower display resolution, greater weight and an obtrusive appearance when compared to the Innovega solution.

Management is not aware of any other solution in the market that can enable the visually impaired to see 20/20 equivalent in normal surroundings and when reading at a normal distance with as large a field of view, as high a resolution, and while weighing under two ounces.

Our Innovative Approach

Innovega’s principal innovation over our competition will be our ability to produce customized and personalized extended reality eyewear for the visually impaired to enable the time efficient fitting, training and adaptation to the wearable technology. The product solution architecture that we are developing will enable rapid fabrication and mass personalization of the contact lens enabled wearable display technology. The optical approach of removing the optics from the eyewear and placing them on or in the eye is fundamental to expanding the field of view while removing the bulk and weight from the eyewear.

The Innovega technology platform includes – multi-patented smart contact lenses and display eyewear configurations – methods of personalizing the eyewear size parameters – software algorithm for image capture, enhancement and presentation – user interface designed with a sensitivity and understanding of the needs of the visually impaired. The eyewear captures high resolution images while the operating system stabilizes the image, reduces latency, and presents the images on the wide and high-resolution displays in the location required for each eye of each user.

| 17 |

We believe that Innovega’s features and enhancements will improve the user experience over the current eyewear in use while also appearing like normal spectacle eyewear. Specifically, the Innovega system is designed to respect normal head tilt and eye positions while enabling the user to see their world at the same distances that normally sighted individuals see. The eyewear is designed by ophthalmic professionals with years of experience in fitting glasses and the user interface and software are the product of input from low vision specialists and visually impaired patients. The camera, processors, power sources, connectivity components and display technology are all available and supported by large global component manufacturers.

Our design engineers incorporated large databases of head, eye, nose and ear location and size information to develop the parameters for the display eyewear and fitting system. Our team members with previous global market leading contact lens designs and products developed the lens materials, methods of manufacturing to include the patented two-state light polarizing filter, the rotationally stabilized lens design, and the systems and methods of fitting the novel iOptik contact lens.

Generic one-size-fits-all AR and VR glasses for the visually impaired ignore the geometric diversity of human heads, human nose shapes and sizes, human eye locations, and human ear heights and locations. The result is eyewear that is far too large for those with small heads and to narrow for those with wide heads. The universal size eyewear generally sits too far in front of the face and are experienced as heavy on the nose. Several designs require a head-strap or head-band to secure the heavy eyewear to the head. To our knowledge, there is currently no commercially viable offering for customizing display eyewear in the same manner that normal spectacle eyewear is personalized. All current systems fail to solve the eyestrain caused by vergence-accommodation conflict for users with two eyes. Most systems attempt to manage the differences in the distribution of human eye separation by enlarging the usable optical port of their systems which in turn exacerbates the vergence-accommodation conflict by reducing the depth of field.

Our iOptik contact lens approach provides for a smart contact lens containing a two-state light polarizing filter and a micro-lens. The two-state light polarizing filter separates the display light from the non-display normal vision light and the micro-lens focuses the display light while the non-display light path has normal vision correction or no correction for those who do not have a prescription. The iOptik contact lens is a disposable lens and it is prescribed using the same examination that eye care practitioners use for fitting soft disposable lenses to correct astigmatism.

Our eyewear design approach includes a fitting system to determine the correct frame size, correct temple length, correct bridge size and location, the correct display position relative to the separation of the eyes, and the correct presets for the camera and display position when performing a number of different visual tasks. We engineered the frame design to produce the thinnest and lightest eyewear with the support of seasoned eyewear frame designers in concert with mechanical and electronic engineers. The novel solutions for resolving the placement of the components while respecting the ultimate goal of normal eyewear appearance are a major achievement.

Feasibility clinical studies at the Ohio State University with fully sighted and visually impaired subjects provided valuable feedback for the design of the iOptik contact lenses and display eyewear. The feedback is incorporated in design changes, software development and user interface design and development. We are in the final phases of product design and development with a global leader in electronic devices for the visually impaired with a target first product launch upon and subject to receiving our FDA market clearance for the iOptik contact lens. Provided we receive FDA market clearance, the launch date is forecast for the first quarter of 2022.

Sales and Marketing

The specific sales process for each of our product applications is based on the strategy and go-to-market model of our licensees.

Visually impaired market application

The company is employing a licensing business model. The intellectual property including the pending and issued patents, know how, and trade secrets will be licensed to strategic partners who will distribute the contact lenses and display eyewear. In some cases, the partner may also undertake manufacturing or may use third parties for manufacturing the eyewear or contact lenses. We are in the negotiation process with a licensee candidate for the display eyewear and in discussions with licensee candidates for the contact lenses.

| 18 |