| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

None | N/A | N/A | ||||||||||||

Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

N/A | ||||||||||||||

| N/A | ||||||||||||||

| N/A | ||||||||||||||

| Large accelerated filer | ☐ | Accelerated filer | ☐ | ||||||||

| ☒ | Smaller reporting company | ||||||||||

| Emerging growth company | |||||||||||

| PAGE | ||||||||

F-1 | ||||||||

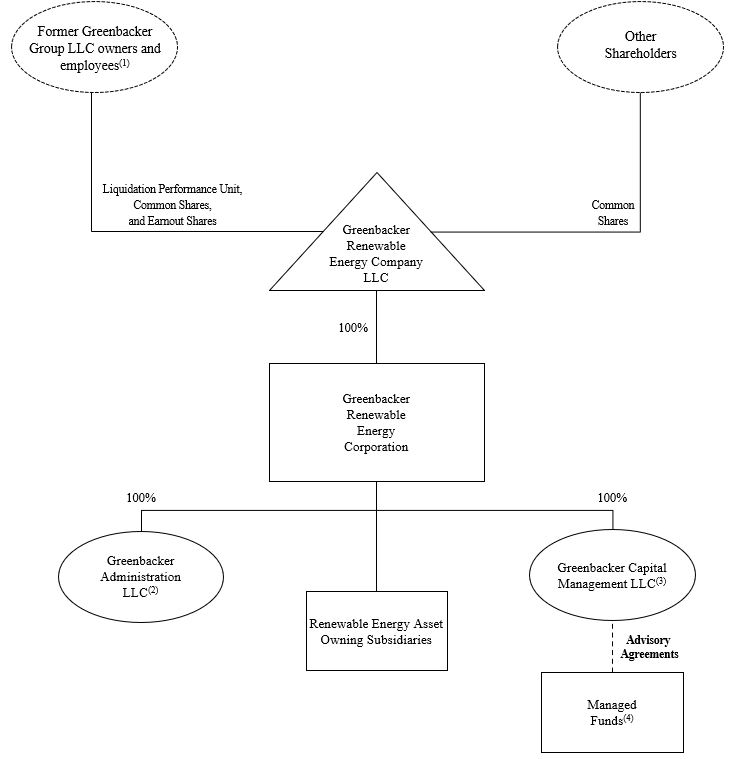

| Acquisition | The management internalization transaction completed by the Company on May 19, 2022 | ||||

| Adjusted EBITDA | A non-GAAP financial measure that the Company uses as a performance measure as well as for internal planning purposes | ||||

| Administration Agreement | First Amended and Restated Administration Agreement between Greenbacker Renewable Energy Company LLC, Greenbacker Renewable Energy Corporation and Greenbacker Administration LLC | ||||

| Advisers Act | The Investment Advisers Act of 1940 | ||||

| Advisory Agreement | Fourth Amended and Restated Advisory Agreement between Greenbacker Renewable Energy Company LLC and Greenbacker Capital Management LLC | ||||

| AEC Companies | LED Funding LLC and Renew AEC One LLC | ||||

| ARO | Asset Retirement Obligation | ||||

| ASC | Accounting Standards Codification | ||||

ASC 946 or Investment Basis | ASC Topic 946, Financial Services – Investment Companies. The accounting method used by the Company prior to the Acquisition on May 19, 2022 | ||||

| Aurora Solar | Aurora Solar Holdings, LLC | ||||

| CES | Clean Energy Standards | ||||

| COD | Commercial Operations Date | ||||

| CODM | Chief Operating Decision Maker | ||||

| Contribution Agreement | Contribution agreement between Greenbacker Renewable Energy Company LLC and Greenbacker Capital Management LLC’s former parent, Greenbacker Group LLC under which the Acquisition was implemented | ||||

| DRP | Distribution Reinvestment Plan | ||||

| Earnout Shares | Class EO common shares issued as part of the Acquisition | ||||

| EBITDA | A non-GAAP financial measure that adjusts income before income taxes to exclude interest, depreciation expense and amortization expense, as well as other income and expense items | ||||

| EIA | U.S. Energy Information Administration | ||||

| EPC | Engineering, procurement, and construction | ||||

| Exchange Act | Securities Exchange Act of 1934 | ||||

| FASB | Financial Accounting Standards Board | ||||

| FERC | U.S. Federal Energy Regulatory Commission | ||||

| FFO | A non-GAAP financial measure that the Company uses as a performance measure to analyze net earnings from operations without the effects of certain non-recurring items that are not indicative of the ongoing operating performance of the business | ||||

| Fifth Operating Agreement | Fifth Amended and Restated Limited Liability Company Operating Agreement of Greenbacker Renewable Energy Company LLC | ||||

| Fourth Operating Agreement | Fourth Amended and Restated Limited Liability Company Operating Agreement of Greenbacker Renewable Energy Company LLC | ||||

| FPA | Federal Power Act | ||||

| GCM | Greenbacker Capital Management LLC | ||||

| GDEV | Greenbacker Development Opportunities Fund I, LP | ||||

| GDEV B | Greenbacker Development Opportunities Fund I (B), LP | ||||

| GDEV GP | Greenbacker Development Opportunities Fund GP I, LLC | ||||

| GDEV GP II | Greenbacker Development Opportunities GP II, LLC | ||||

| GDEV I | Refers collectively to GDEV and parallel fund, GDEV B | ||||

| GDEV II | Greenbacker Development Opportunities Fund II, LP | ||||

| GREC | Greenbacker Renewable Energy Corporation, a Maryland corporation | ||||

| GREC HoldCo or GREC Entity Holdco | GREC Entity HoldCo LLC, a wholly owned subsidiary of GREC | ||||

| GREC II | Greenbacker Renewable Energy Company II, LLC | ||||

| Greenbacker Administration or Administrator | Greenbacker Administration LLC | ||||

| Group LLC | Greenbacker Group LLC | ||||

| GROZ | Greenbacker Renewable Opportunity Zone Fund LLC | ||||

| GROZ, GDEV I, GDEV II and GREC II | The managed funds | ||||

| GW | Gigawatts | ||||

| HLBV | Hypothetical Liquidation at Book Value | ||||

| IM | The Investment Management segment represents GCM’s investment management platform – a renewable energy, energy efficiency and sustainability-related project acquisition, consulting and development company that is registered as an investment adviser under the Advisers Act | ||||

| Investment Basis | Investment Basis ASC Topic 946, Financial Services – Investment Companies | ||||

| IPP | The Independent Power Producer segment represents the active management and operations of the Company's fleet of renewable energy projects, including those in late-stage development and under construction | ||||

| IRA | Inflation Reduction Act of 2022 | ||||

| ITC | Investment Tax Credit | ||||

| JOBS Act | Jumpstart Our Business Startups Act | ||||

| kW | Kilowatts | ||||

| kWh | Kilowatt hours | ||||

| LIBOR | London Interbank Offered Rate | ||||

| LP | Limited partner | ||||

| LPU Holder | GB Liquidation Performance Holder LLC | ||||

| MIPA | Membership Interest Purchase Agreement | ||||

| MSV | Monthly share value | ||||

| MW | Megawatts: (DC) for all solar assets and (AC) for wind assets | ||||

| MWh | Megawatt Hours | ||||

| N/A | Not applicable | ||||

| NAV | Net asset value | ||||

| NCI | Noncontrolling interests | ||||

| NM | Not meaningful | ||||

| Non-Investment Basis | Non-investment company U.S. GAAP accounting the Company applied subsequent to the Acquisition | ||||

| NTP | Notice to Proceed | ||||

| O&O costs | Organization and Offering Costs | ||||

| OYA | OYA-Rosewood Holdings LLC, previously OYA Solar B1 Intermediate Holdco LLC | ||||

| PPA | Power Purchase Agreement | ||||

| PTC | Production Tax Credit | ||||

| PTO | Permission to operate | ||||

| REC | Renewable Energy Credit | ||||

| RNCI | Redeemable noncontrolling interests | ||||

| ROU | Right-of-use asset | ||||

| RPS | Renewable Portfolio Standard | ||||

| SEC | Securities and Exchange Commission | ||||

| SOFR | Secured Overnight Financing Rate | ||||

| Special Unit | Prior to the Acquisition, referred to the special unit of the limited liability company interest in the Greenbacker Renewable Energy Company LLC entitling the Special Unitholder to a performance participation fee | ||||

| Special Unitholder | GREC Advisors, LLC, a Delaware limited liability company, which is a subsidiary of GCM | ||||

| SRP | Share Repurchase Program | ||||

| Tax Equity Investors | Third-party investors under tax equity financing facilities | ||||

| U.S. GAAP | U.S. generally accepted accounting principles | ||||

| VIE | Variable interest entities | ||||

| We, us, our and the Company | Greenbacker Renewable Energy Company LLC and its subsidiaries as of and subsequent to May 19, 2022 | ||||

| We, us, our and the LLC | Greenbacker Renewable Energy Company LLC, Greenbacker Renewable Energy Corporation, GREC Entity HoldCo LLC, GREC Administration LLC and Danforth Shared Services LLC as of and through May 18, 2022 | ||||

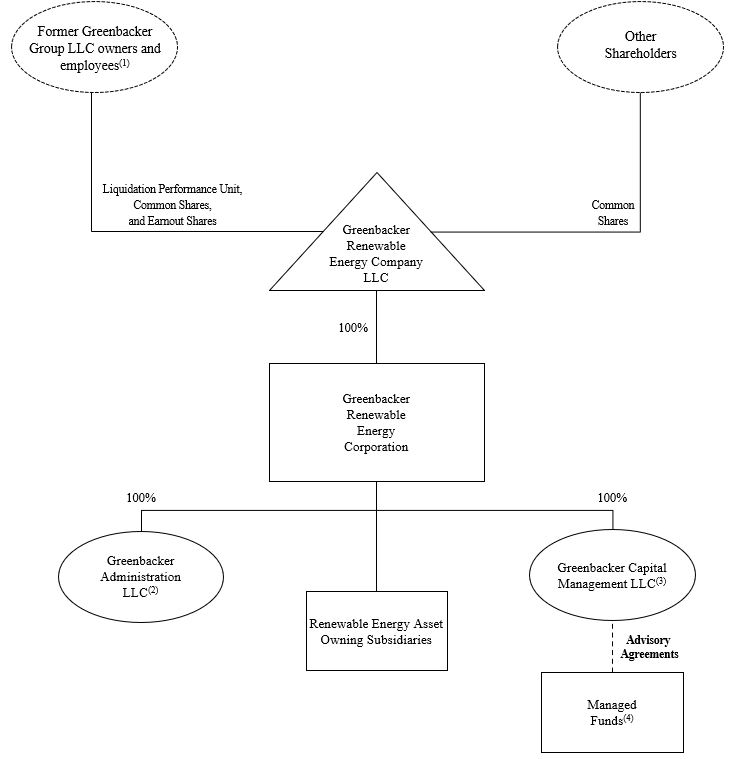

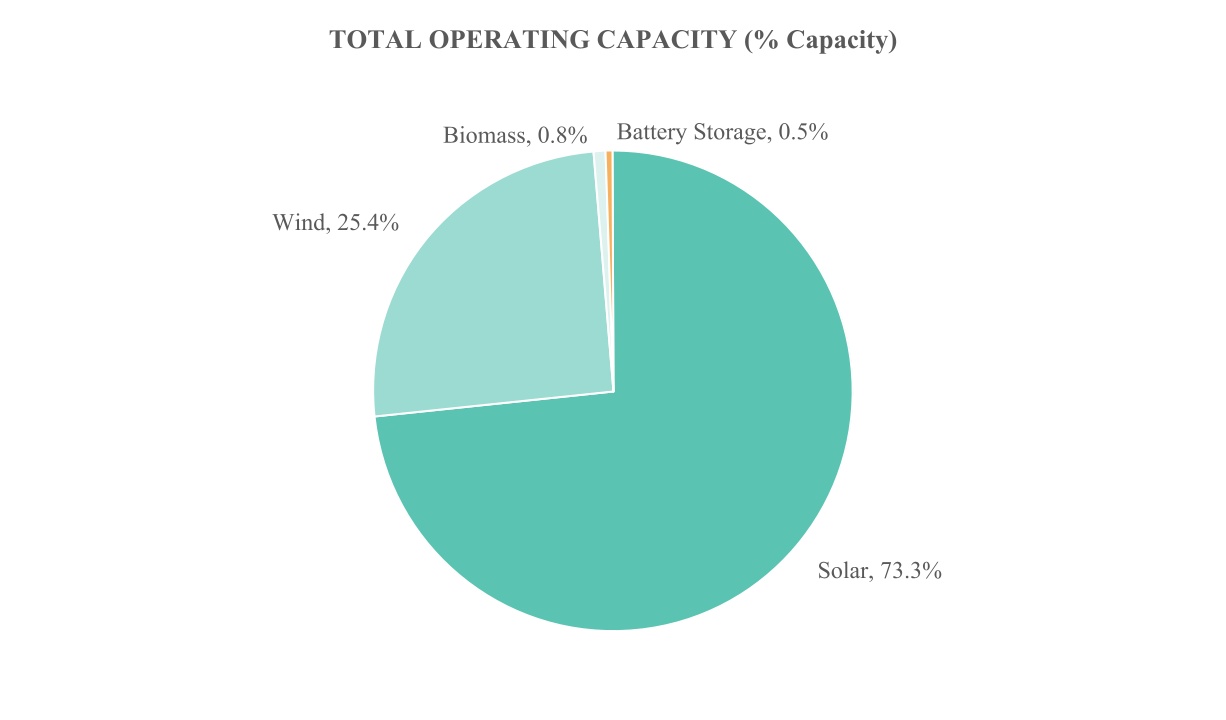

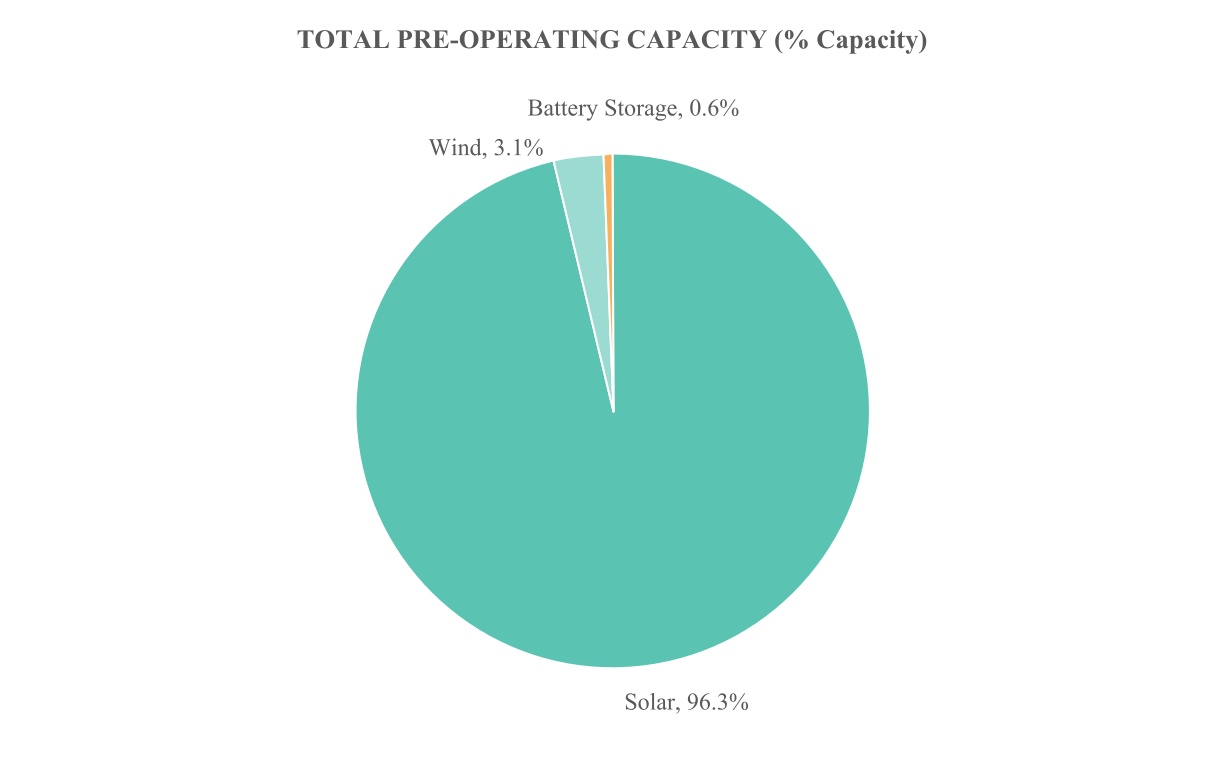

| Technology | Number of Assets | Capacity in MW | ||||||||||||

| Operating | Pre-Operating | Operating | Pre-Operating | |||||||||||

| Solar | 324 | 65 | 1,123.6 | 1,685.8 | ||||||||||

| Wind | 16 | 1 | 389.0 | 54.4 | ||||||||||

| Biomass | 1 | N/A | 12.0 | N/A | ||||||||||

| Battery Storage | 19 | 5 | 8.3 | 10.8 | ||||||||||

| Energy Efficiency | 4 | N/A | N/A | N/A | ||||||||||

| Total | 364 | 71 | 1,532.9 | 1,751.0 | ||||||||||

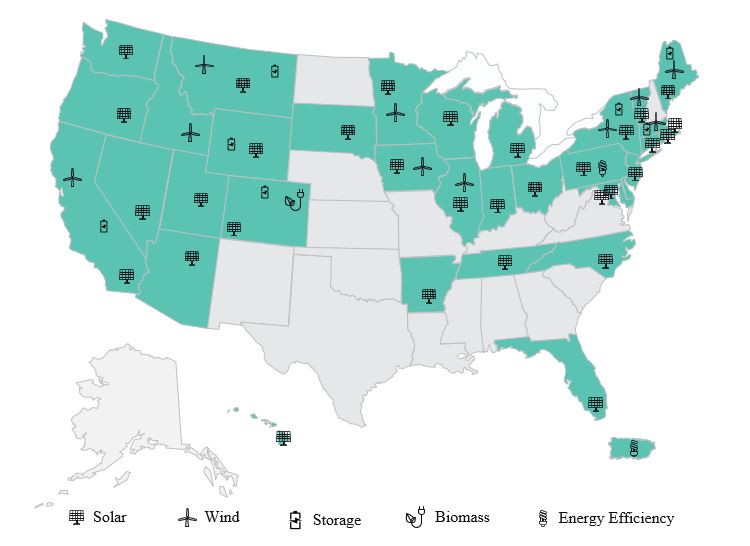

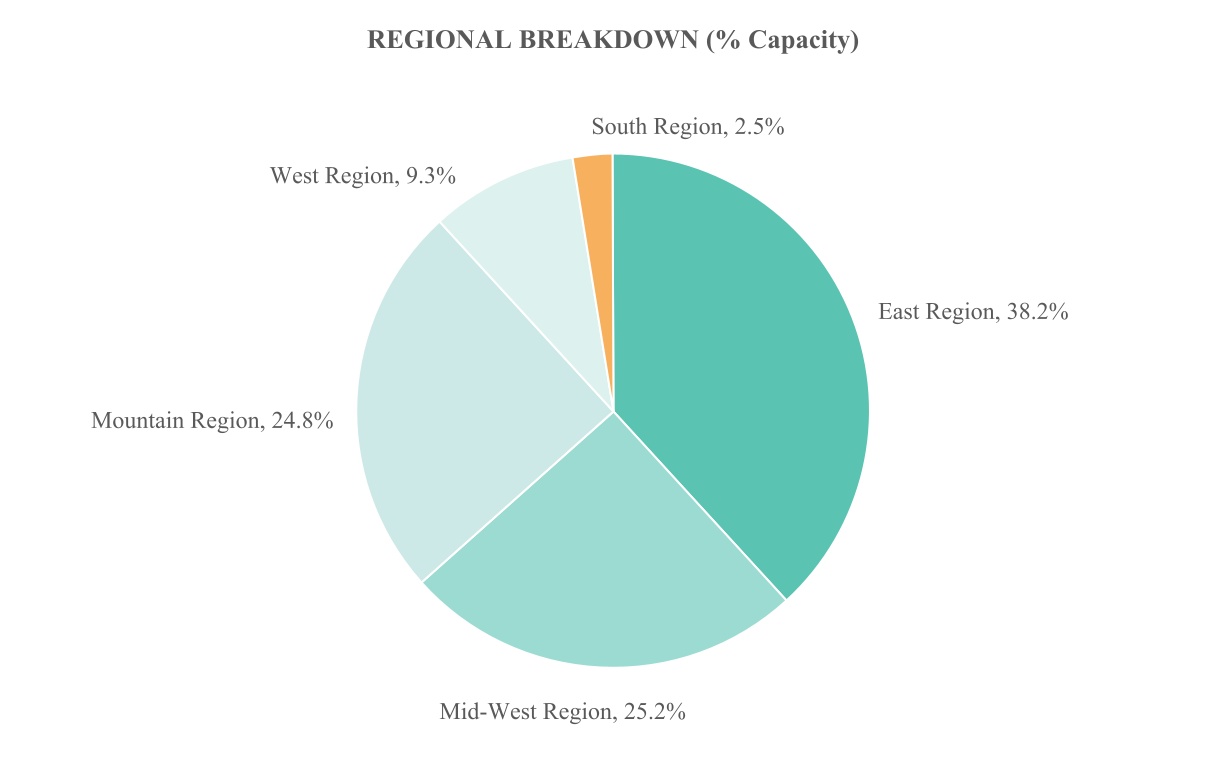

| CAPACITY BREAKDOWN | ||||||||

| Technology | Percent capacity (%) | Size (MW) | ||||||

| Solar | 85.5 | 2,809.4 | ||||||

| Wind | 13.5 | 443.4 | ||||||

| Biomass | 0.4 | 12.0 | ||||||

| Battery Storage | 0.6 | 19.1 | ||||||

| SOLAR/WIND ITC | •Increases back to 30% (planned to be 23% in 2034) | |||||||

| WIND PTC | •Increases rate to $0.0275/kWh (extended to 100% of credit amount; was down to 40%) | |||||||

| SOLAR PTC | •Included a new rate of $0.0275/kWh (in line with Wind PTC) | |||||||

| STORAGE ITC | •New ITC of 30% •Encourages stand-alone storage vs. current incentives which push towards solar + storage | |||||||

| ADDITIONAL POTENTIAL CREDITS (for both ITC & PTC) | •10-20% for low-income communities •10% for energy communities •10% for domestic content | |||||||

| TRANSFERABILITY OF CREDITS | •Owner can sell their tax credits directly to corporate taxpayers seeking to reduce their tax liability | |||||||

| OTHER NOTABLE MENTIONS | •Incentive levels described above require project to meet several requirements such as prevailing wage and apprenticeship requirements (projects >1MWac) •Interconnection eligibility (projects <5MWac) •EV and Hydrogen credits, resource neutrality after 2024 and direct pay | |||||||

| Period | Class | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| From | To | A | C | I | P-A | P-I | P-S | P-T | P-D | EO | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1-Dec-21 | 2-Jan-22 | $ | 8.339 | $ | 8.128 | $ | 8.339 | $ | 8.630 | $ | 8.803 | $ | 8.852 | $ | 8.894 | $ | 8.859 | $ | — | |||||||||||||||||||||||||||||||||||||||||||

| 3-Jan-22 | 31-Jan-22 | $ | 8.339 | $ | 8.128 | $ | 8.339 | $ | 8.630 | $ | 8.803 | $ | 8.852 | $ | 8.894 | $ | 8.859 | $ | — | |||||||||||||||||||||||||||||||||||||||||||

| 1-Feb-22 | 28-Feb-22 | $ | 8.323 | $ | 8.129 | $ | 8.321 | $ | 8.619 | $ | 8.798 | $ | 8.858 | $ | 8.878 | $ | 8.842 | $ | — | |||||||||||||||||||||||||||||||||||||||||||

| 1-Mar-22 | 31-Mar-22 | $ | 8.323 | $ | 8.129 | $ | 8.321 | $ | 8.619 | $ | 8.798 | $ | 8.858 | $ | 8.878 | $ | 8.842 | $ | — | |||||||||||||||||||||||||||||||||||||||||||

| 1-Apr-22 | 1-May-22 | $ | 8.323 | $ | 8.129 | $ | 8.321 | $ | 8.619 | $ | 8.798 | $ | 8.858 | $ | 8.878 | $ | 8.842 | $ | — | |||||||||||||||||||||||||||||||||||||||||||

| 2-May-22 | 31-May-22 | $ | 8.323 | $ | 8.129 | $ | 8.321 | $ | 8.619 | $ | 8.798 | $ | 8.858 | $ | 8.878 | $ | 8.842 | $ | — | |||||||||||||||||||||||||||||||||||||||||||

| 1-Jun-22 | 30-Jun-22 | $ | 8.323 | $ | 8.129 | $ | 8.321 | $ | 8.619 | $ | 8.798 | $ | 8.858 | $ | 8.878 | $ | 8.842 | $ | — | |||||||||||||||||||||||||||||||||||||||||||

| 1-Jul-22 | 31-Jul-22 | $ | 8.323 | $ | 8.129 | $ | 8.321 | $ | 8.619 | $ | 8.798 | $ | 8.858 | $ | 8.878 | $ | 8.842 | $ | — | |||||||||||||||||||||||||||||||||||||||||||

| 1-Aug-22 | 30-Aug-22 | $ | 8.323 | $ | 8.129 | $ | 8.321 | $ | 8.619 | $ | 8.798 | $ | 8.858 | $ | 8.878 | $ | 8.842 | $ | — | |||||||||||||||||||||||||||||||||||||||||||

| 31-Aug-22 | 2-Oct-22 | $ | 8.493 | $ | 8.340 | $ | 8.500 | $ | 8.817 | $ | 8.987 | $ | 9.049 | $ | 9.059 | $ | 9.003 | $ | — | |||||||||||||||||||||||||||||||||||||||||||

| 3-Oct-22 | 31-Oct-22 | $ | 8.493 | $ | 8.340 | $ | 8.500 | $ | 8.817 | $ | 8.987 | $ | 9.049 | $ | 9.059 | $ | 9.003 | $ | — | |||||||||||||||||||||||||||||||||||||||||||

| 1-Nov-22 | 30-Nov-22 | $ | 8.301 | $ | 8.159 | $ | 8.300 | $ | 8.612 | $ | 8.801 | $ | 8.853 | $ | 8.863 | $ | 8.817 | $ | — | |||||||||||||||||||||||||||||||||||||||||||

| 1-Dec-22 | 1-Jan-23 | $ | 8.301 | $ | 8.159 | $ | 8.300 | $ | 8.612 | $ | 8.801 | $ | 8.853 | $ | 8.863 | $ | 8.817 | $ | — | |||||||||||||||||||||||||||||||||||||||||||

| 2-Jan-23 | 31-Jan-23 | $ | 8.301 | $ | 8.159 | $ | 8.300 | $ | 8.612 | $ | 8.801 | $ | 8.853 | $ | 8.863 | $ | 8.817 | $ | — | |||||||||||||||||||||||||||||||||||||||||||

| 1-Feb-23 | 28-Feb-23 | $ | 8.308 | $ | 8.185 | $ | 8.310 | $ | 8.626 | $ | 8.810 | $ | 8.872 | $ | 8.864 | $ | 8.828 | $ | — | |||||||||||||||||||||||||||||||||||||||||||

| 1-Mar-23 | 2-Apr-23 | $ | 8.308 | $ | 8.185 | $ | 8.310 | $ | 8.626 | $ | 8.810 | $ | 8.872 | $ | 8.864 | $ | 8.828 | $ | — | |||||||||||||||||||||||||||||||||||||||||||

| 3-Apr-23 | 30-Apr-23 | $ | 8.308 | $ | 8.185 | $ | 8.310 | $ | 8.626 | $ | 8.810 | $ | 8.872 | $ | 8.864 | $ | 8.828 | $ | — | |||||||||||||||||||||||||||||||||||||||||||

| 1-May-23 | 31-May-23 | $ | 8.328 | $ | 8.211 | $ | 8.331 | $ | 8.651 | $ | 8.834 | $ | 8.887 | $ | 8.882 | $ | 8.851 | $ | — | |||||||||||||||||||||||||||||||||||||||||||

| 1-Jun-23 | 2-Jul-23 | $ | 8.328 | $ | 8.211 | $ | 8.331 | $ | 8.651 | $ | 8.834 | $ | 8.887 | $ | 8.882 | $ | 8.851 | $ | — | |||||||||||||||||||||||||||||||||||||||||||

| 3-Jul-23 | 31-Jul-23 | $ | 8.328 | $ | 8.211 | $ | 8.331 | $ | 8.651 | $ | 8.834 | $ | 8.887 | $ | 8.882 | $ | 8.851 | $ | 8.835 | |||||||||||||||||||||||||||||||||||||||||||

| 1-Aug-23 | 31-Aug-23 | $ | 8.260 | $ | 8.154 | $ | 8.264 | $ | 8.582 | $ | 8.761 | $ | 8.808 | $ | 8.805 | $ | 8.776 | $ | 8.835 | |||||||||||||||||||||||||||||||||||||||||||

| 1-Sept-23 | 1-Oct-23 | $ | 8.260 | $ | 8.154 | $ | 8.264 | $ | 8.582 | $ | 8.761 | $ | 8.808 | $ | 8.805 | $ | 8.776 | $ | 8.835 | |||||||||||||||||||||||||||||||||||||||||||

| 2-Oct-23 | 30-Oct-23 | $ | 8.260 | $ | 8.154 | $ | 8.264 | $ | 8.582 | $ | 8.761 | $ | 8.808 | $ | 8.805 | $ | 8.776 | $ | 8.835 | |||||||||||||||||||||||||||||||||||||||||||

| 31-Oct-23 | 30-Nov-23 | $ | 7.753 | $ | 7.658 | $ | 7.759 | $ | 8.075 | $ | 8.247 | $ | 8.289 | $ | 8.287 | $ | 8.261 | $ | 8.247 | |||||||||||||||||||||||||||||||||||||||||||

| 1-Dec-23 | 1-Jan-24 | $ | 7.753 | $ | 7.658 | $ | 7.759 | $ | 8.075 | $ | 8.247 | $ | 8.289 | $ | 8.287 | $ | 8.261 | $ | 8.247 | |||||||||||||||||||||||||||||||||||||||||||

| 2-Jan-24 | 31-Jan-24 | $ | 7.753 | $ | 7.658 | $ | 7.759 | $ | 8.075 | $ | 8.247 | $ | 8.289 | $ | 8.287 | $ | 8.261 | $ | 8.247 | |||||||||||||||||||||||||||||||||||||||||||

| 1-Feb-24 | 29-Feb-24 | $ | 7.788 | $ | 7.714 | $ | 7.792 | $ | 8.105 | $ | 8.274 | $ | 8.341 | $ | 8.350 | $ | 8.286 | $ | 8.274 | |||||||||||||||||||||||||||||||||||||||||||

| 1-Mar-24 | Current | $ | 7.788 | $ | 7.714 | $ | 7.792 | $ | 8.105 | $ | 8.274 | $ | 8.341 | $ | 8.350 | $ | 8.286 | $ | 8.274 | |||||||||||||||||||||||||||||||||||||||||||

(in thousands) | ||||||||||||||||||||

| Pay Date | Paid in Cash | Value of Shares Issued under DRP | Total | |||||||||||||||||

| February 1, 2023 | $ | 7,386 | $ | 1,975 | $ | 9,361 | ||||||||||||||

| March 1, 2023 | 6,679 | 1,777 | 8,456 | |||||||||||||||||

| March 31, 2023 | 7,420 | 1,942 | 9,362 | |||||||||||||||||

| May 1, 2023 | 7,114 | 1,888 | 9,002 | |||||||||||||||||

| June 1, 2023 | 7,373 | 1,934 | 9,307 | |||||||||||||||||

| July 3, 2023 | 7,145 | 1,871 | 9,016 | |||||||||||||||||

| August 1, 2023 | 7,232 | 1,926 | 9,158 | |||||||||||||||||

| September 1, 2023 | 7,226 | 1,935 | 9,161 | |||||||||||||||||

| October 2, 2023 | 7,003 | 1,872 | 8,875 | |||||||||||||||||

| November 2, 2023 | 7,352 | 1,841 | 9,193 | |||||||||||||||||

| December 1, 2023 | 7,964 | 1,746 | 9,710 | |||||||||||||||||

| January 2, 2024 | 7,606 | 1,786 | 9,392 | |||||||||||||||||

| Total | $ | 87,500 | $ | 22,493 | $ | 109,993 | ||||||||||||||

(in thousands) | ||||||||||||||||||||

| Pay Date | Paid in Cash | Value of Shares Issued under DRP | Total | |||||||||||||||||

| February 1, 2022 | $ | 6,216 | $ | 1,856 | $ | 8,072 | ||||||||||||||

| March 1, 2022 | 5,712 | 1,720 | 7,432 | |||||||||||||||||

| April 1, 2022 | 6,497 | 1,975 | 8,472 | |||||||||||||||||

| May 2, 2022 | 6,291 | 1,935 | 8,226 | |||||||||||||||||

| June 1, 2022 | 6,954 | 2,020 | 8,974 | |||||||||||||||||

| July 1, 2022 | 7,345 | 1,890 | 9,235 | |||||||||||||||||

| August 1, 2022 | 7,570 | 1,955 | 9,525 | |||||||||||||||||

| September 1, 2022 | 7,565 | 1,973 | 9,538 | |||||||||||||||||

| October 3, 2022 | 7,313 | 1,923 | 9,236 | |||||||||||||||||

| November 1, 2022 | 7,507 | 1,987 | 9,494 | |||||||||||||||||

| December 1, 2022 | 7,271 | 1,930 | 9,201 | |||||||||||||||||

| January 3, 2023 | 7,703 | 1,968 | 9,671 | |||||||||||||||||

| Total | $ | 83,944 | $ | 23,132 | $ | 107,076 | ||||||||||||||

| Period | Total Number of Shares Repurchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Maximum Number of Repurchase Shares Offered | ||||||||||||||||||||||

| October 1 to December 31, 2023 | 54,000 | $ | 7.67 | 54,000 | 9,820,630(1) | |||||||||||||||||||||

| October 1 to December 31, 2022 | 3,688,500 | $ | 8.73 | 3,688,500 | 9,409,681 | |||||||||||||||||||||

(dollars in thousands) | For the year ended December 31, 2023 | For the period from May 19, 2022 through December 31, 2022 | |||||||||||||||||||||||||||||||||||||||||||||

| Independent Power Producer | Investment Management | Corporate | Total | Independent Power Producer | Investment Management | Corporate | Total | ||||||||||||||||||||||||||||||||||||||||

| Revenue | |||||||||||||||||||||||||||||||||||||||||||||||

| Energy revenue | $ | 159,301 | $ | — | $ | — | $ | 159,301 | $ | 101,596 | $ | — | $ | — | $ | 101,596 | |||||||||||||||||||||||||||||||

| Investment Management revenue | — | 13,490 | — | 13,490 | — | 1,919 | — | 1,919 | |||||||||||||||||||||||||||||||||||||||

| Other revenue | 8,434 | — | — | 8,434 | 7,506 | — | — | 7,506 | |||||||||||||||||||||||||||||||||||||||

| Operating revenue | $ | 167,735 | $ | 13,490 | $ | — | $ | 181,225 | $ | 109,102 | $ | 1,919 | $ | — | $ | 111,021 | |||||||||||||||||||||||||||||||

| Contract amortization, net | (8,060) | — | — | (8,060) | (10,529) | — | — | (10,529) | |||||||||||||||||||||||||||||||||||||||

| Total revenue | $ | 159,675 | $ | 13,490 | $ | — | $ | 173,165 | $ | 98,573 | $ | 1,919 | $ | — | $ | 100,492 | |||||||||||||||||||||||||||||||

| Operating expenses | |||||||||||||||||||||||||||||||||||||||||||||||

| Direct operating costs | $ | 91,911 | $ | 13,675 | $ | — | $ | 105,586 | $ | 48,714 | $ | 7,175 | $ | — | $ | 55,889 | |||||||||||||||||||||||||||||||

| General and administrative | 13,992 | 3,680 | 42,342 | 60,014 | 6,769 | 3,224 | 35,449 | 45,442 | |||||||||||||||||||||||||||||||||||||||

| Depreciation, amortization and accretion | 116,506 | 1 | 9,236 | 125,743 | 32,464 | — | 6,685 | 39,149 | |||||||||||||||||||||||||||||||||||||||

| Impairment of long-lived assets | 59,294 | — | — | 59,294 | — | — | — | — | |||||||||||||||||||||||||||||||||||||||

| Total operating expenses | $ | 281,703 | $ | 17,356 | $ | 51,578 | $ | 350,637 | $ | 87,947 | $ | 10,399 | $ | 42,134 | $ | 140,480 | |||||||||||||||||||||||||||||||

| Operating (loss) income | $ | (122,028) | $ | (3,866) | $ | (51,578) | $ | (177,472) | $ | 10,626 | $ | (8,480) | $ | (42,134) | $ | (39,988) | |||||||||||||||||||||||||||||||

Operating (loss) income margin(1) | (76)% | (29)% | N/A | (102)% | 11% | NM | N/A | (40)% | |||||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA | $ | 62,180 | $ | (2,674) | $ | (27,754) | $ | 31,752 | $ | 53,627 | $ | (8,480) | $ | (18,767) | $ | 26,380 | |||||||||||||||||||||||||||||||

Adjusted EBITDA margin(2)(3) | 37% | (20)% | N/A | 18% | 49% | NM | N/A | 24% | |||||||||||||||||||||||||||||||||||||||

| Portfolio Metrics | December 31, 2023 | December 31, 2022 | Change | Change as % | ||||||||||

| Power-production capacity of operating fleet at end of period | 1.5 GW | 1.2 GW | 0.3 GW | 24 | % | |||||||||

| Power-generating capacity of pre-operational fleet at end of period | 1.8 GW | 1.9 GW | (0.1) GW | (7) | % | |||||||||

| Total power-generating capacity of fleet at end of period | 3.3 GW | 3.1 GW | 0.2 GW | 5 | % | |||||||||

| YTD total energy produced at end of period (MWh) | 2,509,500 | 2,355,735 | 153,765 | 7 | % | |||||||||

| Total number of fleet assets at end of period | 435 | 456 | (21) | (5) | % | |||||||||

(in thousands) | For the year ended December 31, 2023 | For the period from May 19, 2022 through December 31, 2022 | |||||||||

| Operations and maintenance | $ | 44,360 | $ | 25,286 | |||||||

| Property taxes, insurance and site lease | 27,282 | 13,605 | |||||||||

| Salaries and benefits, professional fees and other | 20,269 | 9,823 | |||||||||

| Direct operating costs - IPP | $ | 91,911 | $ | 48,714 | |||||||

(in thousands) | For the year ended December 31, 2023 | For the period from May 19, 2022 through December 31, 2022 | |||||||||

| Segment Adjusted EBITDA: | |||||||||||

| IPP Adjusted EBITDA | $ | 62,180 | $ | 53,627 | |||||||

| IM Adjusted EBITDA | (2,674) | (8,480) | |||||||||

| Total Segment Adjusted EBITDA | 59,506 | 45,147 | |||||||||

| Reconciliation: | |||||||||||

| Total Segment Adjusted EBITDA | $ | 59,506 | $ | 45,147 | |||||||

| Unallocated corporate expenses | (27,754) | (18,767) | |||||||||

| Total Adjusted EBITDA | 31,752 | 26,380 | |||||||||

| Less: | |||||||||||

| Share-based compensation expense | 11,248 | 6,903 | |||||||||

| Change in fair value of contingent consideration | (603) | 2,100 | |||||||||

| Non-recurring professional services and legal fees | 3,388 | 7,593 | |||||||||

| Non-recurring salaries and personnel related expenses | 1,250 | — | |||||||||

Depreciation, amortization and accretion(1) | 134,647 | 49,772 | |||||||||

| Impairment of long-lived assets | 59,294 | — | |||||||||

| Operating loss | $ | (177,472) | $ | (39,988) | |||||||

| Interest expense, net | (40,519) | (15,889) | |||||||||

| Realized gain (loss) on interest rate swaps, net | 2,428 | (1,322) | |||||||||

| Unrealized gain (loss) on interest rate swaps, net | 17,763 | (249) | |||||||||

| Unrealized gain on investments, net | 932 | 398 | |||||||||

| Other expense, net | (267) | (108) | |||||||||

| Net loss before income taxes | (197,135) | (57,158) | |||||||||

| Benefit from (provision for) income taxes | 21,548 | (3,005) | |||||||||

| Net loss | (175,587) | (60,163) | |||||||||

| Less: Net loss attributable to noncontrolling interests | (96,935) | (59,439) | |||||||||

| Less: Net income attributable to redeemable noncontrolling interests | 819 | — | |||||||||

| Net loss attributable to Greenbacker Renewable Energy Company LLC | $ | (79,471) | $ | (724) | |||||||

(in thousands) | For the year ended December 31, 2023 | For the period from May 19, 2022 through December 31, 2022 | |||||||||

| Net loss attributable to Greenbacker Renewable Energy Company LLC | $ | (79,471) | $ | (724) | |||||||

| Add back or deduct the following: | |||||||||||

| Net loss attributable to noncontrolling interests | (96,935) | (59,439) | |||||||||

| Net income attributable to redeemable noncontrolling interests | 819 | — | |||||||||

| (Benefit from) provision for income taxes | (21,548) | 3,005 | |||||||||

| Interest expense, net | 40,519 | 15,889 | |||||||||

| Realized (gain) loss on interest rate swaps, net | (2,428) | 1,322 | |||||||||

| Unrealized (gain) loss on interest rate swaps, net | (17,763) | 249 | |||||||||

| Unrealized (gain) on investments, net | (932) | (398) | |||||||||

| Other expense, net | 267 | 108 | |||||||||

Depreciation, amortization and accretion(1) | 134,647 | 49,772 | |||||||||

| EBITDA | $ | (42,825) | $ | 9,784 | |||||||

| Share-based compensation expense | 11,248 | 6,903 | |||||||||

| Change in fair value of contingent consideration | (603) | 2,100 | |||||||||

| Impairment of long-lived assets | 59,294 | — | |||||||||

| Non-recurring professional services and legal fees | 3,388 | 7,593 | |||||||||

| Non-recurring salaries and personnel related expenses | 1,250 | — | |||||||||

| Adjusted EBITDA | $ | 31,752 | $ | 26,380 | |||||||

(in thousands) | For the year ended December 31, 2023 | For the period from May 19, 2022 through December 31, 2022 | |||||||||

| Net loss attributable to Greenbacker Renewable Energy Company LLC | $ | (79,471) | $ | (724) | |||||||

| Add back or deduct the following: | |||||||||||

| Net loss attributable to noncontrolling interests | (96,935) | (59,439) | |||||||||

| Net income attributable to redeemable noncontrolling interests | 819 | — | |||||||||

| (Benefit from) provision for income taxes | (21,548) | 3,005 | |||||||||

| Interest expense, net | 40,519 | 15,889 | |||||||||

| Realized (gain) loss on interest rate swaps, net | (2,428) | 1,322 | |||||||||

| Unrealized (gain) loss on interest rate swaps, net | (17,763) | 249 | |||||||||

| Unrealized (gain) on investments, net | (932) | (398) | |||||||||

| Other expense, net | 267 | 108 | |||||||||

Depreciation, amortization and accretion(1) | 134,647 | 49,772 | |||||||||

| Impairment of long-lived assets | 59,294 | — | |||||||||

| Share-based compensation expense | 11,248 | 6,903 | |||||||||

| Change in fair value of contingent consideration | (603) | 2,100 | |||||||||

| Non-recurring professional services and legal fees | 3,388 | 7,593 | |||||||||

| Non-recurring salaries and personnel related expenses | 1,250 | — | |||||||||

| Adjusted EBITDA | $ | 31,752 | $ | 26,380 | |||||||

| Cash portion of interest expense | (27,473) | (11,783) | |||||||||

| Distributions to tax equity investors | (15,748) | (11,363) | |||||||||

| FFO | $ | (11,469) | $ | 3,234 | |||||||

(in thousands, except per share data) | December 31, 2023 | ||||

| Total equity | $ | 1,623,540 | |||

| Add back or deduct the following: | |||||

| Noncontrolling interests | (113,875) | ||||

| Redeemable noncontrolling interests | (2,179) | ||||

| Accumulated unrealized appreciation in fair value of investments | 113,362 | ||||

| Net asset value (members’ equity) | $ | 1,620,848 | |||

| Shares outstanding | 198,622 | ||||

| NAV per share | $ | 8.16 | |||

(in thousands) | |||||

| Components of NAV | December 31, 2023 | ||||

| Investment in renewable energy projects and secured loans, at fair value | $ | 2,312,776 | |||

| Cash and cash equivalents and Restricted cash | 77,887 | ||||

| Derivative assets | 142,168 | ||||

| Other current assets | 55,150 | ||||

| Other noncurrent assets | 334,476 | ||||

| Derivative liabilities | (5,833) | ||||

| Other current liabilities | (49,042) | ||||

| Long-term debt, including current portion | (1,094,420) | ||||

| Other noncurrent liabilities | (152,314) | ||||

| Net Asset Value | $ | 1,620,848 | |||

| Shares outstanding | 198,622 | ||||

(in thousands, except per share data) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Class | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A | C | I | P-A | P-I | P-D | P-S | P-T | EO | Total | ||||||||||||||||||||||||||||||||||||||||||||||||||

| NAV | $ | 123,127 | $ | 20,730 | $ | 50,903 | $ | 6,871 | $ | 1,026,347 | $ | 1,588 | $ | 358,464 | $ | 2,022 | $ | 30,796 | $ | 1,620,848 | |||||||||||||||||||||||||||||||||||||||

| Shares outstanding | 15,809 | 2,706 | 6,533 | 850 | 124,039 | 192 | 44,514 | 249 | 3,730 | 198,622 | |||||||||||||||||||||||||||||||||||||||||||||||||

| NAV per share as of December 31, 2023 | $ | 7.788 | $ | 7.659 | $ | 7.792 | $ | 8.085 | $ | 8.274 | $ | 8.263 | $ | 8.053 | $ | 8.124 | $ | 8.274 | |||||||||||||||||||||||||||||||||||||||||

(in thousands) | For the period from January 1, 2022 through May 18, 2022 | ||||

| Investment income: | |||||

| Dividend income | $ | 12,547 | |||

| Interest income | 1,279 | ||||

| Total investment income | $ | 13,826 | |||

| Key Operating expenses: | |||||

| Management fee expense | $ | 10,662 | |||

| Performance participation fee | 384 | ||||

| Other expenses | 11,981 | ||||

| Total expenses | 23,027 | ||||

| Net investment loss before taxes | (9,201) | ||||

| (Benefit from) income taxes | (4,315) | ||||

| Net investment loss | $ | (4,886) | |||

| Net change in realized and unrealized gain (loss) on investments, foreign currency translation and deferred tax assets: | |||||

| Net realized loss on investments | $ | (2) | |||

| Net change in unrealized appreciation (depreciation) on: | |||||

| Investments | 13,648 | ||||

| Foreign currency translation | (26) | ||||

| Swap contracts | 35,266 | ||||

| (Provision for) income taxes on realized and unrealized gain (loss) on investments, foreign currency translation and swap contracts | (13,223) | ||||

| Net increase in net assets attributed to members' equity | $ | 30,777 | |||

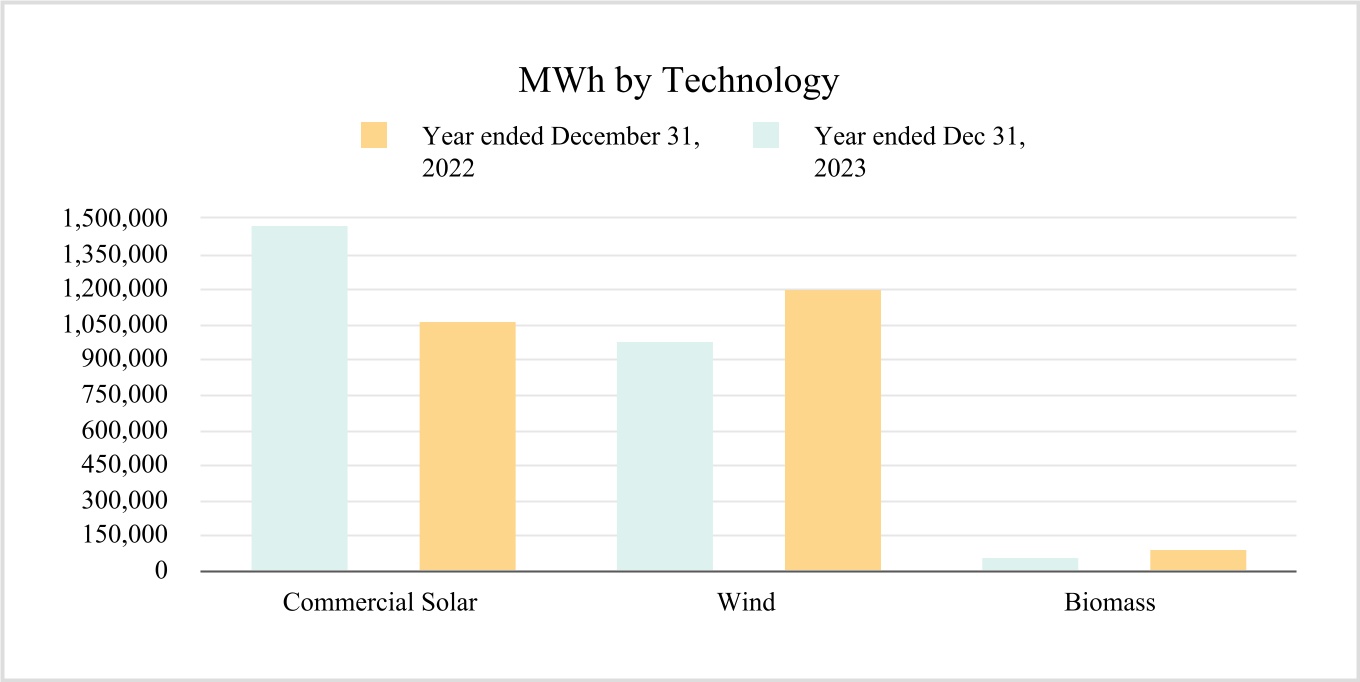

| MWh by Technology | Year ended December 31, 2023 | Year ended December 31, 2022 | YoY change for the year ended December 31 | |||||||||||||||||

| Solar | 1,473,384 | 1,067,114 | 38 | % | ||||||||||||||||

| Wind | 978,236 | 1,198,236 | (18) | % | ||||||||||||||||

| Biomass | 57,880 | 90,385 | (36) | % | ||||||||||||||||

| Total | 2,509,500 | 2,355,735 | 7 | % | ||||||||||||||||

(dollars in thousands) | ||||||||

| Description | For the period from January 1, 2022 through May 18, 2022 | |||||||

Net investment loss before taxes | $ | (9,200) | ||||||

| Shareholder distributions (total including DRP) | $ | 32,203 | ||||||

| Dividend coverage ratio (net investment income/total distributions) | (28.6) | % | ||||||

Realized losses | $ | (2) | ||||||

| Gross dividend coverage ratio (net investment income and realized gains/total shareholder distributions) | (28.6) | % | ||||||

(dollars in thousands) | Outstanding as of December 31, 2023 | Outstanding as of December 31, 2022 | Interest rate | Maturity date | ||||||||||||||||||||||

GREC Entity HoldCo(1) | $ | 65,951 | $ | 74,197 | Daily SOFR + 1.85% | June 20, 2025 | ||||||||||||||||||||

| Midway III Manager LLC | 13,932 | 14,610 | 3 mo. SOFR + 1.73% | September 28, 2025 | ||||||||||||||||||||||

| Trillium Manager LLC | 68,785 | 72,737 | Daily SOFR + 1.98% | June 9, 2027 | ||||||||||||||||||||||

GB Wind Holdco LLC(2) | 50,408 | 122,684 | 3 mo. SOFR + 1.38% | Various(3) | ||||||||||||||||||||||

| Greenbacker Wind Holdings II LLC | 70,628 | 72,477 | 3 mo. SOFR + 1.98% | December 31, 2026 | ||||||||||||||||||||||

| Conic Manager LLC | 23,363 | 24,356 | 3 mo. SOFR + 1.75% | August 8, 2026 | ||||||||||||||||||||||

| Turquoise Manager LLC | 30,994 | 31,687 | 3 mo. SOFR + 1.35% | December 23, 2027 | ||||||||||||||||||||||

Eagle Valley Clean Energy LLC | 35,389 | 35,112 | Various(4) | January 2, 2057 | ||||||||||||||||||||||

| Eagle Valley Clean Energy LLC (Premium financing agreement) | — | 1,064 | 6.99% | November 30, 2023(5) | ||||||||||||||||||||||

Greenbacker Equipment Acquisition Company LLC | — | 6,500 | Prime + 1.00% | December 31, 2023(6) | ||||||||||||||||||||||

| ECA Finco I, LLC | 18,563 | 19,757 | 3 mo. SOFR + 2.60% | February 25, 2028 | ||||||||||||||||||||||

| GB Solar TE 2020 Manager LLC | 18,506 | 19,182 | 3 mo. SOFR + 1.88% | October 30, 2026 | ||||||||||||||||||||||

| Sego Lily Solar Manager LLC | 133,898 | 137,445 | 3 mo. SOFR + 1.53% | June 30, 2028 | ||||||||||||||||||||||

| Celadon Manager LLC | 72,853 | 61,925 | Daily SOFR + 1.60% | February 18, 2029 | ||||||||||||||||||||||

GRP II Borealis Solar LLC | 40,646 | 41,788 | 3 mo. SOFR + 2.00% | June 30, 2027 | ||||||||||||||||||||||

| Ponderosa Manager LLC | 88,594 | 147,080 | 3 mo. SOFR + 1.40% | October 4, 2029(7) | ||||||||||||||||||||||

| PRC Nemasket LLC | 41,806 | 44,488 | Daily SOFR + 1.25% | November 1, 2029 | ||||||||||||||||||||||

| GREC Holdings 1 LLC | 74,594 | 60,000 | 1 mo. SOFR + Applicable Margin(8) | November 29, 2027 | ||||||||||||||||||||||

| Dogwood GB Manager LLC | 57,463 | — | 1 mo. SOFR + 1.63% | March 29, 2030 | ||||||||||||||||||||||

| GREC Warehouse Holdings I LLC | 155,558 | — | 3 mo. SOFR + 2.03% | August 11, 2026 | ||||||||||||||||||||||

| Total debt | $ | 1,061,931 | $ | 987,089 | ||||||||||||||||||||||

| Less: Total unamortized discount and deferred financing fees | (43,679) | (40,459) | ||||||||||||||||||||||||

Less: Current portion of long-term debt(9) | (82,855) | (95,870) | ||||||||||||||||||||||||

| Total long-term debt, net | $ | 935,397 | $ | 850,760 | ||||||||||||||||||||||

(in thousands) | ||||||||

Period ending December 31, | Principal Payments | |||||||

| 2024 | $ | 88,917 | ||||||

| 2025 | 39,546 | |||||||

| 2026 | 277,490 | |||||||

| 2027 | 255,582 | |||||||

| 2028 | 133,462 | |||||||

| Thereafter | 266,934 | |||||||

| $ | 1,061,931 | |||||||

(in thousands) | For the year ended December 31, 2023 | For the period from May 19, 2022 through December 31, 2022 | |||||||||

| Net cash provided by operating activities | $ | 62,401 | $ | 11,695 | |||||||

| Net cash used in investing activities | (323,179) | (468,098) | |||||||||

| Net cash provided by financing activities | 257,755 | 441,652 | |||||||||

| Net decrease in cash, cash equivalents and restricted cash | (3,023) | (14,751) | |||||||||

(in thousands) | For the period from January 1, 2022 through May 18, 2022 | ||||

| Net cash (used in) operating activities | $ | (71,665) | |||

| Net cash provided by financing activities | 57,864 | ||||

| (Decrease) in cash, cash equivalents and restricted cash | (13,801) | ||||

| Quarter Ending | Share Repurchase Limit(s) | ||||

| September 30, 2021, and each quarter thereafter | During any 12-month period, 20.00% of the weighted average number of outstanding shares | ||||

During any fiscal quarter, 5.00% of the weighted average number of shares outstanding in the prior four fiscal quarters | |||||

| PAGE | |||||

| Consolidated Financial Statements (Non-Investment Basis) | |||||

F-2 | |||||

F-4 | |||||

F-5 | |||||

F-6 | |||||

F-7 | |||||

F-9 | |||||

F-10 | |||||

| Consolidated Financial Statements (Investment Basis) | |||||

F-76 | |||||

F-78 | |||||

F-79 | |||||

F-80 | |||||

F-81 | |||||

| December 31, 2023 | December 31, 2022 | ||||||||||

| Assets | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Restricted cash, current | |||||||||||

| Accounts receivable | |||||||||||

| Derivative assets, current | |||||||||||

| Notes receivable, current | |||||||||||

| Other current assets | |||||||||||

| Total current assets | |||||||||||

| Noncurrent assets: | |||||||||||

| Restricted cash | |||||||||||

| Property, plant and equipment, net | |||||||||||

| Intangible assets, net | |||||||||||

| Goodwill | |||||||||||

| Investments, at fair value | |||||||||||

| Derivative assets | |||||||||||

| Other noncurrent assets | |||||||||||

| Total noncurrent assets | |||||||||||

| Total assets | $ | $ | |||||||||

| Liabilities, Redeemable Noncontrolling Interests and Equity | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable and accrued expenses | $ | $ | |||||||||

| Shareholder distributions payable | |||||||||||

| Contingent consideration, current | |||||||||||

| Current portion of long-term debt | |||||||||||

| Current portion of failed sale-leaseback financing | |||||||||||

| Redemptions payable | |||||||||||

| Other current liabilities | |||||||||||

| Total current liabilities | |||||||||||

| Noncurrent liabilities: | |||||||||||

| Long-term debt, net of current portion | |||||||||||

| Failed sale-leaseback financing, net of current portion | |||||||||||

| Contingent consideration | |||||||||||

| Derivative liabilities | |||||||||||

| Deferred tax liabilities, net | |||||||||||

| Operating lease liabilities | |||||||||||

| Out-of-market contracts, net | |||||||||||

| Other noncurrent liabilities | |||||||||||

| Total noncurrent liabilities | |||||||||||

| Total liabilities | $ | $ | |||||||||

Commitments and contingencies (Note 15. Commitments and Contingencies) | |||||||||||

| Redeemable noncontrolling interests | |||||||||||

Redeemable common shares, par value, $ | |||||||||||

| Redeemable common shares, additional paid-in capital | |||||||||||

| Equity: | |||||||||||

Preferred shares, par value, $ | |||||||||||

Common shares, par value, $ | |||||||||||

| Additional paid-in capital | |||||||||||

| Accumulated deficit | ( | ( | |||||||||

| Accumulated other comprehensive income | |||||||||||

| Noncontrolling interests | |||||||||||

| Total equity | |||||||||||

| Total liabilities, redeemable noncontrolling interests and equity | $ | $ | |||||||||

| For the year ended December 31, 2023 | For the period from May 19, 2022 through December 31, 2022 | ||||||||||

| Revenue | |||||||||||

| Energy revenue | $ | $ | |||||||||

| Investment Management revenue | |||||||||||

| Other revenue | |||||||||||

| Contract amortization, net | ( | ( | |||||||||

| Total revenue | |||||||||||

| Operating expenses | |||||||||||

| Direct operating costs | |||||||||||

| General and administrative | |||||||||||

| Depreciation, amortization and accretion | |||||||||||

| Impairment of long-lived assets | |||||||||||

| Total operating expenses | |||||||||||

| Operating loss | ( | ( | |||||||||

| Interest expense, net | ( | ( | |||||||||

| Realized gain (loss) on interest rate swaps, net | ( | ||||||||||

| Unrealized gain (loss) on interest rate swaps, net | ( | ||||||||||

| Unrealized gain on investments, net | |||||||||||

| Other expense, net | ( | ( | |||||||||

| Net loss before income taxes | ( | ( | |||||||||

| Benefit from (provision for) income taxes | ( | ||||||||||

| Net loss | ( | ( | |||||||||

| Less: Net loss attributable to noncontrolling interests | ( | ( | |||||||||

| Less: Net income attributable to redeemable noncontrolling interests | |||||||||||

| Net loss attributable to Greenbacker Renewable Energy Company LLC | $ | ( | $ | ( | |||||||

| Earnings per share | |||||||||||

| Basic | $ | ( | $ | ||||||||

| Diluted | $ | ( | $ | ||||||||

| Weighted average shares outstanding | |||||||||||

| Basic | |||||||||||

| Diluted | |||||||||||

| For the year ended December 31, 2023 | For the period from May 19, 2022 through December 31, 2022 | ||||||||||

| Net loss | $ | ( | $ | ( | |||||||

| Other comprehensive (loss) income, net of tax: | |||||||||||

| Unrealized (loss) gain on derivatives designated as cash flow hedges and changes in Other comprehensive (loss) income, net of tax | ( | ||||||||||

| Total other comprehensive (loss) income, net of tax | $ | ( | $ | ||||||||

| Comprehensive loss | ( | ( | |||||||||

| Less: Comprehensive loss attributable to noncontrolling interests | ( | ( | |||||||||

| Less: Comprehensive gain attributable to redeemable noncontrolling interests | |||||||||||

| Comprehensive (loss) income attributable to Greenbacker Renewable Energy Company LLC | $ | ( | $ | ||||||||

| Shares | Par Value | Additional paid-in capital | Accumulated deficit | Accumulated other comprehensive income | Noncontrolling interests | Total equity | Redeemable common shares | Par value - redeemable common shares | Additional paid-in capital - redeemable common shares | Redeemable noncontrolling interests | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balances as of December 31, 2022 | $ | $ | $ | ( | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Issuance of common shares under distribution reinvestment plan | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Repurchases of common shares | ( | ( | ( | — | — | — | ( | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Proceeds from shares transferred | — | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deferred sales commissions | — | — | — | ( | — | — | ( | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholder distributions | — | — | — | ( | — | — | ( | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive loss, net of tax | — | — | — | — | ( | — | ( | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Contributions from noncontrolling interests, net | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Distributions to noncontrolling interests | — | — | — | — | — | ( | ( | — | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Buyout of noncontrolling interests | — | — | — | — | ( | ( | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Earnout Share participation | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Share-based compensation expense | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Reclassification of participating Earnout Shares to temporary equity | ( | — | ( | — | — | ( | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Reclassification of Class P-I shares to temporary equity | ( | ( | ( | — | — | ( | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other noncontrolling interest activity | — | — | — | — | — | ( | ( | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net (loss) income | — | — | — | ( | — | ( | ( | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balances as of December 31, 2023 | $ | $ | $ | ( | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shares | Par Value | Additional paid-in capital | Accumulated deficit | Accumulated other comprehensive income | Noncontrolling interests | Total equity | Redeemable noncontrolling interests | ||||||||||||||||||||||||||||||||||||||||

| Balances as of May 19, 2022 | $ | $ | $ | ( | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||

| Consolidation of Greenbacker Development Opportunities Fund I, LP | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Deconsolidation of Greenbacker Development Opportunities Fund I, LP | — | — | — | — | ( | ( | — | ||||||||||||||||||||||||||||||||||||||||

| Consolidation of Greenbacker Development Opportunities Fund I GP | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Issuance of common shares as consideration transferred for Acquisition | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

| Issuance of common shares under distribution reinvestment plan | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

| Repurchases of common shares | ( | ( | ( | — | — | — | ( | — | |||||||||||||||||||||||||||||||||||||||

| Other capital activity | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||

| Deferred sales commissions | — | — | — | ( | — | — | ( | — | |||||||||||||||||||||||||||||||||||||||

| Shareholder distributions | — | — | — | ( | — | — | ( | — | |||||||||||||||||||||||||||||||||||||||

| Other comprehensive income | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Contributions from noncontrolling interests, net | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Distributions to noncontrolling interests | — | — | — | — | — | ( | ( | — | |||||||||||||||||||||||||||||||||||||||

| Share-based compensation expense | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | ( | — | ( | ( | — | |||||||||||||||||||||||||||||||||||||||

| Balances as of December 31, 2022 | $ | $ | $ | ( | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||

| For the year ended December 31, 2023 | For the period from May 19, 2022 through December 31, 2022 | ||||||||||

| Cash Flows from Operating Activities | |||||||||||

| Net loss | $ | ( | $ | ( | |||||||

| Adjustments to reconcile net loss to net cash provided by operating activities: | |||||||||||

| Depreciation, amortization and accretion | |||||||||||

| Impairment of long-lived assets | |||||||||||

| Share-based compensation expense | |||||||||||

| Changes in fair value of contingent consideration | ( | ||||||||||

| Amortization of financing costs and debt discounts | |||||||||||

| Amortization of interest rate swap contracts | |||||||||||

| Change in fair value of interest rate swaps | ( | ||||||||||

| Realized (gain) loss on interest rate swaps | ( | ||||||||||

| Change in fair value of investments | ( | ( | |||||||||

| Deferred income taxes | ( | ||||||||||

| Other | |||||||||||

| Changes in operating assets and liabilities: | |||||||||||

| Accounts receivable | ( | ||||||||||

| Current and noncurrent derivative assets | |||||||||||

| Other current and noncurrent assets | ( | ( | |||||||||

| Accounts payable and accrued expenses | ( | ||||||||||

| Operating lease liabilities | ( | ||||||||||

| Other current and noncurrent liabilities | |||||||||||

| Net cash provided by operating activities | |||||||||||

| Cash Flows from Investing Activities | |||||||||||

| Purchases of property, plant and equipment | ( | ( | |||||||||

| Deposits returned (paid) for property, plant and equipment, net | ( | ||||||||||

| Purchases of investments | ( | ( | |||||||||

| Sales of investments | |||||||||||

| Loans made to other parties | ( | ||||||||||

| Receipts of notes receivable to other parties | |||||||||||

| Cash acquired from Acquisition and consolidation of GDEV, net | |||||||||||

| Proceeds from sale of investment in and deconsolidation of GDEV | |||||||||||

| Net cash used in investing activities | ( | ( | |||||||||

| Cash Flows from Financing Activities | |||||||||||

| Shareholder distributions | ( | ( | |||||||||

| Return of collateral paid for swap contract | |||||||||||

| Repurchases of common shares | ( | ( | |||||||||

| Deferred sales commissions | ( | ( | |||||||||

| Contributions from noncontrolling interests | |||||||||||

| Distributions to noncontrolling interests | ( | ( | |||||||||

| Proceeds from borrowings | |||||||||||

| Payments on borrowings | ( | ( | |||||||||

| Proceeds from failed sale-leaseback | |||||||||||

| Payments for loan origination costs | ( | ( | |||||||||

| Other capital activity | ( | ||||||||||

| Net cash provided by financing activities | |||||||||||

| Net decrease in Cash, cash equivalents and Restricted cash | ( | ( | |||||||||

Cash, cash equivalents and Restricted cash at beginning of period* | |||||||||||

| Cash, cash equivalents and Restricted cash at end of period | $ | $ | |||||||||

(in thousands) | May 19, 2022 | ||||

Total members’ equity (net assets) | $ | ||||

| Plus: Fair value of redeemable noncontrolling interests and noncontrolling interests | |||||

| Total net assets of the Company | $ | ||||

| Assets | |||||

| Cash, cash equivalents and Restricted cash | $ | ||||

| Other current assets | |||||

| Total current assets | |||||

| Property, plant and equipment | |||||

| Intangible assets | |||||

| Investments, at fair value | |||||

| Derivative assets | |||||

| Other noncurrent assets | |||||

| Total noncurrent assets | |||||

| Total assets | |||||

| Liabilities | |||||

| Accounts payable and accrued expenses | $ | ||||

| Other current liabilities | |||||

| Total current liabilities | |||||

| Long-term debt, net | |||||

| Out-of-market contracts | |||||

| Other noncurrent liabilities | |||||

| Total noncurrent liabilities | |||||

| Total liabilities | |||||

Total members’ equity, redeemable noncontrolling interests and noncontrolling interests | $ | ||||

(in thousands) | Balances Prior to Deconsolidation | Impact of Sale and Deconsolidation | November 18, 2022 | ||||||||||||||

| Assets | |||||||||||||||||

| Current assets: | |||||||||||||||||

| Cash and cash equivalents | $ | $ | $ | ||||||||||||||

| Other current assets | |||||||||||||||||

| Total current assets | $ | $ | $ | ||||||||||||||

| Noncurrent assets: | |||||||||||||||||

| Investments, at fair value | $ | $ | ( | $ | |||||||||||||

| Total noncurrent assets | ( | ||||||||||||||||

| Total assets | $ | $ | ( | $ | |||||||||||||

| Liabilities, Redeemable Noncontrolling Interests and Equity | |||||||||||||||||

| Current liabilities: | |||||||||||||||||

| Other current liabilities | ( | ||||||||||||||||

| Total current liabilities | ( | ||||||||||||||||

| Total liabilities | $ | $ | ( | $ | |||||||||||||

| Equity: | |||||||||||||||||

| Greenbacker Renewable Energy Company LLC controlling interest | $ | $ | $ | ||||||||||||||

| Accumulated deficit | ( | ||||||||||||||||

| Noncontrolling interests | ( | ||||||||||||||||

| Total equity | $ | $ | ( | $ | |||||||||||||

| Total liabilities, redeemable noncontrolling interests and equity | $ | $ | ( | $ | |||||||||||||

(in thousands) | December 31, 2023 | December 31, 2022 | |||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Restricted cash, current | |||||||||||

| Restricted cash | |||||||||||

Total cash and cash equivalents and restricted cash | $ | $ | |||||||||

(in thousands) | For the year ended December 31, 2023 | For the period from May 19, 2022 through December 31, 2022 | |||||||||

Non-cash investing and financing activities | |||||||||||

| Deferred sales commission payable | $ | $ | |||||||||

| Redemptions payable | |||||||||||

| Distribution payable to shareholders | |||||||||||

| Capital expenditures incurred but not paid | |||||||||||

| Non-cash distributions to noncontrolling interests | |||||||||||

Cash paid for | |||||||||||

| Interest paid, net of amounts capitalized | $ | $ | |||||||||

| Asset Class | Useful Lives (Years) | ||||

| Solar energy systems | |||||

| Wind energy systems | |||||

| Battery storage systems | |||||

(in thousands) | May 19, 2022 | Adjustments | May 19, 2022 as Adjusted | ||||||||||||||

| Fair value of consideration transferred: | |||||||||||||||||

| Equity consideration | $ | $ | — | $ | |||||||||||||

| Contingent consideration | — | ||||||||||||||||

| Assumed expenses of Group LLC | — | ||||||||||||||||

Assumed debt (paid at closing) | — | ||||||||||||||||

| Extinguishment of liabilities | ( | — | ( | ||||||||||||||

| Total purchase consideration | $ | $ | — | $ | |||||||||||||

| Fair value of the Company’s investment in GDEV (held before the Acquisition) | |||||||||||||||||

| Fair value of the NCI in GDEV GP | ( | ||||||||||||||||

| Fair value of the NCI in GDEV | |||||||||||||||||

| Total amount to allocate to net assets acquired and consolidated | $ | $ | $ | ||||||||||||||

(in thousands) | May 19, 2022 | 2022 Adjustments | May 19, 2022 as Adjusted | ||||||||||||||

| Net working capital (including cash) | $ | $ | — | $ | |||||||||||||

| Property, plant and equipment | — | ||||||||||||||||

| Investments, at fair value and other noncurrent assets | — | ||||||||||||||||

| Trademarks | — | ||||||||||||||||

| Channel partner relationships | ( | ||||||||||||||||

| Carried interest | ( | ||||||||||||||||

| Other liabilities | ( | — | ( | ||||||||||||||

| Deferred tax liability | ( | ( | |||||||||||||||

| Goodwill | |||||||||||||||||

| Sum of acquired and consolidated net assets | $ | $ | $ | ||||||||||||||

(dollars in thousands) | ||||||||

| Identified intangible asset | Acquisition date fair value | Weighted-average amortization period (years) | ||||||

| Trademarks | $ | |||||||

| Channel partner relationships | ||||||||

| Goodwill | — | |||||||

(in thousands) | |||||

| Land | $ | ||||

| Property, plant and equipment | |||||

| Intangible assets | |||||

| ROU asset | |||||

| Less: Liabilities assumed | ( | ||||

| Total | $ | ||||

(dollars in thousands) | ||||||||

| Identified intangible asset | Acquisition data fair value | Weighted-average amortization period (years) | ||||||

| PPA contracts - out-of-market | $ | ( | ||||||

| REC contracts - favorable | $ | |||||||

(in thousands) | For the year ended December 31, 2023 | For the period from May 19, 2022 through December 31, 2022 | |||||||||

| Energy sales | $ | $ | |||||||||

| RECs and other incentives | |||||||||||

| Investment Management revenue | |||||||||||

| Other revenue | |||||||||||

| Contract amortization, net | ( | ( | |||||||||

| Total revenue | |||||||||||

| Less: Contract amortization, net | |||||||||||

| Less: Lease revenue | ( | ( | |||||||||

| Less: Investment, dividend and interest income | ( | ( | |||||||||

| Total revenue from contracts with customers | $ | $ | |||||||||

(in thousands) | Amount | ||||

| 2024 | $ | ||||

| 2025 | |||||

| 2026 | |||||

| 2027 | |||||

| 2028 | |||||

| Thereafter | |||||

| Total | $ | ||||

| Fair Value as of December 31, 2023 | |||||||||||||||||||||||

(in thousands) | Level 1 | Level 2 | Level 3 | Total | |||||||||||||||||||

| $ | $ | $ | $ | ||||||||||||||||||||

| Derivative liabilities | ( | ( | |||||||||||||||||||||

| Equity method investments | |||||||||||||||||||||||

| Contingent consideration | ( | ( | |||||||||||||||||||||

| Total | $ | $ | $ | $ | |||||||||||||||||||

| Fair Value as of December 31, 2022 | |||||||||||||||||||||||

(in thousands) | Level 1 | Level 2 | Level 3 | Total | |||||||||||||||||||

| Derivative assets | $ | $ | $ | $ | |||||||||||||||||||

| Equity method investments | |||||||||||||||||||||||

| Contingent consideration | ( | ( | |||||||||||||||||||||

| Total | $ | $ | $ | $ | |||||||||||||||||||

(in thousands) | Equity method investments | Contingent consideration | Total | ||||||||||||||

| Balance as of December 31, 2022 | $ | $ | ( | $ | |||||||||||||

| Purchases | |||||||||||||||||

| Return of capital | ( | ( | |||||||||||||||

| — | |||||||||||||||||

| — | |||||||||||||||||

| Reclassification of participating Earnout Shares | — | ||||||||||||||||

| Balance as of December 31, 2023 | $ | $ | ( | $ | |||||||||||||

| Unobservable Input | Input/Range | |||||||

| Discount rate | ||||||||

| kWh production | ||||||||

| Potential leverage and estimated remaining useful life | ||||||||

| Unobservable Input | Input/Range | |||||||

| Risk-Free Rate Over Earnout Term | ||||||||

| Revenue Discount Rate | ||||||||

| Annualized Revenue Volatility | ||||||||

| Annualized Share Price Volatility | ||||||||

| Quarterly Revenue / Share Price Correlation | ||||||||

(dollars in thousands) | As of December 31, 2023 | As of December 31, 2022 | Year of origination | Interest rate | Maturity date | ||||||||||||||||||||||||

| Notes receivable, current | |||||||||||||||||||||||||||||

| Cider | $ | $ | 2022 | 6/30/2024(1) | |||||||||||||||||||||||||

| OYA | 2022 | 2/17/2023(2) | |||||||||||||||||||||||||||

| Shepherds Run | 2020 | 3/31/2024(1) | |||||||||||||||||||||||||||

| Total notes receivable, current | $ | $ | |||||||||||||||||||||||||||

| Notes receivable, noncurrent | |||||||||||||||||||||||||||||

| New Market | $ | $ | 2019 | 9/30/2022(3) | |||||||||||||||||||||||||

| SE Solar | 2019 | 5/31/2023(4) | |||||||||||||||||||||||||||

| Kane Warehouse | 2015 | 2/24/2025 | |||||||||||||||||||||||||||

| Total notes receivable, noncurrent | $ | $ | |||||||||||||||||||||||||||

Loan reserve(5) | ( | ||||||||||||||||||||||||||||

| Total notes receivable | $ | $ | |||||||||||||||||||||||||||

(in thousands) | December 31, 2023 | December 31, 2022 | |||||||||

| Land | $ | $ | |||||||||

| Plant and equipment | |||||||||||

| Asset retirement obligation | |||||||||||

| Finance right-of-use asset | |||||||||||

| Other | |||||||||||

| Total property, plant and equipment | $ | $ | |||||||||

| Accumulated depreciation | ( | ( | |||||||||

| Property, plant and equipment, net | $ | $ | |||||||||

(in thousands) | Gross carrying amount | Accumulated amortization | Net intangible assets as of December 31, 2023 | ||||||||||||||

| PPA contracts | $ | $ | ( | $ | |||||||||||||

| REC contracts | ( | ||||||||||||||||

| Trademarks | ( | ||||||||||||||||

| Channel partner relationships | ( | ||||||||||||||||

| Other intangible assets | |||||||||||||||||

| Total intangible assets, net | $ | $ | ( | $ | |||||||||||||

(in thousands) | Gross carrying amount | Accumulated amortization | Net intangible assets as of December 31, 2022 | ||||||||||||||

| PPA contracts | $ | $ | ( | $ | |||||||||||||

| REC contracts | ( | ||||||||||||||||

| Trademarks | ( | ||||||||||||||||

| Channel partner relationships | ( | ||||||||||||||||

| Other intangible assets | |||||||||||||||||

| Total intangible assets, net | $ | $ | ( | $ | |||||||||||||

(in thousands) | Gross carrying amount | Accumulated amortization | Net out-of-market contracts as of December 31, 2023 | ||||||||||||||

| PPA contracts | $ | ( | $ | $ | ( | ||||||||||||

| REC contracts | ( | ( | |||||||||||||||

| Total out-of-market contracts, net | $ | ( | $ | $ | ( | ||||||||||||

(in thousands) | Gross carrying amount | Accumulated amortization | Net out-of-market contracts as of December 31, 2022 | ||||||||||||||

| PPA contracts | $ | ( | $ | $ | ( | ||||||||||||

PPA contracts - signed MIPA assets(1) | ( | ( | |||||||||||||||

| REC contracts | ( | ( | |||||||||||||||

REC contracts - signed MIPA assets(1) | ( | ( | |||||||||||||||

| Total out-of-market contracts, net | $ | ( | $ | $ | ( | ||||||||||||

(in thousands) | Amortization Expense | ||||

| 2024 | $ | ||||

| 2025 | |||||

| 2026 | |||||

| 2027 | |||||

| 2028 | |||||

| Thereafter | |||||

| Total | $ | ||||

(in thousands) | For the year ended December 31, 2023 | For the period from May 19, 2022 through December 31, 2022 | |||||||||

| Lease cost | |||||||||||

| Finance lease cost | |||||||||||

| Amortization of right-of-use assets | $ | $ | |||||||||

| Interest on lease liabilities | |||||||||||

| Total finance lease cost | |||||||||||

| Operating lease cost | |||||||||||

| Short-term lease cost | |||||||||||

| Variable lease cost | |||||||||||

| Total lease cost | $ | $ | |||||||||

(dollars in thousands) | December 31, 2023 | December 31, 2022 | |||||||||

| Other information | |||||||||||

Cash paid for amounts included in the measurement of lease liabilities(1) | $ | $ | |||||||||

Operating cash flows from finance leases(1) | $ | ( | $ | ||||||||

Operating cash flows from operating leases(1) | $ | ( | $ | ( | |||||||

Financing cash flows from finance leases(1) | $ | ( | $ | ||||||||

| ROU assets obtained in exchange for new finance lease liabilities | $ | $ | |||||||||

| ROU assets obtained in exchange for new operating lease liabilities | $ | $ | |||||||||

| Weighted average remaining lease term – finance leases | N/A | ||||||||||

| Weighted average remaining lease term – operating leases | |||||||||||

| Weighted average discount rate – finance leases | % | ||||||||||

| Weighted average discount rate – operating leases | % | ||||||||||

(in thousands) | December 31, 2023 | December 31, 2022 | |||||||||

| Operating leases | |||||||||||

| Operating lease assets | $ | $ | |||||||||

| Operating lease liabilities, current | ( | ( | |||||||||

| Operating lease liabilities, noncurrent | ( | ( | |||||||||

| Total operating lease liabilities | $ | ( | $ | ( | |||||||

| Finance leases | |||||||||||

| Property, plant and equipment, at cost | $ | $ | |||||||||

| Accumulated depreciation | ( | ||||||||||

| Property, plant and equipment, net | |||||||||||

| Other current liabilities | ( | ||||||||||

| Other long-term liabilities | ( | ||||||||||

| $ | ( | $ | |||||||||

(in thousands) | |||||||||||

| Year Ending | Operating Leases | Finance Leases | |||||||||

| 2024 | $ | $ | |||||||||

| 2025 | |||||||||||

| 2026 | |||||||||||

| 2027 | |||||||||||

| 2028 | |||||||||||

| Thereafter | |||||||||||

| Total lease payments | |||||||||||

| Less: Imputed interest | ( | ( | |||||||||

| Present value of lease liabilities | $ | $ | |||||||||

(dollars in thousands) | Outstanding as of December 31, 2023 | Outstanding as of December 31, 2022 | Interest rate | Maturity date | |||||||||||||||||||

GREC Entity HoldCo(1) | $ | $ | Daily SOFR + | June 20, 2025 | |||||||||||||||||||

| Midway III Manager LLC | 3 mo. SOFR + | September 28, 2025 | |||||||||||||||||||||

| Trillium Manager LLC | Daily SOFR + | June 9, 2027 | |||||||||||||||||||||

GB Wind Holdco LLC(2) | 3 mo. SOFR + | Various(3) | |||||||||||||||||||||

| Greenbacker Wind Holdings II LLC | 3 mo. SOFR + | December 31, 2026 | |||||||||||||||||||||

| Conic Manager LLC | 3 mo. SOFR + | August 8, 2026 | |||||||||||||||||||||

| Turquoise Manager LLC | 3 mo. SOFR + | December 23, 2027 | |||||||||||||||||||||

Eagle Valley Clean Energy LLC | Various(4) | January 2, 2057 | |||||||||||||||||||||

| Eagle Valley Clean Energy LLC (Premium financing agreement) | November 30, 2023(5) | ||||||||||||||||||||||

Greenbacker Equipment Acquisition Company LLC | Prime + | December 31, 2023(6) | |||||||||||||||||||||

| ECA Finco I, LLC | 3 mo. SOFR + | February 25, 2028 | |||||||||||||||||||||

| GB Solar TE 2020 Manager LLC | 3 mo. SOFR + | October 30, 2026 | |||||||||||||||||||||

| Sego Lily Solar Manager LLC | 3 mo. SOFR + | June 30, 2028 | |||||||||||||||||||||

| Celadon Manager LLC | Daily SOFR + | February 18, 2029 | |||||||||||||||||||||

GRP II Borealis Solar LLC | 3 mo. SOFR + | June 30, 2027 | |||||||||||||||||||||

| Ponderosa Manager LLC | 3 mo. SOFR + | October 4, 2029(7) | |||||||||||||||||||||

| PRC Nemasket LLC | Daily SOFR + | November 1, 2029 | |||||||||||||||||||||

| GREC Holdings 1 LLC | 1 mo. SOFR + Applicable Margin(8) | November 29, 2027 | |||||||||||||||||||||

| Dogwood GB Manager LLC | 1 mo. SOFR + | March 29, 2030 | |||||||||||||||||||||

| GREC Warehouse Holdings I LLC | 3 mo. SOFR + | August 11, 2026 | |||||||||||||||||||||

| Total debt | $ | $ | |||||||||||||||||||||

| Less: Total unamortized discount and deferred financing fees | ( | ( | |||||||||||||||||||||

Less: Current portion of long-term debt(9) | ( | ( | |||||||||||||||||||||

| Total long-term debt, net | $ | $ | |||||||||||||||||||||

(in thousands) | For the year ended December 31, 2023 | For the period from May 19, 2022 through December 31, 2022 | |||||||||

Loan interest(1) | $ | $ | |||||||||

Commitment / letter of credit fees | |||||||||||

| Amortization of deferred financing fees and discount | |||||||||||

| Interest capitalized | ( | ( | |||||||||

| Total | $ | $ | |||||||||

(in thousands) | ||||||||

Period ending December 31, | Principal Payments | |||||||

| 2024 | $ | |||||||

| 2025 | ||||||||

| 2026 | ||||||||

| 2027 | ||||||||

| 2028 | ||||||||

| Thereafter | ||||||||

| $ | ||||||||

(in thousands) | ||||||||

Period ending December 31, | Future Payments | |||||||

| 2024 | $ | |||||||

| 2025 | ||||||||

| 2026 | ||||||||

| 2027 | ||||||||

| 2028 | ||||||||

| Thereafter | ||||||||

| Total lease payments | $ | |||||||

(in thousands) | December 31, 2023 | ||||||||||||||||||||||

| Balance sheet location | Outstanding notional amount | Fair Value - Assets | Fair Value - (Liabilities) | ||||||||||||||||||||

| Derivatives Designated as Hedging Instruments | |||||||||||||||||||||||

| Interest rate swap contracts | Derivative assets, current / Derivative assets / (Derivative liabilities) | $ | $ | $ | ( | ||||||||||||||||||

| Derivatives Not Designated as Hedging Instruments | |||||||||||||||||||||||

| Interest rate swap contracts | Derivative assets, current / Derivative assets / (Derivative liabilities) | ( | |||||||||||||||||||||

| Total | $ | $ | $ | ( | |||||||||||||||||||

(in thousands) | December 31, 2022 | ||||||||||||||||||||||

| Derivatives Designated as Hedging Instruments | Balance sheet location | Outstanding notional amount | Fair Value - Assets | Fair Value - (Liabilities) | |||||||||||||||||||

| Interest rate swap contracts | Derivative assets / (Other liabilities) | $ | $ | $ | |||||||||||||||||||

| Year ended December 31, 2023 | |||||||||||

(in thousands) | Derivatives Designated as Hedging Instruments | Derivatives Not Designated as Hedging Instruments | |||||||||

| Consolidated Other Comprehensive (Loss) Income | |||||||||||

| Loss recognized in other comprehensive income | $ | ( | $ | ||||||||

| Amortization of off-market derivatives | ( | ||||||||||

| Less: Taxes on total net loss recognized in other comprehensive income | |||||||||||

| Consolidated Statements of Operations | |||||||||||

| Change in unrealized gain of interest rate swaps, net | |||||||||||

| Realized gain on interest rate swaps, net | |||||||||||

| For the period from May 19, 2022 through December 31, 2022 | |||||||||||

(in thousands) | Derivatives Designated as Hedging Instruments | Derivatives Not Designated as Hedging Instruments | |||||||||

| Consolidated Other Comprehensive (Loss) Income | |||||||||||

| Gain recognized in other comprehensive income | $ | $ | |||||||||

| Amortization of off-market derivatives | |||||||||||

| Less: Taxes on total net gain recognized in other comprehensive income | ( | ||||||||||

| Consolidated Statements of Operations | |||||||||||

| Change in unrealized loss of interest rate swaps, net | ( | ||||||||||

| Realized loss on interest rate swaps, net | ( | ||||||||||

(in thousands) | |||||

| Balance as of December 31, 2022 | $ | ||||

| Adjustments in estimates for current obligations | ( | ||||

| Asset retirement obligation settled during current period | ( | ||||

| Asset retirement obligation incurred during current period | |||||

| Accretion expense | |||||

| Balance as of December 31, 2023 | $ | ||||

(in thousands) | For the year ended December 31, 2023 | For the period from May 19, 2022 through December 31, 2022 | |||||||||

| Federal | $ | ( | $ | ||||||||

| State | ( | ||||||||||

| Foreign | |||||||||||

| Deferred (benefit) provision for income taxes | $ | ( | $ | ||||||||

| (in thousands) | For the year ended December 31, 2023 | Percentage | For the period from May 19, 2022 through December 31, 2022 | Percentage | |||||||||||||||||||

| Tax (benefit) at statutory U.S. federal income tax rate | $ | ( | % | $ | ( | % | |||||||||||||||||

| State income taxes, net of federal benefit | ( | % | ( | % | |||||||||||||||||||

| Noncontrolling interest | ( | % | ( | % | |||||||||||||||||||

| Share-based compensation | ( | % | ( | % | |||||||||||||||||||

| Federal tax credits | ( | % | ( | % | |||||||||||||||||||

| Change in valuation allowance | ( | % | ( | % | |||||||||||||||||||

| Permanent differences (GREC LLC and other - net) | ( | % | ( | % | |||||||||||||||||||

| Actual provision for income taxes | $ | ( | % | $ | ( | % | |||||||||||||||||

| (in thousands) | December 31, 2023 | December 31, 2022 | |||||||||

| Net operating losses | $ | $ | |||||||||

| Long-term debt and failed sale-leaseback financing | |||||||||||

| Federal tax credits | |||||||||||

| Operating lease liabilities | |||||||||||

| Asset retirement obligations | |||||||||||

| Disallowed interest | |||||||||||

| Other | |||||||||||

| Total deferred tax assets | |||||||||||

| Less: Valuation allowance | ( | ( | |||||||||

| Deferred tax assets, net of valuation allowance | $ | $ | |||||||||

| Property, plant, and equipment | $ | ( | $ | ( | |||||||

| Investments in flow-through entities taxed as partnerships | ( | ( | |||||||||

| Intangibles | ( | ( | |||||||||

| Derivative assets | ( | ( | |||||||||

| Operating lease assets | ( | ( | |||||||||

| Long-term debt | ( | ||||||||||

| Total deferred tax liabilities | ( | ( | |||||||||

| Deferred tax liabilities, net | $ | $ | |||||||||

(in thousands) | Number of RECs | |||||||

| 2024 | ||||||||

| 2025 | ||||||||

| 2026 | ||||||||

| 2027 | ||||||||

| 2028 | ||||||||

| Thereafter | ||||||||

| Total | ||||||||

| Aggregate NAV (Class I, Class D, Class T, and Class S shares) | Management Fee | ||||

On NAV up to and including $ | |||||

On NAV in excess of $ | |||||

| Quarter Ending | Share Repurchase Limit(s) | ||||

| September 30, 2021, and each quarter thereafter | During any 12-month period, | ||||

During any fiscal quarter, | |||||

(in thousands) | Class A | Class C | Class I | Class P-A | Class P-I | Class P-D | Class P-S | Class P-T | Class EO(1) | Total | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shares outstanding as of May 19, 2022 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shares issued to complete the acquisition | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shares issued through reinvestment of distributions | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shares repurchased | ( | ( | ( | ( | ( | ( | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shares transferred | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other capital activity | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shares outstanding as of December 31, 2022 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shares issued through reinvestment of distributions | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shares repurchased | ( | ( | ( | ( | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shares transferred | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other capital activity | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shares outstanding as of December 31, 2023 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Class of Share | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Distribution Period | A | C | I | P-A | P-I | P-D | P-T | P-S | EO | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1-Nov-15 | 31-Jan-16 | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1-Feb-16 | 30-Apr-16 | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1-May-16 | 31-Jul-16 | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1-Aug-16 | 31-Oct-16 | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1-Nov-16 | 31-Jan-17 | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1-Feb-17 | 30-Apr-17 | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1-May-17 | 31-Jul-17 | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1-Aug-17 | 31-Oct-17 | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1-Nov-17 | 31-Oct-18 | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1-Nov-18 | 30-Apr-20 | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1-May-20 | 30-Nov-20 | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1-Dec-20 | 30-Jun-23 | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1-Jul-23 | 31-Dec-23 | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||||

(in thousands) | ||||||||||||||||||||

| Pay Date | Paid in Cash | Value of Shares Issued under DRP | Total | |||||||||||||||||

| February 1, 2023 | $ | $ | $ | |||||||||||||||||

| March 1, 2023 | ||||||||||||||||||||

| March 31, 2023 | ||||||||||||||||||||

| May 1, 2023 | ||||||||||||||||||||

| June 1, 2023 | ||||||||||||||||||||

| July 3, 2023 | ||||||||||||||||||||

| August 1, 2023 | ||||||||||||||||||||

| September 1, 2023 | ||||||||||||||||||||

| October 2, 2023 | ||||||||||||||||||||

| November 2, 2023 | ||||||||||||||||||||

| December 1, 2023 | ||||||||||||||||||||

| January 2, 2024 | ||||||||||||||||||||

| Total | $ | $ | $ | |||||||||||||||||

(in thousands) | ||||||||||||||||||||

| Pay Date | Paid in cash | Value of Shares Issued under DRP | Total | |||||||||||||||||

| June 1, 2022 | $ | $ | $ | |||||||||||||||||

| July 1, 2022 | ||||||||||||||||||||

| August 1, 2022 | ||||||||||||||||||||

| September 1, 2022 | ||||||||||||||||||||

| October 3, 2022 | ||||||||||||||||||||

| November 1, 2022 | ||||||||||||||||||||

| December 1, 2022 | ||||||||||||||||||||

| January 3, 2023 | ||||||||||||||||||||

| Total | $ | $ | $ | |||||||||||||||||

(in thousands) | For the year ended December 31, 2023 | ||||

Restricted share units | $ | ||||

Cash-settled restricted share units | |||||

Performance restricted share units | |||||

Director’s fees | |||||

GDEV I incentive fees(1) | |||||

GDEV II special profits interest | |||||

EO Awards(2) | |||||

Total | $ | ||||

(in thousands, except for per share data) | Restricted Share Units | Weighted Average Fair Value | |||||||||

Unvested balance as of December 31, 2022 | $ | ||||||||||

Granted | $ | ||||||||||

Forfeited | ( | $ | |||||||||

Unvested balance as of December 31, 2023 | $ | ||||||||||

Inputs | Performance Restricted Share Units | |||||||

| Weighted average grant-date fair value per Class P-I share | $ | |||||||

| Performance period (in years) | ||||||||

| Expected share volatility | % | |||||||

| Dividend yield | % | |||||||

| Daily distribution rate | $ | |||||||

| Risk-free interest rate | % | |||||||

(in thousands, except per share data) | Performance Restricted Share Units | Weighted Average Fair Value | |||||||||

Unvested balance as of December 31, 2022 | $ | ||||||||||

Granted | $ | ||||||||||

Unvested balance as of December 31, 2023 | $ | ||||||||||

(in thousands, except per share data) | For the year ended December 31, 2023 | For the period from May 19, 2022 through December 31, 2022 | |||||||||

| Basic and diluted: | |||||||||||

| Net loss attributable to Greenbacker Renewable Energy Company LLC | $ | ( | $ | ( | |||||||

| Weighted average common shares outstanding used in computing net loss per share—basic | |||||||||||

| Weighted average common shares outstanding used in computing net loss per share—diluted | |||||||||||

| Net loss attributable to Greenbacker Renewable Energy Company LLC | |||||||||||

| Net loss per share—basic | $ | ( | $ | ||||||||

| Net loss per share—diluted | $ | ( | $ | ||||||||

(in thousands) | For the year ended December 31, 2023 | For the period from May 19, 2022 through December 31, 2022 | |||||||||

| Energy revenue | $ | $ | |||||||||

| Other revenue | |||||||||||

| Contract amortization, net | ( | ( | |||||||||

| Total IPP revenue | $ | $ | |||||||||

| Investment Management revenue | $ | $ | |||||||||

(in thousands) | For the year ended December 31, 2023 | For the period from May 19, 2022 through December 31, 2022 | |||||||||

| Segment Adjusted EBITDA: | |||||||||||

| IPP Adjusted EBITDA | $ | $ | |||||||||

| IM Adjusted EBITDA | ( | ( | |||||||||

| Total Segment Adjusted EBITDA | $ | $ | |||||||||

| Reconciliation: | |||||||||||

| Total Segment Adjusted EBITDA | $ | $ | |||||||||

| Unallocated corporate expenses | ( | ( | |||||||||

| Total Adjusted EBITDA | |||||||||||

| Less: | |||||||||||

| Share-based compensation expense | |||||||||||

| Change in fair value of contingent consideration | ( | ||||||||||

| Non-recurring professional services and legal fees | |||||||||||

| Non-recurring salaries and personnel related expenses | |||||||||||