Annual Report

September 30, 2022

CrossingBridge Low Duration High Yield Fund

Institutional Class

(CBLDX)

CrossingBridge Responsible Credit Fund

Institutional Class

(CBRDX)

CrossingBridge Ultra-Short Duration Fund

Institutional Class

(CBUDX)

CrossingBridge Pre-Merger SPAC ETF

(SPC)

Investment Adviser

CrossingBridge Advisors, LLC

427 Bedford Road

Suite 220

Pleasantville, New York 10570

Phone: 1-888-898-2780

Table of Contents

|

COMMENTARY

|

3

|

||

|

MANAGEMENT’S DISCUSSION OF

|

|||

|

FUND PERFORMANCE AND ANALYSIS

|

9

|

||

|

EXPENSE EXAMPLE

|

20

|

||

|

INVESTMENT HIGHLIGHTS

|

22

|

||

|

SCHEDULES OF INVESTMENTS

|

30

|

||

|

STATEMENTS OF ASSETS AND LIABILITIES

|

60

|

||

|

STATEMENTS OF OPERATIONS

|

62

|

||

|

STATEMENTS OF CHANGES IN NET ASSETS

|

64

|

||

|

FINANCIAL HIGHLIGHTS

|

68

|

||

|

NOTES TO FINANCIAL STATEMENTS

|

73

|

||

|

REPORT OF INDEPENDENT REGISTERED

|

|||

|

PUBLIC ACCOUNTING FIRM

|

96

|

||

|

BASIS FOR TRUSTEES’ APPROVAL OF

|

|||

|

INVESTMENT ADVISORY AGREEMENT

|

98

|

||

|

REVIEW OF LIQUIDITY RISK MANAGEMENT PROGRAM

|

103

|

||

|

ADDITIONAL INFORMATION

|

104

|

Commentary

In 2022, stock and bond investors have been pummeled, losing money in both asset classes for three consecutive quarters, a first in at least 45 years.A In previous letters, we have discussed our defensive stance, holding “dry powder”B and

remaining disciplined. Yet, as openings occur, we take our shots. We continue to find “money-good”1 bonds and leveraged loans that have attractive yields with potential

for additional upside if anticipated events come to pass:

|

✓long-term debt reclassifying to current liabilities

|

|||

|

✓event-driven corporate actions

|

|||

|

o

|

Mergers and acquisitions

|

||

|

o

|

De-leveraging initiatives

|

||

|

o

|

Relief from debt covenant constraints

|

||

|

✓potential future takeover targets

|

|||

Below, we discuss some of the indicators that we are watching closely and describe some of the opportunities we are seeing that should allow us to “punch above our weight.”

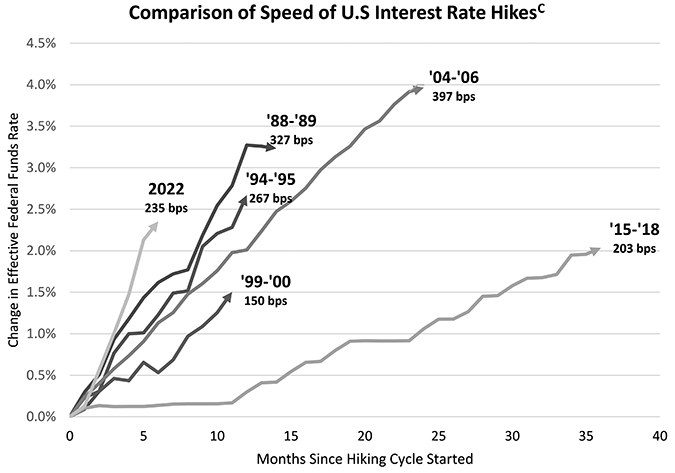

Rapid Rise in Interest Rates

As the Fed grapples with inflation, which is no longer “transitory,” the financial markets have sold off sharply in response to the most rapid interest rate hikes in recent

history. In 2022, the Fed Funds rate rose by 235 basis points in six months with indications that this will continue. The financial markets fear, but may not have fully priced in, the possibility that, ultimately, the Fed’s actions or the

geopolitical backdrop will cause something to break.2 With the dramatic rise in rates, we believe the economy will slow, corporate profit margins will shrink, working

capital costs will increase and debt service will be more expensive. These factors are concerning, but, more importantly, also create opportunities that may be exploited if patience and diligence are exercised.

________________

|

1

|

“Money good” is a term used by CrossingBridge to describe debt it believes will be paid off in full under current market conditions and on a strict priority basis.

|

|

2

|

These tensions were discussed in our 1Q22 letter, Locomotive Breath, and our 2Q22 letter, In Flanders Fields.

|

3

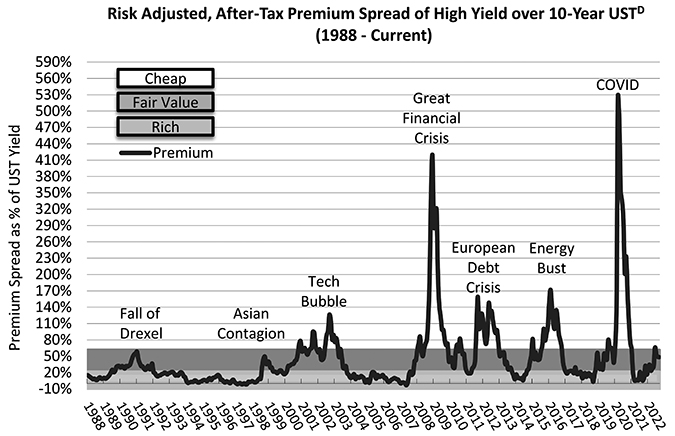

High Yield Spreads versus Risk Free Rate

Credit spreads in the high yield market are almost “cheap” as they have widened by approximately 220 basis points to 550 basis pointsE since the end of 2021. This is slightly below the 25-year average of 552 basis points,3 leaving room to go wider if

unforeseen economic or political events hit the market with a haymaker.4 However, as noted in our 2Q22 letter, a high yield investor who avoided the value destruction

in telecom and utility bonds in 2002, a negative year for high yield overall, would have had a positive return for the year. Similarly, an investor avoiding the deterioration in energy credits in 2015-16 would have experienced far better performance.

Looking forward, we are avoiding industries that continue to struggle due to the impact of COVID, such as cruise lines and movie theaters, and those that will be most impacted by rising costs or cyclical risks to demand, including building materials,

chemicals and auto parts. The sharp rise in interest rates and the widely expected resultant recession may also be the “zombie killer”5 that finally forces a wave of

restructurings among companies reliant on accommodative capital markets to provide cash infusions to cover interest expense. That said, as a result of the dislocation that has already occurred, there are a lot of quality companies with “money good”

debt yielding 7.5-11.5% with maturities in the 1-3-year sweet spot.

________________

|

3

|

The graph above uses the high yield spread calculated by subtracting the 10-year U.S. Treasury rate from the yield-to-worst of the ICE BofA U.S. High Yield Index. This differs from the index spread to worst,

however, which is the index yield-to-worst less the corresponding U.S. Treasury rate which varies daily. Actual credit spread data for periods prior to the end of 1996 is limited.

|

|

4

|

In reference to the title of our 3Q22 letter, a haymaker is a punch thrown with full force and commitment that can be a knockout blow if landed.

|

|

5

|

See our 2Q19 investor letter, Rise of the Living Dead, for a discussion of “zombie companies”.

|

4

Wall-of-Worry Not So Worrisome

The rise in rates should have a more muted impact on the high yield market than in previous rate-hike cycles as many borrowers took advantage of the low rates that prevailed

in 2020 and 2021 to reduce their borrowing cost and extend maturities. As shown above, in 3Q20, a large portion of the corporate credit market was likely to be faced with the need to refinance debt obligations in the 2024-25 period (i.e. orange bars

in T+4 and T+5). With the new-issuance market very active despite the pandemic, debt coming due in that period has now been reduced significantly (i.e. blue bars in T+2 and T+3) while the bulge in upcoming maturities has been pushed out to 2028 (i.e.

blue bar in T+6). Thus, a large portion of high yield issuers completed financings giving them low locked-in borrowing costs for several years. Similarly, many homeowners have benefitted from low interest rate mortgages. Hence the long-awaited

distress cycle may be put off a little longer.

Bonds and Loans Trading at a Discount

5

When interest rates go up, bond prices go down. Consequently, corporate debt is now trading at a discount. The current year has been unusual in that the average bond in the

ICE BofA U.S. High Yield Index has experienced a price decline of nearly 20 points since the end of 2021 as interest rates have moved up and credit spreads have widened. Such a sharp decline would not be unusual for distressed bonds but, in the

absence of a sharp deterioration in credit quality, it is highly unusual. These discounts create the opportunity for an investor to achieve a return in excess of today’s yield to maturity should a corporate event cause a credit quality upgrade or

repayment prior to maturity. Loans are also trading at a discount, but because their interest rates are floating, they have not experienced as much price deterioration as fixed rate bonds. Still, loans trading at a discount may also provide us with

opportunities resulting from corporate events.

Where we are taking our shots

While we remain defensive, we are finding opportunities to throw a few “jabs” and “uppercuts” when we see openings. These investments fall into four categories, but in

general are premised on events we expect to take place within a relatively short time frame.

Called Bonds and SPACs – Bonds that have been called and are expected to be repaid via refinancing or cash

on hand at the end of the call period, typically 30-90 days out. Refinancing among high yield bonds has diminished as the cost of new financing has increased dramatically. However there continues to be a steady flow of investment grade calls and

tenders as the “treasury make-whole” call protection,6 which historically resulted in prohibitively expensive call premiums for these bonds, has now fallen to zero.

Thus, the market yield to exit for investment grade bonds has gravitated to about 4.00-5.00% for calls expected to be completed in 2-6 weeks. Meanwhile, the market for the few high yield bonds that are being called has risen to about 4.50-5.50%. This

compares to the 2.00% yield to exit that was typical for called high yield bonds as recently as the end of 2021. Similarly, the effective yield on SPACs with liquidation dates up to 9 months has risen to 5.50-6.00%.

Long-term Debt Reclassifying to Current Liabilities – Bonds and loans with maturities 1-2 years out. Once

the maturity of these obligations falls within one year, they must be shown on the issuer’s balance sheet as current liabilities, and their auditors must opine on their ability to pay them when they are due. Typically, borrowers prefer to repay or

refinance their debt when there is at least one year to maturity to avoid this issue.

Event-Driven and Corporate Actions – Bonds and loans that are expected to be repaid as a result of mergers

and acquisitions, efforts to de-leverage and/or the desire to remove constraining debt covenants.

Potential Takeover Targets – Bonds and loans issued by companies with relatively low leverage and high cash

flow that, with the dramatic decline in equity valuations, may make them ripe to be acquired. In such an event, there is an increased likelihood of early repayment or improvement in credit quality.

________________

|

6

|

The call premium based on “treasury make-whole” call protection is calculated by discounting all of the scheduled principal and interest payments of the bond by the Treasury rate (plus, typically, 50 or 75

basis points) that corresponds to the bond’s maturity. This premium may not be less than 0 so, if rates rise such that the premium would be negative, the call price is par.

|

6

Picking our spots, rolling with the punches, and patiently awaiting the time to come out swinging,

David K. Sherman and the CrossingBridge Team

Endnotes

________________

|

A

|

All Star Charts, allstarcharts.com

|

|

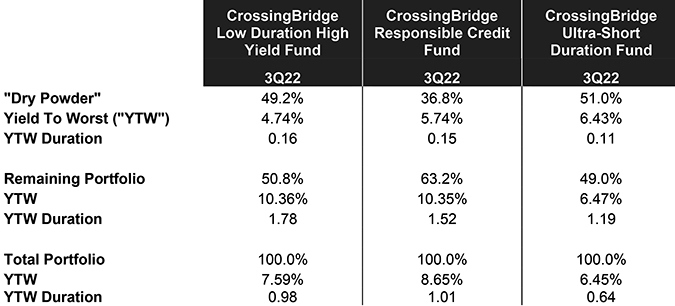

B

|

“Dry powder”, in the context of our mutual fund portfolios, is defined as cash and investments that are expected to be repaid within 90 days as a result of call, redemption or maturity as well as pre-merger

special purpose acquisition corporations (SPACs). The table below reflects dry powder for each CrossingBridge mutual fund as of the end of 3Q22.

|

|

C

|

FRED Economic Data, Federal Reserve Bank of St. Louis https://fred.stlouisfed.org/

|

|

D

|

ICE BofA U.S. High Yield Index, ICE BofA 10-Year U.S. Treasury Index. Calculated based on the high yield credit spread, less taxes at a rate of 34%, less 200 basis points of assumed credit losses, divided by

the 10-year U.S. Treasury rate.

|

|

E

|

ICE BofA U.S. High Yield Index

|

|

F

|

Bank of America Global Research

|

|

G

|

ICE BofA U.S. High Yield Index, S&P/LSTA U.S. Leveraged Loan Select Equal Par Value Index

|

Definitions: Basis Point is one hundredth of 1 percentage point. ICE BofA U.S. High Yield Index

tracks the performance of U.S. dollar denominated below investment grade rated corporate debt publicly issued in the U.S. domestic market. S&P/LSTA U.S. Leveraged Loan Select Equal Par Value Index is a

daily tradable index for the U.S. market that seeks to mirror the market-weighted performance of the largest institutional leveraged loans, as determined by criteria. Yield to Worst is the yield on the

portfolio if all bonds are held to the worst date; yield to worst date is the date of lowest possible yield outcome for each security without a default. Yield to Worst Duration is the weighted average duration

calculated to the yield to worst date.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Past performance does not guarantee future results. Diversification does not assure a profit nor protect against risk in a declining market.

7

Fund holdings and sector allocation are subject to change at any time and should not be considered a recommendation to buy or sell any security. Please see the Schedule of

Investments for complete Fund holdings.

It is not possible to invest directly in an index.

Mutual fund investing involves risk. Principal loss is possible. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually

greater for longer-term debt securities. Investment in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities.

Must be preceded or accompanied by a prospectus.

Distributor: Quasar Distributors, LLC.

8

Management’s Discussion of Fund Performance and Analysis

CrossingBridge Low Duration High Yield Fund

(Unaudited)

The 2022 fiscal year for the CrossingBridge Low Duration High Yield Fund (CBLDX; the “Fund”) covers the twelve-month period of October 1, 2021 through September 30, 2022.

During this period, the Fund lost 0.39% on its Institutional Class shares while the ICE BofA 0-3 Year U.S. High Yield Excluding Financials Index lost 4.35%, the ICE BofA 1-3 Year U.S. Corporate Bond Index lost 5.89% and the ICE BofA 0-3 Year U.S.

Treasury Index lost 3.39%.

Monthly investment results for the fiscal year ranged from -0.78% in June 2022 to 0.37% in July 2022. The Fund generated positive returns for six out of the twelve months

during the fiscal year. The median monthly return for the period was 0.04% with an annualized standard deviation of 3.18%.

The Fund had positive contributions from interest income and had realized gains and unrealized losses during the period. 100% of the income was distributed for a 1-year

dividend yield of 3.20%. The Fund’s subsidized 30 day SEC yield was 5.50% and unsubsidized 30 day SEC yield was 5.50%. The total return for the period was negative. Although the Fund’s NAV decreased from $10.36 on September 30, 2021 to $9.84 on

September 30, 2022, this was offset by the Fund distributing $0.49 in income during the fiscal period.

In the first half of 2022, U.S. equities and fixed income portfolios suffered some of their largest losses in history1 as investors dealt with the effects of inflation and rising rates. During the fiscal year, the Fund was well-prepared for this market as we maintained our defensive positioning with a portfolio duration on the low-end

of its targeted range, continued holding significant dry powder2, and remained disciplined. The Fund also typically has natural cash roll-off of 15-30% of the portfolio

every month, which in a rising rate environment, provides the Fund with the opportunity to reinvest that cash at higher rates. As market conditions have continued to deteriorate and rates have continued to rise, we are starting to see the market

become more bifurcated, creating what we believe to be very attractive opportunities that may be suitable for the Fund.

As of September 30, 2022, the Fund’s net assets were weighted by category as follows: 29.6% in Short Term Securities, 10.9% in Event Driven, 11.5% in Interest Rate Sensitive,

41.0% in Core Value, 1.2% in Credit Opportunities, with the remaining 5.8% in cash and cash equivalents.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Past performance does not guarantee future results.

Diversification does not assure a profit nor protect against risk in a declining market.

________________

|

1

|

In the first half of 2022, the S&P 500 Index declined -20.6%, its worst first half performance since 1970. Investment grade bonds, represented by the ICE BofA U.S. Corporate Bond Index, declined -13.93% in

the first half of the year, their worst first half ever and the worst six-month period since 1Q80 (-16.35%). The ICE BofA U.S. High Yield Index, which declined -14.04% in the first half, had its worst first half ever and worst six-month

period since 4Q08 (-25.43%) (Source: Bloomberg).

|

|

2

|

“Dry powder”, in the context of our portfolios, is defined as cash and investments that are expected to be repaid within 90 days as a result of call, redemption or maturity as well as pre-merger special purpose

acquisition corporations (SPACs).

|

9

Fund holdings and sector allocation are subject to change at any time and should not be considered a recommendation to buy or sell any security. Please see the Schedule of

Investments for complete Fund holdings.

*Definitions: The ICE BofA 0-3 Year U.S. High Yield Excluding Financials Index (HSNF) tracks the performance of short maturity U.S.

dollar-denominated below investment grade rating (based on an average of Moody’s, S&P, and Fitch), at least 18 months to final maturity at the time of issuance, at least one month but less than three years remaining term to final maturity as of

the rebalancing date, a fixed coupon schedule and minimum amount outstanding of $250 million. The ICE BofA 1-3 Year U.S. Corporate Bond Index (C1A0) is a subset of the ICE BofA U.S. Corporate Bond Index

including all securities with a remaining term to final maturity less than three years. The ICE BofA 0-3 Year U.S. Treasury Index (G1QA) tracks the performance of U.S. dollar-denominated sovereign debt

publicly issued by the U.S. government in its domestic market with maturities less than three years. The S&P 500, or simply the S&P, is a stock market index that measures the stock performance of 500

large companies listed on stock exchanges in the United States. The ICE BofA U.S. Corporate Bond Index tracks the performance of U.S. dollar-denominated investment grade rated corporate debt publicly issues in

the U.S. domestic market. The ICE BofA U.S. High Yield Index tracks the performance of U.S. dollar-denominated below investment grade corporate debt publicly issued in the U.S. domestic market.Standard Deviation is a statistical measure that is used to quantify the amount of variation or dispersion of a set of data values. Duration is the weighted average of the

present value of the cash flows and is used as a measure of a bond price’s response to changes in yield. Rising interest rates mean falling bond prices, while declining interest rates mean rising bond prices. Dividend

Yield expresses a percentage of a current share price. SEC yield is a standard yield calculation developed by the U.S. Securities and Exchange Commission (SEC) that allows for fairer comparisons of

bond funds. It is based on the most recent 30-day period covered by the fund’s filings with the SEC. The yield figure reflects the dividends and interest earned during the period after the deduction of the fund’s expenses. It is also referred to as

the “standardized yield”. Basis Point is one hundredth of one percent.

It is not possible to invest directly in an index.

Mutual fund investing involves risk. Principal loss is possible. Investments in foreign securities involve greater volatility and political, economic and

currency risks and differences in accounting methods. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investment in lower-rated and non-rated

securities presents a greater risk of loss to principal and interest than higher-rated securities. The Fund may make short sales of securities, which involves the risk that losses may exceed the original amount invested. The Fund may invest in

exchange-traded funds (“ETFs”) and exchange-traded notes (“ETNs”), which are subject to additional risks that do not apply to conventional mutual funds, including the risks that the market price of an ETF’s and ETN’s shares may trade at a discount to

its net asset value (“NAV”), an active secondary trading market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact the Fund’s ability to sell the shares. The value of ETNs may be

influenced by the level of supply and demand for the ETN, volatility and lack of liquidity. The Fund may invest in derivative securities, which derive their performance from the performance of an underlying asset, index, interest rate or currency

exchange rate. Derivatives can be volatile and involve various types and degrees of risks, and, depending upon the characteristics of a particular derivative, suddenly can become illiquid. Investments in asset-backed, mortgage-backed, and

collateralized mortgage-backed securities include additional risks that investors should be aware of such as credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. The

Fund invests in equity securities and warrants of special purpose acquisition companies (“SPACs”) . Pre-combination SPACs have no operating history or ongoing business other than seeking a merger, share exchange, asset acquisition, share purchase

negotiation or similar business combination (a “Combination”), and the value of their securities is particularly dependent on the ability of the entity’s management to identify and complete a profitable Combination. There is no guarantee that the

SPACs in which the

10

Fund invests will complete a Combination or that any Combination that is completed will be profitable. Unless and until a Combination is completed, a SPAC

generally invests its assets in U.S. government securities, money market securities, and cash. Public stockholders of SPACs may not be afforded a meaningful opportunity to vote on a proposed initial Combination because certain stockholders, including

stockholders affiliated with the management of the SPAC, may have sufficient voting power, and a financial incentive, to approve such a transaction without support from public stockholders. As a result, a SPAC may complete a Combination even though a

majority of its public stockholders do not support such a Combination. Some SPACs may pursue Combinations only within certain industries or regions, which may increase the volatility of their prices. The Fund may invest in SPACs domiciled or listed

outside of the U.S., including, but not limited to, Canada, the Cayman Islands, Bermuda and the Virgin Islands. Investments in SPACs domiciled or listed outside of the U.S. may involve risks not generally associated with investments in the securities

of U.S. SPACs, such as risks relating to political, social, and economic developments abroad and differences between U.S. and foreign regulatory requirements and market practices. Further, tax treatment may differ from U.S. SPACs and securities may

be subject of foreign withholding taxes. Smaller capitalization SPACs will have a more limited pool of companies with which they can pursue a business combination relative to larger capitalization companies. That may make it more difficult for a

small capitalization SPAC to consummate a business combination.

Must be preceded or accompanied by a prospectus.

Distributor: Quasar Distributors, LLC.

11

Management’s Discussion of Fund Performance and Analysis

CrossingBridge Responsible Credit Fund

(Unaudited)

The 2022 fiscal year for the CrossingBridge Responsible Credit Fund (CBRDX; the “Fund”) covers the twelve-month period of October 1, 2021 through September 30, 2022. During

this period, the Fund gained 0.45% on its Institutional Class shares while the ICE BofA U.S. High Yield Index lost 14.06%, the ICE BofA U.S. Corporate Index lost 18.19% and the ICE BofA 3-7 Year U.S. Treasury Index lost 11.08%.

Monthly investment results for the fiscal year ranged from -1.62% in June 2022 to 2.14% in July 2022. The Fund generated positive returns for seven out of the twelve months

during the fiscal period. The median monthly return for the period was 0.11% with an annualized standard deviation of 2.98%.

The Fund had positive contributions from interest income and had realized capital gains and unrealized losses during the period. 100% of the income was distributed for a

1-year dividend yield of 3.87%. The Fund’s subsidized 30-day SEC yield was 6.35% and unsubsidized 30-day SEC yield was 5.64%. The total return for the period was positive. Although the Fund’s NAV decreased from $10.01 on September 30, 2021 to $9.65

on September 30, 2022, that decrease was more than offset as the Fund distributed $0.41 in income during the fiscal year.

In the first half of 2022, U.S. equities and fixed income portfolios suffered some of their largest losses in history1 as investors dealt with the effects of inflation and rising rates. During the fiscal year, the Fund was well-prepared for this market as we maintained our defensive positioning with a portfolio duration well below its

targeted range, continued holding significant dry powder2, and remained disciplined. The Fund was designed to be CrossingBridge’s most flexible and opportunistic Fund,

of which it maintains a non-diversified status, allowing the Fund to have higher concentration than diversified funds. As market conditions have continued to deteriorate and rates have continued to rise, we are starting to see the market become more

bifurcated, creating what we believe to be very attractive opportunities that may be suitable for the Fund.

As of September 30, 2022, the Fund’s net assets were weighted by category as follows: 14.4% in Short Term Securities, 11.5% in Event Driven, 24.1% in Interest Rate Sensitive,

30.7% in Core Value, 17.8% in Credit Opportunities, with the remaining 1.5% in cash and cash equivalents.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Past performance does not guarantee future results.

________________

|

1

|

In the first half of 2022, the S&P 500 Index declined -20.6%, its worst first half performance since 1970. Investment grade bonds, represented by the ICE BofA U.S. Corporate Bond Index, declined -13.93% in

the first half of the year, their worst first half ever and the worst six-month period since 1Q80 (-16.35%). The ICE BofA U.S. High Yield Index, which declined -14.04% in the first half, had its worst first half ever and worst six-month

period since 4Q08 (-25.43%) (Source: Bloomberg).

|

|

2

|

“Dry powder”, in the context of our portfolios, is defined as cash and investments that are expected to be repaid within 90 days as a result of call, redemption or maturity as well as pre-merger special purpose

acquisition corporations (SPACs).

|

12

The Fund is non-diversified under the Investment Company Act of 1940, therefore allowing the Fund to be more concentrated than a diversified fund. Because

the Fund is non-diversified it may invest a greater percentage of its assets in the securities of a single issuer or a smaller number of issuers than if it were a diversified fund. As a result, a decline in the value of an investment in a single

issuer could cause the Fund’s overall value to decline to a greater degree than if the Fund held a more diversified portfolio. Current fund statistics may not be indicative of future positioning.

Fund holdings and sector allocation are subject to change at any time and should not be considered a recommendation to buy or sell any security. Please see the Schedule of

Investments for complete Fund holdings.

Definitions: The ICE BofA U.S. High Yield Index (H0A0) tracks the performance of U.S. dollar-denominated below investment grade

corporate debt publicly issued in the U.S. domestic market. The ICE BofA U.S. Corporate Index (C0A0) tracks the performance of U.S. dollar-denominated investment grade corporate debt publicly issued in the

U.S. domestic market. The ICE BofA 3-7 Year U.S. Treasury Index (G30C) is a subset of ICE BofA U.S. Treasury Index including all securities with a remaining term to final maturity greater than or equal to 3

years and less than 7 years. The S&P 500, or simply the S&P, is a stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the United States. The ICE BofA U.S. Corporate Bond Index tracks the performance of U.S. dollar-denominated investment grade rated corporate debt publicly issues in the U.S. domestic market. The ICE

BofA U.S. High Yield Index tracks the performance of U.S. dollar-denominated below investment grade corporate debt publicly issued in the U.S. domestic market. Basis Point is one hundredth of one

percent.

It is not possible to invest directly in an index.

Mutual fund investing involves risk. Principal loss is possible. Investments in foreign securities involve greater volatility and political, economic and

currency risks and differences in accounting methods. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investment in lower-rated and non-rated

securities presents a greater risk of loss to principal and interest than higher-rated securities. The Fund may make short sales of securities, which involves the risk that losses may exceed the original amount invested. The Fund’s focus on

sustainability considerations (ESG criteria) may limit the number of investment opportunities available to the Fund, and as a result, at times, the Fund may underperform funds that are not subject to similar investment considerations. The Fund

invests in equity securities of special purpose acquisition companies (“SPACs”), which raise assets to seek potential business combination opportunities. Unless and until a business combination is completed, a SPAC generally invests its assets in

U.S. government securities, money market securities, and cash. Because SPACs have no operating history or ongoing business other than seeking a business combination, the value of their securities is particularly dependent on the ability of the

entity’s management to identify and complete a profitable business combination. There is no guarantee that the SPACs in which the Fund invests will complete a business combination or that any business combination that is completed will be profitable.

The Fund is non-diversified meaning it may concentrate its assets in fewer individual holdings than a diversified fund. The Fund invests in equity securities and warrants of SPACs. Pre-combination SPACs have no operating history or ongoing business

other than seeking a merger, share exchange, asset acquisition, share purchase negotiation or similar business combination (a “Combination”), and the value of their securities is particularly dependent on the ability of the entity’s management to

identify and complete a profitable Combination. There is no guarantee that the SPACs in which the Fund invests will complete a Combination or that any Combination that is completed will be profitable. Unless and until a Combination is completed, a

SPAC generally invests its assets in U.S. government securities, money market securities, and cash. Public stockholders of SPACs may not be afforded a meaningful opportunity to vote on a proposed initial Combination because certain stockholders,

including stockholders affiliated with the management of the SPAC, may have sufficient voting power, and a financial incentive, to approve such a transaction without support from public stockholders. As a result, a SPAC

13

may complete a Combination even though a majority of its public stockholders do not support such a Combination. Some SPACs may pursue Combinations only

within certain industries or regions, which may increase the volatility of their prices. The Fund may invest in SPACs domiciled or listed outside of the U.S., including, but not limited to, Canada, the Cayman Islands, Bermuda and the Virgin Islands.

Investments in SPACs domiciled or listed outside of the U.S. may involve risks not generally associated with investments in the securities of U.S. SPACs, such as risks relating to political, social, and economic developments abroad and differences

between U.S. and foreign regulatory requirements and market practices. Further, tax treatment may differ from U.S. SPACs and securities may be subject of foreign withholding taxes. Smaller capitalization SPACs will have a more limited pool of

companies with which they can pursue a business combination relative to larger capitalization companies. That may make it more difficult for a small capitalization SPAC to consummate a business combination.

Must be preceded or accompanied by a prospectus.

Distributor: Quasar Distributors, LLC.

14

Management’s Discussion of Fund Performance and Analysis

CrossingBridge Ultra-Short Duration Fund

(Unaudited)

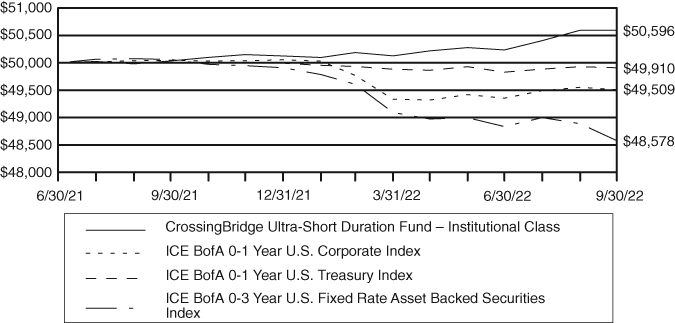

The 2022 fiscal year for the CrossingBridge Ultra-Short Duration Fund (CBUDX; the “Fund”) covers the twelve-month period of October 1, 2021 through September 30, 2022.

During this period, the Fund gained 1.12% on its Institutional Class shares while the ICE BofA 0-1 Year U.S. Corporate Index lost 1.07%, the ICE BofA 0-1 Year U.S. Treasury Index lost 0.20% and the ICE BofA 0-3 Year U.S. Fixed Rate Asset Backed

Securities Index lost 2.96%.

Monthly investment results for the fiscal year ranged from -0.12% in March 2022 to 0.38% in August 2022. The Fund generated positive returns for eight out of the twelve

months during the fiscal year. The median monthly return for the period was 0.11% with an annualized standard deviation of 0.52%

The Fund had positive contributions from interest income and had realized gains and unrealized losses during the period. 100% of the income was distributed for a 1-year

dividend yield of 1.43%. The Fund’s subsidized 30-day SEC yield was 4.00% and unsubsidized 30-day SEC yield was 3.77%. Although the Fund’s NAV decreased from $10.01 on September 30, 2021 to $9.97 on September 30, 2022, this was more than offset by

the distribution of $0.15 of income during the period.

In the first half of 2022, U.S. equities and fixed income portfolios suffered some of their largest losses in history1 as investors dealt with the effects of inflation and rising rates. During the fiscal year, the Fund was well-prepared for this market as we maintained our defensive positioning with an ultra-short duration, continued

holding significant dry powder2, and remained disciplined. Especially within an ultra-short duration portfolio, CrossingBridge stresses preservation of capital rather

than chasing yield. Per the Fund’s prospectus, CrossingBridge manages interest rate risk by maintaining an average portfolio duration of 1 or less by investing in short-term, medium-term, and floating rate securities. As a result, the Fund was well

insulated from the steep rise in rates. In addition, although the Fund has no restrictions as to credit quality, the intention is that the Fund will maintain a minimum of at least 65% of the portfolio in investment grade securities, further

insulating the Fund in the difficult fixed income environment. As of September 30, 2022, the Fund had 70.85% of the portfolio in investment grade securities. As market conditions have continued to deteriorate and rates have continued to rise, we are

starting to see the market become more bifurcated, creating what we believe to be very attractive opportunities that may be suitable for the Fund.

As of September 30, 2022, the Fund’s net assets were weighted by category as follows: 47.5% in Short Term Securities, 9.5% in Event Driven, 6.6% in Interest Rate Sensitive,

35.0% in Core Value, 0.0% in Credit Opportunities, with the remaining 1.4% in cash and cash equivalents.

________________

|

1

|

In the first half of 2022, the S&P 500 Index declined -20.6%, its worst first half performance since 1970. Investment grade bonds, represented by the ICE BofA U.S. Corporate Bond Index, declined -13.93% in

the first half of the year, their worst first half ever and the worst six-month period since 1Q80 (-16.35%). The ICE BofA U.S. High Yield Index, which declined -14.04% in the first half, had its worst first half ever and worst six-month

period since 4Q08 (-25.43%) (Source: Bloomberg).

|

|

2

|

“Dry powder”, in the context of our portfolios, is defined as cash and investments that are expected to be repaid within 90 days as a result of call, redemption or maturity as well as pre-merger special purpose

acquisition corporations (SPACs).

|

15

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Past performance does not guarantee future results.

Diversification does not assure a profit nor protect against risk in a declining market.

Fund holdings and sector allocation are subject to change at any time and should not be considered a recommendation to buy or sell any security. Please see the Schedule of

Investments for complete Fund holdings.

*Definitions: The ICE BofA 0-1 Year U.S. Corporate Index (H540) tracks the performance of short-maturity U.S. dollar-denominated

investment grade corporate debt publicly issued in the U.S. domestic market. The ICE BofA 0-1 Year U.S. Treasury Index (G0QA) tracks the performance of U.S. dollar-denominated sovereign debt publicly issued by

the U.S. government in its domestic market with maturities less than a year. The ICE BofA 0-3 Year U.S. Fixed Rate Asset Backed Securities Index (R1A0) is a subset of ICE BofA U.S. Fixed Rate Asset Backed

Securities Index including all securities with an average life less than 3 years. The S&P 500, or simply the S&P, is a stock market index that measures the stock performance of 500 large companies

listed on stock exchanges in the United States. The ICE BofA U.S. Corporate Bond Index tracks the performance of U.S. dollar-denominated investment grade rated corporate debt publicly issues in the U.S.

domestic market. The ICE BofA U.S. High Yield Index tracks the performance of U.S. dollar-denominated below investment grade corporate debt publicly issued in the U.S. domestic market. Duration is the weighted

average of the present value of the cash flows and is used as a measure of a bond price’s response to changes in yield. Rising interest rates mean falling bond prices, while declining interest rates mean rising bond prices. Standard Deviation is a statistical measure of portfolio risk used to measure variability of total return around an average, over a specified period of time. The greater the standard deviation over the period, the wider the

variability or range of returns and hence, the greater the fund’s volatility. The standard deviation has been calculated since inception and is annualized.

It is not possible to invest directly in an index.

Mutual fund investing involves risk. Principal loss is possible. Investments in foreign securities involve greater volatility and political, economic and

currency risks and differences in accounting methods. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investment in lower-rated and non-rated

securities presents a greater risk of loss to principal and interest than higher-rated securities. The fund may make short sales of securities, which involves the risk that losses may exceed the original amount invested. The Fund invests in equity

securities and warrants of special purpose acquisition companies (“SPACs”). Pre-combination SPACs have no operating history or ongoing business other than seeking a merger, share exchange, asset acquisition, share purchase negotiation or similar

business combination (a “Combination”), and the value of their securities is particularly dependent on the ability of the entity’s management to identify and complete a profitable Combination. There is no guarantee that the SPACs in which the Fund

invests will complete a Combination or that any Combination that is completed will be profitable. Unless and until a Combination is completed, a SPAC generally invests its assets in U.S. government securities, money market securities, and cash.

Public stockholders of SPACs may not be afforded a meaningful opportunity to vote on a proposed initial Combination because certain stockholders, including stockholders affiliated with the management of the SPAC, may have sufficient voting power, and

a financial incentive, to approve such a transaction without support from public stockholders. As a result, a SPAC may complete a Combination even though a majority of its public stockholders do not support such a Combination. Some SPACs may pursue

Combinations only within certain industries or regions, which may increase the volatility of their prices. The Fund may invest in SPACs domiciled or listed outside of the U.S., including, but not limited to, Canada, the Cayman Islands, Bermuda and

the Virgin Islands. Investments in SPACs domiciled or listed outside of the U.S. may involve risks not generally associated with investments in the securities of U.S. SPACs, such as risks relating to political, social, and economic

16

developments abroad and differences between U.S. and foreign regulatory requirements and market practices. Further, tax treatment may differ from U.S.

SPACs and securities may be subject of foreign withholding taxes. Smaller capitalization SPACs will have a more limited pool of companies with which they can pursue a business combination relative to larger capitalization companies. That may make it

more difficult for a small capitalization SPAC to consummate a business combination.

Must be preceded or accompanied by a prospectus.

Distributor: Quasar Distributors, LLC.

17

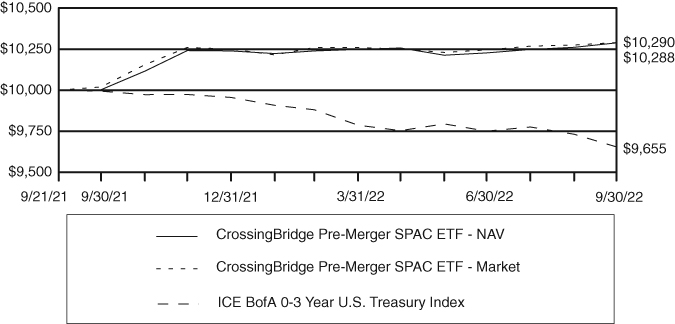

Management’s Discussion of Fund Performance and Analysis

CrossingBridge Pre-Merger SPAC ETF

(Unaudited)

The 2022 fiscal year for the CrossingBridge Pre-Merger SPAC ETF (SPC; the “Fund”) covers the twelve-month period of October 1, 2021 through September 30, 2022. During this

period, the Fund had a NAV return of 2.85% and a market return of 2.70%. The Fund’s market return of 2.70% compared favorably to the ICE BofA 0-3 Year U.S. Treasury Index’s loss of 3.39%. The Fund had realized and unrealized gains during the period.

The total return for the period was higher as the share price increased from $20.04 on September 30, 2021 to $20.56 on September 30, 2022, while the NAV increased from $20.01 to $20.56 for the period.

Given that pre-merger Special Purpose Acquisition Companies (SPACs) behave like fixed income securities due to their IPO proceeds being placed in a trust account typically

invested in ultra-short term U.S. government securities for the benefit of SPAC shareholders, as rates went up for Treasuries, so did the yields for pre-merger SPACs. On September 30, 2021, the weighted average yield of SPACs still seeking an

acquisition target was 1.71%, and on September 30, 2022, that yield increased to 5.80% with a weighted average maturity of just less than 6 months. The current environment in the secondary market for pre-merger SPACs remains robust – as of September

30, 2022, there were 666 pre-merger SPACs totaling $161 billion in total trust value in the U.S.-listed SPAC market. Although the market will experience a large majority of liquidations within the first half of 2023, we believe the current

opportunity for the Fund remains attractive.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Past performance does not guarantee future results.

Diversification does not assure a profit nor protect against risk in a declining market.

Fund holdings and sector allocation are subject to change at any time and should not be considered a recommendation to buy or sell any security. Please see the Schedule of

Investments for complete Fund holdings.

*Definitions: The ICE BofA 0-3 Year U.S. Treasury Index tracks the performance of U.S. dollar-denominated sovereign debt publicly

issued by the U.S. government in its domestic market with maturities less than three years. Weighted Average Yield: similar to a bond’s Yield to Maturity, SPACs have a Yield to Liquidation/Redemption, which

can be calculated using the Gross Spread and Time to Liquidation. Weighted Average Maturity: Similar to a bond’s maturity date, SPACs also have a maturity, which is the defined time period in which they have

to complete a business combination. This is referred to as the Liquidation or Redemption Date.

It is not possible to invest directly in an index.

Investing involves risk; Principal loss is possible. The Fund invests in equity securities and warrants of SPACs. Pre-combination SPACs have no operating

history or ongoing business other than seeking a merger, share exchange, asset acquisition, share purchase negotiation or similar business combination (a “Combination”), and the value of their securities is particularly dependent on the ability of

the entity’s management to identify and complete a profitable Combination. There is no guarantee that the SPACs in which the Fund invests will complete a Combination or that any Combination that is completed will be profitable. Unless and until a

Combination is completed, a SPAC generally invests its assets in U.S. government securities, money market securities, and cash. Public stockholders of SPACs may not be afforded a meaningful opportunity to vote on a proposed initial Combination

because certain

18

stockholders, including stockholders affiliated with the management of the SPAC, may have sufficient voting power, and a financial incentive, to approve

such a transaction without support from public stockholders. As a result, a SPAC may complete a Combination even though a majority of its public stockholders do not support such a Combination. Some SPACs may pursue Combinations only within certain

industries or regions, which may increase the volatility of their prices. The Fund may invest in SPACs domiciled or listed outside of the U.S., including, but not limited to, Canada, the Cayman Islands, Bermuda and the Virgin Islands. Investments in

SPACs domiciled or listed outside of the U.S. may involve risks not generally associated with investments in the securities of U.S. SPACs, such as risks relating to political, social, and economic developments abroad and differences between U.S. and

foreign regulatory requirements and market practices. Further, tax treatment may differ from U.S. SPACs and securities may be subject of foreign withholding taxes. Smaller capitalization SPACs will have a more limited pool of companies with which

they can pursue a business combination relative to larger capitalization companies. That may make it more difficult for a small capitalization SPAC to consummate a business combination. Because the Fund is non-diversified it may invest a greater

percentage of its assets in the securities of a single issuer or a smaller number of issuers than if it were a diversified fund. As a result, a decline in the value of an investment in a single issuer could cause the Fund’s overall value to decline

to a greater degree than if the Fund held a more diversified portfolio.

Must be preceded or accompanied by a prospectus.

Distributor: Foreside Fund Services, LLC.

19

CROSSINGBRIDGE FUNDS

Expense Example

(Unaudited)

As a shareholder of the CrossingBridge Low Duration High Yield Fund, CrossingBridge Responsible Credit Fund and CrossingBridge Ultra-Short Duration Fund, you incur two types

of costs: (1) transaction costs and (2) ongoing costs, including management fees, shareholder servicing plan fees and other Fund expenses. As a shareholder of the CrossingBridge Pre-Merger SPAC ETF, you incur two types of costs: (1) transaction

costs, including brokerage commissions paid on purchases and sales of the Fund’s shares, and (2) ongoing costs, including management fees of the Fund. The Example is intended to help you understand your ongoing costs (in dollars) of investing in the

Funds and to compare these costs with the ongoing costs of investing in other funds. The Example is based on an investment of $1,000 invested at the beginning of the respective period disclosed in the following table and held for the entire

respective period disclosed in the following table.

Actual Expenses

The first line under each Fund in the following table provides information about actual account values and actual expenses for each Fund. You may use the information in this

line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in

the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line under each Fund in the following table provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense

ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. Please note

that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the second line of the table is useful in

comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

20

CROSSINGBRIDGE FUNDS

Expense Example (Continued)

(Unaudited)

|

Beginning

|

Ending

|

|||

|

Annualized

|

Account Value

|

Account Value

|

Expenses

|

|

|

Expense

|

April 1,

|

September 30,

|

Paid During

|

|

|

Ratio

|

2022

|

2022

|

Period*

|

|

|

CrossingBridge Low

|

||||

|

Duration High Yield Fund

|

||||

|

Institutional Class

|

||||

|

Based on actual fund return

|

0.87%

|

$1,000.00

|

$ 988.90

|

$4.34

|

|

Based on hypothetical 5% return

|

0.87%

|

1,000.00

|

1,020.71

|

4.41

|

|

CrossingBridge

|

||||

|

Responsible Credit Fund

|

||||

|

Institutional Class

|

||||

|

Based on actual fund return

|

0.88%

|

1,000.00

|

1,001.20

|

4.41

|

|

Based on hypothetical 5% return

|

0.88%

|

1,000.00

|

1,020.66

|

4.46

|

|

CrossingBridge

|

||||

|

Ultra-Short Duration Fund

|

||||

|

Institutional Class

|

||||

|

Based on actual fund return

|

0.88%

|

1,000.00

|

1,009.40

|

4.43

|

|

Based on hypothetical 5% return

|

0.88%

|

1,000.00

|

1,020.66

|

4.46

|

|

CrossingBridge

|

||||

|

Pre-Merger SPAC ETF

|

||||

|

Based on actual fund return

|

0.80%

|

1,000.00

|

1,003.90

|

4.02

|

|

Based on hypothetical 5% return

|

0.80%

|

1,000.00

|

1,021.06

|

4.05

|

|

*

|

Expenses are calculated using the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by the number of days in the period (183 days), divided by 365 days to

reflect the six month period ended September 30, 2022.

|

21

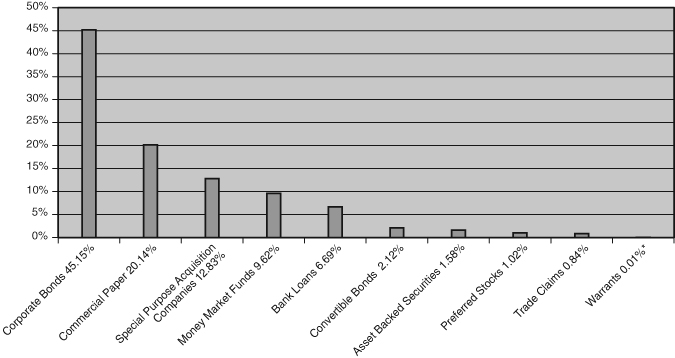

CROSSINGBRIDGE LOW DURATION HIGH YIELD FUND

Investment Highlights

(Unaudited)

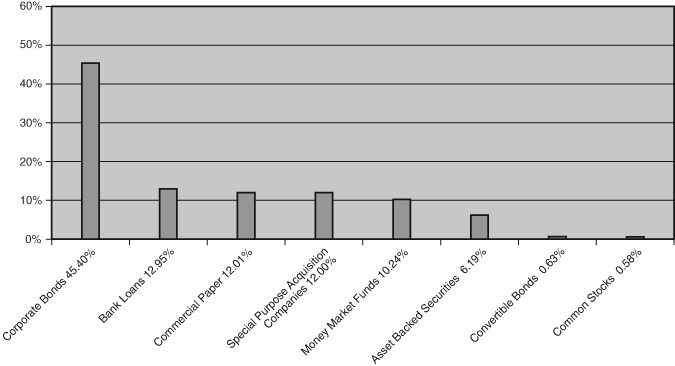

The Fund seeks high current income and capital appreciation consistent with the preservation of capital using a low duration mandate. The allocation of portfolio holdings as

of September 30, 2022 is as follows:

Allocation of Portfolio Holdings

(% of Investments)

|

*

|

Less than 0.05%.

|

Average Annual Total Returns as of September 30, 2022

|

One

|

Three

|

Since

|

|

|

Year

|

Years

|

February 1, 20181

|

|

|

Institutional Class Shares

|

-0.39%

|

3.46%

|

3.23%

|

|

ICE BofA 0-3 Year U.S. High Yield

|

|||

|

Excluding Financials Index

|

-4.35%

|

1.89%

|

2.73%

|

|

ICE BofA 0-3 Year U.S. Treasury Index

|

-3.39%

|

-0.16%

|

0.88%

|

|

ICE BofA 1-3 Year U.S. Corporate Bond Index

|

-5.89%

|

-0.19%

|

1.21%

|

|

1

|

Commencement of investment operations.

|

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will

fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may

be obtained by calling 1-888-898-2780.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total returns would be reduced.

22

CROSSINGBRIDGE LOW DURATION HIGH YIELD FUND

Investment Highlights (Continued)

(Unaudited)

The returns shown assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of

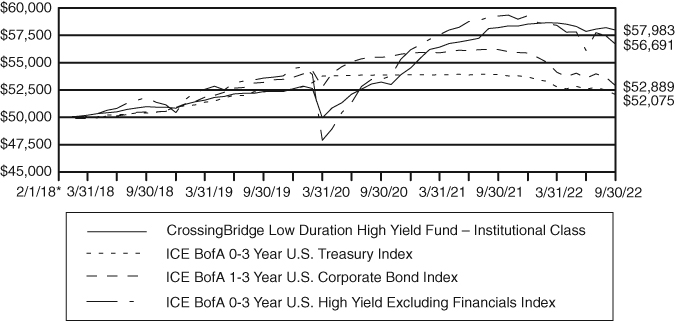

Fund shares. The following graph illustrates performance of a hypothetical investment made in the Fund and the Fund’s primary benchmark index, the ICE BofA 0-3 Year U.S. High Yield Excluding Financials Index, as well as other broad-based securities

indices on the Fund’s inception date. The graph does not reflect any future performance. ICE BofA 0-3 Year U.S. High Yield Excluding Financials Index is a subset of ICE BofA 0-3 Year U.S. High Yield Index

excluding sector level 2 Financial issuers. ICE BofA 0-3 Year U.S. Treasury Index tracks the performance of U.S. dollar denominated sovereign debt publicly issued by the U.S. government in its domestic market

with maturities less than three years. Qualifying securities must have at least 18 months to maturity at point of issuance, at least one month and less than three years remaining term to final maturity, a fixed coupon schedule and minimum amount

outstanding of $1 billion. ICE BofA 1-3 Year U.S. Corporate Bond Index is a subset of ICE BofA U.S. Corporate Bond Index including all securities with a remaining term to final maturity less than 3 years. It

is not possible to invest directly in an index.

Growth of $50,000 Investment

|

*

|

Commencement of investment operations.

|

23

CROSSINGBRIDGE RESPONSIBLE CREDIT FUND

Investment Highlights

(Unaudited)

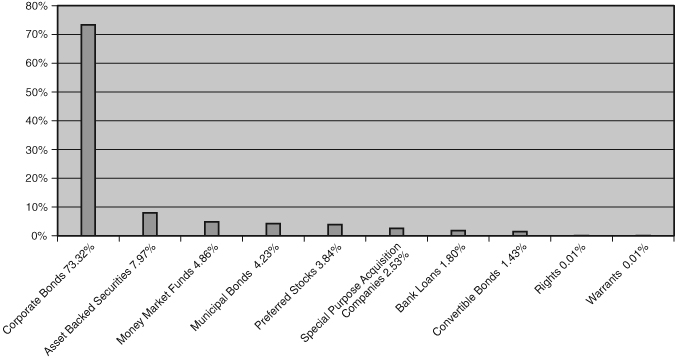

The Fund seeks high current income and capital appreciation consistent with the preservation of capital by investing in fixed income securities that meet the responsible

investing criteria of the Fund’s investment adviser. The allocation of portfolio holdings as of September 30, 2022 is as follows:

Allocation of Portfolio Holdings

(% of Investments)

Average Annual Total Returns as of September 30, 2022

|

One

|

Since

|

|

|

Year

|

June 30, 20211

|

|

|

Institutional Class Shares

|

0.45%

|

0.82%

|

|

ICE BofA U.S. High Yield Index

|

-14.06%

|

-10.73%

|

|

ICE BofA 3-7 Year U.S. Treasury Index

|

-11.08%

|

-9.07%

|

|

ICE BofA U.S. Corporate Index

|

-18.19%

|

-14.85%

|

|

1

|

Commencement of investment operations.

|

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will

fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may

be obtained by calling 1-888-898-2780.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total returns would be reduced.

24

CROSSINGBRIDGE RESPONSIBLE CREDIT FUND

Investment Highlights (Continued)

(Unaudited)

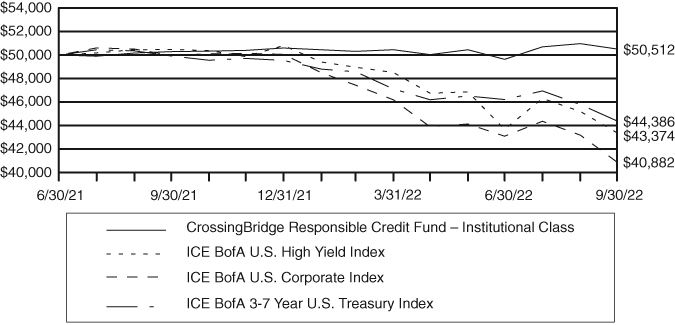

The returns shown assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of

Fund shares. The following graph illustrates performance of a hypothetical investment made in the Fund and the Fund’s primary benchmark index, the ICE BofA U.S. High Yield Index, as well as other broad-based securities indices on the Fund’s inception

date. ICE BofA 3-7 Year U.S. Treasury Index measures the performance of public obligations of the U.S. Treasury that have a remaining maturity of greater than 3 years and less than or equal to 7 years. ICE BofA U.S. Corporate Index is an unmanaged index comprised of U.S. dollar denominated investment grade, fixed rate corporate debt securities publicly issued in the U.S. domestic market with at least one year

remaining term to final maturity and at least $250 million outstanding. ICE BofA U.S. High Yield Index is an unmanaged index that tracks the performance of U.S. dollar denominated, below investment-grade rated

corporate debt publicly issued in the U.S. domestic market. It is not possible to invest directly in an index.

Growth of $50,000 Investment

25

CROSSINGBRIDGE ULTRA-SHORT DURATION FUND

Investment Highlights

(Unaudited)

The Fund seeks to offer a higher yield than cash instruments while maintaining a low duration. The allocation of portfolio holdings as of September 30, 2022 is as follows:

Allocation of Portfolio Holdings

(% of Investments)

Average Annual Total Returns as of September 30, 2022

|

One

|

Since

|

|

|

Year

|

June 30, 20211

|

|

|

Institutional Class Shares

|

1.12%

|

0.95%

|

|

ICE BofA 0-1 Year U.S. Corporate Index

|

-1.07%

|

-0.79%

|

|

ICE BofA 0-1 Year U.S. Treasury Index

|

-0.20%

|

-0.14%

|

|

ICE BofA 0-3 Year U.S. Fixed Rate

|

||

|

Asset Backed Securities Index

|

-2.96%

|

-2.28%

|

|

1

|

Commencement of investment operations.

|

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will

fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may

be obtained by calling 1-888-898-2780.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total returns would be reduced.

26

CROSSINGBRIDGE ULTRA-SHORT DURATION FUND

Investment Highlights (Continued)

(Unaudited)

The returns shown assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of

Fund shares. The following graph illustrates performance of a hypothetical investment made in the Fund and the Fund’s primary benchmark index, ICE BofA 0-1 Year U.S. Corporate Index, as well as other broad-based securities indices on the Fund’s

inception date. ICE BofA 0-1 Year U.S. Corporate Index is a subset of ICE BofA U.S. Corporate Bond Index including all securities with a remaining term to final maturity less than 1 year. ICE BofA 0-1 Year U.S. Treasury Index tracks the performance of U.S. dollar denominated sovereign debt publicly issued by the U.S. government in its domestic market with maturities less than one year. ICE BofA 0-3 Year U.S. Fixed Rate Asset Backed Securities Index is a subset of ICE BofA U.S. Fixed Rate Asset Backed Securities Index including all securities with a remaining term to final maturity less than three

years. It is not possible to invest directly in an index.

Growth of $50,000 Investment

27

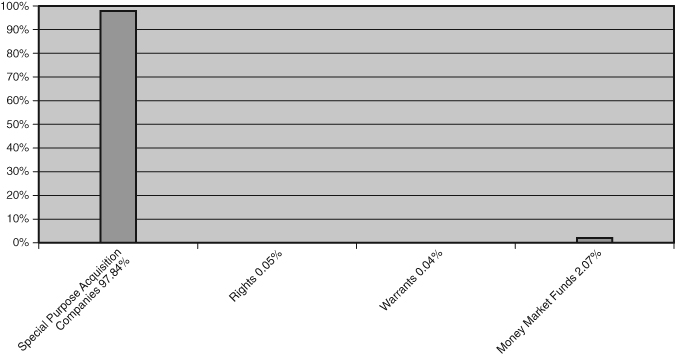

CROSSINGBRIDGE PRE-MERGER SPAC ETF

Investment Highlights

(Unaudited)

The Fund seeks to provide total returns consistent with the preservation of capital. The allocation of portfolio holdings as of September 30, 2022 is as follows:

Allocation of Portfolio Holdings

(% of Investments)

Average Annual Total Returns as of September 30, 2022

|

One

|

Since

|

|

|

Year

|

September 20, 20211

|

|

|

Net Asset Value

|

2.85%

|

2.80%

|

|

Market Value

|

2.70%

|

2.82%

|

|

ICE BofA 0-3 Year U.S. Treasury Index

|

-3.39%

|

-3.36%

|

|

1

|

Commencement of investment operations.

|

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will

fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may

be obtained by calling 1-888-898-2780.

The returns shown assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of

Fund shares. The following graph illustrates performance of a hypothetical investment made in the Fund and broad-based securities indices on the Fund’s inception date. The graph does not reflect any future performance. ICE BofA 0-3 Year U.S. Treasury Index tracks the performance of U.S. dollar denominated sovereign debt publicly issued by the

28

CROSSINGBRIDGE PRE-MERGER SPAC ETF

Investment Highlights (Continued)

(Unaudited)

U.S. government in its domestic market with maturities less than three years. Qualifying securities must have at least 18 months to maturity at point of issuance, at least

one month and less than three years remaining term to final maturity, a fixed coupon schedule and minimum amount outstanding of $1 billion. It is not possible to invest directly in an index.

Growth of $10,000 Investment

29

CROSSINGBRIDGE LOW DURATION HIGH YIELD FUND

|

Schedule of Investments

|

September 30, 2022

|

Face

|

||||||||

|

Amount†

|

Value

|

|||||||

|

ASSET BACKED SECURITIES – 1.63%

|

||||||||

|

Finance and Insurance – 0.18%

|

||||||||

|

HTS Fund I LLC

|

||||||||

|

2021-1, 1.410%, 08/25/2036 (a)

|

1,000,000

|

$

|

967,062

|

|||||

|

Transportation and Warehousing – 1.45%

|

||||||||

|

Hawaiian Airlines 2013-1 Class A Pass Through Certificates

|

||||||||

|

2013-1, 3.900%, 01/15/2026

|

9,817,848

|

7,899,273

|

||||||

|

TOTAL ASSET BACKED SECURITIES (Cost $9,847,972)

|

8,866,335

|

|||||||

|

BANK LOANS – 6.89%

|

||||||||

|

Accommodation and Food Services – 0.35%

|

||||||||

|

Fogo De Chao, Inc.

|

||||||||

|

7.365% (1 Month LIBOR + 4.250%), 04/05/2025 (b)

|

2,036,000

|

1,922,748

|

||||||

|

Administrative and Support and Waste

|

||||||||

|

Management and Remediation Services – 0.63%

|

||||||||

|

Monitronics International, Inc.

|

||||||||

|

10.306% (Base Rate + 7.500%), 03/29/2024 (b)

|

5,162,081

|

3,453,747

|

||||||

|

Construction – 0.20%

|

||||||||

|

Lealand Finance (McDermott)

|

||||||||

|

6.115% (1 Month Base Rate + 3.000%), 06/30/2024 (b)

|

1,750,984

|

1,116,252

|

||||||

|

Finance and Insurance – 0.43%

|

||||||||

|

MoneyGram International, Inc.

|

||||||||

|

7.615% (3 Month LIBOR + 4.500%), 07/21/2026 (b)

|

2,395,458

|

2,346,247

|

||||||

|

Information – 2.64%

|

||||||||

|

Cengage Learning, Inc.

|

||||||||

|

7.814% (Base Rate + 4.750%), 07/14/2026 (b)

|

4,059,963

|

3,686,325

|

||||||

|

Go Daddy Operating Co. LLC

|

||||||||

|

4.865% (1 Month LIBOR + 1.750%), 02/15/2024 (b)

|

10,776,898

|

10,687,988

|

||||||

|

14,374,313

|

||||||||

|

Manufacturing – 1.02%

|

||||||||

|

First Brands Group LLC

|

||||||||

|

8.368% (6 Month SOFR + 5.000%), 03/30/2027 (b)

|

2,130,912

|

2,055,797

|

||||||

|

K&N Parent, Inc.

|

||||||||

|

7.000% (3 Month LIBOR + 4.750%), 10/20/2023 (b)

|

4,366,418

|

3,481,838

|

||||||

|

5,537,635

|

||||||||

The accompanying notes are an integral part of these financial statements.

30

CROSSINGBRIDGE LOW DURATION HIGH YIELD FUND

|

Schedule of Investments (Continued)

|

September 30, 2022

|

Face

|

||||||||

|

Amount†

|

Value

|

|||||||

|

BANK LOANS – 6.89% (CONTINUED)

|

||||||||

|

Mining, Quarrying, and Oil and Gas Extraction – 0.81%

|

||||||||

|

Quarternorth Energy Holding, Inc.

|

||||||||

|

11.115% (1 Month LIBOR + 8.000%), 08/27/2026 (b)

|

4,419,985

|

$

|

4,412,626

|

|||||

|

Professional, Scientific, and Technical Services – 0.81%

|

||||||||

|

Getty Images, Inc.

|

||||||||

|

7.625% (3 Month LIBOR + 4.500%), 02/19/2026 (b)

|

4,423,000

|

4,399,293

|

||||||

|

TOTAL BANK LOANS (Cost $39,602,662)

|

37,562,861

|

|||||||

|

COMMERCIAL PAPER – 20.77%

|

||||||||

|

Information – 3.91%

|

||||||||

|

Crown Castle, Inc.

|

||||||||

|

3.513%, 10/19/2022 (c)

|

11,261,000

|

11,239,069

|

||||||

|

Rogers Communications, Inc.

|

||||||||

|

4.030%, 11/04/2022 (c)

|

5,371,000

|

5,352,437

|

||||||

|

Telus Corp.

|

||||||||

|

3.322%, 12/01/2022 (c)

|

4,750,000

|

4,719,102

|

||||||

|

21,310,608

|

||||||||

|

Manufacturing – 13.62%

|

||||||||

|

Constellation Brands, Inc.

|

||||||||

|

3.912%, 10/24/2022 (c)

|

10,925,000

|

10,897,534

|

||||||

|

FMC Corp.

|

||||||||

|

3.067%, 10/03/2022 (c)

|

8,750,000

|

8,747,363

|

||||||

|

Fortive Corp.

|

||||||||

|

3.057%, 10/14/2022 (c)

|

7,750,000

|

7,739,762

|

||||||

|

Fortune Brands Home & Security, Inc.

|

||||||||

|

3.540%, 10/24/2022 (c)

|

5,750,000

|

5,736,545

|

||||||

|

General Motors Financial Co, Inc.

|

||||||||

|

3.326%, 10/25/2022 (c)

|

5,732,000

|

5,717,272

|

||||||

|

3.833%, 11/28/2022 (c)

|

5,732,000

|

5,694,377

|

||||||

|

HP, Inc.

|

||||||||

|

3.536%, 10/17/2022 (c)

|

11,464,000

|

11,445,702

|

||||||

|

Jabil, Inc.

|

||||||||

|

3.475%, 10/17/2022 (c)

|

11,550,000

|

11,528,838

|

||||||

|

Parker-Hannifin Corp.

|

||||||||

|

3.216%, 11/28/2022 (c)

|

6,750,000

|

6,706,912

|

||||||

|

74,214,305

|

||||||||

The accompanying notes are an integral part of these financial statements.

31

CROSSINGBRIDGE LOW DURATION HIGH YIELD FUND

|

Schedule of Investments (Continued)

|

September 30, 2022

|

Face

|

||||||||

|

Amount†

|

Value

|

|||||||

|

COMMERCIAL PAPER – 20.77% (CONTINUED)

|

||||||||

|

Mining, Quarrying, and Oil and Gas Extraction – 3.24%

|

||||||||

|

Glencore Funding LLC

|

||||||||

|

3.386%, 11/10/2022 (c)

|

9,399,000

|

$

|

9,361,128

|

|||||

|

Targa Resources Corp.

|

||||||||

|

3.550%, 10/13/2022 (c)

|

8,293,000

|

8,283,746

|

||||||

|

17,644,874

|

||||||||

|

TOTAL COMMERCIAL PAPER (Cost $113,197,750)

|

113,169,787

|

|||||||

|

CONVERTIBLE BONDS – 2.18%

|

||||||||

|

Information – 2.18%

|

||||||||

|

BuzzFeed, Inc.

|

||||||||

|

8.500%, 12/03/2026 (a)(e)

|

4,900,000

|

3,724,000

|

||||||

|

Leafly Holdings, Inc.

|

||||||||

|

8.000%, 01/31/2025 (d)(e)

|

7,245,000

|

6,737,850

|

||||||

|

UpHealth, Inc.

|

||||||||

|

6.250%, 06/15/2026 (a)

|

4,636,000

|

1,442,955

|

||||||

|

TOTAL CONVERTIBLE BONDS (Cost $16,659,724)

|

11,904,805

|

|||||||

|

CORPORATE BONDS – 46.56%

|

||||||||

|

Accommodation and Food Services – 0.24%

|

||||||||

|

Nathan’s Famous, Inc.

|

||||||||

|

6.625%, 11/01/2025 (a)

|

1,321,000

|

1,315,293

|

||||||

|

Agriculture, Forestry, Fishing and Hunting – 0.29%

|

||||||||

|

Cooks Venture, Inc.

|

||||||||

|

2022-2, 5.500%, 01/15/2025 (a)

|

1,595,000

|

1,563,898

|

||||||

|

Arts, Entertainment, and Recreation – 0.04%

|

||||||||

|

Gaming Innovation Group Plc

|

||||||||

|

9.979% (3 Month STIBOR + 8.500%), 06/11/2024 (a)(b)(f)(g)

|

SEK 2,250,000

|

205,787

|

||||||

|

Construction – 0.36%

|

||||||||

|

Schletter International BV

|

||||||||

|

7.462% (3 Month EURIBOR + 6.750%), 09/12/2025 (b)(f)(h)

|

EUR 1,990,000

|

1,942,705

|

||||||

|

Educational Services – 0.27%

|

||||||||

|

Hercules Achievement Inc / Varsity Brands Holding Co, Inc.

|

||||||||

|

11.674% (3 Month LIBOR + 8.000%), 12/22/2024 (a)(b)

|

1,533,000

|

1,456,350

|

||||||

The accompanying notes are an integral part of these financial statements.

32

CROSSINGBRIDGE LOW DURATION HIGH YIELD FUND

|

Schedule of Investments (Continued)

|

September 30, 2022

|

Face

|

||||||||

|

Amount†

|

Value

|

|||||||

|

CORPORATE BONDS – 46.56% (CONTINUED)

|

||||||||

|

Finance and Insurance – 3.10%

|

||||||||

|

HMH Holding BV

|

||||||||

|

9.912%, 02/10/2025 (f)

|

4,001,000

|

$

|

4,051,012

|

|||||

|

Icahn Enterprises LP / Icahn Enterprises Finance Corp.

|

||||||||

|

4.750%, 09/15/2024

|

621,000

|

581,587

|

||||||

|

Nordic Capital II

|

||||||||

|

7.910%, 06/30/2024 (f)(i)

|

NOK 10,200,000

|

943,859

|

||||||

|

StoneX Group, Inc.

|

||||||||

|

8.625%, 06/15/2025 (a)

|

11,178,000

|

11,313,198

|

||||||

|

16,889,656

|

||||||||

|

Health Care and Social Assistance – 0.27%

|

||||||||

|

ADDvise Group AB

|

||||||||

|

8.569% (3 Month STIBOR + 7.250%), 05/21/2024 (b)(f)(g)

|

SEK 16,380,000

|

1,472,298

|

||||||

|

Information – 18.58%

|

||||||||

|

American Greetings Corp.

|

||||||||

|

8.750%, 04/15/2025 (a)

|

2,712,000

|

2,608,754

|

||||||

|

Azerion Holding BV

|

||||||||

|

7.250%, 04/28/2024 (f)(h)

|

EUR 3,199,000

|

3,097,326

|

||||||

|

CCO Holdings LLC / CCO Holdings Capital Corp.

|

||||||||

|

4.000%, 03/01/2023 (a)

|

4,319,000

|

4,299,564

|

||||||

|

Cengage Learning, Inc.

|

||||||||

|

9.500%, 06/15/2024 (a)

|

8,486,000

|

7,976,840

|

||||||

|

Clear Channel International BV

|

||||||||

|

6.625%, 08/01/2025 (a)(f)

|

10,961,000

|

10,197,991

|

||||||

|

Connect Finco SARL / Connect US Finco LLC

|

||||||||

|

6.750%, 10/01/2026 (a)(f)

|

7,949,000

|

6,964,658

|