| ||

REGISTRATION STATEMENT PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934 OR | |||||

| ANNUAL REPORT PURSUANT TO SECTION 13(a) OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

No | |||||

No | |||||

| Exhibit Number | Exhibit Description | |||||||

| Annual Information Form of AQN for the year ended December 31, 2022.* | ||||||||

| Management’s Discussion & Analysis of AQN for the year ended December 31, 2022. | ||||||||

Consent Letter from Ernst & Young LLP.* | ||||||||

Certifications of Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. | ||||||||

Certifications of Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. | ||||||||

| Certifications of Chief Executive Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. | ||||||||

| Certifications of Chief Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. | ||||||||

| 101 | Inline Interactive Data File.* | |||||||

| 104 | Cover Page Interactive Data File. | |||||||

| ||

| Significant Subsidiaries | Description | Jurisdiction | Ownership of Voting Securities | ||||||||

| REGULATED SERVICES GROUP | |||||||||||

Liberty Utilities (Canada) Corp. | Canada | 100% | |||||||||

Liberty Utilities Co. (“Liberty Utilities”) | Delaware | 100% | |||||||||

| Liberty Utilities (CalPeco Electric) LLC | Owner of the CalPeco Electric System | California | 100% | ||||||||

| Liberty Utilities (Granite State Electric) Corp. | Owner of the Granite State Electric System | New Hampshire | 100% | ||||||||

| Liberty Utilities (EnergyNorth Natural Gas) Corp. | Owner of the EnergyNorth Gas System | New Hampshire | 100% | ||||||||

| Liberty Utilities (Litchfield Park Water & Sewer) Corp. | Owner of the Litchfield Park Water System | Arizona | 100% | ||||||||

| Liberty Utilities (Midstates Natural Gas) Corp. | Owner of the Midstates Gas Systems | Missouri | 100% | ||||||||

| Liberty Utilities (Peach State Natural Gas) Corp. | Owner of the Peach State Gas System | Georgia | 100% | ||||||||

| Liberty Utilities (New England Natural Gas Company) Corp. | Owner of the New England Gas System | Delaware | 100% | ||||||||

| Liberty Utilities (New York Water) Corp. | Owner of the New York Water System | New York | 100% | ||||||||

| Liberty Utilities (St. Lawrence Gas) Corp. | Owner of the St. Lawrence Gas System | New York | 100% | ||||||||

The Empire District Electric Company (“Empire”) | Owner of, among other things, electric and electric transmission utility assets serving locations in Missouri, Kansas, Oklahoma and Arkansas, and power generation assets | Kansas | 100% | ||||||||

| Neosho Ridge Wind, LLC | Owner of the Neosho Ridge Wind Facility | Delaware | 100%1 | ||||||||

| North Fork Ridge Wind, LLC | Owner of the North Fork Ridge Wind Facility | Delaware | 100%1 | ||||||||

| Kings Point Wind, LLC | Owner of the Kings Point Wind Facility | Delaware | 100%1 | ||||||||

The Empire District Gas Company (“EDG”) | Operator of a natural gas distribution utility in Missouri | Kansas | 100% | ||||||||

Liberty Utilities (Canada) LP (“Liberty Utilities Canada”) | Ontario | 100% | |||||||||

| Liberty Utilities (Gas New Brunswick) LP | Owner of the New Brunswick Gas System | New Brunswick | 100% | ||||||||

| Bermuda Electric Light Company Limited | Owner of an electric distribution, transmission and generation system in Bermuda | Bermuda | 100% | ||||||||

| Empresa de Servicios Sanitarios de Los Lagos S.A. | Owner of a water and wastewater system in Chile | Chile | 64% | ||||||||

| RENEWABLE ENERGY GROUP | |||||||||||

Liberty (AY Holdings) B.V. (“AY Holdings”) | Owner of approximately 42% equity interest in Atlantica | Netherlands | 100% | ||||||||

| Algonquin Power Co. | Ontario | 100% | |||||||||

| Altavista Solar, LLC | Owner of the Altavista Solar Facility | Virginia | 100% | ||||||||

| Deerfield Wind Energy, LLC | Owner of the Deerfield Wind Facility | Delaware | 51%2 | ||||||||

| GSG 6, LLC | Owner of the Shady Oaks Wind Facility | Illinois | 100% | ||||||||

| Maverick Creek Wind, LLC | Owner of the Maverick Creek Wind Facility | Delaware | 100%1 | ||||||||

| Minonk Wind, LLC | Owner of the Minonk Wind Facility | Delaware | 100% | ||||||||

| Odell Wind Farm, LLC | Owner of the Odell Wind Facility | Minnesota | 51%2 | ||||||||

| Senate Wind, LLC | Owner of the Senate Wind Facility | Delaware | 100% | ||||||||

St. Leon Wind Energy LP (“St. Leon LP”) | Owner of the St. Leon Wind Facility | Manitoba | 100% | ||||||||

| Sugar Creek Wind One LLC | Owner of the Sugar Creek Wind Facility | Delaware | 51%2 | ||||||||

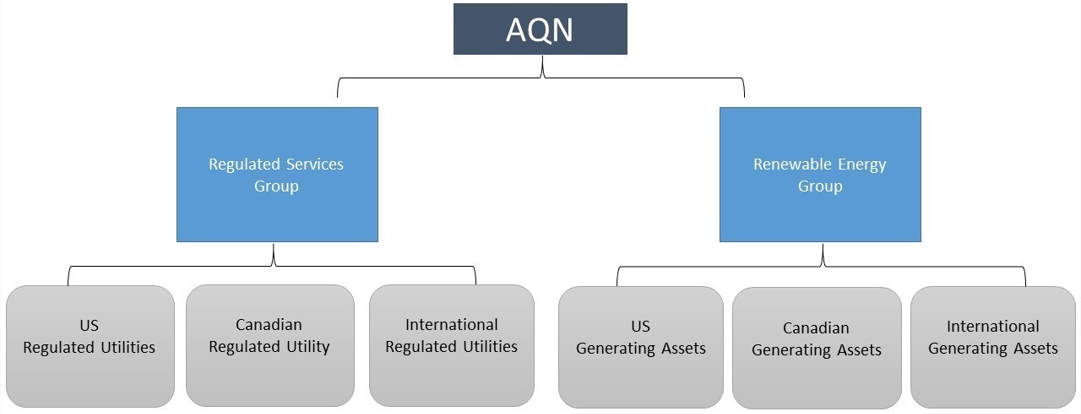

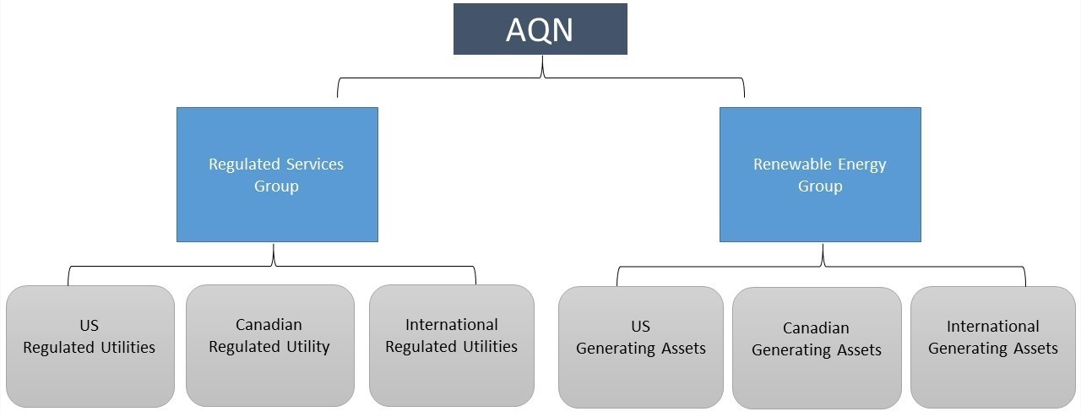

| Regulated Services Group | Renewable Energy Group | |||||||

Electric Utilities Water and Wastewater Utilities Natural Gas Utilities Electric and Natural Gas Transmission Energy Generation and Storage | Wind Power Generation Solar Generation Hydro Electric Generation Thermal Co-Generation Renewable Natural Gas Energy Storage | |||||||

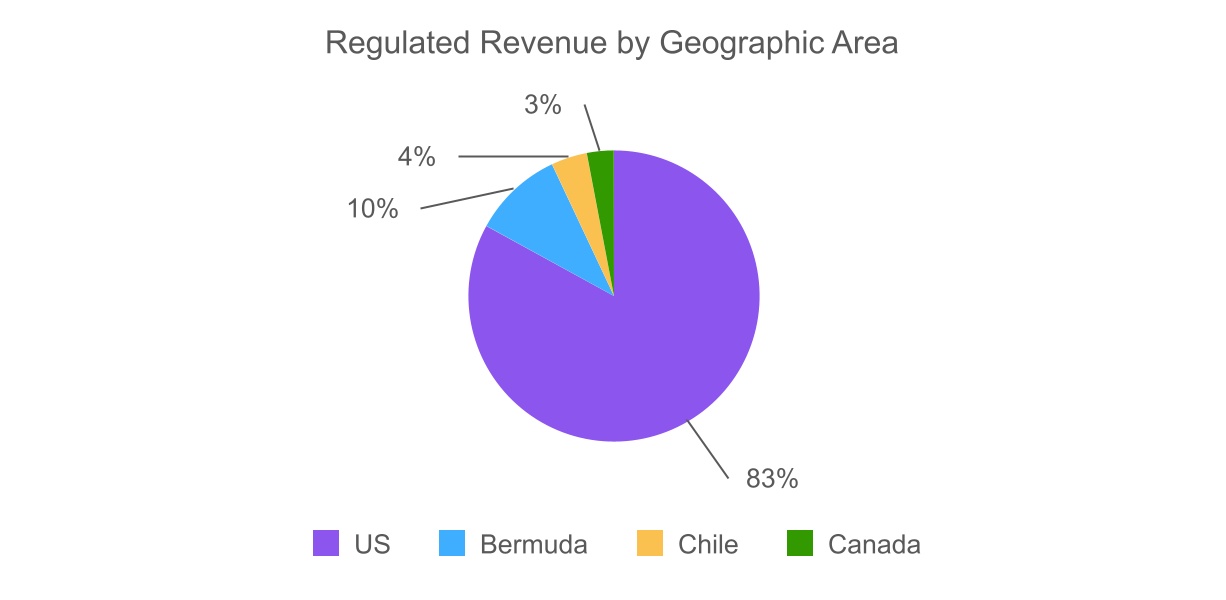

| Geographic Area | % of Total Revenue | ||||

| United States | 83% | ||||

| Canada | 3% | ||||

| Bermuda | 10% | ||||

| Chile | 4% | ||||

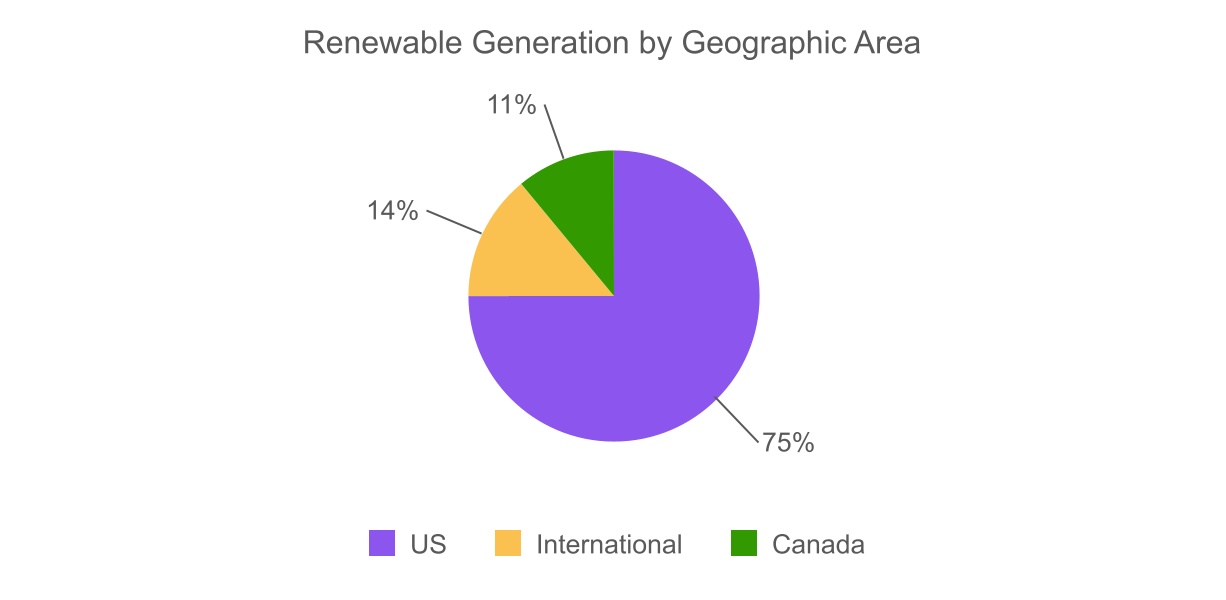

| Geographic Area | % of Generating Capacity | ||||

| United States | 75% | ||||

| Canada | 11% | ||||

| International | 14% | ||||

| Project Name | Location | Anticipated Size (MW) | ||||||

| Projects in Construction | ||||||||

Carvers Creek Solar Project1 | Virginia | 150 | ||||||

Community Solar Projects | New York | 13 | ||||||

Deerfield II Wind Project1 | Michigan | 112 | ||||||

Hayhurst New Mexico Solar Project2 | New Mexico | 20 | ||||||

Hayhurst Texas Solar Project2 | Texas | 25 | ||||||

New Market Solar Project1 | Ohio | 100 | ||||||

Shady Oaks II Wind Project1 | Illinois | 108 | ||||||

Sandy Ridge II Wind Project1 | Pennsylvania | 88 | ||||||

| Total Projects in Construction | 616 | |||||||

| % of Total Revenue | ||||||||

| December 31, 2021 | December 31, 2022 | |||||||

| Utility electricity sales & distribution | 52.0% | 46.2% | ||||||

| Utility water distribution and wastewater treatment sales & distribution | 10.3% | 13.2% | ||||||

| Utility natural gas sales & distribution | 23.1% | 24.8% | ||||||

| Non-regulated energy sales | 11.3% | 12.7% | ||||||

Other revenue1 | 3.2% | 3.1% | ||||||

| % of Revenue | ||||||||

| December 31, 2021 | December 31, 2022 | |||||||

| Utility electricity sales & distribution | 59.2% | 53.6% | ||||||

| Utility water distribution and wastewater treatment sales & distribution | 11.8% | 15.3% | ||||||

| Utility natural gas sales & distribution | 26.3% | 28.8% | ||||||

Other revenue1 | 2.7% | 2.3% | ||||||

| % of Revenue | ||||||||

| December 31, 2021 | December 31, 2022 | |||||||

| Wind generation | 56.9% | 58.4% | ||||||

| Solar generation | 9.8% | 7.9% | ||||||

| Hydroelectric generation | 13.4% | 13.6% | ||||||

| Thermal generation | 13.3% | 12.6% | ||||||

Other revenue1 | 6.7% | 7.5% | ||||||

S&P3 | DBRS4 | Fitch5 | Moody's | ||||||||||||||||||||||||||

| AQN - Issuer rating | BBB | BBB | BBB | - | |||||||||||||||||||||||||

| AQN - Preferred Shares | P-3 (high) | Pfd-3 | - | - | |||||||||||||||||||||||||

| AQN - 2018 Subordinated Notes | BB+ | - | BB+ | - | |||||||||||||||||||||||||

| AQN - 2019 Subordinated Notes | BB+ | - | BB+ | - | |||||||||||||||||||||||||

| AQN – Equity Units | BB+ (Units) | BBB (Notes) | |||||||||||||||||||||||||||

| AQN – 2022-A Subordinated Notes | BB+ | - | BB+ | - | |||||||||||||||||||||||||

| AQN – 2022-B Subordinated Notes | BB+ | - | BB+ | - | |||||||||||||||||||||||||

| APCo - Issuer rating | BBB | BBB | BBB | - | |||||||||||||||||||||||||

| APCo - Senior unsecured debt | BBB | BBB | BBB | - | |||||||||||||||||||||||||

| Liberty Utilities Canada - Issuer Rating | - | BBB | - | - | |||||||||||||||||||||||||

| Liberty Utilities Canada - Senior unsecured debt | - | BBB | - | - | |||||||||||||||||||||||||

| Liberty Utilities - Issuer rating | BBB | - | BBB | Baa2 | |||||||||||||||||||||||||

| Liberty Utilities - Commercial Paper | A-2 | - | F2 | - | |||||||||||||||||||||||||

Liberty Utilities Finance GP1 - Issuer rating2 | BBB | BBB (high) | - | Baa2 | |||||||||||||||||||||||||

Liberty Utilities Finance GP1 - Senior unsecured notes2 | - | BBB (high) | BBB+ | Baa2 | |||||||||||||||||||||||||

Liberty Utilities Finance GP1 – 2.050% senior unsecured notes3 | BBB | BBB+ | Baa2 | ||||||||||||||||||||||||||

| Empire - Issuer rating | BBB | - | - | Baa1 | |||||||||||||||||||||||||

| Empire - First mortgage bonds | A- | - | - | A2 | |||||||||||||||||||||||||

| Empire - Senior unsecured debt | BBB | - | - | Baa1 | |||||||||||||||||||||||||

| TSX | NYSE | |||||||||||||||||||

| 2022 | High (C$) | Low (C$) | Volume | High ($) | Low ($) | Volume | ||||||||||||||

| January | 18.35 | 17.14 | 48,378,280 | 14.46 | 13.51 | 12,879,793 | ||||||||||||||

| February | 18.45 | 17.43 | 34,087,838 | 14.56 | 13.59 | 10,541,538 | ||||||||||||||

| March | 19.58 | 18.18 | 62,236,158 | 15.66 | 14.30 | 15,020,478 | ||||||||||||||

| April | 20.19 | 18.56 | 68,223,059 | 16.01 | 14.45 | 10,343,602 | ||||||||||||||

| May | 18.83 | 17.32 | 50,628,271 | 14.73 | 13.27 | 17,212,711 | ||||||||||||||

| June | 18.65 | 16.75 | 51,750,037 | 14.85 | 12.89 | 17,695,187 | ||||||||||||||

| July | 18.00 | 17.01 | 35,074,758 | 14.05 | 13.03 | 11,162,691 | ||||||||||||||

| August | 18.79 | 17.79 | 25,957,781 | 14.65 | 13.68 | 8,994,674 | ||||||||||||||

| September | 18.27 | 15.03 | 50,274,412 | 13.95 | 10.91 | 12,055,732 | ||||||||||||||

| October | 16.02 | 13.86 | 55,989,920 | 11.78 | 9.94 | 17,416,739 | ||||||||||||||

| November | 15.37 | 9.86 | 144,188,731 | 11.51 | 7.26 | 33,357,043 | ||||||||||||||

| December | 10.36 | 8.70 | 119,071,450 | 7.71 | 6.41 | 41,213,224 | ||||||||||||||

| 2022 | High (C$) | Low (C$) | Volume | ||||||||

| January | 26.15 | 24.71 | 57,110 | ||||||||

| February | 25.56 | 24.61 | 47,589 | ||||||||

| March | 25.59 | 24.42 | 41,180 | ||||||||

| April | 25.11 | 21.41 | 120,321 | ||||||||

| May | 24.05 | 22.23 | 70,282 | ||||||||

| June | 24.50 | 22.52 | 176,718 | ||||||||

| July | 22.89 | 20.77 | 44,543 | ||||||||

| August | 23.20 | 21.43 | 30,689 | ||||||||

| September | 23.25 | 20.16 | 44,870 | ||||||||

| October | 20.79 | 16.86 | 303,809 | ||||||||

| November | 20.34 | 17.90 | 139,679 | ||||||||

| December | 19.57 | 17.71 | 121,101 | ||||||||

| 2022 | High (C$) | Low (C$) | Volume | ||||||||

| January | 26.45 | 24.88 | 74,452 | ||||||||

| February | 25.98 | 24.92 | 41,073 | ||||||||

| March | 25.80 | 24.80 | 63,652 | ||||||||

| April | 25.26 | 22.21 | 66,349 | ||||||||

| May | 25.14 | 22.37 | 147,791 | ||||||||

| June | 25.30 | 23.86 | 58,753 | ||||||||

| July | 24.20 | 21.90 | 24,267 | ||||||||

| August | 24.35 | 22.70 | 39,567 | ||||||||

| September | 24.33 | 21.70 | 40,891 | ||||||||

| October | 21.98 | 17.99 | 281,188 | ||||||||

| November | 20.30 | 18.56 | 135,610 | ||||||||

| December | 19.60 | 18.10 | 222,571 | ||||||||

| 2022 | High ($) | Low ($) | Volume | ||||||||

| January | 26.78 | 26.14 | 618,169 | ||||||||

| February | 27.10 | 25.05 | 550,452 | ||||||||

| March | 26.55 | 25.29 | 935,095 | ||||||||

| April | 26.41 | 24.82 | 460,458 | ||||||||

| May | 26.48 | 25.00 | 593,581 | ||||||||

| June | 25.82 | 23.51 | 463,860 | ||||||||

| July | 25.94 | 24.58 | 197,738 | ||||||||

| August | 26.22 | 24.01 | 281,663 | ||||||||

| September | 25.37 | 23.75 | 476,867 | ||||||||

| October | 24.83 | 20.69 | 982,850 | ||||||||

| November | 24.44 | 22.17 | 716,874 | ||||||||

| December | 24.85 | 22.75 | 506,444 | ||||||||

| 2022 | High ($) | Low ($) | Volume | ||||||||

| January | 27.31 | 26.37 | 488,748 | ||||||||

| February | 26.95 | 25.19 | 398,475 | ||||||||

| March | 27.13 | 25.19 | 952,588 | ||||||||

| April | 26.32 | 24.88 | 567,601 | ||||||||

| May | 25.98 | 23.99 | 438,726 | ||||||||

| June | 25.86 | 23.55 | 386,233 | ||||||||

| July | 25.73 | 23.68 | 304,030 | ||||||||

| August | 26.80 | 23.59 | 392,391 | ||||||||

| September | 24.97 | 23.45 | 418,143 | ||||||||

| October | 24.43 | 21.02 | 384,119 | ||||||||

| November | 23.90 | 21.26 | 894,938 | ||||||||

| December | 23.35 | 21.08 | 510,663 | ||||||||

| 2022 | High ($) | Low ($) | Volume | ||||||||

| January | 47.05 | 44.63 | 5,415,936 | ||||||||

| February | 46.75 | 44.60 | 1,112,421 | ||||||||

| March | 49.57 | 45.56 | 1,366,628 | ||||||||

| April | 50.49 | 46.65 | 1,034,778 | ||||||||

| May | 47.34 | 43.53 | 1,482,262 | ||||||||

| June | 46.69 | 41.88 | 1,888,037 | ||||||||

| July | 45.88 | 43.00 | 550,345 | ||||||||

| August | 47.14 | 44.27 | 1,922,802 | ||||||||

| September | 44.94 | 37.46 | 758,238 | ||||||||

| October | 40.92 | 35.15 | 658,648 | ||||||||

| November | 39.34 | 25.30 | 5,246,201 | ||||||||

| December | 26.62 | 22.79 | 2,649,378 | ||||||||

| Name and Place of Residence | Principal Occupation | Served as Director or Officer of AQN from | ||||||

ARUN BANSKOTA Oakville, Ontario Canada | Arun Banskota is the President & Chief Executive Officer of AQN. He initially joined AQN as President in February 2020. Mr. Banskota has over 30 years of progressively senior roles with experience in energy development, construction, financing, and operations; profit and loss management of multiple large business units; and three start-ups in the clean-tech space. Prior to joining AQN, Mr. Banskota was Vice President, Data Center Global Services and Energy Team at Amazon.com, where he was responsible for the planning, engineering, and delivery of datacenter capacity for Amazon Web Services, a high growth global market-leader of cloud services. As Managing Director of Global Power at El Paso Corporation, he had profit and loss responsibility for a 6,500 MW global portfolio of 32 power plants, project development and approximately 10,000 employees. He was on the leadership team for a large energy company and has successfully managed project development, financing, and operations for solar, wind, and natural gas projects. As President & CEO of EVgo, Mr. Banskota was responsible for taking commercial a high growth start-up company to build scale and presence in the electrical vehicle infrastructure sector. Mr. Banskota also serves on the board of directors of Atlantica. Mr. Banskota holds a Master of Arts from the University of Denver, and a Master of Business Administration from the University of Chicago. | Officer of AQN since February 10, 2020 and Director of AQN since July 17, 2020 | ||||||

MELISSA STAPLETON BARNES Carmel, Indiana, United States | Melissa Stapleton Barnes was formerly Senior Vice President, Enterprise Risk Management, and Chief Ethics and Compliance Officer for Eli Lilly and Company, a global, research-based pharmaceutical company. In this role from January 2013 through June 2021, she was an executive officer and served as a member of the company’s executive committee. During her nearly 27-year career with Eli Lilly and Company, she also held a variety of business operations and legal positions, including the role of Vice President and Deputy General Counsel from 2012 to 2013; and General Counsel, Lilly Diabetes and Lilly Oncology from 2010 to 2012. Ms. Barnes holds a Bachelor of Science in Political Science and Government (highest distinction) from Purdue University and a Juris Doctorate from Harvard Law School. She is a Licensed Attorney with the Indiana State Bar, serves on the Dean’s Advisory Council for Purdue University’s College of Liberal Arts, and is on the board of the Ethics Research Council. Ms. Barnes is also Past Chair of the Ethics and Business Integrity Committee for the International Federation of Pharmaceutical Manufacturers and Associations. | Director of AQN since June 9, 2016 | ||||||

| HELEN BREMNER Calgary, Alberta Canada | Helen Bremner is the Executive Vice President, Strategy and Sustainability of AQN. Ms. Bremner has over 25 years of experience in strategy consulting and executive management in the utilities and energy sectors in Canada, the United States, Australia, and New Zealand. Prior to joining AQN, Ms. Bremner was a Partner (retired) at PwC Strategy& where she led the energy, utilities, mining and industrials practice in Canada. Previous experiences include five years as an Executive Vice President with ENMAX, 15 years in C-Suite roles with Meridian Energy and TransAlta in New Zealand and seven years with Andersen Consulting Strategy practice in Australia and Booz Allen and Hamilton in the U.S. Ms. Bremner holds a Master of Business Administration from the University of Chicago, a Master of Arts (Honours) from the University of St Andrews Scotland, and attended the Stanford Executive Program at the Stanford University Graduate School of Business. She also holds certification from the New Zealand Institute of Directors. | Officer of AQN since November 15, 2021 | ||||||

AMEE CHANDE West Vancouver, British Columbia Canada | Amee Chande is a corporate director and strategy consultant. Ms. Chande is a senior advisor to leading companies in the mobility sector such as ChargePoint. In 2019, Ms. Chande was Chief Commercial Officer for Waymo, Google’s self-driving car project, where she was responsible for defining the overall strategy and laying the foundation for a strong commercial business. From 2015 to 2018, she was a Managing Director at Alibaba Group where she was the first senior executive hired to lead globalization. Ms. Chande has also held divisional Managing Director and Chief Executive Officer roles at global retailers including Tesco, Staples, and Wal-Mart, in both Europe and the United States. She began her career as a strategy consultant with McKinsey & Company. Ms. Chande serves on the Advisory Board of Livingbridge Private Equity, is a director of Air Canada and Thumbtack, Inc., and is a volunteer with the World Association of Girl Guides and Girl Scouts where she recently completed her term as a member of the World Board. Ms. Chande holds a Bachelor of Business Administration degree from Simon Fraser University, a Master of Science degree from the London School of Economics, and a Master of Business Administration from Harvard Business School. | Director of AQN since June 2, 2022 | ||||||

| DAN GOLDBERG Ottawa, Ontario Canada | Dan Goldberg has been the President and Chief Executive Officer of Telesat Corporation since 2006. Prior to joining Telesat, Mr. Goldberg served as Chief Executive Officer of SES New Skies, a position he held following the purchase of New Skies by SES. During that time, Mr. Goldberg also served as a member of the SES Executive Committee. Prior to becoming Chief Executive Officer, he served as Chief Operating Officer of New Skies and prior to that as New Skies’ General Counsel. Before joining New Skies, Mr. Goldberg served as Associate General Counsel and Vice President of Government and Regulatory Affairs at PanAmSat. He began his career as an associate at Covington & Burling and then Goldberg, Godles, Wiener & Wright, law firms in Washington D.C. Mr. Goldberg obtained a Bachelor of Arts in History from the University of Virginia and a Juris Doctor from Harvard Law School. | Director of AQN since March 28, 2022 | ||||||

CHRIS HUSKILSON Wellington, Nova Scotia, Canada | Chris Huskilson is the President and CEO of 5-H Holdings Inc. and Chair of XOCEAN Ltd. An engineer by training, Mr. Huskilson was President and CEO of Emera Inc. for 13 years, over which time he took the business from approximately $3 billion to approximately $30 billion in assets. Recently, Mr. Huskilson has been active in the Atlantic Canadian start-up ecosystem, and is a founding partner at Creative Destruction Lab (CDL - Atlantic), a founding member of Canada’s Ocean Supercluster, a founding director at Endeavor Canada, and a mentor and investor in start-up companies. Mr. Huskilson is a member of the Association of Professional Engineers of Nova Scotia and serves on several not-for-profit boards of directors. Mr. Huskilson is Past-Chair of the Canadian Electricity Association, Past-Chair of the Greater Halifax Partnership, and Past-Chair of the Energy Council of Canada. He was a director of Emera Inc. until 2018 and a director of Tampa Electric until 2019. Mr. Huskilson is a member of the Nova Scotia Business Hall of Fame, a recipient of the Energy Person of the year, a recipient of the Catalyst Canada Award for advancement of women in the workplace and a recipient of the F.H. Sexton Gold Medal for Engineering. Mr. Huskilson holds a Bachelor of Science in Engineering, Master of Science in Engineering and Doctor of Science, Honoris Causa from the University of New Brunswick. | Director of AQN from October 27, 2009 to June 8, 2017, and since January 2, 2020 Trustee of APCo from July 20, 2009 until May 12, 2011 | ||||||

| ANTHONY (JOHNNY) JOHNSTON Toronto, Ontario, Canada | Johnny Johnston is the Chief Operating Officer of AQN. Mr. Johnston has over 25 combined years of international experience in the regulated utility and renewable energy industries. Prior to joining the Corporation, Mr. Johnston, worked for National Grid where he led the transformation of its U.S. gas business. He has held a number of senior leadership roles in operations, customer service and strategy, working in both the U.K. and U.S. across gas and electric businesses. Mr. Johnston has served on the board of the not-for-profit Heartshare Human Services of New York. Mr. Johnston holds a Master of Engineering Science from the University of Oxford and a Master of Business Administration from the University of Cranfield. Mr. Johnston is a registered Chartered Engineer in the U.K. | Officer of AQN since January 8, 2019 | ||||||

D. RANDY LANEY Farmington, Arkansas, USA | D. Randy Laney was most recently Chairman of the board of directors of Empire from 2009 until AQN’s acquisition of Empire on January 1, 2017. He joined the board of Empire in 2003 and served as the Non-Executive Vice Chairman from 2008 to 2009. Mr. Laney, semi-retired since 2008, has held numerous senior level positions with both public and private companies during his career, including 23 years with Wal-Mart Stores, Inc. in various executive positions such as Vice President of Finance, Benefits and Risk Management and Vice President of Finance and Treasurer. In addition, Mr. Laney has provided strategic advisory services to both private and public companies and served on numerous profit and non-profit boards. Mr. Laney brings significant management and capital markets experience, and strategic and operational understanding to his position on the Board. Mr. Laney holds a Bachelor of Science and a Juris Doctor from the University of Arkansas. | Director of AQN since February 1, 2017 | ||||||

| KENNETH MOORE Toronto, Ontario, Canada | Kenneth Moore is the Managing Partner of NewPoint Capital Partners Inc., an investment banking firm. Mr. Moore holds the Chartered Financial Analyst designation and has completed the Chartered Director program of the Directors College (McMaster University) and holds the certification of Chartered Director. | Director of AQN since October 27, 2009 Trustee of APCo from November 12, 1998 until November 10, 2010 | ||||||

| DARREN MYERS Toronto, Ontario Canada | Darren Myers is the Chief Financial Officer of AQN. Mr. Myers joined AQN in 2022 and has over 25 years of broad finance expertise, including public and capital markets experience in Canada and the U.S. Prior to joining AQN, Mr. Myers was Executive Vice President and Chief Financial Officer for Loblaw, Canada’s largest retailer. Mr. Myers also spent 16 years at Celestica, a global supply chain and manufacturing company. He was the Executive Vice President and Chief Financial Officer of Celestica from 2012 to 2017 and had responsibility for Global Business Services and IT. Mr. Myers holds a Bachelor of Commerce degree from McMaster University and is a Chartered Accountant. | Officer of AQN since August 31, 2022 | ||||||

| JEFF NORMAN Burlington, Ontario, Canada | Jeff Norman is the Chief Development Officer of AQN, serving in this role since 2008. He was appointed to the AQN executive team in 2015. Mr. Norman co-founded the Algonquin Power Venture Fund in 2003 and served as President until it was acquired by APCo in 2008. Mr. Norman holds a Bachelor of Arts (Chartered Accountancy) and a Master of Accounting from the University of Waterloo. | Officer of AQN since May 25, 2015 | ||||||

KIRSTEN OLSEN Toronto, Ontario Canada | Kirsten Olsen is the Chief Human Resources Officer of AQN. Ms. Olsen joined AQN in 2019 and has over 20 years of international HR experience with expertise in supporting large-scale change, talent management and M&A. Prior to joining AQN, Kirsten held progressive HR leadership roles over the course of 12 years with GE in the UK. Ms. Olsen holds a Master of Industrial Relations & Human Resources from the University of Toronto and an Honours Bachelor of Arts with Distinction in Psychology from Huron College at the University of Western Ontario. | Officer of AQN since December 11, 2019 | ||||||

| MARY ELLEN PARAVALOS Mississauga, Ontario, Canada | Mary Ellen Paravalos is the Chief Compliance and Risk Officer of AQN. Ms. Paravalos has over 20 years of international experience in the energy industry across operating, strategy and regulation & compliance areas. Prior to joining AQN, Ms. Paravalos was Vice President, ISO, Siting, and Compliance at Eversource Energy, and prior to that held a number of leadership roles at National Grid. Ms. Paravalos has served as a Director and President for the not-for-profit company New England Women in Energy and Environment. Ms. Paravalos holds a Master of Electric Power Engineering from Rensselaer Polytechnic Institute and a Bachelor of Electrical Engineering from Northeastern University. Ms. Paravalos is a registered engineer in the state of Massachusetts. | Officer of AQN since October 9, 2018 | ||||||

| COLIN PENNY Midhurst, Ontario | Colin Penny is the Executive Vice President, Information Technology and Digital Transformation of AQN. Mr. Penny joined the Corporation in 2019 as the Vice President, Information Technology Transformation with over 20 years of experience delivering and operating technology solutions with a focus on business transformation and the strategic use of information and communication technologies within the energy and utilities sectors in North America. Prior to joining AQN, Mr. Penny was the Senior Vice President, Technology and Chief Information Officer of Hydro One Limited where he led the Information Solutions, Security and Telecom groups and before that spent the early part of his career with systems integration firms focused on control systems, cybersecurity, project delivery, and customer systems. Mr. Penny also cofounded and served as a Director for the Canadian Cyber Threat Exchange. Mr. Penny holds a Bachelor of Science (Honours) in Electrical Engineering from Queen’s University. | Officer of AQN since November 15, 2021 | ||||||

MASHEED SAIDI Dana Point, California, United States | Masheed Saidi has over 30 years of operational and business leadership experience in the electric utility industry. Between 2010 and 2017, Ms. Saidi was an Executive Consultant with the Energy Initiatives Group, a specialized group of experienced professionals that provide technical, commercial and business consulting services to utilities, ISOs, government agencies and other organizations in the energy industry. Between 2005 and 2010, Ms. Saidi was the Chief Operating Officer and Executive Vice President of U.S. Transmission for National Grid USA, and she was responsible for all aspects of its U.S. transmission business. Ms. Saidi previously served as Chairperson of the board of directors for the non-profit organization Mary’s Shelter, and also previously served on the board of directors of the Northeast Energy and Commerce Association. She earned her Bachelor’s degree in Power System Engineering from Northeastern University and her Master of Electrical Engineering from the Massachusetts Institute of Technology. She is a Registered Professional Engineer in the state of Massachusetts. | Director of AQN since June 18, 2014 | ||||||

DILEK SAMIL Las Vegas, Nevada, United States | Dilek Samil has over 30 years of finance, operations and business experience in both the regulated energy utility sector as well as wholesale power production. Ms. Samil joined NV Energy as Chief Financial Officer and retired as Executive Vice President and Chief Operating Officer. While at NV Energy, Ms. Samil completed the financial transformation of the company, bringing its financial metrics in line with those of the industry. As Chief Operating Officer, Ms. Samil focused on enhancing the company’s safety and customer care culture. Prior to her role at NV Energy, Ms. Samil gained considerable experience in generation and system operations as President and Chief Operating Officer for CLECO Power. During her tenure at CLECO Power, the company completed construction of its largest generating unit and successfully completed its first rate case in over 10 years. Ms. Samil also served as CLECO Power’s Chief Financial Officer at a time when the industry and the company faced significant turmoil in the wholesale markets. She led the company’s efforts in the restructuring of its wholesale and power trading activities. Prior to NV Energy and CLECO Power, Ms. Samil spent close to 20 years at NextEra where she held positions of increasing responsibility, primarily in the finance area. Ms. Samil holds a Bachelor of Science from the City College of New York and a Master of Business Administration from the University of Florida. | Director of AQN since October 1, 2014 | ||||||

JENNIFER TINDALE Campbellville, Ontario, Canada | Jennifer Tindale is the Chief Legal Officer of AQN. Ms. Tindale has over 20 years of experience advising public companies on acquisitions, dispositions, mergers, financings, corporate governance and disclosure matters. From July 2011 to February 2017, Ms. Tindale was the Executive Vice President, General Counsel & Secretary at a cross-listed real estate investment trust. Prior to that, she was Vice President, Associate General Counsel & Corporate Secretary at a cross-listed pharmaceutical company and before that she was a partner at a top tier Toronto law firm, practising corporate securities law. Ms. Tindale holds a Bachelor of Arts and a Bachelor of Laws from the University of Western Ontario. | Officer of AQN since February 7, 2017 | ||||||

| Services | 2022 Fees (C$) | 2021 Fees (C$) | |||||||||

Audit Fees1 | 6,714,099 | 6,393,021 | |||||||||

Audit-Related Fees2 | 95,500 | 101,458 | |||||||||

Tax Fees3 | 630,204 | 552,786 | |||||||||

All Other Fees4 | 50,000 | 50,000 | |||||||||

| /s/ Arun Banskota | /s/ Darren Myers | |||||||

| Chief Executive Officer | Chief Financial Officer | |||||||

| Regulatory assets and liabilities—Recovery of costs through rate regulation | ||||||||

| Description of the Matter | As described in Note 7 to the consolidated financial statements, the Company has approximately $1.27 billion in regulatory assets and approximately $628.2 million in regulatory liabilities that are subject to regulation by the public utility commissions of the regions in which they operate. Rates are determined under cost of service regulation. The regulation of rates is premised on the full recovery of prudently incurred costs and a reasonable rate of return on assets or common shareholder’s equity. Regulatory decisions can have an impact on the timely recovery of costs and the approved returns. The recoverability of such costs through rate-regulation impacts multiple financial statement line items and disclosures, including property, plant, and equipment, regulatory assets and liabilities, derivative instruments, pension and other post-employment benefit obligation, regulated electricity, gas and water distribution revenues and the corresponding expenses, income tax expense, and depreciation and amortization expense. Although the Company expects to recover its costs from customers through rates, there is a risk that the respective regulator will not approve full recovery of the costs incurred. Auditing the recoverability of these costs through rates is complex and highly judgmental due to the significant judgments and probability assessments made by the Company to support its accounting and disclosure for regulatory matters when final regulatory decisions or orders have not yet been obtained or when regulatory formulas are complex. There is also subjectivity involved in assessing the potential impact of future regulatory decisions on the financial statements. The Company’s judgments include evaluating the probability of recovery of and recovery on costs incurred, or probability of refund to customers through future rates. | |||||||

| How We Addressed the Matter in Our Audit | We obtained an understanding, evaluated the design and tested the operating effectiveness of controls over the Company’s evaluation of the likelihood of recovery of regulatory assets and refund of regulatory liabilities, including management’s controls over the initial recognition and the monitoring and evaluation of regulatory developments that may affect the likelihood of recovering costs in future rates, a refund, or future changes in rates. We performed audit procedures that included, amongst others, evaluating the Company’s assessment of the probability of future recovery for regulatory assets and refund of regulatory liabilities, by comparison to the relevant regulatory orders, filings and correspondence, and other publicly available information including past precedents. For regulatory matters for which regulatory decisions or orders have not yet been obtained, we inspected the Company’s filings for any evidence that might contradict the Company’s assertions, and reviewed other regulatory orders, filings and correspondence for other entities within the same or similar jurisdictions to assess the likelihood of recovery in future rates based on the respective regulator’s treatment of similar costs under similar circumstances. We evaluated the Company’s analysis and compared that analysis with letters from legal counsel, when appropriate, regarding cost recoveries or future changes in rates. We also assessed the methodology and mathematical accuracy of the Company’s calculations of regulatory asset and liability balances based on provisions and formulas outlined in rate orders and other correspondence with regulators. | |||||||

| Impairment of Long-lived Assets | ||||||||

| Description of the Matter | As of December 31, 2022, the Company’s property, plant and equipment and finite-life intangible assets (collectively, long-lived assets) have an aggregate net book value of approximately $12 billion. As described in Note 1 to the consolidated financial statements, the Company reviews long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying value of those assets may not be recoverable. Indicators of impairment may include a deteriorating business climate, including, but not limited to, declines in energy prices, or plans to dispose of a long-lived asset significantly before the end of its useful life. Management determines if long-lived assets are potentially impaired by comparing the undiscounted expected future cash flows to the carrying value when indicators of impairment exist. When the undiscounted cash flow analysis indicates a long-lived asset or asset group may not be recoverable, the amount of the impairment loss is determined by measuring the excess of the carrying amount of the long-lived asset or asset group over its fair value. In 2022, as disclosed in Note 5 to the consolidated financial statements, the Company recognized an asset impairment charge of $159.6 million, related to the Company’s Renewable Energy Group. Auditing the Company’s valuation of long-lived assets involved significant judgment to assess the recoverability and the fair value of these long-lived assets. The fair value analysis is primarily based on the income approach using significant assumptions that included the revenue forecasts driven by expected production, expected energy prices, and projected operating and capital expenditures and the discount rate, which were forward-looking and based upon expectations about future economic and market conditions. | |||||||

| How We Addressed the Matter in Our Audit | We obtained an understanding, evaluated the design and tested the operating effectiveness of the Company’s controls over the identification of impairment indicators and valuation of the long-lived asset, including management’s review controls of the valuation model, the significant assumptions used to develop the estimates, and the completeness and accuracy of the data used in the valuations. When testing the impairment analyses for the Renewable Energy Group, our audit procedures included, among others, obtaining an understanding of management’s strategic view of the facilities given market conditions, evaluating management’s assessment of the lowest level of identifiable cash flows, assessing the appropriateness of the methodology, testing the significant assumptions discussed above, testing the computational accuracy of the valuation model and testing the completeness and accuracy of the underlying data used by the Company in its analyses. We also performed audit procedures that included, among others, assessing the expected production through corroboration with third party engineering reports and historical trends. We assessed the projected operating expenditures by comparison to historical data and third party operating and maintenance agreements. With support of our valuation specialists, we assessed the projected capital expenditures by comparison to historical data and corroboration with independent market data and assessed the estimates of expected energy prices by comparison to historical data, executed power purchase agreements, and to relevant market curves. We also involved our valuation specialists in the evaluation of the discount rates, which included consideration of benchmark interest rates, geographic location and whether the asset is contracted or uncontracted. We also performed sensitivity analyses on significant assumptions to evaluate the changes in the fair value of the long-lived assets that would result from changes in the significant assumptions. | |||||||

| Impairment of long-term investment in Texas Coastal Wind Facilities | ||||||||

| Description of the Matter | As described in Note 8 to the consolidated financial statements, the balance of the Company’s equity method investment in Texas Coastal Wind Facilities, was $206.8 million as of December 31, 2022. Management periodically evaluates its equity method investments to determine whether an other-than-temporary decline in value has occurred and an impairment exists. Management determined that primarily as a result of continued challenges with congestion at the facilities, the carrying value of the interest in the Texas Coastal Wind Facilities required testing for an other-than-temporary impairment. Management assessed whether the fair value of its investment in Texas Coastal Wind Facilities had declined below its carrying value on an other-than-temporary basis in the fourth quarter of 2022. In the fourth quarter of 2022, as disclosed in Note 8 to the consolidated financial statements, the Company recorded an impairment charge of $75.9 million. Auditing the Company’s impairment assessment for Texas Coastal Wind Facilities was complex and required a high degree of auditor judgment, as the valuation included subjective estimates and assumptions in determining the estimated fair value of the investment. The fair value analysis is primarily based on the income approach using significant assumptions that included the expected revenue driven by production, expected energy prices, and projected operating and capital expenditures and the discount rate, which were forward-looking and based upon expectations about future economic and market conditions. | |||||||

| How We Addressed the Matter in Our Audit | We obtained an understanding, evaluated the design and tested the operating effectiveness of the Company’s controls over the equity method investment impairment review process, including management’s review controls of the valuation model, the significant assumptions used to develop the estimates, and the completeness and accuracy of the data used in the valuations. When testing the impairment analyses for Texas Coastal Wind Facilities, our audit procedures included, among others, assessing the appropriateness of the methodology, testing the significant assumptions discussed above, testing the computational accuracy of the valuation model and testing the completeness and accuracy of the underlying data used by the Company in its analyses. We also performed audit procedures that included, among others, assessing the expected production through corroboration with third party engineering reports and historical trends. We assessed the projected operating expenditures by comparison to historical data and third party operating and maintenance agreements. With support of our valuation specialists, we assessed the projected capital expenditures by comparison to historical data and corroboration with independent market data and assessed the expected energy prices by comparison to historical data, executed power purchase agreements, and relevant market curves. We also involved our valuation specialists in the evaluation of the discount rates, which included consideration of benchmark interest rates, geographic location and whether the asset is contracted or uncontracted. We also performed sensitivity analyses on significant assumptions to evaluate the changes in the fair value of the investment that would result from changes in the significant assumptions. | |||||||

/s/ | ||||||||

| Chartered Professional Accountants | ||||||||

| Licensed Public Accountants | ||||||||

| We have served as the Company's auditor since 2013. | ||||||||

| March 17, 2023 | ||||||||

| /s/ Ernst & Young LLP | ||||||||

| Chartered Professional Accountants | ||||||||

| Licensed Public Accountants | ||||||||

| Toronto, Canada | ||||||||

| March 17, 2023 | ||||||||

| Year ended | |||||||||||

| (thousands of U.S. dollars, except per share amounts) | December 31 | ||||||||||

| 2022 | 2021 | ||||||||||

| Revenue | |||||||||||

| Regulated electricity distribution | $ | $ | |||||||||

| Regulated natural gas distribution | |||||||||||

| Regulated water reclamation and distribution | |||||||||||

| Non-regulated energy sales | |||||||||||

| Other revenue | |||||||||||

| Expenses | |||||||||||

| Operating expenses | |||||||||||

| Regulated electricity purchased | |||||||||||

| Regulated natural gas purchased | |||||||||||

| Regulated water purchased | |||||||||||

| Non-regulated energy purchased | |||||||||||

| Administrative expenses | |||||||||||

| Depreciation and amortization | |||||||||||

| Asset impairment charge (note 5) | |||||||||||

| Loss on foreign exchange | |||||||||||

Gain on sale of renewable assets (notes 3(a) and 16(c)) | |||||||||||

| Operating income | |||||||||||

| Interest expense | ( | ( | |||||||||

Fair value change, income (loss) and impairment charge on long-term investments (note 8) | ( | ( | |||||||||

Other net losses (note 19) | ( | ( | |||||||||

Pension and other post-employment non-service costs (note 10) | ( | ( | |||||||||

Gain on derivative financial instruments (note 24(b)(iv)) | |||||||||||

| ( | ( | ||||||||||

| Income (loss) before income taxes | ( | ||||||||||

Income tax recovery (expense) (note 18) | |||||||||||

| Current | ( | ( | |||||||||

| Deferred | |||||||||||

| Net earnings (loss) | ( | ||||||||||

Net effect of non-controlling interests (note 17) | |||||||||||

| Non-controlling interests | |||||||||||

| Non-controlling interests held by related party | ( | ( | |||||||||

| $ | $ | ||||||||||

| Net earnings (loss) attributable to shareholders of Algonquin Power & Utilities Corp. | $ | ( | $ | ||||||||

Preferred shares, Series A and preferred shares, Series D dividend (note 15) | |||||||||||

| Net earnings (loss) attributable to common shareholders of Algonquin Power & Utilities Corp. | $ | ( | $ | ||||||||

Basic and diluted net earnings (loss) per share (note 20) | $ | ( | $ | ||||||||

| Year ended | |||||||||||

| (thousands of U.S. dollars) | December 31 | ||||||||||

| 2022 | 2021 | ||||||||||

| Net earnings (loss) | $ | ( | $ | ||||||||

| Other comprehensive income (loss) (“OCI”): | |||||||||||

Foreign currency translation adjustment, net of tax expense of $ | ( | ( | |||||||||

Change in fair value of cash flow hedges, net of tax expense of $ | ( | ( | |||||||||

Change in pension and other post-employment benefits, net of tax expense of $ | |||||||||||

| OCI, net of tax | ( | ( | |||||||||

| Comprehensive income (loss) | ( | ||||||||||

| Comprehensive loss attributable to the non-controlling interests | ( | ( | |||||||||

| Comprehensive income (loss) attributable to shareholders of Algonquin Power & Utilities Corp. | $ | ( | $ | ||||||||

| (thousands of U.S. dollars) | |||||||||||

| December 31, | December 31, | ||||||||||

| 2022 | 2021 | ||||||||||

| ASSETS | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

Trade and other receivables, net (note 4) | |||||||||||

| Fuel and natural gas in storage | |||||||||||

| Supplies and consumables inventory | |||||||||||

Regulatory assets (note 7) | |||||||||||

| Prepaid expenses | |||||||||||

Derivative instruments (note 24) | |||||||||||

Other assets (note 11) | |||||||||||

Property, plant and equipment, net (note 5) | |||||||||||

Intangible assets, net (note 6) | |||||||||||

Goodwill (note 6) | |||||||||||

Regulatory assets (note 7) | |||||||||||

Long-term investments (note 8) | |||||||||||

| Investments carried at fair value | |||||||||||

| Other long-term investments | |||||||||||

Derivative instruments (note 24) | |||||||||||

Deferred income taxes (note 18) | |||||||||||

Other assets (note 11) | |||||||||||

| $ | $ | ||||||||||

| (thousands of U.S. dollars) | |||||||||||

| December 31, | December 31, | ||||||||||

| 2022 | 2021 | ||||||||||

| LIABILITIES AND EQUITY | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable | $ | $ | |||||||||

| Accrued liabilities | |||||||||||

Dividends payable (note 15) | |||||||||||

Regulatory liabilities (note 7) | |||||||||||

Long-term debt (note 9) | |||||||||||

Other long-term liabilities (note 12) | |||||||||||

Derivative instruments (note 24) | |||||||||||

| Other liabilities | |||||||||||

Long-term debt (note 9) | |||||||||||

Regulatory liabilities (note 7) | |||||||||||

Deferred income taxes (note 18) | |||||||||||

Derivative instruments (note 24) | |||||||||||

Pension and other post-employment benefits obligation (note 10) | |||||||||||

Other long-term liabilities (note 12) | |||||||||||

Redeemable non-controlling interests (note 17) | |||||||||||

| Redeemable non-controlling interest, held by related party | |||||||||||

| Redeemable non-controlling interests | |||||||||||

| Equity: | |||||||||||

| Preferred shares | |||||||||||

Common shares (note 13(a)) | |||||||||||

| Additional paid-in capital | |||||||||||

| Deficit | ( | ( | |||||||||

Accumulated other comprehensive loss (“AOCI”) (note 14) | ( | ( | |||||||||

| Total equity attributable to shareholders of Algonquin Power & Utilities Corp. | |||||||||||

| Non-controlling interests (note 17) | |||||||||||

| Non-controlling interests - tax equity partnership units | |||||||||||

| Other non-controlling interests | |||||||||||

| Non-controlling interest, held by related party | |||||||||||

| Total equity | |||||||||||

Commitments and contingencies (note 22) | |||||||||||

| Subsequent events (notes 3(b), 7, 9(a), 9(d) and 13(a)) | |||||||||||

| $ | $ | ||||||||||

(thousands of U.S. dollars) For the year ended December 31, 2022 | |||||||||||||||||||||||||||||||||||||||||

| Algonquin Power & Utilities Corp. Shareholders | |||||||||||||||||||||||||||||||||||||||||

| Common shares | Preferred shares | Additional paid-in capital | Retained earnings (deficit) | AOCI | Non- controlling interests | Total | |||||||||||||||||||||||||||||||||||

| Balance, December 31, 2021 | $ | $ | $ | $ | ( | $ | ( | $ | $ | ||||||||||||||||||||||||||||||||

| Net loss | — | — | — | ( | — | ( | ( | ||||||||||||||||||||||||||||||||||

Effect of redeemable non-controlling interests not included in equity (note 17) | — | — | — | — | — | ( | ( | ||||||||||||||||||||||||||||||||||

| OCI | — | — | — | — | ( | ( | ( | ||||||||||||||||||||||||||||||||||

| Dividends declared and distributions to non-controlling interests | — | — | — | ( | — | ( | ( | ||||||||||||||||||||||||||||||||||

| Dividends and issuance of shares under dividend reinvestment plan | — | — | ( | — | — | ||||||||||||||||||||||||||||||||||||

| Contributions received from non-controlling interests, net of cost | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||

| Common shares issued upon conversion of convertible debentures | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||

| Common shares issued upon public offering, net of tax effected cost | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||

| Common shares issued under employee share purchase plan | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||

| Share-based compensation | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||

| Common shares issued pursuant to share-based awards | — | ( | ( | — | — | ( | |||||||||||||||||||||||||||||||||||

| Repurchase of non-controlling interest (note 17) | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||||

| Balance, December 31, 2022 | $ | $ | $ | $ | ( | $ | ( | $ | $ | ||||||||||||||||||||||||||||||||

(thousands of U.S. dollars) For the year ended December 31, 2021 | |||||||||||||||||||||||||||||||||||||||||

| Algonquin Power & Utilities Corp. Shareholders | |||||||||||||||||||||||||||||||||||||||||

| Common shares | Preferred shares | Additional paid-in capital | Deficit | AOCI | Non- controlling interests | Total | |||||||||||||||||||||||||||||||||||

| Balance, December 31, 2020 | $ | $ | $ | $ | $ | ( | $ | $ | |||||||||||||||||||||||||||||||||

| Net earnings (loss) | — | — | — | — | ( | ||||||||||||||||||||||||||||||||||||

Effect of redeemable non-controlling interests not included in equity (note 17) | — | — | — | — | — | ( | ( | ||||||||||||||||||||||||||||||||||

| OCI | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||||

| Dividends declared and distributions to non-controlling interests | — | — | — | ( | — | ( | ( | ||||||||||||||||||||||||||||||||||

| Dividends and issuance of shares under dividend reinvestment plan | — | — | ( | — | — | ||||||||||||||||||||||||||||||||||||

| Contributions received from non-controlling interests, net of cost | — | — | — | ( | |||||||||||||||||||||||||||||||||||||

| Common shares issued upon conversion of convertible debentures | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||

| Common shares issued upon public offering, net of tax effected cost | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||

| Contract adjustment payments | — | — | ( | ( | — | — | ( | ||||||||||||||||||||||||||||||||||

| Common shares issued under employee share purchase plan | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||

| Share-based compensation | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||

| Common shares issued pursuant to share-based awards | — | ( | ( | — | — | ( | |||||||||||||||||||||||||||||||||||

| Non-controlling interest assumed on asset acquisition (note 3(d)) | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||

| Balance, December 31, 2021 | $ | $ | $ | $ | ( | $ | ( | $ | $ | ||||||||||||||||||||||||||||||||

| (thousands of U.S. dollars) | Year ended December 31 | ||||||||||

| 2022 | 2021 | ||||||||||

| Cash provided by (used in): | |||||||||||

| Operating activities | |||||||||||

| Net earnings (loss) | $ | ( | $ | ||||||||

| Adjustments and items not affecting cash: | |||||||||||

| Depreciation and amortization | |||||||||||

| Deferred taxes | ( | ( | |||||||||

| Initial value and unrealized loss (gain) on derivative financial instruments | ( | ||||||||||

| Share-based compensation | |||||||||||

| Cost of equity funds used for construction purposes | ( | ( | |||||||||

| Change in value of investments carried at fair value | |||||||||||

| Pension and post-employment expense lower than contributions | ( | ( | |||||||||

| Distributions received from equity investments, net of income | |||||||||||

| Impairment of assets | |||||||||||

| Other | |||||||||||

Net change in non-cash operating items (note 23) | ( | ( | |||||||||

| Financing activities | |||||||||||

| Increase in long-term debt | |||||||||||

| Repayments of long-term debt | ( | ( | |||||||||

| Issuance of common shares, net of costs | |||||||||||

| Cash dividends on common shares | ( | ( | |||||||||

| Dividends on preferred shares | ( | ( | |||||||||

| Contributions from non-controlling interests and redeemable non-controlling interests | |||||||||||

| Production-based cash contributions from non-controlling interest | |||||||||||

Distributions to non-controlling interests, related party (note 17) | ( | ( | |||||||||

| Distributions to non-controlling interests | ( | ( | |||||||||

| Payments upon settlement of derivatives | ( | ( | |||||||||

| Shares surrendered to fund withholding taxes on exercised share options | ( | ( | |||||||||

| Acquisition of non-controlling interest | ( | ||||||||||

| Increase in other long-term liabilities | |||||||||||

| Decrease in other long-term liabilities | ( | ( | |||||||||

| Investing activities | |||||||||||

| Additions to property, plant and equipment and intangible assets | ( | ( | |||||||||

| Increase in long-term investments | ( | ( | |||||||||

Acquisitions of operating entities (note 3(c)) | ( | ||||||||||

| Increase in other assets | ( | ( | |||||||||

| Receipt of principal on development loans receivable | |||||||||||

| Decrease in long-term investments | |||||||||||

| Other proceeds | |||||||||||

| ( | ( | ||||||||||

| Effect of exchange rate differences on cash and restricted cash | ( | ( | |||||||||

| Increase (decrease) in cash, cash equivalents and restricted cash | ( | ||||||||||

| Cash, cash equivalents and restricted cash, beginning of year | |||||||||||

| Cash, cash equivalents and restricted cash, end of year | $ | $ | |||||||||

| Algonquin Power & Utilities Corp. Consolidated Statements of Cash Flows (continued) | |||||||||||

| (thousands of U.S. dollars) | Year ended December 31 | ||||||||||

| 2022 | 2021 | ||||||||||

| Supplemental disclosure of cash flow information: | |||||||||||

| Cash paid during the year for interest expense | $ | $ | |||||||||

| Cash paid during the year for income taxes | $ | $ | |||||||||

| Cash received during the year for distributions from equity investments | $ | $ | |||||||||

| Non-cash financing and investing activities: | |||||||||||

| Property, plant and equipment acquisitions in accruals | $ | $ | |||||||||

| Issuance of common shares under dividend reinvestment plan and share-based compensation plans | $ | $ | |||||||||

| Property, plant and equipment, intangible assets and accrued liabilities in exchange of note receivable | $ | $ | |||||||||

| Algonquin Power & Utilities Corp. | ||

| Notes to the Consolidated Financial Statements | ||

December 31, 2022 and 2021 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Algonquin Power & Utilities Corp. | ||

| Notes to the Consolidated Financial Statements | ||

December 31, 2022 and 2021 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Algonquin Power & Utilities Corp. | ||

| Notes to the Consolidated Financial Statements | ||

December 31, 2022 and 2021 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Algonquin Power & Utilities Corp. | ||

| Notes to the Consolidated Financial Statements | ||

December 31, 2022 and 2021 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Range of useful lives | Weighted average useful lives | ||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

| Generation | |||||||||||||||||||||||

| Distribution | |||||||||||||||||||||||

| Equipment | |||||||||||||||||||||||

| Algonquin Power & Utilities Corp. | ||

| Notes to the Consolidated Financial Statements | ||

December 31, 2022 and 2021 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Algonquin Power & Utilities Corp. | ||

| Notes to the Consolidated Financial Statements | ||

December 31, 2022 and 2021 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Algonquin Power & Utilities Corp. | ||

| Notes to the Consolidated Financial Statements | ||

December 31, 2022 and 2021 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Algonquin Power & Utilities Corp. | ||

| Notes to the Consolidated Financial Statements | ||

December 31, 2022 and 2021 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Algonquin Power & Utilities Corp. | ||

| Notes to the Consolidated Financial Statements | ||

December 31, 2022 and 2021 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Algonquin Power & Utilities Corp. | ||

| Notes to the Consolidated Financial Statements | ||

December 31, 2022 and 2021 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Algonquin Power & Utilities Corp. | ||

| Notes to the Consolidated Financial Statements | ||

December 31, 2022 and 2021 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Algonquin Power & Utilities Corp. | ||

| Notes to the Consolidated Financial Statements | ||

December 31, 2022 and 2021 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Algonquin Power & Utilities Corp. | ||

| Notes to the Consolidated Financial Statements | ||

December 31, 2022 and 2021 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Working capital | $ | ||||

| Property, plant and equipment (i) | |||||

| Goodwill (ii) | |||||

| Regulatory assets (iii) | |||||

| Other assets | |||||

| Pension and other post-employment benefits | ( | ||||

| Regulatory liabilities (iii) | ( | ||||

| Other liabilities | ( | ||||

| Total net assets acquired | $ | ||||

| Cash and cash equivalents acquired | |||||

| Total net assets acquired, net of cash and cash equivalents | $ | ||||

| Algonquin Power & Utilities Corp. | ||

| Notes to the Consolidated Financial Statements | ||

December 31, 2022 and 2021 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Mid-West Wind | |||||

| Working capital | $ | ( | |||

| Property, plant and equipment | |||||

| Long-term debt | ( | ||||

| Asset retirement obligation | ( | ||||

| Deferred tax liability | ( | ||||

| Other liabilities | ( | ||||

| Non-controlling interest (tax equity investors) | ( | ||||

| Total net assets acquired | |||||

| Cash and cash equivalents | |||||

| Net assets acquired, net of cash and cash equivalents | $ | ||||

| Altavista Solar | |||||

| Working capital | $ | ||||

| Property, plant and equipment | |||||

| Long-term debt | ( | ||||

| Deferred tax liability | ( | ||||

| Asset retirement obligation | ( | ||||

| Total net assets acquired | |||||

| Cash and cash equivalents | |||||

| Net assets acquired, net of cash and cash equivalents | $ | ||||

| Algonquin Power & Utilities Corp. | ||

| Notes to the Consolidated Financial Statements | ||

December 31, 2022 and 2021 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Maverick Creek and Sugar Creek | |||||

| Working capital | $ | ( | |||

| Property, plant and equipment | |||||

| Long-term debt | ( | ||||

| Asset retirement obligation | ( | ||||

| Deferred tax liability | ( | ||||

| Derivative instruments | |||||

| Total net assets acquired | |||||

| Cash and cash equivalents | |||||

| Net assets acquired, net of cash and cash equivalents | $ | ||||

| 2022 | |||||||||||||||||

| Cost | Accumulated depreciation | Net book value | |||||||||||||||

| Renewable generation facilities | $ | $ | $ | ||||||||||||||

| Utility plant | |||||||||||||||||

| Land | |||||||||||||||||

| Equipment | |||||||||||||||||

| Construction in progress | |||||||||||||||||

| Generation | |||||||||||||||||

| Distribution and transmission | |||||||||||||||||

| $ | $ | $ | |||||||||||||||

| Algonquin Power & Utilities Corp. | ||

| Notes to the Consolidated Financial Statements | ||

December 31, 2022 and 2021 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| 2021 | |||||||||||||||||

| Cost | Accumulated depreciation | Net book value | |||||||||||||||

| Renewable generation facilities | $ | $ | $ | ||||||||||||||

| Utility plant | |||||||||||||||||

| Land | |||||||||||||||||

| Equipment | |||||||||||||||||

| Construction in progress | |||||||||||||||||

| Generation | |||||||||||||||||

| Distribution and transmission | |||||||||||||||||

| $ | $ | $ | |||||||||||||||

| 2022 | 2021 | ||||||||||

| Interest capitalized on non-regulated property | $ | $ | |||||||||

| AFUDC capitalized on regulated property: | |||||||||||

| Allowance for borrowed funds | |||||||||||

| Allowance for equity funds | |||||||||||

| $ | $ | ||||||||||

| Algonquin Power & Utilities Corp. | ||

| Notes to the Consolidated Financial Statements | ||

December 31, 2022 and 2021 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| 2022 | Cost | Accumulated amortization | Net book value | ||||||||||||||

| Power sales contracts | $ | $ | $ | ||||||||||||||

| Customer relationships | |||||||||||||||||

| Interconnection agreements | |||||||||||||||||

Other (a) | |||||||||||||||||

| $ | $ | $ | |||||||||||||||

| 2021 | Cost | Accumulated amortization | Net book value | ||||||||||||||

| Power sales contracts | $ | $ | $ | ||||||||||||||

| Customer relationships | |||||||||||||||||

| Interconnection agreements | |||||||||||||||||

Other (a) | |||||||||||||||||

| $ | $ | $ | |||||||||||||||

| 2022 | 2021 | ||||||||||

| Opening balance | $ | $ | |||||||||

| Business acquisitions (note 3) | |||||||||||

| Foreign exchange | ( | ( | |||||||||

| Closing balance | $ | $ | |||||||||

| Algonquin Power & Utilities Corp. | ||

| Notes to the Consolidated Financial Statements | ||

December 31, 2022 and 2021 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Utility | State, Province or Country | Regulatory Proceeding Type | Details | ||||||||

| BELCO | Bermuda | General rate review | On March 18, 2022, the Regulatory Authority (“RA”) approved an annual increase of $ | ||||||||

| Empire Electric | Missouri | General Rate Case (GRC) and Securitization | On April 6, 2022, the Missouri Public Service Commission (the "MPSC") approved an annual base rate increase of $ On January 19, 2022, Empire Electric filed a petition for securitization of the costs associated with the impact of the Midwest Extreme Weather Event. On March 21, 2022, Empire Electric filed a petition for securitization of the costs associated with the retirement of the Asbury generating plant. On August 18, 2022, and September 22, 2022, the MPSC issued and amended, respectively, a Report and Order authorizing Empire Electric to securitize approximately $ | ||||||||

| Algonquin Power & Utilities Corp. | ||

| Notes to the Consolidated Financial Statements | ||

December 31, 2022 and 2021 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Utility | State, Province or Country | Regulatory Proceeding Type | Details | ||||||||

| Empire Electric | Kansas | GRC | On May 27, 2021, Empire Electric submitted an abbreviated rate review seeking to recover costs associated with the addition of the Empire Wind Facilities, the retirement of Asbury and non-growth related plant investments since the 2019 rate review. In May 2022, the Commission approved the unanimous partial settlement resolving the rate treatment of the Asbury retirement and the non-wind investments resulting in a base rate decrease of $ | ||||||||

| Empire District Gas Company | Missouri | GRC | In June 2022, the Commission approved an annual increase of $ | ||||||||

| Empire Electric | Oklahoma | GRC | On December 29, 2022 the Commission approved a joint stipulation and agreement filed by the Company and Staff authorizing an annual base rate revenue increase of $ | ||||||||

| New Brunswick Gas | Canada | GRC | On November 22, 2021, New Brunswick Gas filed its 2022 general rate application for a revenue decrease based on the Energy & Utilities Board's recent decision authorizing a capital structure of | ||||||||

| Apple Valley Ranchos Water System | California | GRC | Subsequent to year-end, on February 3, 2023, the Commission issued a Final Order authorizing an annual revenue increase of $ | ||||||||

| Park Water System | California | GRC | Subsequent to year-end, on February 3, 2023, the Commission issued a Final Order authorizing an annual revenue increase of $ | ||||||||

| Algonquin Power & Utilities Corp. | ||

| Notes to the Consolidated Financial Statements | ||

December 31, 2022 and 2021 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| December 31, 2022 | December 31, 2021 | ||||||||||

| Regulatory assets | |||||||||||

| Fuel and commodity cost adjustments (a) | $ | $ | |||||||||

| Retired generating plant (b) | |||||||||||

| Rate adjustment mechanism (c) | |||||||||||

| Income taxes (d) | |||||||||||

| Deferred capitalized costs (e) | |||||||||||

| Pension and post-employment benefits (f) | |||||||||||

| Environmental remediation (g) | |||||||||||

| Wildfire mitigation and vegetation management (h) | |||||||||||

| Clean energy and other customer programs (i) | |||||||||||

| Asset retirement obligation (j) | |||||||||||

| Debt premium (k) | |||||||||||

| Cost of removal (l) | |||||||||||

| Rate review costs (m) | |||||||||||

| Long-term maintenance contract (n) | |||||||||||

| Other (o) | |||||||||||

| Total regulatory assets | $ | $ | |||||||||

| Less: current regulatory assets | ( | ( | |||||||||

| Non-current regulatory assets | $ | $ | |||||||||

| Regulatory liabilities | |||||||||||

| Income taxes (d) | $ | $ | |||||||||

| Cost of removal (l) | |||||||||||

| Pension and post-employment benefits (f) | |||||||||||

| Fuel and commodity cost adjustments (a) | |||||||||||

| Clean energy and other customer programs (i) | |||||||||||

| Rate adjustment mechanism (c) | |||||||||||

| Other | |||||||||||

| Total regulatory liabilities | $ | $ | |||||||||

| Less: current regulatory liabilities | ( | ( | |||||||||

| Non-current regulatory liabilities | $ | $ | |||||||||

| Algonquin Power & Utilities Corp. | ||

| Notes to the Consolidated Financial Statements | ||

December 31, 2022 and 2021 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Algonquin Power & Utilities Corp. | ||

| Notes to the Consolidated Financial Statements | ||

December 31, 2022 and 2021 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Algonquin Power & Utilities Corp. | ||

| Notes to the Consolidated Financial Statements | ||

December 31, 2022 and 2021 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Algonquin Power & Utilities Corp. | ||

| Notes to the Consolidated Financial Statements | ||

December 31, 2022 and 2021 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| December 31, 2022 | December 31, 2021 | ||||||||||

| Long-term investments carried at fair value | |||||||||||

| Atlantica (a) | $ | $ | |||||||||

| Atlantica Yield Energy Solutions Canada Inc. (b) | |||||||||||

| Other | |||||||||||

| $ | $ | ||||||||||

| Other long-term investments | |||||||||||

| Equity-method investees (c) | $ | $ | |||||||||

| Development loans receivable from equity-method investees (d) | |||||||||||

| San Antonio Water System and other (e) | |||||||||||

| $ | $ | ||||||||||

| Year ended December 31, | ||||||||||||||

| 2022 | 2021 | |||||||||||||

| Fair value gain (loss) on investments carried at fair value | ||||||||||||||

| Atlantica | $ | ( | $ | ( | ||||||||||

| Atlantica Yield Energy Solutions Canada Inc. | ( | ( | ||||||||||||

| Other | ( | |||||||||||||

| $ | ( | $ | ( | |||||||||||

| Dividend and interest income from investments carried at fair value | ||||||||||||||

| Atlantica | $ | $ | ||||||||||||

| Atlantica Yield Energy Solutions Canada Inc. | ||||||||||||||

| Other | ||||||||||||||

| $ | $ | |||||||||||||

| Other long-term investments | ||||||||||||||

| Equity method loss (c) | $ | ( | $ | ( | ||||||||||

| Impairment of equity-method investee (c) | ( | |||||||||||||

| Interest and other income | ||||||||||||||

| $ | ( | $ | ( | |||||||||||

| Fair value change, income (loss) and impairment expense related to long-term investments | $ | ( | $ | ( | ||||||||||

| Algonquin Power & Utilities Corp. | ||

| Notes to the Consolidated Financial Statements | ||

December 31, 2022 and 2021 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Economic interest | Capacity | ||||||||||

| Texas Coastal Wind Facilities | % | ||||||||||

| Blue Hill Wind Facility | % | ||||||||||

| Red Lily Wind Facility | % | ||||||||||

| Val-Eo Wind Facility | % | ||||||||||

| Algonquin Power & Utilities Corp. | ||

| Notes to the Consolidated Financial Statements | ||

December 31, 2022 and 2021 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| 2022 | 2021 | ||||||||||

| Carrying value, January 1 | $ | $ | |||||||||

| Additional Investments | |||||||||||

| Net loss attributable to AQN | ( | ( | |||||||||

| Other comprehensive income (loss) attributable to AQN (a) | ( | ||||||||||

| Operating projects bought back by AQN | ( | ||||||||||

| Dividend received | ( | ( | |||||||||

| Impairment | ( | ||||||||||

| Reclassification during the period (note 8(e)) | ( | ||||||||||

| Other | |||||||||||

| Carrying value, December 31 | $ | 381,802 | $ | 433,850 | |||||||

| 2022 | 2021 | ||||||||||

| Total assets | $ | $ | |||||||||

| Total liabilities | |||||||||||

| Net assets | |||||||||||

| AQN's ownership interest in the entities | |||||||||||

Difference between investment carrying amount and underlying equity in net assets(a) | |||||||||||

| Total carrying value | $ | $ | |||||||||

| Algonquin Power & Utilities Corp. | ||

| Notes to the Consolidated Financial Statements | ||

December 31, 2022 and 2021 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| 2022 | 2021 | ||||||||||

| Revenue | $ | $ | |||||||||

| Net loss | $ | ( | $ | ( | |||||||

Other comprehensive income (loss) (a) | $ | ( | $ | ||||||||

| Net loss attributable to AQN | $ | ( | $ | ( | |||||||

Other comprehensive loss attributable to AQN (a) | $ | ( | $ | ||||||||

| 2022 | 2021 | ||||||||||

| AQN's maximum exposure in regards to VIEs | |||||||||||

| Carrying amount | $ | $ | |||||||||

| Development loans receivable (d) | |||||||||||

| Performance guarantees and other commitments on behalf of VIEs | |||||||||||

| $ | $ | ||||||||||

| Algonquin Power & Utilities Corp. | ||

| Notes to the Consolidated Financial Statements | ||

December 31, 2022 and 2021 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Borrowing type | Weighted average coupon | Maturity | Par value | December 31, 2022 | December 31, 2021 | |||||||||||||||||||||||||||

| Senior unsecured revolving credit facilities (a) | — | 2024-2027 | N/A | $ | $ | |||||||||||||||||||||||||||

| Senior unsecured bank credit facilities and delayed draw term facility (b) | — | 2023-2031 | N/A | |||||||||||||||||||||||||||||

| Commercial paper | — | 2023 | N/A | |||||||||||||||||||||||||||||

| U.S. dollar borrowings | ||||||||||||||||||||||||||||||||

| Senior unsecured notes (Green Equity Units) (c) | % | 2026 | $ | |||||||||||||||||||||||||||||

| Senior unsecured notes (d) | % | 2023-2047 | $ | |||||||||||||||||||||||||||||

| Senior unsecured utility notes | % | 2023-2035 | $ | |||||||||||||||||||||||||||||

| Senior secured utility bonds | % | 2026-2044 | $ | |||||||||||||||||||||||||||||

| Canadian dollar borrowings | ||||||||||||||||||||||||||||||||

| Senior unsecured notes (e) | % | 2027-2050 | C$ | |||||||||||||||||||||||||||||

| Senior secured project notes | % | 2027 | C$ | |||||||||||||||||||||||||||||

| Chilean Unidad de Fomento borrowings | ||||||||||||||||||||||||||||||||

| Senior unsecured utility bonds | % | 2028-2040 | CLF | |||||||||||||||||||||||||||||

| $ | $ | |||||||||||||||||||||||||||||||

| Subordinated U.S. dollar borrowings | ||||||||||||||||||||||||||||||||

| Subordinated unsecured notes (f) | % | 2082 | C$ | |||||||||||||||||||||||||||||

| Subordinated unsecured notes (f) | % | 2078-2082 | $ | |||||||||||||||||||||||||||||

| $ | $ | |||||||||||||||||||||||||||||||

| Less: current portion | ( | ( | ||||||||||||||||||||||||||||||

| $ | $ | |||||||||||||||||||||||||||||||

| Algonquin Power & Utilities Corp. | ||

| Notes to the Consolidated Financial Statements | ||

December 31, 2022 and 2021 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| December 31, 2022 | December 31, 2021 | |||||||||||||

| Revolving and term credit facilities | $ | $ | ||||||||||||

| Funds drawn on facilities/ commercial paper issued | ( | ( | ||||||||||||

| Letters of credit issued | ( | ( | ||||||||||||

| Liquidity available under the facilities | ||||||||||||||

| Undrawn portion of uncommitted letter of credit facilities | ( | ( | ||||||||||||

| Cash on hand | ||||||||||||||

| Total liquidity and capital reserves | $ | $ | ||||||||||||

| Algonquin Power & Utilities Corp. | ||

| Notes to the Consolidated Financial Statements | ||

December 31, 2022 and 2021 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| Algonquin Power & Utilities Corp. | ||

| Notes to the Consolidated Financial Statements | ||

December 31, 2022 and 2021 | ||

| (in thousands of U.S. dollars, except as noted and per share amounts) | ||

| 2022 | 2021 | ||||||||||

| Long-term debt | $ | $ | |||||||||

| Commercial paper, credit facility draws and related fees | |||||||||||

| Accretion of fair value adjustments | ( | ( | |||||||||

| Capitalized interest and AFUDC capitalized on regulated property | ( | ( | |||||||||

| Other | |||||||||||

| $ | $ | ||||||||||

| 2023 | 2024 | 2025 | 2026 | 2027 | Thereafter | Total | ||||||||||||||||||||||||||||||||

| $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||

| Algonquin Power & Utilities Corp. | ||

| Notes to the Consolidated Financial Statements | ||

December 31, 2022 and 2021 | ||