true

true

true

true

4

5

true

true

4

3

185

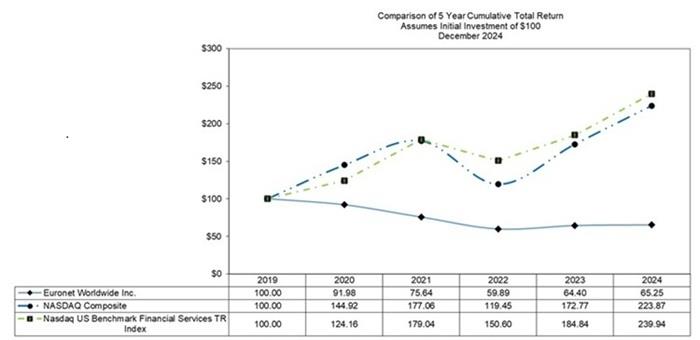

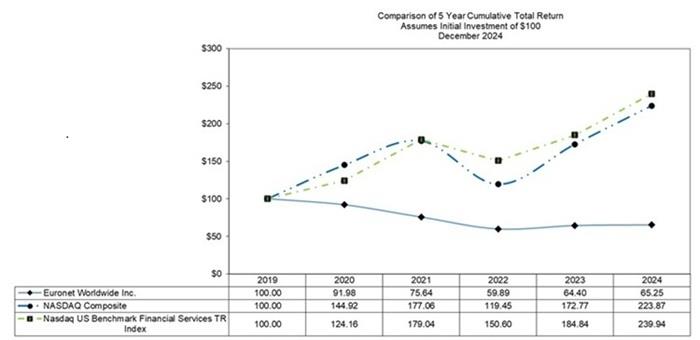

2019 2020 2021 2022 2023 2024

2016 2017 2018 2019 2020 2021 2022 2023 2024

2019 2020 2021 2022 2023 2024

2016 2017 2018 2019 2020 2021 2022 2023 2024

2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

0

10

0

FY

2024

--12-31

false

0001029199

http://fasb.org/us-gaap/2024#UsefulLifeTermOfLeaseMember

false

false

false

false

0001029199

eeft:UncommittedLoanAgreementMember

2024-01-01

2024-06-21

0001029199

2025-02-24

0001029199

us-gaap:HerMajestysRevenueAndCustomsHMRCMember

us-gaap:ForeignCountryMember

2024-01-01

2024-12-31

0001029199

us-gaap:TaxAuthoritySpainMember

us-gaap:ForeignCountryMember

2024-01-01

2024-12-31

0001029199

eeft:GreeceTaxAuthorityMember

us-gaap:ForeignCountryMember

2024-01-01

2024-12-31

0001029199

us-gaap:FederalMinistryOfFinanceGermanyMember

us-gaap:ForeignCountryMember

2024-01-01

2024-12-31

0001029199

us-gaap:InternalRevenueServiceIRSMember

us-gaap:DomesticCountryMember

2024-01-01

2024-12-31

0001029199

us-gaap:MaterialReconcilingItemsMember

2024-12-31

0001029199

us-gaap:AllowanceForCreditLossMember

2024-12-31

0001029199

us-gaap:AllowanceForCreditLossMember

2022-01-01

2022-12-31

0001029199

us-gaap:AllowanceForCreditLossMember

2022-12-31

0001029199

us-gaap:StockCompensationPlanMember

2024-12-31

0001029199

us-gaap:StockCompensationPlanMember

2022-01-01

2022-12-31

0001029199

us-gaap:EmployeeStockOptionMember

2022-01-01

2022-12-31

0001029199

2021-12-31

0001029199

2023-12-31

0001029199

2024-06-30

0001029199

eeft:PerformanceBasedRestrictedStockMember

2024-12-31

0001029199

eeft:TimeBasedRestrictedStockMember

2024-12-31

0001029199

us-gaap:RestrictedStockMember

2022-01-01

2022-12-31

0001029199

us-gaap:RestrictedStockMember

2024-12-31

0001029199

us-gaap:EmployeeStockOptionMember

2024-12-31

0001029199

us-gaap:NonUsMember

2024-12-31

0001029199

eeft:OtherCountriesMember

2024-12-31

0001029199

country:BR

2024-12-31

0001029199

country:CA

2024-12-31

0001029199

country:NL

2024-12-31

0001029199

country:NZ

2024-12-31

0001029199

country:AU

2024-12-31

0001029199

country:MY

2024-12-31

0001029199

country:GR

2024-12-31

0001029199

country:FR

2024-12-31

0001029199

country:IN

2024-12-31

0001029199

country:PL

2024-12-31

0001029199

country:IT

2024-12-31

0001029199

country:GB

2024-12-31

0001029199

country:ES

2024-12-31

0001029199

country:DE

2024-12-31

0001029199

country:US

2024-12-31

0001029199

eeft:OtherCountriesMember

2022-01-01

2022-12-31

0001029199

country:BR

2022-01-01

2022-12-31

0001029199

country:CA

2022-01-01

2022-12-31

0001029199

country:NL

2022-01-01

2022-12-31

0001029199

country:NZ

2022-01-01

2022-12-31

0001029199

country:AU

2022-01-01

2022-12-31

0001029199

country:MY

2022-01-01

2022-12-31

0001029199

country:GR

2022-01-01

2022-12-31

0001029199

country:FR

2022-01-01

2022-12-31

0001029199

country:IN

2022-01-01

2022-12-31

0001029199

country:PL

2022-01-01

2022-12-31

0001029199

country:IT

2022-01-01

2022-12-31

0001029199

country:GB

2022-01-01

2022-12-31

0001029199

country:ES

2022-01-01

2022-12-31

0001029199

country:DE

2022-01-01

2022-12-31

0001029199

us-gaap:MaterialReconcilingItemsMember

2022-12-31

0001029199

us-gaap:MaterialReconcilingItemsMember

2022-01-01

2022-12-31

0001029199

us-gaap:FairValueMeasurementsRecurringMember

2024-12-31

0001029199

us-gaap:IndemnificationGuaranteeMember

2024-12-31

0001029199

us-gaap:PerformanceGuaranteeMember

2024-12-31

0001029199

us-gaap:FinancialGuaranteeMember

2024-12-31

0001029199

us-gaap:FinancialStandbyLetterOfCreditMember

2024-12-31

0001029199

eeft:RontecLtdMember

2022-01-01

2022-12-31

0001029199

us-gaap:StateAndLocalJurisdictionMember

2024-12-31

0001029199

us-gaap:ForeignCountryMember

2024-12-31

0001029199

us-gaap:NonUsMember

2022-01-01

2022-12-31

0001029199

eeft:PosTerminalsMember

srt:MaximumMember

2024-12-31

0001029199

eeft:PosTerminalsMember

srt:MinimumMember

2024-12-31

0001029199

country:US

2022-01-01

2022-12-31

0001029199

eeft:UncommittedCreditAgreementMember

2024-12-31

0001029199

us-gaap:RevolvingCreditFacilityMember

2024-12-31

0001029199

srt:MaximumMember

us-gaap:ComputerEquipmentMember

2024-12-31

0001029199

srt:MinimumMember

us-gaap:ComputerEquipmentMember

2024-12-31

0001029199

srt:MaximumMember

eeft:AtmsMember

2024-12-31

0001029199

srt:MinimumMember

eeft:AtmsMember

2024-12-31

0001029199

eeft:ConvertibleNotes0.75PercentDue2049Member

2022-01-01

2022-12-31

0001029199

eeft:SeniorNotes1.375PercentDue2026Member

2024-12-31

0001029199

eeft:ConvertibleNotes0.75PercentDue2049Member

2024-12-31

0001029199

us-gaap:NotesReceivableMember

2024-12-31

0001029199

eeft:EFTProcessingSegmentMember

2024-12-31

0001029199

eeft:EpaySegmentMember

2024-12-31

0001029199

eeft:MoneyTransferSegmentMember

2024-12-31

0001029199

us-gaap:NoncompeteAgreementsMember

2024-12-31

0001029199

us-gaap:ComputerSoftwareIntangibleAssetMember

2024-12-31

0001029199

us-gaap:TrademarksAndTradeNamesMember

2024-12-31

0001029199

us-gaap:CustomerRelationshipsMember

2024-12-31

0001029199

us-gaap:LandAndBuildingMember

2024-12-31

0001029199

eeft:ComputersAndSoftwareMember

2024-12-31

0001029199

eeft:VehiclesAndOfficeEquipmentMember

2024-12-31

0001029199

eeft:PosTerminalsMember

2024-12-31

0001029199

eeft:AtmsMember

2024-12-31

0001029199

eeft:CollateralOnBankCreditArrangementsAndOtherMember

2024-12-31

0001029199

eeft:CashHeldInTrustOrOnBehalfOfOthersMember

2024-12-31

0001029199

eeft:CollateralOnBankCreditArrangementsAndOtherMember

2024-12-31

0001029199

eeft:MoneyTransferSegmentMember

eeft:OtherGeographicLocationsMember

us-gaap:OperatingSegmentsMember

2023-01-01

2023-12-31

0001029199

eeft:EpaySegmentMember

eeft:OtherGeographicLocationsMember

us-gaap:OperatingSegmentsMember

2023-01-01

2023-12-31

0001029199

srt:ConsolidationEliminationsMember

2022-01-01

2022-12-31

0001029199

eeft:OtherGeographicLocationsMember

eeft:EFTProcessingSegmentMember

us-gaap:OperatingSegmentsMember

2023-01-01

2023-12-31

0001029199

us-gaap:LeaseholdImprovementsMember

2024-12-31

0001029199

us-gaap:NoncontrollingInterestMember

2024-12-31

0001029199

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-12-31

0001029199

srt:AsiaPacificMember

eeft:MoneyTransferSegmentMember

us-gaap:OperatingSegmentsMember

2023-01-01

2023-12-31

0001029199

eeft:EpaySegmentMember

srt:AsiaPacificMember

us-gaap:OperatingSegmentsMember

2023-01-01

2023-12-31

0001029199

eeft:EFTProcessingSegmentMember

srt:AsiaPacificMember

us-gaap:OperatingSegmentsMember

2023-01-01

2023-12-31

0001029199

eeft:MoneyTransferSegmentMember

srt:NorthAmericaMember

us-gaap:OperatingSegmentsMember

2023-01-01

2023-12-31

0001029199

us-gaap:RetainedEarningsMember

2024-12-31

0001029199

us-gaap:TreasuryStockCommonMember

2024-12-31

0001029199

us-gaap:AdditionalPaidInCapitalMember

2024-12-31

0001029199

us-gaap:CommonStockMember

2024-12-31

0001029199

us-gaap:NoncontrollingInterestMember

2022-12-31

0001029199

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0001029199

srt:NorthAmericaMember

eeft:EpaySegmentMember

us-gaap:OperatingSegmentsMember

2023-01-01

2023-12-31

0001029199

srt:NorthAmericaMember

eeft:EFTProcessingSegmentMember

us-gaap:OperatingSegmentsMember

2023-01-01

2023-12-31

0001029199

srt:EuropeMember

eeft:MoneyTransferSegmentMember

us-gaap:OperatingSegmentsMember

2023-01-01

2023-12-31

0001029199

srt:EuropeMember

eeft:EpaySegmentMember

us-gaap:OperatingSegmentsMember

2023-01-01

2023-12-31

0001029199

srt:EuropeMember

eeft:EFTProcessingSegmentMember

us-gaap:OperatingSegmentsMember

2023-01-01

2023-12-31

0001029199

us-gaap:RetainedEarningsMember

2022-12-31

0001029199

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-01-01

2022-12-31

0001029199

eeft:OtherGeographicLocationsMember

eeft:MoneyTransferSegmentMember

us-gaap:OperatingSegmentsMember

2024-01-01

2024-12-31

0001029199

us-gaap:NoncontrollingInterestMember

2022-01-01

2022-12-31

0001029199

us-gaap:RetainedEarningsMember

2022-01-01

2022-12-31

0001029199

us-gaap:TreasuryStockCommonMember

2022-12-31

0001029199

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001029199

us-gaap:CommonStockMember

2022-12-31

0001029199

us-gaap:TreasuryStockCommonMember

2022-01-01

2022-12-31

0001029199

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-12-31

0001029199

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0001029199

eeft:ConvertibleNotes0.75PercentDue2049Member

2024-01-01

2024-12-31

0001029199

eeft:ConvertibleNotes0.75PercentDue2049Member

2023-01-01

2023-12-31

0001029199

eeft:ConvertibleNotes0.75PercentDue2049Member

2019-03-18

0001029199

eeft:ConvertibleNotes0.75PercentDue2049Member

2019-03-18

2019-03-18

0001029199

eeft:SeniorNotes1.375PercentDue2026Member

2019-05-22

0001029199

srt:MaximumMember

2024-12-31

0001029199

us-gaap:NoncontrollingInterestMember

2021-12-31

0001029199

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-12-31

0001029199

us-gaap:RetainedEarningsMember

2021-12-31

0001029199

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001029199

us-gaap:CommonStockMember

2021-12-31

0001029199

eeft:ConvertibleSeniorNotesMember

2024-01-01

2024-12-31

0001029199

2024-01-01

2024-12-31

0001029199

eeft:OtherGeographicLocationsMember

eeft:EpaySegmentMember

us-gaap:OperatingSegmentsMember

2024-01-01

2024-12-31

0001029199

eeft:OtherGeographicLocationsMember

eeft:EFTProcessingSegmentMember

us-gaap:OperatingSegmentsMember

2024-01-01

2024-12-31

0001029199

srt:AsiaPacificMember

eeft:MoneyTransferSegmentMember

us-gaap:OperatingSegmentsMember

2024-01-01

2024-12-31

0001029199

srt:AsiaPacificMember

eeft:EpaySegmentMember

us-gaap:OperatingSegmentsMember

2024-01-01

2024-12-31

0001029199

srt:AsiaPacificMember

eeft:EFTProcessingSegmentMember

us-gaap:OperatingSegmentsMember

2024-01-01

2024-12-31

0001029199

srt:NorthAmericaMember

eeft:MoneyTransferSegmentMember

us-gaap:OperatingSegmentsMember

2024-01-01

2024-12-31

0001029199

srt:NorthAmericaMember

eeft:EpaySegmentMember

us-gaap:OperatingSegmentsMember

2024-01-01

2024-12-31

0001029199

country:BR

2023-12-31

0001029199

country:BR

2023-01-01

2023-12-31

0001029199

country:CA

2023-12-31

0001029199

country:CA

2023-01-01

2023-12-31

0001029199

country:NL

2023-12-31

0001029199

country:NL

2023-01-01

2023-12-31

0001029199

country:BR

2024-01-01

2024-12-31

0001029199

country:CA

2024-01-01

2024-12-31

0001029199

country:NL

2024-01-01

2024-12-31

0001029199

2023-01-01

2023-12-31

0001029199

us-gaap:CommonStockMember

2024-01-01

2024-12-31

0001029199

srt:NorthAmericaMember

eeft:EFTProcessingSegmentMember

us-gaap:OperatingSegmentsMember

2024-01-01

2024-12-31

0001029199

srt:EuropeMember

eeft:MoneyTransferSegmentMember

us-gaap:OperatingSegmentsMember

2024-01-01

2024-12-31

0001029199

srt:EuropeMember

eeft:EpaySegmentMember

us-gaap:OperatingSegmentsMember

2024-01-01

2024-12-31

0001029199

eeft:EFTProcessingSegmentMember

srt:EuropeMember

us-gaap:OperatingSegmentsMember

2024-01-01

2024-12-31

0001029199

eeft:AccruedExpensesAndOtherCurrentLiabilitiesMember

us-gaap:ForeignExchangeContractMember

us-gaap:NondesignatedMember

2023-12-31

0001029199

us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember

us-gaap:ForeignExchangeContractMember

us-gaap:NondesignatedMember

2023-12-31

0001029199

eeft:CashHeldInTrustOrOnBehalfOfOthersMember

2023-12-31

0001029199

eeft:CollateralOnBankCreditArrangementsAndOtherMember

2023-12-31

0001029199

eeft:AtmsMember

2023-12-31

0001029199

eeft:PosTerminalsMember

2023-12-31

0001029199

eeft:VehiclesAndOfficeEquipmentMember

2023-12-31

0001029199

eeft:ComputersAndSoftwareMember

2023-12-31

0001029199

us-gaap:LandAndBuildingMember

2023-12-31

0001029199

srt:MaximumMember

eeft:RiaOperationsMember

us-gaap:ForeignExchangeContractMember

2024-01-01

2024-12-31

0001029199

us-gaap:CustomerRelationshipsMember

2023-12-31

0001029199

us-gaap:TrademarksAndTradeNamesMember

2023-12-31

0001029199

us-gaap:ComputerSoftwareIntangibleAssetMember

2023-12-31

0001029199

us-gaap:NoncompeteAgreementsMember

2023-12-31

0001029199

us-gaap:IndemnificationGuaranteeMember

2023-12-31

0001029199

us-gaap:FairValueMeasurementsRecurringMember

2023-12-31

0001029199

eeft:RontecLtdMember

2024-01-01

2024-12-31

0001029199

eeft:RontecLtdMember

2023-01-01

2023-12-31

0001029199

eeft:OtherCountriesMember

2023-12-31

0001029199

country:NZ

2023-12-31

0001029199

country:AU

2023-12-31

0001029199

country:MY

2023-12-31

0001029199

country:GR

2023-12-31

0001029199

us-gaap:RestrictedStockMember

2023-12-31

0001029199

us-gaap:RestrictedStockMember

2024-01-01

2024-12-31

0001029199

eeft:SeniorNotes1.375PercentDue2026Member

2023-12-31

0001029199

country:FR

2023-12-31

0001029199

country:IN

2023-12-31

0001029199

country:PL

2023-12-31

0001029199

country:IT

2023-12-31

0001029199

country:GB

2023-12-31

0001029199

country:ES

2023-12-31

0001029199

country:DE

2023-12-31

0001029199

country:US

2023-12-31

0001029199

us-gaap:NonUsMember

2023-12-31

0001029199

eeft:OtherCountriesMember

2023-01-01

2023-12-31

0001029199

eeft:OtherCountriesMember

2024-01-01

2024-12-31

0001029199

country:NZ

2023-01-01

2023-12-31

0001029199

country:NZ

2024-01-01

2024-12-31

0001029199

country:MY

2023-01-01

2023-12-31

0001029199

country:MY

2024-01-01

2024-12-31

0001029199

country:AU

2023-01-01

2023-12-31

0001029199

country:AU

2024-01-01

2024-12-31

0001029199

us-gaap:AccountingStandardsUpdate202006Member

us-gaap:RetainedEarningsMember

2024-12-31

0001029199

us-gaap:CommonStockMember

2023-01-01

2023-12-31

0001029199

us-gaap:CommonStockMember

2023-12-31

0001029199

us-gaap:CommonStockMember

2024-01-01

2024-12-31

0001029199

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-12-31

0001029199

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001029199

us-gaap:AdditionalPaidInCapitalMember

2024-01-01

2024-12-31

0001029199

us-gaap:RetainedEarningsMember

2023-01-01

2023-12-31

0001029199

us-gaap:RetainedEarningsMember

2023-12-31

0001029199

us-gaap:RetainedEarningsMember

2024-01-01

2024-12-31

0001029199

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-12-31

0001029199

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-12-31

0001029199

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-01-01

2024-12-31

0001029199

us-gaap:NoncontrollingInterestMember

2023-01-01

2023-12-31

0001029199

us-gaap:NoncontrollingInterestMember

2023-12-31

0001029199

us-gaap:NoncontrollingInterestMember

2024-01-01

2024-12-31

0001029199

us-gaap:ForeignCountryMember

2023-12-31

0001029199

us-gaap:StateAndLocalJurisdictionMember

2023-12-31

0001029199

us-gaap:RestrictedStockMember

2023-01-01

2023-12-31

0001029199

eeft:TimeBasedRestrictedStockMember

2024-01-01

2024-12-31

0001029199

eeft:PerformanceBasedRestrictedStockMember

2024-01-01

2024-12-31

0001029199

country:GR

2023-01-01

2023-12-31

0001029199

country:GR

2024-01-01

2024-12-31

0001029199

country:FR

2023-01-01

2023-12-31

0001029199

country:FR

2024-01-01

2024-12-31

0001029199

country:IN

2023-01-01

2023-12-31

0001029199

country:IN

2024-01-01

2024-12-31

0001029199

country:PL

2023-01-01

2023-12-31

0001029199

country:PL

2024-01-01

2024-12-31

0001029199

country:IT

2023-01-01

2023-12-31

0001029199

country:IT

2024-01-01

2024-12-31

0001029199

country:GB

2023-01-01

2023-12-31

0001029199

country:GB

2024-01-01

2024-12-31

0001029199

country:ES

2023-01-01

2023-12-31

0001029199

country:ES

2024-01-01

2024-12-31

0001029199

country:DE

2023-01-01

2023-12-31

0001029199

country:DE

2024-01-01

2024-12-31

0001029199

us-gaap:NonUsMember

2023-01-01

2023-12-31

0001029199

us-gaap:NonUsMember

2024-01-01

2024-12-31

0001029199

country:US

2023-01-01

2023-12-31

0001029199

country:US

2024-01-01

2024-12-31

0001029199

eeft:SeniorNotes1.375PercentDue2026Member

2024-01-01

2024-12-31

0001029199

us-gaap:TreasuryStockCommonMember

2021-12-31

0001029199

us-gaap:TreasuryStockCommonMember

2023-01-01

2023-12-31

0001029199

us-gaap:TreasuryStockCommonMember

2024-01-01

2024-12-31

0001029199

us-gaap:TreasuryStockCommonMember

2023-12-31

0001029199

eeft:RiaOperationsMember

us-gaap:ForeignExchangeContractMember

2023-12-31

0001029199

eeft:CorporateOperationsMember

us-gaap:ForeignExchangeContractMember

2023-12-31

0001029199

eeft:XeOperationsMember

us-gaap:TradingRevenueMember

2024-01-01

2024-12-31

0001029199

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel1Member

2023-12-31

0001029199

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel3Member

2023-12-31

0001029199

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel2Member

2023-12-31

0001029199

eeft:XeOperationsMember

us-gaap:TradingRevenueMember

2023-01-01

2023-12-31

0001029199

eeft:UncommittedCreditAgreementMember

2023-06-27

2023-06-27

0001029199

srt:MinimumMember

us-gaap:RevolvingCreditFacilityMember

2024-01-01

2024-12-31

0001029199

srt:MaximumMember

us-gaap:RevolvingCreditFacilityMember

2024-01-01

2024-12-31

0001029199

us-gaap:RevolvingCreditFacilityMember

eeft:CreditFacilityWithSublimit1Member

2023-12-31

0001029199

us-gaap:EmployeeStockOptionMember

eeft:ValuationTechniqueBlackScholesMertonOptionPricingOrMonteCarloSimulationModelMember

2024-01-01

2024-12-31

0001029199

us-gaap:EmployeeStockOptionMember

eeft:ValuationTechniqueBlackScholesMertonOptionPricingOrMonteCarloSimulationModelMember

2023-01-01

2023-12-31

0001029199

us-gaap:EmployeeStockOptionMember

eeft:ValuationTechniqueBlackScholesMertonOptionPricingOrMonteCarloSimulationModelMember

2023-12-31

0001029199

srt:MinimumMember

us-gaap:StockCompensationPlanMember

2024-01-01

2024-12-31

0001029199

srt:MaximumMember

us-gaap:StockCompensationPlanMember

2024-01-01

2024-12-31

0001029199

us-gaap:EmployeeStockOptionMember

2024-01-01

2024-12-31

0001029199

us-gaap:EmployeeStockOptionMember

2023-12-31

0001029199

us-gaap:EmployeeStockOptionMember

2023-01-01

2023-12-31

0001029199

us-gaap:ForeignCountryMember

us-gaap:EarliestTaxYearMember

2024-01-01

2024-12-31

0001029199

us-gaap:ForeignCountryMember

us-gaap:LatestTaxYearMember

2024-01-01

2024-12-31

0001029199

us-gaap:AdditionalPaidInCapitalMember

us-gaap:AccountingStandardsUpdate202006Member

2023-01-01

2023-12-31

0001029199

us-gaap:StateAndLocalJurisdictionMember

us-gaap:EarliestTaxYearMember

2024-01-01

2024-12-31

0001029199

us-gaap:StateAndLocalJurisdictionMember

us-gaap:LatestTaxYearMember

2024-01-01

2024-12-31

0001029199

us-gaap:NotesReceivableMember

2023-10-19

0001029199

eeft:MoneyTransferSegmentMember

us-gaap:OperatingSegmentsMember

2024-12-31

0001029199

us-gaap:AdditionalPaidInCapitalMember

us-gaap:AccountingStandardsUpdate202006Member

2022-01-01

2022-12-31

0001029199

eeft:EFTProcessingSegmentMember

us-gaap:OperatingSegmentsMember

2024-12-31

0001029199

eeft:EpaySegmentMember

us-gaap:OperatingSegmentsMember

2024-12-31

0001029199

us-gaap:EmployeeStockOptionMember

eeft:ValuationTechniqueBlackScholesMertonOptionPricingOrMonteCarloSimulationModelMember

2024-12-31

0001029199

us-gaap:RevolvingCreditFacilityMember

eeft:CreditFacilityWithSublimit1Member

eeft:SwinglineLoansUSDollarMember

2024-12-31

0001029199

us-gaap:EmployeeStockOptionMember

eeft:ValuationTechniqueBlackScholesMertonOptionPricingOrMonteCarloSimulationModelMember

2022-01-01

2022-12-31

0001029199

us-gaap:EmployeeStockOptionMember

eeft:ValuationTechniqueBlackScholesMertonOptionPricingOrMonteCarloSimulationModelMember

2022-12-31

0001029199

eeft:EpaySegmentMember

us-gaap:OperatingSegmentsMember

2022-12-31

0001029199

eeft:MoneyTransferSegmentMember

us-gaap:OperatingSegmentsMember

2022-12-31

0001029199

us-gaap:SeniorNotesMember

us-gaap:FairValueInputsLevel2Member

2024-12-31

0001029199

eeft:EFTProcessingSegmentMember

us-gaap:OperatingSegmentsMember

2022-12-31

0001029199

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel3Member

2024-12-31

0001029199

us-gaap:ConvertibleNotesPayableMember

us-gaap:FairValueInputsLevel2Member

2024-12-31

0001029199

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel1Member

2024-12-31

0001029199

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel2Member

2024-12-31

0001029199

eeft:NotSubjectToExpirationMember

us-gaap:ForeignCountryMember

2024-12-31

0001029199

us-gaap:DomesticCountryMember

us-gaap:ResearchMember

2024-12-31

0001029199

eeft:ExpiringInFiveYearsMember

us-gaap:ForeignCountryMember

2024-12-31

0001029199

eeft:ExpiringInMoreThanFiveYearsMember

us-gaap:ForeignCountryMember

2024-12-31

0001029199

eeft:ExpiringInThreeYearsMember

us-gaap:ForeignCountryMember

2024-12-31

0001029199

eeft:ExpiringInFourYearsMember

us-gaap:ForeignCountryMember

2024-12-31

0001029199

eeft:ExpiringInOneYearMember

us-gaap:ForeignCountryMember

2024-12-31

0001029199

eeft:ExpiringInTwoYearsMember

us-gaap:ForeignCountryMember

2024-12-31

0001029199

eeft:XeOperationsMember

us-gaap:TradingRevenueMember

2022-01-01

2022-12-31

0001029199

eeft:CorporateOperationsMember

us-gaap:ForeignExchangeContractMember

2024-12-31

0001029199

us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember

us-gaap:ForeignExchangeContractMember

us-gaap:NondesignatedMember

2024-12-31

0001029199

eeft:AccruedExpensesAndOtherCurrentLiabilitiesMember

us-gaap:ForeignExchangeContractMember

us-gaap:NondesignatedMember

2024-12-31

0001029199

eeft:RiaOperationsMember

us-gaap:ForeignExchangeContractMember

2024-12-31

0001029199

us-gaap:ForeignExchangeContractMember

eeft:XeOperationsMember

2024-12-31

0001029199

us-gaap:RevolvingCreditFacilityMember

eeft:CreditFacilityWithSublimit1Member

eeft:SwinglineLoansForeignCurrenciesMember

2024-12-31

0001029199

us-gaap:RevolvingCreditFacilityMember

srt:MaximumMember

2024-12-31

0001029199

us-gaap:RevolvingCreditFacilityMember

eeft:CreditFacilityWithSublimit1Member

2024-12-31

0001029199

2022-12-31

0001029199

2022-01-01

2022-12-31

0001029199

2024-12-31

0001029199

us-gaap:NotesReceivableMember

2023-10-19

2023-10-19

0001029199

eeft:UncommittedCreditAgreementMember

2023-06-27

0001029199

eeft:UncommittedLoanAgreementMember

2023-06-26

2023-06-26

0001029199

eeft:ConvertibleNotes0.75PercentDue2049Member

2023-12-31

0001029199

us-gaap:DomesticCountryMember

us-gaap:EarliestTaxYearMember

us-gaap:ResearchMember

2024-01-01

2024-12-31

0001029199

us-gaap:LatestTaxYearMember

us-gaap:ResearchMember

us-gaap:DomesticCountryMember

2024-01-01

2024-12-31

0001029199

us-gaap:RetainedEarningsMember

us-gaap:AccountingStandardsUpdate202006Member

2023-01-01

2023-12-31

0001029199

eeft:EFTProcessingSegmentMember

us-gaap:OperatingSegmentsMember

2024-01-01

2024-12-31

0001029199

eeft:EpaySegmentMember

us-gaap:OperatingSegmentsMember

2024-01-01

2024-12-31

0001029199

eeft:MoneyTransferSegmentMember

us-gaap:OperatingSegmentsMember

2024-01-01

2024-12-31

0001029199

us-gaap:AccountingStandardsUpdate202006Member

us-gaap:AdditionalPaidInCapitalMember

2024-12-31

0001029199

eeft:EFTProcessingSegmentMember

us-gaap:OperatingSegmentsMember

2023-01-01

2023-12-31

0001029199

eeft:EpaySegmentMember

us-gaap:OperatingSegmentsMember

2023-01-01

2023-12-31

0001029199

eeft:MoneyTransferSegmentMember

us-gaap:OperatingSegmentsMember

2023-01-01

2023-12-31

0001029199

eeft:EFTProcessingSegmentMember

us-gaap:OperatingSegmentsMember

2023-12-31

0001029199

eeft:EpaySegmentMember

us-gaap:OperatingSegmentsMember

2023-12-31

0001029199

eeft:MoneyTransferSegmentMember

us-gaap:OperatingSegmentsMember

2023-12-31

0001029199

eeft:EpaySegmentMember

us-gaap:OperatingSegmentsMember

2022-01-01

2022-12-31

0001029199

eeft:MoneyTransferSegmentMember

us-gaap:OperatingSegmentsMember

2022-01-01

2022-12-31

0001029199

srt:ConsolidationEliminationsMember

eeft:MoneyTransferSegmentMember

2022-01-01

2022-12-31

0001029199

eeft:EFTProcessingSegmentMember

us-gaap:OperatingSegmentsMember

2022-01-01

2022-12-31

0001029199

srt:ConsolidationEliminationsMember

eeft:EFTProcessingSegmentMember

2022-01-01

2022-12-31

0001029199

srt:ConsolidationEliminationsMember

eeft:EpaySegmentMember

2022-01-01

2022-12-31

0001029199

eeft:OtherGeographicLocationsMember

eeft:MoneyTransferSegmentMember

us-gaap:OperatingSegmentsMember

2022-01-01

2022-12-31

0001029199

eeft:OtherGeographicLocationsMember

us-gaap:OperatingSegmentsMember

2022-01-01

2022-12-31

0001029199

eeft:OtherGeographicLocationsMember

eeft:EFTProcessingSegmentMember

us-gaap:OperatingSegmentsMember

2022-01-01

2022-12-31

0001029199

eeft:OtherGeographicLocationsMember

eeft:EpaySegmentMember

us-gaap:OperatingSegmentsMember

2022-01-01

2022-12-31

0001029199

srt:AsiaPacificMember

eeft:MoneyTransferSegmentMember

us-gaap:OperatingSegmentsMember

2022-01-01

2022-12-31

0001029199

srt:AsiaPacificMember

us-gaap:OperatingSegmentsMember

2022-01-01

2022-12-31

0001029199

srt:AsiaPacificMember

eeft:EFTProcessingSegmentMember

us-gaap:OperatingSegmentsMember

2022-01-01

2022-12-31

0001029199

srt:AsiaPacificMember

eeft:EpaySegmentMember

us-gaap:OperatingSegmentsMember

2022-01-01

2022-12-31

0001029199

srt:NorthAmericaMember

eeft:MoneyTransferSegmentMember

us-gaap:OperatingSegmentsMember

2022-01-01

2022-12-31

0001029199

srt:NorthAmericaMember

us-gaap:OperatingSegmentsMember

2022-01-01

2022-12-31

0001029199

srt:NorthAmericaMember

eeft:EFTProcessingSegmentMember

us-gaap:OperatingSegmentsMember

2022-01-01

2022-12-31

0001029199

srt:NorthAmericaMember

eeft:EpaySegmentMember

us-gaap:OperatingSegmentsMember

2022-01-01

2022-12-31

0001029199

eeft:MoneyTransferSegmentMember

srt:EuropeMember

us-gaap:OperatingSegmentsMember

2022-01-01

2022-12-31

0001029199

srt:EuropeMember

us-gaap:OperatingSegmentsMember

2022-01-01

2022-12-31

0001029199

eeft:EFTProcessingSegmentMember

srt:EuropeMember

us-gaap:OperatingSegmentsMember

2022-01-01

2022-12-31

0001029199

eeft:EpaySegmentMember

srt:EuropeMember

us-gaap:OperatingSegmentsMember

2022-01-01

2022-12-31

0001029199

us-gaap:CustomerRelationshipsMember

srt:MinimumMember

2024-12-31

0001029199

us-gaap:CustomerRelationshipsMember

srt:MaximumMember

2024-12-31

0001029199

us-gaap:AccountingStandardsUpdate202006Member

us-gaap:AdditionalPaidInCapitalMember

2024-01-01

2024-12-31

0001029199

us-gaap:AccountingStandardsUpdate202006Member

us-gaap:TreasuryStockCommonMember

2024-01-01

2024-12-31

0001029199

us-gaap:AccountingStandardsUpdate202006Member

us-gaap:RetainedEarningsMember

2024-01-01

2024-12-31

0001029199

us-gaap:RevolvingCreditFacilityMember

2024-01-01

2024-12-31

0001029199

eeft:UncommittedLoanAgreementMember

2023-06-26

0001029199

us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember

2023-01-01

2023-12-31

0001029199

us-gaap:ComputerSoftwareIntangibleAssetMember

srt:MinimumMember

2024-12-31

0001029199

us-gaap:ComputerSoftwareIntangibleAssetMember

srt:MaximumMember

2024-12-31

0001029199

eeft:ShareRepurchasePlan1Member

2024-01-01

2024-12-31

0001029199

us-gaap:TrademarksAndTradeNamesMember

srt:MinimumMember

2024-12-31

0001029199

us-gaap:TrademarksAndTradeNamesMember

srt:MaximumMember

2024-12-31

0001029199

srt:MinimumMember

us-gaap:NoncompeteAgreementsMember

2024-12-31

0001029199

us-gaap:NoncompeteAgreementsMember

srt:MaximumMember

2024-12-31

0001029199

eeft:ShareRepurchasePlan2Member

2024-01-01

2024-12-31

0001029199

us-gaap:ForeignExchangeContractMember

eeft:XeOperationsMember

2023-12-31

0001029199

srt:ConsolidationEliminationsMember

eeft:EFTProcessingSegmentMember

2024-01-01

2024-12-31

0001029199

srt:ConsolidationEliminationsMember

eeft:EFTProcessingSegmentMember

2023-01-01

2023-12-31

0001029199

srt:ConsolidationEliminationsMember

eeft:EpaySegmentMember

2024-01-01

2024-12-31

0001029199

srt:ConsolidationEliminationsMember

eeft:EpaySegmentMember

2023-01-01

2023-12-31

0001029199

srt:ConsolidationEliminationsMember

eeft:MoneyTransferSegmentMember

2024-01-01

2024-12-31

0001029199

eeft:CollateralOnBankCreditArrangementsAndOtherMember

2023-12-31

0001029199

us-gaap:StockCompensationPlanMember

2024-01-01

2024-12-31

0001029199

srt:ConsolidationEliminationsMember

eeft:MoneyTransferSegmentMember

2023-01-01

2023-12-31

0001029199

srt:MaximumMember

eeft:XeOperationsMember

2024-01-01

2024-12-31

0001029199

us-gaap:StockCompensationPlanMember

2023-01-01

2023-12-31

0001029199

srt:EuropeMember

us-gaap:OperatingSegmentsMember

2024-01-01

2024-12-31

0001029199

srt:NorthAmericaMember

us-gaap:OperatingSegmentsMember

2024-01-01

2024-12-31

0001029199

srt:AsiaPacificMember

us-gaap:OperatingSegmentsMember

2024-01-01

2024-12-31

0001029199

eeft:OtherGeographicLocationsMember

us-gaap:OperatingSegmentsMember

2024-01-01

2024-12-31

0001029199

srt:EuropeMember

us-gaap:OperatingSegmentsMember

2023-01-01

2023-12-31

0001029199

eeft:SeniorNotes1.375PercentDue2026Member

2024-01-01

2024-12-31

0001029199

us-gaap:AccountingStandardsUpdate202006Member

2023-01-01

2023-12-31

0001029199

us-gaap:MaterialReconcilingItemsMember

2024-01-01

2024-12-31

0001029199

us-gaap:AccountingStandardsUpdate202006Member

2024-12-31

0001029199

us-gaap:MaterialReconcilingItemsMember

2023-01-01

2023-12-31

0001029199

us-gaap:MaterialReconcilingItemsMember

2023-12-31

0001029199

us-gaap:AllowanceForCreditLossMember

2024-01-01

2024-12-31

0001029199

us-gaap:AllowanceForCreditLossMember

2023-01-01

2023-12-31

0001029199

us-gaap:AllowanceForCreditLossMember

2021-12-31

0001029199

us-gaap:AllowanceForCreditLossMember

2023-12-31

0001029199

us-gaap:AccountingStandardsUpdate202006Member

2024-01-01

2024-12-31

0001029199

srt:ConsolidationEliminationsMember

2024-01-01

2024-12-31

0001029199

srt:ConsolidationEliminationsMember

2023-01-01

2023-12-31

0001029199

srt:NorthAmericaMember

us-gaap:OperatingSegmentsMember

2023-01-01

2023-12-31

0001029199

srt:AsiaPacificMember

us-gaap:OperatingSegmentsMember

2023-01-01

2023-12-31

0001029199

eeft:UncommittedCreditAgreementMember

2023-06-28

2023-11-30

0001029199

eeft:OtherGeographicLocationsMember

us-gaap:OperatingSegmentsMember

2023-01-01

2023-12-31

0001029199

eeft:VehiclesAndOfficeEquipmentMember

srt:MinimumMember

2024-12-31

0001029199

eeft:VehiclesAndOfficeEquipmentMember

srt:MaximumMember

2024-12-31

0001029199

eeft:InfinitiumGroupMember

2024-02-01

2024-02-01

0001029199

eeft:InfinitiumGroupMember

2024-02-01

0001029199

eeft:UncommittedLoanAgreementMember

2024-06-21

0001029199

eeft:UncommittedLoanAgreementMember

2024-06-21

2024-06-21

0001029199

eeft:UncommittedLoanAgreementMember

2024-12-31

0001029199

eeft:UncommittedLoanAgreementMember

2024-06-27

0001029199

eeft:UncommittedLoanAgreementMember

2024-06-27

2024-06-27

0001029199

us-gaap:RevolvingCreditFacilityMember

2024-12-17

0001029199

us-gaap:RevolvingCreditFacilityMember

eeft:SwinglineLoansForeignCurrenciesMember

2024-12-17

0001029199

us-gaap:RevolvingCreditFacilityMember

eeft:SwinglineLoansUSDollarMember

2024-12-17

0001029199

us-gaap:ForeignLineOfCreditMember

2024-10-09

0001029199

us-gaap:UnfavorableRegulatoryActionMember

2024-07-31

0001029199

eeft:InfinitiumGroupMember

us-gaap:CustomerRelationshipsMember

2024-02-01

0001029199

eeft:ShareRepurchasePlan1Member

2022-09-13

0001029199

us-gaap:RevolvingCreditFacilityMember

2024-12-17

2024-12-17

0001029199

eeft:ShareRepurchasePlan2Member

2023-09-13

0001029199

eeft:ShareRepurchasePlan3Member

2024-09-11

0001029199

us-gaap:RevolvingCreditFacilityMember

2024-12-16

0001029199

eeft:UncommittedLoanAgreementMember

2024-06-22

2024-12-31

0001029199

eeft:UncommittedLoanAgreementMember

2024-06-28

2024-12-31

xbrli:shares

xbrli:pure

iso4217:EUR

iso4217:MYR

utr:D

iso4217:USD

iso4217:USD

xbrli:shares

eeft:Item

eeft:SEGMENT

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

|

(Mark One) |

|

|

|

☑ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

For the fiscal year ended: December 31, 2024 |

|

|

|

OR |

|

|

|

|

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

For the transition period from to |

|

Commission File Number

EURONET WORLDWIDE, INC.

(Exact name of Registrant as specified in its charter)

________________________

|

Delaware |

74-2806888 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| 11400 Tomahawk Creek Parkway, Suite 300 |

|

| Leawood, Kansas |

66211 |

| (Address of principal executive offices) |

(Zip Code) |

(913) 327-4200

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

Trading Symbol(s) |

Name of Each Exchange on Which Registered |

|

Common Stock |

EEFT |

Nasdaq Global Select Market |

|

1.375% Senior Notes due 2026 |

EEFT26 |

Nasdaq Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

_________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

|

☑ |

|

Accelerated filer |

☐ |

| Non-accelerated filer |

☐ |

|

Smaller reporting company |

☐ |

|

|

|

|

Emerging growth company |

☐ |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

As of June 30, 2024, the aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant was approximately $4.4 billion. The aggregate market value was determined based on the closing price of the Common Stock on June 30, 2024.

As of February 24, 2025, the registrant had 43,742,542 shares of Common Stock outstanding.

Documents Incorporated By Reference

Portions of the registrant's Proxy Statement for its 2024 Annual Meeting of Stockholders, which will be filed with the Securities and Exchange Commission no later than 120 days after December 31, 2024, are incorporated by reference into Part III of this Annual Report on Form 10-K.

EURONET WORLDWIDE, INC. AND SUBSIDIARIES

References in this report to "we," "our," "us," the "Company" and "Euronet" refer to Euronet Worldwide, Inc. and its subsidiaries unless the context indicates otherwise.

Business Overview

General Overview

Euronet is a leader in electronic payment and transaction processing solutions for Financial Institutions, Retailers, Service Providers, and Individual Consumers utilizing our global payments network, platforms, and technologies. Through a collection of diverse technologies and services, our business segments and solutions meet a wide variety of payments requirements and process transactions throughout the world. We move money in all the ways the world depends on. With a global footprint we provide compliant solutions that make financial transactions easier, faster, and secure.

Core Business Segments

We operate in the following three segments as of December 31, 2024:

Electronic Funds Transfer ("EFT") Segment

Our Electronic Funds Transfer ("EFT") segment meets the needs of financial institutions and consumers through Euronet-owned and outsourced Automated Teller Machines ("ATMs") and Point-of-Sale ("POS") terminals combined with value added and transaction processing services. We deploy and operate our own ATMs, providing ATM services for financial institutions and providing electronic payment processing solutions. EFT offers a suite of integrated electronic financial transaction software solutions for electronic payment and transaction delivery systems. Transactions processed span a network of 55,248 ATMs, as of December 31, 2024, and approximately 1,160,000 POS terminals. In 2024, the EFT Processing Segment accounted for approximately 29% of Euronet's consolidated revenues.

epay Segment

Our epay segment provides retail payment solutions and delivers innovative connections between the digital content of the world’s leading brands and consumers. epay has one of the largest retail networks across Europe and Asia for the distribution of physical and digital third-party content, including branded payments, mobile, and alternative payments, partnering with 1,000+ of the world’s leading brands. In addition, through our own products, we have leveraged our technology to solve business challenges, delivering scalable solutions to drive efficiency and effectiveness. Our comprehensive range of consumer products simplifies transactions and provides financial convenience across a wide range of branded payments. epay operates in 60+ countries. We operate a network that includes approximately 777,000 POS terminals that enable electronic processing of prepaid mobile airtime "top-up" services and other digital media content. In 2024, the epay Segment accounted for approximately 29% of Euronet's consolidated revenues.

Money Transfer Segment

Our Money Transfer segment provides global money transfers and currency exchange information in retail stores, apps, and websites through Ria Money Transfer, Xe and the Dandelion cross-border real-time payments network. Euronet’s Money Transfer segment offers real-time, cross-border payments to consumers and businesses across 198 countries and territories, enabling banks, fintechs and big tech platforms to integrate an international payments solution into their own platforms. In 2024, the Money Transfer Segment accounted for approximately 42% of Euronet's consolidated revenues.

Ria Money Transfer, one of the largest consumer remittance companies in the world offers real-time international money transfers with a special focus on emerging markets. In addition, Ria offers safe and affordable money transfers through a global network of cash locations and online, serving over 20 million customers annually.

Xe offers web and app based currency information and industry-leading consumer and business cross border money transfer services. Customers can send money, buy property overseas, and execute other international payments via the Xe website or app.

Dandelion is a leading real-time cross-border payment platform; it offers consumer and business transaction processing and fulfillment with alternative payout channels like bank accounts, cash pick-up and mobile wallets. Dandelion powers cross-border payments for Xe and Ria, as well as third party banks, fintechs, and big tech platforms.

Historical Perspective

Euronet started in Central Europe in 1994 and has grown to become a global real-time digital and cash payments network with millions of touchpoints today, with products and services in more than 200 countries and territories provided through its own brand and branded business segments, Euronet and its financial technologies and networks offer payment transaction services. Euronet serves clients from 67 offices worldwide.

Business Segment Overview

For a discussion of operating results by segment, please see Item 7 - Management's Discussion and Analysis of Financial Condition and Results of Operations, and Note 18, Business Segment Information, to the Consolidated Financial Statements.

EFT Processing Segment

Overview

Our EFT Processing Segment provides comprehensive electronic payment solutions consisting of ATM cash withdrawal and deposit services, ATM network participation, outsourced ATM and POS management solutions, credit, debit and prepaid card outsourcing, card issuing and merchant acquiring services. In addition to our core business, we offer a variety of value-added services, including ATM and POS DCC, domestic and international surcharge, foreign currency dispensing, advertising, digital content sales at ATMs, Customer Relationship Management ("CRM"), prepaid mobile top-up, bill payment, money transfer, fraud management, foreign remittance payout, cardless payout, banknote recycling solutions and tax-refund services. We provide these services either through our Euronet-owned ATMs and POS terminals, through contracts under which we operate ATMs and POS terminals on behalf of our customers or, for certain services, as stand-alone products. Through this segment, we also offer a suite of integrated electronic financial transaction software solutions for electronic payment and transaction delivery systems.

Sources of Revenues

The primary sources of revenues generated by our ATM network are recurring monthly management fees, transaction-based fees, surcharges, and margins earned on DCC transactions. We receive fixed monthly fees under many of our outsourced management contracts. The EFT Processing Segment also generates revenues from POS operations and merchant management, card network management for credit, debit, prepaid and loyalty cards, prepaid mobile airtime recharge and other electronic content on ATMs and ATM advertising. We primarily operate across Europe, Africa, the Middle East, Asia Pacific, Latin America and the United States. As of December 31, 2024, we operated 55,248 ATMs compared to 47,303 at December 31, 2023.

We monitor the number of transactions made by cardholders on our network. These include cash withdrawals, balance inquiries, deposits, prepaid mobile airtime recharge purchases, DCC transactions and certain denied (unauthorized) transactions. We do not bill certain transactions on our network to financial institutions, and we have excluded these transactions for reporting purposes. The number of transactions processed over our networks has increased over the last five years at a compound annual growth rate ("CAGR") of approximately 36.7% as indicated in the following table:

|

(in millions) |

2020 |

2021 |

2022 |

2023 |

2024

|

|

EFT Processing Segment transactions per year |

3,275 |

4,366 |

6,459 |

8,473 |

11,424 |

The increase in transactions for the past few years is the result of a significant increase in the volume of lower value, real time payment processing transactions on any wallet or e-commerce site in Asia Pacific. The associated revenue of these lower value, digitally initiated payment processing transactions is lower. As a result, our revenue growth will not correlate proportionately with the increase in our transaction volume growth.

Our processing centers for the EFT Processing Segment are located in Germany, Hungary, India, China, Indonesia and Pakistan. Our processing centers run two types of proprietary transaction switching software: our legacy ITM software, which we have used and sold to financial institutions since 1998 through our Software Solutions unit, and an innovative switching software package named "Ren", which is hosted in Germany, India and Indonesia, that was released in 2019. The processing centers operate 24 hours a day, seven days a week. We have been progressively transitioning all of our networks to Ren.

EFT Processing Products and Services

Outsourced Management Solutions

Euronet offers outsourced management solutions to financial institutions, merchants, mobile phone operators and other organizations using our processing centers' electronic financial transaction processing software. Our outsourced management solutions include management of existing ATM networks, development of new ATM networks, management of POS networks, management of automated deposit terminals, management of credit, debit and prepaid card databases and other financial processing services. These solutions include 24-hour monitoring of each ATM's status and cash condition, managing the cash levels in each ATM, coordinating the cash delivery, and providing automatic dispatches for necessary service calls. We also provide real-time transaction authorization, advanced monitoring, network gateway access, network switching, 24-hour customer service, maintenance, cash settlement and reconciliation, forecasting, and reporting. Since our infrastructure can support a significant increase in transactions, new outsourced management solutions agreements should provide additional revenue with lower incremental cost.

Our outsourced management solutions agreements generally provide for fixed monthly management fees and, in most cases, fees payable for each transaction. The transaction fees under these agreements are generally lower than those under card acceptance agreements.

Euronet-Branded ATM Transaction Processing

Our Euronet-branded ATM networks, also known as IAD networks, are primarily managed by a processing center that uses our market-leading internally developed software solutions. The ATMs in our IAD networks are able to process transactions for holders of credit, debit and prepaid products issued by or bearing the logos of financial institutions and international card organizations such as American Express®, Visa®, Mastercard®, JCB, Diners Club International®, Discover® and UnionPay International©, as well as international ATM networks such as PLUS, CIRRUS and PULSE® or domestic networks such as NYCE, Shazam, AFFN, STAR and others across North America. This is accomplished through our agreements and relationships with these institutions, international credit, debit and prepaid card issuers, international card associations and domestic card associations.

When a bank cardholder conducts a transaction on a Euronet-owned ATM or automated deposit terminal, we receive a fee from the cardholder's bank for that transaction. The bank pays us this fee either directly or indirectly through a central switching and settlement network. When paid indirectly, this fee is referred to as the "interchange fee." We receive transaction processing fees for successful transactions and, in certain circumstances, for transactions that are not completed because they fail to receive authorization. The fees paid to us by the card issuers are independent of any fees charged by the card issuers to cardholders in connection with the ATM transactions. In some cases, we may also charge a direct access fee or surcharge to cardholders at the ATM. The direct access fee is added to the amount of the cash withdrawal and debited from the cardholder's account.

We generally receive fees or earn margins from our customers for all types of ATM transactions:

Card Acceptance or Sponsorship Agreements

Our agreements with financial institutions and international card organizations generally provide that all credit and debit cards issued by the financial institution or organization may be used at all ATMs that we operate in for a given market. In most markets, we operate under sponsorship by our own e-money or payment service licensed entities. In some markets, we have agreements with a financial institution under which we are designated as a service provider (which we refer to as "sponsorship agreements") for the acceptance of domestic cards and/or cards bearing international logos, such as Visa® and Mastercard®. These card acceptance or sponsorship agreements allow us to receive transaction authorization directly from the card issuing institution or international card organizations on a stand-in basis. Our agreements generally provide for a term of three to seven years and renew automatically unless either party provides notice of non-renewal prior to the termination date. In some cases, the agreements are terminable by either party upon six months' notice. We are generally able to connect a financial institution to our network within 30 to 90 days of signing a card acceptance agreement. The financial institution provides the cash needed to complete transactions on the ATM, but we provide a significant portion of the cash to our IAD network to fund ATM transactions ourselves. Euronet is generally liable for the cash in the ATM networks.

Under our card acceptance agreements, the ATM transaction fees we charge vary depending on the type of transaction and the number of transactions attributable to a particular card issuer. Our agreements generally provide for payment in local currency, though transaction fees are sometimes denominated in euros or U.S. dollars. Transaction fees are billed to financial institutions and card organizations with payment terms typically no longer than one month.

Dynamic Currency Conversion

We offer dynamic currency conversion, or DCC, over our IAD networks, ATM networks that we operate on an outsourced basis for financial institutions, and over financial institutions' ATM networks or POS devices as a stand-alone service. DCC is a feature of the underlying ATM or POS transaction that is offered to customers completing transactions using a foreign debit or credit card issued in a country with a currency other than the currency where the ATM or POS is located. The customer is offered a choice between completing the transaction in the local currency or in the customer's home currency via a DCC transaction. If a cardholder chooses to perform a DCC transaction, the acquirer or processor performs the foreign exchange conversion at the time that the funds are delivered at an ATM or the transactions are completed through the POS terminal, which results in a pre-defined amount of the customer's home currency being charged to their card. Alternatively, the customer may have the transaction converted by the card issuing bank, in which the amount of local currency is communicated to the card issuing bank and the card issuing bank makes the conversion to the customer's home currency.

When a customer chooses DCC at an ATM or POS device and Euronet acts as the acquirer or processor, we receive all or a portion of the foreign exchange margin on the conversion of the transaction. On our IAD ATMs, Euronet receives the entire foreign exchange margin. If Euronet is not the acquirer or processor of the transaction, we share the DCC revenue with the sponsor bank. On ATMs or POS devices that are operated for financial institutions, or where we offer DCC as a stand-alone service to financial institutions or merchants, we share the foreign exchange margin. The foreign exchange margin on a DCC transaction increases the amount Euronet earns from the underlying ATM or POS transaction and supports deployment of additional ATMs in new locations.

Other Products and Services

Our network of owned or operated ATMs allows for the sale of additional financial and other products or services at a low incremental cost. We have developed value-added services in addition to basic cash withdrawal and balance inquiry transactions. These value-added services include mobile top-up, fraud management, bill payment, domestic and international surcharge, CRM, foreign remittance payout, cardless payout, banknote recycling, electronic content, ticket and voucher, foreign currency withdrawal, advertising and tax-refund services. We are committed to the ongoing development of innovative new products and services to offer our EFT processing customers.

Euronet offers multinational merchants a Single European Payments Area ("SEPA")-compliant cross-border transaction processing solution. SEPA is an area in which all electronic payments can be made and received in euros, whether between or within national boundaries, under the same basic conditions, rights, and obligations, regardless of the location. This single, centralized acquiring platform enables merchants to benefit from cost savings and faster, more efficient payments transfer. Although many European countries are not members of the eurozone, our platform can serve merchants in these countries as well, through our multi-currency functionality.

Software Solutions

We also offer a suite of integrated software solutions for electronic payments and transaction delivery systems. We generate revenues for our software products from licensing, professional services and maintenance fees for software and sales of related hardware, primarily to financial institutions around the world.

Ren Payments Platform

Ren was built from the ground up to operate in the evolving digital payments landscape of real-time settlements and emerging forms of payment, including QR codes, PINs and biometrics. Ren primarily serves financial institutions, central banks and fintech companies. It is offered as an on-premise technology where these businesses install the platform in their own data centers or as a software as a service (SaaS) offering where development teams access it in Euronet’s global data centers using APIs. Versatile, Ren can be used as a payment hub or to deliver core banking functionality such as issuing, merchant acquiring, transaction switching, and ATM management. For real-time payments, Ren is used by central banks to process transactions and member banks that use Ren to connect their legacy systems to real-time payment networks in their countries.

EFT Processing Segment Strategy

The EFT Processing Segment maintains a strategy to expand the network of ATMs and POS terminals into new and existing markets that have the greatest potential for growth. We continue to focus on diversifying our business by expanding our market presence and product portfolio, as well as outsourcing opportunities. In addition, we follow a supporting strategy to increase the penetration of value added (or complementary) services across our existing customer base, including DCC, transaction-based fees, surcharge, cardless payment, banknote recycling solutions, tax refund services, advertising, fraud management, bill payment, mobile top-up, CRM and foreign remittance payout.

We continually strive to make our own ATM networks more efficient by removing unprofitable ATMs and redeploying them to new profitable locations. We make selective additions to our own ATM network if we see market demand and profit opportunities. In tourist locations, we also seasonally deactivate ATMs when tourist activity is low.

In recent years, the need for "all-in" services has increased. Banks, particularly smaller banks, are increasingly looking for integrated ATM, POS and card issuing processing and management services. Euronet is well positioned for this opportunity as it can offer a full end-to-end solution to potential partners.

Additional growth opportunities are driven through financial institutions that are receptive to outsourcing the operation of their ATM, POS and card networks. The operation of these devices requires expensive hardware and software and specialized personnel. These resources are available to us, and we offer them to our customers under outsourcing contracts. The expansion and enhancement of our outsourced management solutions in new and existing markets will remain an important business opportunity for Euronet. Increasing the number of non-owned ATMs and POS terminals that we operate under management services agreements and continued development of our credit, debit and prepaid card outsourcing business could provide continued growth while minimizing our capital investment.

In addition, complementary services offered by our epay Segment, where we provide prepaid mobile top-up services through POS terminals, strengthens the EFT Processing Segment's line of services. We plan to continue to expand our technology and business methods into other markets where we operate and further leverage our relationships with mobile operators, other content providers and financial institutions to facilitate that expansion.

Seasonality

Our EFT Processing business experiences its heaviest demand for cash withdrawals and DCC during the third quarter of the fiscal year, coinciding with the tourism season. It is also impacted by seasonality during the fourth quarter and first quarter of each year due to higher transaction levels during the holiday season and lower levels after the holiday season. This seasonality is increased due to our practice of seasonally deactivating ATMs in tourist locations that experience significantly higher traffic during their peak tourist seasons. Seasonally deactivating involves shutting down the ATMs during the slower months and results in lower overall transaction volumes in the EFT Processing Segment during those months. As we have expanded our IAD network in tourist locations, the financial impact of seasonally deactivating has increased, because we continue to bear the expense of seasonally deactivated ATMs even though they do not generate transactions during the slower months.

Significant Customers and Government Contracts

No individual customer of the EFT Processing Segment makes up greater than 10% of total consolidated revenues. EFT maintains contract relationships with a number of banks, financial institutions, telecommunications companies, and clients whose ownership includes the government.

Competition

Our principal EFT Processing Segment competitors include ATM networks owned by financial institutions and national switches consisting of consortiums of local banks that provide outsourcing and transaction services to financial institutions and independent ATM deployers in a particular country. Additionally, large, well-financed companies that operate ATMs offer ATM network and outsourcing services, and those that provide card outsourcing, POS processing and merchant acquiring services also compete with us in various markets. Small local operators have also recently begun offering their services, particularly in the IAD market. None of these competitors has a dominant market share in any of our markets. Competitive advantages in our EFT Processing Segment include breadth of service offering, network availability and response time, price to both the financial institution and to its customers, ATM location and access to other networks.

epay Segment

Overview

We currently process and distribute prepaid mobile airtime and other electronic content and payment processing services for various prepaid products, cards, and services on a network of approximately 777,000 POS terminals across approximately 362,000 retailer locations in Europe, the Middle East and Africa, Asia Pacific, North America and South America. Our processing centers for the epay segment are located in the United Kingdom, Germany, Italy, and the United States.

We have continued to expand our prepaid business in new and existing markets by drawing upon our depth of experience to build and expand relationships with content providers, mobile operators, and retailers. We offer a wide range of products across our retail networks, including prepaid mobile airtime, prepaid debit cards, prepaid gift cards, other prepaid electronic content such as music, games and software, prepaid vouchers, transport payments and lottery, and bill payment processing assistance through partnerships with various licensed money transmitters.

Sources of Revenues

The epay Segment generates commissions and processing fees from the distribution of electronic content from mobile operators and other content providers. In 2024, approximately 68% of total revenues and approximately 76% of gross profit for the epay Segment was from electronic content other than prepaid mobile airtime (digital media products).

Customers purchase digital media prepaid content as a gift or for self-use. Content is generally purchased in two ways: (1) directly online from the content provider using an online payment method, or (2) through physical retail stores, online retailers, or other electronic channels, including payment wallets, online banking, mobile applications, and other sources.

Customers using mobile phones generally pay for usage in one of two ways: (1) through "postpaid" accounts, where usage is billed at the end of each billing period, or (2) through "prepaid" accounts, where customers pay in advance by crediting their accounts prior to usage.

Although mobile operators in the U.S. and certain European countries have provided service principally through postpaid accounts, the norm in many other countries in Europe and the rest of the world is to offer wireless service on a prepaid basis.

Prepaid mobile phone credits are generally distributed using personal identification numbers ("PINs"). We distribute PINs in two ways. First, we establish an electronic connection to the mobile operator and the retailer. When the sale to a customer is initiated, the terminal requests the PIN from the mobile operator via our transaction processing platform. These transactions obtain the PIN directly from the mobile operator. The customer pays the retailer, and the retailer becomes obligated to make settlement to us of the purchased amount of the mobile airtime. We maintain systems that know the amount of mobile top-up sold by the retailer which allows us in turn to bill that retailer for the mobile top-up sold.

Second, we purchase PINs from the mobile operator which are electronically sent to our processing platform. We establish an electronic connection with the POS terminals in retailer locations and our processing platform provides the terminal with a PIN when the mobile top-up is purchased. We maintain systems that monitor transaction levels at each terminal. As sales of prepaid mobile airtime to customers are completed, the inventory on the platform is reduced by the PIN purchased. The customer payment and settlement with the retailer are the same as described above.

We expand our distribution networks by signing new contracts with retailers, and in some markets, by acquiring existing networks. We continue to focus on growing our distribution network through independent sales organizations that contract directly with retailers in their network to distribute prepaid mobile airtime or other digital media content from the retailers' POS terminals. We continue to increase our focus on direct relationships with chains of supermarkets, convenience stores, gas stations, and other larger scale retailers, where we can negotiate multi-year agreements with the retailers. In addition to the sale of traditional mobile top-up volume described above, we have expanded distribution into digital media products and other value-added services. We have leveraged our existing technology infrastructure to sell digital media products, which have been sold through our traditional retail network and new retailer networks such as digital channels. In the U.S., most prepaid digital media content is purchased for gifting; in markets outside the U.S., consumers generally purchase prepaid digital media content for self-use.

epay Products and Services

Prepaid Mobile Airtime Transaction Processing

We process prepaid mobile airtime top-up transactions on our international POS network for two types of clients: distributors and retailers. Both types of client transactions start with a consumer in a retail store. The retailer uses a specially programmed POS terminal in the store, the retailer's electronic cash register (ECR) system, or web-based POS device that is connected to our network to buy prepaid mobile airtime. The consumer will select a predefined amount of mobile airtime from the carrier of choice, and the retailer enters the selection into the POS terminal. The consumer will pay that amount to the retailer (in cash or other payment methods accepted by the retailer). The POS device then transmits the selected transaction to our processing center. Using the electronic connection we maintain with the mobile phone operator or drawing from our inventory of PINs, the purchased amount of mobile airtime will be either credited to the consumer's account or delivered via a PIN printed by the terminal and given to the consumer. In the case of PINs printed by the terminal, the consumer must then call the mobile phone operator's toll-free number to activate the purchased airtime to the consumer's mobile account.

One difference in our relationships with various retailers and distributors is the way in which we charge for our services. For distributors and certain very large retailers, we charge a processing fee. However, the majority of our transactions occur with smaller retailers. With these clients, we receive a commission or discount on each transaction that is withheld from the payments made to the mobile phone operator, and we share that commission/discount with the retailers.

Closed Loop Gift Cards

Closed loop (private-branded) gift cards are generally described as merchant-specific prepaid cards, used for purchases exclusively at a particular merchant's locations. We distribute closed loop gift cards in various categories, including dining, retail, and digital media, such as music, games, and software. Generally, the gift card is activated when a consumer loads funds (with cash, debit or credit card payment) or purchases a preloaded value gift card at a retail store location or online.

Open Loop Gift Cards

Open loop gift cards are prepaid gift cards associated with an electronic payment network (such as Visa® or Mastercard®) and are honored at multiple, unaffiliated locations (wherever cards from these networks are generally accepted). They are not merchant-specific. We distribute and issue single-use, non-reloadable open loop gift cards carrying the Visa® brand in our retail channels. After the consumer purchases the preloaded value gift card at a retail store location or online, the consumer must call the toll-free number on the back of the card to activate it.

Open Loop Reloadable

We distribute Visa® and Mastercard® issued debit cards provided by card issuers. We also manage and distribute a proprietary debit card that allows a retailer to issue its own reloadable store-branded card. Open loop reloadable cards have features similar to a bank checking account, including direct deposit, purchasing capability wherever a credit card is accepted, bill payment and ATM access. Fees are charged to consumers for the initial load and reload transactions, monthly account maintenance and other transactions.

Other Products and Services