UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-K

ANNUAL REPORT PURSUANT TO REGULATION A OF THE SECURITIES ACT OF 1933

For the fiscal year ended: December 31, 2021

| The Chosen, LLC |

| (Exact name of issuer as specified in its charter) |

| Utah |

| 82-3246222 |

| State or other jurisdiction of incorporation or organization |

| (I.R.S. Employer Identification No.) |

4 S 2600 W, Suite 5, Hurricane, Utah 84737

(Full mailing address of principal executive offices)

(435) 767-1338

(Issuer’s telephone number, including area code)

Preferred Class A

(Title of each class of securities issued pursuant to Regulation A)

STATEMENTS REGARDING FORWARD-LOOKING INFORMATION AND FIGURES

This Annual Report on Form 1-K, or the Annual Report, of The Chosen, LLC, a Utah limited liability company, contains certain forward-looking statements that are subject to various risks and uncertainties. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “outlook,” “seek,” “anticipate,” “estimate,” “approximately,” “believe,” “could,” “project,” “predict,” or other similar words or expressions. Forward-looking statements are based on certain assumptions, discuss future expectations, describe future plans and strategies, contain financial and operating projections or state other forward-looking information. Our ability to predict results or the actual effect of future events, actions, plans or strategies, and the impact of the recent novel coronavirus (COVID-19) pandemic is inherently uncertain. Although we believe that the expectations reflected in our forward-looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth or anticipated in our forward-looking statements.

When considering forward-looking statements, you should keep in mind the potential risks and other cautionary statements in this report. Readers are cautioned not to place undue reliance on any of these forward-looking statements, which reflect our views as of the date of this report. The matters summarized below and elsewhere in this report could cause our actual results and performance to differ materially from those set forth or anticipated in forward-looking statements. Accordingly, we cannot guarantee future results or performance. Furthermore, except as required by law, we are under no duty to, and we do not intend to, update any of our forward-looking statements after the date of this report, whether as a result of new information, future events or otherwise.

All figures provided herein are approximate.

Item 1. Business

Description of Business

Unless the context otherwise requires or indicates, references in this offering circular to “us,” “we,” “our” or “our Company” refer to The Chosen, LLC, a Utah limited liability company.

The Chosen, LLC, a Utah limited liability company, was formed on October 24, 2017. Our Company has two wholly owned subsidiaries, The Chosen Texas, LLC and The Chosen House, LLC, and one subsidiary, Impossible Math, LLC of which the Company owns 100% voting interest (and none of the nonvoting interests), whose activities have been consolidated into The Chosen, LLC with all significant intercompany balances and transactions being eliminated. Our objective is to develop and produce an episodic television series entitled “The Chosen” (the “Series”). “The Chosen” is the first-ever multi-season TV series about the life of Christ and those He touched. Our Company produces, markets and distributes the series to a worldwide market. Our large faith-based audience has risen to the call to help fund and support the project as devoted fans and investors, contributing to The Chosen’s success. Our Company has successfully released Season 1 and Season 2 and a theatrical release of a special Christmas episode and is in the pre-production phase of Season 3 (with production scheduled to begin late spring/early summer 2022), in anticipation of additional funding to continue to produce the Series.

Our Company’s principal products include 1) digital media which is streamed via Video-on-Demand (VOD), Subscription Video-on-Demand (SVOD) and other forms of VOD through an exclusive licensing agreement with Angel Studios, Inc. 2) Physical media sales of Blu-Ray discs and DVDs to end users of which the maintenance and distribution of the physical inventory product is managed by Angel Studios, Inc. who remits a portion of the net revenue to us. 3) Physical book sales, including devotional books, children’s books, and study guides, of which the maintenance and distribution of the inventory products is managed by our publishers and Angel Studios, Inc. who remit a portion of the net revenue to us. 4) Merchandise sales, consisting mainly of hoodies and T-Shirts, of which the maintenance and distribution of the inventory products is also managed by Angel Studios, Inc. who works with a 3rd party vendor/supplier and remits a portion of the net revenue to us.

| 2 |

During 2018 and 2019, our Company’s “The Chosen” marketing campaign became the most crowdfunded Television/Movie project of all time as of the end of 2019, raising just over 11 million dollars. The funds were used to cover offering expenses and the completion of Episodes 1-8 of Season 1. With the offering statement filed on Form 1-A with the United States Securities and Exchange Commission, or the SEC, on March 8, 2018 (File #: 024-10814), which offering statement was qualified by the SEC on June 15, 2018 and the offering statement filed under Regulation CF of the SEC on Form C with the SEC, on June 24, 2019 (File # 020-25447), there were 11,190,030 Class A Preferred Units issued at a purchase price of $1.00 per Class A Preferred Unit. Episodes 1-4 of Season 1 were released in April 2019, Episodes 5-8 of Season 1 were released in late November 2019, and Season 2, Episodes 1-8 were released in the Spring and Summer of 2020. The revenues generated in 2020 and 2021 from the release of Seasons 1 and 2 of the Series and the Christmas special were sufficient to cover the full production cost of Season 2 and a significant portion of Season 3 which is currently in pre-production, along with significant marketing costs incurred related to the release of Season 1 and 2.

As of the date of this Annual Report, we have been focused on the pre-production of Season 3 of the Series, including coordinating the building of a sound stage and new set, with production anticipated to begin late Spring/early Summer 2022. We anticipate the release of the first couple of episodes in the fourth quarter of 2022 and to continue over the following weeks and months. Our plan of operations, including material expenditures, over the next fiscal year is focused on the production and marketing of Season 3, development of Season 4, and continued marketing of Seasons 1 and 2.

We are managed by our sole manager, The Chosen Productions, LLC, a Utah limited liability company (the “Manager”). Our Chief Executive Officer and Chief Creative Officer are principals of the Company’s Manager. During 2021, we entered into employment contracts with individuals that are involved in various areas of operations, marketing, and production. All personnel involved only with the production of Seasons 1, 2, and 3 including writers, directors, actors, crew and other production personnel, have been hired as independent contractors by our subsidiary, The Chosen TX, LLC.

Operational or industry risk factors

As of April 20, 2022, we had issued 11,190,030 of our Class A Units and had $25,775,307 in cash on hand. We expect to have sufficient cash resources, including expected future cash receipts from Seasons 1 and 2, to finish the production of Season 3 and begin pre-production of Season 4; however, it is too early to predict the financial success of the Series and we cannot predict whether the release of Season 3 will be a material source of liquidity in the short-term or long-term.

On March 11, 2020, the World Health Organization, or WHO, officially characterized the outbreak of COVID-19 as a pandemic. Our distributor, Angel Studios, Inc., was able to adjust their employment work-from-home policies quickly which provided for minimal disruption in the distribution of our products. The production timeline for Season 2 had increased costs due to CDC Health Guidelines and has contributed to a delay in the construction of the sound stage and set to be used for Season 3. Due to strict SAG Guidelines regarding the COVID-19 pandemic, we anticipate spending upwards of $1,000,000 to enforce the guidelines and maintain a COVID free workplace. To date, we have had no COVID delays or shutdowns.

| 3 |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

General

As of the date of this Annual Report, Seasons 1 and 2 of the Series had been successfully released via a SVOD model and multiple Transaction Video-on-Demand (TVOD) platforms, along with physical product. We also began selling merchandise and other “The Chosen” products in October 2019 through a third-party producer/distributor. The production phase for Season 3 is expected to begin late Spring/early Summer 2022 in anticipation of sufficient funding from ongoing revenues and cash receipts to continue to produce the series.

Results of Operations – For the Year Ended December 31, 2021

Year Ended December 31, 2021:

Revenues

Revenue produced by Seasons 1 and 2 and the Christmas episode through the Exclusive Video-on-demand, Subscription video-on-demand license agreement with Angel Studios, Inc. box office sales and physical media sales was $40,053,520 with revenues of $2,726,344 from the sale of film-related books and materials. Revenues related to merchandise sales in 2021 were $5,554,873, with cost of sales of $305,965. (We ceased managing the merchandise during 2021, and recorded revenues on a net basis once we ceased managing the merchandise.) Other miscellaneous revenues, including ad share revenues of $595,318, were received totaling $680,922.

Expenses

The production of Seasons 1 and 2 were finalized at a total cost of $20,331,553. Film costs are capitalized and amortized over a period of time in proportion to ultimate revenue production. Amortization of Film Costs for 2021 was $6,158,897.

Operating expenses other than the amortization of film costs were $8,164,404. These expenses were primarily attributable to $2,319,504 in advertising and marketing, $2,430,838 in wages and related taxes, $1,413,162 in royalties, $890,719 in legal and professional fees, $331,457 in contracted services, and $778,724 in travel, computer services, insurance and other miscellaneous operating expenses.

Additionally, we made a donation of cash to Feeding Texas of $5,000.

Income Taxes

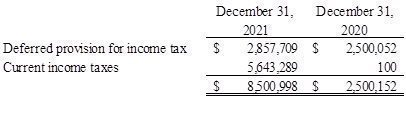

We elected to be taxed as a C-corporation, effective January 1, 2018. The IRS approved the election in October 2019. The provision for income taxes of $8,500,998 for the year ended December 31, 2021 is primarily attributable to current federal and state income tax of $5,643,289 and deferred income tax expense of $2,857,709.

Excluding the provision for income taxes, de minimis interest income, and donations set forth above we recorded income from operations in 2021 of $34,386,393; however, following the inclusion of interest, donations, and taxes we had net consolidated income of $25,885,146 in 2021.

Year Ended December 31, 2020:

Revenues

Revenue produced by Season 1 through the Exclusive Video-on-demand, Subscription video-on-demand license agreement with Angel Studios, Inc. and physical media sales was $15,939,907 with revenues of $641,318 from the sale of film-related books and materials. Revenues related to merchandise sales in 2020 were $3,914,125, with cost of sales of $2,008,904. Other miscellaneous revenues were $256,058.

Expenses

The production of Season 1 was finalized at a total cost of $8,270,567. Film costs are capitalized and amortized over a period of time in proportion to ultimate revenue production. Amortization of Film Costs for 2020 was $5,512,755.

| 4 |

Operating expenses other than the amortization of film costs were $3,619,125. These expenses were primarily attributable to $2,335,551 in advertising and marketing, $570,098 in royalties, $239,351 in wages and related taxes, $226,957 in legal and professional fees, and $121,337 in travel, computer and contract services, insurance and other miscellaneous operating expenses.

Income Taxes

We elected to be taxed as a C-corporation, effective January 1, 2018. The IRS approved the election in October 2019. The provision for income taxes of $2,500,152 for the year ended December 31, 2020 is primarily attributable to state income tax of $100 and deferred income tax expense of $2,500,052.

Excluding de minimis interest income and the income tax benefit set forth above we recorded income from operations in 2020 of $9,610,622; however, following the inclusion of interest and taxes we had net consolidated income of $7,110,799 in 2020.

Liquidity and Capital Resources

Year ended December 31, 2021

We filed a preliminary offering under Regulation A on September 3, 2020, for the additional $20,000,001 that was anticipated as needed to complete the production of Seasons 2 and 3. As revenues from Season 1 were sufficient to provide the necessary funds for Season 2 and we have a significant portion of the funds for the production of Season 3, we have abandoned the offering.

As of December 31, 2021, we have cash on hand of $15,932,446 with $13,767,532 in accounts receivable and $3,236,641 of accounts payable and accrued current liabilities. Impossible Math, LLC, organized in May 2021, of which we own a 100% voting interest in and whose activity has been consolidated into our financial statements, has invested in the construction of a $13 million sound stage of which is one-third complete at the end of 2021. The construction is being funded by loans from The Chosen and capital invested from the non-controlling equity partner in the project. Cash Receipts from revenues from Seasons 1 and 2 of the Series are being used for the sound stage loans, production costs of Season 3, operations, and to advertise and market Seasons 1 and 2. Production costs to complete Season 3 are expected to be approximately $24,000,000 and advertising and marketing costs between approximately $2,000,000 and $3,000,000 during 2022.

Trend Information

As of the date of this Annual Report, 2022 revenues have flattened from the large fall 2021 numbers when we released the special Christmas episode in Theatres. As the first episodes of Season 3 will not be released until the fourth quarter of 2022, we expect 2022 revenues to be lower than 2021 revenues, during which we released new episodes between April and July.

Other than the above mentioned, we have not identified any known trends, uncertainties, demands, commitments or events involving our business that are reasonably likely to have a material effect on our revenues, income from continuing operations, profitability, liquidity or capital resources, or that would cause the reported financial information in this report to not be indicative of future operating results or financial condition.

| 5 |

Item 3. Directors and Officers

Our sole manager is The Chosen Productions, LLC, and Derral Eves is the sole manager of our manager. Set forth below are our executive officers. Our manager has delegated our day-to-day operations to our executive officers.

| Name |

| Position |

| Age |

| Term of Office |

| Hours/Year (for Part-time Employees) |

| Derral Eves |

| Chief Executive Officer and Sole Manager of our Manager |

| 47 |

| February 2018 |

| N/A |

| Dallas Jenkins |

| Chief Creative Officer |

| 46 |

| February 2018 |

| N/A |

| Bradley Pelo |

| President |

| 59 |

| December 2021 |

| N/A |

| Adam Swerdlow |

| Vice President, Operations |

| 37 |

| July 2020 |

| N/A |

| Jeremiah Smith |

| Vice President, Creative Director |

| 45 |

| August 2021 |

| N/A |

| Katherine Warnock |

| Vice President, Original Content |

| 41 |

| September 2021 |

| N/A |

| Robert Starnes |

| Vice President, Product and Licensing |

| 64 |

| February 2022 |

| N/A |

Biographical Information

Biographical information regarding our executive officers and executive officer nominees is set forth below.

Derral Eves

Derral Eves is our Chief Executive Officer and the sole manager of our manager, The Chosen Productions, LLC. Mr. Eves graduated from Southern Utah University with a bachelor’s degree in Communications and Public Relations and a minor in Spanish. Since January 2006, Mr. Eves has served as the Chief Executive Officer of Creatus, LLC. Mr. Eves is the creator of VidSummit, the leading professional conference for social media creators. Mr. Eves is one of the world’s top YouTube and online video marketing experts. The content on Mr. Eves’ distribution channels have received over 24 billion video views on YouTube and over 9 billion views on Facebook. Mr. Eves is also the mentor of some of the biggest and most impactful YouTube and social media stars. He has been featured on Good Morning America, The Today Show, NBC, ABC, CBS, FOX, ESPN, FORBES, AdWeek, Christians Today, World Religion News, and several other media outlets. He was recently featured in an article published by Forbes as #4 on the list of “20 Must Watch YouTube Channels That Will Change Your Business.”

Dallas Jenkins

Dallas Jenkins is our Chief Creative Officer. Mr. Jenkins graduated from Northwestern College with a bachelor’s degree in Bible and Communications. Mr. Jenkins currently serves as the president of Jenkins Entertainment and is primarily responsible for the oversight of the production of all films and videos produced by Jenkins Entertainment. Mr. Jenkins is also a film writer who has worked in Hollywood for nearly two decades, creating films for Warner Brothers, Lionsgate, Hallmark Channel, PureFlix and Universal. Mr. Jenkins has created several faith-based films, such as Midnight Clear, What If…, Though None Go With Me and The Resurrection of Gavin Stone. Mr. Jenkins is the son of celebrated Christian author Jerry B. Jenkins (the creator of The Left Behind Series and The Jesus Chronicles Series).

| 6 |

Bradley Pelo

Mr. Pelo serves as The Chosen’s President. He is a serial entrepreneur and executive producer. Brad co-founded and lead Ancestry.com, Folio (now part of Microsoft), NextPage (now Proofpoint), I.TV and SAY. He was the executive producer of The Legend of Johnny Lingo (MGM), Outlaw Trail and Forever Strong as well as the annual fourth of July telecast for the Pentagon Channel, Stadium of Fire. Most recently Brad was Chief Distribution Officer at Angel Studios before joining The Chosen. He serves on charitable boards that support the arts and leadership development.

Adam Swerdlow

Mr. Swerdlow serves as VP of Operations. Mr. Swerdlow graduated from University of Massachusetts-Amherst with a bachelor’s degree in Communications and a minor in Film. Originally from the suburbs of New York City in Connecticut, starting in 2011 Adam built a financial planning practice at Northwestern Mutual. In order to be closer to his family who moved to California in 2007, Adam moved his practice and tenacity to Newport Beach in Q3 of 2016. During his tenure at Northwestern Mutual he accomplished many goals including achieving million dollar round table (MDRT) and other numerous company and industry accolades. He was also responsible for recruiting, building and managing teams of Financial Advisors in his respective offices. Adam left Northwestern in 2019 to practice as an Independent Financial Advisor and also co-founded The Financial Advisors Alliance, a coaching and consulting firm for Financial Advisors. In 2020 The Financial Advisors Alliance was acquired by Model FA where Adam continues to consult. Not only does he bring his wealth of knowledge from his near decade as a Financial Advisor, he also brings his skillset in business development, operations and management. Adam also stays active as a member of a few local charities, chambers and community foundations. When he is not working, he enjoys being as physically active as possible with his wife Shaylene, daughter Hazel and dog, Poppy.

Robert Starnes

Mr. Starnes serves The Chosen as VP Product Distribution & Licensing. Mr. Starnes has served as an executive in the licensing, product distribution space for 30+ years. His career began in retail at Target, where he served as one of the youngest operations executive in their history. Building on his time at Target, Bob went on to open a chain of children’s retail stores which won the Playthings Magazine award for “Best Up and Coming Toy Retailers of the 90’s” (FAO Schwarz was the co-winner). Bob went on to oversee stores for Lemstone Christian Bookstores and then served as VP of Licensing and Publishing at Big Idea VeggieTales before opening Brentwood Studios with former COO of VeggieTales Terry Pefanis and Brock Starnes. Serving as the Senior partner he oversaw three divisions of the worldwide brands in consulting, publishing, and production for 13+ years. Mr. Starnes is known as the key licensing and distribution executive on products with a Biblical worldview.

Katherine Warnock

Katherine Warnock is VP of Original Content with the global phenomenon television series The Chosen. Katherine holds a background in strategic content, marketing, and branding-based leadership spanning media, fashion, and social enterprise. Previously head of faith and family content at MGM Studios, Katherine helped to steer growth by 985% to a 24 million-plus audience, averaging 1.4 billion organic video views yearly. A dual resident of America and the UK, Katherine has worked with elite brands from Paramount Pictures, Warner Brothers, and Sony to Ford, Aerie, and Gillette with a goal of positively affecting culture through purposeful, anchored, mission-driven media.

Jeremiah Smith

Mr. Smith has worked in marketing at scale in three distinct industries. As a young pastor in New England, he cut his marketing teeth as a consultant for Purpose-Driven Ministries and the Willow Creek Association. Then, as a content strategist and producer for multiple global brands, his work appeared in over 20 languages across print, digital, and television. Most recently, Jeremiah was responsible for brand and creative across Walmart communications, including some of their largest branding efforts in company history. Jeremiah and his family are passionate foster and adoption advocates.

| 7 |

Director and Executive Compensation

Our Manager does not receive compensation for acting in its capacity as Manager of the Company. However, the executive officers receive compensation from the Company as employees and the Manager and executive officers may receive compensation if employed or as independent contractors of the Company for services performed in connection with the creation, distribution and production of the Series.

Item 4. Security Ownership of Management and Certain Security holders

Our Company has two classes of membership interests outstanding, the Class A Units and the Common Units. There are currently 14,380,466 Common Units and 11,190,030 Class A Units outstanding. Purchasers of our units of membership interest become members in our Company with respect to their ownership of units (the “Members”). Our Manager has the right to create, authorize and issue new units of membership interests in our Company, including new classes.

Capitalization

The following table sets forth the beneficial ownership of our membership units of each of our Manager, executive officers, and security holders who own more that 10% of our outstanding membership units:

| Title of Class |

| Name and Address of Beneficial Owner |

| Amount and Nature of Beneficial Ownership (1) |

| Amount and Nature of Beneficial Ownership Acquirable |

| Percent of Membership Interest |

| Common Units |

| Dallas Jenkins 4 S 2600 W Ste 5 Hurricane, UT 84737 |

| 6,255,000 Common Units |

| N/A |

| 44% |

| Common Units |

| Derral Eves 4 S 2600 W Ste 5 Hurricane, UT 84737 |

| 3,614,000 Common Units |

| N/A |

| 25% |

| Common Units |

| Ricky Ray Butler 9849 Yoakum Dr Beverly Hills, CA 90210 |

| 2,780,000 Common Units |

| N/A |

| 19% |

(1) Each beneficial owner owns his interest through the Manager.

Item 5. Interest of Management and Others in Certain Transactions

Obligations to Other Entities

Our Manager and executive officers are involved in other businesses, including other television and film production businesses. Therefore, conflicts of interest may exist between their obligations to such businesses and to us. Under our Operating Agreement, our Manager is permitted to have outside business activities, including those that compete with our business. We believe our Manager and executive officers have the capacity to discharge their responsibilities to our Company notwithstanding participation in other present and future investment programs and projects.

| 8 |

Transactions with the Company

The Manager may, and may cause its affiliates to, engage in any transaction (including, without limitation, the purchase, sale, lease, or exchange of any property or the rendering of any service, or the establishment of any salary, other compensation, or other terms of employment) with the Company so long as such transaction is not expressly prohibited by the Operating Agreement and so long as the terms and conditions of such transaction, on an overall basis, are fair and reasonable to the Company and are at least as favorable to the Company as those that are generally available from persons capable of similarly performing them in similar transactions between parties operating at arm’s length. A transaction between the Manager and/or its affiliates, on the one hand, and the Company, on the other hand, shall be conclusively determined to constitute a transaction on terms and conditions, on an overall basis, fair and reasonable to the Company and at least as favorable to the Company as those generally available in a similar transaction between parties operating at arm’s length if a majority of the membership interests having no interest in such transaction (other than their interests as Members) affirmatively vote or consent in writing to approve the transaction. Notwithstanding the foregoing, the Manager shall not have any obligation in connection with any such transaction between the Company and the Manager or its affiliate, to seek the consent of the Members.

A Member may lend money to and transact other business with the Company with prior approval of the Manager and after full disclosure of the Member’s involvement. Such Member has the same rights and obligations with respect thereto as a person who is not a Member. A loan to the Company by a Member will not dilute the ownership interests of any other Member. We do not have any outstanding loans or loan guarantees with any related party, and, as of the date of this filing, we do not have any intentions to enter into any such transactions.

Related Party Transaction

The Company entered into an agreement with a member of the Company as a Director and Writer for the second season and paid the member $0 during 2021 and $87,500 during 2020 related to writing and pre-production work on Season 2.

During 2019, the company engaged an advertising agency, which is wholly-owned by one of the members of the Company’s parent company. The Company paid the advertising agency $0 in 2021 and $37,925 in 2020.

We have entered into various agreements with a company owned by a member of the Company and the member’s spouse to write various books related to the Series. The related company receives a percentage of sales for each book. In total, the amount paid and accrued to the related company for writer fees and book royalties was $269,416 as of December 31, 2021, and $23,741 as of December 31, 2020.

During 2021, we also engaged a relative of one of the members to provide social media advertising services. The Company paid the related party $5,500 in 2021.

Item 6. Other Information

None

| 9 |

Item 7. Financial Statements

CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2021 and 2020

TOGETHER WITH REPORT OF INDEPENDENT AUDITOR

| 10 |

The Chosen, LLC

|

|

| F-2 |

| |

|

|

| F-3 |

| |

|

|

| F-4 |

| |

|

|

| F-5 |

| |

|

|

| F-6 |

| |

|

|

| F-7 |

|

| F-1 |

| Table of Contents |

Report of Independent Accountants

To Management and Members of The Chosen, LLC

Opinion

We have audited the accompanying consolidated financial statements of The Chosen, LLC and subsidiaries (collectively, the Company), which comprise the consolidated balance sheets as of December 31, 2021 and 2020, and the related consolidated statements of operations, equity, and cash flows for the years then ended, and the related notes to consolidated financial statements.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of the Company as of December 31, 2021 and 2020, and the results of its operations and its cash flows for the years then ended in accordance with accounting principles generally accepted in the United States of America (US GAAP).

Basis for Opinion

We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Our responsibilities under those standards are further described in the Auditors’ Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of the Company and to meet our other ethical responsibilities in accordance with the relevant ethical requirements relating to our audits. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Responsibilities of Management for the Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in accordance with US GAAP, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern within one year after the date that the financial statements are available to be issued.

Auditors’ Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditors’ report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with generally accepted auditing standards will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the financial statements.

In performing an audit in accordance with generally accepted auditing standards, we:

|

| · | Exercise professional judgment and maintain professional skepticism throughout the audit. |

|

|

|

|

|

| · | Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. |

|

|

|

|

|

| · | Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. Accordingly, no such opinion is expressed. |

|

|

|

|

|

| · | Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the financial statements. |

|

|

|

|

|

| · | Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for a reasonable period of time. |

We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control related matters that we identified during the audit.

/s/ Tanner LLC

Lehi, UT

May 2, 2022

| F-2 |

| Table of Contents |

The Chosen, LLC

As of December 31, 2021 and 2020

|

|

| 2021 |

|

| 2020 |

| ||

|

|

|

|

|

|

|

| ||

| Assets |

|

|

|

|

|

| ||

| Current assets |

|

|

|

|

|

| ||

| Cash |

| $ | 15,932,446 |

|

| $ | 5,693,461 |

|

| Accounts receivable |

|

| 13,767,532 |

|

|

| 3,982,295 |

|

| Other current assets |

|

| 2,181,807 |

|

|

| 103,086 |

|

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

| 31,881,785 |

|

|

| 9,778,842 |

|

|

|

|

|

|

|

|

|

|

|

| Property and equipment |

|

|

|

|

|

|

|

|

| Equipment, net of depreciation |

|

| 239,172 |

|

|

| 6,221 |

|

| Furniture and fixtures, net of depreciation |

|

| 14,184 |

|

|

| - |

|

| Vehicles, net of depreciation |

|

| 336,172 |

|

|

| - |

|

| Buildings and improvements, net of depreciation |

|

| 1,233,202 |

|

|

| 468,582 |

|

| Construction in process |

|

| 6,901,446 |

|

|

| - |

|

| Land |

|

| 89,545 |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

| Total property and equipment |

|

| 8,813,721 |

|

|

| 474,803 |

|

|

|

|

|

|

|

|

|

|

|

| Other assets |

|

|

|

|

|

|

|

|

| Film costs, net of amortization |

|

| 10,044,976 |

|

|

| 9,416,259 |

|

| Trademark, net of amortization |

|

| 7,962 |

|

|

| 8,881 |

|

| Capital raise costs |

|

| - |

|

|

| 119,853 |

|

|

|

|

|

|

|

|

|

|

|

| Total other assets |

|

| 10,052,938 |

|

|

| 9,544,993 |

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

| $ | 50,748,444 |

|

| $ | 19,798,638 |

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and Equity |

|

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

| Accounts and credit cards payable |

| $ | 2,139,985 |

|

| $ | 608,607 |

|

| Other current liabilities |

|

| 1,096,656 |

|

|

| 421,083 |

|

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

| 3,236,641 |

|

|

| 1,029,690 |

|

|

|

|

|

|

|

|

|

|

|

| Long-term liabilities |

|

|

|

|

|

|

|

|

| Deferred tax liability |

|

| 5,074,409 |

|

|

| 2,216,700 |

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

| 8,311,050 |

|

|

| 3,246,390 |

|

|

|

|

|

|

|

|

|

|

|

| Commitments and contingencies (see Note 2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Members’ equity |

|

| 42,464,898 |

|

|

| 16,552,248 |

|

| Noncontrolling interest |

|

| (27,504 | ) |

|

| - |

|

| Total equity |

|

| 42,437,394 |

|

|

| 16,552,248 |

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities and equity |

| $ | 50,748,444 |

|

| $ | 19,798,638 |

|

See accompanying notes to the consolidated financial statements.

| F-3 |

| Table of Contents |

The Chosen, LLC

Consolidated Statements of Operations

For the Years Ended December 31, 2021 and 2020

|

|

| 2021 |

|

| 2020 |

| ||

|

|

|

|

|

|

|

| ||

| Revenues |

|

|

|

|

|

| ||

| Licensing revenues, net |

| $ | 41,153,716 |

|

| $ | 16,581,225 |

|

| Merchandise sales |

|

| 5,554,873 |

|

|

| 3,914,125 |

|

| Other revenues |

|

| 2,307,070 |

|

|

| 256,058 |

|

|

|

|

|

|

|

|

|

|

|

| Total revenues |

|

| 49,015,659 |

|

|

| 20,751,408 |

|

|

|

|

|

|

|

|

|

|

|

| Cost of goods sold |

|

| 305,965 |

|

|

| 2,008,904 |

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

| 48,709,694 |

|

|

| 18,742,504 |

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses |

|

|

|

|

|

|

|

|

| Advertising and marketing |

|

| 2,319,504 |

|

|

| 2,335,551 |

|

| Amortization of film costs |

|

| 6,158,897 |

|

|

| 5,512,755 |

|

| Depreciation and amortization expense |

|

| 36,182 |

|

|

| 872 |

|

| General and administrative |

|

| 5,808,718 |

|

|

| 1,282,704 |

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

| 14,323,301 |

|

|

| 9,131,882 |

|

|

|

|

|

|

|

|

|

|

|

| Net operating income |

|

| 34,386,393 |

|

|

| 9,610,622 |

|

|

|

|

|

|

|

|

|

|

|

| Other income/(expense) |

|

|

|

|

|

|

|

|

| Interest income |

|

| 4,751 |

|

|

| 329 |

|

| Donations |

|

| (5,000 | ) |

|

| - |

|

|

|

|

|

|

|

|

|

|

|

| Total other income/(expense) |

|

| (249 | ) |

|

| 329 |

|

|

|

|

|

|

|

|

|

|

|

| Net income before provision for income taxes |

|

| 34,386,144 |

|

|

| 9,610,951 |

|

|

|

|

|

|

|

|

|

|

|

| Provision for income taxes |

|

| (8,500,998 | ) |

|

| (2,500,152 | ) |

|

|

|

|

|

|

|

|

|

|

| Net consolidated income |

|

| 25,885,146 |

|

|

| 7,110,799 |

|

|

|

|

|

|

|

|

|

|

|

| Net loss attributable to noncontrolling interest |

|

| 27,504 |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to The Chosen, LLC |

| $ | 25,912,650 |

|

| $ | 7,110,799 |

|

|

|

|

|

|

|

|

|

|

|

| Earnings per common unit, basic and diluted |

| $ | 1.85 |

|

| $ | 0.51 |

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common units, basic and diluted |

|

| 14,020,117 |

|

|

| 14,020,117 |

|

See accompanying notes to the consolidated financial statements.

| F-4 |

| Table of Contents |

The Chosen, LLC

Consolidated Statements of Equity

For the Years Ended December 31, 2021 and 2020

|

|

|

|

| Class A |

|

|

|

|

|

| Total |

|

|

|

|

| ||||||||||||

|

|

| Common |

|

| Preferred |

|

| Contributed |

|

| Accumulated |

|

| Members’ |

|

| Noncontrolling |

|

| Total |

| |||||||

|

|

| Units |

|

| Units |

|

| Capital |

|

| (Deficit)/Income |

|

| Equity |

|

| Interest |

|

| Equity |

| |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

| Balance at December 31, 2019 |

|

| 13,900,000 |

|

|

| 11,190,030 |

|

| $ | 10,249,559 |

|

| $ | (808,110 | ) |

| $ | 9,441,449 |

|

| $ | - |

|

| $ | 9,441,449 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Issuance of common units for offering expense |

|

| 480,466 |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

| Net income |

|

| - |

|

|

| - |

|

|

| - |

|

|

| 7,110,799 |

|

|

| 7,110,799 |

|

|

| - |

|

|

| 7,110,799 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at December 31, 2020 |

|

| 14,380,466 |

|

|

| 11,190,030 |

|

|

| 10,249,559 |

|

|

| 6,302,689 |

|

|

| 16,552,248 |

|

|

| - |

|

|

| 16,552,248 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income / (loss) |

|

| - |

|

|

| - |

|

|

| - |

|

|

| 25,912,650 |

|

|

| 25,912,650 |

|

|

| (27,504 | ) |

|

| 25,885,146 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at December 31, 2021 |

|

| 14,380,466 |

|

|

| 11,190,030 |

|

| $ | 10,249,559 |

|

| $ | 32,215,339 |

|

| $ | 42,464,898 |

|

| $ | (27,504 | ) |

| $ | 42,437,394 |

|

See accompanying notes to the consolidated financial statements.

| F-5 |

| Table of Contents |

The Chosen, LLC

Consolidated Statements of Cash Flows

For the Years Ended December 31, 2021 and 2020

|

|

| 2021 |

|

| 2020 |

| ||

|

|

|

|

|

|

|

| ||

| Cash flows from operating activities |

|

|

|

|

|

| ||

| Net consolidated income |

| $ | 25,885,146 |

|

| $ | 7,110,799 |

|

| Adjustments to reconcile net consolidated income to net cash from operating activities: |

|

|

|

|

|

|

|

|

| Depreciation and amortization expense |

|

| 36,182 |

|

|

| 872 |

|

| Amortization of film costs |

|

| 6,158,897 |

|

|

| 5,512,755 |

|

| Deferred income tax provision |

|

| 2,857,709 |

|

|

| 2,500,052 |

|

| Abandonment of capital raise costs |

|

| 119,853 |

|

|

| - |

|

| Changes in operating assets and liabilities |

|

|

|

|

|

|

|

|

| (Increase)/decrease in accounts receivable |

|

| (9,785,237 | ) |

|

| (3,376,730 | ) |

| (Increase)/decrease in other current assets |

|

| (2,078,721 | ) |

|

| (93,308 | ) |

| (Increase)/decrease in film costs |

|

| (6,787,614 | ) |

|

| (6,890,010 | ) |

| Increase/(decrease) in accounts payable |

|

| (355,773 | ) |

|

| 519,072 |

|

| Increase/(decrease) in accrued expenses |

|

| 675,573 |

|

|

| 384,042 |

|

|

|

|

|

|

|

|

|

|

|

| Net cash flows from operating activities |

|

| 16,726,015 |

|

|

| 5,667,544 |

|

|

|

|

|

|

|

|

|

|

|

| Cash flows from investing activities |

|

|

|

|

|

|

|

|

| Acquisition of property & equipment |

|

| (6,487,030 | ) |

|

| (475,368 | ) |

| Acquisition of trademark |

|

| - |

|

|

| (9,187 | ) |

|

|

|

|

|

|

|

|

|

|

| Net cash flows from investing activities |

|

| (6,487,030 | ) |

|

| (484,555 | ) |

|

|

|

|

|

|

|

|

|

|

| Cash flows from financing activities |

|

|

|

|

|

|

|

|

| Capital raise costs |

|

| - |

|

|

| (119,853 | ) |

|

|

|

|

|

|

|

|

|

|

| Net cash flows from financing activities |

|

| - |

|

|

| (119,853 | ) |

|

|

|

|

|

|

|

|

|

|

| Net change in cash |

|

| 10,238,985 |

|

|

| 5,063,136 |

|

|

|

|

|

|

|

|

|

|

|

| Cash, beginning of period |

|

| 5,693,461 |

|

|

| 630,325 |

|

|

|

|

|

|

|

|

|

|

|

| Cash, end of period |

| $ | 15,932,446 |

|

| $ | 5,693,461 |

|

|

|

|

|

|

|

|

|

|

|

| Supplemental disclosure of cash flow information: |

|

|

|

|

|

|

|

|

| Cash paid for income taxes |

| $ | 5,936,784 |

|

| $ | 100 |

|

| Supplemental disclosure of non-cash investing and |

|

|

|

|

|

|

|

|

| financing information: |

|

|

|

|

|

|

|

|

| Purchase of building with accounts payable |

| $ | 1,837,393 |

|

| $ | - |

|

| Purchase of vehicle with accounts payable |

| $ | 49,758 |

|

| $ | - |

|

See accompanying notes to the consolidated financial statements.

| F-6 |

| Table of Contents |

The Chosen, LLC

Notes to the Consolidated Financial Statements

December 31, 2021 and 2020

Note 1 Summary of Significant Accounting Policies

Organization

The Chosen, LLC (Chosen), a Utah limited liability company, is an independent television and film production company formed on October 24, 2017 solely to develop and produce an episodic television series entitled “The Chosen.” The Series is based on the gospels of the Bible and tells the story of the life of Jesus Christ primarily through the perspectives of those who met him throughout his life.

Consolidation

The consolidated financial statements include the accounts of The Chosen, LLC, its wholly owned subsidiaries The Chosen Texas, LLC and The Chosen House, LLC, and its controlling interest in Impossible Math, LLC (collectively, the Company). All significant intercompany balances and transactions have been eliminated in consolidation.

The Chosen Texas, LLC

The Chosen Texas, was formed on September 6, 2018 and is a wholly owned subsidiary of The Chosen, LLC. The Chosen Texas facilitates the filming of the productions.

The Chosen House, LLC

The Chosen House, LLC was formed on May 26, 2021, and owns real estate located in Midlothian, Texas. The property is used as lodging for employees, contractors, and actors to stay while performing services for The Company.

Impossible Math, LLC

Impossible Math, LLC was formed on May 7, 2021, to own and manage a sound stage that is being built and will be leased to the Chosen, LLC. The Chosen, LLC owns a controlling voting interest in the entity, with 100% of the voting units, while its share of the operation’s profit and loss is 26.9% in 2021.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect reported amounts and disclosures. Accordingly, actual results could differ from those estimates. Key management estimates include the estimated ultimate revenues of the series for the amortization of film costs and useful lives of property and equipment.

| F-7 |

| Table of Contents |

The Chosen, LLC

Notes to the Consolidated Financial Statements

December 31, 2021 and 2020

Note 1 Summary of Significant Accounting Policies, continued

Concentrations of Credit Risk

The Company maintains its cash in bank deposit accounts which, at times, exceed federally insured limits. As of December 31, 2021 and December 31, 2020, the bank balance exceeded the federally insured limit by $15,357,148 and $4,772,891, respectively.

A major customer is considered to be one that comprises more than 10% of the Company’s accounts receivable or annual revenues. For the years ended December 31, 2021 and 2020, 96% and 80%, respectively, of the Company’s revenues related to one customer – Angel Studios, Inc. (Angel Studios). As of December 31, 2021 and 2020, 99% of the Company’s accounts receivable is related to Angel Studios.

Accounts Receivable

Accounts receivable are carried at original invoice amount less an estimate for doubtful accounts based on a review of all outstanding amounts. Management determines the allowance for doubtful accounts by identifying specific troubled accounts and applying historical experience. Receivables are written off when management determines the likelihood of collection is remote. Recoveries of receivables previously written off are recorded when payment is received.

Property and Equipment

Property and equipment are carried at cost less accumulated depreciation and amortization. Depreciation of property and equipment is provided using the straight-line method. Expenditures for major renewals and betterments that extend the useful lives of property and equipment have been capitalized. Expenditures for routine repairs are expensed as incurred. Depreciation is based on the following useful lives:

|

|

| Years |

| |

| Buildings & Improvements |

|

25 - 30 |

| |

| Equipment |

| 3 - 15 |

| |

| Vehicles |

|

| 8 |

|

| Furniture and Fixtures |

|

| 5 |

|

The Company reviews long-lived assets for impairment whenever events or changes in circumstances indicate that the asset’s carrying amount may not be recoverable.

| F-8 |

| Table of Contents |

The Chosen, LLC

Notes to the Consolidated Financial Statements

December 31, 2021 and 2020

Note 1 Summary of Significant Accounting Policies, continued

Film Costs

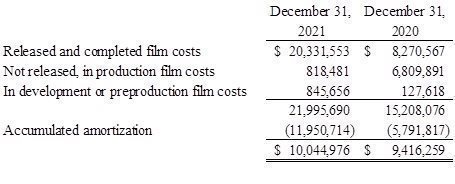

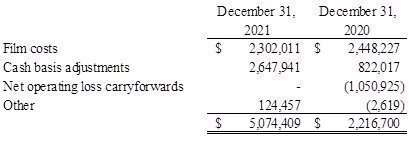

Costs incurred in the direct production of video content are capitalized and stated at the lower of the unamortized costs or net realizable value. The Company periodically evaluates the net realizable value of content by considering expected future revenue generation. The Company has determined no impairment existed during the periods presented. The following table represents the components of film costs as of December 31:

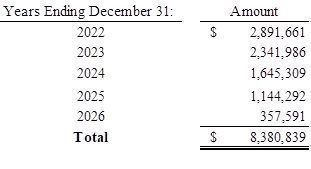

The Company amortizes film costs in proportion to the recognition of the related revenue from each episodic production block. Amortization expense for film costs for the years ended December 31, 2021 and 2020, was $6,158,897 and $5,152,755, respectively.

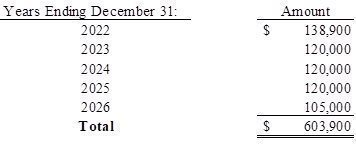

The future aggregate amounts of amortization expense expected to be recognized over the next five years related to released and completed film costs as of December 31, 2021, are as follows:

| F-9 |

| Table of Contents |

The Chosen, LLC

Notes to the Consolidated Financial Statements

December 31, 2021 and 2020

Note 1 Summary of Significant Accounting Policies, continued

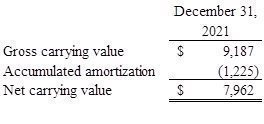

Intangibles – Trademark

The Company has one intangible asset, a trademark that is amortized over its economic life.

Capital Raise Costs

The Company filed a preliminary offering under Regulation A on September 3, 2020, for an additional $20,000,001 to fund the production of future seasons of The Chosen. Costs expended in preparation for this potential capital raise were included in the Company’s financial statements as an asset until such time as the Offering was activated or abandoned. In 2021, the Company made the decision to not initiate the offering and the previously capitalized costs, totaling $119,853, have been written off as general and administrative expense.

Revenue Recognition

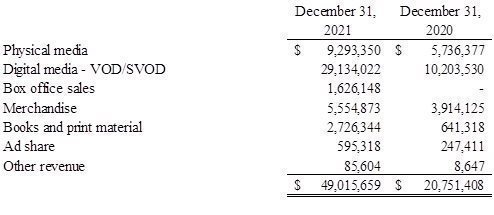

The Company generates revenue from 1) licensing agreements with Angel Studios relating to the streaming of the Company’s intellectual property via digital media – Video-on-Demand (VOD) and Subscription Video-on-Demand (SVOD), 2) physical media, books, and print material sales, 3) licensing agreements with Angel Studios relating to showing the Company’s intellectual property in movie theaters, 4) merchandise sales, and 5) ad share revenue. The Company recognizes revenue when a customer obtains control of promised products or services. The amount of revenue recognized reflects the consideration that the Company expects to be entitled to receive in exchange for these products or services.

To achieve the core principle of Topic 606, the Company applies the following five steps:

1) Identify the contract with the customer

2) Identify the performance obligations in the contract

3) Determine the transaction price

4) Allocate the transaction price to performance obligations in the contract

5) Recognize revenue when or as the Company satisfies a performance obligation

| F-10 |

| Table of Contents |

The Chosen, LLC

Notes to the Consolidated Financial Statements

December 31, 2021 and 2020

Note 1 Summary of Significant Accounting Policies, continued

Revenue Recognition, continued

Digital Media (VOD and SVOD)

Digital media revenue stems from licensing agreements with Angel Studios, wherein Angel Studios streams the Company’s intellectual property. The license is not distinct from the streaming services, and the arrangement represents a sale or usage-based royalty with the license representing the predominant item to which the royalty relates. The VOD sales and SVOD usage revenues are determined according to the licensing agreement based on hours viewed by Angel Studios’ customers during each quarter of the year. Angel Studios provides the Company quarterly royalty reports detailing the sales or usage-based royalties, which amounts Angel Studios remits to the Company. The Company recognizes revenue based on these royalty reports, which represents when the sales or usage occurred and the satisfaction of the performance obligation to the end customer. During the years ended December 31, 2021, and December 31, 2020, the digital media revenue was substantially all related to the first and second television season of The Chosen. As Angel Studios is primarily responsible to fulfil the performance obligation and sets the pricing, the Company recognizes revenue on a net basis, which represents the royalty amounts the Company receives from Angel Studios.

Physical Media, Books, and Print Material Sales

The Company sells Blu-Ray discs, DVD’s, books, and related print material to end users. The Company does not own or maintain the physical media inventory. The inventory is held by the book publishers and Angel Studios who fulfill the orders. Revenue is recognized when the end customer receives and pays for the physical media. The book publishers and Angel Studios remit a portion of the sales amount to the Company. The Company recognizes revenue on a net basis.

Box Office Sales

Box office sales stem from licensing agreements with Angel Studios, wherein Angel Studios made arrangements for the Company’s Christmas episode to be released for viewing in theaters across the nation in December 2021. Fathom Events coordinated the event. Revenue is recognized on a net basis reduced for portions due to the theater, the event coordinator, and Angel Studios. Revenue is recognized on the date of the showing on each ticket.

Merchandise Revenue

The Company sells The Chosen merchandise – mainly clothing. Revenue is recognized when the customer receives and pays for the merchandise. The Company does not own or maintain the merchandise inventory. However, when the goods ship from the third party to the customer, the Company has risk-of-loss, and is responsible for goods in transit. Through Mid-March 2021, the Company managed an online store through a third-party application and orders were drop shipped to end customers using the third-party platform.

The Company contracted with a third-party supplier that is responsible for fulfilling the sales. The third-party supplier invoiced the Company for inventory sold and fulfillment services; all of the cost of goods sold is related to the third-party supplier costs. The Company recognized revenue and respective expenses on a gross basis. Revenue is disaggregated from contracts with customers by goods or services as we believe it best depicts how the nature, amount, timing and uncertainty of our revenue and cash flows are affected by economic factors. Since Mid-March 2021, merchandise sales are managed by Angel Studios and inventories are maintained and recognized in the same manner as physical media (all merchandise inventory is owned by Angel Studios).

Ad Share Revenue

The Company has monetized their YouTube and Facebook marketing videos allowing the Company to share in revenue from advertisements shown before, during or alongside the uploaded clip. Revenue is recognized when the ad share payment is payable from the various social media platforms.

| F-11 |

| Table of Contents |

The Chosen, LLC

Notes to the Consolidated Financial Statements

December 31, 2021 and 2020

Note 1 Summary of Significant Accounting Policies, continued

Revenue Recognition, continued

The following table presents the Company’s revenue disaggregated by the previously mentioned performance obligations for the years ended December 31, 2021 and 2020.

Advertising

Advertising costs are expensed as incurred. Advertising expenses for the years ended December 31, 2021 and 2020 totaled $2,319,504 and $2,335,551, respectively.

Income Taxes

The Company is a Utah limited liability company which has elected to be taxed as a C-Corporation. Under this structure, the Company is liable for the income taxes on the Company’s income or loss at the Federal and State levels. Its members are also liable for income taxes on any distributions (dividends) received by the Company. The company has recorded federal and state income taxes receivable of $230,327 and $20,606, respectively, as of December 31, 2021, which are included in “other current assets” on the balance sheet.

The Company accounts for income taxes under the asset and liability method, which requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements. Under this method, the Company determines deferred tax assets and liabilities on the basis of the differences between the financial statement and tax bases of assets and liabilities by using enacted tax rates in effect for the year in which the differences are expected to reverse. The effect of a change in tax rates on deferred tax assets and liabilities is recognized in income in the period that includes the enactment date.

The Company recognizes deferred tax assets to the extent that these assets are considered to be realizable. In making such a determination, the Company considers all available positive and negative evidence, including future reversals of existing taxable temporary differences, projected future taxable income, tax-planning strategies, and results of recent operations. If the Company determines that deferred tax assets would be realized in the future in excess of their net recorded amount, an adjustment would be made to the deferred tax asset valuation allowance, which would reduce the provision for income taxes.

| F-12 |

| Table of Contents |

The Chosen, LLC

Notes to the Consolidated Financial Statements

December 31, 2021 and 2020

Note 1 Summary of Significant Accounting Policies, continued

Income Taxes, continued

The provision for income taxes for the years ended December 31, 2021, and 2020, is comprised of the following components:

Significant components of the Company’s deferred income tax liability are as follows:

The Company has concluded that there are no significant uncertain tax position requiring disclosure, and there are no material amounts of unrecognized tax benefits.

Recently Issued Accounting Pronouncements

In February 2016, the FASB established Topic 842, Leases, by issuing Accounting Standards Update (ASU) No. 2016-02, which requires lessees to recognize leases on-balance sheet and disclose key information about leasing arrangements. Topic 842 was subsequently amended by ASU No. 2018-01, Land Easement Practical Expedient for Transition to Topic 842; ASU No. 2018-10; Codification Improvements to Topic 842, Leases; and ASU No. 2018-11, Targeted Improvements. The new standard establishes a right-of-use model (ROU) that requires a lessee to recognize a ROU asset and lease liability on the balance sheet for all leases with a term longer than 12 months. Leases will be classified as finance or operating, with classification affecting the pattern and classification of expense recognition in the income statement. The Company is required to adopt the new standard effective January 1, 2022. The Company has not yet determined the financial impact the adoption of this ASU will have on the Company’s financial statements.

Subsequent Events

Management has evaluated events and transactions for potential recognition or disclosure through May 2, 2022, which is the date the financial statements were available to be issued.

| F-13 |

| Table of Contents |

The Chosen, LLC

Notes to the Consolidated Financial Statements

December 31, 2021 and 2020

Note 2 Commitments and Contingencies

Litigation

The Company is involved in legal proceedings from time to time arising in the normal course of business. Management, after consultation with legal counsel, believes that the outcome of these proceedings will not have a material impact on the Company’s financial position, results of operations, or liquidity.

Exclusivity Agreement

In 2018, the Company entered into an exclusive video-on-demand and subscription licensing agreement with Angel Studios, for distribution of the Company’s television series. This agreement was amended in November 2019 and September 2020.

Consulting and Coordination Agreement

During the year ended December 31, 2020, the Company issued Angel Studios 480,466 common units. This issuance was for the completion of services included in the 2018 consulting and coordination agreement related to the Company’s Regulation A offering for Preferred A Units. As these are costs of the equity offering, the units are presented on a net basis in contributed capital.

Employee Agreements

The Company has entered into employment agreements with members of management and certain contractors. The terms of the agreements vary but include one or more of the following provisions: stipulated base salary, profit sharing, royalties, retention bonuses, vacation benefits, and severance.

Independent Contractor Agreement

The Company has entered into an independent contractor agreement with Out of Order Studios for services related to the production of the Series and its related products. The initial term of the agreement is for one-year at $500,000 and includes automatic one-year term renewals with $50,000 annual increases until the agreement is terminated.

Lease Agreements

The Company leases some of its operating and office facilities for various terms under long-term, non-cancelable operating lease agreements. The leases expire at various dates through 2026 and provide for renewal options ranging from one month to four terms of ten-years. In the normal course of business, it is expected that these leases will be renewed or replaced by leases on other properties.

The leases do not provide for increases in future minimum annual rental payments. One of the leases requires quarterly payments of the greater of $30,000 or 20% of the gross revenues of the tenant, Impossible Math, LLC. In general, the lease agreements require the Company to pay for real estate taxes, repairs, and maintenance.

| F-14 |

| Table of Contents |

The Chosen, LLC

Notes to the Consolidated Financial Statements

December 31, 2021 and 2020

Note 2 Commitments and Contingencies, continued

Lease Agreements, continued

The following is a maturity analysis of the annual undiscounted cash flows of the operating leases as of December 31, 2021:

Note 3 Preferred Units

The Company’s Class A Preferred Units (Units) are non-voting. If and when distributions are declared, distributions are first made to the holders of the Units until 120% of $1 per Unit has been distributed to the holders in proportion to their interest. Thereafter, distributions are made to the holders of the common units in proportion to their interest.

The Company has authorized 2,857,143 non-voting Class B Preferred Units; none are issued and outstanding. After any issuance of Class B Preferred Units, and if and when distributions are declared, Class B unitholders receive distributions after the Class A unitholders and before common unit holders until 110% of $7 per unit has been distributed to the Class B unitholders in proportion to their interest.

Note 4 Related Party Transactions

The Company entered into an agreement with a member of the Company as a Director and Writer for the second season and paid the member $0 during 2021 and $87,500 during 2020 related to writing and pre-production work on season 2.

During 2019, the Company engaged an advertising agency, which is wholly owned by one of the members of the Company’s parent company. The Company paid the advertising agency $0 in 2021 and $37,925 in 2020.

The Company has entered into various agreements with a company owned by a member of the Company and the member’s spouse to write various books related to the Series. The related company receives a percentage of sales for each book. In total, the amount paid and accrued to the related company for writer fees and book royalties was $269,416 as of December 31, 2021 and $23,741 as of December 31, 2020.

During 2021, the Company engaged a relative of one of the members to provide social media advertising services. The Company paid the related party $5,500 in 2021.

| F-15 |

SIGNATURES

Pursuant to the requirements of Regulation A, the issuer has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized,

| Date | The Chosen, LLC | ||

|

|

| ||

|

| By: The Chosen Productions, LLC | ||

|

| Its: Manager | ||

|

|

|

|

|

|

| By: | /s/ Derral Eves |

|

|

|

| Derral Eves |

|

|

|

| Manager |

|

Pursuant to the requirements of Regulation A, this report has been signed below by the following persons on behalf of the issuer and in the capacities and on the dates indicated.

|

| By: | /s/ Derral Eves |

|

|

|

| Derral Eves |

|

|

|

| Principal Executive Officer, Principal |

|

|

|

| Financial Officer and Principal Accounting Officer |

|

| 11 |