ITEM 1. SCHEDULE OF INVESTMENTS.

The Schedule(s) of Investments is attached herewith.

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Consolidated Schedule of Investments —

December 31, 2023 (Unaudited)

The unaudited consolidated schedule of investments of Partners Group Private Equity (Master Fund), LLC (the “Fund”), a Delaware limited liability company that is registered under the Investment Company Act of 1940, as amended (the “Investment Company Act”), as a non-diversified, closed-end management investment company, as of December 31, 2023, is set forth below:

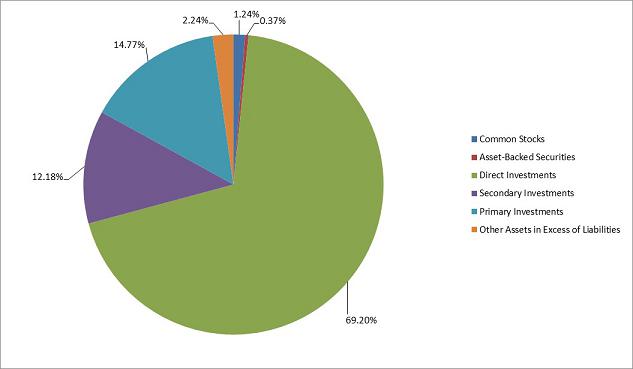

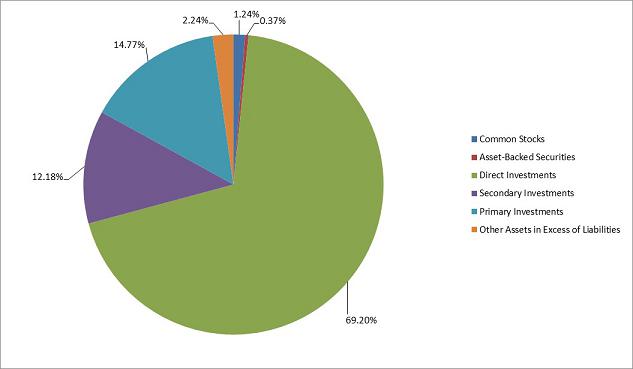

INVESTMENT PORTFOLIO AS A PERCENTAGE OF TOTAL NET ASSETS

| Industry | Acquisition Date | Shares | Fair Value | |||||||||

| Common Stocks (1.24%) | ||||||||||||

| North America (0.68%) | ||||||||||||

| American Tower Corp. | Communication | 05/29/20 | 34,189 | $ | 7,386,533 | |||||||

| American Water Works Co., Inc. | Utilities | 02/16/16 | 53,279 | 7,032,295 | ||||||||

| Apollo Global Management, LLC | Diversified Financial Services | 09/05/23 | 31,608 | 2,944,917 | ||||||||

| Ares Capital Corp. | Diversified Financial Services | 02/16/16 | 141,722 | 2,838,692 | ||||||||

| Ares Management Corp. | Diversified Financial Services | 06/28/19 | 20,960 | 2,492,144 | ||||||||

| Atmos Energy Corp. | Utilities | 02/16/16 | 35,557 | 4,121,056 | ||||||||

| Blackstone Group, Inc. | Diversified Financial Services | 07/12/19 | 30,514 | 3,995,198 | ||||||||

| Brookfield Asset Management, Inc. | Diversified Financial Services | 07/18/22 | 28,626 | 1,149,580 | ||||||||

| Brookfield Corp. | Diversified Financial Services | 12/12/22 | 30,526 | 1,224,703 | ||||||||

| Canadian National Railway Co. | Transportation | 05/14/19 | 33,222 | 4,186,534 | ||||||||

| CMS Energy Corp. | Utilities | 11/01/19 | 87,915 | 5,103,466 | ||||||||

| Crown Castle International Corp. | Communication | 02/16/16 | 30,977 | 3,567,621 | ||||||||

| CSX Corp. | Transportation | 11/28/23 | 66,772 | 2,314,985 | ||||||||

| Equinix Inc. | Diversified Financial Services | 07/31/20 | 4,650 | 3,745,063 | ||||||||

| Fortis Inc. | Utilities | 12/18/17 | 78,949 | 3,257,422 | ||||||||

| Golub Capital BDC Inc. | Diversified Financial Services | 02/24/22 | 189,765 | 2,865,452 | ||||||||

| HarbourVest Global Private Equity | Diversified Financial Services | 12/21/18 | 82,676 | 2,486,448 | ||||||||

| KKR & Co., Inc. | Diversified Financial Services | 02/16/16 | 71,534 | 5,925,877 | ||||||||

| Oaktree Specialty Lending Corp. | Financials | 04/07/21 | 114,385 | 2,335,721 | ||||||||

| Onex Corporation | Diversified Financial Services | 02/16/16 | 26,142 | 1,829,481 | ||||||||

| Republic Services Inc. | Commercial & Professional Services | 08/28/17 | 35,956 | 5,928,785 | ||||||||

| SBA Communications Corp. | Real Estate | 09/05/23 | 13,622 | 3,455,629 | ||||||||

| Sempra Energy | Utilities | 06/28/23 | 28,100 | 2,100,756 | ||||||||

| TC Energy Corp. | Utilities | 11/01/19 | 45,416 | 1,780,852 | ||||||||

| The Williams Companies, Inc. | Utilities | 03/20/23 | 54,869 | 1,911,087 | ||||||||

| TPG Specialty Lending, Inc. | Diversified Financial Services | 01/25/23 | 104,644 | 2,258,218 | ||||||||

| Udemy, Inc. | Transportation | 12/14/23 | 60 | 884 | ||||||||

| Union Pacific Corp. | Transportation | 06/29/16 | 19,401 | 4,766,244 | ||||||||

| Waste Management Inc. | Utilities | 07/02/20 | 17,423 | 3,122,899 | ||||||||

| Total North America (0.68%) | 96,128,542 | |||||||||||

| Western Europe (0.56%) | ||||||||||||

| 3i Group Plc | Diversified Financial Services | 10/01/20 | 175,294 | 5,405,930 | ||||||||

| Aena SA | Transportation | 12/21/18 | 39,774 | 7,209,326 | ||||||||

| Apax Global Alpha Ltd. | Diversified Financial Services | 01/19/21 | 485,904 | 993,214 | ||||||||

| BBGI SICAV S.A. | Diversified Financial Services | 03/21/19 | 2,930,094 | 5,287,286 | ||||||||

| Cellnex Telecom SA | Communication | 05/15/19 | 228,106 | 8,984,945 | ||||||||

| Elia System Operator SA/NV | Utilities | 11/03/22 | 25,487 | 3,182,119 | ||||||||

| EQT AB | Diversified Financial Services | 04/06/20 | 69,107 | 1,947,235 | ||||||||

| HBM Healthcare Investments AG | Diversified Financial Services | 04/07/20 | 5,024 | 1,086,658 | ||||||||

| HgCapital Trust PLC | Diversified Financial Services | 02/12/16 | 1,142,673 | 6,232,377 | ||||||||

| HICL Infrastructure Co Ltd. | Diversified Financial Services | 03/30/16 | 2,266,101 | 4,002,492 | ||||||||

| ICG Graphite Enterprise Trust PLC | Diversified Financial Services | 02/12/16 | 119,861 | 1,863,484 | ||||||||

| Intermediate Capital Group PLC | Diversified Financial Services | 12/12/16 | 130,026 | 2,783,732 | ||||||||

| Investment AB Kinnevik | Diversified Financial Services | 04/06/20 | 287,319 | 3,076,924 | ||||||||

| Investor AB | Diversified Financial Services | 08/28/17 | 164,963 | 3,817,271 | ||||||||

| National Grid PLC | Utilities | 02/12/16 | 366,270 | 4,938,272 | ||||||||

| NB Private Equity Partners Ltd. | Diversified Financial Services | 11/06/19 | 72,012 | 1,530,696 | ||||||||

| Orsted AS | Utilities | 06/15/21 | 24,183 | 1,341,362 | ||||||||

| Pantheon International Participations Plc | Diversified Financial Services | 11/04/19 | 413,440 | 1,628,017 | ||||||||

The accompanying notes are an integral part of these Consolidated Financial Statements.

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Consolidated Schedule of Investments —

December 31, 2023 (Unaudited) (continued)

| Industry | Acquisition Date | Shares | Fair Value | |||||||||

| Public Investments (continued) | ||||||||||||

| Common Stocks (continued) | ||||||||||||

| Western Europe (continued) | ||||||||||||

| Terna Rete Elettrica Nazionale SpA | Utilities | 01/05/18 | 620,822 | $ | 5,178,849 | |||||||

| Vinci SA | Transportation | 02/12/16 | 64,738 | 8,132,778 | ||||||||

| Total Western Europe (0.56%) | 78,622,967 | |||||||||||

| Total Common Stocks (Cost $145,954,179)(1.24%) | $ | 174,751,509 | ||||||||||

| Asset-Backed Securities (0.37%) | ||||||||||||

| Interest | Acquisition Date | Maturity Date | Investment Type | Principal | Fair Value** | ||||||||||||

| North America (0.17%) | |||||||||||||||||

| CIFC Funding 2021-VI Ltd. ***, + | 6.51% + SFvv | 09/22/21 | 10/15/34 | Series 2021-6A, Class E | $ | 1,500,000 | $ | 1,505,313 | |||||||||

| CIFC Funding 2022-IV Ltd. ***, + | 7.00% + SFvv | 04/20/22 | 07/16/35 | Series 2022-4A, Class E | 1,250,000 | 1,295,917 | |||||||||||

| CIFC Funding Ltd. ***, + | 7.27% + SFvv | 04/05/22 | 04/21/35 | Series 2022-3A, Class E | 1,000,000 | 1,026,985 | |||||||||||

| Madison Park Funding LX Ltd. + | 5.50% + SFvv | 11/28/22 | 10/25/35 | Series 2022-60A, Class D | 1,000,000 | 1,022,965 | |||||||||||

| Madison Park Funding LX Ltd. + | 8.95% + SFvv | 11/28/22 | 10/25/35 | Series 2022-60A, Class E | 1,250,000 | 1,320,235 | |||||||||||

| Magnetite CLO Ltd. ***, + | 6.46% + SFvv | 10/01/21 | 10/25/34 | Series 2021-30A, Class E | 1,625,000 | 1,641,693 | |||||||||||

| Magnetite XXIV Ltd. ***, + | 6.40% + SFvv | 02/04/22 | 04/15/35 | Series 2019-24A, Class ER | 4,000,000 | 3,982,296 | |||||||||||

| Magnetite XXVI Ltd. ***, + | 6.21% + SFvv | 08/02/21 | 07/25/34 | Series 2020-26A, Class ER | 1,000,000 | 1,003,484 | |||||||||||

| Neuberger Berman CLO XXI Ltd. ***, + | 3.56% + SFvv | 04/02/21 | 04/20/34 | Series 2016-21A, Class DR2 | 500,000 | 501,376 | |||||||||||

| Neuberger Berman CLO XXI Ltd. ***, + | 6.72% + SFvv | 04/02/21 | 04/20/34 | Series 2016-21A, Class ER2 | 1,000,000 | 1,008,382 | |||||||||||

| Neuberger Berman Loan Advisers CLO 45 Ltd. ***, + | 6.51% + SFvv | 10/07/21 | 10/14/35 | Series 2021-45A, Class E | 1,000,000 | 1,010,656 | |||||||||||

| Ocean Trails CLO IX ***, + | 7.71% + SFvv | 09/22/21 | 10/15/34 | Series 2020-9A, Class ER | 2,647,264 | 2,526,404 | |||||||||||

| Ocean Trails CLO XII Ltd. ***, + | 8.11% + SFvv | 05/13/22 | 07/20/35 | Series 2022-12A, Class E | 1,000,000 | 997,243 | |||||||||||

| Southwick Park CLO LLC ***, + | 6.51% + SFvv | 11/16/21 | 07/20/32 | Series 2019-4A, Class ER | 800,000 | 792,659 | |||||||||||

| Symphony CLO XXV Ltd. ***, + | 6.76% + SFvv | 03/12/21 | 04/19/34 | Series 2021-25A, Class E | 752,616 | 754,486 | |||||||||||

| Symphony CLO XXXIII Ltd. ***, + | 7.10% + SFvv | 04/27/22 | 04/24/35 | Series 2022-33A, Class E | 1,250,000 | 1,281,396 | |||||||||||

| Tallman Park CLO Ltd. ***, + | 6.61% + SFvv | 04/09/21 | 04/20/34 | Series 2021-1A, Class E | 500,000 | 511,721 | |||||||||||

| Wellman Park CLO Ltd. ***, + | 6.51% + SFvv | 05/10/21 | 07/15/34 | Series 2021-1A, Class E | 1,000,000 | 1,022,389 | |||||||||||

| Total North America (0.17%) | 23,205,600 | ||||||||||||||||

| Western Europe (0.20%) | |||||||||||||||||

| Aurium CLO V Designated Activity Co. ***, + | 6.16% + E## | 03/08/21 | 04/17/34 | Series 5A, Class ER | 1,500,000 | 1,646,030 | |||||||||||

| Aurium CLO VII DAC ***, + | 5.86% + E## | 02/04/22 | 05/15/34 | Series 7A, Class E | 1,521,243 | 1,575,423 | |||||||||||

The accompanying notes are an integral part of these Consolidated Financial Statements.

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Consolidated Schedule of Investments —

December 31, 2023 (Unaudited) (continued)

| Interest | Acquisition Date | Maturity Date | Investment Type | Principal | Fair Value** | ||||||||||||

| Public Investments (continued) | |||||||||||||||||

| Asset-Backed Securities (continued) | |||||||||||||||||

| Western Europe (continued) | |||||||||||||||||

| Avoca CLO XXVI DAC ***, + | 9.12% + E## | 02/23/22 | 04/15/35 | Series 26A, Class F | $ | 1,200,000 | $ | 1,271,811 | |||||||||

| Avoca CLO XXVI DAC ***, + | 6.51% + E## | 02/23/22 | 04/15/35 | Series 26A, Class E | 750,000 | 812,844 | |||||||||||

| Blackrock European CLO VIII DAC ***, + | 3.30% + E## | 02/03/22 | 01/20/36 | Series 8A, Class DR | 1,000,000 | 1,027,158 | |||||||||||

| Blackrock European CLO VIII DAC ***, + | 6.26% + E## | 02/03/22 | 01/20/36 | Series 8A, Class ER | 2,500,000 | 2,566,338 | |||||||||||

| Boyce Park CLO Ltd. ***, + | 6.25% + SFvv | 01/28/22 | 04/21/35 | Series 2022-1A, Class E | 2,625,000 | 2,542,460 | |||||||||||

| Carlyle Euro CLO 2021-1 DAC ***, + | 6.12% + E## | 05/01/21 | 04/15/34 | Series 2021-1A, Class D | 333,000 | 344,558 | |||||||||||

| Carlyle Global Market Strategies 2015-1 Ltd. ***, + | 0.00% | 01/20/22 | 01/16/33 | Series 2015-1A, Class SUB | 3,000,000 | 1,202,563 | |||||||||||

| Carlyle Global Market Strategies 2015-1 Ltd. ***, + | 5.50% + E## | 01/20/22 | 01/16/33 | Series 2015-1A, Class DR | 1,502,063 | 1,577,340 | |||||||||||

| Carysfort Park CLO ***, + | 6.14% + E## | 03/12/21 | 07/28/34 | Series 2021-1A, Class D | 500,000 | 542,847 | |||||||||||

| CVC Cordatus Loan Fund + | 6.16% + E## | 11/07/22 | 01/15/37 | Series 26A, Class D1 | 1,100,000 | 1,258,413 | |||||||||||

| CVC Cordatus Loan Fund + | 7.73% + E## | 11/07/22 | 01/15/37 | Series 26A, Class D2 | 400,000 | 461,847 | |||||||||||

| Edmondstown Park CLO DAC + | 6.19% + E## | 11/18/22 | 07/21/35 | Series 1A, Class D | 1,100,000 | 1,250,694 | |||||||||||

| Edmondstown Park CLO DAC + | 6.77% + E## | 11/18/22 | 07/21/35 | Series 1A, Class E | 1,250,000 | 1,439,034 | |||||||||||

| Octagon 58 Ltd. ***, + | 7.20% + SFvv | 04/21/22 | 07/15/37 | Series 2022-1A, Class E | 2,140,000 | 2,139,050 | |||||||||||

| Otranto Park CLO ***, + | 7.05% + E## | 03/04/22 | 05/15/35 | Series 1A, Class E | 1,172,000 | 1,281,551 | |||||||||||

| Otranto Park CLO ***, + | 4.15% + E## | 03/04/22 | 05/15/35 | Series 1A, Class D | 750,000 | 824,942 | |||||||||||

| Palmer Square European Loan Funding 2021-1 DAC ***, + | 5.95% + E## | 08/02/21 | 04/15/31 | Series 2021-1A, Class E | 714,000 | 773,301 | |||||||||||

| Palmer Square European Loan Funding 2021-2 DAC ***, + | 8.05% + E## | 10/15/21 | 07/15/31 | Series 2021-2A, Class F | 375,000 | 389,489 | |||||||||||

| Palmer Square European Loan Funding 2021-2 DAC ***, + | 5.90% + E## | 10/15/21 | 07/15/31 | Series 2021-2A, Class E | 625,000 | 670,945 | |||||||||||

| Palmer Square European Loan Funding 2022-1 DAC ***, + | 5.90% + E## | 02/03/22 | 10/15/31 | Series 2022-1A, Class E | 667,000 | 711,911 | |||||||||||

| Palmer Square European Loan Funding 2022-1 DAC ***, + | 8.05% + E## | 02/03/22 | 10/15/31 | Series 2022-1A, Class F | 500,000 | 517,074 | |||||||||||

| Palmer Square European Loan Funding 2022-1 DAC ***, + | 7.37% + E## | 03/17/22 | 10/15/31 | Series 2022-2A, Class E | 1,500,000 | 1,648,493 | |||||||||||

| Total Western Europe (0.20%) | 28,476,116 | ||||||||||||||||

| Total Asset-Backed Securities (Cost $52,195,404)(0.37%) | $ | 51,681,716 | |||||||||||||||

| Private Equity Investments (96.15%) | |||||||||||||||||

| Direct Investments * (69.20%) | |||||||||||||||||

| Direct Equity (61.26%) | |||||||||||||||||

| Investment Type | Acquisition Date | Shares | Fair Value** | |||||||||

| Asia - Pacific (3.85%) | ||||||||||||

| AAVAS Financiers Limited +, a | Common equity | 06/23/16 | 3,891,752 | $ | 64,932,449 | |||||||

| Argan Mauritius Limited +, a | Common equity | 05/09/16 | 106,215 | 19,059,581 | ||||||||

| KKR Pebble Co-Invest L.P. +, a, c | Limited partnership interest | 05/13/21 | — | 31,268,793 | ||||||||

| Partners Terra Pte. Ltd. +, a, b, e | Common equity | 05/14/21 | 5,486,085 | 8,218,337 | ||||||||

| PG Esmeralda Pte. Ltd. +, a, b | Common equity | 03/03/21 | 5,433,284 | 4,070,464 | ||||||||

The accompanying notes are an integral part of these Consolidated Financial Statements.

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Consolidated Schedule of Investments —

December 31, 2023 (Unaudited) (continued)

| Investment Type | Acquisition Date | Shares | Fair Value** | |||||||||

| Private Equity Investments (continued) | ||||||||||||

| Direct Investments * (continued) | ||||||||||||

| Direct Equity (continued) | ||||||||||||

| PG Esmeralda Pte. Ltd. +, a, b | Preferred equity | 03/03/21 | 488,996 | $ | 36,634,175 | |||||||

| PG Esmeralda Pte. Ltd. +, a, b | Preferred equity | 09/26/22 | 78,171 | 9,922,069 | ||||||||

| PG Loa Pte. Ltd. +, a | Common equity | 04/25/22 | 118,793 | 1,448,554 | ||||||||

| PG Loa Pte. Ltd. +, a | Preferred equity | 04/25/22 | 2,257,072 | 27,522,517 | ||||||||

| Sunsure Energy Private Limited +, a, b, c | Member interest | 12/27/22 | — | 7,523,306 | ||||||||

| Sunsure Energy Private Limited +, a, b | Common equity | 12/27/22 | 481,884 | 541,475 | ||||||||

| Sunsure Energy Private Limited +, a, b | Preferred equity | 12/27/22 | 1,927,535 | 2,006,215 | ||||||||

| TPG Upswing Co-Invest, L.P. +, a, c | Limited partnership interest | 01/10/19 | — | 23,310,548 | ||||||||

| Zenith Longitude Limited +, a, b, e | Common equity | 08/13/21 | 26,838,037 | 305,779,788 | ||||||||

| Total Asia - Pacific (3.85%) | 542,238,271 | |||||||||||

| North America (29.50%) | ||||||||||||

| Alliant Insurance Services, Inc. +, a, c, e | Limited partnership interest | 12/01/21 | — | 36,727,088 | ||||||||

| AmSurg HoldCo, LLC +, a | Common equity | 11/03/23 | 896,098 | 31,671,279 | ||||||||

| AP VIII Prime Security Services Holdings, L.P. +, a, c | Limited partnership interest | 05/02/16 | — | 8,608,177 | ||||||||

| Astorg VII Co-Invest ERT +, a, c, e | Limited partnership interest | 01/31/20 | — | 61,437,252 | ||||||||

| Astorg VII Co-Invest ERT +, a, c | Limited partnership interest | 04/28/21 | — | 12,808,058 | ||||||||

| BCPE Hercules Holdings, L.P. +, a, c, e | Limited partnership interest | 07/30/18 | — | 73,458,368 | ||||||||

| BI Gen Holdings, Inc. +, a | Common equity | 01/01/21 | 14,561 | 316,755 | ||||||||

| CapitalSpring Finance Company, LLC +, a, b | Common equity | 03/01/17 | 3,020,546 | 2,690,874 | ||||||||

| CB Poly Holdings, LLC +, a | Preferred equity | 08/16/16 | 171,270 | 47,967,340 | ||||||||

| CB Titan MidCo Holdings, Inc. +, a | Common equity | 01/01/21 | 56,634 | 1 | ||||||||

| CBI Parent, L.P. +, a, b, e | Common equity | 01/06/21 | 1,145,918 | — | ||||||||

| CBI Parent, L.P. +, a, b, c | Member interest | 10/17/22 | — | — | ||||||||

| CD&R Mercury Co-Investor, L.P. +, a, c, e | Limited partnership interest | 10/14/20 | — | 289,847,637 | ||||||||

| Checkers Topco, LLC +, a | Common equity | 06/16/23 | 9,517 | 74,966 | ||||||||

| Confluent Health Holdings LP +, a, b, e | Common equity | 05/30/19 | 30,362 | 74,578,745 | ||||||||

| ConvergeOne Investment L.P. +, a | Common equity | 07/03/19 | 3,120 | — | ||||||||

| Cowboy Topco, Inc. +, a | Common equity | 05/18/22 | 1,348,750 | 1,562,690 | ||||||||

| Cure Holdings, LLC +, a | Common equity | 05/13/21 | 241,557 | 1,379,360 | ||||||||

| Dermatology Holdings, L.P. +, a, b, c, e | Limited partnership interest | 04/01/22 | — | 130,539,294 | ||||||||

| DIF VI Co-Invest Project 2C C.V. +, a, c | Limited partnership interest | 03/15/22 | — | 52,590,046 | ||||||||

| ECP Parent, LLC +, a, b, e | Common equity | 11/15/21 | 105,520,023 | 97,383,093 | ||||||||

| ECP Parent, LLC +, a | Preferred equity | 12/21/23 | 4,258,337 | 4,278,645 | ||||||||

| EdgeCore Holdings, L.P. +, a, b, c, e | Limited partnership interest | 11/10/22 | — | 76,404,757 | ||||||||

| Encore Holdings LP +, a, b, c, e | Limited partnership interest | 07/01/22 | — | 97,998,407 | ||||||||

| EnfraGen LLC +, a, b, e | Common equity | 09/17/19 | 37,786 | 86,795,293 | ||||||||

| EQT Infrastructure IV Co-Investment (B) SCSp +, a, c, e | Limited partnership interest | 03/09/20 | — | 123,200,707 | ||||||||

| EQT IX Co-Investment (F) SCSp +, a, c | Limited partnership interest | 11/15/21 | — | 127,040,173 | ||||||||

| EQT VIII Co-Investment (C) SCSp +, a, c, e | Limited partnership interest | 01/25/19 | — | 104,137,838 | ||||||||

| EXW Coinvest L.P. +, a, c, e | Limited partnership interest | 06/17/16 | — | 5,154,865 | ||||||||

| FRP Investors II, L.P. +, a, c | Limited partnership interest | 09/16/22 | — | 57,868,887 | ||||||||

| Halo Parent Newco, LLC +, a | Preferred equity | 02/22/22 | 1,109 | 19,249,906 | ||||||||

| Icebox Holdco I Inc. +, a, b, c | Member interest | 03/01/22 | — | 62,602,357 | ||||||||

| Icebox Parent L.P. +, a, b, c, e | Limited partnership interest | 12/22/21 | — | 193,647,033 | ||||||||

| Idera Parent L.P. +, a, b, c, e | Limited partnership interest | 03/02/21 | — | 267,175,174 | ||||||||

| KDOR Merger Sub Inc. +, a | Common equity | 05/11/18 | 481 | 1 | ||||||||

| KENE Holdings, L.P. +, a, c | Limited partnership interest | 08/08/19 | — | 432,845 | ||||||||

| KKR Cavalry Co-Invest Blocker Parent L.P. +, a, c | Limited partnership interest | 03/24/22 | — | 57,249,629 | ||||||||

| KKR Enterprise Co-Invest AIV A L.P. +, a, c | Limited partnership interest | 07/31/20 | — | 549,611 | ||||||||

| KKR Enterprise Co-Invest L.P. +, a | Common equity | 10/09/18 | 9,684 | — | ||||||||

| KPOCH Holdings, L.P. +, a, b, c, e | Limited partnership interest | 11/10/22 | — | 178,972,125 | ||||||||

| KPSKY Holdings L.P. +, a, b, c | Limited partnership interest | 10/19/21 | — | 79,966,908 | ||||||||

The accompanying notes are an integral part of these Consolidated Financial Statements.

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Consolidated Schedule of Investments —

December 31, 2023 (Unaudited) (continued)

| Investment Type | Acquisition Date | Shares | Fair Value** | |||||||||

| Private Equity Investments (continued) | ||||||||||||

| Direct Investments * (continued) | ||||||||||||

| Direct Equity (continued) | ||||||||||||

| KSLB Holdings, LLC +, a | Common equity | 07/30/18 | 252,000 | $ | 1 | |||||||

| LTF Holdings, Inc. +, a, e | Common equity | 01/06/20 | 3,464,630 | 52,211,958 | ||||||||

| Matterhorn Topco, L.P. +, a, c | Limited partnership interest | 12/27/23 | — | 15,396,472 | ||||||||

| MHS Acquisition Holdings, LLC +, a, b | Common equity | 03/10/17 | 356 | 565,444 | ||||||||

| MHS Acquisition Holdings, LLC +, a, b | Preferred equity | 03/10/17 | 35,285 | 307,131 | ||||||||

| MHS Blocker Purchaser L.P. +, a, b, c | Limited partnership interest | 03/10/17 | — | 67,466,895 | ||||||||

| Milestone Investment Holdings, LLC +, a, e | Common equity | 09/23/21 | 22,293,150 | 33,478,085 | ||||||||

| National Spine & Pain Centers, LLC +, a | Common equity | 04/01/23 | 43,791 | 1 | ||||||||

| NC Ocala Co-Invest Alpha, L.P. +, a, c | Limited partnership interest | 11/24/21 | — | 83,866,617 | ||||||||

| OHCP IV SF COI, L.P. +, a, b, c, e | Limited partnership interest | 01/31/18 | — | 70,390,776 | ||||||||

| OMNIA Coinvest L.P. +, a, c, e | Limited partnership interest | 10/23/20 | — | 28,256,945 | ||||||||

| Onex Fox, L.P. +, a, c, e | Limited partnership interest | 04/25/19 | — | 79,263,722 | ||||||||

| Orion Opportunity L.P. +, a, c, e | Limited partnership interest | 09/01/21 | — | 45,920,627 | ||||||||

| Patriot SPV, L.P. +, a, c, e | Limited partnership interest | 03/18/21 | — | 88,587,126 | ||||||||

| PG BRPC Investment, LLC +, a, b | Common equity | 08/01/19 | 32,079 | 85,184,699 | ||||||||

| PG Delta HoldCo, LLC +, a, b, e | Common equity | 06/24/21 | 39,869 | 82,776,819 | ||||||||

| Raptor Holding Parent, L.P. +, a | Common equity | 04/01/22 | 11,209 | 1,557,861 | ||||||||

| Real Hero Topco, L.P. +, a, c | Limited partnership interest | 04/01/21 | — | 15,689,532 | ||||||||

| Safari Co-Investment L.P. +, a, c | Limited partnership interest | 03/14/18 | — | 11,056,545 | ||||||||

| SC Landco Parent, LLC +, a | Preferred equity | 04/21/17 | — | 1 | ||||||||

| SC Landco Parent, LLC +, a | Common equity | 11/21/13 | 2,672 | 485,499 | ||||||||

| Shermco Intermediate Holdings, Inc. +, a | Common equity | 06/05/18 | 11,525 | 2,679,492 | ||||||||

| Shingle Coinvest L.P. +, a, c, d | Limited partnership interest | 05/29/18 | — | 175,735,176 | ||||||||

| SIH RP HoldCo L.P. +, a, e | Common equity | 09/10/19 | 5,995,126 | 63,141,509 | ||||||||

| SLP West Holdings Co-Invest Feeder II, L.P. +, a, c | Limited partnership interest | 08/18/17 | — | 28,691,142 | ||||||||

| SnackTime PG Holdings, Inc. +, a, b, e | Common equity | 05/23/18 | 12 | — | ||||||||

| SnackTime PG Holdings, Inc. +, a, b, c, e | Member interest | 05/23/18 | — | 10,218,799 | ||||||||

| Specialty Pharma Holdings LP +, a, b, c, e | Limited partnership interest | 04/01/21 | — | 145,737,422 | ||||||||

| Starfish Intermediate, Inc. +, a | Preferred equity | 06/06/22 | 7,136,374 | 209,123,557 | ||||||||

| Stonepeak Tiger (Co-Invest) Holdings (I-B) L.P. +, a, c | Limited partnership interest | 08/17/21 | — | 33,219,000 | ||||||||

| SureWerx Topco, L.P. +, a, b, c | Limited partnership interest | 12/28/22 | — | 52,745,291 | ||||||||

| T-VIII Mercury Co-Invest L.P. +, a, c | Limited partnership interest | 07/29/21 | — | 6,913,292 | ||||||||

| Thermostat Purchaser, L.P. +, a, b, c | Limited partnership interest | 08/31/21 | — | 76,663,526 | ||||||||

| TKC Topco LLC +, a | Common equity | 10/14/16 | 4,632,829 | — | ||||||||

| VEEF II Co-Invest 2-A, L.P. +, a, c, e | Limited partnership interest | 03/15/22 | — | 4,456,405 | ||||||||

| Velocity Holdings US LP +, a, c | Limited partnership interest | 08/31/22 | — | 28,977,003 | ||||||||

| VEPF VII Co-Invest 2-A, L.P. +, a, c | Limited partnership interest | 04/06/21 | — | 55,499,298 | ||||||||

| VEPF VII Co-Invest 2-A, L.P. +, a, c, e | Limited partnership interest | 04/06/21 | — | 22,450,583 | ||||||||

| WHCG Purchaser, Inc. +, a, b, c | Member interest | 06/14/23 | — | 2,356,975 | ||||||||

| WHCG Purchaser, L.P. +, a, b, c | Limited partnership interest | 06/22/21 | — | 10,386,624 | ||||||||

| Woof Parent L.P. +, a | Common equity | 12/21/20 | 1,441 | 1,133,714 | ||||||||

| Total North America (29.50%) | 4,158,957,748 | |||||||||||

| Rest of World (1.74%) | ||||||||||||

| Carlyle Retail Turkey Partners, L.P. +, a, c, e | Limited partnership interest | 07/11/13 | — | 7,297,988 | ||||||||

| Zabka Polska SA +, a | Preferred equity | 09/25/19 | 120,777,003 | 3,608,945 | ||||||||

| Zabka Polska SA +, a, e | Common equity | 09/25/19 | 2,551,723 | 234,029,482 | ||||||||

| Total Rest of World (1.74%) | 244,936,415 | |||||||||||

| South America (0.02%) | ||||||||||||

| Centauro Co-Investment Fund, L.P. +, a, c, e | Limited partnership interest | 11/28/13 | — | 3,297,127 | ||||||||

| Total South America (0.02%) | 3,297,127 | |||||||||||

The accompanying notes are an integral part of these Consolidated Financial Statements.

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Consolidated Schedule of Investments —

December 31, 2023 (Unaudited) (continued)

| Investment Type | Acquisition Date | Shares | Fair Value** | |||||||||

| Private Equity Investments (continued) | ||||||||||||

| Direct Investments * (continued) | ||||||||||||

| Direct Equity (continued) | ||||||||||||

| Western Europe (26.15%) | ||||||||||||

| Ark EquityCo SAS +, a, c | Limited partnership interest | 02/21/22 | — | $ | 15,688,699 | |||||||

| Aston Lux Acquisitions S.à.r.l. +, a, c, e | Limited partnership interest | 11/28/19 | — | 3,518,557 | ||||||||

| Aston Lux Acquisitions S.à.r.l. +, a | Common equity | 01/11/21 | 218,625 | 239,732 | ||||||||

| Astorg VIII Co-Invest Open Health +, a, c | Limited partnership interest | 08/04/22 | — | 23,360,205 | ||||||||

| Astorg VIII Co-Invest Open Health +, a, c | Limited partnership interest | 07/14/23 | — | 391,849 | ||||||||

| Bock Capital JVCo Nature S.à.r.l. +, a, b | Common equity | 07/01/21 | 12,590,000,000 | 180,862,862 | ||||||||

| Camelia Investment 1 Limited +, a, b | Preferred equity | 10/12/17 | 6,768,617,529 | 155,879,381 | ||||||||

| Camelia Investment 1 Limited +, a, b | Common equity | 10/12/17 | 86,516 | 6,773,078 | ||||||||

| Capri Acquisitions Topco Limited +, a, e | Common equity | 11/01/17 | 8,345,985 | 77,283,835 | ||||||||

| CD&R Market Co-Investor, L.P. +, a, c | Limited partnership interest | 11/10/21 | — | 61,584,417 | ||||||||

| Ciddan S.à.r.l. +, a | Preferred equity | 09/15/17 | 23,249,522 | 28,529,658 | ||||||||

| Ciddan S.à.r.l. +, a | Common equity | 09/15/17 | 12,263,240 | 82,521,007 | ||||||||

| Climeworks AG +, a, e | Common equity | 04/25/22 | 63,085 | 698,782 | ||||||||

| Climeworks AG +, a, e | Preferred equity | 04/25/22 | 7,823,400 | 86,658,118 | ||||||||

| EQT Future Co-Investment (C) SCSp +, a, c, e | Limited partnership interest | 02/15/23 | — | 70,711,225 | ||||||||

| EQT Jaguar Co-Investment SCSp +, a, b, c, e | Limited partnership interest | 11/30/18 | — | 45,153,258 | ||||||||

| EQT Jaguar Co-Investment SCSp +, a, b, c | Limited partnership interest | 11/30/18 | — | 11,775,266 | ||||||||

| EQT VIII Co-Investment (D) SCSp +, a, c, e | Limited partnership interest | 10/01/19 | — | 218,172,872 | ||||||||

| EQT VIII Co-Investment (D) SCSp +, a, c | Limited partnership interest | 10/01/19 | — | 13,608,429 | ||||||||

| Fides S.p.A +, a | Common equity | 12/15/16 | 78,505 | 451,101 | ||||||||

| Global Blue Group Holding AG +, a, d | Common equity | 09/11/20 | 97,250 | 457,369 | ||||||||

| Global Blue Holding L.P. +, a, c, d, e | Limited partnership interest | 07/31/12 | — | 7,715,000 | ||||||||

| Green DC LuxCo S.à.r.l. +, a, b, c | Member interest | 01/20/22 | — | 23,652,999 | ||||||||

| Green DC LuxCo S.à.r.l. +, a, b | Common equity | 01/20/22 | 23,694,756 | 99,073,775 | ||||||||

| KKR Pegasus Co-Invest L.P. +, a, c | Limited partnership interest | 07/07/22 | — | 16,139,247 | ||||||||

| KKR Sprint Co-Invest L.P. +, a, c | Limited partnership interest | 09/29/22 | — | 24,076,124 | ||||||||

| KKR Traviata Co-invest L.P. +, a, c | Limited partnership interest | 12/18/19 | — | 144,269,037 | ||||||||

| Luxembourg Investment Company 261 S.à.r.l. +, a | Common equity | 07/31/18 | 1,484 | 69,872,499 | ||||||||

| Luxembourg Investment Company 261 S.à.r.l. +, a, c | Member interest | 07/31/18 | — | 63,336,952 | ||||||||

| Luxembourg Investment Company 285 S.à.r.l. +, a, b | Preferred equity | 08/22/19 | 7,865,820 | 20,456,214 | ||||||||

| Luxembourg Investment Company 285 S.à.r.l. +, a, b, c | Member interest | 08/22/19 | — | 22,005,099 | ||||||||

| Luxembourg Investment Company 285 S.à.r.l. +, a, b, e | Common equity | 08/22/19 | 6,999,953 | — | ||||||||

| Luxembourg Investment Company 293 S.à.r.l. +, a, b, e | Common equity | 06/26/19 | 9,789,622 | 42,270,237 | ||||||||

| Luxembourg Investment Company 293 S.à.r.l. +, a, b, c, e | Member interest | 06/26/19 | — | 11,727,699 | ||||||||

| Luxembourg Investment Company 314 S.à.r.l. +, a, b, e | Common equity | 08/22/19 | 192,000 | 1 | ||||||||

| Luxembourg Investment Company 404 S.à.r.l. +, a, b, e | Common equity | 02/14/23 | 145,800 | 6,667,035 | ||||||||

| Luxembourg Investment Company 404 S.à.r.l. +, a, b | Preferred equity | 02/14/23 | — | 14,221,469 | ||||||||

| Luxembourg Investment Company 414 S.à.r.l. +, a, b, c | Member interest | 07/02/21 | — | 41,477,597 | ||||||||

| Luxembourg Investment Company 414 S.à.r.l. +, a, b | Common equity | 07/02/21 | 12,316,087 | 60,109,394 | ||||||||

| Luxembourg Investment Company 430 S.à.r.l. +, a, b | Common equity | 05/10/21 | 52,594,635 | 62,274,752 | ||||||||

| Luxembourg Investment Company 430 S.à.r.l. +, a, b, c | Member interest | 05/10/21 | — | 16,067,354 | ||||||||

| Magnesium Co-Invest SCSp +, a, c | Limited partnership interest | 05/19/22 | — | 98,127,415 | ||||||||

| Mauritius (Luxemburg) Investments S.à.r.l. +, a | Common equity | 10/19/21 | 11,698 | 1 | ||||||||

| May Co-Investment S.C.A. +, a, b, e | Common equity | 11/09/20 | 1,059,375 | 89,529,030 | ||||||||

| Nerve Co-Invest SCSp +, a, c | Limited partnership interest | 01/27/21 | — | 52,876,857 | ||||||||

| Nerve Co-Invest SCSp +, a, c | Limited partnership interest | 01/31/23 | — | 7,166,722 | ||||||||

| Oakley Capital V Co-Investment (A) SCSp +, a, c | Limited partnership interest | 12/12/22 | — | 45,939,852 | ||||||||

| Orbiter Investments S.à.r.l. +, a, b | Common equity | 12/17/21 | 2,708,100 | 95,639,541 | ||||||||

| Orbiter Investments S.à.r.l. +, a, b, e | Common equity | 12/17/21 | 5,379,543 | 189,984,485 | ||||||||

| OT Luxco 3 & Cy S.C.A. +, a | Warrants | 12/01/17 | 844,553 | 1,192,847 | ||||||||

| Partners Group Satellite HoldCo S.à.r.l. +, a, b | Common equity | 03/22/23 | 7,017,978 | 625,301 | ||||||||

| Partners Group Satellite HoldCo S.à.r.l. +, a, b | Preferred equity | 03/22/23 | 7,975,901 | 54,132,583 | ||||||||

The accompanying notes are an integral part of these Consolidated Financial Statements.

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Consolidated Schedule of Investments —

December 31, 2023 (Unaudited) (continued)

| Investment Type | Acquisition Date | Shares | Fair Value** | |||||||||

| Private Equity Investments (continued) | ||||||||||||

| Direct Investments * (continued) | ||||||||||||

| Direct Equity (continued) | ||||||||||||

| Partners Group Satellite Warehouse S.C.S. +, a, b, c, e | Member interest | 03/22/23 | — | $ | 1,234,712 | |||||||

| PG Investment Company 1 S.à.r.l. +, a, b, c | Member interest | 10/28/21 | — | 93,073,129 | ||||||||

| PG Investment Company 1 S.à.r.l. +, a, b | Common equity | 10/28/21 | 12,822,040 | 8,040,831 | ||||||||

| PG Investment Company 18 S.à.r.l. +, a, b | Preferred equity | 07/07/22 | 113,856,528 | 149,044,747 | ||||||||

| PG Investment Company 18 S.à.r.l. +, a, b | Common equity | 07/07/22 | 12,650,106 | 19,223,979 | ||||||||

| PG Investment Company 24 S.à.r.l. +, a, b | Common equity | 07/13/22 | 891,924 | 26,182,301 | ||||||||

| PG Investment Company 24 S.à.r.l. +, a, b | Preferred equity | 07/13/22 | 101,367,616 | 128,447,213 | ||||||||

| PG Lion Management Warehouse S.C.S +, a, b, c | Limited partnership interest | 08/22/19 | — | 410,126 | ||||||||

| PG TLP S.à.r.l. +, a, b, c, d | Member interest | 04/14/21 | — | 28,840,473 | ||||||||

| PG TLP S.à.r.l. +, a, b, d | Common equity | 04/14/21 | 6,473,126 | 81,321,746 | ||||||||

| PG Wave Limited +, a, b | Common equity | 02/03/22 | 53,215,581 | 87,587,841 | ||||||||

| Pharmathen GP S.à.r.l. +, a, b | Common equity | 01/20/22 | 110,300 | 1 | ||||||||

| Pharmathen Topco S.à.r.l. +, a, b | Preferred equity | 01/20/22 | 98,858,068 | 131,393,768 | ||||||||

| Pharmathen Topco S.à.r.l. +, a, b | Common equity | 01/20/22 | 79,910 | 21,604,114 | ||||||||

| Polyusus Lux XVI S.à.r.l. +, a, b, e | Common equity | 05/23/18 | 44,442,345 | — | ||||||||

| Polyusus Lux XVI S.à.r.l. +, a, b, e | Preferred equity | 05/23/18 | 244,659,996 | — | ||||||||

| Polyusus Lux XVI S.à.r.l. +, a, b, c | Member interest | 10/01/22 | — | 629,997 | ||||||||

| Polyusus Lux XXIII S.à.r.l. +, a | Preferred equity | 04/11/22 | 1,155,552 | 51,679 | ||||||||

| Polyusus Lux XXIII S.à.r.l. +, a, e | Preferred equity | 08/19/21 | 13,114,964 | 909,612 | ||||||||

| Polyusus Lux XXIII S.à.r.l. +, a, e | Common equity | 08/19/21 | 3,936,244 | 34,257 | ||||||||

| Polyusus Lux XXIII S.à.r.l. +, a | Common equity | 08/19/21 | 447,324 | 122,889 | ||||||||

| Refresco 2 Co-Invest SCSp +, a, c, e | Limited partnership interest | 07/12/22 | — | 46,122,155 | ||||||||

| Rivage Luxco S.à.r.l. +, a | Common equity | 02/22/22 | 900,000 | 65,487,828 | ||||||||

| Root JVCo S.à.r.l. +, a, b, c | Member interest | 09/29/20 | — | 40,820,929 | ||||||||

| Root JVCo S.à.r.l. +, a, b | Common equity | 02/07/23 | 2,362,997 | 639,188 | ||||||||

| Root JVCo S.à.r.l. +, a, b | Preferred equity | 02/07/23 | 8,686,753 | 53,073,397 | ||||||||

| S.TOUS, S.L +, a | Common equity | 10/06/15 | 622 | 19,532,563 | ||||||||

| Strider Investment 2 +, a, e | Preferred equity | 04/01/23 | 278,539 | 845,643 | ||||||||

| Strider Investment 3 +, a, e | Preferred equity | 04/01/23 | 24,476 | 27,043 | ||||||||

| Strider Topco S.a.s. +, a, c, e | Member interest | 04/01/23 | — | 3,688,930 | ||||||||

| Strider Topco S.a.s. +, a, e | Common equity | 04/01/23 | 8,103,589 | 24,658,915 | ||||||||

| Strider Topco S.a.s. +, a, e | Preferred equity | 04/01/23 | 52,066,591 | 62,418,465 | ||||||||

| Surfaces SLP (SCSp) +, a, b, c, e | Limited partnership interest | 10/01/20 | — | 31,967,443 | ||||||||

| Vanquish Bidco +, a, c | Member interest | 05/25/23 | — | 3,627,963 | ||||||||

| Vanquish Topco +, a | Common equity | 05/25/23 | 379,731 | 1 | ||||||||

| Vanquish Topco +, a | Preferred equity | 05/25/23 | 34,851,987 | 46,124,498 | ||||||||

| Veonet Co-Invest SCSp (Lux) +, a, c | Limited partnership interest | 03/09/22 | — | 44,369,276 | ||||||||

| Total Western Europe (26.15%) | 3,686,504,470 | |||||||||||

| Total Direct Equity (61.26%) | $ | 8,635,934,031 | ||||||||||

| Direct Debt (7.94%) | ||||||||||||

| Interest | Acquisition Date | Maturity Date | Investment Type | Principal | Fair Value** | |||||||||||

| Asia - Pacific (0.41%) | ||||||||||||||||

| BYJU's Alpha, Inc. +, a | Cash 8.00% + P (0.75% Floor) | 01/19/22 | 11/24/26 | Senior | $ | 2,707,968 | $ | 990,670 | ||||||||

| FFML Holdco Limited +, a | Cash 6.25% + BBSY (0.75% Floor)†† | 11/30/22 | 11/30/28 | Senior | 12,229,627 | 12,296,148 | ||||||||||

| Fugue Finance B.V. +, a | Cash 3.25% + E## | 08/24/20 | 08/30/24 | Senior | 1,299,487 | 1,222,028 | ||||||||||

| Fugue Finance B.V. +, a | Cash 4.50% + SF (0.50% Floor)vv | 03/10/23 | 01/31/28 | Senior | 3,483,725 | 3,504,139 | ||||||||||

| Global Academic Group Limited +, a | Cash 6.00% + BBSY (0.50% Floor)†† | 07/26/22 | 07/26/27 | Senior | 12,728,400 | 12,733,610 | ||||||||||

| Global Academic Group Limited +, a | Cash 6.00% + BBSY (0.50% Floor)†† | 07/29/22 | 07/29/27 | Senior | $ | 4,651,970 | $ | 4,488,650 | ||||||||

| Greencross Limited +, a | Cash 5.75% + SF (0.75% Floor)vv | 03/22/22 | 03/23/28 | Senior | 10,261,238 | 10,191,641 | ||||||||||

| ICON Cancer Care +, a, e | Cash 7.25% + BBSY (0.50% Floor)† | 04/12/22 | 03/29/30 | Second Lien | 10,284,819 | 9,262,006 | ||||||||||

| Snacking Investments BidCo Pty Limited +, a | Cash 4.00% + SF (1.00% Floor)v | 01/15/20 | 12/18/26 | Senior | 1,251,250 | 1,253,077 | ||||||||||

| Voyage Australia Pty Ltd +, a | Cash 3.50% + SF (0.50% Floor)vv | 07/23/21 | 06/18/28 | Senior | 1,666,000 | 1,665,904 | ||||||||||

| Total Asia - Pacific (0.41%) | 57,607,873 | |||||||||||||||

The accompanying notes are an integral part of these Consolidated Financial Statements.

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Consolidated Schedule of Investments —

December 31, 2023 (Unaudited) (continued)

| Interest | Acquisition Date | Maturity Date | Investment Type | Principal | Fair Value** | |||||||||||

| Private Equity Investments (continued) | ||||||||||||||||

| Direct Investments * (continued) | ||||||||||||||||

| Direct Debt (continued) | ||||||||||||||||

| North America (5.04%) | ||||||||||||||||

| Acrisure LLC +, a | Cash 3.75% + SF (0.50% Floor)v | 08/18/21 | 02/13/27 | Senior | 2,156,000 | 2,151,575 | ||||||||||

| Acrisure LLC +, a | Cash 3.50% + SFv | 03/27/20 | 02/15/27 | Senior | 1,839,334 | 1,833,422 | ||||||||||

| Acrisure LLC +, a | Cash 4.25% + SF (0.50% Floor)v | 12/08/21 | 02/15/27 | Senior | 982,500 | 983,680 | ||||||||||

| Acrisure LLC +, a | Cash 4.50% + SFvv | 11/10/23 | 10/18/30 | Senior | 1,000,000 | 1,003,335 | ||||||||||

| ADMI Corp. +, a | Cash 3.75% + SF (0.50% Floor)vv | 07/14/21 | 12/23/27 | Senior | 1,372,000 | 1,304,352 | ||||||||||

| Aimbridge Acquisition Co., Inc. +, a | Cash 3.75% + SFv | 04/26/23 | 02/02/26 | Senior | 2,984,456 | 2,783,199 | ||||||||||

| Air Medical Group Holdings, Inc. +, a | Cash 4.75% + SF (1.00% Floor)vv | 02/25/21 | 10/02/25 | Senior | 972,500 | 764,685 | ||||||||||

| AIT Buyer, LLC +, a, e | Cash 7.50% + SF (0.75% Floor)v | 04/06/21 | 03/30/29 | Second Lien | 6,860,000 | 6,838,830 | ||||||||||

| Alliant Holdings Intermediate, LLC +, a | Cash 3.50% + SF (0.50% Floor)v | 12/08/21 | 11/05/27 | Senior | 1,568,000 | 1,292,188 | ||||||||||

| Amneal Pharmaceuticals, Inc. +, a, e | Cash 3.50% + SFv | 06/03/22 | 05/04/25 | Senior | 8,409,542 | 8,342,518 | ||||||||||

| Apex Group Treasury Limited +, a | Cash 3.75% + SF (0.50% Floor)vv | 08/27/21 | 07/27/28 | Senior | 2,060,962 | 2,050,565 | ||||||||||

| Apex Tool Group +, a | Cash 5.25% + SF (0.50% Floor)v | 02/22/22 | 02/08/29 | Senior | 987,500 | 868,647 | ||||||||||

| Applovin Corporation +, a | Cash 3.10% + SFv | 03/24/21 | 08/15/25 | Senior | 972,054 | 971,571 | ||||||||||

| Applovin Corporation +, a | Cash 3.10% + SF (0.50% Floor)v | 12/08/21 | 10/25/28 | Senior | 1,379,000 | 1,378,168 | ||||||||||

| AQA Acquisition Holding, Inc. +, a, e | Cash 4.25% + SF (0.50% Floor)vv | 03/18/21 | 03/03/28 | Senior | 1,075,250 | 1,073,047 | ||||||||||

| AqGen Island Holdings, Inc. +, a, e | Cash 6.50% + SF (0.50% Floor)vv | 08/19/21 | 08/02/29 | Second Lien | 7,049,750 | 6,798,603 | ||||||||||

| athenahealth Group, Inc. +, a, e | Cash 3.50% + SF (0.50% Floor)vv | 02/23/22 | 02/15/29 | Senior | 4,677,344 | 4,648,007 | ||||||||||

| Banff Guarantor, Inc. +, a | Cash 5.50% + SF (0.50% Floor)v | 01/31/22 | 02/27/26 | Second Lien | 1,700,000 | 1,700,000 | ||||||||||

| Banff Merger Sub Inc. +, a, e | Cash 3.75% + SFvv | 01/31/22 | 10/02/25 | Senior | 2,783,762 | 2,798,557 | ||||||||||

| Barracuda Networks, Inc. +, a | Cash 7.00% + SF (0.50% Floor)vv | 05/17/22 | 08/15/30 | Second Lien | 4,000,000 | 3,575,840 | ||||||||||

| Bausch & Lomb Inc. +, a, e | Cash 3.25% + SF (0.50% Floor)vvvv | 05/18/22 | 05/10/27 | Senior | 3,258,750 | 3,232,289 | ||||||||||

| Bausch + Lomb Corp. +, a | Cash 4.00% + SFv | 09/14/23 | 09/29/28 | Senior | 2,000,000 | 1,997,494 | ||||||||||

| BCPE Empire Holdings, Inc. +, a | Cash 4.75% + SF (0.50% Floor)v | 06/07/23 | 12/11/28 | Senior | 2,284,275 | 2,287,527 | ||||||||||

| Bella Holding Company, LLC +, a | Cash 3.75% + SF (0.75% Floor)v | 05/13/21 | 04/01/28 | Senior | 3,528,000 | 3,502,672 | ||||||||||

| BI Gen Holdings, Inc. +, a | Cash 4.25% + SFvv | 10/04/18 | 09/05/25 | Senior | 5,540,815 | 5,531,543 | ||||||||||

| BlueConic Holding, Inc. +, a | Cash 6.50% + SF (0.75% Floor)vv | 01/27/22 | 01/27/28 | Senior | 18,912,000 | 18,616,453 | ||||||||||

| BlueConic Holding, Inc. +, a | Cash 6.50% + SF (0.75% Floor)vv | 06/13/23 | 01/27/28 | Senior | 7,092,000 | 6,981,170 | ||||||||||

| Brown Group Holding, LLC +, a, e | Cash 3.75% + SF (0.50% Floor)vv | 06/09/22 | 07/02/29 | Senior | 1,686,482 | 1,689,003 | ||||||||||

| Burger Bossco Intermediate, Inc. +, a | Cash 4.25% + SF (1.00% Floor)vv | 01/01/21 | 04/25/24 | Senior | 56,834 | 56,942 | ||||||||||

| Campaign Monitor (UK) Limited +, a | Cash 8.90% + SF (1.00% Floor)vv | 01/01/21 | 11/06/25 | Second Lien | 1,650,000 | 1,640,482 | ||||||||||

| CapitalSpring Finance Company, LLC +, a, b | PIK 5.00% | 03/01/17 | 02/10/25 | Mezzanine | 3,841,036 | 3,361,537 | ||||||||||

| CapitalSpring Finance Company, LLC +, a, b, e | Cash 8.00% | 03/01/17 | 02/10/25 | Mezzanine | 3,767,924 | 3,560,726 | ||||||||||

| Carestream Dental Equipment, Inc. +, a | Cash 4.50% + SF (0.50% Floor)vv | 11/26/21 | 09/01/24 | Senior | 1,376,009 | 1,147,825 | ||||||||||

| Carestream Dental Equipment, Inc. +, a | Cash 8.00% + SF (1.00% Floor)vv | 11/26/21 | 09/01/25 | Second Lien | 3,000,000 | 1,350,000 | ||||||||||

| Cengage Learning, Inc. +, a | Cash 4.75% + SF (1.00% Floor)vv | 11/09/23 | 07/14/26 | Senior | 1,994,898 | 2,003,516 | ||||||||||

| Central Parent, Inc. +, a | Cash 4.50% + SF (0.50% Floor)vv | 07/12/22 | 07/06/29 | Senior | 992,500 | 999,269 | ||||||||||

| Charlotte Buyer Inc +, a | Cash 5.25% + SF (0.50% Floor)vv | 08/16/22 | 02/11/28 | Senior | 3,392,500 | 3,402,279 | ||||||||||

| Charter NEX US, Inc. +, a | Cash 3.75% + SF (0.75% Floor)v | 05/31/19 | 12/01/27 | Senior | 1,423,557 | 1,431,792 | ||||||||||

The accompanying notes are an integral part of these Consolidated Financial Statements.

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Consolidated Schedule of Investments —

December 31, 2023 (Unaudited) (continued)

| Interest | Acquisition Date | Maturity Date | Investment Type | Principal | Fair Value** | |||||||||||

| Private Equity Investments (continued) | ||||||||||||||||

| Direct Investments * (continued) | ||||||||||||||||

| Direct Debt (continued) | ||||||||||||||||

| Checkers Drive-in Restaurants, Inc. +, a | Cash 7.00% + SFvv | 06/16/23 | 06/16/27 | Senior | $ | 7,136 | $ | 7,178 | ||||||||

| Cheniere Energy Partners +, a, e | Cash 3.75% + SF (0.50% Floor)vvvv | 06/09/21 | 06/04/28 | Senior | 3,225,750 | 2,935,180 | ||||||||||

| Clydesdale Acquisition Holdings, Inc. +, a | Cash 4.175% + SF (0.50% Floor)vv | 04/19/22 | 04/13/29 | Senior | 1,283,750 | 1,287,703 | ||||||||||

| CommScope, Inc. +, a, e | Cash 3.25% + SFv | 04/26/19 | 04/06/26 | Senior | 3,481,865 | 3,114,666 | ||||||||||

| ConnectWise, LLC +, a | Cash 3.50% + SF (0.76% Floor)v | 10/06/21 | 09/29/28 | Senior | 1,670,250 | 1,666,000 | ||||||||||

| Conservice Midco, LLC +, a | Cash 4.25% + SFvv | 05/18/20 | 05/13/27 | Senior | 1,649,000 | 1,650,968 | ||||||||||

| ConvergeOne Holdings, Inc. +, a | Cash 5.00% + SFvvv | 03/27/19 | 01/04/26 | Senior | 2,865,000 | 1,625,203 | ||||||||||

| ConvergeOne Holdings, Inc. +, a | Cash 8.50% + SFvv | 04/15/19 | 01/04/27 | Second Lien | 31,200,000 | 7,595,328 | ||||||||||

| Convergint Tech LLC +, a | Cash 6.75% + SF (0.76% Floor)v | 04/12/21 | 03/30/29 | Second Lien | 1,400,000 | 1,269,331 | ||||||||||

| Cornerstone OnDemand, Inc. +, a | Cash 3.75% + SF (0.50% Floor)v | 10/22/21 | 10/16/28 | Senior | 1,182,000 | 1,143,630 | ||||||||||

| Cornerstone OnDemand, Inc. +, a | Cash 6.00% + SF (1.00% Floor)v | 09/07/23 | 10/16/28 | Senior | 2,992,500 | 2,903,740 | ||||||||||

| Critical Start +, a | Cash 3.125% + SF (0.75% Floor)vv + PIK 3.125% | 05/18/22 | 05/18/28 | Senior | 8,422,318 | 8,252,443 | ||||||||||

| Critical Start, Inc. +, a, e | Cash 6.25% + SF (0.75% Floor)vv | 05/18/22 | 05/18/28 | Senior | 1,348,750 | 696,530 | ||||||||||

| Critical Start, Inc. +, a | Cash 6.25% + SF (0.75% Floor)vv | 03/27/23 | 05/17/28 | Senior | 4,591,970 | 4,498,210 | ||||||||||

| Crown Subsea Communications Holding, Inc. +, a | Cash 4.75% + SF (0.75% Floor)v | 05/05/21 | 04/27/27 | Senior | 4,487,671 | 4,521,329 | ||||||||||

| CSC Holdings, LLC +, a, e | Cash 2.50% + SFv | 08/11/21 | 04/15/27 | Senior | 2,020,051 | 1,916,109 | ||||||||||

| CSC Holdings, LLC +, a, e | Cash 4.50% + SFv | 12/07/18 | 01/15/26 | Senior | 2,870,649 | 2,820,413 | ||||||||||

| DCert Buyer, Inc. +, a | Cash 4.00% + SFv | 10/24/19 | 10/16/26 | Senior | 1,933,646 | 1,915,821 | ||||||||||

| Deerfield Dakota Holding, LLC +, a | Cash 3.75% + SF (1.00% Floor)vv | 06/01/20 | 04/09/27 | Senior | 967,500 | 957,159 | ||||||||||

| Delta Topco, Inc. +, a, e | Cash 3.75% + SF (0.75% Floor)vv | 01/06/21 | 12/01/27 | Senior | 2,052,750 | 2,049,036 | ||||||||||

| Dentive Capital, LLC +, a, e | Cash 7.00% + SF (0.75% Floor)vv | 12/23/22 | 12/22/28 | Senior | 1,557,757 | 317,272 | ||||||||||

| Dentive Capital, LLC +, a | Cash 7.00% + SF (0.75% Floor)vv | 12/23/22 | 12/22/28 | Senior | 12,189,043 | 12,010,126 | ||||||||||

| Dexko Global, Inc. +, a | Cash 3.75% + SF (0.50% Floor)vv | 10/07/21 | 10/04/28 | Senior | 1,576,000 | 1,565,665 | ||||||||||

| DG Investment Intermediate Holdings 2, Inc. +, a | Cash 4.75% + SF (0.75% Floor)vv | 11/15/22 | 03/31/28 | Senior | 2,286,725 | 2,280,950 | ||||||||||

| DG Investment Intermediate Holdings 2, Inc. +, a, e | Cash 3.75% + SF (0.76% Floor)v | 04/23/21 | 03/31/28 | Senior | 1,270,792 | 1,259,170 | ||||||||||

| Diamond Parent Midco Inc. +, a | Cash 6.25% + SF (1.00% Floor)vv | 09/01/22 | 08/04/25 | Senior | 29,064,529 | 29,061,900 | ||||||||||

| Dieter’s Metal Fabricating Limited +, a | Cash 5.25% + SF (1.00% Floor)vv | 12/19/23 | 12/19/29 | Senior | — | 433,873 | ||||||||||

| EAB Global, Inc. +, a | Cash 4.00% + SF (0.75% Floor)v | 08/25/21 | 11/19/26 | Senior | — | 2,156,000 | ||||||||||

| ECI Macola/Max Holding, LLC +, a | Cash 3.75% + SF (0.75% Floor)vv | 09/13/21 | 11/09/27 | Senior | 1,661,558 | 1,660,021 | ||||||||||

| Element Materials Technology +, a, f | Cash 4.25% + SF (0.50% Floor)vv | 08/17/22 | 06/22/29 | Senior | 313,421 | 1,875,804 | ||||||||||

| Element Materials Technology +, a, f | Cash 4.25% + SFvv | 08/17/22 | 06/22/29 | Senior | 679,079 | 4,064,242 | ||||||||||

| Emrld Borrower L.P. +, a, e | Cash 3.00% + SFvv | 05/04/23 | 05/31/30 | Senior | 834,862 | 836,681 | ||||||||||

| Endurance International Group Holdings, Inc. +, a, e | Cash 3.50% + SF (0.75% Floor)vv | 04/28/21 | 02/10/28 | Senior | 3,812,250 | 3,735,367 | ||||||||||

| Engineered Machinery Holdings, Inc. +, a | Cash 3.50% + SF (0.75% Floor)vv | 08/16/21 | 05/21/28 | Senior | 1,572,000 | 1,561,383 | ||||||||||

| Epiq Systems +, a, e | Cash 4.75% + SF (0.75% Floor)v | 06/02/22 | 04/26/29 | Senior | 3,960,000 | 3,914,035 | ||||||||||

| Evergreen Services Group, LLC +, a | Cash 6.25% + SF (0.75% Floor)vv | 06/15/22 | 06/15/29 | Senior | 13,688,425 | 13,764,742 | ||||||||||

| Explorer Holdings, Inc. +, a | Cash 8.00% + SF (0.50% Floor)v | 02/04/20 | 02/04/28 | Second Lien | 19,491,899 | 18,322,384 | ||||||||||

| Filtration Group Corporation +, a | Cash 3.50% + SF (0.50% Floor)v | 11/01/21 | 10/21/28 | Senior | 2,058,000 | 2,057,882 | ||||||||||

| First Student Bidco Inc. +, a, e | Cash 3.00% + SF (0.98% Floor)vv | 08/11/21 | 08/21/28 | Senior | 1,085,622 | 1,022,258 | ||||||||||

| First Student Bidco, Inc. +, a, e | Cash 4.00% + SF (0.50% Floor)vv | 08/05/22 | 07/21/28 | Senior | 927,958 | 927,378 | ||||||||||

| Flynn Restaurant Group LP +, a | Cash 4.25% + SF (0.50% Floor)v | 12/10/21 | 11/22/28 | Senior | 3,359,838 | 3,372,146 | ||||||||||

| Galls, LLC +, a | Cash 6.25% + SF (1.00% Floor)vv | 12/22/20 | 01/31/25 | Senior | 514,031 | 492,522 | ||||||||||

| GHX Ultimate Parent Corporation +, a | Cash 4.75% + SF (1.00% Floor)vv | 01/01/21 | 06/22/24 | Senior | 1,901,058 | 1,908,586 | ||||||||||

The accompanying notes are an integral part of these Consolidated Financial Statements.

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Consolidated Schedule of Investments —

December 31, 2023 (Unaudited) (continued)

| Interest | Acquisition Date | Maturity Date | Investment Type | Principal | Fair Value** | |||||||||||

| Private Equity Investments (continued) | ||||||||||||||||

| Direct Investments * (continued) | ||||||||||||||||

| Direct Debt (continued) | ||||||||||||||||

| GHX Ultimate Parent Corporation +, a | Cash 4.75% + SF (0.50% Floor)v | 05/09/23 | 06/30/27 | Senior | $ | — | $ | 957,819 | ||||||||

| Great American Outdoors Group, LLC +, a | Cash 3.75% + SF (0.75% Floor)vv | 05/14/21 | 03/06/28 | Senior | 1,750,770 | 1,748,487 | ||||||||||

| GTCR W Merger Sub, LLC +, a, f | Cash 3.00% + SF (0.50% Floor)vv | 09/20/23 | 09/20/30 | Senior | 1,800,000 | 1,810,134 | ||||||||||

| Heartland Dental Holdings, Inc. +, a | Cash 5.00% + SF (0.75% Floor)vv | 05/15/18 | 04/30/25 | Senior | 5,811,426 | 5,874,821 | ||||||||||

| Heartland Home Services, Inc. +, a | Cash 6.75% + SF (1.00% Floor)vv | 11/08/22 | 12/15/26 | Senior | 11,940,000 | 11,916,519 | ||||||||||

| Help/Systems Holdings, Inc. +, a | Cash 6.75% + SF (0.75% Floor)vv | 11/05/21 | 11/19/27 | Second Lien | 3,600,000 | 2,958,192 | ||||||||||

| Help/Systems Holdings, Inc. +, a | Cash 4.00% + SF (1.00% Floor)vv | 05/25/21 | 11/19/26 | Senior | 4,093,939 | 3,873,327 | ||||||||||

| High Bar Brands Operating, LLC +, a, e | Cash 5.25% + SF (1.00% Floor)vv | 12/19/23 | 12/19/29 | Senior | 442,727 | 2,089,417 | ||||||||||

| Hornblower Sub, LLC +, a | Cash 4.50% + SFvv | 05/01/19 | 04/27/25 | Senior | 931,371 | 41,139 | ||||||||||

| Howden Group Holdings Ltd. +, a | 01/01/00 | 04/18/30 | 1,400,000 | 1,404,956 | ||||||||||||

| Hub International Ltd. +, a, e | Cash 4.25% + SF (0.75% Floor)vv | 06/08/23 | 06/20/30 | Senior | 1,100,000 | 1,103,521 | ||||||||||

| Husky Injection Molding Systems Ltd. +, a, e | Cash 3.00% + SF (1.00% Floor)vv | 05/22/19 | 03/28/25 | Senior | 4,923,047 | 4,909,532 | ||||||||||

| Idera, Inc. +, a, b | Cash 3.75% + SF (0.75% Floor)vv | 12/17/18 | 06/27/24 | Senior | 1,238,627 | 1,231,590 | ||||||||||

| Indy US Bidco, LLC +, a, e | Cash 3.75% + SFvv | 03/29/21 | 03/06/28 | Senior | 975,100 | 933,222 | ||||||||||

| INNIO Group Holdings GmbH +, a | Cash 3.25% + E# | 11/30/18 | 10/31/25 | Senior | 1,415,436 | 1,383,848 | ||||||||||

| Integrity Marketing Acquisition, LLC +, a | Cash 6.02% + SF (0.75% Floor)vv | 06/21/22 | 08/27/25 | Senior | 20,054,413 | 19,728,705 | ||||||||||

| Integrity Marketing Intermediate, LLC +, a, e | Cash 6.00% + SF (0.75% Floor)vv | 05/23/23 | 08/27/26 | Senior | 5,741,423 | 4,077,877 | ||||||||||

| Iris Holdings Inc. +, a | Cash 4.75% + SF (0.50% Floor)vv | 06/15/22 | 06/28/28 | Senior | 1,830,508 | 1,691,482 | ||||||||||

| KCIBT Intermediate II, Inc. +, a, e | Cash 1.00% + SF (1.00% Floor)vv | 12/23/20 | 06/01/25 | Senior | 250,658 | 158,332 | ||||||||||

| KENE Acquisition, Inc. +, a | Cash 8.25% + SF (1.00% Floor)vv | 01/01/21 | 08/09/27 | Second Lien | 1,638,000 | 1,625,353 | ||||||||||

| KENE Acquisition, Inc. +, a | Cash 8.25% + SFvv | 08/05/22 | 08/09/27 | Second Lien | 984,997 | 977,392 | ||||||||||

| Kingpin Intermediate Holdings LLC +, a | Cash 3.50% + SFv | 10/05/18 | 07/03/24 | Senior | 4,302,851 | 4,297,427 | ||||||||||

| Knowlton Development Corporation Inc. +, a, e | Cash 3.75% + SFv | 06/24/22 | 12/22/25 | Senior | 1,480,620 | 1,470,256 | ||||||||||

| KSLB Holdings, LLC +, a | Cash 8.75% + SF (1.00% Floor)vv | 01/01/21 | 07/30/26 | Second Lien | 3,212,308 | 2,428,762 | ||||||||||

| LBM Acquisition, LLC +, a, e | Cash 3.25% + SF (0.75% Floor)v | 09/07/21 | 12/17/27 | Senior | 3,228,376 | 4,771,300 | ||||||||||

| LogMeIn, Inc. +, a, e | Cash 4.75% + SFvv | 09/03/20 | 08/31/27 | Senior | 4,845,760 | 3,221,030 | ||||||||||

| LSCS Holdings, Inc. +, a | Cash 4.50% + SF (0.50% Floor)vv | 02/14/22 | 12/16/28 | Senior | 2,554,500 | 2,515,513 | ||||||||||

| Magenta Buyer LLC +, a | Cash 8.25% + SF (0.75% Floor)vv | 10/13/21 | 07/27/29 | Second Lien | 2,000,000 | 800,000 | ||||||||||

| Magenta Buyer LLC +, a | Cash 5.00% + SF (0.75% Floor)vv | 08/02/21 | 07/27/28 | Senior | 3,430,000 | 2,454,594 | ||||||||||

| Maverick Bidco, Inc. +, a | Cash 6.75% + SF (0.75% Floor)vv | 05/26/21 | 05/18/29 | Second Lien | 6,603,000 | 6,124,282 | ||||||||||

| Max US BidCo, Inc. +, a | Cash 5.00% + SF (0.50% Floor)vv | 10/11/23 | 10/03/30 | Senior | 5,000,000 | 4,686,250 | ||||||||||

| McAfee Inc. +, a | Cash 3.75% + SF (0.50% Floor)vv | 03/09/22 | 03/01/29 | Senior | 2,567,500 | 2,557,274 | ||||||||||

| Medline Borrower, L.P. +, a | Cash 3.25% + SF (0.50% Floor)v | 11/03/21 | 10/23/28 | Senior | 1,083,500 | 1,087,251 | ||||||||||

| Mercury Borrower, Inc. +, a | Cash 6.50% + SF (0.50% Floor)vv | 04/11/22 | 08/02/29 | Second Lien | 900,000 | 867,937 | ||||||||||

| Mitchell International, Inc. +, a | Cash 3.75% + SF (0.50% Floor)v | 10/21/21 | 10/15/28 | Senior | 3,743,000 | 3,737,271 | ||||||||||

| Mitchell International, Inc. +, a | Cash 6.50% + SF (0.50% Floor)vv | 10/26/21 | 10/15/29 | Second Lien | 1,000,000 | 983,855 | ||||||||||

| MJH Healthcare Holdings, LLC +, a, e | Cash 3.50% + SF (0.50% Floor)vv | 04/08/22 | 01/28/29 | Senior | 1,674,500 | 1,666,074 | ||||||||||

| National Spine & Pain Centers, LLC +, a | Cash 8.50% + SFvv | 04/01/23 | 02/13/26 | Senior | 463,906 | 178,609 | ||||||||||

| Navicure, Inc. +, a, e | Cash 4.00% + SFvv | 11/19/19 | 10/22/26 | Senior | 2,907,191 | 2,907,633 | ||||||||||

| NEP Group, Inc. +, a, e | Cash 3.25% + SFv + PIK 1.50% | 02/10/22 | 10/20/25 | Senior | 1,051,205 | 1,013,091 | ||||||||||

| NEP Group, Inc. +, a | Cash 4.00% + SF (0.50% Floor)vvvv | 12/06/21 | 10/20/25 | Senior | 1,866,750 | 1,810,438 | ||||||||||

| Netsmart Technologies, Inc. +, a | Cash 3.75% + SF (1.00% Floor)vv | 07/16/18 | 10/01/27 | Senior | 2,199,735 | 2,201,127 | ||||||||||

| NSM Top Holdings Corp. +, a | Cash 5.25% + SFvv | 11/26/19 | 11/16/26 | Senior | 1,443,750 | 1,399,803 | ||||||||||

| NSPC Intermediate II, LLC +, a, e | Cash 8.00% + SF (1.00% Floor)vv | 08/15/23 | 02/13/26 | Senior | 46,876 | 42,155 | ||||||||||

The accompanying notes are an integral part of these Consolidated Financial Statements.

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Consolidated Schedule of Investments —

December 31, 2023 (Unaudited) (continued)

| Interest | Acquisition Date | Maturity Date | Investment Type | Principal | Fair Value** | |||||||||||

| Private Equity Investments (continued) | ||||||||||||||||

| Direct Investments * (continued) | ||||||||||||||||

| Direct Debt (continued) | ||||||||||||||||

| NSPC Intermediate II, LLC +, a | Cash 8.00% + SF (1.00% Floor)vv | 05/08/23 | 02/13/26 | Senior | $ | 22,601 | $ | 20,325 | ||||||||

| nThrive Health Inc. +, a | Cash 4.00% + SF (0.50% Floor)vv | 05/24/22 | 12/18/28 | Senior | 1,970,000 | 1,570,526 | ||||||||||

| Oceankey (U.S.) II Corp. +, a, e | Cash 3.50% + SF (0.05% Floor)vv | 01/06/22 | 12/15/28 | Senior | 1,871,500 | 1,829,415 | ||||||||||

| Odyssey Logistics & Technology Corp. +, a | Cash 4.50% + SF (0.50% Floor)vv | 08/10/23 | 10/12/27 | Senior | 2,524,200 | 2,503,210 | ||||||||||

| OEConnection LLC +, a | Cash 4.00% + SFvv | 10/28/19 | 09/25/26 | Senior | 2,899,151 | 2,890,624 | ||||||||||

| Olympus Water US Holding Corp. +, a, e | Cash 5.00% + SF (1.50% Floor)vv | 05/24/23 | 11/09/28 | Senior | 1,500,000 | 1,506,851 | ||||||||||

| OneDigital Borrower LLC +, a, f | Cash 4.25% + SF (0.50% Floor)vv | 12/11/20 | 11/16/27 | Senior | 2,743,862 | 4,834,580 | ||||||||||

| OneDigital Holdings, LLC +, a | Cash 6.00% + SF (0.50% Floor)v | 03/21/23 | 11/16/27 | Senior | 7,646,535 | 7,519,888 | ||||||||||

| PAI Holdco, Inc. +, a | Cash 3.75% + SF (1.00% Floor)vv | 11/09/20 | 10/22/27 | Senior | 1,169,999 | 1,091,879 | ||||||||||

| Pascal Midco 2, LLC +, a | Cash 6.00% + SF (0.75% Floor)vv | 07/01/22 | 07/21/27 | Senior | 13,673,306 | 13,573,432 | ||||||||||

| PECF USS Intermediate Holding III Corporation +, a, e | Cash 4.25% + SF (0.50% Floor)vv | 10/07/22 | 12/15/28 | Senior | 987,437 | 773,831 | ||||||||||

| Peraton Corp. +, a | Cash 3.75% + SF (0.75% Floor)v | 04/12/21 | 02/01/28 | Senior | 1,908,690 | 1,910,829 | ||||||||||

| Pluto Acquisition I, Inc. +, a, e | Cash 7.00% + SF (0.50% Floor)v | 07/02/21 | 12/14/29 | Senior | 3,700,000 | 1,303,906 | ||||||||||

| Polaris Newco, LLC +, a | Cash 4.00% + SF (0.50% Floor)v | 06/15/21 | 06/02/28 | Senior | 1,176,000 | 1,156,138 | ||||||||||

| Pre-Paid Legal Services, Inc. +, a, e | Cash 7.00% + SF (0.50% Floor)v | 01/18/22 | 12/14/29 | Senior | 3,700,000 | 3,385,500 | ||||||||||

| Pretium PKG Holdings, Inc. +, a | Cash 6.75% + SF (0.50% Floor)vv | 10/05/21 | 10/01/29 | Second Lien | 1,800,000 | 716,139 | ||||||||||

| ProAmpac PG Borrower, LLC +, a | Cash 4.50% + SF (0.75% Floor)v | 09/26/23 | 09/15/28 | Senior | 2,007,790 | 2,013,653 | ||||||||||

| Procera Networks, Inc. +, a | Cash 4.50% + SFv | 11/20/18 | 10/31/25 | Senior | 1,128,717 | 914,261 | ||||||||||

| Project Alpha Intermediate Holding, Inc. +, a | Cash 4.75% + SF (0.50% Floor)v | 10/31/23 | 10/28/30 | Senior | 4,500,000 | 4,535,437 | ||||||||||

| Project Leopard Holdings, Inc. +, a | Cash 5.25% + SF (0.50% Floor)vv | 06/15/22 | 07/20/29 | Senior | 2,977,500 | 2,700,235 | ||||||||||

| Prometric Holdings PIK, Inc. +, a | Cash 7.50% + SF (1.00% Floor)vv; PIK 9.25% | 10/06/23 | 07/31/28 | Mezzanine | 7,159,000 | 7,106,662 | ||||||||||

| Prometric Holdings, Inc. +, a | Cash 3.00% + SF (1.00% Floor)vv | 10/26/23 | 01/31/28 | Senior | 5,894,407 | 5,899,948 | ||||||||||

| Prometric Holdings, Inc. +, a | Cash 7.50% + SF (1.00% Floor)v | 10/06/23 | 01/31/28 | Senior | 1,632,000 | 1,633,534 | ||||||||||

| Quintiles IMS Inc. +, a | Cash 2.00% + E (0.50% Floor)## | 06/22/18 | 06/11/25 | Senior | 2,803,629 | 6,399 | ||||||||||

| Radiate HoldCo, LLC +, a | Cash 3.25% + SF (0.75% Floor)vv | 07/16/19 | 09/25/26 | Senior | 982,500 | 789,361 | ||||||||||

| Radiology Partners, Inc. +, a, e | Cash 4.25% + SFvv | 01/01/21 | 07/09/25 | Senior | 2,398,864 | 1,929,892 | ||||||||||

| Radwell Parent, LLC +, a, e | Cash 6.75% + SF (0.75% Floor)vv | 12/01/22 | 04/01/29 | Senior | 1,120,924 | 236,480 | ||||||||||

| Radwell Parent, LLC +, a | Cash 6.75% + SF (0.75% Floor)vv | 04/06/22 | 04/01/29 | Senior | 14,005,299 | 14,074,617 | ||||||||||

| Radwell Parent, LLC +, a | Cash 6.50% + SF (0.75% Floor)vv | 12/01/22 | 04/01/29 | Senior | 5,956,472 | 5,986,030 | ||||||||||

| Raptor Parent, LLC +, a | Cash 5.75% + SF (0.75% Floor)vv | 04/06/22 | 04/01/29 | Senior | 113,461 | 114,312 | ||||||||||

| RBMedia +, a, e | Cash 4.00% + SFv | 06/17/22 | 08/29/25 | Senior | 1,148,950 | — | ||||||||||

| RC Buyer, Inc. +, a | Cash 6.25% + SF (0.75% Floor)vv | 08/03/21 | 07/26/29 | Second Lien | 2,800,000 | 2,716,000 | ||||||||||

| Recess Holdings, Inc. +, a | Cash 4.00% + SF (1.00% Floor)vv | 09/06/23 | 03/17/27 | Senior | 3,800,000 | 3,823,667 | ||||||||||

| Red Planet Borrower, LLC +, a | Cash 3.75% + SF (0.50% Floor)v | 10/04/21 | 10/02/28 | Senior | 3,584,571 | 4,471,733 | ||||||||||

| Redstone Holdco 2 L.P. +, a | Cash 4.75% + SF (0.75% Floor)v | 05/10/21 | 04/27/28 | Senior | 1,083,705 | 825,902 | ||||||||||

| Redstone Holdco 2 L.P. +, a | Cash 7.75% + SF (0.75% Floor)v | 05/03/21 | 04/16/29 | Second Lien | 2,500,000 | 1,550,000 | ||||||||||

| Rent-A-Center, Inc. +, a | Cash 4.00% + SF (0.75% Floor)vv | 03/02/21 | 02/17/28 | Senior | 927,340 | 926,580 | ||||||||||

| Restaurant Technologies, Inc. +, a | Cash 4.25% + SF (0.50% Floor)vv | 04/06/22 | 04/02/29 | Senior | 3,447,500 | 3,415,109 | ||||||||||

| Restoration Hardware, Inc. +, a | Cash 3.25% + SF (0.50% Floor)vv | 05/24/22 | 10/20/28 | Senior | 4,455,000 | 4,360,430 | ||||||||||

| RLG Holdings, LLC +, a | Cash 4.25% + SF (0.75% Floor)v | 07/19/21 | 07/10/28 | Senior | 1,965,000 | 1,848,280 | ||||||||||

| Rocket Software, Inc. +, a, e | Cash 4.25% + SFv | 12/05/18 | 11/28/25 | Senior | 5,800,482 | 5,695,575 | ||||||||||

| Rough Country, LLC +, a | Cash 3.25% + SF (0.75% Floor)vv | 08/03/21 | 07/26/28 | Senior | 1,857,250 | 1,851,446 | ||||||||||

| Ryan, LLC +, a, e | Cash 4.50% + SF (0.50% Floor)v | 11/20/23 | 11/14/30 | Senior | 1,447,619 | 1,454,408 | ||||||||||

| Ryan, LLC +, a | Cash 4.50% + SF (0.50% Floor)vv | 11/09/23 | 11/14/30 | Senior | 152,381 | 152,381 | ||||||||||

| Sabre GLBL Inc. +, a, e | Cash 3.50% + SF (0.50% Floor)v | 08/09/21 | 12/17/27 | Senior | 1,118,754 | 983,944 | ||||||||||

| Sabre GLBL Inc. +, a, e | Cash 3.50% + SF (0.50% Floor)vv | 08/09/21 | 12/17/27 | Senior | 715,945 | 628,056 | ||||||||||

| Safe Fleet Holdings LLC +, a, b | Cash 3.75% + SF (0.50% Floor)vv | 03/04/22 | 02/23/29 | Senior | 3,841,500 | 3,847,326 | ||||||||||

| SCIH Salt Holdings, Inc. +, a | Cash 4.00% + SF (0.75% Floor)v | 04/17/20 | 03/16/27 | Senior | 795,892 | 795,819 | ||||||||||

The accompanying notes are an integral part of these Consolidated Financial Statements.

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Consolidated Schedule of Investments —

December 31, 2023 (Unaudited) (continued)

| Interest | Acquisition Date | Maturity Date | Investment Type | Principal | Fair Value** | |||||||||||

| Private Equity Investments (continued) | ||||||||||||||||

| Direct Investments * (continued) | ||||||||||||||||

| Direct Debt (continued) | ||||||||||||||||

| Senneca Holdings, Inc. +, a | PIK 11.00% | 01/01/21 | 05/11/26 | Second Lien | $ | 1,276,647 | $ | 3 | ||||||||

| Senneca Holdings, Inc. +, a | PIK 10.00% | 01/01/21 | 11/11/25 | 1.5 Lien | 1,337,500 | 1 | ||||||||||

| Shearer's Foods, LLC +, a | Cash 3.50% + SF (1.00% Floor)v | 05/17/18 | 09/23/27 | Senior | 3,074,220 | 3,104,569 | ||||||||||

| Shearer's Foods, LLC +, a | Cash 7.75% + SF (1.00% Floor)v | 10/14/20 | 09/22/28 | Second Lien | 720,000 | 722,704 | ||||||||||

| Skopima Consilio Parent LLC +, a | Cash 4.00% + SF (0.76% Floor)vvvv | 05/18/21 | 04/30/28 | Senior | 4,581,190 | 4,560,935 | ||||||||||

| Skopima Consilio Parent LLC +, a | Cash 4.50% + SF (0.50% Floor)vv | 10/11/23 | 05/12/28 | Senior | 8,300,000 | 8,270,576 | ||||||||||

| Sorenson Communications, LLC +, a | Cash 5.50% + SF (0.75% Floor)v | 03/23/21 | 03/12/28 | Senior | 2,231,428 | 2,170,476 | ||||||||||

| Sound Inpatient Physicians, Inc +, a | Cash 3.00% + SFvv | 08/23/18 | 06/27/25 | Senior | 1,326,500 | 444,382 | ||||||||||

| Sovos Compliance, LLC +, a | Cash 4.50% + SF (0.50% Floor)v | 08/16/21 | 08/11/28 | Senior | 1,671,502 | 1,650,579 | ||||||||||

| Spring Education Group, Inc. +, a | Cash 4.50% + SFvv | 09/29/23 | 10/04/30 | Senior | 4,506,049 | 4,523,510 | ||||||||||

| SSH Group Holdings, Inc. +, a | Cash 4.25% + SFv | 06/05/19 | 07/30/25 | Senior | 3,332,161 | 3,345,073 | ||||||||||

| Star US Bidco, LLC +, a | Cash 4.25% + SF (1.00% Floor)v | 04/24/20 | 03/17/27 | Senior | 1,254,072 | 1,854,673 | ||||||||||

| Surgery Center Holdings, Inc. +, a, f | Cash 3.50% + SFvv | 12/05/23 | 12/19/30 | Senior | 897,089 | 901,862 | ||||||||||

| Tank Holding Corp. +, a, e | Cash 6.00% + SF (0.75% Floor)vv | 03/31/22 | 03/31/28 | Senior | — | 186,081 | ||||||||||

| Tank Holdings Corporation +, a | Cash 5.75% + SF (0.75% Floor)vv | 04/11/22 | 03/31/28 | Senior | 21,276,675 | 20,373,898 | ||||||||||

| Telenet Financing USD LLC +, a | Cash 2.00% + SFv | 04/27/20 | 04/30/28 | Senior | 1,400,000 | 1,394,575 | ||||||||||

| Thevelia (US), LLC +, a, e | Cash 4.75% + SFvv | 03/29/23 | 06/18/29 | Senior | 6,887,889 | 6,900,763 | ||||||||||

| Tivity Health Inc +, a | Cash 6.00% + SF (0.75% Floor)vv | 06/28/22 | 06/28/29 | Senior | 15,494,490 | 15,389,869 | ||||||||||

| TLP Acquisition Holdings, LLC +, a | Cash 8.00% + SF (1.00% Floor)v | 02/26/19 | 02/26/26 | Mezzanine | 34,070,313 | 33,842,655 | ||||||||||

| Tory Burch LLC +, a, e | Cash 3.50% + SF (0.50% Floor)v | 04/30/21 | 04/16/28 | Senior | 977,500 | 974,469 | ||||||||||

| Trident TPI Holdings, Inc. +, a | Cash 4.00% + SF (0.50% Floor)vv | 09/22/21 | 09/15/28 | Senior | 1,667,064 | 1,660,445 | ||||||||||

| Trilon Group, LLC +, a, e | Cash 6.25% + SF (0.75% Floor)vv | 06/02/22 | 05/27/29 | Senior | 11,458,125 | 10,464,747 | ||||||||||

| Triton Water Holdings, Inc. +, a | Cash 3.50% + SF (0.50% Floor)vv | 04/19/21 | 03/31/28 | Senior | 1,368,503 | 1,354,766 | ||||||||||

| UKG Inc. +, a | Cash 3.25% + SF (0.75% Floor)vv | 07/13/20 | 05/04/26 | Senior | 972,693 | 974,090 | ||||||||||

| Upstream Newco, Inc. +, a | Cash 4.25% + SFvv | 08/04/21 | 11/20/26 | Senior | 3,421,250 | 5,877,635 | ||||||||||

| Utz Quality Foods, LLC +, a | Cash 3.00% + SFvv | 01/29/21 | 01/20/28 | Senior | 3,598,263 | 3,598,238 | ||||||||||

| VeriFone Systems, Inc. +, a | Cash 4.00% + SFvv | 09/25/19 | 08/20/25 | Senior | 3,514,708 | 3,411,463 | ||||||||||

| Virtusa Corporation +, a | Cash 3.75% + SF (0.75% Floor)vv | 02/28/22 | 02/11/28 | Senior | 2,167,000 | 2,166,904 | ||||||||||

| Vision Solutions, Inc. +, a | Cash 4.25% + SF (0.75% Floor)vv | 05/06/21 | 04/24/28 | Senior | 3,822,000 | 3,792,007 | ||||||||||

| Vision Solutions, Inc. +, a | Cash 7.25% + SF (0.75% Floor)vv | 09/07/21 | 04/23/29 | Second Lien | 2,300,000 | 2,118,875 | ||||||||||

| VS Buyer, LLC +, a | Cash 3.00% + SFvv | 04/10/20 | 02/28/27 | Senior | 1,930,000 | 1,928,619 | ||||||||||

| Weld North Education LLC +, a | Cash 3.75% + SF (0.75% Floor)vv | 01/06/21 | 12/15/27 | Senior | 1,264,250 | 1,262,419 | ||||||||||

| Weld North Education LLC +, a | Cash 3.75% + SF (0.50% Floor)vv | 11/27/23 | 12/21/27 | Senior | 3,255,859 | 2,996,357 | ||||||||||

| WHCG Purchaser, Inc. +, a, b | PIK 20% + SF (1.00% Floor)vv | 09/19/23 | 06/22/28 | Senior | 3,098,152 | 3,245,873 | ||||||||||

| Windsor Holdings III, LLC +, a | Cash 4.50% + SFv | 08/07/23 | 08/01/30 | Senior | 1,900,000 | 1,911,833 | ||||||||||

| Woof Holdings, Inc. +, a | Cash 7.25% + SF (0.75% Floor)vv | 01/08/21 | 12/22/28 | Second Lien | 7,200,000 | 5,223,977 | ||||||||||

| Woof Holdings, Inc. +, a | Cash 3.75% + SF (0.75% Floor)vv | 09/26/23 | 12/21/27 | Senior | 1,994,885 | 2,434,050 | ||||||||||

| WWEX UNI TopCo Holdings, LLC +, a | Cash 4.00% + SF (0.75% Floor)vv | 08/03/21 | 07/26/28 | Senior | 2,652,750 | 2,599,404 | ||||||||||

| YI Group Midco, LLC +, a | Cash 5.75% + SF (1.00% Floor)vv | 12/01/23 | 12/01/29 | Senior | 960,229 | 6,022,556 | ||||||||||

| Zacapa S.à.r.l. +, a, e | Cash 4.25% + SF (0.50% Floor)vv | 07/31/18 | 07/02/25 | Senior | 2,207,878 | 2,201,051 | ||||||||||

| Total North America (5.04%) | 710,828,781 | |||||||||||||||

| Rest of World (0.02%) | ||||||||||||||||

| Gems Education +, a, e | Cash 4.75% + SFv | 08/15/22 | 07/31/26 | Senior | 1,970,187 | 1,980,865 | ||||||||||

| Total Rest of World (0.02%) | 1,980,865 | |||||||||||||||

| Western Europe (2.47%) | ||||||||||||||||

| Acuris Finance US, Inc. +, a | Cash 4.00% + SF (0.50% Floor)vv | 03/11/21 | 02/16/28 | Senior | 677,083 | 677,720 | ||||||||||

| AD Education +, a | PIK 8.50% | 06/21/22 | 03/30/29 | Mezzanine | 13,084,544 | 14,315,000 | ||||||||||

| AEA International Holdings (Luxembourg) S.à.r.l. +, a | Cash 3.75% + SF (0.50% Floor)vv | 09/15/21 | 09/07/28 | Senior | 2,259,750 | 2,262,453 | ||||||||||

| AI PLEX AcquiCo GmbH +, a, e | Cash 5.00% + SFv | 08/23/19 | 07/31/26 | Senior | 4,807,218 | 4,255,296 | ||||||||||

| Albion Financing 3 S.à.r.l +, a | Cash 5.25% + SF (0.50% Floor)vv | 01/14/22 | 08/17/26 | Senior | 2,456,250 | 2,468,890 | ||||||||||

The accompanying notes are an integral part of these Consolidated Financial Statements.

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Consolidated Schedule of Investments —

December 31, 2023 (Unaudited) (continued)

| Interest | Acquisition Date | Maturity Date | Investment Type | Principal | Fair Value** | |||||||||||

| Private Equity Investments (continued) | ||||||||||||||||

| Direct Investments * (continued) | ||||||||||||||||

| Direct Debt (continued) | ||||||||||||||||

| Alcumus +, a, e | Cash 5.75% + S>> | 03/09/22 | 03/09/29 | Senior | $ | 1,984,236 | $ | 1,923,771 | ||||||||

| Altice France S.A. +, a, e | Cash 5.50% + SFvv | 01/27/21 | 08/14/26 | Senior | 3,824,170 | 3,575,064 | ||||||||||

| Asgard Investments B.V. +, a | Cash 5.50% + E## | 03/15/22 | 03/15/29 | Senior | 13,721,320 | 13,615,048 | ||||||||||

| Aston Finco S.à.r.l. +, a | Cash 4.25% + SFv | 11/14/19 | 10/09/26 | Senior | 2,695,000 | 2,291,222 | ||||||||||

| Aston Finco S.à.r.l. +, a | Cash 8.25% + S> | 10/25/19 | 10/09/27 | Second Lien | 36,733,592 | 31,156,905 | ||||||||||

| Auris Luxembourg III S.à.r.l. +, a, f | Cash 3.75% + SFvv | 04/04/19 | 02/27/26 | Senior | 956,203 | 5,879,722 | ||||||||||

| Babar Bidco +, a | Cash 4.00% + E### | 12/04/20 | 11/17/27 | Senior | 1,214,051 | 1,106,807 | ||||||||||

| BK LC Lux SPV S.à.r.l. +, a | Cash 3.25% + SF (0.50% Floor)vv | 07/09/21 | 04/28/28 | Senior | 1,746,468 | 741,893 | ||||||||||

| CD&R Firefly Bidco Limited +, a | Cash 4.75% + S>> | 08/31/18 | 06/23/25 | Senior | 7,113,072 | 6,889,551 | ||||||||||

| CEP V Investment 22 S.à.r.l. (Lux) +, a | PIK 8.25% + SFv | 02/28/22 | 08/31/30 | Mezzanine | 6,575,005 | 6,600,949 | ||||||||||

| CEP V Investment 22 S.à.r.l. (Lux) +, a | PIK 8.25% + E### | 02/28/22 | 08/31/30 | Mezzanine | 940,656 | 949,925 | ||||||||||

| Cidron Kuma 2 S.à.r.l. +, a | Cash 7.00% + E (0.50% Floor)### | 01/01/21 | 02/28/26 | Second Lien | 1,146,938 | 778,426 | ||||||||||

| Constellation Automotive Group Limited +, a | Cash 4.75% + S>>> | 09/03/21 | 07/28/28 | Senior | 1,387,192 | 1,189,451 | ||||||||||

| Constellation Automotive Limited +, a | Cash 7.50% + S>>> | 10/18/21 | 07/30/29 | Second Lien | 1,372,084 | 928,681 | ||||||||||

| Constellation BidCo GmbH +, a | Cash 5.25% + E## | 10/26/22 | 06/27/29 | Senior | 26,760,488 | 29,275,944 | ||||||||||

| CTEC III GmbH +, a | Cash 3.75% + E## | 03/29/18 | 03/07/25 | Senior | 4,055,926 | 3,522,390 | ||||||||||

| Dragon Bidco Limited +, a | Cash 5.75% + S>> | 03/09/22 | 03/09/29 | Senior | 8,941,459 | 8,595,078 | ||||||||||

| Eagle Bidco Limited +, a | Cash 3.75% + E# | 09/07/23 | 03/20/28 | Senior | 7,386,454 | 7,463,645 | ||||||||||

| Envirotainer +, a, e | Cash 5.75% + E## | 07/29/22 | 07/27/29 | Senior | 8,191,195 | 8,758,109 | ||||||||||

| Envirotainer +, a | Cash 5.75% + SF (0.75% Floor)vv | 07/29/22 | 07/27/29 | Senior | 4,089,559 | 4,032,615 | ||||||||||

| Financière Mendel +, a | Cash 4.25% + SFvv | 12/06/23 | 11/12/30 | Senior | 2,400,000 | 2,407,128 | ||||||||||

| Fusilli AcquiCo S.à.r.l. +, a, e | Cash 5.25% + E### | 01/27/22 | 04/12/26 | Senior | 2,764,167 | 2,527,306 | ||||||||||

| Grupo Iberica de Congelados, SA +, a | Cash 7.12% + E# | 06/28/19 | 11/28/24 | Senior | 1,074,234 | 821,289 | ||||||||||

| HIG Finance 2 Limited +, a | Cash 3.25% + E (0.75% Floor)## + P 2.25% (1.75% Floor) | 10/05/21 | 11/12/27 | Senior | 3,143,951 | 3,147,832 | ||||||||||

| HNVR Holdco Limited +, a, e | Cash 5.50% + E### | 01/25/22 | 09/12/27 | Senior | 3,321,745 | 3,318,814 | ||||||||||

| Holding Socotec SAS +, a | Cash 4.00% + SF (0.75% Floor)vv | 09/10/21 | 06/30/28 | Senior | 1,470,000 | 1,458,975 | ||||||||||

| Hunter Douglas NV +, a | Cash 3.50% + SF (0.50% Floor)vv | 03/07/22 | 02/26/29 | Senior | 1,777,500 | 1,769,312 | ||||||||||

| Hunter Holdco 3 Limited +, a, e | Cash 4.25% + SF (0.50% Floor)vv | 08/26/21 | 08/19/28 | Senior | 3,085,188 | 3,082,611 | ||||||||||

| IGT Holding IV AB +, a | Cash 4.80% + SF (0.50% Floor)vv | 07/21/21 | 03/31/28 | Senior | 1,852,500 | 1,850,060 | ||||||||||

| Ineos Quattro Holdings UK Limited +, a | Cash 3.75% + SFv | 03/17/23 | 03/01/30 | Senior | 1,995,000 | 1,960,150 | ||||||||||

| INNIO Group Holding GmbH +, a, f | Cash 4.25% + SFvvv | 12/13/23 | 11/02/28 | Senior | 2,511,634 | 2,516,883 | ||||||||||

| International Park Holdings B.V. +, a | Cash 5.00% + E# | 11/16/21 | 06/13/24 | Senior | 2,967,557 | 2,894,987 | ||||||||||

| ION Trading Finance Limited +, a | Cash 4.75% + SF (1.00% Floor)vv | 05/25/21 | 04/01/28 | Senior | 2,737,000 | 2,735,542 | ||||||||||

| Lernen Bidco Ltd. +, a, e | Cash 4.75% + E## | 06/16/23 | 04/24/29 | Senior | 6,523,196 | 6,635,242 | ||||||||||

| Loire UK Midco 3 Limited +, a | Cash 3.50% + SF (0.75% Floor)vv | 07/09/21 | 04/21/27 | Senior | 1,264,361 | 1,235,021 | ||||||||||

| Loire UK Midco 3 Limited +, a | Cash 3.00% + SFv | 06/08/20 | 04/21/27 | Senior | 1,355,176 | 1,323,624 | ||||||||||

| Mar Bidco S.à.r.l. +, a | Cash 4.25% + SFvv | 07/30/21 | 07/06/28 | Senior | 2,940,000 | 2,785,875 | ||||||||||

| Matador Bidco S.à.r.l. +, a | Cash 4.50% + SF (0.76% Floor)v | 11/12/19 | 10/15/26 | Senior | 3,023,676 | 3,043,330 | ||||||||||

| Nomad Foods Limited +, a | Cash 3.75% + SF (0.50% Floor)vv | 12/09/22 | 11/12/29 | Senior | 1,173,110 | 1,178,043 | ||||||||||

| Nouryon Finance B.V. +, a | Cash 4.00% + SFvv | 03/03/23 | 04/03/28 | Senior | 2,394,000 | 2,399,940 | ||||||||||

| OT Luxco 3 & Cy S.C.A. +, a | Cash 8.75% + E (1.00% Floor)###; PIK 9.00% | 05/31/17 | 05/31/27 | Mezzanine | 29,894,215 | 30,263,176 | ||||||||||

| PEARLS (Netherlands) Bidco B.V. +, a | Cash 4.00% + SFvvv | 03/30/22 | 03/01/29 | Senior | 1,477,500 | 1,462,697 | ||||||||||

| Pegasus BidCo B.V. +, a | Cash 4.25% + SF (0.50% Floor)vv | 08/08/22 | 07/12/29 | Senior | 2,744,630 | 2,743,274 | ||||||||||

| Rainbow Jvco Ltd. +, a | Cash 7.25% + E##; PIK 7.25% | 02/24/22 | 02/24/30 | Mezzanine | 10,163,513 | 10,288,038 | ||||||||||

| RC Acquisition II B.V. +, a | Cash 6.25% + E## | 12/19/23 | 12/18/30 | Senior | 8,405,600 | 9,031,867 | ||||||||||

The accompanying notes are an integral part of these Consolidated Financial Statements.

Partners Group Private Equity (Master Fund), LLC

(a Delaware Limited Liability Company)

Consolidated Schedule of Investments —

December 31, 2023 (Unaudited) (continued)

| Interest | Acquisition Date | Maturity Date | Investment Type | Principal | Fair Value** | |||||||||||

| Private Equity Investments (continued) | ||||||||||||||||

| Direct Investments * (continued) | ||||||||||||||||

| Direct Debt (continued) | ||||||||||||||||

| Sapphire Bidco B.V. +, a | Cash 3.00% + E## | 05/25/18 | 05/05/25 | Senior | $ | 2,271,578 | $ | 2,221,006 | ||||||||

| Seren Bidco AB +, a | Cash 7.25% + SR ¤¤ | 11/16/21 | 11/16/29 | Second Lien | 16,653,255 | 14,575,693 | ||||||||||

| Sevetys Invest +, a | Cash 6.25% + E## | 12/16/22 | 12/07/28 | Senior | 15,740,503 | 15,851,351 | ||||||||||

| Sigma Holdco B.V. +, a | Cash 4.75% + SFvvv | 09/20/23 | 01/02/28 | Senior | 5,600,000 | 5,514,600 | ||||||||||

| Skywalker BidCo GmbH +, a | Cash 6.00% + E### | 12/20/23 | 12/20/30 | Senior | 6,832,400 | 7,368,299 | ||||||||||

| Spinnaker DebtCo Limited +, a | Cash 6.25% + E## | 12/21/22 | 12/14/29 | Senior | 15,346,207 | 15,799,625 | ||||||||||

| Starfruit Finco B.V. +, a | Cash 2.75% + SFvv | 11/14/18 | 10/01/25 | Senior | 2,743,121 | 2,750,352 | ||||||||||

| Summer (BC) Bidco B LLC +, a | Cash 4.50% + SF (0.75% Floor)vv | 09/08/21 | 12/04/26 | Senior | 980,000 | 969,406 | ||||||||||

| Sunshine Luxembourg VII S.à.r.l. +, a, e | Cash 3.50% + SF (0.75% Floor)vv | 10/22/19 | 10/01/26 | Senior | 2,715,375 | 2,726,071 | ||||||||||

| team.blue Finco S.à.r.l. +, a | Cash 3.75% + E# | 06/25/21 | 03/27/28 | Senior | 4,043,536 | 3,664,271 | ||||||||||

| TMF Sapphire Bidco B.V. +, a | Cash 5.00% + SFvvv | 07/25/23 | 05/03/28 | Senior | 1,400,000 | 1,411,669 | ||||||||||

| Vertical Midco GmbH +, a | Cash 3.50% + SFvv | 09/09/20 | 07/30/27 | Senior | 3,881,348 | 3,886,821 | ||||||||||

| Virgin Media Bristol, LLC +, a | Cash 2.50% + SFv | 02/07/18 | 01/31/28 | Senior | 5,486,250 | 5,489,302 | ||||||||||

| Total Western Europe (2.47%) | 348,364,037 | |||||||||||||||